Professional Documents

Culture Documents

Fundamental of Accounting Accounting Basic Termonologies: Compiled By: AWAIS JAVEED

Uploaded by

blue lakeOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fundamental of Accounting Accounting Basic Termonologies: Compiled By: AWAIS JAVEED

Uploaded by

blue lakeCopyright:

Available Formats

FUNDAMENTAL OF ACCOUNTING

ACCOUNTING BASIC TERMONOLOGIES

ACCOUNTING: Accounting Is Language of Business.

BUSINESS: Any legal activity which is undertaken for the purpose of earning profit.

BOOK-KEEPING: Recording of business transaction in a systematic way.

PROPRIETOR: the owner of concern, invest capital, time and attention, bear loss n

enjoy profit.

CAPITAL: Anything n amount invest by the owner.

Three Major Types of Businesses:

a) Service (accountant, Lawyer, Doctor)

b) Merchandising (Wal-Mart, Safeway, The Gap)

c) Manufacturing (cotton mills, General Motors)

TRANSACTION: Any dealing between two person or things. (it may be for cash, it may

be on credit)

DRAWINGS: Good n cash taken away by the owner.

GOOD/MERCHANDIZ: all things in which business deals.

PURCHASES: Anything purchase for re sale purpose.

ASSETS: all the things own or possessed by the biz.

LIABILITIES: any debts due by biz.

SALES: goods are sold for profit.

RETURNS: if return by customer its sales return and if return to seller/supplier its

purchases return.

REVENUE: Any income generating by biz.

DISCOUNT: Any reduction in price.

TRADE DISCOUNT: Any concession in listed/printed price,at the spot.

CASH DISCOUNT:Deduction allowed by the creditor to the debtor for prompt

payment.

ALLOWANCE: Any reduction in price due to defect.

DEBTORS: from whom the biz receive.

CREDITOR:To whom the biz pay.

COST: Any assets acquired.

EXPENSES: Used/enjoyed benefit of expenditure

STOCK/INVENTORY: Unsold goods.

ACCOUNT: Brief record of transaction; about person or things.

Compiled By: AWAIS JAVEED Page 1

GENERALLY ACCEPTED ACCOUNTING PRINCIPLES(GAAP)

ACCOUNTING CONCEPTS:

BUSINESS ENTITY

GOING CONCERN

MONEY MEASUREMENT

COST

DUAL ASPECT

ACCOUNTING PERIOD

MATCHING

REALISATION

ACCOUNTING CONVENTIONS:

PROPER DISCLOSURE

MATERIALITY

CONSISTENCY

CONSERVATISM

ACCOUNTING CONCEPTS

BUSINESS ENTITY CONCEPT: Business and business man/owner both are separate

entities accounting deals and concerned with only business, financial matters. in short we

done our work of accounting with business point of view.

GOING CONCERN CONCEPT: It shows that the business will exist for a long time to

come.

MONEY MEASUREMENT CONCEPT: Accounting records only those transactions

which can be expressed in terms of money. Transaction or event which cannot be

expressed in money do not place in books of accounts.

(HISTORICAL) COST CONCEPT: recording of an assets at their purchasing price.

ACCOUNTING PERIOD CONCEPT: The life of the business is divided into equal

segments, for studying the results after each segment. The time/duration of business can

be annually, semi annually, quarterly, monthly.

MATCHING CONCEPT: Compare business expense of a particular period with its

relevant period’s revenue. Match the expenses with revenue

REVENUE REALISATION CONCEPT: Record the revenue at the time of delivering

of product/Services to the customer/client irrespective of receipt of cash.

Compiled By: AWAIS JAVEED Page 2

DUAL ASPECT CONCEPT: Every transaction has two aspects. One what benefit

business is receiving and other what benefit business is giving.

Compiled By: AWAIS JAVEED Page 3

You might also like

- Accounts Theory NotesDocument3 pagesAccounts Theory Notesvihaajain050209No ratings yet

- Accounting (Introduction)Document66 pagesAccounting (Introduction)Fatima AsgharNo ratings yet

- Basic Accounting ConceptsDocument61 pagesBasic Accounting ConceptsJAY Solanki100% (1)

- Learned Questions For MidsDocument8 pagesLearned Questions For MidsshamaNo ratings yet

- Book KeepingDocument11 pagesBook KeepingRocket SinghNo ratings yet

- Unit I A Introduction AccoutingDocument21 pagesUnit I A Introduction AccoutingGopal KrishnanNo ratings yet

- Cca Notes..Document6 pagesCca Notes..Hajji Iršłäñ ÂkrämNo ratings yet

- Basic Accounting Concepts, Conventions, Bases & Policies, Concept of Balance SheetDocument44 pagesBasic Accounting Concepts, Conventions, Bases & Policies, Concept of Balance SheetVivan Menezes86% (7)

- Chapter: 1 Meaning, Objectives and Basic Accounting TermsDocument19 pagesChapter: 1 Meaning, Objectives and Basic Accounting TermsGudlipNo ratings yet

- Principle of Accounting Notes CompleteDocument34 pagesPrinciple of Accounting Notes Completemuzammilamiri2No ratings yet

- Basics of Accounting and Book KeepingDocument16 pagesBasics of Accounting and Book KeepingPuneet DhuparNo ratings yet

- Unit 1 TAPDocument19 pagesUnit 1 TAPchethanraaz_66574068No ratings yet

- Cambridge Made a Cake Walk: IGCSE Accounting theory- exam style questions and answersFrom EverandCambridge Made a Cake Walk: IGCSE Accounting theory- exam style questions and answersRating: 2 out of 5 stars2/5 (4)

- Basics of Accounting WPDocument11 pagesBasics of Accounting WPRajveer Singh SekhonNo ratings yet

- BasicsDocument11 pagesBasicsRathan SettyNo ratings yet

- Chapter 6 Financial Accounting and ManagementDocument7 pagesChapter 6 Financial Accounting and ManagementmaryelaliporoNo ratings yet

- Hps Poa FINALDocument14 pagesHps Poa FINALUmer AshfaqNo ratings yet

- Accounting Training: Confidential PresentationDocument74 pagesAccounting Training: Confidential Presentationzee_iitNo ratings yet

- Accounting Notes Module - 1Document16 pagesAccounting Notes Module - 1Bheemeswar ReddyNo ratings yet

- Basics of Business AccountingDocument34 pagesBasics of Business AccountingMadhusmita MishraNo ratings yet

- Chap 2 Book Keeping and Accounting and Basic TerminologiesDocument4 pagesChap 2 Book Keeping and Accounting and Basic Terminologiesyousaf.mast777No ratings yet

- By-Raghu Ram RajuDocument15 pagesBy-Raghu Ram RajuNänį RøÿalNo ratings yet

- Basic Accounting Concepts: The Entity ConceptDocument56 pagesBasic Accounting Concepts: The Entity ConceptUttam Kr Patra100% (3)

- The Original Attachment: BasicsDocument32 pagesThe Original Attachment: BasicsVijayGogulaNo ratings yet

- Unit - Ii Introduction To Financial AccountingDocument37 pagesUnit - Ii Introduction To Financial AccountingdownloaderNo ratings yet

- Chapter 1Document35 pagesChapter 1nadima behzadNo ratings yet

- Accounting ConceptsDocument5 pagesAccounting ConceptsAakanksha ThodupunooriNo ratings yet

- ACCOUNTING CONCEPTS and AssignmentDocument21 pagesACCOUNTING CONCEPTS and AssignmentSumiya YousefNo ratings yet

- Accounting Notes For EE SubjectDocument32 pagesAccounting Notes For EE SubjectSanjay YadavNo ratings yet

- All Basic Terms of AccountingDocument20 pagesAll Basic Terms of AccountingpoornapavanNo ratings yet

- Basics of Accounts11Document40 pagesBasics of Accounts11Vinay BehraniNo ratings yet

- Principle of AccountingDocument25 pagesPrinciple of AccountingBaktash Ahmadi100% (1)

- Business FinanceDocument3 pagesBusiness Financesk001No ratings yet

- Accounting Basic Definition and Basic Equation: For Journal, Balance Sheet andDocument123 pagesAccounting Basic Definition and Basic Equation: For Journal, Balance Sheet andEugene JoubertNo ratings yet

- Accounting Concepts and ConventionsDocument40 pagesAccounting Concepts and ConventionsAmrita TatiaNo ratings yet

- Accounting Concepts and PrinciplesDocument5 pagesAccounting Concepts and PrinciplesMahmud Abdullahi SarkiNo ratings yet

- Igse Accounting: by Ms Tara EsaDocument89 pagesIgse Accounting: by Ms Tara EsaDIllaNo ratings yet

- LECTURE 1 - WEEK 1 - CHAP 1, 2, 4 EditedDocument27 pagesLECTURE 1 - WEEK 1 - CHAP 1, 2, 4 Editedarmanx800No ratings yet

- Final Assignment VJDocument91 pagesFinal Assignment VJb3316730No ratings yet

- Accounting (Introduction) 1Document66 pagesAccounting (Introduction) 1محمد زاہد مغل100% (1)

- Unit - 1 (Hotel Accounts)Document19 pagesUnit - 1 (Hotel Accounts)Joseph Kiran ReddyNo ratings yet

- Accounts PresentationDocument22 pagesAccounts PresentationSenthil Kumar N GNo ratings yet

- Majid 12 3762 1 Accounting Principles and ConceptsDocument5 pagesMajid 12 3762 1 Accounting Principles and ConceptsHasnain BhuttoNo ratings yet

- Course Objective: To Impart The Ability To Understand and Use Accounting Data To Make Business DecisionsDocument41 pagesCourse Objective: To Impart The Ability To Understand and Use Accounting Data To Make Business DecisionsKertik SinghNo ratings yet

- Accounting Concepts (Satyanath Mohapatra)Document16 pagesAccounting Concepts (Satyanath Mohapatra)smrutiranjan swainNo ratings yet

- ACCOUNTDocument7 pagesACCOUNTGovind SharmaNo ratings yet

- Accounts Notes 1Document7 pagesAccounts Notes 1Dynmc ThugzNo ratings yet

- Acount BitDocument1 pageAcount BitOrbin SunnyNo ratings yet

- Introduction To Accounting NewDocument73 pagesIntroduction To Accounting NewSneha ChhabraNo ratings yet

- Basics of AccountingDocument82 pagesBasics of AccountingDivyaNo ratings yet

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 3.5 out of 5 stars3.5/5 (2)

- Basic AccountingDocument34 pagesBasic AccountingdavidnormorNo ratings yet

- Financial Accounting For ManagersDocument40 pagesFinancial Accounting For ManagersRAHUL G JAIN 1727621No ratings yet

- Others Important Terms: LiabilitiesDocument5 pagesOthers Important Terms: LiabilitiesLegacy GuptaNo ratings yet

- Ig CommerceDocument159 pagesIg CommerceRouful RasoolNo ratings yet

- Local Media5374970280966884062Document23 pagesLocal Media5374970280966884062Cristine Joy Petallana100% (1)

- Concepts ConventionsDocument5 pagesConcepts Conventionssinghriya2513No ratings yet

- Accounts UpdatedDocument25 pagesAccounts UpdatedykanikaNo ratings yet

- Computerized Accounting With Tally (Al Jamia)Document26 pagesComputerized Accounting With Tally (Al Jamia)Ribinshad100% (1)

- Basics of AccountingDocument42 pagesBasics of AccountingGgaurav KumarNo ratings yet

- Literature Review On Loans and AdvancesDocument5 pagesLiterature Review On Loans and Advancesc5rnbv5r100% (1)

- Student Financial Statement: Enrolment and Financial Details For The SemesterDocument3 pagesStudent Financial Statement: Enrolment and Financial Details For The Semesterziyu haoNo ratings yet

- Audit of Cash: Problem No. 1Document4 pagesAudit of Cash: Problem No. 1Kathrina RoxasNo ratings yet

- Accounting Practice Set Forms ANIMEDocument20 pagesAccounting Practice Set Forms ANIMETrishia Camille SatuitoNo ratings yet

- Cherry Vantica - 201950336 - Uts - Ak318d - Apliaud - LBR JawabDocument13 pagesCherry Vantica - 201950336 - Uts - Ak318d - Apliaud - LBR JawabCherry VanticaNo ratings yet

- Family Office Directory User GuideDocument111 pagesFamily Office Directory User GuideMufaddal PittalwalaNo ratings yet

- CBZ Bank Mortgage Finance Product OfferingDocument15 pagesCBZ Bank Mortgage Finance Product OfferingmusvibaNo ratings yet

- Abm TermsDocument2 pagesAbm TermsAxeliaNo ratings yet

- Class-12 CH-1& 2 Notes-1Document9 pagesClass-12 CH-1& 2 Notes-1uphighdownhardshowtimeNo ratings yet

- Annual Report 2022 en Final WebsiteDocument76 pagesAnnual Report 2022 en Final WebsiteSin SeutNo ratings yet

- Acct2015 - 2021 Paper Final SolutionDocument128 pagesAcct2015 - 2021 Paper Final SolutionTan TaylorNo ratings yet

- Chapter - 15 M0 PDFDocument5 pagesChapter - 15 M0 PDFSesotya Putri AlfaniNo ratings yet

- Personal Finance 4th Edition Madura Test BankDocument18 pagesPersonal Finance 4th Edition Madura Test Bankkhuyenfrederickgjk8100% (26)

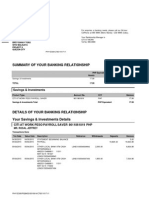

- Summary of Your Banking Relationship: Savings & InvestmentsDocument3 pagesSummary of Your Banking Relationship: Savings & InvestmentsJeffreyNo ratings yet

- Acowtancy F3 Notes PDFDocument437 pagesAcowtancy F3 Notes PDFŞâh ŠůmiťNo ratings yet

- Income Tax Guide FY 2023-24Document11 pagesIncome Tax Guide FY 2023-24akshay yadavNo ratings yet

- Remittance Directory: Metrobank Foreign Branches & SubsidiariesDocument11 pagesRemittance Directory: Metrobank Foreign Branches & SubsidiariesJay PelitroNo ratings yet

- Services Marketing (Text & Cases) by Rajendra NargundkarDocument360 pagesServices Marketing (Text & Cases) by Rajendra NargundkarFarid Nawaz Khan100% (9)

- FM SimpleDocument19 pagesFM SimpleFrancine ParrochaNo ratings yet

- Statement of Profit or Loss For The Year Ended 31 March 2009Document1 pageStatement of Profit or Loss For The Year Ended 31 March 2009Plawan GhimireNo ratings yet

- Investment ProductsDocument8 pagesInvestment Productscams parnsNo ratings yet

- Long Term Based ChuchuDocument22 pagesLong Term Based ChuchuSharmie Angel TogononNo ratings yet

- Financing CompaniesDocument15 pagesFinancing CompaniesMomo MontefalcoNo ratings yet

- Lecture-2 (Cash Book)Document31 pagesLecture-2 (Cash Book)Ali AhmedNo ratings yet

- 4001 4607Document1,214 pages4001 4607DrPraveen Kumar TyagiNo ratings yet

- Bank Rates': Submitted by Rudra Sayak Sardar Pooja Kumari Aarti Singh Shresth Kotish Geetashri PinguaDocument11 pagesBank Rates': Submitted by Rudra Sayak Sardar Pooja Kumari Aarti Singh Shresth Kotish Geetashri PinguaShresth KotishNo ratings yet

- SFM Marking Scheme 2019Document10 pagesSFM Marking Scheme 2019Dilu - SNo ratings yet

- Sukhvinder SinghDocument2 pagesSukhvinder SinghBhavesh PopatNo ratings yet

- LOPEZ, ELLA MARIE - QUIZ 2 FinAnaRepDocument4 pagesLOPEZ, ELLA MARIE - QUIZ 2 FinAnaRepElla Marie LopezNo ratings yet

- Uqud in Islamic Financial TransactionsDocument40 pagesUqud in Islamic Financial Transactionsmohamed saidNo ratings yet