Professional Documents

Culture Documents

Hawkins

Uploaded by

NatarajOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Hawkins

Uploaded by

NatarajCopyright:

Available Formats

Hawkins Cookers Ltd.

Regd. Office: Maker Tower F 101, Cuffe Parade, Mumbai 400005.

Corporate Identity Number: L28997MH1959PLC011304

Phone: 022–22186607, Fax: 022–22181190

ho@hawkinscookers.com www.hawkinscookers.com

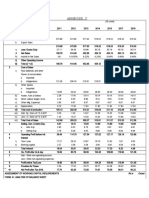

FINANCIAL RESULTS AS PER Ind AS

FOR THE QUARTER & YEAR ENDED MARCH 31, 2021

( Rs. CRORES)

QUARTER ENDED YEAR ENDED

Audited* Unaudited Audited* Audited

*See Note 9 below Mar.2021 Dec.2020 Mar.2020 Mar.2021 Mar.2020

1. Revenue from operations (net of discounts) 243.41 231.05 145.97 768.46 673.87

2. Other income 2.13 2.62 0.75 7.32 3.18

3. Total Revenue (1 + 2) 245.54 233.67 146.72 775.78 677.05

4. Expenses

a) Cost of materials consumed 88.82 85.69 61.68 246.11 237.12

b) Purchases of stock-in-trade 29.99 27.62 17.06 83.85 78.61

c) Changes in inventories of finished goods, –5.42 –13.61 –21.00 35.23 –25.66

work-in-progress and stock-in-trade

d) Employee benefits expense 29.27 28.60 22.51 100.95 93.73

e) Finance costs 1.18 1.22 1.01 4.73 3.99

f) Depreciation and amortization expense 1.48 1.38 1.32 5.33 4.71

g) Other expenses 68.59 70.14 51.17 191.50 186.19

Total Expenses 213.91 201.04 133.75 667.72 578.69

5. Profit before exceptional and/or Extraordinary items 31.63 32.63 12.97 108.06 98.35

and Tax (3 – 4)

6. Exceptional and/or Extraordinary items NIL NIL NIL NIL NIL

7. Profit before tax (5 – 6) 31.63 32.63 12.97 108.06 98.35

8. Tax Expense

a) Current Tax 7.10 8.40 3.42 26.85 25.34

b) Deferred Tax 0.56 0.01 0.19 0.58 0.52

9. Net Profit for the period after Tax (7 – 8) 23.97 24.22 9.36 80.64 72.49

10. Other Comprehensive Income 0.31 –0.22 –0.85 –0.36 –0.45

Actuarial Gain/(–) Loss on Defined Benefit Plans (net of tax)

(not to be reclassified to Profit or Loss)

11. Total Comprehensive Income for the period (9 + 10) 24.28 24.00 8.52 80.27 72.04

12. Paid-up equity share capital (Face value of Rs.10 per share) 5.29 5.29 5.29 5.29 5.29

13. Reserves, excluding Revaluation Reserves 172.34 134.37 134.37 172.34 134.37

(as shown in the preceding/completed year-end Balance Sheet)

14. Earnings per equity share in Rs. not annualised for quarters 45.33 45.81 17.71 152.49 137.09

(Per share of Rs. 10 each, Basic and Diluted)

FOR THE

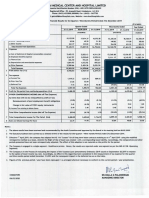

STATEMENT OF AUDITED AS AT STATEMENT OF CASH FLOWS YEAR ENDED (AUDITED)

ASSETS AND LIABILITIES March 31, March 31, March 31, March 31,

( Rs. CRORES) 2021 2020 ( Rs. CRORES) 2021 2020

ASSETS A. Cash Flow from Operating Activities:

1. Non–Current Assets Profit before tax 108.06 98.35

(a) Property, Plant and Equipment 38.92 32.19 Adjustments for:

(b) Capital work-in-progress 2.78 1.99 Depreciation and amortization expense 5.33 4.71

(c) Intangible Assets 0.09 0.10 Profit on sale of property, plant and equipment (net) –0.13 –0.04

(d) Financial Assets Interest income –6.51 –3.09

(i) Investments 0.00 0.00 Dividend income NIL 0.00

(ii) Other non-current financial assets 11.10 1.07 Finance costs 4.73 3.99

(e) Non–current tax assets (net) 2.09 2.07 Operating profit before working capital changes 111.49 103.92

(f) Deferred tax assets (net) 0.86 1.31 Changes in working capital

(g) Other non-current assets 3.65 2.85 Adjustments for (–) increase/decrease in operating assets

Subtotal – Non-Current Assets 59.49 41.60 Inventories 35.84 –32.95

2. Current Assets Trade receivables 10.21 28.33

(a) Inventories 97.18 133.01 Other current financial assets –0.36 –0.55

(b) Financial Assets Other current assets –0.07 –5.29

(i) Trade receivables 40.00 50.21 Other non-current financial assets –0.08 0.01

(ii) Cash and cash equivalents 21.34 1.96 Other non-current assets 0.38 0.24

(iii) Bank balances other than above 145.75 46.52 Adjustments for increase/(–) decrease in operating liabilities

(iv) Other current financial assets 5.23 2.04 Trade payables 27.25 –3.46

(c) Other current assets 23.06 23.00 Non-current provision for compensated absences 1.64 –0.03

Current provision for compensated absences –0.33 0.59

Subtotal – Current Assets 332.56 256.74

Other current financial liabilities 6.62 1.72

Total Assets 392.04 298.34

Other current liabilities 22.47 0.20

EQUITY AND LIABILITIES

Cash generated from operations 215.06 92.75

Equity Income taxes paid (net) –26.12 –27.06

(a) Equity Share capital 5.29 5.29 Net Cash from Operating Activities (A) 188.94 65.68

(b) Other Equity 172.34 134.37 B. Cash Flow from Investing Activities:

Subtotal – Equity 177.62 139.65 Purchase of property, plant and equipment –14.07 –10.75

LIABILITIES (including capital advances)

1. Non-Current Liabilities Sale of property, plant and equipment 0.18 0.09

(a) Financial Liabilities Increase in fixed deposits with banks –109.18 –11.93

(i) Borrowings 23.06 13.12 Interest received 3.67 2.90

(b) Provisions 5.62 3.98 Dividend received NIL 0.00

Subtotal – Non-Current Liabilities 28.68 17.10 Net Cash used in Investing Activities (B) –119.39 –19.71

2. Current Liabilities C. Cash Flow from Financing Activities:

(a) Financial Liabilities Finance costs paid –5.64 –2.50

(i) Borrowings 4.80 14.95 Dividend paid (including tax on dividend, where applicable) –42.42 –51.00

(ii) Trade payables Proceeds from fixed deposits 12.89 1.99

To micro and small enterprises 7.75 3.13 Repayment of fixed deposits –4.99 –0.64

To other than micro 68.81 46.18 Net Cash used in Financing Activities (C) –40.16 –52.15

and small enterprises Net Increase/(–) Decrease in Cash 29.39 –6.17

(iii) Other current financial liabilities 54.57 50.39 and Cash Equivalents (A + B + C)

(b) Other current liabilities 47.22 24.75 Cash and cash equivalents at the –8.06 –1.88

(c) Provisions 1.34 1.67 commencement of the year (D)

(d) Current Tax Liabilities (Net) 1.25 0.51 Cash and cash equivalents as at the end of the year (E) 21.34 –8.06

Subtotal – Current Liabilities 185.74 141.58 Net Increase/(–) Decrease in Cash and 29.39 –6.17

Total Equity and Liabilities 392.04 298.34 Cash Equivalents (E – D)

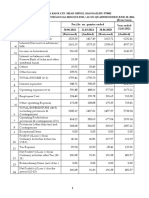

NOTES: 1. These results were approved at the meeting of the Board of Directors held on May 27, 2021. 2. In view of the continuing uncertainties

due to COVID, it was decided by the Board that it will not recommend any final dividend for 2020-21. The interim dividend of Rs.80 per equity share

of paid-up and face value of Rs.10 each paid in September 2020 shall be taken as the total dividend for the financial year ended March 31, 2021. 3. The

Company operates in a single segment: manufacture, trading and sale of Kitchenware. 4. COVID has impacted both sales and production April 2021

onwards. Our Factories are operating with reduced output. Non-factory management is working from home as our Mumbai offices are required to be

shut. We are following all guidelines and are ready to ramp up operations as and when the country opens up. 5. At the meeting of the Board held today,

the Directors resolved to recommend a suitable resolution for the approval of the shareholders at the 61st Annual General Meeting to appoint

Mr. Tej Paul Sharma as Executive Director Sales with effect from August 1, 2021. Mr. Sharma has 39 years of experience in Hawkins; his current

designation in Hawkins is Executive Vice President Sales. 6. At the meeting of the Board held today, the Directors resolved to recommend a suitable

resolution for the approval of the shareholders at the 61st Annual General Meeting to appoint Mr. Neil Vasudeva as Executive Director Marketing with

effect from August 1, 2021. Mr. Vasudeva has worked 24 years in Hawkins; his current designation in Hawkins is Executive Vice President Marketing.

7. At the meeting of the Board held today, the Directors resolved to recommend a suitable resolution for the approval of the shareholders at the

61st Annual General Meeting to appoint Mr. M. A. Teckchandani as an Independent Director with effect from August 1, 2021. 8. At the meeting of the

Board held today, the Directors resolved to recommend a suitable resolution for the approval of the shareholders at the 61st Annual General Meeting to

re-appoint Mr. Ravi Kant as an Independent Director with effect from August 4, 2021. 9. The figures in respect of the results for the quarters ended

March 31, 2021, and March 31, 2020, are the balancing figures between the audited figures in respect of the full financial years ended March 31, 2021,

and March 31, 2020, and the unaudited published year-to-date figures up to the third quarters ended December 31, 2020, and December 31, 2019,

respectively. 10. Previous periods' figures have been regrouped wherever necessary to conform to this period's classification. Certain figures apparently

may not add up because of rounding off but are wholly accurate in themselves.

Mumbai For Hawkins Cookers Limited, Sudeep Yadav

May 27, 2021 Vice Chairman and Chief Financial Officer

You might also like

- GHCL Limited (CIN: L24100GJ1983PLC006513)Document10 pagesGHCL Limited (CIN: L24100GJ1983PLC006513)soumyasibaniNo ratings yet

- ITC Financial Result Q1 FY2024 SfsDocument3 pagesITC Financial Result Q1 FY2024 SfsAlricNo ratings yet

- Standalone Result Mar23Document9 pagesStandalone Result Mar23Amit KumarNo ratings yet

- Scrip Code: MSUMI Scrip Code: 543498 Ref.: Un-Audited Financial Results For The Quarter Ended June 30, 2022Document3 pagesScrip Code: MSUMI Scrip Code: 543498 Ref.: Un-Audited Financial Results For The Quarter Ended June 30, 2022Amruta TarmaleNo ratings yet

- MRF Limited: Regd - Office: 114, Greams Road, Chennai - 600 006Document8 pagesMRF Limited: Regd - Office: 114, Greams Road, Chennai - 600 006pradeepNo ratings yet

- 2016 Annual ReportDocument7 pages2016 Annual ReportHeadshot's GameNo ratings yet

- Standalone Results - Mar'23 - 0Document5 pagesStandalone Results - Mar'23 - 0Honey SinghalNo ratings yet

- Tata Motors Group Q4 Annual Financial Results FY19 20Document10 pagesTata Motors Group Q4 Annual Financial Results FY19 20Anil Kumar AkNo ratings yet

- ITC Financial Result Q4 FY2023 CfsDocument6 pagesITC Financial Result Q4 FY2023 Cfsnishi25wadhwaniNo ratings yet

- Indiabulls Housing Finance Limited (CIN: L65922DL2005PLC136029)Document9 pagesIndiabulls Housing Finance Limited (CIN: L65922DL2005PLC136029)hemant goyalNo ratings yet

- JM Financial: L Indi N L 1 LDocument9 pagesJM Financial: L Indi N L 1 LPiyush LuthraNo ratings yet

- Indiabulls Housing Finance Limited (CIN: L65922DL2005PLC136029)Document6 pagesIndiabulls Housing Finance Limited (CIN: L65922DL2005PLC136029)Kumar RajputNo ratings yet

- Consol Result Mar23Document16 pagesConsol Result Mar23Amit KumarNo ratings yet

- Consolidated Q4Document6 pagesConsolidated Q4Qazi MudasirNo ratings yet

- MRF Limited: Regd - Office: 114, Greams Road, Chennai - 600 006Document10 pagesMRF Limited: Regd - Office: 114, Greams Road, Chennai - 600 006Sourya MitraNo ratings yet

- BHSL UFR 2021-22-Q2 CroreDocument10 pagesBHSL UFR 2021-22-Q2 CroreMidhunNo ratings yet

- Devyani International Q3 ResultsDocument9 pagesDevyani International Q3 ResultsSaurabh AggarwalNo ratings yet

- 2000 5000 Corp Action 20220525Document62 pages2000 5000 Corp Action 20220525Contra Value BetsNo ratings yet

- Financial Results of Hardwyn India Sept 2023Document9 pagesFinancial Results of Hardwyn India Sept 2023prashant_natureNo ratings yet

- BSE Limited National Stock Exchange of India Limited: Company Secretary and Compliance OfficerDocument9 pagesBSE Limited National Stock Exchange of India Limited: Company Secretary and Compliance OfficerABHIRAJ PARMARNo ratings yet

- Icici 2009Document4 pagesIcici 2009Anudeep ReddyNo ratings yet

- Digitally Signed by Debolina Karmakar Date: 2023.08.10 12:39:40 +05'30'Document5 pagesDigitally Signed by Debolina Karmakar Date: 2023.08.10 12:39:40 +05'30'Mahesh hamneNo ratings yet

- 2022 04 Q4-2022 PR2-New-roomDocument10 pages2022 04 Q4-2022 PR2-New-roomTejpal SainiNo ratings yet

- ITC Financial Result Q4 FY2022 SfsDocument6 pagesITC Financial Result Q4 FY2022 SfsMoksh PorwalNo ratings yet

- Bannari Amman Spinning Mills LimitedDocument20 pagesBannari Amman Spinning Mills LimitedVT GNo ratings yet

- Sebi Release EditDocument2 pagesSebi Release Editkarthikpranesh7No ratings yet

- ITC Financial Result Q4 FY2023 SfsDocument6 pagesITC Financial Result Q4 FY2023 Sfsaanchal prasadNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Annual Financial Results 2020Document9 pagesAnnual Financial Results 2020Yathish Us ThodaskarNo ratings yet

- Standalone Results - June 2017 - 0Document3 pagesStandalone Results - June 2017 - 0Varun SidanaNo ratings yet

- Ice Make Refrigeration LimitedDocument8 pagesIce Make Refrigeration LimitedPositive ThinkerNo ratings yet

- Dabur 5Document1 pageDabur 5faheem.ashrafNo ratings yet

- Q3FY22Document7 pagesQ3FY22Pratik PatilNo ratings yet

- 4.varroc Consolidated Result Sheet June 2021 SignedDocument3 pages4.varroc Consolidated Result Sheet June 2021 SignedA kumarNo ratings yet

- Castrol India Limited: Statement of Audited Financial Results For The Quarter and Year Ended 31 December 2018Document3 pagesCastrol India Limited: Statement of Audited Financial Results For The Quarter and Year Ended 31 December 2018Sona DuttaNo ratings yet

- Financial Result Q4fy22 ConsolidatedDocument6 pagesFinancial Result Q4fy22 ConsolidatedTharunyaNo ratings yet

- Financial Results 31 Mar 2010 HSBC Invest DirectDocument2 pagesFinancial Results 31 Mar 2010 HSBC Invest Directbhavnesh_muthaNo ratings yet

- Itc Annual ReportDocument6 pagesItc Annual ReportAditya AgrawalNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results 9M 2020 21Document1 pageStandalone Financial Results 9M 2020 21Shekhar AgarwalNo ratings yet

- Q1 20 - DhunseriDocument4 pagesQ1 20 - Dhunserica.anup.kNo ratings yet

- Mahindra & Mahindra Limited: Rs. in CroresDocument4 pagesMahindra & Mahindra Limited: Rs. in CroresGeorge Chalissery RajuNo ratings yet

- Latest Financials - DR Agarwals May 2022Document11 pagesLatest Financials - DR Agarwals May 2022Mr SmartNo ratings yet

- Bal SheetDocument4 pagesBal SheetVishal JainNo ratings yet

- Q4FY19 Press TableDocument9 pagesQ4FY19 Press TableSumit SharmaNo ratings yet

- APL Outcome BM 26072021 NSE 26072021150942Document26 pagesAPL Outcome BM 26072021 NSE 26072021150942Karun KumarNo ratings yet

- T Hi Liv S: - Ouc NG e OverDocument9 pagesT Hi Liv S: - Ouc NG e OverRavi AgarwalNo ratings yet

- Enduring ValueDocument6 pagesEnduring ValueMandeep BatraNo ratings yet

- Unaudited Financial Results For Quarter Ended December 31 2022Document3 pagesUnaudited Financial Results For Quarter Ended December 31 2022Shradha mamNo ratings yet

- Kovai Medical Center and Hospital Limited: PartlcularsDocument2 pagesKovai Medical Center and Hospital Limited: PartlcularsVickyNo ratings yet

- Unaudited Consolidated Financial Results 30 06 2022 5fbd98142dDocument5 pagesUnaudited Consolidated Financial Results 30 06 2022 5fbd98142dheerkummar2006No ratings yet

- Apollo Tyres Ltd.Document3 pagesApollo Tyres Ltd.Nishant HardiyaNo ratings yet

- MM Q3 F22 Financial Results PackDocument12 pagesMM Q3 F22 Financial Results PackBharathNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Wovensacks Projections in ExcelDocument57 pagesWovensacks Projections in ExcelPradeep TlNo ratings yet

- ITC Financial Result Q4 FY2021 CfsDocument8 pagesITC Financial Result Q4 FY2021 CfsKaushik ViswanathanNo ratings yet

- Q1-Results Bal 2019-20Document5 pagesQ1-Results Bal 2019-20Krish PatelNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- SEBI PAPER PUB 30 06 2021 FINAL (27 07 2021) FDocument20 pagesSEBI PAPER PUB 30 06 2021 FINAL (27 07 2021) FYathish Us ThodaskarNo ratings yet

- Bajaj Auto Ltd. (India) : SourceDocument5 pagesBajaj Auto Ltd. (India) : SourceDivyagarapatiNo ratings yet

- F7-FINANCIAL REPORTING - ACCA (INT) 2011 JunDocument9 pagesF7-FINANCIAL REPORTING - ACCA (INT) 2011 JunIrfanNo ratings yet

- Tool Type Have? Completed Questions Score %Document12 pagesTool Type Have? Completed Questions Score %Ramona FrandesNo ratings yet

- PLAR Self AssessmentDocument15 pagesPLAR Self AssessmentBillHayerNo ratings yet

- Current Liabilities - QuizDocument4 pagesCurrent Liabilities - QuizArvin PaculanangNo ratings yet

- Name of The Business: Egreen Shop Nature of Business: Online Grossary ShopDocument7 pagesName of The Business: Egreen Shop Nature of Business: Online Grossary ShopShakil AhsanNo ratings yet

- Prac1: Multiple ChoiceDocument9 pagesPrac1: Multiple ChoiceROMAR A. PIGANo ratings yet

- Inci FS 2017 12Document67 pagesInci FS 2017 12DragashenNo ratings yet

- Exercise 2-General LedgerDocument2 pagesExercise 2-General LedgerTerefe DubeNo ratings yet

- Financial Analysis Thesis PDFDocument5 pagesFinancial Analysis Thesis PDFtujed1wov1f2100% (2)

- #Value!: Legal Name Trading Name AddressDocument31 pages#Value!: Legal Name Trading Name AddressShereen HossamNo ratings yet

- Case 1 For PrintDocument8 pagesCase 1 For PrintRichardDinongPascualNo ratings yet

- Financial Management (Problems)Document12 pagesFinancial Management (Problems)Prasad GowdNo ratings yet

- Plant Asset Natural ResourcesDocument21 pagesPlant Asset Natural ResourcesMarco LawinataNo ratings yet

- FCFF vs. FCFE CompletedDocument1 pageFCFF vs. FCFE CompletedPragathi T NNo ratings yet

- Axia Corporation Limited Pre Listing StatementDocument42 pagesAxia Corporation Limited Pre Listing StatementmichaelNo ratings yet

- Intermediate Accounting, 11th Edition - Chapter 05 - Balance Sheet and Statement of Cash FlowsDocument149 pagesIntermediate Accounting, 11th Edition - Chapter 05 - Balance Sheet and Statement of Cash FlowsJarid Wade100% (1)

- LK - Final - Chandra Asri Petrochemical TBK 06 2020Document91 pagesLK - Final - Chandra Asri Petrochemical TBK 06 2020herriNo ratings yet

- GENERAL ACCOUNTING RevisedDocument43 pagesGENERAL ACCOUNTING RevisedAkendombi EmmanuelNo ratings yet

- Bisal Thesis FinalDocument123 pagesBisal Thesis FinalPramod Rijal75% (16)

- Business Math: Interest On Mortgage, Amortization, Services, Utilities, Deposits, and LoansDocument12 pagesBusiness Math: Interest On Mortgage, Amortization, Services, Utilities, Deposits, and Loansmikasa ackerman100% (1)

- Statement of Cash Flow - Thorstved CoDocument5 pagesStatement of Cash Flow - Thorstved Cotun ibrahimNo ratings yet

- Principles of Accounting, Volume 1: Financial Accounting: Chapter 16 Statement of Cash FlowsDocument53 pagesPrinciples of Accounting, Volume 1: Financial Accounting: Chapter 16 Statement of Cash FlowsAdam Andrew OngNo ratings yet

- Revised Sustainability Improvement ReportDocument17 pagesRevised Sustainability Improvement ReportÇrox Rmg PunkNo ratings yet

- Excel Drill - CAPM & WACCDocument8 pagesExcel Drill - CAPM & WACCgjlastimozaNo ratings yet

- 02 - Soft - Copy - Laporan - Keuangan - Laporan Keuangan Tahun 2017 - TW3 - FPNI - FPNI - FS-Consol Q3 2017 (Un-Audited) PDFDocument72 pages02 - Soft - Copy - Laporan - Keuangan - Laporan Keuangan Tahun 2017 - TW3 - FPNI - FPNI - FS-Consol Q3 2017 (Un-Audited) PDFno allNo ratings yet

- Accounting ProjectDocument31 pagesAccounting ProjectDaisy Marie A. Rosel50% (2)

- Topic 2 - Financial Statements For Decisions (STU)Document42 pagesTopic 2 - Financial Statements For Decisions (STU)thiennnannn45No ratings yet

- Laurente Cleaning ServiceDocument3 pagesLaurente Cleaning ServicegracehelenNo ratings yet