Professional Documents

Culture Documents

Ventura, Mary Mickaella R. No. 1

Uploaded by

Mary VenturaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ventura, Mary Mickaella R. No. 1

Uploaded by

Mary VenturaCopyright:

Available Formats

Mary Mickaella R.

Ventura

BSA 3-A

Financial Management Final Exam

Item no. 1

1. What is your Favorite Topic or The Topic you loved most in Financial Management (PRELIMS to

MIDTERMS)? Why that topic? What lesson or learnings did you get and How can you apply it in your

life? How can it help you in your career?

Your answer shall show the depth of knowledge and mastery of the topic you have chosen.

Answer:

My favorite topic is the deeper understanding about finance which takes place on week 3 of

the discussion. Goal ng finance is mamaximize ang shareholders wealth. Ang goal ng finance is not to

maximize profits, but to maximize shareholder's wealth. Ang pagpapalaki sa profits ay short-term at

ang tendency ay nako-compromise na ang stakeholders, lalo na ang environment. Hindi ito

makabubuti sa future ng isang company at maaari pang mauwi sa pagkasara. Kaya, mahalaga na

ang pinapataas ay ang value or wealth ng company at hindi naka-focus sa kita lang at para na rin sa

long term run ng isang company. Ang value ng pera ngayon ay hindi na same ng value sa future

because of inflation. Ang impact ng inflation sa time value of money ay mas lumiliit yung value ng

pera over time. In inflation mas tumataas yung price ng bilihin, effectively nababawasan din yung

bilang ng goods and services na mabibili mo sa pera mo in the future kesa sa pera mo ngayon. Ang

average healthy inflation rate ay 3%. Kapag masyadong mataas ang inflation rate, masyadong

mabilis tumaas ang presyo ng mga bilihin ang tendency gagastos ka na ngayon dahil iniisip mo na

mas maganda na bumili ako ngayon dahil tataas ang presyo nito sa susunod. So mas marami kang

bibiling property mas kaunti ang pera na hawak mo. Kapag masyadong mababa naman ihohold mo

yung money di ka gagastos babagal yung economy o yung paggalaw ng pera.

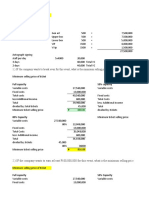

The cash cycle is very important not only to the business but also to the creditors and suppliers

that transact and rely on the entity to project their own timings. There are 3 Cash Conversion Cycle: 1.

Days in Inventory - ratio sya to measure yung average number of days na hinohold yung inventory

nila bago ibenta. 2. Days REceivable - number of days kung kelan may outstanding na invoice pa yung

customer bago ito kolektahin. 3. Days Payable - average number of days na maococnsume ng

company para mabayaran ang accounts payable nila. In finance, we use projections to track the

performance or the situation ng pera, it is because it is base on sales na makakatulong sa

pagdetermine ng kita by means of different analysis. It is also a way to study the economy more,

helps us to be wise in investments matter.

You might also like

- Financial Behavior Modification Starter Guide: A Simple Guide to Managing Your FinancesFrom EverandFinancial Behavior Modification Starter Guide: A Simple Guide to Managing Your FinancesRating: 3 out of 5 stars3/5 (1)

- Assignment 1. Credit: Credit Has Great Connection in Our Connection Growth, As OurDocument1 pageAssignment 1. Credit: Credit Has Great Connection in Our Connection Growth, As OurCharisse Rabago TanNo ratings yet

- Important Skills A Manager Should Possess: Assignment #2Document3 pagesImportant Skills A Manager Should Possess: Assignment #2Roldan Hiano ManganipNo ratings yet

- Low Risk, High Reward (Review and Analysis of Reiss' Book)From EverandLow Risk, High Reward (Review and Analysis of Reiss' Book)No ratings yet

- Types of budgets and importance of financial managementDocument2 pagesTypes of budgets and importance of financial managementGulzar AlishahNo ratings yet

- Financial Management Research Paper - Juliana Honeylet L. Amper - MEMDocument10 pagesFinancial Management Research Paper - Juliana Honeylet L. Amper - MEMJuliana Honeylet L. AmperNo ratings yet

- Tanudtanud, Charisse R. BSHM-3 FINANCE 3508 TTH 0130-0300 PM (ASSIGNMENT 1. CREDIT)Document3 pagesTanudtanud, Charisse R. BSHM-3 FINANCE 3508 TTH 0130-0300 PM (ASSIGNMENT 1. CREDIT)Charisse Rabago TanNo ratings yet

- BigZag Facing ZigZag SolveDocument4 pagesBigZag Facing ZigZag SolveMd. Sakib HossainNo ratings yet

- Financial Planning & Budgeting RAK: Sbs/Abs - Bba Assignment - 2021Document19 pagesFinancial Planning & Budgeting RAK: Sbs/Abs - Bba Assignment - 2021Toppers AENo ratings yet

- Cristina Mae U. Lagmay Bsba - FM 3A Credit & Collection Prof: Melinda Verano AbichuelaDocument1 pageCristina Mae U. Lagmay Bsba - FM 3A Credit & Collection Prof: Melinda Verano AbichuelaCristina maeNo ratings yet

- Personal FinanceDocument5 pagesPersonal FinanceFred Jaff Fryan RosalNo ratings yet

- MODULE 4 SVV Time Value of Money StudentDocument5 pagesMODULE 4 SVV Time Value of Money StudentJessica RosalesNo ratings yet

- Speaking TestDocument16 pagesSpeaking Testminhhao3698No ratings yet

- Nicole Tommarazzo - Writing Samples 11-2023Document5 pagesNicole Tommarazzo - Writing Samples 11-2023api-703391791No ratings yet

- Business NotesDocument20 pagesBusiness NotesMike LyonsNo ratings yet

- Self driving portfolios provide benefits of reduced time pressureDocument5 pagesSelf driving portfolios provide benefits of reduced time pressureMohan0% (1)

- New Microsoft Word DocumentDocument7 pagesNew Microsoft Word DocumentSaiful HoqueNo ratings yet

- FM Chap 1 Learning ActivityDocument3 pagesFM Chap 1 Learning ActivityLysss EpssssNo ratings yet

- Explain The Concept of Risk Return TradeDocument3 pagesExplain The Concept of Risk Return TradeKaushal ChopraNo ratings yet

- Script Financial LiteracyDocument6 pagesScript Financial LiteracyAngelica AruyalNo ratings yet

- Navigating UncertaintyDocument24 pagesNavigating Uncertaintyz god luckNo ratings yet

- Written Exam 1 After Research PresentationsDocument3 pagesWritten Exam 1 After Research Presentationsjemalyn turinganNo ratings yet

- Chapter 1 Elements of Relationship MarketingDocument8 pagesChapter 1 Elements of Relationship MarketingRhondrew HudsonNo ratings yet

- Massigment1 FinancialDocument2 pagesMassigment1 FinancialMicah FortinNo ratings yet

- LESSON 13 - CREATING-WEALTHDocument5 pagesLESSON 13 - CREATING-WEALTHKaryll Kelvet GoñaNo ratings yet

- Financial Statements Analysis, Part 1 - DiscussionDocument13 pagesFinancial Statements Analysis, Part 1 - DiscussionMark Angelo BustosNo ratings yet

- SalesDocument28 pagesSalesKopal GothwalNo ratings yet

- Understanding Total Quality ManagementDocument6 pagesUnderstanding Total Quality Managementnoor hasanNo ratings yet

- Module 3Document8 pagesModule 3Kai Gg100% (1)

- Core Values and Financial Risk ManagementDocument4 pagesCore Values and Financial Risk ManagementXJ WashNo ratings yet

- SM Prime Employee AbsenteeismDocument7 pagesSM Prime Employee AbsenteeismJoy del Rosario100% (1)

- Personal Finance Chapter 3Document2 pagesPersonal Finance Chapter 3api-526065196No ratings yet

- Final 3Document8 pagesFinal 3MohamedNo ratings yet

- G.A.M.E Video AnalysisDocument2 pagesG.A.M.E Video AnalysisHIMANSHU RAWATNo ratings yet

- Business Finance Last ActivityDocument4 pagesBusiness Finance Last ActivityIts Omar VlogNo ratings yet

- SFM Semi ReadyDocument21 pagesSFM Semi ReadyDhaamel GlkNo ratings yet

- Chapter Five SalesDocument5 pagesChapter Five SalesBelay AdamuNo ratings yet

- Improve Bench Press and Upper Body WorkoutsDocument2 pagesImprove Bench Press and Upper Body WorkoutsUmama TahirNo ratings yet

- Exit SlipDocument2 pagesExit SlipMILBERT DE GRACIANo ratings yet

- Mcgill Personal Finance Essentials Transcript Module 4: Strategic Budget Building, Part 1Document5 pagesMcgill Personal Finance Essentials Transcript Module 4: Strategic Budget Building, Part 1shourav2113No ratings yet

- 19BBL053 RPR BusinessDocument6 pages19BBL053 RPR Businesskhushi vaswaniNo ratings yet

- How banks dealt with conflicts during the pandemicDocument4 pagesHow banks dealt with conflicts during the pandemicsNo ratings yet

- ACC Newsline Wrapper Aug Issue Version 3 - RemovedDocument21 pagesACC Newsline Wrapper Aug Issue Version 3 - RemovedpadmaniaNo ratings yet

- Mid-Term Summary Writing Part - 2: Etlam JaswanthDocument5 pagesMid-Term Summary Writing Part - 2: Etlam JaswanthEtlam JashwanthNo ratings yet

- Entrepreneurial Mindset Activities CompilationDocument9 pagesEntrepreneurial Mindset Activities CompilationSubito, Ma. Daisy A.No ratings yet

- Defination of Financial Management ? Functions ?Document16 pagesDefination of Financial Management ? Functions ?Arin majumderNo ratings yet

- MBA Finance Principles and ConceptsDocument17 pagesMBA Finance Principles and ConceptsmaheswaranNo ratings yet

- Managing Cash DisbursementsDocument18 pagesManaging Cash DisbursementsKath LeynesNo ratings yet

- FINMANDocument3 pagesFINMANCLAIRE PAJONo ratings yet

- Bbmf2093 Corporate FinanceDocument9 pagesBbmf2093 Corporate FinanceXUE WEI KONGNo ratings yet

- Elc 590Document4 pagesElc 590MUHAMAD FADHIL ABDUL WAHABNo ratings yet

- Sample Research Paper On Financial ManagementDocument8 pagesSample Research Paper On Financial Managementhxmchprhf100% (1)

- Md. Jakaria Rahman Id.51943064Document6 pagesMd. Jakaria Rahman Id.51943064Zakaria ShuvoNo ratings yet

- Principles of Business For CSEC®: 2nd EditionDocument8 pagesPrinciples of Business For CSEC®: 2nd EditionKerine Williams-FigaroNo ratings yet

- A Doctor's Prescription To Comprehensive Financial WellnessDocument15 pagesA Doctor's Prescription To Comprehensive Financial WellnessHank WeinstockNo ratings yet

- FINANCEDocument1 pageFINANCEmae salingbayNo ratings yet

- RW4 Trung 1Document2 pagesRW4 Trung 1Trần Bá TrungNo ratings yet

- SampleDocument6 pagesSampleMaya JoshiNo ratings yet

- Ventura, Mary Mickaella R. No. 5Document3 pagesVentura, Mary Mickaella R. No. 5Mary VenturaNo ratings yet

- Ventura, Marymickaellar Chapter6 (2,3,4,20,21)Document2 pagesVentura, Marymickaellar Chapter6 (2,3,4,20,21)Mary VenturaNo ratings yet

- Ventura, Mary Mickaella R - RetirementplanDocument6 pagesVentura, Mary Mickaella R - RetirementplanMary VenturaNo ratings yet

- Ventura, Marymickaellar Chapter6 (30 40)Document4 pagesVentura, Marymickaellar Chapter6 (30 40)Mary VenturaNo ratings yet

- Ventura, Mary Mickaella R - Chapter9 (No.4,5,7,8,9,10,16)Document4 pagesVentura, Mary Mickaella R - Chapter9 (No.4,5,7,8,9,10,16)Mary VenturaNo ratings yet

- Ventura, Mary Mickaella R - Chapter9p.466Document1 pageVentura, Mary Mickaella R - Chapter9p.466Mary VenturaNo ratings yet

- Ventura, Mary Mickaella R. No. 6Document2 pagesVentura, Mary Mickaella R. No. 6Mary VenturaNo ratings yet

- Simple Interest Versus Compound Interest (LO1) First City Bank Pays 8 Percent Simple InterestDocument4 pagesSimple Interest Versus Compound Interest (LO1) First City Bank Pays 8 Percent Simple InterestMary VenturaNo ratings yet

- Ventura, Mary Mickaella R - YtmDocument1 pageVentura, Mary Mickaella R - YtmMary VenturaNo ratings yet

- Ventura, Mary Mickaella R. No. 4Document2 pagesVentura, Mary Mickaella R. No. 4Mary VenturaNo ratings yet

- Ventura, Mary Mickaella R Chapter 4 - MinicaseDocument5 pagesVentura, Mary Mickaella R Chapter 4 - MinicaseMary Ventura100% (1)

- Ventura, Mary Mickaella R. No. 3Document3 pagesVentura, Mary Mickaella R. No. 3Mary VenturaNo ratings yet

- Ventura, Mary Mickaella R Chapter4 - p.112-118Document8 pagesVentura, Mary Mickaella R Chapter4 - p.112-118Mary VenturaNo ratings yet

- Ventura, Mary Mickaella R. - Breakeven AnalysisDocument9 pagesVentura, Mary Mickaella R. - Breakeven AnalysisMary VenturaNo ratings yet

- Ventura, Mary Mickaella R. No. 8Document4 pagesVentura, Mary Mickaella R. No. 8Mary VenturaNo ratings yet

- Ventura, Marymickaellar Chapter5 (17,19,20)Document1 pageVentura, Marymickaellar Chapter5 (17,19,20)Mary VenturaNo ratings yet

- Ventura, Mary Mickaella R - Chapter8p.255-256Document3 pagesVentura, Mary Mickaella R - Chapter8p.255-256Mary VenturaNo ratings yet

- Ventura, Mary Mickaella R - Chapter7p.228-230Document3 pagesVentura, Mary Mickaella R - Chapter7p.228-230Mary VenturaNo ratings yet

- Ventura, Mary Mickaella R Chapter 3 - MinicaseDocument6 pagesVentura, Mary Mickaella R Chapter 3 - MinicaseMary VenturaNo ratings yet

- Ventura, Mary Mickaella R. No. 7Document1 pageVentura, Mary Mickaella R. No. 7Mary VenturaNo ratings yet

- Ventura, Mary Mickaella R - Noncurrentassetsheldforsale - Group3Document2 pagesVentura, Mary Mickaella R - Noncurrentassetsheldforsale - Group3Mary VenturaNo ratings yet

- Ventura, Mary Mickaella R. No. 2Document2 pagesVentura, Mary Mickaella R. No. 2Mary VenturaNo ratings yet

- Ventura, Mary Mickaella R - Chapter8p.256-258Document3 pagesVentura, Mary Mickaella R - Chapter8p.256-258Mary VenturaNo ratings yet

- Ventura, Mary Mickaella R - Education PlanDocument1 pageVentura, Mary Mickaella R - Education PlanMary VenturaNo ratings yet

- Ventura, Mary Mickaella R - Chapter9 (No.4,5,7,8,9,10,16)Document4 pagesVentura, Mary Mickaella R - Chapter9 (No.4,5,7,8,9,10,16)Mary VenturaNo ratings yet

- Ventura, Mary Mickaella R - Revenue From Contracts - p.209 - Group3Document5 pagesVentura, Mary Mickaella R - Revenue From Contracts - p.209 - Group3Mary VenturaNo ratings yet

- Ventura, Mary Mickaella R - Comprehensive Income - p.88 - Group3Document7 pagesVentura, Mary Mickaella R - Comprehensive Income - p.88 - Group3Mary VenturaNo ratings yet

- Ventura, Mary Mickaella R - p.44 - Statement of Financial PositionDocument6 pagesVentura, Mary Mickaella R - p.44 - Statement of Financial PositionMary VenturaNo ratings yet

- Ventura, Mary Mickaella R - Noncurrentassetsheldforsale (2) - Group 3Document5 pagesVentura, Mary Mickaella R - Noncurrentassetsheldforsale (2) - Group 3Mary VenturaNo ratings yet

- Prescription VS LapsesDocument2 pagesPrescription VS LapsesJerry CaneNo ratings yet

- Government Procurement Reform Act PDFDocument16 pagesGovernment Procurement Reform Act PDFliemorixNo ratings yet

- Tan Vs ZanduetaDocument2 pagesTan Vs ZanduetaPearl Deinne Ponce de LeonNo ratings yet

- Basic Microeconomics Semi Final Exam ReviewDocument3 pagesBasic Microeconomics Semi Final Exam ReviewEnergy Trading QUEZELCO 1No ratings yet

- Yes O Action Plan FinalDocument4 pagesYes O Action Plan FinalRHENAN BACOLOD100% (1)

- Full Text of Results CPA Board ExamDocument2 pagesFull Text of Results CPA Board ExamTheSummitExpressNo ratings yet

- Perceptual Thinking StyleDocument5 pagesPerceptual Thinking StyleAmirul Faris50% (2)

- Krishna Grameena BankDocument101 pagesKrishna Grameena BankSuresh Babu ReddyNo ratings yet

- Achieving Balance Through SincerityDocument15 pagesAchieving Balance Through Sinceritychocoholic_soph91No ratings yet

- Bhanu ResumeDocument7 pagesBhanu ResumeOrugantirajaNo ratings yet

- Vedanta KesariDocument56 pagesVedanta Kesarigeo_unoNo ratings yet

- Free Tuition Fee Application Form: University of Rizal SystemDocument2 pagesFree Tuition Fee Application Form: University of Rizal SystemCes ReyesNo ratings yet

- An Argument For The Eastern Origins of CatharismDocument22 pagesAn Argument For The Eastern Origins of CatharismDiana Bernal ColonioNo ratings yet

- Co-creator Rights in Archival DescriptionDocument7 pagesCo-creator Rights in Archival Descriptioncinnamonbun1No ratings yet

- Romblon Site Evaluation WorksheetDocument4 pagesRomblon Site Evaluation WorksheetMariel TrinidadNo ratings yet

- Tata Teleservices Limited.: Project ConnectDocument28 pagesTata Teleservices Limited.: Project ConnectshekarNo ratings yet

- 3gringos CookbookDocument22 pages3gringos Cookbookg7w0% (1)

- Ugc Good PracticesDocument21 pagesUgc Good PracticesIngryd Lo TierzoNo ratings yet

- Sopa de LetrasDocument2 pagesSopa de LetrasLuisa Fernanda ArboledaNo ratings yet

- Strategic Management Journal Article Breaks Down Strategizing vs EconomizingDocument20 pagesStrategic Management Journal Article Breaks Down Strategizing vs EconomizingVinícius RodriguesNo ratings yet

- Pigovian Welfare Economics 3Document4 pagesPigovian Welfare Economics 3vikram inamdar100% (1)

- Micro and Macro Environment of NestleDocument2 pagesMicro and Macro Environment of Nestlewaheedahmedarain56% (18)

- The Gnostic and Their RemainsDocument271 pagesThe Gnostic and Their RemainsAT SuancoNo ratings yet

- QTS Class Action Complaint & SummonsDocument20 pagesQTS Class Action Complaint & SummonsLong Beach PostNo ratings yet

- Loan Agreement DetailsDocument21 pagesLoan Agreement DetailssherrieNo ratings yet

- Hiv/Aids: Project BackgroundDocument1 pageHiv/Aids: Project BackgroundKristine JavierNo ratings yet

- SAP PM EAM Configuration 1 1617832490Document9 pagesSAP PM EAM Configuration 1 1617832490Mayte López AymerichNo ratings yet

- Mumbai to Goa Flight Ticket BookingDocument3 pagesMumbai to Goa Flight Ticket BookingDarshNo ratings yet

- The Mandala Theory of ArthashastraDocument15 pagesThe Mandala Theory of ArthashastraDìýaShílíñ100% (1)

- Chapter V Compensation and BenefitsDocument44 pagesChapter V Compensation and BenefitsJeoven Izekiel RedeliciaNo ratings yet