Professional Documents

Culture Documents

75 - 78 CAF.05 IAS-20 (Government Grants) 75-78

Uploaded by

manadish nawaz0 ratings0% found this document useful (0 votes)

31 views1 pageThis document contains summaries of 4 lectures on government grants (IAS 20). The lectures discuss key concepts of government grants such as recognition criteria, reimbursement of expenses for past or future costs, and repayment of grants. Examples are provided on grants received for acquisition of fixed assets and to cover environmental expenses over multiple years. Homework includes practice questions on accounting for government grants using direct and indirect methods.

Original Description:

Original Title

75 - 78 CAF.05 IAS-20 (Government Grants)75-78

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains summaries of 4 lectures on government grants (IAS 20). The lectures discuss key concepts of government grants such as recognition criteria, reimbursement of expenses for past or future costs, and repayment of grants. Examples are provided on grants received for acquisition of fixed assets and to cover environmental expenses over multiple years. Homework includes practice questions on accounting for government grants using direct and indirect methods.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

31 views1 page75 - 78 CAF.05 IAS-20 (Government Grants) 75-78

Uploaded by

manadish nawazThis document contains summaries of 4 lectures on government grants (IAS 20). The lectures discuss key concepts of government grants such as recognition criteria, reimbursement of expenses for past or future costs, and repayment of grants. Examples are provided on grants received for acquisition of fixed assets and to cover environmental expenses over multiple years. Homework includes practice questions on accounting for government grants using direct and indirect methods.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

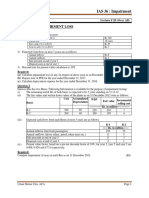

CAF-05 IAS-20 Government Grants

Lecture# 1 Lecture # 75 (Over All)

Concept Discussed

GOVT. Grant(IAS-20)

Class work

Completion of investment property & Hand written Notes distributed

Example.1 ABC Co. receive a grant of Rs. 40M in 2002 to acquire a water cleaning station. The cost

of station is Rs 100M and its useful life is 8 years. ABC Co. acquire the station on 1-July-2002 and

year end is 31 December.

Home Work

Practice set Question# 2(SOCIE)

Jalib Industries with both method (SOCF)

Practice set Question#3,4(IAS-40)

Class assignment Question# 1,2

Lecture# 2 Lecture # 76 (Over All)

Concept Discussed

GOVT. Grant

1.For the acquisition of fixed asset

2.Reimbursement of Expenses/Cost

Class work

Example.1 complete

Example.2ABC company received a grant of 10M in 2002 to cover the expenses for the environment

measures taken by ABC company during 20002 to 2005. ABC co. assumes to spend Rs. 4M each in

2002,2003&2004 and Rs.2M in 2005(total 14M) .

Home Work

Practice Question # 1(FCC), Question Bak# 1(Katie)

Lecture# 3 Lecture # 77 (Over All)

Concept Discussed

Recognition Criteria(IAS-20)

Reimbursement of expenses (1.For past cash incurred/present, 2.For future cash to be incurred)

Repayment of Govt. Grant

Class work

Discussion of Home work Practice Question # 1(FCC), Question Bak# 1(Katie)

Example. On 1.1.2004 Govt. got NARAZ and Govt. grant become fully repayable

Home Work

Practice set Question# 2,4

Example 5,6 on page#705

Lecture# 4 Lecture # 78 (Over All)

Concept Discussed

Class work

Practice set Question#4(Basit limited) with direct&indirect method

Example#6 discuss

Home Work

Practice set Question #3(potato limit)

Umair Sheraz Utra, ACA Page |1

You might also like

- Operations Management Midterm ExamDocument2 pagesOperations Management Midterm ExamCharisa SamsonNo ratings yet

- Project Management Exam QuestionsDocument7 pagesProject Management Exam QuestionsBedri M Ahmedu100% (1)

- Project Proposal: Office of The Municipal Planning and Development Officer EmailDocument5 pagesProject Proposal: Office of The Municipal Planning and Development Officer EmailMary John Paul BetontaNo ratings yet

- 14-Plant Design-Ans Key-Master FileDocument22 pages14-Plant Design-Ans Key-Master FilePaul Philip LabitoriaNo ratings yet

- Deakin University Faculty of Business and Law MMP211 - Statutory Valuation Examination Trimester 1, 2021Document3 pagesDeakin University Faculty of Business and Law MMP211 - Statutory Valuation Examination Trimester 1, 2021Ochweda JnrNo ratings yet

- Chap 12 - Assignment - DTUTDocument7 pagesChap 12 - Assignment - DTUTĐặng Trần Minh QuânNo ratings yet

- Hartford VT Joint Rec Bond Project CostsDocument1 pageHartford VT Joint Rec Bond Project CostsF.X. FlinnNo ratings yet

- Sem 3rd INTERNAl - Income Tax Law & PracticeDocument2 pagesSem 3rd INTERNAl - Income Tax Law & PracticeAdarsh SinghNo ratings yet

- (Autonomous) : Page 1 of 17Document17 pages(Autonomous) : Page 1 of 17tomsonNo ratings yet

- IFM - Assignment FinalDocument31 pagesIFM - Assignment FinalDglNo ratings yet

- PME CM Midterm Assessment Assignment Spring 20 14052020 083835amDocument3 pagesPME CM Midterm Assessment Assignment Spring 20 14052020 083835amSharjeel Humayun HassanNo ratings yet

- Cost Compiled Past Papers UpdatedDocument364 pagesCost Compiled Past Papers UpdatedAbubakar PalhNo ratings yet

- PM ExamDocument12 pagesPM ExamAderaw GashayieNo ratings yet

- Tongi 80 MW Gas Turbine Power PlantDocument3 pagesTongi 80 MW Gas Turbine Power PlantMd Maidul HayderNo ratings yet

- Plant Design MODocument21 pagesPlant Design MOFran LeeNo ratings yet

- CH040 WS 2.5 - Mendoza, Oliver RDocument5 pagesCH040 WS 2.5 - Mendoza, Oliver Rjillea mendozaNo ratings yet

- Week 4 Assignment Solutions PM592Document5 pagesWeek 4 Assignment Solutions PM592if_silkNo ratings yet

- CPA Canada Core 2 Mock Exam - Bolt Blades LTDDocument6 pagesCPA Canada Core 2 Mock Exam - Bolt Blades LTDAva DasNo ratings yet

- Management Accounting 1 (Acc103) Assignment (15%) Sem 1, 2021 Due Date: 5 Apr 2021 General InstructionsDocument9 pagesManagement Accounting 1 (Acc103) Assignment (15%) Sem 1, 2021 Due Date: 5 Apr 2021 General InstructionsRan CastiloNo ratings yet

- Assignment 2018Document5 pagesAssignment 2018gayneNo ratings yet

- CMA - Solar CookerDocument14 pagesCMA - Solar Cookeranjali shilpa kajalNo ratings yet

- Click Here To Download The Careerscloud App: Affairscloud Launched A New Long Awaited Mobile AppDocument12 pagesClick Here To Download The Careerscloud App: Affairscloud Launched A New Long Awaited Mobile AppPriya PudumathiNo ratings yet

- ACC103 Assign Sem 1, 2020 PDFDocument9 pagesACC103 Assign Sem 1, 2020 PDFWSLee0% (1)

- Cost MidtermDocument15 pagesCost MidtermDeepakNo ratings yet

- Revision Long Q JJ2020 Mco1Document31 pagesRevision Long Q JJ2020 Mco1Amir ArifNo ratings yet

- A Progress Report AboutDocument6 pagesA Progress Report Aboutedmartin lombrinoNo ratings yet

- Tute MTIIDocument22 pagesTute MTIIJatin GargNo ratings yet

- ACCT 312 - Exam 2 (Part 1) - Spring 2022 FinalDocument8 pagesACCT 312 - Exam 2 (Part 1) - Spring 2022 FinalMercy Jerop KimutaiNo ratings yet

- Seminar 2 - Investment AppraisalDocument3 pagesSeminar 2 - Investment AppraisalRukshani RefaiNo ratings yet

- Exercise 1 Concrete and Concise WordingsDocument2 pagesExercise 1 Concrete and Concise Wordingsotaku hime0% (2)

- Cbse Model QP Class Xii (KMS)Document269 pagesCbse Model QP Class Xii (KMS)aleenaNo ratings yet

- PreliminaryDocument15 pagesPreliminaryanilNo ratings yet

- Acc 577 Quiz Week 3 PDF FreeDocument12 pagesAcc 577 Quiz Week 3 PDF FreeWhalien 52No ratings yet

- P1 Question June 2019Document6 pagesP1 Question June 2019S.M.A AwalNo ratings yet

- MTC 2020 Covid TestDocument4 pagesMTC 2020 Covid TestNileNo ratings yet

- CE 22 - Engineering EconomyDocument2 pagesCE 22 - Engineering EconomyLenard PunzalNo ratings yet

- 2023 - 6!11!147 - CL3 - Advanced Management Accounting - June 2023 - EnglishDocument14 pages2023 - 6!11!147 - CL3 - Advanced Management Accounting - June 2023 - EnglishfcNo ratings yet

- Indian Institute of Management Kozhikode: Financial Management 1 EPGP Kochi Campus Batch 09Document35 pagesIndian Institute of Management Kozhikode: Financial Management 1 EPGP Kochi Campus Batch 09juilee bhoirNo ratings yet

- Linear Programming ApproachDocument15 pagesLinear Programming ApproachInciaNo ratings yet

- ACC 312 - Exam 1 - Form A - Fall 2012 PDFDocument14 pagesACC 312 - Exam 1 - Form A - Fall 2012 PDFGeetika InstaNo ratings yet

- CVE30004 Cost Engineering Portfolio 4Document2 pagesCVE30004 Cost Engineering Portfolio 4we haveNo ratings yet

- Weekly Progress Report: (F00002 - GJBS - WR0006 - 041519)Document4 pagesWeekly Progress Report: (F00002 - GJBS - WR0006 - 041519)amresh tiwariNo ratings yet

- Tutorial 11-Inventory Management and MRP PDFDocument4 pagesTutorial 11-Inventory Management and MRP PDFKhiren MenonNo ratings yet

- Engineering Economy: Page 1 of 1Document1 pageEngineering Economy: Page 1 of 1Den CelestraNo ratings yet

- 17501-2019-Winter-Model-Answer-Paper (Msbte Study Resources)Document19 pages17501-2019-Winter-Model-Answer-Paper (Msbte Study Resources)noorNo ratings yet

- C Task-3Document10 pagesC Task-3Mukta AktherNo ratings yet

- Terminal 5 Q4 2021 Update and Terminal 5 Reefer Plug Infrastructure GrantDocument19 pagesTerminal 5 Q4 2021 Update and Terminal 5 Reefer Plug Infrastructure GrantWestSeattleBlogNo ratings yet

- Business Plan FormatDocument10 pagesBusiness Plan FormatMNo ratings yet

- ASE20098 Mark Scheme March 2019Document11 pagesASE20098 Mark Scheme March 2019Ti SodiumNo ratings yet

- Mba 202 PDFDocument2 pagesMba 202 PDFSimanta KalitaNo ratings yet

- Cost Lecture Details Autumn 2022 6Document11 pagesCost Lecture Details Autumn 2022 6Bushra AsgharNo ratings yet

- 1TS310 (3 Credits) Industrial Management: Homework Assignment October, Year 2020Document8 pages1TS310 (3 Credits) Industrial Management: Homework Assignment October, Year 2020Ujjwal M ReddyNo ratings yet

- Strategic Financial Management - Assignment Dec 2022 2NAxMQxiVSDocument2 pagesStrategic Financial Management - Assignment Dec 2022 2NAxMQxiVSSubhana NasimNo ratings yet

- SPM 2Document16 pagesSPM 2developer fixNo ratings yet

- India01 3Document4 pagesIndia01 3Sarthak ChatterjeeNo ratings yet

- Quiz To Civil EngineersDocument16 pagesQuiz To Civil EngineersKidist100% (1)

- PVC Pipe, Hdpe Pipe ManufacuringDocument10 pagesPVC Pipe, Hdpe Pipe ManufacuringDijin MaroliNo ratings yet

- PVC Pipe, Hdpe Pipe ManufacuringDocument10 pagesPVC Pipe, Hdpe Pipe ManufacuringPriyanshu ChokhaniNo ratings yet

- Business Plan5Document10 pagesBusiness Plan5ECE DeptNo ratings yet

- Guidebook for Demand Aggregation: Way Forward for Rooftop Solar in IndiaFrom EverandGuidebook for Demand Aggregation: Way Forward for Rooftop Solar in IndiaNo ratings yet

- Inventory (Questions) : Question No. H-1Document4 pagesInventory (Questions) : Question No. H-1manadish nawazNo ratings yet

- CAF-9 Mock (Q.P)Document5 pagesCAF-9 Mock (Q.P)manadish nawazNo ratings yet

- CAF SyllabusDocument89 pagesCAF Syllabusmanadish nawazNo ratings yet

- 92 98 Revenue Caf 05Document2 pages92 98 Revenue Caf 05manadish nawazNo ratings yet

- 62 - 71 Lecture Notes SOCF (1-10)Document5 pages62 - 71 Lecture Notes SOCF (1-10)manadish nawazNo ratings yet

- 20 - 24 Lecture Notes (1-4) IAS-36 (Impairment)Document4 pages20 - 24 Lecture Notes (1-4) IAS-36 (Impairment)manadish nawaz100% (1)

- 10 Lecture 10 PPE NOTEDocument2 pages10 Lecture 10 PPE NOTEmanadish nawazNo ratings yet