Professional Documents

Culture Documents

Divine Company Began Operations

Uploaded by

Queen ValleOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Divine Company Began Operations

Uploaded by

Queen ValleCopyright:

Available Formats

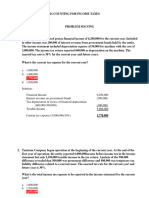

Divine Company began operations on January 1, 2017.

During the first three years of operations, the

entity reported the following net income and dividends declared:

Net Income Dividend

2017 800,000 0

2018 2,500,000 1,000,000

2019 3,000,000 1,000,000

The entity provided the following information for 2020:

Income before income tax 4,800,000

Prior period error – understatement of 2018 depreciation before tax 400,000

Cumulative decrease in income from

700,000

change in inventory method before tax

Dividend declared (of this amount,

2,000,000

P500,000 will be paid on January 15. 2021)

Income tax rate 30%

What amount should be reported as retained earnings on December 31, 2020? – 4,890,000

Net effect

2017 800,000

2018 (2500000 – 1000000) 1,500,000

2019 (3000000 – 1000000) 2,000,000 4,300,000

(4.8M*.30)- 4.8M= 3,360,000

Income before tax

Understatement of (400000* .70) (280,000)

depreciation

Change in Inventory method (700000* .70) (490,000)

Dividend declared (2,000,000)

RE, adjusted 4,890,000

You might also like

- Accounting For Income TaxationDocument8 pagesAccounting For Income Taxationangelian bagadiongNo ratings yet

- ACT150 Assignment DIMAAMPAODocument4 pagesACT150 Assignment DIMAAMPAOJeromeNo ratings yet

- CAF 2 Spring 2021Document8 pagesCAF 2 Spring 2021Muhammad Ahsan RiazNo ratings yet

- MQ2 Answer KeyDocument8 pagesMQ2 Answer KeyAldric Jayson TaclanNo ratings yet

- Bahasan Soal AK 2Document9 pagesBahasan Soal AK 2nikenapNo ratings yet

- SS Q1 Test Tax317 Dec 2021Document1 pageSS Q1 Test Tax317 Dec 2021Nik Syarizal Nik MahadhirNo ratings yet

- Chapter 8Document4 pagesChapter 8Coursehero PremiumNo ratings yet

- Chapter 9Document7 pagesChapter 9jeanNo ratings yet

- Chapter 08 - Change in Accounting Policy: Problem 8-1 (AICPA Adapted)Document5 pagesChapter 08 - Change in Accounting Policy: Problem 8-1 (AICPA Adapted)Kimberly Claire AtienzaNo ratings yet

- Intermediate Accounting 3: PROBLEM 1-11Document3 pagesIntermediate Accounting 3: PROBLEM 1-11Gemmalyn JulatonNo ratings yet

- Far First PB 1017Document25 pagesFar First PB 1017Din Rose Gonzales100% (1)

- Solution - Accounting For Income TaxesDocument12 pagesSolution - Accounting For Income TaxesKlarissemay MontallanaNo ratings yet

- CPAT Reviewer - TRAIN (Tax Reform) #1Document8 pagesCPAT Reviewer - TRAIN (Tax Reform) #1Zaaavnn VannnnnNo ratings yet

- CE Interim ReportingDocument2 pagesCE Interim ReportingalyssaNo ratings yet

- Insurance Expense Allocated To The Quarter: SolutionDocument4 pagesInsurance Expense Allocated To The Quarter: Solutionasdfghjkl zxcvbnmNo ratings yet

- Problems Accouting For Deferred Taxes Webinar ReoDocument7 pagesProblems Accouting For Deferred Taxes Webinar ReocrookshanksNo ratings yet

- Assignment#2Document5 pagesAssignment#2Kristine Esplana ToraldeNo ratings yet

- ASSIGNMENT#2Document5 pagesASSIGNMENT#2Kristine Esplana ToraldeNo ratings yet

- Xii AccDocument3 pagesXii Accantonytreesa8No ratings yet

- Ege, Kenneth M. Bsa22A1Document3 pagesEge, Kenneth M. Bsa22A1Kenneth Marcial Ege IINo ratings yet

- 30 - Aathifah Teta Fitranti - 195020307111072 - AKM 3Document2 pages30 - Aathifah Teta Fitranti - 195020307111072 - AKM 3Aathifah Teta FitrantiNo ratings yet

- Financial Accounting 3A Assignment 2tendai MakosaDocument5 pagesFinancial Accounting 3A Assignment 2tendai MakosaTendai MakosaNo ratings yet

- Name: Jean Rose T. Bustamante Bsma-3 Set B Income TaxationDocument5 pagesName: Jean Rose T. Bustamante Bsma-3 Set B Income TaxationJean Rose Tabagay BustamanteNo ratings yet

- Special Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureDocument5 pagesSpecial Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureClarisse AlimotNo ratings yet

- Topic 1: Accounting For Income TaxesDocument13 pagesTopic 1: Accounting For Income TaxesPillos Jr., ElimarNo ratings yet

- TAX2 ReyesDocument9 pagesTAX2 ReyesClaire BarrettoNo ratings yet

- Individuals Assign3Document7 pagesIndividuals Assign3jdNo ratings yet

- Sunil Panda Commerce Classes (SPCC) Accounts Term 2 Day 1 Home Work For PracticeDocument2 pagesSunil Panda Commerce Classes (SPCC) Accounts Term 2 Day 1 Home Work For PracticeHarsh MishraNo ratings yet

- Cfas Chapter 25Document6 pagesCfas Chapter 25Kristel FieldsNo ratings yet

- Single Entry and Error Correction QuizDocument2 pagesSingle Entry and Error Correction QuizMarii M.No ratings yet

- PGBP QuestionsDocument6 pagesPGBP QuestionsHdkakaksjsb100% (2)

- Book 3Document1 pageBook 3Quincy Lawrence DimaanoNo ratings yet

- Finalchapter-16 2Document22 pagesFinalchapter-16 2Jud Rossette ArcebesNo ratings yet

- Assessment 4 Tax 1Document3 pagesAssessment 4 Tax 1Judy Ann Gaceta0% (1)

- Chapter 18 CompilationDocument21 pagesChapter 18 CompilationMaria Licuanan0% (1)

- 3.3 Exercise - Improperly Accumulated Earnings TaxDocument2 pages3.3 Exercise - Improperly Accumulated Earnings TaxRenzo KarununganNo ratings yet

- CFS - ProblemsDocument5 pagesCFS - Problemskatasani likhithNo ratings yet

- Finacc 6 A3 1Document4 pagesFinacc 6 A3 1200617No ratings yet

- Illustration: The Following Data Were Reported For 200A Business Activities of Western UniversitiesDocument3 pagesIllustration: The Following Data Were Reported For 200A Business Activities of Western UniversitiesCarlo QuiambaoNo ratings yet

- Far Tutor 3Document4 pagesFar Tutor 3Rian RorresNo ratings yet

- Chapter 11Document13 pagesChapter 11jake doinog100% (6)

- Interim Financial Reporting and Operating Segment Discussion Problems and Answer KeyDocument4 pagesInterim Financial Reporting and Operating Segment Discussion Problems and Answer Keyprincess QNo ratings yet

- Accounting For Income TaxDocument4 pagesAccounting For Income Taxchowchow123No ratings yet

- Exercises - Individual IT - TLDocument1 pageExercises - Individual IT - TLClyde SaulNo ratings yet

- CpaDocument37 pagesCparav danoNo ratings yet

- Latihan Soal Chapter 22Document9 pagesLatihan Soal Chapter 22JulyaniNo ratings yet

- A. Journal Entries For 2020Document6 pagesA. Journal Entries For 2020Ollid Kline Jayson JNo ratings yet

- Mary Joy Asis QUIZ 1Document6 pagesMary Joy Asis QUIZ 1Joseph AsisNo ratings yet

- Adv MTP A20Document14 pagesAdv MTP A20Pawan AgrawalNo ratings yet

- Chapter 15 PDFDocument29 pagesChapter 15 PDFKimNo ratings yet

- Pitino Acquired 90 Percent of Brey's Outstanding SharesDocument40 pagesPitino Acquired 90 Percent of Brey's Outstanding SharesKailash KumarNo ratings yet

- DEFERRED TAXES 4-Year ExamplsDocument4 pagesDEFERRED TAXES 4-Year Examplsryanclarke628No ratings yet

- Compensation Income - (250,000 - 400,000) : Dazai OsamuDocument5 pagesCompensation Income - (250,000 - 400,000) : Dazai OsamuGideon Tangan Ines Jr.No ratings yet

- Special Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureDocument4 pagesSpecial Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureNoorodden50% (2)

- Accounting For Taxes & Employee BenefitsDocument5 pagesAccounting For Taxes & Employee BenefitsAveryl Lei Sta.Ana100% (1)

- Tax1 Q Chapter-11 12 13 With-AnswerDocument2 pagesTax1 Q Chapter-11 12 13 With-AnswerPrincess Edelyn CastorNo ratings yet

- PROJ Jul22 BBAHONS AFM8 Final 20221205090359Document10 pagesPROJ Jul22 BBAHONS AFM8 Final 20221205090359Melokuhle MhlongoNo ratings yet

- Of Shares Of: ST ND RDDocument6 pagesOf Shares Of: ST ND RDKingChryshAnneNo ratings yet

- Financial Plan Income StatementDocument1 pageFinancial Plan Income Statementbien groyonNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Stages in Statistical InvestigationDocument3 pagesStages in Statistical InvestigationQueen Valle100% (1)

- Project, Portfolio, Operation Management - PMDocument3 pagesProject, Portfolio, Operation Management - PMQueen Valle100% (1)

- Principles of Income and Business TaxationDocument3 pagesPrinciples of Income and Business TaxationQueen ValleNo ratings yet

- Project Management Process GroupsDocument10 pagesProject Management Process GroupsQueen Valle100% (1)

- Project Management Is Not NewDocument2 pagesProject Management Is Not NewQueen ValleNo ratings yet

- The New Areopagi of Mission: I. Cultural SectorDocument2 pagesThe New Areopagi of Mission: I. Cultural SectorQueen ValleNo ratings yet

- The Mark of A True CICM The Zeal For Missionary WorkDocument2 pagesThe Mark of A True CICM The Zeal For Missionary WorkQueen ValleNo ratings yet

- Understanding The Discipline of Project Management.: ProjectsDocument5 pagesUnderstanding The Discipline of Project Management.: ProjectsQueen ValleNo ratings yet

- Types and Categories or Cooperative - LawsDocument2 pagesTypes and Categories or Cooperative - LawsQueen ValleNo ratings yet

- Variables and Measurement ScalesDocument4 pagesVariables and Measurement ScalesQueen ValleNo ratings yet

- Ethics and Psychology "Ethics Has Something To Do With What My Feelings Tell Me Is Right or Wrong."Document3 pagesEthics and Psychology "Ethics Has Something To Do With What My Feelings Tell Me Is Right or Wrong."Queen ValleNo ratings yet

- Data & SamplingDocument3 pagesData & SamplingQueen ValleNo ratings yet

- Value-Added TaxDocument4 pagesValue-Added TaxQueen ValleNo ratings yet

- Definition of EthicsDocument2 pagesDefinition of EthicsQueen ValleNo ratings yet

- Escape From TaxationDocument3 pagesEscape From TaxationQueen Valle100% (1)

- Data & SamplingDocument3 pagesData & SamplingQueen ValleNo ratings yet

- 2.4.2.2 Governance of Portfolios, Programs, and ProjectsDocument6 pages2.4.2.2 Governance of Portfolios, Programs, and ProjectsQueen Valle100% (1)

- Assessment1 Stat - AnalysisDocument2 pagesAssessment1 Stat - AnalysisQueen ValleNo ratings yet

- 2.2 Enterprise Environmental FactorsDocument4 pages2.2 Enterprise Environmental FactorsQueen ValleNo ratings yet

- Cooperative UnionsDocument5 pagesCooperative UnionsQueen ValleNo ratings yet

- Business Combination (PFRS 3)Document5 pagesBusiness Combination (PFRS 3)Queen ValleNo ratings yet

- Ethics and Psychology "Ethics Has Something To Do With What My Feelings Tell Me Is Right or Wrong."Document3 pagesEthics and Psychology "Ethics Has Something To Do With What My Feelings Tell Me Is Right or Wrong."Queen ValleNo ratings yet

- 2.4.2.2 Governance of Portfolios, Programs, and ProjectsDocument6 pages2.4.2.2 Governance of Portfolios, Programs, and ProjectsQueen Valle100% (1)

- Escape From TaxationDocument3 pagesEscape From TaxationQueen Valle100% (1)

- Understanding The Discipline of Project Management.: ProjectsDocument5 pagesUnderstanding The Discipline of Project Management.: ProjectsQueen ValleNo ratings yet

- Definition of EthicsDocument2 pagesDefinition of EthicsQueen ValleNo ratings yet

- Business Combination (PFRS 3)Document5 pagesBusiness Combination (PFRS 3)Queen ValleNo ratings yet

- Assessment1 Stat - AnalysisDocument2 pagesAssessment1 Stat - AnalysisQueen ValleNo ratings yet

- 2.2 Enterprise Environmental FactorsDocument4 pages2.2 Enterprise Environmental FactorsQueen ValleNo ratings yet

- Cooperative UnionsDocument5 pagesCooperative UnionsQueen ValleNo ratings yet