Professional Documents

Culture Documents

5 Percent. 1 Percent. 3 Percent. 2 Percent. 7 Percent

Uploaded by

AliceJohnOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

5 Percent. 1 Percent. 3 Percent. 2 Percent. 7 Percent

Uploaded by

AliceJohnCopyright:

Available Formats

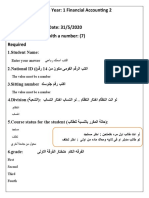

An investor requires a 3 percent increase in purchasing power in order to induce her to lend.

She

expects inflation to be 2 percent next year. The nominal rate she must charge is about

- 5 percent.

1 percent.

3 percent.

2 percent.

7 percent.

If you earn 0.5 percent a month in your bank account, this would be the same as earning a 6 percent

annual interest rate with annual compounding.

True

- False

An individual actually earned a 4 percent nominal return last year. Prices went up by 3 percent over

the year. Given that the investment income was subject to a federal tax rate of 28 percent and a

state and local tax rate of 6 percent, what was the investor's actual real after-tax rate of return?

= -0.36 percent

2.64 percent

1.45 percent

0.72 percent

0.66 percent

{0.04 * [1 - (0.28 + 0.06)]}-0.03

Which of the following bond types pays interest that is exempt from federal taxation?

- Municipal bonds

Corporate bonds

Treasury bonds

Convertible bonds

Municipal bonds and Treasury bonds

An investor earned a 5 percent nominal risk-free rate over the year. However, over the year, prices

increased by 2 percent. The investor's real risk-free rate was less than his nominal rate of return.

- True

False

You might also like

- Scribd NotesDocument14 pagesScribd NotesLeeAnn MarieNo ratings yet

- Wall Street Prep Premium Exam Flashcards QuizletDocument1 pageWall Street Prep Premium Exam Flashcards QuizletRaghadNo ratings yet

- Bonds Payable QuizDocument7 pagesBonds Payable Quizjustine reine cornico100% (2)

- Credit Card Agreement For Consumer Cards in Capital One Bank (USA), N.ADocument8 pagesCredit Card Agreement For Consumer Cards in Capital One Bank (USA), N.Ajeremywright100% (1)

- Corporate FinanceDocument15 pagesCorporate Financecaglar ozyesilNo ratings yet

- Concept Check Quiz: First SessionDocument27 pagesConcept Check Quiz: First SessionMichael MillerNo ratings yet

- I-Bond Rate: TreasurydirectDocument19 pagesI-Bond Rate: TreasurydirectkoggleNo ratings yet

- Should Municipal Bonds be a Tool in Your Retirement Planning Toolbox?From EverandShould Municipal Bonds be a Tool in Your Retirement Planning Toolbox?No ratings yet

- Acknowledgement: Group Assignment PMG 3093 - January 2018Document35 pagesAcknowledgement: Group Assignment PMG 3093 - January 2018AliceJohn0% (1)

- Case Study 3 Module 3Document4 pagesCase Study 3 Module 3AliceJohnNo ratings yet

- Business Plan For Direct Lending BusinessDocument5 pagesBusiness Plan For Direct Lending BusinessRhap Sody90% (10)

- Six Sigma: "Quality Is Our Job, Customer Satisfaction Is Our Duty, Customer Loyalty Is Our Future"Document66 pagesSix Sigma: "Quality Is Our Job, Customer Satisfaction Is Our Duty, Customer Loyalty Is Our Future"AliceJohnNo ratings yet

- Exercises - Corporate Finance 1Document12 pagesExercises - Corporate Finance 1Hông HoaNo ratings yet

- PV Examples S10Document6 pagesPV Examples S10Paul Christian Lopez FiedacanNo ratings yet

- Exam #2 NotesDocument3 pagesExam #2 NotesMoreskyNo ratings yet

- Coporate Finance FIN 3433 Individual Assignment 2Document1 pageCoporate Finance FIN 3433 Individual Assignment 2Divya NandiniNo ratings yet

- Chapter 7Document5 pagesChapter 7Trí Bùi HữuNo ratings yet

- Part I. Multiple Choice Questions: Select The Best Statement or Words That Corresponds To The QuestionDocument8 pagesPart I. Multiple Choice Questions: Select The Best Statement or Words That Corresponds To The QuestionNhel AlvaroNo ratings yet

- Chapter 8: Capital Market - Bond Market: Mr. Al MannaeiDocument39 pagesChapter 8: Capital Market - Bond Market: Mr. Al MannaeiMarwa HassanNo ratings yet

- Bs204 Frequently Asked QuestionsDocument13 pagesBs204 Frequently Asked QuestionsTakudzwa GwemeNo ratings yet

- Week 7 Revision Exercise (Quest)Document4 pagesWeek 7 Revision Exercise (Quest)Eleanor ChengNo ratings yet

- Aynur Efendiyeva - Maliye 1Document7 pagesAynur Efendiyeva - Maliye 1Sheen Carlo AgustinNo ratings yet

- Effective Payment1Document3 pagesEffective Payment1Joel D ValenciaNo ratings yet

- Lec 21 SIMPLE INTEREST PRACTICE QUESTIONSDocument3 pagesLec 21 SIMPLE INTEREST PRACTICE QUESTIONShaiqa malikNo ratings yet

- MGT 3078 Exam 1Document2 pagesMGT 3078 Exam 18009438387No ratings yet

- Assignment 1Document2 pagesAssignment 1yashthakurjii1No ratings yet

- Revision For Midterm - Wo AnswersDocument3 pagesRevision For Midterm - Wo AnswersNghinh Xuan TranNo ratings yet

- Section A QUESTION 1 (Compulsory Question - 40 Marks)Document5 pagesSection A QUESTION 1 (Compulsory Question - 40 Marks)Jay Napstar NkomoNo ratings yet

- Finance PSet2Document1 pageFinance PSet2Vishal KhandareNo ratings yet

- d15 Hybrid f9 Q PDFDocument8 pagesd15 Hybrid f9 Q PDFhelenxiaochingNo ratings yet

- Group 2 Presentation SlidesDocument27 pagesGroup 2 Presentation SlidesJasonNo ratings yet

- DR Bahaa Quizes CH 3&4 PDFDocument3 pagesDR Bahaa Quizes CH 3&4 PDFislam hamdyNo ratings yet

- Queries: Question of The WeekDocument1 pageQueries: Question of The WeekkrjuluNo ratings yet

- Interest Rates of Small Savings Schemes RaisedDocument2 pagesInterest Rates of Small Savings Schemes RaisedRamya GowdaNo ratings yet

- Practice Test MidtermDocument6 pagesPractice Test Midtermrjhuff41No ratings yet

- AnalyinDocument4 pagesAnalyinCarissa PalomoNo ratings yet

- Citibank ChargesDocument11 pagesCitibank ChargesarmppNo ratings yet

- Actg 470-HW #1Document3 pagesActg 470-HW #1Brittany Neilson0% (1)

- Debt Funds & PicksDocument14 pagesDebt Funds & Pickssantanu_1310No ratings yet

- Asis 3 (CH 5 & 6) - PertanyaanDocument4 pagesAsis 3 (CH 5 & 6) - PertanyaanAndre JonathanNo ratings yet

- Project IntroductionsDocument5 pagesProject IntroductionsAbhay SharmaNo ratings yet

- Balance Conv TandCs Final 1Document12 pagesBalance Conv TandCs Final 1kannankadirveluNo ratings yet

- Worldwide Personal Tax Guide 2012 - 2013 Going To Mexico: Local InformationDocument5 pagesWorldwide Personal Tax Guide 2012 - 2013 Going To Mexico: Local InformationJonas VetsNo ratings yet

- Mid-Term Test - MondayDocument3 pagesMid-Term Test - MondayMi 12A1 - 19 Nguyễn Ngọc TràNo ratings yet

- Assignment 3Document3 pagesAssignment 3Inès ChougraniNo ratings yet

- Rabobank Loan AssessmentDocument5 pagesRabobank Loan AssessmentSatyanand BrajkishorepdNo ratings yet

- Sosc Ver 210313Document3 pagesSosc Ver 210313Shashank AgarwalNo ratings yet

- Report On SBLF Participants' Small Business Lending GrowthDocument8 pagesReport On SBLF Participants' Small Business Lending GrowthGerry DomingoNo ratings yet

- Topic 2 Practice QuestionDocument4 pagesTopic 2 Practice Questionaarzu dangiNo ratings yet

- Instructions For Form 4548 2011 Michigan Business Tax (MBT) Quarterly ReturnDocument4 pagesInstructions For Form 4548 2011 Michigan Business Tax (MBT) Quarterly ReturnjoshisanjeevNo ratings yet

- solution of math first امتحانDocument8 pagessolution of math first امتحانMagdy KamelNo ratings yet

- Answer and ExplanationDocument2 pagesAnswer and ExplanationJohn TomNo ratings yet

- Inflation Rate Latest Information OlivDocument10 pagesInflation Rate Latest Information OlivCool ManNo ratings yet

- Tutorial 5 TVM Application - SVDocument5 pagesTutorial 5 TVM Application - SVHiền NguyễnNo ratings yet

- Down Payments: Tighter Lending StandardsDocument10 pagesDown Payments: Tighter Lending StandardsraqibappNo ratings yet

- Quiz 3Document15 pagesQuiz 3help215No ratings yet

- Chapter 3 - Concept Questions and ExercisesDocument3 pagesChapter 3 - Concept Questions and ExercisesPhương Nguyễn ThuNo ratings yet

- FIN 370 Final Exam (29/30 Correct Answers)Document13 pagesFIN 370 Final Exam (29/30 Correct Answers)KyleWalkeer0% (1)

- Ch. 4 - The Time Value of MoneyDocument46 pagesCh. 4 - The Time Value of MoneyNeha BhayaniNo ratings yet

- Problems For CBDocument28 pagesProblems For CBĐức HàNo ratings yet

- Assignment 1Document7 pagesAssignment 1Camilo Andres MesaNo ratings yet

- Chapter 3 - Concept Questions and ExercisesDocument3 pagesChapter 3 - Concept Questions and Exercisesmin - radiseNo ratings yet

- Continuous Improvement ProgramDocument16 pagesContinuous Improvement ProgramAliceJohnNo ratings yet

- RACI Matrix Template: Project Name: Roles TableDocument2 pagesRACI Matrix Template: Project Name: Roles TableAliceJohnNo ratings yet

- This Study Resource Was: Total Quality ManagementDocument5 pagesThis Study Resource Was: Total Quality ManagementAliceJohnNo ratings yet

- Chapter 02 Financial Statements AnalysisDocument15 pagesChapter 02 Financial Statements AnalysisAliceJohnNo ratings yet

- Chapter 02 Financial Statements AnalysisDocument25 pagesChapter 02 Financial Statements AnalysisAliceJohnNo ratings yet

- SectorsDocument131 pagesSectorsAliceJohnNo ratings yet

- Final Project Example NissanDocument19 pagesFinal Project Example NissanAliceJohnNo ratings yet

- DocxDocument17 pagesDocxAliceJohnNo ratings yet

- RUNNER: Nissan Case Study: Final Analysis Page - 1Document31 pagesRUNNER: Nissan Case Study: Final Analysis Page - 1AliceJohnNo ratings yet

- Construction Schedule For New Manipal University BuildingsDocument12 pagesConstruction Schedule For New Manipal University BuildingsAliceJohnNo ratings yet

- 7 1 Final Project Submission Comprehensive Case Study AnalysisDocument16 pages7 1 Final Project Submission Comprehensive Case Study AnalysisAliceJohnNo ratings yet

- 7 1 Final Project Submission Comprehensive Case Study AnalysisDocument16 pages7 1 Final Project Submission Comprehensive Case Study AnalysisAliceJohnNo ratings yet

- A Report On Operations at Pizza HutDocument14 pagesA Report On Operations at Pizza HutAliceJohnNo ratings yet

- Manipal University Dubai: 703-Supply Chain Management Assignment 1: PresentationDocument1 pageManipal University Dubai: 703-Supply Chain Management Assignment 1: PresentationAliceJohnNo ratings yet

- Valuation of Companies Valuation Based On Discounted CashflowDocument5 pagesValuation of Companies Valuation Based On Discounted CashflowAliceJohnNo ratings yet

- Planning FOR Quality and Productivity: A Nissan Case StudyDocument5 pagesPlanning FOR Quality and Productivity: A Nissan Case StudyAliceJohnNo ratings yet

- Student Name: Student ID: Instructor: Course Title: InstituteDocument11 pagesStudent Name: Student ID: Instructor: Course Title: InstituteAliceJohnNo ratings yet

- Company Financial Analysis Project: Nke - Nyse Nike IncDocument37 pagesCompany Financial Analysis Project: Nke - Nyse Nike IncAliceJohnNo ratings yet

- Supply Chain ManagementDocument4 pagesSupply Chain ManagementAliceJohnNo ratings yet