Professional Documents

Culture Documents

Options Problem

Uploaded by

prapulla sureshOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Options Problem

Uploaded by

prapulla sureshCopyright:

Available Formats

OPTIONS PROBLEMS

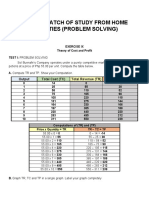

1.The following quotes were observed by Ms. Smitha on March 11th 2015 in economic times.

Contracts Open High Low Close Open Traded No of Underlying

interest quantity contact

CE- 191.05 205 191.05 204.90 41000 1600 8 Nifty

1950marc

h 2015

PE- 19.50 26 18.65 19.9 264700 1369000 6845 Nifty

1950marc 0

h 2015

2. The following quotes were observed by Ms. Sanjay on March 11th 2017in economic times.

Contracts Open High Low Close OI Traded No of Underlying

quantity contact

CA-370 7.35 9.60 7.35 8.75 649500 13800 92 ACC

March

2015

PA-135 3.00 3.10 1.75 1.90 203200 102400 64 MTNL

March

2015

Ans : Strike price : 350 and 135

3. The shares of B crop ltd are selling at Rupees 105 each. Mr. Chandrashekar wants to chip

in buying a 3 months call option at a premium of Rs 10 per option. The exercise price is

rupees 110. Five possible prices per share on the expiration date ranging from ₹100 to ₹140

with intervals of ₹10 are taken into consideration by him. what is Mr. Chandrashekar payoff

as call option holder on expiration .

4. Mr. Ganesh has purchased European call options on reliance .He also purchase the

following European put option on ACC. what decision would he take on expiry if

reliance(RIL) closes at rupees 835 and ACC closes at rupees 565 .Ignore premium paid.

a) RIL 830 call

b) ACC 510 Put

c) RIL 840 call

d) ACC 520 Put.

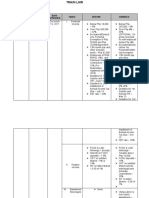

5.Identify which of the following is ITM,OTM and ATM for the buyer of the option . Which

of these option would be exercised.

a) RIL 840 CALL when the price on expiry is Rs 855

b) ACC 510 PUT when the price of the expiry is Rs 510 .

c) RIL 830 CALL when the price on expiry is Rs 840

d) ACC 520 PUT when the price of the expiry is Rs 500

e) RIL 800 CALL when the price on expiry is Rs 765

f) ACC 540 PUT when the price of the expiry is Rs 555

6) Find Intrinsic value time value. Premium paid is given in bracket. Detail of option

purchase are given.

a) HLL 180 PUT (RS 9)

b) L& T 1510 PUT (RS 2)

c) HLL 205 CALL (RS 2)

d) L& T 1500 CALL(RS 12)

e) RIL 800 Call(Rs 37)

f) ACC 540 PUT (Rs 39)

On the day of expiry the prices of stock were HLL Rs 200, L&T 1510, RIL Rs 825 and ACC

Rs 515.

7. state whether the options it is ITM, OTM and ATM

Stock Options Strike price Stock price

A CALL 250 260

B PUT 250 260

C PUT 260 250

D CALL 260 250

8. create a table showing stock price, strike price, IV, option price, TV. Strike price is 25

Stock Price Call option Price

25 3.00

30 7.50

35 12.00

40 16.50

45 21.

50 25.50

9. Find Intrinsic value

Stock Price Strike Price Premium Nature

25 25 13 CALL

30 35 17.5 PUT

35 25 22 PUT

40 25 16.5 CALL

45 55 12 PUT

50 50 20.5 PUT

You might also like

- The eBay Millionaire: Titanium PowerSeller Secrets for Building a Big Online BusinessFrom EverandThe eBay Millionaire: Titanium PowerSeller Secrets for Building a Big Online BusinessRating: 3 out of 5 stars3/5 (2)

- Options ProblemDocument2 pagesOptions Problemprapulla sureshNo ratings yet

- FX Option Performance: An Analysis of the Value Delivered by FX Options since the Start of the MarketFrom EverandFX Option Performance: An Analysis of the Value Delivered by FX Options since the Start of the MarketNo ratings yet

- OPTION STRATAGY VVVVDocument18 pagesOPTION STRATAGY VVVVRTG Mechanical EnggNo ratings yet

- Daily Calculations: Payoff CalculationDocument13 pagesDaily Calculations: Payoff CalculationShravanRigNo ratings yet

- Finance 30210 Problem Set #2Document15 pagesFinance 30210 Problem Set #2bilal javedNo ratings yet

- 1 Viren Mayani 29 3 Lakshmi Bhatia 7 2 Maneesh Patney 36 4 Sayli Bhadekar 5 5 Pallavi Verma 59Document15 pages1 Viren Mayani 29 3 Lakshmi Bhatia 7 2 Maneesh Patney 36 4 Sayli Bhadekar 5 5 Pallavi Verma 59GmitNo ratings yet

- MARKET MOVEMENTDocument13 pagesMARKET MOVEMENTGmitNo ratings yet

- A. Start Up Supply: Pre-Operational Expenditures Taxes and LicensesDocument30 pagesA. Start Up Supply: Pre-Operational Expenditures Taxes and LicensesJOANA MARIE CALARA AMBOY 4C1No ratings yet

- ALK QiqiDocument7 pagesALK QiqiDhina KimNo ratings yet

- Lookup FormulasDocument53 pagesLookup FormulasnawplaypoNo ratings yet

- Subject Code:: Prepared byDocument6 pagesSubject Code:: Prepared byDarmmini MiniNo ratings yet

- Guideline ICE1 TextOnlyDocument4 pagesGuideline ICE1 TextOnlyRima AkidNo ratings yet

- Ch03 Accounting For MaterialsDocument4 pagesCh03 Accounting For MaterialsAndrew ChongNo ratings yet

- USHA PRAVIN GANDHI COLLEGE MIXER GRINDER PROJECTDocument17 pagesUSHA PRAVIN GANDHI COLLEGE MIXER GRINDER PROJECTrajbastardNo ratings yet

- Options Premium Calculator: Note: You Can Change Only Those Cells Which Are Marked in Yellow ColourDocument6 pagesOptions Premium Calculator: Note: You Can Change Only Those Cells Which Are Marked in Yellow ColourMayank JAinNo ratings yet

- Chapter 5 SolutionsDocument8 pagesChapter 5 Solutionsmajid asadullahNo ratings yet

- What is Microeconomics and Managerial Decision MakingDocument59 pagesWhat is Microeconomics and Managerial Decision Makingsunit dasNo ratings yet

- Instrument Position X/FV: PayoffsDocument10 pagesInstrument Position X/FV: PayoffsAkshay GuptaNo ratings yet

- Feasibility Study Report On Liyu Fitness CenterDocument19 pagesFeasibility Study Report On Liyu Fitness CenterAndinet75% (4)

- Tutorial Exercises 7: Perfect Competition: Essential Readings: Chapter 7Document18 pagesTutorial Exercises 7: Perfect Competition: Essential Readings: Chapter 7tahmeemNo ratings yet

- Excel 02Document15 pagesExcel 02Jahid RahmanNo ratings yet

- Slide 17+660 I 6m h23 EstDocument1 pageSlide 17+660 I 6m h23 EstSebastián Molina AndradeNo ratings yet

- Nippon India Nifty 50 Bees ETFDocument10 pagesNippon India Nifty 50 Bees ETFAshis MingalaNo ratings yet

- Project Proposal Work Sheet-Getacho Agriculture FinalDocument22 pagesProject Proposal Work Sheet-Getacho Agriculture FinalTesfaye DegefaNo ratings yet

- E9-1 Quantity Cost/Unit NRV Total Cost 110 111 112 113 120 121 122Document25 pagesE9-1 Quantity Cost/Unit NRV Total Cost 110 111 112 113 120 121 122Eunice MiloNo ratings yet

- Lect OptionsDocument31 pagesLect OptionsknightrrodersNo ratings yet

- Deals PlanDocument9 pagesDeals PlanVarun AkashNo ratings yet

- Krishnan SirDocument4 pagesKrishnan SirvenkatmatsNo ratings yet

- Investment Simulation Portfolio ReturnsDocument14 pagesInvestment Simulation Portfolio ReturnsRuchika SinghNo ratings yet

- Option Market and ContractDocument46 pagesOption Market and ContractSheikh YajidulNo ratings yet

- Simpati Kode Keterangan Nominal HargaDocument3 pagesSimpati Kode Keterangan Nominal HargaDefri Syahputra SKep NsNo ratings yet

- Payroll report for January 2011Document2 pagesPayroll report for January 2011Razie MandaNo ratings yet

- Managerial Economics - Cost & ProfitDocument2 pagesManagerial Economics - Cost & ProfitCrystal ApinesNo ratings yet

- FundamentalsOfFinancialManagement Chapter8Document17 pagesFundamentalsOfFinancialManagement Chapter8Adoree RamosNo ratings yet

- Guerero CHAPTER 4Document16 pagesGuerero CHAPTER 4MARC OLIVER CASTANEDANo ratings yet

- Financial Reporting IAS-16 Assignment F2021314036Document24 pagesFinancial Reporting IAS-16 Assignment F2021314036Abdullah MaqsoodNo ratings yet

- RAB BBP-CHINA GAR 34 32 DES 22 - Muara PantaiDocument1 pageRAB BBP-CHINA GAR 34 32 DES 22 - Muara Pantainextop capitalNo ratings yet

- RAB BBP-CHINA GAR 34 32 DES 22 - Adang BayDocument1 pageRAB BBP-CHINA GAR 34 32 DES 22 - Adang Baynextop capitalNo ratings yet

- Basic & Math Function AssigmentDocument19 pagesBasic & Math Function AssigmentINSPIRATION 25No ratings yet

- Cost & Management Accounting: Material Costing Lecture-8 Mian Ahmad Farhan (ACA)Document21 pagesCost & Management Accounting: Material Costing Lecture-8 Mian Ahmad Farhan (ACA)AnsariRiaz100% (1)

- Quizzes and midterms accounting answer keyDocument3 pagesQuizzes and midterms accounting answer keyAlta SophiaNo ratings yet

- Decision Theory Expected ValuesDocument4 pagesDecision Theory Expected Valuesmichean mabaoNo ratings yet

- Name: Espiritu, Christopher D. Year & Section: Bsma 1-ADocument2 pagesName: Espiritu, Christopher D. Year & Section: Bsma 1-AchingNo ratings yet

- Cape, Jessielyn Vea C. PCBET-01-301P AC9/ THURSAY/ 9:00AM-12:00PMDocument5 pagesCape, Jessielyn Vea C. PCBET-01-301P AC9/ THURSAY/ 9:00AM-12:00PMhan jisungNo ratings yet

- Instructions: Students May Work in Groups On The Problem Set. Each Student Must Turn in His/herDocument11 pagesInstructions: Students May Work in Groups On The Problem Set. Each Student Must Turn in His/herTahseenNo ratings yet

- XX 10Document5 pagesXX 10Kenneth Chong ChongNo ratings yet

- Second Batch of Study From Home Activities (Problem Solving)Document8 pagesSecond Batch of Study From Home Activities (Problem Solving)Carmela Kristine JordaNo ratings yet

- Futurepreneurs Workbook 2020 - Compressed 2Document46 pagesFuturepreneurs Workbook 2020 - Compressed 2Erica JayasunderaNo ratings yet

- GM Best Offer Residential Project Cost Analysis Under 40 LacsDocument2 pagesGM Best Offer Residential Project Cost Analysis Under 40 LacsNic KnightNo ratings yet

- Safety factor graph showing soil propertiesDocument1 pageSafety factor graph showing soil propertiesSebastián Molina AndradeNo ratings yet

- Total Volume AnjanpuraDocument15 pagesTotal Volume AnjanpuraVishwa AradhyaNo ratings yet

- Exhibit 1 Item 345, Prices and Production, 1998-2003Document14 pagesExhibit 1 Item 345, Prices and Production, 1998-2003SofiNo ratings yet

- LEC6 Lubrication 2022Document40 pagesLEC6 Lubrication 2022mohamed hodiriNo ratings yet

- CHAPTER 4 CostDocument16 pagesCHAPTER 4 CostTan P. IsmaelNo ratings yet

- Uplifted Pesquet's Parrot Explorer, Preservationist, GeneticistDocument3 pagesUplifted Pesquet's Parrot Explorer, Preservationist, GeneticistbluecthulhuNo ratings yet

- Capacity WestfaliaDocument1 pageCapacity WestfaliaAlexanderNo ratings yet

- MH AT Catalogue - 380V 24082017Document4 pagesMH AT Catalogue - 380V 24082017Marsinta PurbaNo ratings yet

- Option Chain (Equity Derivatives)Document3 pagesOption Chain (Equity Derivatives)RJ LaxmikaantNo ratings yet

- Q F (K, L) K L: (Please Show Complete Solution.)Document4 pagesQ F (K, L) K L: (Please Show Complete Solution.)Karl Simone EsmillaNo ratings yet

- Options On Stock IndexDocument2 pagesOptions On Stock Indexprapulla sureshNo ratings yet

- Cost sheet format breakdownDocument2 pagesCost sheet format breakdownabhijeetNo ratings yet

- Cost Sheet ProblemsDocument10 pagesCost Sheet Problemsprapulla sureshNo ratings yet

- Cost Sheet ProblemsDocument10 pagesCost Sheet Problemsprapulla sureshNo ratings yet

- Cost Sheet ProblemsDocument10 pagesCost Sheet Problemsprapulla sureshNo ratings yet

- Cost sheet format breakdownDocument2 pagesCost sheet format breakdownabhijeetNo ratings yet

- Cost sheet format breakdownDocument2 pagesCost sheet format breakdownabhijeetNo ratings yet

- Mrginal Costing Lecture 7Document6 pagesMrginal Costing Lecture 7prapulla sureshNo ratings yet

- Cost Sheet ProblemsDocument10 pagesCost Sheet Problemsprapulla sureshNo ratings yet

- Marginal Costing 6Document4 pagesMarginal Costing 6prapulla sureshNo ratings yet

- Cost Sheet ProblemsDocument10 pagesCost Sheet Problemsprapulla sureshNo ratings yet

- Cost Sheet ProblemsDocument10 pagesCost Sheet Problemsprapulla sureshNo ratings yet

- Maximizing Profit with Limited ResourcesDocument4 pagesMaximizing Profit with Limited Resourcesprapulla sureshNo ratings yet

- Lecture 5 - Marginal Costing Differential Cost AnalysisDocument2 pagesLecture 5 - Marginal Costing Differential Cost Analysisprapulla sureshNo ratings yet

- Make or Buy Decisions Lecture Marginal CostingDocument3 pagesMake or Buy Decisions Lecture Marginal Costingprapulla sureshNo ratings yet

- Marginal Costing 2-ApplicationDocument11 pagesMarginal Costing 2-Applicationprapulla sureshNo ratings yet

- Module 1Document50 pagesModule 1prapulla sureshNo ratings yet

- Foundations of MISDocument48 pagesFoundations of MISprapulla sureshNo ratings yet

- Tax Inter Quick Referencer by ICAIDocument17 pagesTax Inter Quick Referencer by ICAITushar kumarNo ratings yet

- Afar 03 Partnership DissolutionDocument2 pagesAfar 03 Partnership DissolutionJohn Laurence LoplopNo ratings yet

- MOIST Basic Microeconomics Module 02Document16 pagesMOIST Basic Microeconomics Module 02MARJUN ABOGNo ratings yet

- Capital Market Report on HDFC BankDocument9 pagesCapital Market Report on HDFC BankMohmmedKhayyum0% (1)

- Hubungan Perundingan Dengan Penyelesaian Masalah Di Kalangan Peniaga-Peniaga Kecil Di MalaysiaDocument16 pagesHubungan Perundingan Dengan Penyelesaian Masalah Di Kalangan Peniaga-Peniaga Kecil Di Malaysiashaan7821No ratings yet

- Chapter 7-١Document27 pagesChapter 7-١zkNo ratings yet

- FDI and FORIEGN AID 1Document13 pagesFDI and FORIEGN AID 1violetNo ratings yet

- Notes From Invest Malaysia 2014: KPJ HealthcareDocument7 pagesNotes From Invest Malaysia 2014: KPJ Healthcareaiman_077No ratings yet

- Éstudo Bibli0teca de TradeDocument40 pagesÉstudo Bibli0teca de TradeAnderson Carlos100% (2)

- Company Profile: Business Consultant With A Global PerspectiveDocument20 pagesCompany Profile: Business Consultant With A Global PerspectiveSulistia WatiNo ratings yet

- History of derivatives from ancient times to modern marketsDocument15 pagesHistory of derivatives from ancient times to modern marketsUyên NguyễnNo ratings yet

- A Project Reprot On Awareness of Labour Laws at Gokak MillsDocument82 pagesA Project Reprot On Awareness of Labour Laws at Gokak MillsBabasab Patil (Karrisatte)No ratings yet

- A Project Report On Fluctuation of Share MarketDocument11 pagesA Project Report On Fluctuation of Share MarketChristifer ChristyNo ratings yet

- Contract DocumentDocument49 pagesContract DocumentEngineeri TadiyosNo ratings yet

- Wharton Consulting Club Casebook 2012Document95 pagesWharton Consulting Club Casebook 2012Betty Wang100% (2)

- Assignment The Big ShortDocument1 pageAssignment The Big ShortDaveNo ratings yet

- @deloitte #Yemen Highlights - Tax & Duties 2011Document3 pages@deloitte #Yemen Highlights - Tax & Duties 2011Yemen ExposedNo ratings yet

- Ask Warren Buffett - Complete CNBC Squawk Box Transcript - March 1, 2010Document88 pagesAsk Warren Buffett - Complete CNBC Squawk Box Transcript - March 1, 2010CNBC100% (3)

- Credit Risk Management LectureDocument80 pagesCredit Risk Management LectureAbhishek KarekarNo ratings yet

- APICS - Materials Manager Competency Model 2014 (Materials-Manager-Competency-Model) PDFDocument24 pagesAPICS - Materials Manager Competency Model 2014 (Materials-Manager-Competency-Model) PDFjhlaravNo ratings yet

- Metag Catalog 2021Document108 pagesMetag Catalog 2021atssbcNo ratings yet

- Tax Law and JurisprudenceDocument9 pagesTax Law and JurisprudenceMeanne Maulion-EbeNo ratings yet

- President Rodrigo Duterte: December 19, 2017Document7 pagesPresident Rodrigo Duterte: December 19, 2017Chelsy SantosNo ratings yet

- Monson Jack ResumeDocument1 pageMonson Jack Resumeapi-488264962No ratings yet

- Programación de La Semana Mundial Del Agua 2017Document162 pagesProgramación de La Semana Mundial Del Agua 2017CJCINo ratings yet

- Miles Arnone - 17 - August 2016 - Junery Bagunas JRDocument3 pagesMiles Arnone - 17 - August 2016 - Junery Bagunas JRJunery Bagunas Jr.No ratings yet

- Chapter 2 (EdDocument7 pagesChapter 2 (Ednafisul hoque moinNo ratings yet

- Reaction PaperDocument1 pageReaction PaperAlyssa Azutea Fernandez100% (1)

- Akshay Finance PRJCTDocument38 pagesAkshay Finance PRJCTsamarthadhkariNo ratings yet

- Macroeconomics Assignment EquilibriumDocument8 pagesMacroeconomics Assignment EquilibriumFebri EldiNo ratings yet