Professional Documents

Culture Documents

Lesson 1 Test

Uploaded by

Aayush Patel0 ratings0% found this document useful (0 votes)

23 views3 pagesThis document contains details of an accounting exam for class 12 including sections on partnership accounts. Section A contains 5 multiple choice questions about topics like interest on partner's loan and drawings. Section B contains 10 short answer questions about topics like methods to maintain capital accounts and definitions related to partnerships. Section C contains 5 long answer/numerical questions involving calculation of partner's shares and profits based on given profit-sharing ratios and other financial details of partnerships.

Original Description:

Original Title

LESSON 1 TEST-converted

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains details of an accounting exam for class 12 including sections on partnership accounts. Section A contains 5 multiple choice questions about topics like interest on partner's loan and drawings. Section B contains 10 short answer questions about topics like methods to maintain capital accounts and definitions related to partnerships. Section C contains 5 long answer/numerical questions involving calculation of partner's shares and profits based on given profit-sharing ratios and other financial details of partnerships.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

23 views3 pagesLesson 1 Test

Uploaded by

Aayush PatelThis document contains details of an accounting exam for class 12 including sections on partnership accounts. Section A contains 5 multiple choice questions about topics like interest on partner's loan and drawings. Section B contains 10 short answer questions about topics like methods to maintain capital accounts and definitions related to partnerships. Section C contains 5 long answer/numerical questions involving calculation of partner's shares and profits based on given profit-sharing ratios and other financial details of partnerships.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

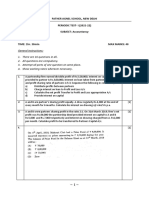

MEHUL SIR’S

MO: 98 245 98 542 GROUP OF EDUCATION

STD: 12 MARKS: 45

SUBJECT: ACCOUNTANCY - PARTNERSHIP ACCOUNTS

DURATION: 90 MINUTES

SECTION: A Choose the correct option from the given. [Each 1 marks] [5]

(1) What is interest on loan of partner for partner?

(a) Expenses (b) Income (c) Assets (d) Receivable

(2) What is interest on debit balance of current account of partner for firm?

(a) Receivable (b) Reserve (c) Assets (d) Liabilities

(3) The capital to be brought in by the partners in the firm is determined by

______________.

(a) Partnership Agreement (b) Partnership Deed

(c) a & b both (d) none of this

(4) In which year partnership act arise?

(a) 1947 (b) 1923 (c) 1932 (d) 1954

(5) If the current account has a credit balance it is shown on which side?

(a) Debit side of P & L appropriation account (b) assets

(c) Credit side of P & L appropriation account (d) Liabilities

SECTION: B Answer the following question. [Each 1 marks] [10]

(6)Write the name of method to keep Capital Account in Partnership.

(7) How many partners are there in Non Banking Partnership?

(6) Write journal of closing of Drawings account at the end of the year?

(9) Write the main object for preparation of Partnership Deed.

(10)Write the definition of partnership according to partnership law.

(11)When partner’s capital accounts & current accounts are separately

maintained, than interests on partner’s drawings are debited to which account?

(12) It is desirable that an agreement between the partners should be in writing.

True OR False. Explain.

(13)Amul & Sumul share profit & loss in the ratio of 3:2. If the profit of the firm at

the end of the year is Rs.50000 than what will be the share of each partner?

(14) If in partnership firm partner A withdraw same amount at the starting of the

month from 1st May His total withdrawal is Rs.8000 & firm obey the calendar year

than what will be the interest on drawings?

(15)Is a partner entitled to salary as per partnership deed, even if the firm has

suffered a loss?

SECTION: C Answer the following question. [ EACH 3 MARKS] [30]

(16) Palak, Mehul & Kiran are partners sharing profits and losses in the ratio of

3:2:1. Their capitals in 31st march, 2015, were Rs.80, 000, Rs. 60,000 & Rs.

50,000 after distributing profit. It was found after preparing accounts that interest

MEHUL SIR’S GROUP OF EDUCATION MOBILE: 98 245 98 542

on capital at 5% was omitted. The profit for the year was Rs.50, 000 and Partner’s

drawings were Rs.5, 000, Rs.10, 000 & RS. 5,000 respectively.

(17)DEvarsh, Vedanshi, & Raxa are partner sharing profits and losses in the ratio

of 5:3:2. After preparing accounts at the close of the year, it was found that

interest n drawings as given below have been omitted.

Devarsh Rs, 5000 Vedanshi Rs. 4000 Raxa Rs. 3000

Give the adjustment entry.

(18)Mohit & Suraj are partners of one firm. Ratio of their capital is 5:4. Mohit gets

Rs. 3,000 as monthly salary and commission after deducting commission from net

profit at 6%. If the firm gets profit of Rs. 1, 42,000 at the end of the year than what

is received by Mohit.

(19) Pankaj, Hardik, Akshit are partner sharing profit & loss equally. Their total

capital is Rs. 4, 00,000. The ratio of their capitals is 2:3:5. Firm allows interest at

6% p.a. on capitals. Pankaj has received Rs. 1, 24,800 including the interest on

capital, what will be the amount received by partner Akshit including interest on

capital.

(20) Mankad & Machchhar is partners in a firm. Mankad withdraw Rs.4000 from

the firm on the first day of every month. While Machchhar withdraw Rs. 4000 on

the last day of every month. Find the difference in the interest at 12 % on the

drawings of both.

(21)Prayag, Jaishil & Viraj are partners in a partnership firm. They share profit and

loss in the ratio of 3:2:1. Their capital is Rs. 10,000, Rs. 20,000 and Rs. 30,000

respectively. They receive 10% interest on their capital. Partners received from

profit including interest, total Rs. 4,000. Find out total profit of the firm.

(22)Vijay, Dhvani and Mehul are partners sharing Profit – loss in the ratio of 2:2:1.

Mehul is to be paid a commission of 10% on the remaining profit after charging

such commission. Total Profit of the firm was Rs. 44000. Find out what total

income will be received by mehul?

(23)Write short note on Partnership Deed.

(24) Write difference between Profit & Loss Account – Profit & loss appropriation

Account.

(25)Atpatia, Khatpatia and Zatpatia share profit and losses in the ratio of 3:2:1.

Khatpatia gets commission at 5% on profit after deducting the commission. If

Khatpatia gets Rs.8000 as commission, find out the profit of firm before charging

commission and also find out the share of Zatpatia in profit.

You might also like

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- SBSA Statement 2023-01-09Document39 pagesSBSA Statement 2023-01-09Maestro ProsperNo ratings yet

- CH 2 MCQ Acc.Document13 pagesCH 2 MCQ Acc.abiNo ratings yet

- Revision Worksheet 1Document2 pagesRevision Worksheet 1Mayank DuhalniNo ratings yet

- Account Part 1 CH 1Document4 pagesAccount Part 1 CH 1Aayush PatelNo ratings yet

- Practice Questions On Partnership BusinessDocument4 pagesPractice Questions On Partnership BusinessBamidele AdegboyeNo ratings yet

- CH 2 MCQ Acc.Document13 pagesCH 2 MCQ Acc.Amit GuptaNo ratings yet

- 5280MCQ DK GoalDocument285 pages5280MCQ DK GoalVAIBHAV BADOLANo ratings yet

- Part-1 Chapter-1 TestDocument1 pagePart-1 Chapter-1 Testsuhan CharaniaNo ratings yet

- Revision Fundamentals 1Document7 pagesRevision Fundamentals 1LexNo ratings yet

- Wa0011.Document6 pagesWa0011.Pieck AckermannNo ratings yet

- Class XII Accounts Set 4Document7 pagesClass XII Accounts Set 4HTML Learning HubNo ratings yet

- Jairam Higher Secondary School, Salem-8 Quarterly Examination-2020-2021 Class: Xii Accountancy MARKS: 90 DATE: 16.10.2020 TIME: 2 Hrs I. Choose The Correct Answer: (20 X 1 20)Document6 pagesJairam Higher Secondary School, Salem-8 Quarterly Examination-2020-2021 Class: Xii Accountancy MARKS: 90 DATE: 16.10.2020 TIME: 2 Hrs I. Choose The Correct Answer: (20 X 1 20)ShruthikaNo ratings yet

- 12 Accountancy Ch01 Test Paper 01 Profit and Loss AppropriationDocument3 pages12 Accountancy Ch01 Test Paper 01 Profit and Loss AppropriationHari SharmaNo ratings yet

- ACC Assignment Questions Extra PractiseDocument20 pagesACC Assignment Questions Extra Practisesikeee.exeNo ratings yet

- 28 07 2023 - 344571Document4 pages28 07 2023 - 344571Boda TanviNo ratings yet

- Partnership AccountingDocument21 pagesPartnership AccountingTharun P.Mu.No ratings yet

- New AccountsDocument26 pagesNew AccountsStudyNo ratings yet

- 457712th MCQ Test 29-1-2019Document6 pages457712th MCQ Test 29-1-2019MohitTagotraNo ratings yet

- STD: 12 First Term MARKS:100 Subject: Accounts Duration:3 HrsDocument4 pagesSTD: 12 First Term MARKS:100 Subject: Accounts Duration:3 HrsAayush PatelNo ratings yet

- Partnership FundamentalsDocument5 pagesPartnership Fundamentalsdiyadhannawat06No ratings yet

- 12 - Acc - Ch2 - Learning FeedbackDocument2 pages12 - Acc - Ch2 - Learning FeedbackSHAH SHREYANo ratings yet

- Accountancy MCQs For Class 12 With Answers Chapter 1 Accounting For Partnership Firms - Fundamentals - NCERT BooksDocument34 pagesAccountancy MCQs For Class 12 With Answers Chapter 1 Accounting For Partnership Firms - Fundamentals - NCERT Booksbabaaijaz01No ratings yet

- Accounting Daily Test 04Document8 pagesAccounting Daily Test 04theprintconerNo ratings yet

- Chapter 1Document67 pagesChapter 1income taxNo ratings yet

- Quiz 2 Lesson 3Document5 pagesQuiz 2 Lesson 3Andreau Granada0% (1)

- 1 TEST, 2020-21 Class: Xii AccountancyDocument1 page1 TEST, 2020-21 Class: Xii AccountancyKul DeepNo ratings yet

- Ultimate Sample Paper 4Document16 pagesUltimate Sample Paper 4Subhamita DasNo ratings yet

- Accountancy Final (R) XIIDocument55 pagesAccountancy Final (R) XIIKavin .DNo ratings yet

- Kerala Sahodaya CME Acc (055) QP & MS Set 1 (23-24)Document30 pagesKerala Sahodaya CME Acc (055) QP & MS Set 1 (23-24)SIBINo ratings yet

- Fundamental of PartnershipDocument28 pagesFundamental of Partnershipincome taxNo ratings yet

- 68588e0f-f729-4e81-840c-aa4ab1fe0356Document3 pages68588e0f-f729-4e81-840c-aa4ab1fe0356ATHARVA GHORPADENo ratings yet

- Paper For Term-1 2020-21 For Accountancy Xii PDFDocument11 pagesPaper For Term-1 2020-21 For Accountancy Xii PDFPrashil AgrawalNo ratings yet

- L2 - Accounting For Partnership FirmsDocument11 pagesL2 - Accounting For Partnership FirmsMary JaineNo ratings yet

- Class Test Fundamentals and Goodwill Set A 01.05.2023 1Document2 pagesClass Test Fundamentals and Goodwill Set A 01.05.2023 1ANTECNo ratings yet

- RA1 AccountsPDFDocument2 pagesRA1 AccountsPDFAnshita KohliNo ratings yet

- Partnership Fundamentals - Worksheet NewDocument6 pagesPartnership Fundamentals - Worksheet NewChristo RajanNo ratings yet

- Fundamentals 2024 PDF SPCCDocument82 pagesFundamentals 2024 PDF SPCCJeetalal GadaNo ratings yet

- 591617884861 (1)Document9 pages591617884861 (1)YashviNo ratings yet

- RKG Imp Q (CH 1 & 2) DoneDocument3 pagesRKG Imp Q (CH 1 & 2) Donepriyanshi.bansal25No ratings yet

- Class XII ACCOUNTANCY ASSIGNMENTDocument3 pagesClass XII ACCOUNTANCY ASSIGNMENTTvisha DhingraNo ratings yet

- 12th AccountsDocument6 pages12th AccountsHarjinder SinghNo ratings yet

- Account Ch-1 Partnership Firm - FundamentalsDocument3 pagesAccount Ch-1 Partnership Firm - Fundamentalsapsonline8585No ratings yet

- Partnership Fundamental 12 (2023)Document3 pagesPartnership Fundamental 12 (2023)Hansika SahuNo ratings yet

- General Instructions:: Class: XII Max. Marks: 30 Date: 13-08-2021 Time: 1 HourDocument3 pagesGeneral Instructions:: Class: XII Max. Marks: 30 Date: 13-08-2021 Time: 1 HourDANESH RICHARDNo ratings yet

- 12 Cbse Accountancy Set 1 QPDocument12 pages12 Cbse Accountancy Set 1 QPAymenNo ratings yet

- Accountancy PB 1 Mock Test PaperDocument10 pagesAccountancy PB 1 Mock Test PaperUjwal Anish ReddyNo ratings yet

- Accountancy Question BankDocument146 pagesAccountancy Question BankSiddhi Jain100% (1)

- Father Agnel School, New Delhi PERIODIC TEST-I (2021-22) SUBJECT: Accountancy Class: Xii TIME: 1hr. 30min Max Marks: 40Document4 pagesFather Agnel School, New Delhi PERIODIC TEST-I (2021-22) SUBJECT: Accountancy Class: Xii TIME: 1hr. 30min Max Marks: 40fffffNo ratings yet

- Xii PB 2023 Acct QP 16112023Document9 pagesXii PB 2023 Acct QP 16112023NARESH KUMARNo ratings yet

- Delhi Public School: ACCOUNTANCY - (Subject Code: 055)Document4 pagesDelhi Public School: ACCOUNTANCY - (Subject Code: 055)AbhishekNo ratings yet

- Partnership Fundamentals - WorksheetDocument7 pagesPartnership Fundamentals - WorksheetMihika GunturNo ratings yet

- Class 12 Mock Test AccountancyDocument13 pagesClass 12 Mock Test AccountancyLPS ANJALI SHARMANo ratings yet

- +2-Accountancy-1-2-3-5-Mark Theory Material-Em-2023Document34 pages+2-Accountancy-1-2-3-5-Mark Theory Material-Em-2023saravanan.ma0611No ratings yet

- Class XII Accountancy Paper For Half Yearly PDFDocument13 pagesClass XII Accountancy Paper For Half Yearly PDFJoshi DrcpNo ratings yet

- Question No. 1 To 20 1marksDocument3 pagesQuestion No. 1 To 20 1markssameeksha kosariaNo ratings yet

- SAMPLE PAPER-4 (Solved) Accountancy Class - XII: General InstructionsDocument5 pagesSAMPLE PAPER-4 (Solved) Accountancy Class - XII: General InstructionsDeepakPhalkeNo ratings yet

- Rbse Class 12 Accountancy Question Paper 2020Document10 pagesRbse Class 12 Accountancy Question Paper 2020rajwanikajal24No ratings yet

- Accounts First Term Grade 12Document5 pagesAccounts First Term Grade 12NivpreeNo ratings yet

- Accountancy Model Unit Test - 2Document7 pagesAccountancy Model Unit Test - 2Raaja YoganNo ratings yet

- Accounting For Partnership FirmDocument11 pagesAccounting For Partnership FirmNeha AhilaniNo ratings yet

- Chapter-2 Principles of ManagementDocument10 pagesChapter-2 Principles of ManagementAayush PatelNo ratings yet

- STD-12, Eco-Ch-1Document11 pagesSTD-12, Eco-Ch-1Aayush PatelNo ratings yet

- Chapter-2 Indicators of Growth & Development: TopicsDocument12 pagesChapter-2 Indicators of Growth & Development: TopicsAayush PatelNo ratings yet

- STD: 12 First Term MARKS:100 Subject: Accounts Duration:3 HrsDocument4 pagesSTD: 12 First Term MARKS:100 Subject: Accounts Duration:3 HrsAayush PatelNo ratings yet

- Lesson 1 To 5-1Document3 pagesLesson 1 To 5-1Aayush PatelNo ratings yet

- Direct Indirect ExerciseDocument5 pagesDirect Indirect ExerciseAayush PatelNo ratings yet

- Industrial Internship Report ON Fundamental Analysis of Indian Steel IndustryDocument60 pagesIndustrial Internship Report ON Fundamental Analysis of Indian Steel IndustryAayush PatelNo ratings yet

- 12stats Chap1 Sec F 2Document12 pages12stats Chap1 Sec F 2Aayush PatelNo ratings yet

- Chapter-1 Nature and Significance of ManagementDocument15 pagesChapter-1 Nature and Significance of ManagementAayush PatelNo ratings yet

- 12 Stats 1.3-1Document11 pages12 Stats 1.3-1Aayush PatelNo ratings yet

- Cllla Oblained: Ba PT Middle ,. - Dunp Livina Ya, 201S Ya, 2013 Fmdina TR Ya, 2011 1s.ooo P Ya, 201SDocument12 pagesCllla Oblained: Ba PT Middle ,. - Dunp Livina Ya, 201S Ya, 2013 Fmdina TR Ya, 2011 1s.ooo P Ya, 201SAayush PatelNo ratings yet

- Advertising Agency Business PlanDocument60 pagesAdvertising Agency Business Plananish rahmanNo ratings yet

- Statement of Account 156621012845061595Document7 pagesStatement of Account 156621012845061595fineboi321No ratings yet

- Advance Accounting Installment Sales Manual MillanDocument14 pagesAdvance Accounting Installment Sales Manual MillanHades AcheronNo ratings yet

- Equity Analysis and Valuation: AnalyzeDocument13 pagesEquity Analysis and Valuation: AnalyzeElfrida YulianaNo ratings yet

- Understanding GAAP - AccountingDocument9 pagesUnderstanding GAAP - Accountingshanu104100% (1)

- Its Earning That Count SummaryDocument115 pagesIts Earning That Count SummaryTheda VeldaNo ratings yet

- Exam 1 - QuestionsDocument89 pagesExam 1 - QuestionsTSZ YING CHAUNo ratings yet

- Daily Report 726 02-09-2021Document156 pagesDaily Report 726 02-09-2021jay ResearchNo ratings yet

- Unit 9 SharesDocument39 pagesUnit 9 Shareskonica chhotwaniNo ratings yet

- Restaurant Brands International: Investment BriefDocument4 pagesRestaurant Brands International: Investment BriefrickescherNo ratings yet

- MAF653 TEST 1 NOV 2022 QuestionDocument11 pagesMAF653 TEST 1 NOV 2022 QuestionAyunieazahaNo ratings yet

- Kelompok 3 - Teori Akuntansi PositifDocument17 pagesKelompok 3 - Teori Akuntansi PositifanrassNo ratings yet

- Tybaf Sem5 Fm-Ii Nov18Document5 pagesTybaf Sem5 Fm-Ii Nov18rizwan hasmiNo ratings yet

- Bank ReconciliationDocument3 pagesBank ReconciliationBianca Jane GaayonNo ratings yet

- Securities Regulation Code CA51025 PDFDocument31 pagesSecurities Regulation Code CA51025 PDFKiana FernandezNo ratings yet

- Par Cor Quizzes Soln Pca 2019Document27 pagesPar Cor Quizzes Soln Pca 2019mariellec907No ratings yet

- Investments 3Document5 pagesInvestments 3Marinel AbrilNo ratings yet

- Accounting Equation and Debit and Credit Rules PDFDocument5 pagesAccounting Equation and Debit and Credit Rules PDFوجد ميانNo ratings yet

- Problem 27Document3 pagesProblem 27Jhon Paul BalabaNo ratings yet

- Aaca Receivables and Sales ReviewerDocument13 pagesAaca Receivables and Sales ReviewerLiberty NovaNo ratings yet

- Special Purpose Books - II (Non-Cash) : Pradeep Varmecha / Accountancy / Xi / 9425104917Document20 pagesSpecial Purpose Books - II (Non-Cash) : Pradeep Varmecha / Accountancy / Xi / 9425104917Archana KongeNo ratings yet

- Pfrs 13 Fair Value MeasurementDocument22 pagesPfrs 13 Fair Value MeasurementShane PasayloNo ratings yet

- Ipo DocumentDocument16 pagesIpo Documentalan ruzarioNo ratings yet

- Income Taxation Solution Manual 2019 Ed 2Document40 pagesIncome Taxation Solution Manual 2019 Ed 2Alexander DimaliposNo ratings yet

- Chapter 3 Comp. ProblemsDocument9 pagesChapter 3 Comp. ProblemsIrish Gracielle Dela CruzNo ratings yet

- TB Understanding Financial Statements 11ge Lyn M. FraserDocument85 pagesTB Understanding Financial Statements 11ge Lyn M. Fraseremanmamdouh596No ratings yet

- Meaning & Characteristics of A CompanyDocument19 pagesMeaning & Characteristics of A Companysakshi100% (2)

- Ambani Organics Limited Annual Report 2017-2018Document83 pagesAmbani Organics Limited Annual Report 2017-2018shark123No ratings yet

- Commercial BQSDocument47 pagesCommercial BQSStefhanie Khristine PormanesNo ratings yet