Professional Documents

Culture Documents

Auditing Activity

Uploaded by

Princess0 ratings0% found this document useful (0 votes)

13 views4 pagesCopyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

13 views4 pagesAuditing Activity

Uploaded by

PrincessCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 4

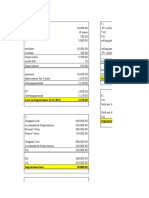

PROBLEM 1.

PAKO COMPANY

1 Beg. Balance 1,800,000

Purch. of 4 machines 1,080,000

Installation of 4 machines 48,000

Cost of old machine (150,000)

Cost of traded machine (90,000)

Cost of new machine from trade 270,000

Ending Balance 2,958,000

2 Depreciation of machineries included in beginning balance but not sold

Beg. Balance 1,800,000

Cost of sold and trade machines (240,000)

Balance 1,560,000

Depreciation Rate 10%

Depreciation 156,000

Depreciation of Sold Machine

Cost 150,000

Depreciation rate 10%

Annual Depreciation 15,000

Up to Sept. 30 3/4

Derpeciation 11,250

Depreciation of Traded Machine

Cost 90,000

Depreciation rate 10%

Annual Depreciation 9,000

Up to Dec. 1 11/12

Depreciation 8,250

Depreciation of Four New Machines

Cost 1,128,000

Depreciation Rate 10%

Annual Depreciation 112,800

From June 30 to Dec. 31 1/2

Depreciation 56,400

Depreciation of New Machine from Trade

Cost 270,000

Depreciation Rate 10%

Annual Depreciation 27,000

From Dec. 1 to Dec 31 1/12

Depreciation 2,250

Total Depreciation 234,150

PROBLEM 2. BROMPLEY COMPANY

LAND BUILDING MACHINERY&EQUIPMENT

Beg. Balance 100,000 300,000 500,000

Item I 74,000 - -

Item I 50,000 150,000 -

Item II - - 153,000

Item III - - -

Item IV - - (20,000)

Item V 23,000 78,000 -

Item VI - - 32,000

Adjusted Balance 247,000 528,000 665,000

PROBLEM 3 PUTI CORPORATION

LAND LAND MACHINERY & BUILDING

IMPROVEMENTS EQUIPMENT

Purchase of Land 10,000,000 - - -

Mortgage assumed 16,000,000 - - -

Relocate Squatters 400,000 - - -

Tearing down old bulding - - - 300,000

Recovered from salvage - - - -600,000

Cost of Fencing - 440,000 - -

Paid to Contractor - - - 8,000,000

Building Permit - - - 50,000

Excavation - - - 250,000

Architect's fee - - - 100,000

Invoice cost of machinery - - 8,000,000 -

Freight and other charges - - 240,000 -

Customs duties - - 560,000 -

Paid to foreign technicians - - 1,600,000 -

Reaaltor's Commission 1,200,000 - - -

Legal fees 200,000 - - -

Ending Balance 27,800,000 440,000 10,400,000 8,100,000

PROBLEM 4 HONEST

1 Wasting Asset 5,200,000

Estimated tons of Silver 4,000,000

Depletion Rate 1.30

Mined Silver 5,000

Depletion 6,500

2 Wasting Asset 2005 5,468,500

Adjusted Estimate 6,995,000

Depletion Rate 0.78

Mined Silver 1,000,000

Depletion 2005 780,000

Wasting Asset 2006 5,788,500

Estimate tons of silver 5,995,000

Depletion Rate 0.97

Mined Silver 2,500,000

Depletion 2006 2,425,000

3 Depreciable amount of Building 1,473,437.5

Estimated tons of Silver 6,995,000

Depreciation Rate 0.21

Mined Silver 1,000,000

Depreciation 2005 210,000

Depreciable amount of Building 1,263,438

Estimated tons of Silver 5,995,000

Depreciation Rate 0.21

Mined Silver 2,500,000

Depreciation 2005 525,000

You might also like

- Mystic SportsDocument6 pagesMystic SportsBatista Firangi100% (2)

- Answer Key - Chapter 6 - ACCOUNTINGDocument92 pagesAnswer Key - Chapter 6 - ACCOUNTINGIL MareNo ratings yet

- CAJEGAS CHLOE WorksheetDocument8 pagesCAJEGAS CHLOE WorksheetChloe Cataluna100% (1)

- Mystic SportsDocument34 pagesMystic SportshelloNo ratings yet

- Lec04 SolutionDocument12 pagesLec04 SolutionedrianclydeNo ratings yet

- Property, Plant and Equipment Chapter 15Document9 pagesProperty, Plant and Equipment Chapter 15Kiminosunoo Lel100% (3)

- Property, Plant and Equipment Chapter 15Document9 pagesProperty, Plant and Equipment Chapter 15Kiminosunoo LelNo ratings yet

- AP-5903 - PPE & IntangiblesDocument8 pagesAP-5903 - PPE & IntangiblesDreiu EsmeleNo ratings yet

- Sol. Man. - Chapter 17 - Depletion of Mineral Resources - Ia Part 1B 1Document6 pagesSol. Man. - Chapter 17 - Depletion of Mineral Resources - Ia Part 1B 1Rezzan Joy Camara Mejia67% (6)

- Let's Check (ULO J)Document8 pagesLet's Check (ULO J)Kirei MinaNo ratings yet

- Exercise 1 1. P290,000 2. P29,000: SolutionDocument5 pagesExercise 1 1. P290,000 2. P29,000: SolutionSheena MarieNo ratings yet

- Exercise 1 1. P290,000 2. P29,000: SolutionDocument5 pagesExercise 1 1. P290,000 2. P29,000: SolutionSheena MarieNo ratings yet

- Cash Flow Ore Nickel MiningDocument1 pageCash Flow Ore Nickel MiningISTAMBUL GOWANo ratings yet

- Cash Flow Statement AssignmentDocument2 pagesCash Flow Statement AssignmentYoungsonya JubeckingNo ratings yet

- Accounting PrinciplesDocument4 pagesAccounting PrinciplesNazir AhmadNo ratings yet

- INTACC2 - Chapter 30Document2 pagesINTACC2 - Chapter 30Shane TabunggaoNo ratings yet

- ANS - 1 (A, B, C)Document5 pagesANS - 1 (A, B, C)Nazir AhmadNo ratings yet

- Tutorial4 - Sol - New UpdateDocument13 pagesTutorial4 - Sol - New UpdateHa NguyenNo ratings yet

- Answer KEY PPEDocument6 pagesAnswer KEY PPExjammerNo ratings yet

- Acccob 2 - 6-1 - 6-10Document27 pagesAcccob 2 - 6-1 - 6-10Ayanna Beyonce CameroNo ratings yet

- Activity Worksheet PreparationDocument16 pagesActivity Worksheet PreparationLowelle Cielo PacotNo ratings yet

- Cost of Table Water ProductionDocument4 pagesCost of Table Water ProductionNasiru029No ratings yet

- Master PDFDocument4 pagesMaster PDFNasiru029No ratings yet

- Done by Omar Gamal Tawfik 291800293: There Will Under Applied by 8000 SoDocument7 pagesDone by Omar Gamal Tawfik 291800293: There Will Under Applied by 8000 SoOmar SoussaNo ratings yet

- Chapter 27Document7 pagesChapter 27Shane Ivory ClaudioNo ratings yet

- PpeDocument9 pagesPpeYvonne Joy Mondano TehNo ratings yet

- Sir Mac Book SolmanDocument10 pagesSir Mac Book SolmanJAY AUBREY PINEDANo ratings yet

- Answer Key - Midterm ExamDocument5 pagesAnswer Key - Midterm ExamSilvermist AriaNo ratings yet

- Group 2-Fin 6000BDocument7 pagesGroup 2-Fin 6000BBellindah wNo ratings yet

- Category Cost of Asset Accumulated DepreciationDocument10 pagesCategory Cost of Asset Accumulated DepreciationAaliyah ManuelNo ratings yet

- Financial Statement HandoutDocument5 pagesFinancial Statement Handoutmuzamilarshad31No ratings yet

- Sol. Man. - Chapter 15 - Ppe Part 1 - Ia Part 1BDocument5 pagesSol. Man. - Chapter 15 - Ppe Part 1 - Ia Part 1BMahasia MANDIGANNo ratings yet

- @ProCA - Inter Contract Costing Past Exam QuestionsDocument10 pages@ProCA - Inter Contract Costing Past Exam QuestionscallbvipinjainNo ratings yet

- Cases PpeDocument19 pagesCases PpeDavid Harrison PascualNo ratings yet

- Module 5 Intacc SoluDocument13 pagesModule 5 Intacc SoluMiks EnriquezNo ratings yet

- Business Plan: The Company Is Located in Lumbia, Cagayan de Oro City, Misamis OrientalDocument3 pagesBusiness Plan: The Company Is Located in Lumbia, Cagayan de Oro City, Misamis OrientalIvy SaliseNo ratings yet

- Epitome CompanyDocument2 pagesEpitome CompanyAnswer Key 019No ratings yet

- Prctice SetDocument9 pagesPrctice SetAdam CuencaNo ratings yet

- Problem 9 Requirement 1: Adjusting EntriesDocument7 pagesProblem 9 Requirement 1: Adjusting EntriesJobby JaranillaNo ratings yet

- Jawaban TugasDocument23 pagesJawaban TugasRusnawati Nur AminahNo ratings yet

- Siklus AkuntansiDocument15 pagesSiklus AkuntansiBachrul AlamNo ratings yet

- Chapter 26Document5 pagesChapter 26Shane Ivory ClaudioNo ratings yet

- Assigment 1Document5 pagesAssigment 1Born 99No ratings yet

- (Outside Project Site Rental) (Barracks To Project Site) (Site Office, Stockpile, Workshop, Etc.)Document23 pages(Outside Project Site Rental) (Barracks To Project Site) (Site Office, Stockpile, Workshop, Etc.)Christian CabacunganNo ratings yet

- Chapter 23 IaDocument4 pagesChapter 23 IaKiminosunoo LelNo ratings yet

- Group 6 Drill WS & FSDocument12 pagesGroup 6 Drill WS & FSSheilla Dela Torre PaderangaNo ratings yet

- PT Go Green Indonesia - ReportDocument32 pagesPT Go Green Indonesia - ReportDenny SumantriNo ratings yet

- Answer Key - Chapter 6 - ACCOUNTING1Document19 pagesAnswer Key - Chapter 6 - ACCOUNTING1IL MareNo ratings yet

- Karwenyi Cert 4Document115 pagesKarwenyi Cert 4benonsunday9No ratings yet

- Resource Company Required Debit Credit 2020 Rock and Gravel PropertyDocument10 pagesResource Company Required Debit Credit 2020 Rock and Gravel PropertyAnonnNo ratings yet

- Depletion PDFDocument6 pagesDepletion PDFargoNo ratings yet

- Date Particulars DR CRDocument6 pagesDate Particulars DR CRRyll BedasNo ratings yet

- Chapter 9 - Presentation of Fs (Statement of Comprehensive Income)Document2 pagesChapter 9 - Presentation of Fs (Statement of Comprehensive Income)Mark IlanoNo ratings yet

- Building EstimatesDocument4 pagesBuilding EstimatesVirgilio VelascoNo ratings yet

- Untitled DocumentDocument2 pagesUntitled DocumentRochelle ObadoNo ratings yet

- Advanced Taxation Practice Question QuestionDocument8 pagesAdvanced Taxation Practice Question QuestionDanisa NdhlovuNo ratings yet

- Make or Buy Decision: Resource Management (Cem) M. T - S - Ii C E & MDocument6 pagesMake or Buy Decision: Resource Management (Cem) M. T - S - Ii C E & MxjsddjwefNo ratings yet

- Mechanical Properties and Performance of Engineering Ceramics and Composites X: A Collection of Papers Presented at the 39th International Conference on Advanced Ceramics and CompositesFrom EverandMechanical Properties and Performance of Engineering Ceramics and Composites X: A Collection of Papers Presented at the 39th International Conference on Advanced Ceramics and CompositesDileep SinghNo ratings yet

- Plumbers and Visionaries: Securities Settlement and Europe's Financial MarketFrom EverandPlumbers and Visionaries: Securities Settlement and Europe's Financial MarketNo ratings yet

- AT Quizzer (CPAR) - Audit SamplingDocument2 pagesAT Quizzer (CPAR) - Audit SamplingPrincessNo ratings yet

- UB SR 2019 Digital 0521Document61 pagesUB SR 2019 Digital 0521PrincessNo ratings yet

- Policy Outline SuggestionDocument5 pagesPolicy Outline SuggestionPrincessNo ratings yet

- BDO Unibank 2020 Annual ReportDocument96 pagesBDO Unibank 2020 Annual ReportPrincessNo ratings yet

- Firm Infrastructure Risk Management Human Resources Technologic Al Developme NTDocument3 pagesFirm Infrastructure Risk Management Human Resources Technologic Al Developme NTPrincessNo ratings yet

- Annual Report 2019 - 07-31-2020Document336 pagesAnnual Report 2019 - 07-31-2020PrincessNo ratings yet

- Sustainability Report 2018Document68 pagesSustainability Report 2018PrincessNo ratings yet

- Annual Report 2016 - 01-01-2017Document277 pagesAnnual Report 2016 - 01-01-2017PrincessNo ratings yet

- Annual Report 2017 - 01-01-2018Document329 pagesAnnual Report 2017 - 01-01-2018PrincessNo ratings yet

- Annual Report 2020 - 06-04-2021Document342 pagesAnnual Report 2020 - 06-04-2021PrincessNo ratings yet

- Annual Report 2018 - 01-01-2019Document325 pagesAnnual Report 2018 - 01-01-2019PrincessNo ratings yet

- Labor LawDocument58 pagesLabor LawPrincessNo ratings yet

- Shareholder's WealthDocument1 pageShareholder's WealthPrincessNo ratings yet

- Business Combinations: Advantages Disadvantages T Y E PDocument1 pageBusiness Combinations: Advantages Disadvantages T Y E PPrincessNo ratings yet

- Cash Fraud Schemes: The FraudsterDocument2 pagesCash Fraud Schemes: The FraudsterPrincessNo ratings yet

- Ra 10142 Financial Rehabilitaion and Insolvency ActDocument41 pagesRa 10142 Financial Rehabilitaion and Insolvency ActPrincessNo ratings yet

- Special TransactionDocument2 pagesSpecial TransactionPrincessNo ratings yet

- Special Transaction ACtivityDocument4 pagesSpecial Transaction ACtivityPrincessNo ratings yet

- Pakistan Company Requirement 1: Journal EntryDocument4 pagesPakistan Company Requirement 1: Journal EntryPrincessNo ratings yet

- PROBLEM 1: Goodwill and Barain Purchase Option Requirement 1Document2 pagesPROBLEM 1: Goodwill and Barain Purchase Option Requirement 1PrincessNo ratings yet

- Rigidifying Global Financial Conditions and Inequality Brought Upon by Enduring PovertyDocument2 pagesRigidifying Global Financial Conditions and Inequality Brought Upon by Enduring PovertyPrincessNo ratings yet

- Law On PatentDocument30 pagesLaw On PatentPrincessNo ratings yet

- WFP Specialized Nutritious Foods Sheet: Treating Moderate Acute Malnutrition (MAM)Document2 pagesWFP Specialized Nutritious Foods Sheet: Treating Moderate Acute Malnutrition (MAM)elias semagnNo ratings yet

- Art. 19 1993 P.CR - LJ 704Document10 pagesArt. 19 1993 P.CR - LJ 704Alisha khanNo ratings yet

- Managerial AccountingDocument7 pagesManagerial AccountingKim Patrick VictoriaNo ratings yet

- Uboot Rulebook v1.1 EN PDFDocument52 pagesUboot Rulebook v1.1 EN PDFUnai GomezNo ratings yet

- QBE 2022 Sustainability ReportDocument44 pagesQBE 2022 Sustainability ReportVertika ChaudharyNo ratings yet

- Ciplaqcil Qcil ProfileDocument8 pagesCiplaqcil Qcil ProfileJohn R. MungeNo ratings yet

- Wilferd Madelung, The Sufyānī Between Tradition and HistoryDocument45 pagesWilferd Madelung, The Sufyānī Between Tradition and HistoryLien Iffah Naf'atu FinaNo ratings yet

- Construction Companies in MauritiusDocument4 pagesConstruction Companies in MauritiusJowaheer Besh100% (1)

- Albert EinsteinDocument3 pagesAlbert EinsteinAgus GLNo ratings yet

- AGM Minutes 2009Document3 pagesAGM Minutes 2009Prateek ChawlaNo ratings yet

- Shareholder Activism in India - Practical LawDocument10 pagesShareholder Activism in India - Practical LawSommya KhandelwalNo ratings yet

- 1: Identify and Explain The Main Issues in This Case StudyDocument1 page1: Identify and Explain The Main Issues in This Case StudyDiệu QuỳnhNo ratings yet

- ContinueDocument3 pagesContinueGedion KilonziNo ratings yet

- Eo - Bhert 2023Document3 pagesEo - Bhert 2023Cyrus John Velarde100% (1)

- Show Catalogue: India's Leading Trade Fair For Organic ProductsDocument58 pagesShow Catalogue: India's Leading Trade Fair For Organic Productsudiptya_papai2007No ratings yet

- Dawah Course Syllabus - NDocument7 pagesDawah Course Syllabus - NMahmudul AminNo ratings yet

- DramaturgyDocument4 pagesDramaturgyThirumalaiappan MuthukumaraswamyNo ratings yet

- Term Paper Air PollutionDocument4 pagesTerm Paper Air Pollutionaflsnggww100% (1)

- 3 Longman Academic Writing Series 4th Edition Answer KeyDocument21 pages3 Longman Academic Writing Series 4th Edition Answer KeyZheer KurdishNo ratings yet

- Marketing Chapter001Document22 pagesMarketing Chapter001Reham MohamedNo ratings yet

- Islam and PatriarchyDocument21 pagesIslam and PatriarchycarolinasclifosNo ratings yet

- Verka Project ReportDocument69 pagesVerka Project Reportkaushal244250% (2)

- Tan Vs PeopleDocument1 pageTan Vs PeopleGian Tristan MadridNo ratings yet

- Types of Quiz-2-QDocument9 pagesTypes of Quiz-2-QAhmed Tamzid 2013028630No ratings yet

- ECONOMÍA UNIT 5 NDocument6 pagesECONOMÍA UNIT 5 NANDREA SERRANO GARCÍANo ratings yet

- Individual Paper Proposal For Biochar Literature ReviewDocument2 pagesIndividual Paper Proposal For Biochar Literature ReviewraiiinydaysNo ratings yet

- Aims of The Big Three'Document10 pagesAims of The Big Three'SafaNo ratings yet

- Just Design Healthy Prisons and The Architecture of Hope (Y.Jewkes, 2012)Document20 pagesJust Design Healthy Prisons and The Architecture of Hope (Y.Jewkes, 2012)Razi MahriNo ratings yet

- Hack Tata Docomo For Free G..Document3 pagesHack Tata Docomo For Free G..Bala Rama Krishna BellamNo ratings yet

- IMMI S257a (s40) Requirement To Provide PIDsDocument4 pagesIMMI S257a (s40) Requirement To Provide PIDsAshish AshishNo ratings yet