Professional Documents

Culture Documents

Part-1 Chapter-1 Test

Part-1 Chapter-1 Test

Uploaded by

suhan Charania0 ratings0% found this document useful (0 votes)

13 views1 pageThis document contains a practice test for the Elements of Accountancy chapter on partnerships. It includes 15 multiple choice and short answer questions testing concepts like interest on partners' capital, treatment of drawings, profit sharing ratios, and rectifying errors in capital account interest. It also provides 3 word problems to solve involving calculation of partners' shares of profit based on given profit sharing ratios and amounts, as well as journal entries to rectify errors in charging interest on partners' capital. The document aims to help students prepare for an upcoming test on the key concepts of partnerships.

Original Description:

Chemistry

Original Title

Part-1 Chapter-1 Test_e9919932-68df-4cf5-a1f9-e2f2419c42d3

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains a practice test for the Elements of Accountancy chapter on partnerships. It includes 15 multiple choice and short answer questions testing concepts like interest on partners' capital, treatment of drawings, profit sharing ratios, and rectifying errors in capital account interest. It also provides 3 word problems to solve involving calculation of partners' shares of profit based on given profit sharing ratios and amounts, as well as journal entries to rectify errors in charging interest on partners' capital. The document aims to help students prepare for an upcoming test on the key concepts of partnerships.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

13 views1 pagePart-1 Chapter-1 Test

Part-1 Chapter-1 Test

Uploaded by

suhan CharaniaThis document contains a practice test for the Elements of Accountancy chapter on partnerships. It includes 15 multiple choice and short answer questions testing concepts like interest on partners' capital, treatment of drawings, profit sharing ratios, and rectifying errors in capital account interest. It also provides 3 word problems to solve involving calculation of partners' shares of profit based on given profit sharing ratios and amounts, as well as journal entries to rectify errors in charging interest on partners' capital. The document aims to help students prepare for an upcoming test on the key concepts of partnerships.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

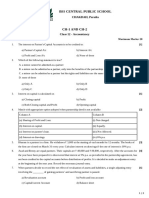

GAUTAM CLASSES

Std: XII (GSEB) Sub: Elements of Accountancy Chap- 1 [Part-1]

Date: 03-01-22 January Class Test Marks: 25

Select appropriate option for each question: [05]

1) What is the interest on partners’ capital for a partner?

[a] An expense [b] Income [c] Liability [d] Loss

2) At the end of the year where will you transfer drawings account, in fixed capital account method?

[a] To capital account [b] To current account

[c] To profit and loss account [d] To profit and loss appropriation account

3) How would you consider the interest on debit balance of partners’ current account for firm?

[a] An expense [b] Liability [c] Income [d] Loss

4) What percentage of interest will be paid when no provision is made pertaining to interest on

capital in the partnership deed?

[a] 6% [b] 12% [c] 9% [d] No interest

5) The capital proportion of A, B and C is 3:2:1 respectively. The divisible profit is ₹ 66000.

What will be the amount of profit of C?

[a] ₹11,000 [b] ₹22,000 [c] ₹33,000 [d] ₹66,000

Answer the following in one sentence: [05]

6) What is partnership?

7) What is maximum and minimum limit of partners to constitute a partnership firm?

8) What is the partnership deed for a firm?

9) Profit of a partner is credited to which account under fixed capital account method?

10) Profit and loss appropriation account is a part of which account?

Solve the following: [15]

11) Sheela, Surbhi and Seema are partners sharing profit-loss in the ratio of 5:7:9. Manager Sanket is

entitled to receive 10% commission from profit after deduction of his such commission. Surbhi

receives share profit ₹7000. Determine the amount of commission of Sanket. Also determine

amount of profit before the commission of manager.

12) Ram, Laxman and Sita are partners of a firm. On 1-4-2016 their capital was ₹40,000, ₹30,000 and

₹80000 respectively. At the end of the year after distribution of profit it was realised that

charging of interest on capital 12% is missed out. Write journal entry for rectification.

13) The profit-loss sharing ratio of Rajkumar, Kaushik and Sharma is 15:10:9. The total profit of the

year of firm is ₹68,000. Determine the share in profit of each partner.

14) Ram, Rahim and Ishu are partners of a partnership firm. Their capital as on 1-4-2016 was ₹60,000,

₹40,000 and ₹50,000 respectively. After the distribution of the profit of the year, it was realised

that charging of 6% interest on partners’ capital accounts was missed out. Write an entry

for the rectification of error.

15) The closing capital of Raghuvir is ₹80,000. In which ₹12,500 drawings of current year profit of

₹17,800 are recorded. What will be the interest at 6% p.a. on the opening capital?

Best of Luck

You might also like

- EMS & OHSMS Internal Audit ChecklistDocument44 pagesEMS & OHSMS Internal Audit ChecklistRaajha Munibathiran92% (13)

- Path To PurchaseDocument2 pagesPath To Purchasedanny lastNo ratings yet

- Kuis-Kuis MANPRODocument52 pagesKuis-Kuis MANPROMiranda CahayaNo ratings yet

- Gls University Faculty of Commerce Sub: Advanced Corporate Account - 2 Objective Questions (17-18) Unit:-Accounts of Banking CompaniesDocument11 pagesGls University Faculty of Commerce Sub: Advanced Corporate Account - 2 Objective Questions (17-18) Unit:-Accounts of Banking Companiessumathi psgcas0% (1)

- Project CharterDocument4 pagesProject CharteraroojNo ratings yet

- Lesson 1 TestDocument3 pagesLesson 1 TestAayush PatelNo ratings yet

- M.M 80 Accounts 12thDocument7 pagesM.M 80 Accounts 12thjashanjeetNo ratings yet

- Partnership Fundamentals - Worksheet NewDocument6 pagesPartnership Fundamentals - Worksheet NewChristo RajanNo ratings yet

- Ultimate Sample Paper 4Document16 pagesUltimate Sample Paper 4Subhamita DasNo ratings yet

- STD: 12 First Term MARKS:100 Subject: Accounts Duration:3 HrsDocument4 pagesSTD: 12 First Term MARKS:100 Subject: Accounts Duration:3 HrsAayush PatelNo ratings yet

- CH 2 MCQ Acc.Document13 pagesCH 2 MCQ Acc.abiNo ratings yet

- Revision Worksheet 1Document2 pagesRevision Worksheet 1Mayank DuhalniNo ratings yet

- CH 2 MCQ Acc.Document13 pagesCH 2 MCQ Acc.Amit GuptaNo ratings yet

- Test-chapter-1-Accountancy 12Document5 pagesTest-chapter-1-Accountancy 12Umesh JaiswalNo ratings yet

- Accountancy Final (R) XIIDocument55 pagesAccountancy Final (R) XIIKavin .DNo ratings yet

- RKG Imp Q (CH 1 & 2) DoneDocument3 pagesRKG Imp Q (CH 1 & 2) Donepriyanshi.bansal25No ratings yet

- Partnership FundamentalsDocument5 pagesPartnership Fundamentalsdiyadhannawat06No ratings yet

- MCQ Fundamentals Chapter 1Document2 pagesMCQ Fundamentals Chapter 1navyanigam11No ratings yet

- Kerala Sahodaya CME Acc (055) QP & MS Set 1 (23-24)Document30 pagesKerala Sahodaya CME Acc (055) QP & MS Set 1 (23-24)SIBINo ratings yet

- Accountancy XIIDocument6 pagesAccountancy XIIGurmehar KaurNo ratings yet

- Ultimate Sample Paper 2Document22 pagesUltimate Sample Paper 2Tûshar ThakúrNo ratings yet

- 5280MCQ DK GoalDocument285 pages5280MCQ DK GoalVAIBHAV BADOLANo ratings yet

- ACCOUNTS Specimen For ISCDocument15 pagesACCOUNTS Specimen For ISCStudy HelpNo ratings yet

- 10065CBSE Guess Paper 2022-23Document8 pages10065CBSE Guess Paper 2022-23Dhriti KarnaniNo ratings yet

- Chapter 1Document67 pagesChapter 1income taxNo ratings yet

- Acct Q 20 Marks BSSDocument2 pagesAcct Q 20 Marks BSSPapia SenNo ratings yet

- Jairam Higher Secondary School, Salem-8 Quarterly Examination-2020-2021 Class: Xii Accountancy MARKS: 90 DATE: 16.10.2020 TIME: 2 Hrs I. Choose The Correct Answer: (20 X 1 20)Document6 pagesJairam Higher Secondary School, Salem-8 Quarterly Examination-2020-2021 Class: Xii Accountancy MARKS: 90 DATE: 16.10.2020 TIME: 2 Hrs I. Choose The Correct Answer: (20 X 1 20)ShruthikaNo ratings yet

- +2-Accountancy-1-2-3-5-Mark Theory Material-Em-2023Document34 pages+2-Accountancy-1-2-3-5-Mark Theory Material-Em-2023saravanan.ma0611No ratings yet

- Kentcoc 2Document1 pageKentcoc 2Starilazation KDNo ratings yet

- General Instructions:: Class: XII Max. Marks: 30 Date: 13-08-2021 Time: 1 HourDocument3 pagesGeneral Instructions:: Class: XII Max. Marks: 30 Date: 13-08-2021 Time: 1 HourDANESH RICHARDNo ratings yet

- 12 - Acc - Ch2 - Learning FeedbackDocument2 pages12 - Acc - Ch2 - Learning FeedbackSHAH SHREYANo ratings yet

- Assignments For +2Document3 pagesAssignments For +2Prakhar SinghNo ratings yet

- Class 12 Accountancy HHDocument58 pagesClass 12 Accountancy HHkomal barotNo ratings yet

- Fundamental of PartnershipDocument28 pagesFundamental of Partnershipincome taxNo ratings yet

- Xii PB 2023 Acct QP 16112023Document9 pagesXii PB 2023 Acct QP 16112023NARESH KUMARNo ratings yet

- Wa0011.Document6 pagesWa0011.Pieck AckermannNo ratings yet

- Accouting TestDocument3 pagesAccouting TestManoranjan SenaaptiNo ratings yet

- Practice Questions On Partnership BusinessDocument4 pagesPractice Questions On Partnership BusinessBamidele AdegboyeNo ratings yet

- Account Ch-1 Partnership Firm - FundamentalsDocument3 pagesAccount Ch-1 Partnership Firm - Fundamentalsapsonline8585No ratings yet

- Solution 26 MinDocument1 pageSolution 26 Minnawanikhushi48No ratings yet

- 591617884861 (1)Document9 pages591617884861 (1)YashviNo ratings yet

- L2 - Accounting For Partnership FirmsDocument11 pagesL2 - Accounting For Partnership FirmsMary JaineNo ratings yet

- Quiz 2 Lesson 3Document5 pagesQuiz 2 Lesson 3Andreau Granada0% (1)

- Accountancy Model Unit Test - 2Document7 pagesAccountancy Model Unit Test - 2Raaja YoganNo ratings yet

- 12th AccountsDocument6 pages12th AccountsHarjinder SinghNo ratings yet

- Accountancy MCQs For Class 12 With Answers Chapter 1 Accounting For Partnership Firms - Fundamentals - NCERT BooksDocument34 pagesAccountancy MCQs For Class 12 With Answers Chapter 1 Accounting For Partnership Firms - Fundamentals - NCERT Booksbabaaijaz01No ratings yet

- ACC Assignment Questions Extra PractiseDocument20 pagesACC Assignment Questions Extra Practisesikeee.exeNo ratings yet

- Paper 2 Accountancy 2 2pb QP Set 2Document9 pagesPaper 2 Accountancy 2 2pb QP Set 2Harini NarayananNo ratings yet

- Multiple Choice Question (1 Mark) : Best Higher Secondary School AhmedabadDocument10 pagesMultiple Choice Question (1 Mark) : Best Higher Secondary School Ahmedabadapi-232747878No ratings yet

- New AccountsDocument26 pagesNew AccountsStudyNo ratings yet

- 28 07 2023 - 344571Document4 pages28 07 2023 - 344571Boda TanviNo ratings yet

- AccountancyDocument183 pagesAccountancyAnita YadavNo ratings yet

- 12 Acc SP 03Document32 pages12 Acc SP 03ठाकुर रुद्र प्रताप सिंहNo ratings yet

- Ut-1 JR.12Document4 pagesUt-1 JR.12Anju RuhalNo ratings yet

- Premium Mock 03Document13 pagesPremium Mock 03Rahul MajumdarNo ratings yet

- 68588e0f-f729-4e81-840c-aa4ab1fe0356Document3 pages68588e0f-f729-4e81-840c-aa4ab1fe0356ATHARVA GHORPADENo ratings yet

- Accountancy Question BankDocument146 pagesAccountancy Question BankSiddhi Jain100% (1)

- 12 Accountancy QP Prep T1 21Document9 pages12 Accountancy QP Prep T1 21mitaliNo ratings yet

- Cbleacpu 01Document10 pagesCbleacpu 01tripatjotkaur757No ratings yet

- Class 12 Pre Board SQP Accountancy 01Document21 pagesClass 12 Pre Board SQP Accountancy 01Mayank SharmaNo ratings yet

- Fundamentals 1Document3 pagesFundamentals 1D. Naarayan NandanNo ratings yet

- Class XII ACCOUNTANCY ASSIGNMENTDocument3 pagesClass XII ACCOUNTANCY ASSIGNMENTTvisha DhingraNo ratings yet

- Accountancy Test-40 MarkDocument2 pagesAccountancy Test-40 MarkCharming CuteNo ratings yet

- Income Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawFrom EverandIncome Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawRating: 3.5 out of 5 stars3.5/5 (4)

- Coe Odd Sem - 2023-24Document2 pagesCoe Odd Sem - 2023-24vidyaos.sit20No ratings yet

- Disadvantages/Problems of The Depository SystemDocument3 pagesDisadvantages/Problems of The Depository SystemChintan K MehtaNo ratings yet

- Labor 2 M1&2 DigestDocument59 pagesLabor 2 M1&2 Digestrussel leah mae malupengNo ratings yet

- Blackbook BSEDocument114 pagesBlackbook BSEKrishna Sharma100% (1)

- Determinants of Extent of Technological Innovation Among Food Processing Enterprises in Davao RegionDocument15 pagesDeterminants of Extent of Technological Innovation Among Food Processing Enterprises in Davao RegionRyiehmNo ratings yet

- Principles of Cost AccountingDocument6 pagesPrinciples of Cost AccountingMr DamphaNo ratings yet

- Banking and Finance: Bharathiar University: Coimbatore - 641 046Document7 pagesBanking and Finance: Bharathiar University: Coimbatore - 641 046Aswathy S RNo ratings yet

- Final Examination Set 4Document1 pageFinal Examination Set 4Joven CastilloNo ratings yet

- Airborne Freight Corporation Reports Third Quarter 1997 ResultsDocument2 pagesAirborne Freight Corporation Reports Third Quarter 1997 Resultscychen_scribdNo ratings yet

- Session 21 The First Meat Sector IPO Al Shaheer CorporationDocument23 pagesSession 21 The First Meat Sector IPO Al Shaheer CorporationAnas SohailNo ratings yet

- Elevate Access Global Admin Role: Azure AD Admin Roles Azure Active Directory TenantDocument3 pagesElevate Access Global Admin Role: Azure AD Admin Roles Azure Active Directory Tenantbouga2No ratings yet

- Branding Apple IncDocument21 pagesBranding Apple Incanisach25No ratings yet

- Transpo Midterms Notes PDFDocument28 pagesTranspo Midterms Notes PDFAriel Mark PilotinNo ratings yet

- Eadr Project On Infosys CompanyDocument5 pagesEadr Project On Infosys CompanyDivyavadan MateNo ratings yet

- The Impact of ESG During COVID 19Document54 pagesThe Impact of ESG During COVID 19Andrew SumirNo ratings yet

- Quick Learning - RCADocument6 pagesQuick Learning - RCAConfluenceNo ratings yet

- Unit 1-4Document104 pagesUnit 1-4ዝምታ ተሻለNo ratings yet

- EPMS Transport & LogisticsDocument15 pagesEPMS Transport & LogisticsAggie MTNo ratings yet

- NCM107 PlanningDocument59 pagesNCM107 Planningebtg_f100% (1)

- Functions As Banker and Financial Advisor of The GovernmentDocument51 pagesFunctions As Banker and Financial Advisor of The GovernmentRigel Kent MendiolaNo ratings yet

- Sample MYDATA 2Document7 pagesSample MYDATA 2khalsom3981No ratings yet

- SAP Yard Logistics: Lisa Kühner, SAP Andreas Hegenscheidt, SAPDocument18 pagesSAP Yard Logistics: Lisa Kühner, SAP Andreas Hegenscheidt, SAPstarimpactNo ratings yet

- Concepts Relating To Foreign ExchangeDocument89 pagesConcepts Relating To Foreign Exchangedeepakpandeyji2001No ratings yet

- Certified Facility ManagerDocument11 pagesCertified Facility ManagerYoga PristlinNo ratings yet

- Managing The System Development Life CycleDocument6 pagesManaging The System Development Life Cyclefathma azzahroNo ratings yet