Professional Documents

Culture Documents

ACC1 Midterm 1 2018

Uploaded by

Shilakha DhawanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ACC1 Midterm 1 2018

Uploaded by

Shilakha DhawanCopyright:

Available Formats

ACC1 Midterm 2018 Name:____ ________________________________ ID.

:_______________________

Accounting 1

Name:

Student No

Year Month Day

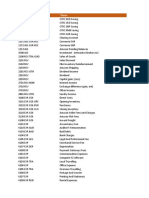

1 2018 Feb 1 You invest to open a business called, <<Your Name>>, consultant. $35,000.00

2 2018 Feb 1 You pay the rent $1,500.00

3 2018 Feb 2 You buy cash Computer Equipment for Note 1 $5,000.00

4 2018 Feb 3 You receive Professional Fees cash $6,250.00

5 2018 Feb 3 you paid the electricity bill $530.00

6 2018 Feb 4 You buy cash Office Equipment for Note 2 $4,530.00

7 2018 Feb 5 You have provided Professional Fees on account $5,280.00

8 2018 Feb 6 You buy cash Office supplies for Note 5 $452.00

9 2018 Feb 9 You pay salaries expenses (secretary) $1,120.00

10 2018 Feb 9 You pay salaries expenses (Owner) $1,750.00

11 2018 Feb 10 You sign a 5 month contract Note 3 $3,600.00

12 2018 Feb 11 You receive paiement on account receivable $2,180.00

13 2018 Feb 12 You buy on account: Computer equipment $2,845.00

14 2018 Feb 13 You withdraw for personal use $1,015.00

15 2018 Feb 14 You paid the insurance for 2 years Note 4 $4,200.00

16 2018 Feb 19 You make partial payment on account payable $925.00

17 2018 Feb 23 You pay salaries expenses (secretary) $1,600.00

18 2018 Feb 23 You pay salaries expenses (Owner) $2,500.00

19 2018 Feb 24 You buy cash Office Equipment for $3,500.00

20 2018 Feb 24 You withdraw for personal use $2,000.00

21 2018 Feb 25 You receive Professional Fees cash $7,887.00

Prepare the following documents

1 General Journal

2 T accounts

3 Trial Balance

4 Income statement

5 Owner Equity

6 Balance Sheet

Note

1 Computer Equipment linear depreciation on 36 months, residual of $825.00

2 Office Equipment linear depreciation on 24 months, residual of $470.00

3 The contract start on the 15

4 The insurance is a 2 years contract.

5 The Office Supplies used for the month is $317.00

You might also like

- Global Marketing Chapter 2Document3 pagesGlobal Marketing Chapter 2Shilakha DhawanNo ratings yet

- Following Are The Stages in The Product Life Cycle StagesDocument4 pagesFollowing Are The Stages in The Product Life Cycle StagesShilakha DhawanNo ratings yet

- Global Marketing Assignment - Chapter 4Document4 pagesGlobal Marketing Assignment - Chapter 4Shilakha DhawanNo ratings yet

- Acc1 Exercise General LedgerDocument6 pagesAcc1 Exercise General LedgerShilakha DhawanNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Special Income Tax Treatment of Gains and Losses From Dealings in PropertyDocument52 pagesSpecial Income Tax Treatment of Gains and Losses From Dealings in PropertyAngeliqueGiselleCNo ratings yet

- Code Report Code NameDocument24 pagesCode Report Code NameLucy Marie RamirezNo ratings yet

- Valuation of BondsDocument5 pagesValuation of BondsSAURAVNo ratings yet

- Finance Research Analysis (FRA) Project ReportDocument63 pagesFinance Research Analysis (FRA) Project ReportKyotoNo ratings yet

- Meezan Rozana Amdani FundDocument112 pagesMeezan Rozana Amdani FundIjaz HussainNo ratings yet

- Jawaban AKL UTSDocument15 pagesJawaban AKL UTSSalsabila A FajrNo ratings yet

- Requirement 1 This Year Last Year: Case 3 (Comprehensive Ratio Analysis)Document6 pagesRequirement 1 This Year Last Year: Case 3 (Comprehensive Ratio Analysis)Mark Jayson Gonzaga CerezoNo ratings yet

- Introduction To Corporate Finance, Megginson, Smart and LuceyDocument6 pagesIntroduction To Corporate Finance, Megginson, Smart and LuceyGvz HndraNo ratings yet

- Peachtree ProjectDocument2 pagesPeachtree ProjectAmyn AhmedNo ratings yet

- Assignment - Module 2 - Stock and Their Valuation - QuestionDocument4 pagesAssignment - Module 2 - Stock and Their Valuation - QuestionMary Justine PaquibotNo ratings yet

- Quixote ConsultingDocument13 pagesQuixote ConsultingKailash Kumar100% (1)

- Advanced Accounting Chapter 1 PDF FreeDocument11 pagesAdvanced Accounting Chapter 1 PDF FreeSitiNo ratings yet

- Case Study 4Document4 pagesCase Study 4Nenad MazicNo ratings yet

- 7 - Capital BudgetingDocument3 pages7 - Capital BudgetingChristian LimNo ratings yet

- Evaluate The Factors That The Owners of A Rapidly Expanding Private Limited Company Should Consider Before Deciding Whether To Convert It Into A Public Limited CompanyDocument2 pagesEvaluate The Factors That The Owners of A Rapidly Expanding Private Limited Company Should Consider Before Deciding Whether To Convert It Into A Public Limited Companyoptionpocket65No ratings yet

- Growth, Profitability, and Financial Ratios For Starbucks Corp (SBUX) From MorningstarDocument2 pagesGrowth, Profitability, and Financial Ratios For Starbucks Corp (SBUX) From Morningstaraboubakr soultanNo ratings yet

- Test Bank For Intermediate Accounting 12th Edition Donald e Kieso DownloadDocument40 pagesTest Bank For Intermediate Accounting 12th Edition Donald e Kieso Downloadjasondaviskpegzdosmt100% (20)

- Module 1 Paper 1 GRMCE Book 29102021Document568 pagesModule 1 Paper 1 GRMCE Book 29102021elliot fernandesNo ratings yet

- Daily Equity Market Report - 22.03.2022Document1 pageDaily Equity Market Report - 22.03.2022Fuaad DodooNo ratings yet

- Grade 11 Unit 8Document2 pagesGrade 11 Unit 8Nipuni PereraNo ratings yet

- Intangible AssetDocument44 pagesIntangible Assetatikah yetinsa100% (1)

- XII CBSE ACCOUNTS Test - 4Document1 pageXII CBSE ACCOUNTS Test - 4Dump AccNo ratings yet

- 2010 Apr 12 - AMFraser - Thomson MedicalDocument4 pages2010 Apr 12 - AMFraser - Thomson MedicalKyithNo ratings yet

- Chapter 3 Depreciation - Sum of The Years Digit MethodPart 4Document8 pagesChapter 3 Depreciation - Sum of The Years Digit MethodPart 4Tor GineNo ratings yet

- Handout 13 Chart of AccountDocument3 pagesHandout 13 Chart of AccountKyle Adrian ParoneNo ratings yet

- Ventura, Mary Mickaella R. No. 1Document2 pagesVentura, Mary Mickaella R. No. 1Mary VenturaNo ratings yet

- S08 - Cash Flow StatementDocument55 pagesS08 - Cash Flow StatementYassin DyabNo ratings yet

- Soal UAS MANAJEMEN Eksekutif 2021Document2 pagesSoal UAS MANAJEMEN Eksekutif 2021Yudi ArdianaNo ratings yet

- Private Equity StatementsDocument40 pagesPrivate Equity Statementsakashrawat26No ratings yet

- Auditing PDFDocument14 pagesAuditing PDFJessica MalijanNo ratings yet