Professional Documents

Culture Documents

CAC 4202 Farming Tutorial 2020: Livestock Account

Uploaded by

nkosieOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CAC 4202 Farming Tutorial 2020: Livestock Account

Uploaded by

nkosieCopyright:

Available Formats

CAC 4202 Farming Tutorial 2020

An A2 farmer, submits the following accounts in support of the year ended December 2019

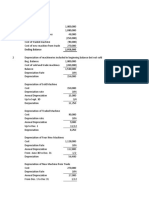

Livestock Account

Opening stock $ $

2 bulls 3 500 100 sales 120 000

60 cows @ FSV $650 39000 20 deaths -----

20 oxen @ FSV $700 14000 Closing stock

30 heifers @ FSV 350 10 500 5 bulls 9 500

20 tollies@ FSV $300 6000 100 cows @ FSV $650 65 000

50 calves@FSV 250 12500 30 oxen @FSV 700 21 000

Purchases 20 heifers @FSV 350 7 000

3 bulls @ cost 6000 80 tollies@ FSV $300 24 000

60 cows 42 000 110 calves @ $250 27 500

120 births ------

Gross profit 115 500

465 274 000 465 274 000

Profit and Loss Account

Expenditure Income

Livestock expenses 49 600 Gross profit 115 500

Crop expenses 9 500 Maize sales 16 000

Fertilizer 5 250 VAT refund 2 700

Electricity bills 7 200 Profit on sale of vehicle 10 000

Interest 7 550 interest on loan 1 500

Depreciation 13 200 Vegetable sales 7 500

Sundry expenses 5 500 Dividends CABS Building Society 2 500

Insurance 3 200

General expenses 4 780

Net profit 45 720

155 700 155 700

Notes

1. His farm is situated in a designated “drought stricken area”, he sold 50 toliies due to drought

conditions for $40 500, it is established that this amount is included in the total sales of $

120 000. He makes an election in terms of paragraph 5 0f the 7 th schedule.

2. The VAT refund was in respect of output tax erroneously charged on sales of livestock.

3. Interest was on a loan of $60 000 used to build Mr. Tolle’s house in Burnside, the house was

completed during the year.

4. Interest received is in respect of a loan advanced to his neighbour to purchase cattle feed.

5. The passenger motor vehicle had been bought on the 23 rd of November 2017 for $35 000,

had been used 25% for private purposes by the taxpayer and was sold for $40 000 during the

year under review.

6. General expenses comprise of the following:

i) Legal fees- water rights application 3 400

ii) Packaging materials 900

iii) Refurbishment of dip tank 480

4 780

7. Insurance:

i) Life ( Mr. Tolle) 900

ii) Loss of profit 2 300

3 200

8. Assets added during the year:

i) Mr. Tolle’s house 95 000

ii) Land rover (second hand) used for business 45 000

iii) Farm school(used 80% by farm workers children) 125 000

9. Income tax values at end of previous year:

i) Plant and equipment 13 000

ii) Tractor 4 000

iii) Truck 6 000

10. Sundry expenses:

i) Aerial surveys 1 750

ii) Contour ridges 830

iii) Temporary roads 560

iv) Donations to local church 750

v) Loan raising fees (house) 1 500

vi) Fencing 110

5 500

Required

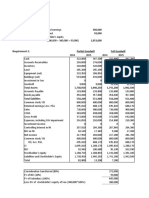

Compute his taxable income or loss for the year indicating the implications of drought sales on his

tax status. [ 30 marks]

You might also like

- Gold Company Provided The Following Trial Balance On June 30 PDFDocument3 pagesGold Company Provided The Following Trial Balance On June 30 PDFRengeline LucasNo ratings yet

- Practice Qs - Closing EntriesDocument1 pagePractice Qs - Closing EntriesAhmed P. FatehNo ratings yet

- Assignment ACC705 T2 2017Document5 pagesAssignment ACC705 T2 2017babar zuberiNo ratings yet

- Assignment ACC705 T2 2017Document5 pagesAssignment ACC705 T2 2017babar zuberiNo ratings yet

- Financial Statement HandoutDocument5 pagesFinancial Statement Handoutmuzamilarshad31No ratings yet

- ACC705 Corporate Accounting AssignmentDocument9 pagesACC705 Corporate Accounting AssignmentMuhammad AhsanNo ratings yet

- Financial Accounting 2 BBA 212 Instructions: 1 Answer One (1) Question Only Q. 1Document4 pagesFinancial Accounting 2 BBA 212 Instructions: 1 Answer One (1) Question Only Q. 1Mwilah Joshua ChalobaNo ratings yet

- IB124 Introduction To Financial Accounting Autumn Term 2020 Seminar QuestionsDocument7 pagesIB124 Introduction To Financial Accounting Autumn Term 2020 Seminar QuestionsS3F1No ratings yet

- Book 1Document2 pagesBook 1Eman RehanNo ratings yet

- Accounts HomeworkDocument9 pagesAccounts HomeworkSasha KingNo ratings yet

- Acc311 2021 2Document4 pagesAcc311 2021 2hoghidan1No ratings yet

- New Microsoft Word Document (5) BDocument5 pagesNew Microsoft Word Document (5) BoctoNo ratings yet

- Unadjusted Trial Balance Adjusting Journal Entries Account Debit Credit Debit CreditDocument5 pagesUnadjusted Trial Balance Adjusting Journal Entries Account Debit Credit Debit CreditChristine RepuldaNo ratings yet

- RATIO QuestionsDocument5 pagesRATIO QuestionsikkaNo ratings yet

- Advanced Taxation Practice Question QuestionDocument8 pagesAdvanced Taxation Practice Question QuestionDanisa NdhlovuNo ratings yet

- Auditing ActivityDocument4 pagesAuditing ActivityPrincessNo ratings yet

- CUAC 408 Group Assignment 1 2021Document6 pagesCUAC 408 Group Assignment 1 2021Blessed Nyama100% (1)

- Problem 1Document3 pagesProblem 1karthikeyan01No ratings yet

- Ap-Problems - 2015Document20 pagesAp-Problems - 2015jayson100% (1)

- Working Notes Profit and Loss Adjustment AccountDocument11 pagesWorking Notes Profit and Loss Adjustment Accountkvrajan6No ratings yet

- Conso FS LessonDocument54 pagesConso FS Lessondbpcastro8No ratings yet

- NOMSA NYANDOWE - ACC136 November 2020 Question PaperDocument8 pagesNOMSA NYANDOWE - ACC136 November 2020 Question Papernomsanyandowe371No ratings yet

- CH 3 SolutionsDocument37 pagesCH 3 SolutionsRavneet BalNo ratings yet

- Activity 03 Name: - ID No.: - Score: - Rating: - Problem 01Document3 pagesActivity 03 Name: - ID No.: - Score: - Rating: - Problem 01Ellyssa Ann MorenoNo ratings yet

- Company Accounting-IgcseDocument2 pagesCompany Accounting-IgcseGodfreyFrankMwakalingaNo ratings yet

- Liabilities 31.03.20X1 Rs. 31.03.20X 2 Rs. Assets 31.03.20X 1 Rs. 31.03.20X2 RsDocument3 pagesLiabilities 31.03.20X1 Rs. 31.03.20X 2 Rs. Assets 31.03.20X 1 Rs. 31.03.20X2 RsAmit GodaraNo ratings yet

- Practice 6 Consolidated Statement One Year After AcquisitionDocument10 pagesPractice 6 Consolidated Statement One Year After AcquisitionGloria Lisa SusiloNo ratings yet

- Assignments QuestionDocument8 pagesAssignments Questionmuhammad qasim0% (1)

- Fra Midterm Question Pgexp 2023Document2 pagesFra Midterm Question Pgexp 2023Sarvesh MishraNo ratings yet

- Budget Plan Safewood FixDocument1 pageBudget Plan Safewood FixCynthia Dhyaa NNo ratings yet

- Consolidation ReportDocument10 pagesConsolidation Reportbabar zuberiNo ratings yet

- Quiz 1 - Limited CompaniesDocument2 pagesQuiz 1 - Limited CompaniesELIZABETH MARGARETHANo ratings yet

- Advacc 1 Millan 2019 Advac 1 Special Transactions 2019Document11 pagesAdvacc 1 Millan 2019 Advac 1 Special Transactions 2019Charlene BolandresNo ratings yet

- Session 2Document8 pagesSession 2Muhammad Haris100% (1)

- Group Assignment Account SEM1Document7 pagesGroup Assignment Account SEM1NUR LIEYANA BINTI MOHD SHUKOR MoeNo ratings yet

- Intercompany Sale of PPE Problem 2: Requirement: January 1, 20x4Document31 pagesIntercompany Sale of PPE Problem 2: Requirement: January 1, 20x4Abegail LibreaNo ratings yet

- Cashflwo TABBA F7Document6 pagesCashflwo TABBA F7Pocpoca100% (2)

- FR111. FFA Solution CMA January 2022 ExaminationDocument5 pagesFR111. FFA Solution CMA January 2022 ExaminationMohammed Javed UddinNo ratings yet

- Advanced Accounting 1 - Millan: Problem 1-4: Exercises: ComputationalDocument10 pagesAdvanced Accounting 1 - Millan: Problem 1-4: Exercises: ComputationalFritzNo ratings yet

- CAC1201201008 Financial Accounting 1BDocument6 pagesCAC1201201008 Financial Accounting 1Bnyasha gundaniNo ratings yet

- Answer Key - Midterm ExamDocument5 pagesAnswer Key - Midterm ExamSilvermist AriaNo ratings yet

- Trial BalanceDocument2 pagesTrial BalanceVenkata Raja Sekhar RyalyNo ratings yet

- Mock Exam 2 Suggested SolutionsDocument10 pagesMock Exam 2 Suggested SolutionsAna-Maria GhNo ratings yet

- Project Report For A Broiler Poultry Farm (500 Birds A Week)Document3 pagesProject Report For A Broiler Poultry Farm (500 Birds A Week)Rajesh Jangir100% (1)

- Solman Milan Special TransDocument158 pagesSolman Milan Special TransPanda AsiaNo ratings yet

- DB Accounting Answers 1852Document9 pagesDB Accounting Answers 1852Faiza AliNo ratings yet

- Assignment in Buscom at Acquisition and SubsequentDocument15 pagesAssignment in Buscom at Acquisition and SubsequentToni MarquezNo ratings yet

- Business Taxation: (Malawi)Document11 pagesBusiness Taxation: (Malawi)angaNo ratings yet

- Financial Accounting QPDocument3 pagesFinancial Accounting QPmallikarjunbpatilNo ratings yet

- Accounting PrinciplesDocument4 pagesAccounting PrinciplesNazir AhmadNo ratings yet

- Seminar 2 FeedbackDocument5 pagesSeminar 2 FeedbackjekaterinaNo ratings yet

- Siklus AkuntansiDocument15 pagesSiklus AkuntansiBachrul AlamNo ratings yet

- AKL 2 - Tugas 3 Marselinus A H T (A31113316)Document3 pagesAKL 2 - Tugas 3 Marselinus A H T (A31113316)Marselinus Aditya Hartanto TjungadiNo ratings yet

- ASSIGNMENTDocument3 pagesASSIGNMENTDoreen OngNo ratings yet

- Tutorial 5 Trial Balance and Errors.Document3 pagesTutorial 5 Trial Balance and Errors.annahkaupaNo ratings yet

- Priduction CapacityDocument5 pagesPriduction CapacityJemalNo ratings yet

- Problem 8-9 Akl 2Document4 pagesProblem 8-9 Akl 2andi nanaNo ratings yet

- Act 202 - Financial Accounting QDocument3 pagesAct 202 - Financial Accounting QShebgatul MursalinNo ratings yet

- Profit from the Peak: The End of Oil and the Greatest Investment Event of the CenturyFrom EverandProfit from the Peak: The End of Oil and the Greatest Investment Event of the CenturyRating: 5 out of 5 stars5/5 (1)

- GroupDocument1 pageGroupnkosieNo ratings yet

- Part IV Timetables June 2020Document2 pagesPart IV Timetables June 2020nkosieNo ratings yet

- Group MembersDocument1 pageGroup MembersnkosieNo ratings yet

- Group 1 Question 1 AuditDocument2 pagesGroup 1 Question 1 AuditnkosieNo ratings yet

- Finance StructureDocument6 pagesFinance StructurenkosieNo ratings yet

- Project Management, Project Planning, Templates and Advice: Acme Europe Upgrade To Cxs V12 ACME - UPGCXSV12 - 038 - CONSDocument27 pagesProject Management, Project Planning, Templates and Advice: Acme Europe Upgrade To Cxs V12 ACME - UPGCXSV12 - 038 - CONSNeha KumarNo ratings yet

- Food StocktakeeDocument51 pagesFood StocktakeenkosieNo ratings yet

- PAIB IGPG ED Project and Investment Appraisal For Sustainable Value Creation 0Document31 pagesPAIB IGPG ED Project and Investment Appraisal For Sustainable Value Creation 0nkosieNo ratings yet

- The Impact of Managerial Accounting PracDocument61 pagesThe Impact of Managerial Accounting PracnkosieNo ratings yet

- Mscrulesfinal 2014Document79 pagesMscrulesfinal 2014xytiseNo ratings yet

- TLE 8-1st PT-animal ProductionDocument3 pagesTLE 8-1st PT-animal ProductionMARIA CRISTINA TEMAJO100% (2)

- Etymology of Opium, Poppy, Cannabis, Hashish, Linum Usitatissimum, Hemp & MarijuanaDocument109 pagesEtymology of Opium, Poppy, Cannabis, Hashish, Linum Usitatissimum, Hemp & MarijuanaRavi Vararo100% (1)

- A Study On ITC Limited With Reference To Its Stakeholders & CSR ActivitiesDocument26 pagesA Study On ITC Limited With Reference To Its Stakeholders & CSR ActivitiesGovind N VNo ratings yet

- Brand Preferrence of Packaged MilkDocument73 pagesBrand Preferrence of Packaged MilkSUKUMAR82% (17)

- Learn With Us 2 - Extension Unit 4Document2 pagesLearn With Us 2 - Extension Unit 4Julieta RuizNo ratings yet

- Advanced History of India 1000045250Document539 pagesAdvanced History of India 1000045250jusakhil100% (3)

- Stout Charolais RanchDocument35 pagesStout Charolais RanchsurfnewmediaNo ratings yet

- Meal Planning Soft DietDocument6 pagesMeal Planning Soft Dietkaycelyn jimenez0% (1)

- The Flavonoid, Carotenoid and Pectin Content in Peels of Citrus Cultivated in TaiwanDocument8 pagesThe Flavonoid, Carotenoid and Pectin Content in Peels of Citrus Cultivated in Taiwanmurdanetap957No ratings yet

- K22739 PressureCookerManualDocument16 pagesK22739 PressureCookerManualTed KozenewskiNo ratings yet

- Lab Ex. G - 6 1Document5 pagesLab Ex. G - 6 1Shane LinamasNo ratings yet

- Caf-Nos and Spos: The Problems With CafosDocument7 pagesCaf-Nos and Spos: The Problems With Cafosapi-308174583No ratings yet

- Business Plan Niel4Document23 pagesBusiness Plan Niel4Niel S. Defensor100% (2)

- OatsDocument2 pagesOatsAnanda PreethiNo ratings yet

- TNPSC Vas Syllabus1Document5 pagesTNPSC Vas Syllabus1karthivisu2009No ratings yet

- Dairy FarmingDocument26 pagesDairy FarmingHassanMubasherNo ratings yet

- The Future of The Seed Business: Matthew Mouw Sr. Marketing ManagerDocument19 pagesThe Future of The Seed Business: Matthew Mouw Sr. Marketing ManagerkhalidhamdanNo ratings yet

- Rffi, &us: QrfrutDocument2 pagesRffi, &us: QrfrutJitendra Kumar SagarNo ratings yet

- 14 August 2019Document180 pages14 August 2019A. S.No ratings yet

- Impact of Planting Position and Planting Material On Root Yield of Cassava (Manihot Esculenta Crantz)Document7 pagesImpact of Planting Position and Planting Material On Root Yield of Cassava (Manihot Esculenta Crantz)noor100% (1)

- IB Entrance Exam 2022Document7 pagesIB Entrance Exam 2022Tomek KossakowskiNo ratings yet

- Agricultural Revolution Notes and DrillsDocument6 pagesAgricultural Revolution Notes and Drillsapi-245769776No ratings yet

- Industrialization Change Society and The Economy Sociology EssayDocument3 pagesIndustrialization Change Society and The Economy Sociology EssaybobbyNo ratings yet

- 03j Texas A&M Feeding Broiler Litter To Beef CattleDocument6 pages03j Texas A&M Feeding Broiler Litter To Beef CattleGlenn PintorNo ratings yet

- Name: Abigail Z. Corre DVM III Class Schedule: U034 (3:00-5:00) W Exercise No. 1: Dairy Cattle BreedsDocument5 pagesName: Abigail Z. Corre DVM III Class Schedule: U034 (3:00-5:00) W Exercise No. 1: Dairy Cattle Breedsabigail correNo ratings yet

- Northern Afghanistan or Letters From The Afghan Boundary Commission (1888)Document470 pagesNorthern Afghanistan or Letters From The Afghan Boundary Commission (1888)Bilal AfridiNo ratings yet

- Hard Rock Cafe - Print MenuDocument4 pagesHard Rock Cafe - Print MenumohitshuklamarsNo ratings yet

- Zahav: Un Mundo de Cocina IsraelíDocument12 pagesZahav: Un Mundo de Cocina IsraelíMayra Zepeda ArriagaNo ratings yet

- Ielts Academic Reading Task Type 5 Matching HeadingsDocument3 pagesIelts Academic Reading Task Type 5 Matching HeadingsTUTOR IELTSNo ratings yet