Professional Documents

Culture Documents

FAR-4201 (Financial Statements)

Uploaded by

Gwyneth CartallaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FAR-4201 (Financial Statements)

Uploaded by

Gwyneth CartallaCopyright:

Available Formats

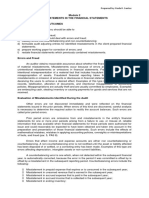

ReSA - THE REVIEW SCHOOL OF ACCOUNTANCY

CPA Review Batch 42 October 2021 CPA Licensure Exam Week No. 1

FINANCIAL ACCOUNTING & REPORTING C. Uberita G. Macariola J. Binaluyo

FAR-4201: FINANCIAL STATEMENTS

Purpose of financial statements:

Financial statements are a structured representation of the financial position and financial performance of an

entity. The objective of financial statements is to provide information about the financial position , financial

performance and cash flows of an entity that is useful to a wide range of users in making economic decisions.

Financial statements also show the results of the management stewardship of the resources entrusted to it. To

meet this objective, financial statements provide information about an entity's (a) assets (b) liabilities (c) equity

(d) income and expenses, including gains and losses (e) contributions by and distributions to owners in their

capacity as owners and (f) cash flows. This information, along with other information in the notes, assists users

of financial statements in predicting the entity's future cash flows and , in particular, their timing and certainty.

Complete set of financial statements:

A. A statement of financial position as at the end of the period

B. A statement of profit or loss and other comprehensive income for the period

C. A statement of changes in equity for the period

D. A statement of cash flows for the period

E. Notes, comprising significant accounting policies and other explanatory information

F. A statement financial position as at the beginning of the preceeding period when an entity applies an

accounting policy retrospectively or makes a retrospective restatement of items in its financial statements,

or when it reclassifies items in its financial statements.

Statement of financial position (balance sheet) – is a statement of financial position that presents the

resources (assets), obligations (liabilities) and equity at a given point in time.

Elements of Statement of Financial Position

Assets – are resources controlled by the entity as a result of past events and from which future economic benefits

are expected to flow to the entity.

Liabilities – are present obligations of the entity arising from past events, the settlement of which are expected

to result in an outflow from the entity of resources embodying economic benefits.

Equity – is the owners’ residual interest in the assets of an entity that remains after deducting its liabilities.

Recognition of Assets and Liabilities:

Assets – are recognized in the balance sheet when it is probable that the future economic benefits will flow to

the entity and the asset has a cost or value that can be measured reliably.

Liabilities – are recognized in the balance sheet when it is probable that an outflow of resources embodying

economic benefits will result from the settlement of a present obligation and the amount at which the settlement

will take place can be measured reliably.

Current and Non-current Classification:

Assets and liabilities should be separately classified on the face of the balance sheet except in circumstances

when a liquidity-based presentation provides more reliable and relevant information.

Current asset-

IAS/PAS 1, paragraph 66: An entity shall classify an asset as current when:

a. It expects to realize the asset or intends to sell or consume it, in its normal operating cycle;

b. It holds the asset primarily for purpose of trading.

c. It expects to realize the asset within twelve months after the reporting period; or

d. The asset is cash or cash equivalent unless the asset is restricted from being exchanged or used to settle a

liability for at least twelve months after the reporting period.

An entity shall classify all other assets as non-current.

Current liabilities –

IAS/PAS 1, paragraph 69: An entity shall classify a liability as current when:

a) It expects to settle the liability in its normal operating cycle;

b) It holds the liability primarily for the purpose of trading;

c) The liability is due to be settled within twelve months after the reporting period; or

d) The entity does not have an unconditional right to defer settlement of the liability for at least twelve months

after the reporting period.

An entity shall classify all other liabilities as non-current.

Information to be presented in the statement of financial position:

As a minimum, the face of the balance sheet shall include line items that present the following amounts:

a. Property, plant and equipment

b. Investment property

c. Intangible assets

Page 1 of 8 0915-2303213/0908-6567516 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY FAR-4201

Week 1: FINANCIAL STATEMENTS

d. Financial assets (excluding amounts shown under e, h and i)

e. Investment accounted for using the equity method

f. Biological assets within the scope of IAS 41 Agriculture

g. Inventories

h. Trade and other receivables

i. Cash and cash equivalents

j. The total assets classified as held for sale and assets included in disposal groups classified as held for sale in

accordance with IFRS 5

k. Trade and other payables

l. Provisions

m. Financial liabilities (excluding amounts shown in (K) and (L)

n. Liabilities and assets for current tax as defined in IAS 12 Income taxes

o. Deferred tax liabilities and deferred tax assets as defined in IAS 12 Income taxes

p. Liabilities included in the disposal groups classified as held for sale in accordance with IFRS 5

q. non.controlling interest, presented within equity

r. Issued capital and reserves attributable to equity holders of the parent

Additional line items, headings and subtotals shall be presented on the face of the balance sheet when such

presentation is relevant to an understanding of the entity’s position.

When an entity presents current and non-current assets and current and non-current liabilities as separate

classifications in its statement of financial position, it shall not classify deferred tax assets (liabilities) as current

assets (liabilities).

Information to be presented either in the statement of financial position or in the notes - an entity shall disclose,

either in the statement of financial position or in the notes further subclassifications of the line items presented,

classified in a manner appropriate to the entity. The disclosures vary each item, for example:

• Items of property, plant and equipment are disaggregated into classes in accordance with IAS 16

• Receivables are disaggregated into amounts receivable from trade customers, receivables from related parties

prepayments and other amounts;

• Inventories are sub-classified, in accordance with PAS 2, into classifications such as merchandise, production

supplies, materials, work in progress and finished goods;

• Provisions are disaggregated into provisions for employee benefits and other items; and

• Equity capital and reserves are disaggregated into various classes, such as paid-in capital, share premium

and reserves.

An entity shall disclose the following, either on the face of the balance sheet or in the notes:

• For each class of share capital;

• The number of shares authorized;

• The number of shares issued and fully paid, and issued but not fully paid;

• Par value per share, or the shares have no par value;

• A reconciliation of the number of share outstanding at the beginning and at the end of the period;

• The rights, preferences and restrictions attaching to the class including restrictions on the distribution of

dividends and the repayment of capital;

• Shares in the equity held by the entity or by its subsidiaries or associates; and

• Shares reserved for issue under options and contracts for the sale of shares, including the terms and amounts;

and

• A description of the nature and purpose of each reserve within equity.

Statement of profit or loss and other comprehensive income

The statement of profit or loss and other comprehensive income shall present, in addition to the profit or loss

and other comprehensive income sections:

a) profit or loss

b) Total comprehensive income

c) Comprehensive income for the period, being the total of profit or loss and other comprehensive income

If an entity presents a separate statement of profit or los it does not present the profit or loss section in the

statement presenting comprehensive income.

An entity shall present the following items, in addition to the profit or loss and other comprehensive income

sections, as allocation of profit or loss and other comprehensive income for the period;

(a) P rofit or loss for the period attributable to

(1) non-controlling interests and

(2) owners of the parent

(b) comprehensive income for the period attributable to:

(1) non-controlling interest and

(2) Owners of the parent

Page 2 of 8 0915-2303213/0908-6567516 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY FAR-4201

Week 1: FINANCIAL STATEMENTS

In addition to items required by other IFRSs, the profit or loss section or the statement of profit or loss shall

include line items that present the following amounts for the period;

(a) revenue, presenting separately interest revenue calculated using the effective interest method

(b) Gains and losses arising from the derecognition of financial assets measured at amortized cost

(c) Finance costs

(d) Impairment losses (including reversals of impairment losses or impairment gains

(e) Share of profit or loss of associates and joint ventures accounted for using the equity method

(f) If a financial asset is reclassified out of the amortized costs measurement category so that it is measured at

fair value through profit or loss, any gain or loss arising from the difference between the previous amortized

cost of the financial asset and its fair value at the reclassification date

(g) If a financial asset is reclassified out of the fair value through other comprehensive income measurement

category so that it is measured at fair value through profit or loss, any cumulative gain or loss previously

recognized in other comprehensive income that is reclassified to profit or loss

(h) Tax expense

(i) A single amount for the total of discontinued operation

Forms of Presenting the Statement of Profit or loss and other comprehensive income:

1. Functional presentation – also known as cost of sales method, this form classifies expenses according to

their function as part of cost of sales, selling activities, administrative activities and other activities. At a

minimum, an entity discloses its cost of sales under this method separately from other expenses.

Revenue P xxx

Cost of sales (xxx)

Gross profit xxx

Other income xxx

Distribution costs (xxx)

Administrative costs (xxx)

Other expenses (xxx)

Profit P xxx

Net income after tax P xxx

Other comprehensive income, net of tax:

Unrealized gains P xx

Unrealized losses (xx) xxx

Comprehensive net income P xxx

2. Natural presentation – also known as nature of expense method, this form, expenses are aggregated

according to their nature and not allocated among various functions within the entity. (for example,

depreciation, purchase of materials, transport costs, employee benefits, and advertising costs), and are not

reallocated among various functions within the entity.

Revenue P xxx

Other income xxx

Changes in inventory of finished goods and work in process xxx

Raw materials and consumables used xxx

Employee benefits costs xxx

Depreciation and amortization expense xxx

Other expenses xxx (xxx)

Profit P xxx

Income tax (xx)

Net income after tax P xxx

Other comprehensive income, net of tax:

Gains P xx

Losses ( xx) xxx

Comprehensive net income P xxx

An entity classifying expenses by function shall disclose additional information on the nature of expenses,

including depreciation and amortization expense and employee benefits expense.

Statement of changes in equity.

Information to be presented in the statement of changes in equity:

(a) total comprehensive income for the period, showing separately the total amounts attributable to owners of

the parent and to non-controlling interests.

(b) For each component of equity, the effects of retrospective application or retrospective restatement recognized

in accordance with IAS 8

(c) For each component of equity, a reconciliation between the carrying amount at the beginning and the end of

the period, separately (as a minimum) disclosing changes resulting from (1) profit or loss (2) other

comprehensive income and (3) transactions with owners in their capacity as owners, showing separately

contributions by and distributions to owners and changes in ownership interest in subsidiaries that do not

result in a loss of control.

Statement of Cash Flows

Cash flow information provides users of financial statements with a basis to assess the ability of the entity to

generate cash and cash equivalents and the needs of the entity to utilize those cash flows. IAS 37 sets out

requirements for the presentation and disclosure of cash flow information.

Page 3 of 8 0915-2303213/0908-6567516 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY FAR-4201

Week 1: FINANCIAL STATEMENTS

1. The major elements of the income statement are

a. revenue, cost of goods sold, selling expenses, and general expense.

b. operating section, nonoperating section, discontinued operations and cumulative effect.

c. revenues, expenses, gains, and losses.

d. All of these.

2. The income statement reveals

a. resources and equities of a firm at a point in time.

b. resources and equities of a firm for a period of time.

c. net earnings (net income) of a firm at a point in time.

d. net earnings (net income) of a firm for a period of time.

3. Which method of income measurement is used in the preparation of the income statement?

a. Capital maintenance approach.

b. Transaction approach.

c. Cash-flow approach.

d. Income components approach.

4. Which of the following equations expresses the definition of “income”?

a. Income = Revenues – Expenses

b. Income = (Revenues + Gains) – (Expenses + Losses)

c. Income = Revenues + Gains

d. Income = Gains – Losses

5. The definition of expenses includes

a. losses only.

b. expenses and losses.

c. expenses only.

d. expenses, losses and unrealized losses on available-for-sale securities.

6. IFRS requires that a single amount be disclosed within the income statement for

a. the post-tax profit/loss on discontinued operations and the pre-tax gain/loss on the disposal of

discontinued operational assets.

b. the pre-tax profit/loss on discontinued operations and the post-tax gain/loss on the disposal of

discontinued operational assets.

c. the pre-tax profit/loss on discontinued operations and the pre-tax gain/loss on the disposal of discontinued

operational assets.

d. the post-tax profit/loss on discontinued operations and the post-tax gain/loss on the disposal

of discontinued operational assets.

7. Which of the following is not a generally practiced method of presenting the income statement?

a. Including prior period adjustments in determining net income.

b. The condensed income statement.

c. The consolidated income statement.

d. Including gains and losses from discontinued operations of a component of a business in determining net

income.

8. Which of the following is not a selling expense?

a. Advertising expense.

b. Office salaries expense.

c. Freight-out.

d. Store supplies consumed.

9. Which of the following is included in comprehensive income?

a. Investments by owners.

b. Unrealized gains on non-trading equity securities.

c. Distributions to owners.

d. Changes in accounting principles.

10. Comprehensive income includes all of the following except

a. dividend revenue.

b. losses on disposal of assets.

c. investments by owners.

d. unrealized holding gains.

11. Comprehensive income includes all of the following, except

a. revenues and gains.

b. expenses and losses.

c. preference share dividends.

d. unrealized gains and losses on non-trading equity securities.

Page 4 of 8 0915-2303213/0908-6567516 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY FAR-4201

Week 1: FINANCIAL STATEMENTS

12. The statement of financial position is useful for analyzing all of the following except

a. liquidity.

b. solvency.

c. profitability.

d. financial flexibility.

13. The statement of financial position can help assess all of the following except

a. Solvency.

b. Financial flexibility.

c. Profitability.

d. Liquidity.

14. The net assets of a business are equal to

a. current assets minus current liabilities.

b. total assets plus total liabilities.

c. total assets minus total shareholders' equity.

d. none of these choices are correct.

15. The basis for classifying assets as current or noncurrent is conversion to cash within

a. the accounting cycle or one year, whichever is shorter.

b. the operating cycle or one year, whichever is longer.

c. the accounting cycle or one year, whichever is longer.

d. the operating cycle or one year, whichever is shorter.

16. The basis for classifying assets as current or noncurrent is the period of time normally required by the

accounting entity to convert cash invested in

a. inventory back into cash, or 12 months, whichever is shorter.

b. receivables back into cash, or 12 months, whichever is longer.

c. tangible fixed assets back into cash, or 12 months, whichever is longer.

d. inventory back into cash, or 12 months, whichever is longer.

17. The current assets section of the statement of financial position should include

a. machinery.

b. patents.

c. goodwill.

d. Inventory.

18. Which of the following is a current asset?

a. Cash surrender value of a life insurance policy of which the company is the bene-ficiary.

b. Investment in equity securities for the purpose of controlling the issuing company.

c. Cash designated for the purchase of tangible fixed assets.

d. Trade installment receivables normally collectible in 18 months.

19. Each of the following are an intangible asset except

a. copyrights.

b. goodwill.

c. plant expansion fund.

d. trademarks.

20. Which of the following is not a long-term investment?

a. Investments in ordinary shares

b. Franchise

c. Land held for speculation

d. A sinking fund

21. Which item below is not a current liability?

a. Unearned revenue

b. Share dividends distributable

c. The currently maturing portion of long-term debt

d. Trade accounts payable

22. An example of an item which is not an element of working capital is

a. accrued interest on notes receivable.

b. goodwill.

c. goods in process.

d. short-term investments.

23. Non-current liabilities include

a. obligations not expected to be liquidated within the next year or operating cycle.

b. obligations payable at some date beyond the next year or operating cycle.

Page 5 of 8 0915-2303213/0908-6567516 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY FAR-4201

Week 1: FINANCIAL STATEMENTS

c. deferred income taxes and most lease obligations.

d. All of these choices are correct.

24. Treasury shares should be reported as a(n)

a. current asset.

b. investment.

c. other asset.

d. reduction of equity.

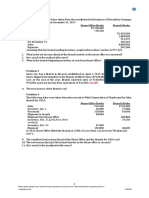

25. The adjusted trial balance of BTS Company includes the following accounts at December31, 2021:

Sales revenue P 8,000,000

Sales returns 500,000

Commission income 30,000

Interest expense 180,000

Inventory, December 31, 2021 ?

Purchases 5,500,000

Sales salaries and commissions 350,000

Administrative staff costs 650,000

Office supplies expense 120,000

Dividends declared 800,000

Dividend income 20,000

Loss on sale of equipment 40,000

Rent expense 250,000

Gain on sale of machinery 50,000

Net unrealized gain on FVOCI 90,000

Depreciation expense- Store Equipment 60,000

Depreciation expense- Office Equipment 70,000

Freight-out 130,000

Freight-in 400,000

Additional information:

1. Inventory, January 1, 2021, P 750,000

2. Gross profit rate is 25% of net sales revenue

3. Rent expense is allocated 55% to selling and 45% to administrative

4. Ignore income tax

Compute the following:

A B C D

Q1. Distribution cost 677,500 540,000 410,000 547,500

Q2. Income from operations 305,000 125,000 165,000 345,000

Q3. Profit or Loss 125,000 215,000 35,000 395,000

26. Ortiz Co. had the following account balances:

Sales revenue P 120,000

Cost of goods sold 60,000

Salaries and wages expense 10,000

Depreciation expense 20,000

Dividend revenue 4,000

Utilities expense 8,000

Rent revenue 25,000

Interest expense 12,000

Sales returns 11,000

Advertising expense 13,000

What amount would Ortiz report as other income in its profit or loss statement?

a. P29,000

b. P17,000

c. P25,000

d. P13,000

27. Ortiz Co. had the following account balances:

Sales revenue P 180,000

Cost of goods sold 90,000

Salaries and wages expense 15,000

Depreciation expense 30,000

Dividend revenue 6,000

Utilities expense 12,000

Rent revenue 30,000

Page 6 of 8 0915-2303213/0908-6567516 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY FAR-4201

Week 1: FINANCIAL STATEMENTS

Interest expense 18,000

Sales returns 16,500

Advertising expense 19,500

What amount would Ortiz report as income from operations in its profit or loss statement?

a. P73,500

b. P45,000

c. P33,000

d. P15,000

28. For Matter Company, the following information is available:

Cost of goods sold P240,000

Sales discounts 8,000

Income tax expense 24,000

Operating expenses 92,000

Sales revenue 400,000

In Matter’s statement of profit or loss using the natural presentation, gross profit

a. should not be reported.

b. should be reported at P36,000.

c. should be reported at P152,000.

d. should be reported at P160,000.

29. For Rook Company, the following information is available:

Cost of goods sold P270,000

Sales returns and allowances 12,000

Income tax expense 27,000

Operating expenses 105,000

Sales revenue 450,000

In Rook's statement of profit or loss using the functional presentation, gross profit

a. should not be reported.

b. should be reported at P36,000.

c. should be reported at P168,000.

d. should be reported at P180,000.

30. Use the following information (in thousands):

Service Revenue P1,600,000

Income from continuing operations 200,000

Net Income 180,000

Income from operations 440,000

Selling & administrative expenses 1,160,000

Income before income tax 380,000

Non-operating expenses 20,000

Determine the amount of finance cost.

a. P40,000

b. P160,000

c. P200,000

d. P20,000

31. Use the following information (in thousands):

Service Revenue P1,600,000

Income from continuing operations 200,000

Net Income 180,000

Income from operations 440,000

Selling & administrative expenses 1,000,000

Income before income tax 400,000

Determine the amount of discontinued operation.

a. P40,000

b. P20,000

c. P200,000

d. P160,000

32. Stine Corp.'s trial balance reflected the following account balances at December 31, 2020:

Accounts receivable (net) P24,000

Trading securities 6,000

Accumulated depreciation—equipment 15,000

Cash 21,000

Page 7 of 8 0915-2303213/0908-6567516 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY FAR-4201

Week 1: FINANCIAL STATEMENTS

Inventory 30,000

Equipment 25,000

Patent 4,000

Prepaid expenses 2,000

Land held for future business site 18,000

In Stine's December 31, 2020 statement of financial position, the current assets total is

a. P101,000.

b. P92,000.

c. P87,000.

d. P83,000.

33. The accounts and balances shown below are gathered from Cyclops Company’s adjusted trial balance.

Bonds payable 250,000 Investment at amortized cost 300,000

Cash in bank 175,000 Intangible asset 48,000

Investment at FVPL 600,000 Investment in Associate 700,000

Cash Dividends payable 140,000 Deferred tax liability 228,000

Prepaid expenses 136,000 Accounts payable 248,000

Inventory 820,000 Accounts receivable 366,000

Investment property 525,000 Property, plant and equipment 1,200,000

Petty Cash fund 153,000 Advances to suppliers 450,000

Accumulated depreciation-PPE 400,000 Advances from shareholder 900,000

Compute the following:

A B C D

Q1. Current assets 2,700,000 2,373,000 3,150,000 2,250,000

Q2. Non-current assets 2,700,000 2,373,000 3,173,000 2,823,000

Q3. Current liabilities 388,000 1,288,000 838,000 1,378,000

Q4. Non-current liabilities 478,000 928,000 1,600,000 1,378,000

34. Houston Company has the following items: share capital–ordinary, P820,000; treasury shares, P85,000;

deferred taxes P100,000 and retained earnings, P313,000.

What amount should Houston Company report as total equity?

a. P 948,000.

b. P1,048,000.

c. P1,148,000.

d. P1,218,000.

35. Belle Corp. has two classes of share capital outstanding: 12%, P100 par value preference share and P50

par value ordinary share. Balances on January 1, 2021 were as follows:

Preference Share Capital – 5,000 shares P500,000

Ordinary Share Capital – 50,000 shares 2,500,000

Share premium – Preference 200,000

Share premium – Ordinary 2,000,000

Accumulated profits 4,000,000

The following data summarize the transactions for 2021:

a. Issue of 20,000 shares of ordinary at P50 per share on January 20.

b. Purchase of 5,000 of the company’s own ordinary shares from stockholders at P60 per share on February

20.

c. A 2 for 1 share split on the ordinary on April 1.

d. 20% stock dividend to ordinary shares was declared on April 30 and distributed on May 20. The prevailing

fair value of share on this date was P60 per share.

e. Reissuance of 3,000 reacquired shares at P40 per share on May 3.

f. Donation of 15,000 shares of ordinary by shareholders on June 5.

g. Reissuance of 10,000 donated stocks at P40 per share on July 1.

h. Declaration of P12 cash dividends to preference shares and P3 per share dividends to ordinary on

November 30 to stockholders as of December 20 payable on January 30 of the next year.

i. Total comprehensive income for the year comprises of net income amounting to P1,200,000 and

Unrealized loss on Investment at FVOCI amounting to P200,000.

What is the total Stockholder’s equity as of December 31, 2021?

a. 10,458,000 b. 10,898,000 c. 10,868,000 d. 11,318,000

Page 8 of 8 0915-2303213/0908-6567516 www.resacpareview.com

You might also like

- Chapter 1Document13 pagesChapter 1Ella Marie WicoNo ratings yet

- Unit 1 Audit of Property PLant and EquipmentDocument5 pagesUnit 1 Audit of Property PLant and EquipmentJustin SolanoNo ratings yet

- AdvDocument2 pagesAdvJhaNo ratings yet

- PDF ReceivablesDocument6 pagesPDF ReceivablesJanine SarzaNo ratings yet

- P1 1Document12 pagesP1 1Donna Mae Hernandez0% (1)

- Auditing Theories and Problems Quiz WEEK 2Document16 pagesAuditing Theories and Problems Quiz WEEK 2Van MateoNo ratings yet

- Audit-Of Inventory ACHA - KJDocument47 pagesAudit-Of Inventory ACHA - KJKhrisna Joy AchaNo ratings yet

- LagunaDocument8 pagesLagunarandom17341No ratings yet

- Investment AccountingDocument3 pagesInvestment AccountingMaxineNo ratings yet

- 8 - PFRS 15 Five Step Model PDFDocument6 pages8 - PFRS 15 Five Step Model PDFDarlene Faye Cabral RosalesNo ratings yet

- editedQUIZ CHAPTER-6 FINANCIAL-ASSETSDocument3 pageseditedQUIZ CHAPTER-6 FINANCIAL-ASSETSanna mariaNo ratings yet

- AC20 MIDTERM EXAMINATION FY21 22 - DGCupdDocument10 pagesAC20 MIDTERM EXAMINATION FY21 22 - DGCupdMaricar PinedaNo ratings yet

- Standard Audit Programme Guide: SAPG Ref.: Function: Stock & Materials Handling Activity/System: Stock ControlDocument13 pagesStandard Audit Programme Guide: SAPG Ref.: Function: Stock & Materials Handling Activity/System: Stock Control06l01a0224No ratings yet

- Ap-1403 ReceivablesDocument18 pagesAp-1403 Receivableschowchow123No ratings yet

- Auditing Problems SOLUTION v.1 - 2018Document12 pagesAuditing Problems SOLUTION v.1 - 2018Ramainne RonquilloNo ratings yet

- Far-1 4Document3 pagesFar-1 4Raymundo Eirah100% (1)

- 3-Import ExportDocument13 pages3-Import ExportStephiel SumpNo ratings yet

- Acctg CycleDocument13 pagesAcctg Cyclefer maNo ratings yet

- Cash ProblemsDocument5 pagesCash ProblemsAnna AldaveNo ratings yet

- Retrospectively in The First Set of Financial Statements Authorized For Issue AfterDocument7 pagesRetrospectively in The First Set of Financial Statements Authorized For Issue Aftermax pNo ratings yet

- Review 105 - Day 3 Theory of AccountsDocument13 pagesReview 105 - Day 3 Theory of Accountschristine anglaNo ratings yet

- AnswerrDocument7 pagesAnswerrLeslie Mae Vargas ZafeNo ratings yet

- Finals Quiz 2 Buscom Version 2Document3 pagesFinals Quiz 2 Buscom Version 2Kristina Angelina ReyesNo ratings yet

- With SOLNS AP Merged2 PDFDocument51 pagesWith SOLNS AP Merged2 PDFAlma Jean MonterozoNo ratings yet

- 90,000 40,000 102,000 Correct Answer 110,000 100,000 300,000 312,000 314,000Document11 pages90,000 40,000 102,000 Correct Answer 110,000 100,000 300,000 312,000 314,000Hazel Grace PaguiaNo ratings yet

- Sample Probles For Corpo Liquidation Part 2Document1 pageSample Probles For Corpo Liquidation Part 2Kezia GuevarraNo ratings yet

- Statement of Comprehensive Income Part 2Document8 pagesStatement of Comprehensive Income Part 2AG VenturesNo ratings yet

- Module 2 MISSTATEMENTS IN THE FINANCIAL STATEMENTSDocument7 pagesModule 2 MISSTATEMENTS IN THE FINANCIAL STATEMENTSNiño Mendoza MabatoNo ratings yet

- The Auditor Is Auditing Financial Statements For The Year Ended December 31Document2 pagesThe Auditor Is Auditing Financial Statements For The Year Ended December 31Something ChicNo ratings yet

- Reviewer Acc111Document5 pagesReviewer Acc111Desiree Nicole ReyesNo ratings yet

- AC 3101 Discussion ProblemDocument1 pageAC 3101 Discussion ProblemYohann Leonard HuanNo ratings yet

- Donors Tax DWCLDocument6 pagesDonors Tax DWCLKyle Jezrel GimaoNo ratings yet

- Auditing Practice Problem 6Document2 pagesAuditing Practice Problem 6Jessa Gay Cartagena TorresNo ratings yet

- VI. 80% Owned-Subsidiary: Cost Model - Full Goodwill Approach Downstream and Upstream of Property, Unrealized Gain and Realized Gain On SaleDocument3 pagesVI. 80% Owned-Subsidiary: Cost Model - Full Goodwill Approach Downstream and Upstream of Property, Unrealized Gain and Realized Gain On SaleMa'arifa HussainNo ratings yet

- Assurance Principles MT Quiz 1 and 2 FinalDocument13 pagesAssurance Principles MT Quiz 1 and 2 FinalSunshineNo ratings yet

- Quiz No. 2Document5 pagesQuiz No. 2VernnNo ratings yet

- Intermediate Acctg A 1 10Document10 pagesIntermediate Acctg A 1 10Leonila RiveraNo ratings yet

- FranchisingDocument10 pagesFranchisingKRABBYPATTY PHNo ratings yet

- Problem 7-1: True or False False: Fact PatternDocument6 pagesProblem 7-1: True or False False: Fact Patternrichmond naragNo ratings yet

- Internal Control Measures: Page 1 of 7Document7 pagesInternal Control Measures: Page 1 of 7Lucy HeartfiliaNo ratings yet

- ANSWER KEY AUDITING THEORY (3rd Edition-2009)Document2 pagesANSWER KEY AUDITING THEORY (3rd Edition-2009)Mary FlorNo ratings yet

- Chapter 4 SalosagcolDocument3 pagesChapter 4 SalosagcolElvie Abulencia-BagsicNo ratings yet

- Midterm Exam AST With AnswersDocument15 pagesMidterm Exam AST With AnswersJames CantorneNo ratings yet

- Problem 1Document4 pagesProblem 1Live LoveNo ratings yet

- Accounting For Special Transactions - Semi FinalsDocument4 pagesAccounting For Special Transactions - Semi FinalsKarlo PalerNo ratings yet

- Chapter 3Document11 pagesChapter 3Christlyn Joy BaralNo ratings yet

- AccountingDocument3 pagesAccountingrenoNo ratings yet

- Jamolod - Unit 1 - General Features of Financial StatementDocument8 pagesJamolod - Unit 1 - General Features of Financial StatementJatha JamolodNo ratings yet

- Chapter 1-4 Review QuestionsDocument24 pagesChapter 1-4 Review QuestionsSophia JunelleNo ratings yet

- CHAPTER 8 - Audit of Liabilities: Problem 1Document27 pagesCHAPTER 8 - Audit of Liabilities: Problem 1Mikaela Gale CatabayNo ratings yet

- AlagangWency - Partnersip Dissolution Short QuizDocument1 pageAlagangWency - Partnersip Dissolution Short QuizKristian Paolo De LunaNo ratings yet

- Group Quizbowl FormattedDocument17 pagesGroup Quizbowl FormattedSarah BalisacanNo ratings yet

- Calculation For Liquidation Value at Closure Date Is Somewhat Like The Book Value CalculationDocument3 pagesCalculation For Liquidation Value at Closure Date Is Somewhat Like The Book Value CalculationALYZA ANGELA ORNEDONo ratings yet

- Z 5Document8 pagesZ 5Helios HexNo ratings yet

- Partnership FormationDocument13 pagesPartnership FormationGround ZeroNo ratings yet

- Acctg Ats1Document2 pagesAcctg Ats1Christian N MagsinoNo ratings yet

- FARAP-4516Document10 pagesFARAP-4516Accounting StuffNo ratings yet

- 2.3.1 Financial Statement PresentationDocument10 pages2.3.1 Financial Statement PresentationRichard Jr RjNo ratings yet

- NAS 1: Presentation of Financial Statements: Prepared By: CA Anish GyawaliDocument22 pagesNAS 1: Presentation of Financial Statements: Prepared By: CA Anish GyawaliSujit DasNo ratings yet

- Chapter 14 Financial StatementsDocument12 pagesChapter 14 Financial Statementsmaria isabella100% (1)

- Muscle Relaxants Mcqs ExplainedDocument2 pagesMuscle Relaxants Mcqs ExplainedGwyneth CartallaNo ratings yet

- AP-100 (Audit of Shareholders' Equity)Document8 pagesAP-100 (Audit of Shareholders' Equity)Gwyneth CartallaNo ratings yet

- Case StudyDocument3 pagesCase StudyGwyneth CartallaNo ratings yet

- Ointment Cream and GelsDocument79 pagesOintment Cream and GelsGwyneth Cartalla100% (2)

- Sample MAS (Absorption & Variable Costing With Pricing Decision)Document6 pagesSample MAS (Absorption & Variable Costing With Pricing Decision)Gwyneth CartallaNo ratings yet

- Risk Management Plan TemplateDocument4 pagesRisk Management Plan TemplateGwyneth CartallaNo ratings yet

- Microenvironment Chronic Inflammation Oxygen Free Radicals: Nat GenetDocument6 pagesMicroenvironment Chronic Inflammation Oxygen Free Radicals: Nat GenetGwyneth Cartalla100% (1)

- Anticoagulants, ACE InhibitorsDocument2 pagesAnticoagulants, ACE InhibitorsGwyneth CartallaNo ratings yet

- Alkaline Phosphatase - Physiology and PropertiesDocument2 pagesAlkaline Phosphatase - Physiology and PropertiesGwyneth CartallaNo ratings yet

- The Effect of ObsessiveDocument5 pagesThe Effect of ObsessiveGwyneth CartallaNo ratings yet

- Abc-Case Study-Part 2 1Document26 pagesAbc-Case Study-Part 2 1Danny ClintonNo ratings yet

- Liquid CultureDocument16 pagesLiquid CultureDolly BadlaniNo ratings yet

- Project Report On Comparative Analysis of Public and Private Sector Steel Companies in IndiaDocument57 pagesProject Report On Comparative Analysis of Public and Private Sector Steel Companies in IndiaDharminder KumarNo ratings yet

- CBC Blue Book: Market ReviewDocument36 pagesCBC Blue Book: Market ReviewColdwell Banker CommercialNo ratings yet

- Money Market Interest RatesDocument4 pagesMoney Market Interest RatesTeffi Boyer MontoyaNo ratings yet

- Financial Accounting: Theory and Analysis: Text and CasesDocument69 pagesFinancial Accounting: Theory and Analysis: Text and CasesgabiNo ratings yet

- CAT Owning PDFDocument54 pagesCAT Owning PDFErick Del Pino HurtadoNo ratings yet

- Flujo TXD InternationalDocument4,278 pagesFlujo TXD InternationalhackingmexicoNo ratings yet

- Case Study One CapitecDocument10 pagesCase Study One Capitecstanely ndlovuNo ratings yet

- Group-Project FIN410 Section 5 Group-3Document33 pagesGroup-Project FIN410 Section 5 Group-3Nahida Akter JannatNo ratings yet

- Fundamental Analysis of Axis and ICICI BankDocument18 pagesFundamental Analysis of Axis and ICICI BankAnu100% (2)

- 2 Financial Accounting ReportingDocument5 pages2 Financial Accounting ReportingBizness Zenius HantNo ratings yet

- In Re: Qmect, Inc. - Document No. 6Document2 pagesIn Re: Qmect, Inc. - Document No. 6Justia.comNo ratings yet

- Financial Performance Evaluation Using RATIO ANALYSISDocument31 pagesFinancial Performance Evaluation Using RATIO ANALYSISGurvinder Arora100% (1)

- ID22 Financial PresentationDocument48 pagesID22 Financial PresentationRISHAV BAIDNo ratings yet

- Responsive Document - CREW: Department of Education: Regarding For-Profit Education: 8/16/201111-00026-F (Ginns Redactions2) (PART 3)Document500 pagesResponsive Document - CREW: Department of Education: Regarding For-Profit Education: 8/16/201111-00026-F (Ginns Redactions2) (PART 3)CREWNo ratings yet

- Topic 2 Case StudiesDocument20 pagesTopic 2 Case StudiesEricKang100% (1)

- The Japanese Challenge To The American Neoliberal World Order Identity Meaning and Foreign Policy PDFDocument151 pagesThe Japanese Challenge To The American Neoliberal World Order Identity Meaning and Foreign Policy PDFJazmin DuarteNo ratings yet

- Ebook PDF Corporate Finance A Focused Approach 7th Edition PDFDocument41 pagesEbook PDF Corporate Finance A Focused Approach 7th Edition PDFjennifer.browne345100% (36)

- Cash Flow - Turtorial 8Document33 pagesCash Flow - Turtorial 8Kevin ChandraNo ratings yet

- CIR v. Mindanao SanitariumDocument30 pagesCIR v. Mindanao SanitariumEmary GutierrezNo ratings yet

- Properties of High Frequency DAX Returns Intraday Patterns, Philippe MassetDocument28 pagesProperties of High Frequency DAX Returns Intraday Patterns, Philippe MassetDigito DunkeyNo ratings yet

- Bluehouse Capital - Property XpressDocument4 pagesBluehouse Capital - Property XpressProperty XpressNo ratings yet

- ICICI Bank Ltd. Versus Official Liquidator of APS StarDocument17 pagesICICI Bank Ltd. Versus Official Liquidator of APS StarAman Kumar YadavNo ratings yet

- Eastboro Machine Tools CorporationDocument32 pagesEastboro Machine Tools Corporationrifki100% (2)

- Beiersdorf AG 2019 Annual Financial Statements PDFDocument40 pagesBeiersdorf AG 2019 Annual Financial Statements PDFPotato ChanNo ratings yet

- Kangra Central Cooperative Bank Report 2016-17 Pankajrana209@Document54 pagesKangra Central Cooperative Bank Report 2016-17 Pankajrana209@pankaj91% (11)

- CW3 AppDocument2 pagesCW3 AppSamir IsmailNo ratings yet

- Social Responsibility and Financial Performance - The Role of Good Corporate GovernanceDocument15 pagesSocial Responsibility and Financial Performance - The Role of Good Corporate GovernanceRiyan Ramadhan100% (1)

- Accounting CycleDocument16 pagesAccounting CycleBekanaNo ratings yet