Professional Documents

Culture Documents

Special Journal Purchase Journal

Uploaded by

Baekhunnie Byun0 ratings0% found this document useful (0 votes)

14 views5 pagesThe document discusses various journals used in accounting including the purchase journal, cash payments journal, sales journal, and cash receipts journal. It provides examples of journal entries for transactions like purchases on account, expenses paid in cash, sales on account, and cash received from accounts receivable. The document also covers topics like merchandising, shipping terms, adjusting entries, and the accounting cycle.

Original Description:

notes

Original Title

Notes

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses various journals used in accounting including the purchase journal, cash payments journal, sales journal, and cash receipts journal. It provides examples of journal entries for transactions like purchases on account, expenses paid in cash, sales on account, and cash received from accounts receivable. The document also covers topics like merchandising, shipping terms, adjusting entries, and the accounting cycle.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

14 views5 pagesSpecial Journal Purchase Journal

Uploaded by

Baekhunnie ByunThe document discusses various journals used in accounting including the purchase journal, cash payments journal, sales journal, and cash receipts journal. It provides examples of journal entries for transactions like purchases on account, expenses paid in cash, sales on account, and cash received from accounts receivable. The document also covers topics like merchandising, shipping terms, adjusting entries, and the accounting cycle.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 5

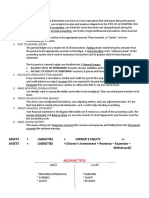

SPECIAL JOURNAL

PURCHASE JOURNAL

Purchase of merchandise on cash and account basis.

Kapag bumili ka ng goods tapos on account mo siya babayaran or utang mo pa siya sa

binilhan mo sa purchase journal mo siya ilalagay.

Example:

Purchase 15,000

Accounts Payable 15,000

CASH PAYMENTS JOURNAL

All transactions with a credit to cash on hand and in bank.

Ito yung binayaran mo cash on hand.

Cash in bank

Example:

Accounts Payable 15,000

Cash on Hand 15,000

Accounts Payable 15,000

Cash in Bank 15,000

Rent Expense 15,000

Cash on hand 15,000

SALES JOURNAL

All sales of merchandise on account and cash basis.

Kapag may bumili sa store niyo.

Nabenta tapos utang siya ng customer

Example:

Accounts Receivable 15,000

Sales 15,000

CASH RECEIPTS JOURNAL

All transactions with a debit to cash on hand and in bank.

Natatanggap mong pera

Example:

Cash on Hand 15,000

Accounts Receivable 15,000

Cash in Bank 15,000

Sales 15,000

NOTE:

Net Credit Sales – sales or cash sales

Net book value/ carrying value

MERCHANDISING

Shipping Terms:

FOB Shipping Point

The buyers pays the freight – FREIGHT IN

FOB Destination

The seller pays the freight – FREIGHT OUT

FOB Shipping Point:

Freight Prepaid (abono) – Freight In

Seller pays freight & adds this to the account of the buyer.

Freight Collect – Freight Out

Seller does not pay the freight

NOTE:

Purchases – contra asset

Freight – adjunct account

Selling Expense (in Income Statement) – gastos kapag nagbenta ka.

General and Administrative Expense (in Income Statement) – gastos ng office.

Voucher – cash on hand

Check Voucher – cash in bank

Cash Voucher – cash on hand

NOTE IN JOURNALIZING:

Accounts Payable 50,680

Purchase Discount (101,360 x 2%) 2,027.2

Cash on Hand (50,680 – 2,027.2) 48,652.80

Kapag may discount yung partial payment and discount mo sa next payment ay yung

remaining balance.

Kapag walang discount yung partial payment ang discount mo sa next payment ay yung

original price.

NOTE:

Sale of Fixed Assets (Property & Equipment)

Formula: Net book value = Cost of equipment – accumulated

Gain on Sale of Equipment = Selling Price – Net book value

Example:

Selling Price = P2,500

Cost of Equipment = P5,000

Accumulated = P3,000

Net book value = 5,000 – 3,000 = P2,000

Therefore, there is a gain on sale of equipment = P500

P2,500 – P2,000 = P500

ADJUSTING ENTRIES

Depreciation Expense

Is the allocation of the cost of the asset throughout its economic/ useful life.

Prepaid Expense

Expenses paid in advance by the business.

Expense Method

Asset (unexpired/unused)

The Expense account will be in CREDIT.

Example: Supplies Expense Method (unused portion)

Asset Method

Expense (expired/used)

The Expense account will be in DEBIT.

Example: Supplies Asset Method (used portion)

Unearned Income

Income collected in advance.

Income Method

Unearned

The Income account will be in DEBIT.

Liability Method

Earned income

The Income account will be in CREDIT.

ACCOUNTING CYCLE

REVERSING ENTRIES

Adjusting entries Not reversed

1) Depreciation Expense 3) Prepaid expense when ASSET method is

used

2) Bad Debts Expense 4) Unearned Income when LIABILITY method is

used

Adjusting entries Reversed

1) Accrued Income 3) Prepaid expense when EXPENSE method is

used

2) Accrued expenses 4) Unearned Income when INCOME method is

used

You might also like

- The Barrington Guide to Property Management Accounting: The Definitive Guide for Property Owners, Managers, Accountants, and Bookkeepers to ThriveFrom EverandThe Barrington Guide to Property Management Accounting: The Definitive Guide for Property Owners, Managers, Accountants, and Bookkeepers to ThriveNo ratings yet

- Merchandising Business: Buying and Selling ActivitiesDocument50 pagesMerchandising Business: Buying and Selling ActivitiesjaisahNo ratings yet

- Chapter 5Document53 pagesChapter 5Kylie BatitisNo ratings yet

- Processing Transactions NewDocument34 pagesProcessing Transactions NewAkanksha Gupta100% (1)

- Lecture 5Document101 pagesLecture 5Paron MarNo ratings yet

- 2.recording Financial TransactionsDocument10 pages2.recording Financial TransactionsGetrude MazimbaNo ratings yet

- Module4 AccountsReceivablePartIDocument6 pagesModule4 AccountsReceivablePartIGab OdonioNo ratings yet

- Fundamentals of Accounting Notes - The Double Entry Bookkeeping SystemDocument6 pagesFundamentals of Accounting Notes - The Double Entry Bookkeeping SystemArop FrancisNo ratings yet

- Answer Key Quizzer On MerchandisingDocument5 pagesAnswer Key Quizzer On MerchandisingClarissa De GuzmanNo ratings yet

- Module 4 Cash and Accrual BasisDocument4 pagesModule 4 Cash and Accrual BasisSeulgi KangNo ratings yet

- Module in Cash To Accrual and Vice VersaDocument12 pagesModule in Cash To Accrual and Vice Versayugyeom rojasNo ratings yet

- Unit 3 - Trial BalanceDocument11 pagesUnit 3 - Trial Balancegogo chanNo ratings yet

- Cash and Accrual Basis and Single EntryDocument21 pagesCash and Accrual Basis and Single EntryJohn Mark FernandoNo ratings yet

- Accounting For MerchandisingDocument2 pagesAccounting For MerchandisingEvelyn MaligayaNo ratings yet

- Ac1 Reviewer FinalsDocument5 pagesAc1 Reviewer FinalsMark Christian BrlNo ratings yet

- CBSE Class 11 Accounting-End of Period AccountsDocument34 pagesCBSE Class 11 Accounting-End of Period AccountsRudraksh PareyNo ratings yet

- Accounting Non-Accountants Part 2Document37 pagesAccounting Non-Accountants Part 2Vanessa Gapas0% (1)

- FUNACC - Accounting Cycle of A Merchandising BusinessDocument12 pagesFUNACC - Accounting Cycle of A Merchandising BusinessSassy GirlNo ratings yet

- P2 Notes MerchandisingDocument14 pagesP2 Notes Merchandisingchen.abellar.swuNo ratings yet

- Chapter 5 - Perpetual Vs Periodic SystemDocument4 pagesChapter 5 - Perpetual Vs Periodic SystemkanyaNo ratings yet

- Class No - 8, 9Document38 pagesClass No - 8, 9WILD๛SHOTッ tanvirNo ratings yet

- Journalizing Transactions (Review) - 9.5.17Document13 pagesJournalizing Transactions (Review) - 9.5.17Jessa Beloy100% (1)

- Class 11 Accountancy Chapter-3 Revision NotesDocument11 pagesClass 11 Accountancy Chapter-3 Revision NotesMohd. Khushmeen KhanNo ratings yet

- Accounting For Merchandising AE1311Document24 pagesAccounting For Merchandising AE1311Apple Joy YutaNo ratings yet

- The Basis of All Accounting Is Concerned With The Ascertaining and Analyzing of Business ResultsDocument42 pagesThe Basis of All Accounting Is Concerned With The Ascertaining and Analyzing of Business ResultsAswin S PanickerNo ratings yet

- Merchandising BusinessDocument26 pagesMerchandising BusinessDan Gideon CariagaNo ratings yet

- Accounting RevisionDocument15 pagesAccounting Revisionurwafahanuk2No ratings yet

- Valuation of Accounts ReceivableDocument7 pagesValuation of Accounts ReceivableUwuuUNo ratings yet

- Lec Merchandising Perpetual PeriodicDocument8 pagesLec Merchandising Perpetual PeriodicAiddan Clark De JesusNo ratings yet

- Merchandising OperationsDocument27 pagesMerchandising OperationsAbegail Lheani GuiaNo ratings yet

- Tally NotesDocument32 pagesTally NotesenuNo ratings yet

- Compilation Notes On Journal Ledger and Trial BalanceDocument14 pagesCompilation Notes On Journal Ledger and Trial BalanceAB12P1 Sanchez Krisly AngelNo ratings yet

- Financial Statement Preparation, Analysis and InterpretationDocument3 pagesFinancial Statement Preparation, Analysis and Interpretationjhosal diazNo ratings yet

- Accounting For Sales PDFDocument20 pagesAccounting For Sales PDFJasmine Acta100% (1)

- Chapter 7 09302019Document38 pagesChapter 7 09302019Arjay Molina100% (1)

- Cash and Accrual BasisDocument4 pagesCash and Accrual BasisSeulgi KangNo ratings yet

- Supp MaterialsDocument76 pagesSupp MaterialsPham Thi Khanh Linh (FGW HN)No ratings yet

- 2018-1383 Samsona, Melanie S.Document8 pages2018-1383 Samsona, Melanie S.Melanie SamsonaNo ratings yet

- 003accounting Basic ConceptsDocument4 pages003accounting Basic ConceptsSmitesh BhosaleNo ratings yet

- Basic Accounting Reviewer Step 1 To 3Document12 pagesBasic Accounting Reviewer Step 1 To 3Mary Gleyne100% (1)

- Financial Accounting 1 Lesson 3 - SO1 Double Entry - RecordingDocument35 pagesFinancial Accounting 1 Lesson 3 - SO1 Double Entry - RecordingZudjian WarriorNo ratings yet

- Red Hat Bookkeeping Presentation 2015Document42 pagesRed Hat Bookkeeping Presentation 2015nxjhdjs gdeiwqntbgd2c gve2s23No ratings yet

- Merchandising Organized As A Partnership BusinessDocument23 pagesMerchandising Organized As A Partnership BusinessIzza WrapNo ratings yet

- Rules of Debit and Credit Module 3Document12 pagesRules of Debit and Credit Module 3rima riveraNo ratings yet

- Analysis of Business TransactionsDocument21 pagesAnalysis of Business TransactionsDan Gideon Cariaga100% (1)

- Merchandising Accounting: Youtube Channel Link (Also Subscribe) Because I Need Your FeedbackDocument27 pagesMerchandising Accounting: Youtube Channel Link (Also Subscribe) Because I Need Your FeedbackBharti PahujaNo ratings yet

- Double Entry SystemDocument17 pagesDouble Entry SystemDastaan Ali100% (1)

- The Effect of Profit or Loss On Capital and The Double Entry System For Expenses and RevenueDocument35 pagesThe Effect of Profit or Loss On Capital and The Double Entry System For Expenses and Revenueshabanzuhura706No ratings yet

- NC Iii Bookkeeping: Prepared By: Jubailyn V. VillegasDocument48 pagesNC Iii Bookkeeping: Prepared By: Jubailyn V. VillegasFlorinda Gagasa100% (1)

- Selling A Product or A ServiceDocument54 pagesSelling A Product or A ServiceGaluh Boga KuswaraNo ratings yet

- Chapter 3 Inventories and Cost of Goods SoldDocument84 pagesChapter 3 Inventories and Cost of Goods SoldSampanna Shrestha100% (1)

- FFA Lecture Part DDocument102 pagesFFA Lecture Part Dleopardking77No ratings yet

- Tally Prime Book by Hardik PanchalDocument55 pagesTally Prime Book by Hardik PanchalHardik PanchalNo ratings yet

- Identify Transactions: Accounting CycleDocument6 pagesIdentify Transactions: Accounting CycleNezhreen MaruhomNo ratings yet

- 3 Accounting MechanicsDocument50 pages3 Accounting MechanicsVasu Narang100% (1)

- Accounting For MerchandisingDocument45 pagesAccounting For Merchandisingcristin l. viloriaNo ratings yet

- Rules in Debit and CreditDocument17 pagesRules in Debit and CreditWenibet SilvanoNo ratings yet

- Financial Accounting 1 Week 2Document28 pagesFinancial Accounting 1 Week 2Muhammad Asim Shahzad100% (1)

- Cambridge Made a Cake Walk: IGCSE Accounting theory- exam style questions and answersFrom EverandCambridge Made a Cake Walk: IGCSE Accounting theory- exam style questions and answersRating: 2 out of 5 stars2/5 (4)

- FA BOOK Final REVIEWDocument31 pagesFA BOOK Final REVIEWSayandeep ShillNo ratings yet

- RBV-Apple CaseDocument11 pagesRBV-Apple CaseJkNo ratings yet

- Sol. Man. - Chapter 8 - Inventory Estimation - Ia Part 1aDocument5 pagesSol. Man. - Chapter 8 - Inventory Estimation - Ia Part 1aYamateNo ratings yet

- Theories of International TradeDocument35 pagesTheories of International TradeRishika ParmarNo ratings yet

- Merchandising (Part 14) "Normal Operating Cycle"Document2 pagesMerchandising (Part 14) "Normal Operating Cycle"Kyla CelebreNo ratings yet

- A162 Answer Tutorial 1 and Answer Siti NorlizaDocument13 pagesA162 Answer Tutorial 1 and Answer Siti NorlizaXiao Yun Yap0% (2)

- Role of A Secretary in Capital Formation Xii Commerce SP New SyllabusDocument28 pagesRole of A Secretary in Capital Formation Xii Commerce SP New SyllabusSanthosh KumarNo ratings yet

- Unit 7 - Eval. of MediaDocument24 pagesUnit 7 - Eval. of MediaTara RastogiNo ratings yet

- SSM Kualiti AlamDocument9 pagesSSM Kualiti Alamyusniza88No ratings yet

- BRisk Report of Ve Commercial Vehicles Limited - 307948 - 01-08-2023Document103 pagesBRisk Report of Ve Commercial Vehicles Limited - 307948 - 01-08-2023Preeti A MishraNo ratings yet

- BlueStack Platform Marketing PlanDocument10 pagesBlueStack Platform Marketing PlanFıratcan KütükNo ratings yet

- ABM ReviewerDocument5 pagesABM ReviewerKRISTELLE ROSARIONo ratings yet

- NCCMP BrochureDocument4 pagesNCCMP BrochureArun RadhaKrishnanNo ratings yet

- PA2 X ESP HW9 G1 Revanza TrivianDocument9 pagesPA2 X ESP HW9 G1 Revanza TrivianRevan KonglomeratNo ratings yet

- Marketing in Small TownsDocument16 pagesMarketing in Small TownsGaurav GuptaNo ratings yet

- Two Automobile Companies - Comparative Study and Marketing StrategiesDocument10 pagesTwo Automobile Companies - Comparative Study and Marketing StrategiesMarketingProjectReportsNo ratings yet

- Haramaya University Sheep and Goat FatteDocument23 pagesHaramaya University Sheep and Goat FatteAbelNo ratings yet

- Ebook PDF Commercial Applications of Company Law 2020 PDFDocument28 pagesEbook PDF Commercial Applications of Company Law 2020 PDFrobert.gonzales146100% (38)

- HLB Annual Report 2023Document452 pagesHLB Annual Report 2023limkq-wb20No ratings yet

- FinalDocument2 pagesFinalbrNo ratings yet

- Capital Structure, Cost of Capital and ValueDocument33 pagesCapital Structure, Cost of Capital and Valuemanish9890No ratings yet

- Byjus 5 C's AnalysisDocument7 pagesByjus 5 C's Analysisakshara singh100% (1)

- Red Lobster Case AnalysisDocument4 pagesRed Lobster Case AnalysisTitah Laksamana100% (2)

- Senior Sales Manager National Accounts in Atlanta GA Resume Jay BlackmonDocument2 pagesSenior Sales Manager National Accounts in Atlanta GA Resume Jay BlackmonJayBlackmonNo ratings yet

- Session+Transcript+7 2Document16 pagesSession+Transcript+7 2AKHIL REDDYNo ratings yet

- 1 - 1st September 2007 (010907)Document4 pages1 - 1st September 2007 (010907)Chaanakya_cuimNo ratings yet

- Dictionar Roman Englez Termeni EconDocument75 pagesDictionar Roman Englez Termeni EconЧудеса СегодняNo ratings yet

- Architecture Firm Business PlanDocument28 pagesArchitecture Firm Business PlanOliviaNo ratings yet

- Variance MASDocument24 pagesVariance MASLorraine TomasNo ratings yet

- Fundamentals of Entrepreneurial Finance 2019Document800 pagesFundamentals of Entrepreneurial Finance 2019joshuagohejNo ratings yet