Professional Documents

Culture Documents

IPCL Finals Exam

Uploaded by

Cyril Ann IriberriCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IPCL Finals Exam

Uploaded by

Cyril Ann IriberriCopyright:

Available Formats

NAME:

YEAR and SECTION:

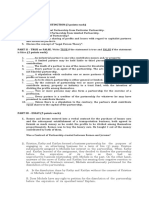

PART I – DISCUSSION/DISTINCTION (5 points each)

1. State and discuss the attributes of a Corporation.

2. Give at least 4 distinctions between Partnership and Corporation.

3. Distinguish De Jure Corporation from De Facto Corporation.

4. Distinguish Stock Corporation from Non-Stock Corporation.

5. Distinguish Public Corporation from Private Corporation.

6. Distinguish Ultra Vires Acts from Illegal Acts.

7. Distinguish Merger from Consolidation.

8. Discuss the concept of “Corporate Entity Theory”.

9. Distinguish Parent/Holding Company from Subsidiaries.

10. Distinguish Domestic Corporation from Foreign Corporation

PART II- TRUE OR FALSE. Write TRUE if the statement is true and FALSE if the statement

is false. (2 points each)

___________ 1. Subsidiaries are those corporations which are subject to common control and

operated as part of the system. They are sometimes called as “sister companies”.

___________ 2. Private corporations are defined as those formed and organized for the

government or a portion of the State or any of its political subdivisions and which have for

their purpose the general good and welfare.

___________ 3. Close corporations are those whose shares of stocks are held by limited

number of persons like the family or other close-knit group.

___________ 4. Corporators are those stockholders or members mentioned in the articles of

incorporation as forming and composing the corporation and who are signatories thereof.

___________ 5. Authorized Capital signifies the maximum amount fixed in the articles of

incorporation to be subscribed and paid-in or secured to be paid by the subscribers. It may

also refer to the maximum number of shares that the corporation can issue,

___________ 6. The term of corporate existence cannot exceed more than 50 years unless

sooner dissolved or unless the period indicated in the articles of incorporation is amended

extending the same.

___________ 7. A corporation comes into existence upon issuance of the Articles of

Incorporation.

___________ 8. A corporation has a legal personality separate and distinct from those

composing it.

____________ 9. Corporate Liquidation is the extinguishment of corporate franchise and the

termination of corporate existence.

___________ 10. A dissolved corporation shall continue to be a body corporate for three (3)

years from the time it is dissolved for the purpose of winding up its corporate affairs.

PART III – ESSAY (5 points each)

1. What is the procedure in amending the articles of incorporation to extend/shorten

corporate term?

2. In case of merger, are employees of the absorbed corporation absorbed by the surviving

corporation?

3. C, a Steel and Nail Co., Inc., owned by X had financial obligations to its employees. C

ceased operation and was immediately succeeded on the next day by E Steel Corporation.

Further, all of the assets of C Corporation were turned over to E Corporation. 90% of the

subscribed shares of which were also owned by X.

a. Explain the “Doctrine of Piercing the Veil of Corporate Fiction”.

b. May E Steel Corporation be held liable for the financial obligation of C Steel and Nail

Co. to its employees?

4. Sunny is an incorporator and original director of Business Media Philippines, Inc.

(BMPI). The latter commissioned Printwell for printing of its magazine that BMPI published

and sold. BMPI placed with Printwell several orders on credit, evidenced by invoices and

delivery receipts. For failure to pay the total amount, Printwell sued BMPI for collection of

the unpaid balance in the RTC. Printwell amended the complaint in order to implead as

defendants all the original stockholders and incorporators to recover on their unpaid

subscriptions. The defendants averred that BMPI had a separate personality from those of

its stockholders and that the directors and stockholders of BMPI had resolved to dissolve

BMPI during the annual meeting.

a. Can Printwell validly pierce the veil of corporate fiction by impleading the original

stockholders and incorporators?

b. What are the instances where the corporate veil is pierced?

You might also like

- Section: HRM3C: North Eastern Mindanao State University (Nemsu)Document3 pagesSection: HRM3C: North Eastern Mindanao State University (Nemsu)Cyril Ann IriberriNo ratings yet

- Labor Law SyllabusDocument14 pagesLabor Law SyllabusCyril Ann IriberriNo ratings yet

- JuratDocument3 pagesJuratCyril Ann IriberriNo ratings yet

- Midterm Exam (Labor Law)Document3 pagesMidterm Exam (Labor Law)Cyril Ann IriberriNo ratings yet

- AffidavitDocument2 pagesAffidavitCyril Ann IriberriNo ratings yet

- Sections: FM3A and FM3B: North Eastern Mindanao State University (Nemsu)Document1 pageSections: FM3A and FM3B: North Eastern Mindanao State University (Nemsu)Cyril Ann IriberriNo ratings yet

- North Eastern Mindanao State University (Nemsu) : Section: HRM3CDocument3 pagesNorth Eastern Mindanao State University (Nemsu) : Section: HRM3CCyril Ann IriberriNo ratings yet

- North Eastern Mindanao State UniversityDocument3 pagesNorth Eastern Mindanao State UniversityCyril Ann IriberriNo ratings yet

- Answers For Quiz #1Document1 pageAnswers For Quiz #1Cyril Ann IriberriNo ratings yet

- Part IDocument1 pagePart ICyril Ann IriberriNo ratings yet

- Answer Key Midterm ExamDocument2 pagesAnswer Key Midterm ExamCyril Ann IriberriNo ratings yet

- Affidavit of Kinship: AffiantDocument1 pageAffidavit of Kinship: AffiantCyril Ann IriberriNo ratings yet

- LABOR LAW ONLINE QUIZ (April 23, 2021)Document1 pageLABOR LAW ONLINE QUIZ (April 23, 2021)Cyril Ann IriberriNo ratings yet

- Contract of ServiceDocument2 pagesContract of ServiceCyril Ann IriberriNo ratings yet

- IPCL Midterm ExamDocument2 pagesIPCL Midterm ExamCyril Ann IriberriNo ratings yet

- 1 Deed of Absolute SaleDocument2 pages1 Deed of Absolute SalejmarkgNo ratings yet

- Affidavit of 2DP (Rustico Luga)Document1 pageAffidavit of 2DP (Rustico Luga)Cyril Ann IriberriNo ratings yet

- Affidavit of Loss (Driver's License)Document1 pageAffidavit of Loss (Driver's License)Cyril Ann IriberriNo ratings yet

- Affidavit of Loss (Driver's License)Document1 pageAffidavit of Loss (Driver's License)Cyril Ann IriberriNo ratings yet

- Affidavit of 2DP (Jorge)Document2 pagesAffidavit of 2DP (Jorge)Cyril Ann IriberriNo ratings yet

- Contract To SellDocument2 pagesContract To SellCyril Ann IriberriNo ratings yet

- Affidavit of 2DP (Gina)Document2 pagesAffidavit of 2DP (Gina)Cyril Ann IriberriNo ratings yet

- AFFIDAVIT OF ACKNOWLEDGEMENT OF PATERNITY (Bondan)Document1 pageAFFIDAVIT OF ACKNOWLEDGEMENT OF PATERNITY (Bondan)Diaz Law OfficeNo ratings yet

- Affidavit of Loss (Acknowledgment Receipt) )Document1 pageAffidavit of Loss (Acknowledgment Receipt) )Cyril Ann IriberriNo ratings yet

- AcknowledgementDocument1 pageAcknowledgementCyril Ann IriberriNo ratings yet

- Affidavit of Loss (Passbook)Document1 pageAffidavit of Loss (Passbook)Cyril Ann IriberriNo ratings yet

- AcknowledgementDocument1 pageAcknowledgementCyril Ann IriberriNo ratings yet

- Affidavit of Loss (Passbook)Document1 pageAffidavit of Loss (Passbook)Cyril Ann IriberriNo ratings yet

- Affidavit of Loss (Diploma)Document2 pagesAffidavit of Loss (Diploma)Cyril Ann IriberriNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Subsidiary Functions of ManagementDocument2 pagesSubsidiary Functions of ManagementMariam Mathen100% (2)

- Pertemuan 13 Bu There Lanjutan Chapter 9Document44 pagesPertemuan 13 Bu There Lanjutan Chapter 9CYNTHIA ARYA PRANATANo ratings yet

- Seminar 4 Set Work SolutionsDocument5 pagesSeminar 4 Set Work SolutionsStephanie XieNo ratings yet

- Advisory Agreement Quasi-FinalDocument28 pagesAdvisory Agreement Quasi-FinalMartineOrangeNo ratings yet

- KPIs For ESG 3 0 FinalDocument174 pagesKPIs For ESG 3 0 FinalLucho Paolantonio100% (1)

- Carrasquillo-Ortiz v. American Airlines, Inc., 1st Cir. (2016)Document42 pagesCarrasquillo-Ortiz v. American Airlines, Inc., 1st Cir. (2016)Scribd Government DocsNo ratings yet

- The Global EmployerDocument198 pagesThe Global EmployercokemasterNo ratings yet

- Civil Liberties Union v. Executive Secretary, 194 SCRA 317Document17 pagesCivil Liberties Union v. Executive Secretary, 194 SCRA 317Tin SagmonNo ratings yet

- Vodafone International Holdings V UOIDocument3 pagesVodafone International Holdings V UOISiwalik MishraNo ratings yet

- SM Chap 9Document41 pagesSM Chap 9Debora BongNo ratings yet

- Plugin Taxguide 511 Iht BPR Groups Dec 2011Document17 pagesPlugin Taxguide 511 Iht BPR Groups Dec 2011Rashad ShamimNo ratings yet

- Solutions Manual, Chapter 10: 2005 Mcgraw-Hill Ryerson Limited. All Rights Reserved. 416Document60 pagesSolutions Manual, Chapter 10: 2005 Mcgraw-Hill Ryerson Limited. All Rights Reserved. 416salehin1969No ratings yet

- Project REFYHNE at The Shell Rhineland Refinery - Building The World Largest PEM ElectrolyserDocument16 pagesProject REFYHNE at The Shell Rhineland Refinery - Building The World Largest PEM Electrolysermsantosu000No ratings yet

- Project On MNCDocument31 pagesProject On MNCswati1991100% (4)

- Further Consolidation Issues II: Accounting For Indirect Interests and Changes in Degree of Ownership of A SubsidiaryDocument24 pagesFurther Consolidation Issues II: Accounting For Indirect Interests and Changes in Degree of Ownership of A SubsidiaryDanish JamaliNo ratings yet

- Corporation Cases MidtermsDocument661 pagesCorporation Cases MidtermsAnonymous 2UPF2xNo ratings yet

- Unit 16 Financial Management in Public Sector Government Enterprises PDFDocument25 pagesUnit 16 Financial Management in Public Sector Government Enterprises PDFjayeshNo ratings yet

- Holding Company ADNRDocument10 pagesHolding Company ADNRsachinNo ratings yet

- Share Capital Materials-1 (Theory and Framework)Document18 pagesShare Capital Materials-1 (Theory and Framework)Joydeep DuttaNo ratings yet

- Ufo 2015Document145 pagesUfo 2015Jupe JonesNo ratings yet

- Group Accounting Consolidation F3Document5 pagesGroup Accounting Consolidation F3salehin1969No ratings yet

- Chapter 11 Introduction To CompanyDocument11 pagesChapter 11 Introduction To CompanyHajra Nawaz100% (1)

- 10 Kapila Hingorani CaseDocument39 pages10 Kapila Hingorani CaseAshutosh KumarNo ratings yet

- Mercer 2012 PK TRS Job Matching BookletDocument595 pagesMercer 2012 PK TRS Job Matching BookletBurn HallNo ratings yet

- Carpio vs. DorojaDocument2 pagesCarpio vs. DorojaAimee Dela Cruz100% (1)

- Pre-Week Com Law 2023Document48 pagesPre-Week Com Law 2023Miss_AccountantNo ratings yet

- Shell CanadaDocument12 pagesShell CanadaTee KaihongNo ratings yet

- Advanced Accounting: Consolidated Financial Statements-Date of AcquisitionDocument52 pagesAdvanced Accounting: Consolidated Financial Statements-Date of AcquisitiongoerginamarquezNo ratings yet

- Vdocuments - MX - Chapter 5 578590693cc3a PDFDocument43 pagesVdocuments - MX - Chapter 5 578590693cc3a PDFAmrita TamangNo ratings yet

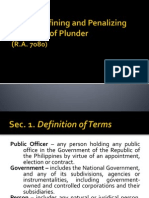

- An Act Defining and Penalizing The Crime of Plunder PPT VersionDocument14 pagesAn Act Defining and Penalizing The Crime of Plunder PPT Versionimwishie11100% (1)