Professional Documents

Culture Documents

Personal Finance Chapter 3

Uploaded by

api-526065196Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Personal Finance Chapter 3

Uploaded by

api-526065196Copyright:

Available Formats

Chapter 3.

1 Concept Check

1. Summarize the content in Figure 3-1, the overview of effective financial planning.

The content in figure 3-1 illustrates one couple's overall financial plan. The content in 3-1

provides excellent managerial efforts to help push towards financial success.

2. What is the biggest financial worry of most individuals, and what can they do about

it? The biggest financial worry of most individuals is how to pay for unexpected

emergency expenses. People can set up an emergency fund in order to have extra funds to

spend on emergency expenses that may occur.

3. Summarize how financial goals follow from one’s values. Financial goals follow from

one’s values because of what is most important to them in their spending and saving.

Whether this be saving for college, planning a vacation, or owning a home, these values

dictate how money is saved and spent in a financial plan.

4. Pick two wealth-building principles for life and explain what they mean to you. Two

wealth-building principles for life are to spend less than you earn and live everyday

knowing that your financial future is under control. These principles are meaningful to

me because I am a spender and if I continue to spend my as I get it, I could go into debt.

To live everyday knowing your financial success is under control is meaningful to me

because as of right now I do not have a paying job which makes me worry about how

much I will have to spend in college and after. I just need to remember that after college I

will find a good job where I can get an income and be successful.

Chapter 3.2 Concept Check

1. Define the balance sheet and give two examples of how to increase one’s net worth.

A balance sheet describes an individual’s or family’s financial condition on a specific

date by sowing assets, liabilities, and net worth. To increase net worth one can by

increasing assets, decreasing liabilities, or both.

2. Define the cash-flow statement and explain what it does. A cash-flow statement

summarizes the total amounts that have been received and spent over a period of time.

Cash-flow statements show whether or not you were able to live within your income

during a time period, while also reflecting the flow of funds in and out.

3. How should assets and liabilities be valued for the balance sheet, and why? Assets

and liabilities should equal each other when added up.

4. Distinguish between fixed and variable expenses, and give two examples of each.

Fixed expenses are expenses that are often paid in the same amount that recur at fixed

intervals. Variable expenses are expenses over which you have substantial control. Two

examples of fixed expenses are insurance and telephone payments. And two examples of

variable expenses are clothing and accessories, and credit card payments.

5. Which two financial ratios for evaluating financial progress do you like, and why?

The two financial ratios I like are debt-to-income ratio and investment assets-to-total

asset ratio because I feel they can be applied to my life right now and can help me with

my finances at the moment.

Chapter 3.3 Concept Check

1. List some advantages of keeping good financial records. Some advantages of keeping

good financial records are they help you save money as well as make money, allow you

review the results of financial transactions, and help you take advantage of available tax

deductions when filing for income taxes.

2. Name three financial records that might best be kept in a safe-deposit box or in an

envelope at a safe place like at work. Three financial records that might best be kept in

a safe-deposit or in a safe place at work are financial plans, employer retirement plan

correspondence, and credit reports and scores.

Chapter 3.4 Concept Check

1. Identify two money topics you think might be valuable to discuss with a partner.

Two money topics I think are valuable to discuss with a partner are creating a budget and

setting up an emergency fund and talking with your partner regularly about financial

matters.

2. Identify two money topics that you think might present some challenges when

discussing them with a partner. Two money topics I think might present some

challenges when discussing them with a partner are telling money secrets and checking

each other's credit score and credit history.

You might also like

- Financial Stability: A Guide to Achieving Short and Long-Term Money ManagementFrom EverandFinancial Stability: A Guide to Achieving Short and Long-Term Money ManagementNo ratings yet

- Budget Like a Boss: Take Control of Your Finances with Simple Budgeting and Saving StrategiesFrom EverandBudget Like a Boss: Take Control of Your Finances with Simple Budgeting and Saving StrategiesNo ratings yet

- Making Your Money Work for You: Practical Tips for Financial SuccessFrom EverandMaking Your Money Work for You: Practical Tips for Financial SuccessNo ratings yet

- Financial Freedom Roadmap - Achieving Early Retirement through the FIRE Movement: Alex on Finance, #1From EverandFinancial Freedom Roadmap - Achieving Early Retirement through the FIRE Movement: Alex on Finance, #1No ratings yet

- Financial Freedom: Achieving Your Goals and Living Debt FreeFrom EverandFinancial Freedom: Achieving Your Goals and Living Debt FreeRating: 5 out of 5 stars5/5 (1)

- The Obvious Solution: Custom-Designed Financial Peace of MindFrom EverandThe Obvious Solution: Custom-Designed Financial Peace of MindNo ratings yet

- Principle 1: Personal Financial ManagementDocument12 pagesPrinciple 1: Personal Financial Managementapi-315024834No ratings yet

- Financial Themes: Your Fast Track to Financial Freedom! Learn Everything There Is to Know About Finances and Setting Up Successful Passive Income StreamsFrom EverandFinancial Themes: Your Fast Track to Financial Freedom! Learn Everything There Is to Know About Finances and Setting Up Successful Passive Income StreamsNo ratings yet

- Napkin Finance: Build Your Wealth in 30 Seconds or LessFrom EverandNapkin Finance: Build Your Wealth in 30 Seconds or LessRating: 3 out of 5 stars3/5 (3)

- Money Management Skills: A Beginners Guide On Personal Finance And Living Debt FreeFrom EverandMoney Management Skills: A Beginners Guide On Personal Finance And Living Debt FreeNo ratings yet

- Financial Behavior Modification Starter Guide: A Simple Guide to Managing Your FinancesFrom EverandFinancial Behavior Modification Starter Guide: A Simple Guide to Managing Your FinancesRating: 3 out of 5 stars3/5 (1)

- Money Saving Strategies for Teens: A Blueprint to Financial SuccessFrom EverandMoney Saving Strategies for Teens: A Blueprint to Financial SuccessRating: 5 out of 5 stars5/5 (1)

- Financial Empowerment - A Step-by-Step Guide to Achieving Financial FreedomFrom EverandFinancial Empowerment - A Step-by-Step Guide to Achieving Financial FreedomNo ratings yet

- Financial Freedom: Proven Steps To Accumulating Wealth And Understanding Passive MoneyFrom EverandFinancial Freedom: Proven Steps To Accumulating Wealth And Understanding Passive MoneyRating: 4 out of 5 stars4/5 (3)

- Financial Self-Defense (Review and Analysis of Givens' Book)From EverandFinancial Self-Defense (Review and Analysis of Givens' Book)No ratings yet

- Financial Planning Made Easy: A Beginner's Handbook to Financial SecurityFrom EverandFinancial Planning Made Easy: A Beginner's Handbook to Financial SecurityNo ratings yet

- Mastering the Art of Budgeting: A Comprehensive Guide for Financial SuccessFrom EverandMastering the Art of Budgeting: A Comprehensive Guide for Financial SuccessNo ratings yet

- Budgeting: How to Make a Budget and Manage Your Money and Personal Finances Like a ProFrom EverandBudgeting: How to Make a Budget and Manage Your Money and Personal Finances Like a ProNo ratings yet

- Financial Empowerment: Master Your Money and Transform Your LifeFrom EverandFinancial Empowerment: Master Your Money and Transform Your LifeRating: 5 out of 5 stars5/5 (1)

- Financial Freedom: How to make All the Money You Will Ever Need. Your Best Plan for Financial FitnessFrom EverandFinancial Freedom: How to make All the Money You Will Ever Need. Your Best Plan for Financial FitnessNo ratings yet

- Let Me Teach You To Be Rich: A One Month Strategy That Truly WorksFrom EverandLet Me Teach You To Be Rich: A One Month Strategy That Truly WorksNo ratings yet

- 6 Financial LiteracyDocument7 pages6 Financial LiteracyELDREI VICEDONo ratings yet

- Financial Fitness: Achieve Your Money Goals with Discipline and StrategyFrom EverandFinancial Fitness: Achieve Your Money Goals with Discipline and StrategyNo ratings yet

- Pursue Lesson 1Document14 pagesPursue Lesson 1Kent Andojar MarianitoNo ratings yet

- Millionaire Mindest: 2 Manuscript in 1 : Financial Freedom for Beginners: How to Become Financially Independent and Retire Early + How to Create Wealth: Live the Life of Your Dreams Creating Success and Being UnstoppableFrom EverandMillionaire Mindest: 2 Manuscript in 1 : Financial Freedom for Beginners: How to Become Financially Independent and Retire Early + How to Create Wealth: Live the Life of Your Dreams Creating Success and Being UnstoppableNo ratings yet

- Get Out of Debt! Book Four: Putting Your Financial Life Back TogetherFrom EverandGet Out of Debt! Book Four: Putting Your Financial Life Back TogetherRating: 2 out of 5 stars2/5 (1)

- Millions in Cash - The Definitive Guide to Building Your FortuneFrom EverandMillions in Cash - The Definitive Guide to Building Your FortuneNo ratings yet

- Intro To Business - Chapter 1 - Managing and Management ResponsibilitiesDocument2 pagesIntro To Business - Chapter 1 - Managing and Management Responsibilitiesapi-526065196No ratings yet

- Pe Lesson PlanDocument2 pagesPe Lesson Planapi-526065196No ratings yet

- Personal Finance Chapter 13Document3 pagesPersonal Finance Chapter 13api-526065196No ratings yet

- Personal Finance Chapter 17Document3 pagesPersonal Finance Chapter 17api-526065196No ratings yet

- Grace Pfenning - Exhibition Prep 7Document1 pageGrace Pfenning - Exhibition Prep 7api-526065196No ratings yet

- Grace Pfenning - Exhibition PrepDocument2 pagesGrace Pfenning - Exhibition Prepapi-526065196No ratings yet

- Personal Finance Chapter 6Document3 pagesPersonal Finance Chapter 6api-526065196No ratings yet

- Personal Finance Chapter 12Document3 pagesPersonal Finance Chapter 12api-526065196No ratings yet

- Business Managment Chapter 1 NotesDocument2 pagesBusiness Managment Chapter 1 Notesapi-526065196No ratings yet

- Personal Finance Chapter 7Document3 pagesPersonal Finance Chapter 7api-526065196No ratings yet

- Grace Pfenning - Reflection 5Document2 pagesGrace Pfenning - Reflection 5api-526065196No ratings yet

- Grace Pfenning - The Troubled MindDocument3 pagesGrace Pfenning - The Troubled Mindapi-526065196No ratings yet

- Intro To Business Chapter 6 1Document2 pagesIntro To Business Chapter 6 1api-526065196No ratings yet

- Personal Finance Chapter 6 - Do The MathDocument3 pagesPersonal Finance Chapter 6 - Do The Mathapi-526065196No ratings yet

- Intro To Business Chapter 6Document2 pagesIntro To Business Chapter 6api-526065196No ratings yet

- Grace Pfenning - Reflection 3Document1 pageGrace Pfenning - Reflection 3api-526065196No ratings yet

- Personal Finance - Chapter 3 - Do The MathDocument2 pagesPersonal Finance - Chapter 3 - Do The Mathapi-526065196100% (1)

- Grace Pfenning - Scip Relfection 1Document1 pageGrace Pfenning - Scip Relfection 1api-526065196No ratings yet

- Marketing TodayDocument2 pagesMarketing Todayapi-526065196No ratings yet

- Personal Finance - Chapter 1 - What Do You RecommendDocument1 pagePersonal Finance - Chapter 1 - What Do You Recommendapi-526065196No ratings yet

- Grace Pfenning - Rate Project Transferable Skills ReflectionDocument2 pagesGrace Pfenning - Rate Project Transferable Skills Reflectionapi-526065196No ratings yet

- Grace Pfenning - Rate ProjectDocument2 pagesGrace Pfenning - Rate Projectapi-526065196No ratings yet

- Grace Pfenning - Scip Project PlanDocument1 pageGrace Pfenning - Scip Project Planapi-526065196No ratings yet

- Personal Finance Chapter 4Document2 pagesPersonal Finance Chapter 4api-526065196No ratings yet

- Grace Pfenning - Sleep JournalDocument3 pagesGrace Pfenning - Sleep Journalapi-526065196No ratings yet

- Grace Pfenning - The Science of AddictionDocument4 pagesGrace Pfenning - The Science of Addictionapi-526065196No ratings yet

- Grace Pfenning - What Happens To Consciousness During Wake and SleepDocument3 pagesGrace Pfenning - What Happens To Consciousness During Wake and Sleepapi-526065196No ratings yet

- The World of The Senses WKST - Grace PfenningDocument2 pagesThe World of The Senses WKST - Grace Pfenningapi-526065196No ratings yet

- Grace Pfenning - WKST Freuds Theories of ConsciousnessDocument3 pagesGrace Pfenning - WKST Freuds Theories of Consciousnessapi-526065196No ratings yet

- UHF Integrated Long-Range Reader: Installation and User ManualDocument24 pagesUHF Integrated Long-Range Reader: Installation and User ManualARMAND WALDONo ratings yet

- Banking Sector Reforms: by Bhupinder NayyarDocument18 pagesBanking Sector Reforms: by Bhupinder NayyarPraveen SinghNo ratings yet

- Cases CrimproDocument139 pagesCases CrimproApril GonzagaNo ratings yet

- Facts:: Villarosa, Joan Cristine 2015-1635Document3 pagesFacts:: Villarosa, Joan Cristine 2015-1635Tin VillarosaNo ratings yet

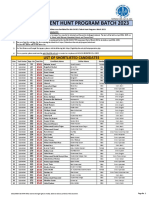

- Iba Ogdcl Talent Hunt Program Batch 2023: List of Shortlisted CandidatesDocument30 pagesIba Ogdcl Talent Hunt Program Batch 2023: List of Shortlisted CandidatesSomil KumarNo ratings yet

- Group 4 Written ReportDocument21 pagesGroup 4 Written ReportEm Bel100% (1)

- DENTAL JURIS - Dental Legislation PDFDocument2 pagesDENTAL JURIS - Dental Legislation PDFIsabelle TanNo ratings yet

- ARLANXEO EPDM at A GlanceDocument6 pagesARLANXEO EPDM at A GlanceErwin ErwinNo ratings yet

- Tift County Board of Commissioners - Press Release July 25, 2022Document3 pagesTift County Board of Commissioners - Press Release July 25, 2022WFXL_NewsNo ratings yet

- Iso 5167 2 PDFDocument54 pagesIso 5167 2 PDFSree288No ratings yet

- JF 2 7 ProjectSolution Functions 8pDocument8 pagesJF 2 7 ProjectSolution Functions 8pNikos Papadoulopoulos0% (1)

- PAS 7 and PAS 41 SummaryDocument5 pagesPAS 7 and PAS 41 SummaryCharles BarcelaNo ratings yet

- Legal and Illegal Earning in The Light of Quran and HadithDocument12 pagesLegal and Illegal Earning in The Light of Quran and HadithComm SofianNo ratings yet

- Questa Sim Qrun UserDocument50 pagesQuesta Sim Qrun UsertungnguyenNo ratings yet

- CLASS XI Business - Studies-Study - MaterialDocument44 pagesCLASS XI Business - Studies-Study - MaterialVanshNo ratings yet

- Delo Protecion CATERPILLARDocument1 pageDelo Protecion CATERPILLARjohnNo ratings yet

- POLITICAL SYSTEM of USADocument23 pagesPOLITICAL SYSTEM of USAMahtab HusaainNo ratings yet

- Demand Letter WiwiDocument1 pageDemand Letter WiwiflippinturtleNo ratings yet

- BBM 301 Advanced Accounting Chapter 1, Section 2Document6 pagesBBM 301 Advanced Accounting Chapter 1, Section 2lil telNo ratings yet

- COM670 Chapter 5Document19 pagesCOM670 Chapter 5aakapsNo ratings yet

- US vs. TANDOCDocument2 pagesUS vs. TANDOCRay MondNo ratings yet

- Tanganyika Buffer SDS 20160112Document8 pagesTanganyika Buffer SDS 20160112Jorge Restrepo HernandezNo ratings yet

- Classroom Objects Vocabulary Esl Unscramble The Words Worksheets For Kids PDFDocument4 pagesClassroom Objects Vocabulary Esl Unscramble The Words Worksheets For Kids PDFLocky HammerNo ratings yet

- 309 SCRA 177 Phil Inter-Island Trading Corp Vs COADocument7 pages309 SCRA 177 Phil Inter-Island Trading Corp Vs COAPanda CatNo ratings yet

- Gabriela SilangDocument9 pagesGabriela SilangEshaira Morales100% (1)

- Customer Master - CIN Details Screen ChangesDocument4 pagesCustomer Master - CIN Details Screen Changespranav kumarNo ratings yet

- Prom 2015: The Great GatsbyDocument14 pagesProm 2015: The Great GatsbyMaple Lake MessengerNo ratings yet

- New Mexico V Steven Lopez - Court RecordsDocument13 pagesNew Mexico V Steven Lopez - Court RecordsMax The Cat0% (1)

- HHI Elite Club - Summary of Benefits 3Document3 pagesHHI Elite Club - Summary of Benefits 3ghosh_prosenjitNo ratings yet

- The Poetical PolicemanDocument6 pagesThe Poetical PolicemanYiannis KatsanevakisNo ratings yet