Professional Documents

Culture Documents

FCFF vs. FCFE Completed

Uploaded by

Pragathi T N0 ratings0% found this document useful (0 votes)

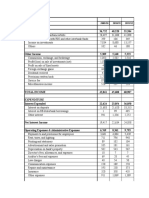

11 views1 pageThis document contains projections for free cash flow to the firm (FCFF) and free cash flow to equity (FCFE) from 2021-2029 for a company. It provides inputs like debt ratio, cost of equity, cost of debt, tax rates, EBIT, depreciation, capital expenditures, changes in working capital and calculates FCFF and FCFE each year. It then uses the perpetuity growth method to calculate terminal value in 2029 and determines the total value of the firm is Rs. 2,423 with a value of equity of Rs. 2,016.

Original Description:

Original Title

FCFF Vs. FCFE Completed

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains projections for free cash flow to the firm (FCFF) and free cash flow to equity (FCFE) from 2021-2029 for a company. It provides inputs like debt ratio, cost of equity, cost of debt, tax rates, EBIT, depreciation, capital expenditures, changes in working capital and calculates FCFF and FCFE each year. It then uses the perpetuity growth method to calculate terminal value in 2029 and determines the total value of the firm is Rs. 2,423 with a value of equity of Rs. 2,016.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views1 pageFCFF vs. FCFE Completed

Uploaded by

Pragathi T NThis document contains projections for free cash flow to the firm (FCFF) and free cash flow to equity (FCFE) from 2021-2029 for a company. It provides inputs like debt ratio, cost of equity, cost of debt, tax rates, EBIT, depreciation, capital expenditures, changes in working capital and calculates FCFF and FCFE each year. It then uses the perpetuity growth method to calculate terminal value in 2029 and determines the total value of the firm is Rs. 2,423 with a value of equity of Rs. 2,016.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 1

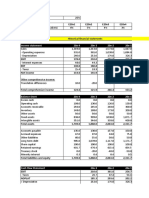

FCFF to FCFE FY2021 FY2022 FY2023 FY2024 FY2025 FY2026 FY2027 FY2028 FY2029

Inputs

Debt Ratio 16.8%

Terminal growth rate 2.0% D 16.8%

Cost of equity 7.6% E 83.2%

Pre-tax cost of debt 5.6% Ke 7.6%

After-tax cost of debt 3.9% Kd 3.9%

Cost of capital 7.0% WACC 7.0%

Free Cash Flow to the Firm

EBIT 102.5 116.0 125.7 131.2 131.9 174.5 180.5 176.8

Tax Rate, % 30.0% 30.0% 30.0% 30.0% 30.0% 30.0% 30.0% 30.0%

NOPAT 71.8 81.2 88.0 91.8 92.3 122.1 126.4 123.8

Add: Depreciation & amortization 207.5 201.8 197.9 196.5 198.1 156.1 149.1 150.3

Add: Stock-based compensation 6.0 6.0 6.0 6.0 6.0 6.0 6.0 6.0

Less: Change in WC (0.3) (2.1) (0.3) (0.4) (0.3) (0.3) (0.3) (0.3)

Less: CAPEX 200.0 185.0 170.0 160.0 155.0 150.0 145.0 140.0

FCFF 85.6 106.0 122.2 134.7 141.7 134.6 136.7 140.4

Terminal value 2,892.0

FCFF +Terminal Value 85.6 106.0 122.2 134.7 141.7 134.6 136.7 3,032.4

Value of Firm 2,423

Value of Debt 407.2

Value of equity 2,016

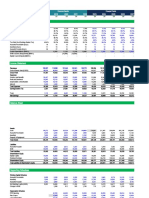

Free Cash Flow to Equity

EBIT 102.5 116.0 125.7 131.2 131.9 174.5 180.5 176.8

Interest Expense 22.9 23.7 24.3 24.8 25.3 25.7 26.2 26.8

EBT 79.6 92.3 101.4 106.3 106.6 148.7 154.3 150.1

Taxes 23.9 27.7 30.4 31.9 32.0 44.6 46.3 45.0

Net Income 55.7 64.6 71.0 74.4 74.6 104.1 108.0 105.0

Add: Depreciation & amortization 207.5 201.8 197.9 196.5 198.1 156.1 149.1 150.3

Add: Stock-based compensation 6.0 6.0 6.0 6.0 6.0 6.0 6.0 6.0

Add: New Debt Issued 13.9 11.5 9.5 8.1 7.5 9.2 9.5 9.5

Less: Change in WC (0.3) (2.1) (0.3) (0.4) (0.3) (0.3) (0.3) (0.3)

Less: CAPEX 200.0 185.0 170.0 160.0 155.0 150.0 145.0 140.0

FCFE 83.5 100.9 114.7 125.4 131.5 125.8 127.8 131.2

Terminal value 2,406.1

FCFE + Terminal Value 83.5 100.9 114.7 125.4 131.5 125.8 127.8 2,537.3

Value of Equity ₹ 2,016

You might also like

- FCFF Vs FCFE Reconciliation TemplateDocument2 pagesFCFF Vs FCFE Reconciliation TemplateLalit KheskwaniNo ratings yet

- FCFF Vs FCFE Reconciliation Template: Strictly ConfidentialDocument2 pagesFCFF Vs FCFE Reconciliation Template: Strictly ConfidentialvishalNo ratings yet

- Colgate Palmolive ModelDocument51 pagesColgate Palmolive ModelAde FajarNo ratings yet

- Uv0052 Xls EngDocument12 pagesUv0052 Xls Engpriyanshu14No ratings yet

- Masonite Corp DCF Analysis FinalDocument5 pagesMasonite Corp DCF Analysis FinaladiNo ratings yet

- Gross Profit Ad Expenses Depreciation (Dedicated Inv) Jell-O Equipment DepreciationDocument11 pagesGross Profit Ad Expenses Depreciation (Dedicated Inv) Jell-O Equipment Depreciationanmolsaini01No ratings yet

- Marriott WACC and Divisional Cost of Capital AnalysisDocument15 pagesMarriott WACC and Divisional Cost of Capital AnalysisSaadatNo ratings yet

- AirThreads Valuation SolutionDocument20 pagesAirThreads Valuation SolutionBill JoeNo ratings yet

- CVR - Case - Excel FileDocument7 pagesCVR - Case - Excel FileVinay JajuNo ratings yet

- Atherine S OnfectioneryDocument3 pagesAtherine S OnfectioneryVanshika SinghNo ratings yet

- FCFF Vs Fcfe StudentDocument5 pagesFCFF Vs Fcfe StudentKanchan GuptaNo ratings yet

- Nike Inc. Cost of Capital DCF AnalysisDocument6 pagesNike Inc. Cost of Capital DCF AnalysisrizqighaniNo ratings yet

- IS Excel Participant - Simplified v2Document9 pagesIS Excel Participant - Simplified v2Art EuphoriaNo ratings yet

- XLS EngDocument26 pagesXLS EngcellgadizNo ratings yet

- How to Calculate Share Price Using DCF ModelDocument2 pagesHow to Calculate Share Price Using DCF ModelMd Rasel Uddin ACMANo ratings yet

- Ten Year Review - Standalone: Asian Paints LimitedDocument10 pagesTen Year Review - Standalone: Asian Paints Limitedmaruthi631No ratings yet

- Rosetta Stone IPODocument5 pagesRosetta Stone IPOFatima Ansari d/o Muhammad AshrafNo ratings yet

- Optimal Capital Structure and WACC CalculationDocument8 pagesOptimal Capital Structure and WACC CalculationThuy Tran TrangNo ratings yet

- Manaal - Commercial Banking W J.P MorganDocument9 pagesManaal - Commercial Banking W J.P Morganmanaal.murtaza1No ratings yet

- CH 32Document2 pagesCH 32Mukul KadyanNo ratings yet

- BIOCON Ratio AnalysisDocument3 pagesBIOCON Ratio AnalysisVinuNo ratings yet

- Valuation of Apollo Tyres Using 4 Methods Shows UndervaluationDocument3 pagesValuation of Apollo Tyres Using 4 Methods Shows UndervaluationnityaNo ratings yet

- Nucor Mill ValuationDocument1 pageNucor Mill ValuationSantoshNo ratings yet

- Assumptions: Comparable Companies:Market ValueDocument18 pagesAssumptions: Comparable Companies:Market ValueTanya YadavNo ratings yet

- Discounted Cash Flow (DCF) Valuation: This Model Is For Illustrative Purposes Only and Contains No FormulasDocument2 pagesDiscounted Cash Flow (DCF) Valuation: This Model Is For Illustrative Purposes Only and Contains No Formulasrito2005No ratings yet

- Werner - Financial Model - Final VersionDocument2 pagesWerner - Financial Model - Final VersionAmit JainNo ratings yet

- IS Excel Participant - Simplified v2Document9 pagesIS Excel Participant - Simplified v2animecommunity04No ratings yet

- Marriott Corp BDocument15 pagesMarriott Corp BEshesh GuptaNo ratings yet

- Data Patterns Income&CashFlow - 4 Years - 19052020Document8 pagesData Patterns Income&CashFlow - 4 Years - 19052020Sundararaghavan RNo ratings yet

- Revenue, Costs, Profits, and Financial Analysis of Company from 1995-2011Document4 pagesRevenue, Costs, Profits, and Financial Analysis of Company from 1995-2011Anchal ChokhaniNo ratings yet

- Ducati Valuation - LPDocument11 pagesDucati Valuation - LPuygh gNo ratings yet

- Is Excel Participant Samarth - Simplified v2Document9 pagesIs Excel Participant Samarth - Simplified v2samarth halliNo ratings yet

- Appendix 1 Conservative Approach: (In FFR Million)Document6 pagesAppendix 1 Conservative Approach: (In FFR Million)Sarvagya JhaNo ratings yet

- Davis Industries Financial Summary 2015-2017Document10 pagesDavis Industries Financial Summary 2015-2017Aaron Pool0% (2)

- Simplified CFROI valuation model auditDocument8 pagesSimplified CFROI valuation model auditJosephNo ratings yet

- Financial Projections and Analysis 2005-2011Document7 pagesFinancial Projections and Analysis 2005-2011akashNo ratings yet

- Is Excel Participant - Simplified v2Document9 pagesIs Excel Participant - Simplified v2dikshapatil6789No ratings yet

- IS Excel Participant - Simplified v2Document9 pagesIS Excel Participant - Simplified v2deepika0% (1)

- IS Excel Participant (Risit Savani) - Simplified v2Document9 pagesIS Excel Participant (Risit Savani) - Simplified v2risitsavaniNo ratings yet

- 1958-1977 Financial Analysis and NPV Calculations of a Potential New ProductDocument6 pages1958-1977 Financial Analysis and NPV Calculations of a Potential New ProductDHRUV SONAGARANo ratings yet

- News Release INDY Result 6M22Document7 pagesNews Release INDY Result 6M22Rama Usaha MandiriNo ratings yet

- UntitledDocument3 pagesUntitledSankalp MishraNo ratings yet

- Case 1 MarriottDocument14 pagesCase 1 Marriotthimanshu sagar100% (1)

- Leveraged Buyout Valuation and AnalysisDocument5 pagesLeveraged Buyout Valuation and AnalysisfutyNo ratings yet

- Income Statement 20x-4 20x-3 20x-2 20x-1Document6 pagesIncome Statement 20x-4 20x-3 20x-2 20x-1gregNo ratings yet

- PGPF - 01 - 017 - CV - Assignment - 5 - Keshav v1Document26 pagesPGPF - 01 - 017 - CV - Assignment - 5 - Keshav v1nidhidNo ratings yet

- Investment Banking, 3E: Valuation, Lbos, M&A, and IposDocument10 pagesInvestment Banking, 3E: Valuation, Lbos, M&A, and IposBook SittiwatNo ratings yet

- Nike Inc Cost of Capital Blaine KitchenwDocument11 pagesNike Inc Cost of Capital Blaine KitchenwAlvaro Gallardo FernandezNo ratings yet

- Projection and Valuation Example - SolutionDocument13 pagesProjection and Valuation Example - SolutionPrince Akonor AsareNo ratings yet

- 17pgp216 ApolloDocument5 pages17pgp216 ApolloVamsi GunturuNo ratings yet

- Valuation of Airthread April 2012Document26 pagesValuation of Airthread April 2012Perumalla Pradeep KumarNo ratings yet

- TMW Co. Ltd Financial ProjectionsDocument15 pagesTMW Co. Ltd Financial ProjectionsgabegwNo ratings yet

- Ten year financial performance of Asian PaintsDocument10 pagesTen year financial performance of Asian Paintsmaruthi631No ratings yet

- Exhibit 1: Gross Profit 3,597.1Document15 pagesExhibit 1: Gross Profit 3,597.1Rendy Setiadi MangunsongNo ratings yet

- Hero Motocorp EvaDocument1 pageHero Motocorp EvaproNo ratings yet

- Projections 2023Document8 pagesProjections 2023DHANAMNo ratings yet

- AirThread CalcDocument15 pagesAirThread CalcSwati VermaNo ratings yet

- Power Markets and Economics: Energy Costs, Trading, EmissionsFrom EverandPower Markets and Economics: Energy Costs, Trading, EmissionsNo ratings yet

- Government Publications: Key PapersFrom EverandGovernment Publications: Key PapersBernard M. FryNo ratings yet

- CardhektestDocument37 pagesCardhektestPragathi T NNo ratings yet

- CardsDocument4 pagesCardsPragathi T NNo ratings yet

- Payments IntroDocument15 pagesPayments IntroPragathi T NNo ratings yet

- NAB CombinepdfDocument97 pagesNAB CombinepdfPragathi T NNo ratings yet

- Banking Elective-Module - 4-FinalDocument33 pagesBanking Elective-Module - 4-FinalPragathi T NNo ratings yet

- DDM Exercise 1Document5 pagesDDM Exercise 1Pragathi T NNo ratings yet

- Federal Bank ValuationDocument8 pagesFederal Bank ValuationPragathi T NNo ratings yet

- Initial Public OfferingsDocument13 pagesInitial Public OfferingsPragathi T NNo ratings yet

- Football Field Valuation ChartDocument4 pagesFootball Field Valuation ChartPragathi T NNo ratings yet

- Historical Financials and Forecast with Key MetricsDocument3 pagesHistorical Financials and Forecast with Key MetricsPragathi T NNo ratings yet

- Federal Bank Student SupplementDocument8 pagesFederal Bank Student SupplementYash AgarwalNo ratings yet

- Historical Financials and Forecast with Key MetricsDocument3 pagesHistorical Financials and Forecast with Key MetricsPragathi T NNo ratings yet

- Crypto CurrenciesDocument17 pagesCrypto CurrenciesPragathi T NNo ratings yet

- DCF 2 CompletedDocument4 pagesDCF 2 CompletedPragathi T NNo ratings yet

- Fintech SolutionsDocument32 pagesFintech SolutionsPragathi T NNo ratings yet

- Module 5. Preferential TaxationDocument6 pagesModule 5. Preferential TaxationYolly DiazNo ratings yet

- Our Lady of The Pillar College - CauayanDocument5 pagesOur Lady of The Pillar College - CauayanAnnhtak PNo ratings yet

- Kazi Md. Mehdi Hasan2Document4 pagesKazi Md. Mehdi Hasan2Md. Obayed UllahNo ratings yet

- Trinidad and Tobago National Budget 2022Document60 pagesTrinidad and Tobago National Budget 2022brandon davidNo ratings yet

- Reviewer 1 - 6 Intacc 2Document58 pagesReviewer 1 - 6 Intacc 2Ivory ClaudioNo ratings yet

- MidTerm-Govt.-accounting-RAMOS, ROSEMARIE CDocument12 pagesMidTerm-Govt.-accounting-RAMOS, ROSEMARIE Cagentnic100% (1)

- AUDIT REPORT OLGATUNI CAMP LIMITED - 2020 - Financial StatementsDocument19 pagesAUDIT REPORT OLGATUNI CAMP LIMITED - 2020 - Financial StatementsRohit RathiNo ratings yet

- Chapter 3 Numerical Descriptive MeasuresDocument7 pagesChapter 3 Numerical Descriptive MeasuresKultum DemieNo ratings yet

- J B Gupta Classes: Lease Decisions Lease Decisions Lease Decisions Lease DecisionsDocument51 pagesJ B Gupta Classes: Lease Decisions Lease Decisions Lease Decisions Lease DecisionsTihor LuharNo ratings yet

- Trading and Profit & Loss Account and Balance Sheet for Shri PatdiwalaDocument2 pagesTrading and Profit & Loss Account and Balance Sheet for Shri PatdiwalaOm MansattaNo ratings yet

- MCQs Problems For Merchandising Business - For UploadDocument8 pagesMCQs Problems For Merchandising Business - For UploadIrish Trisha PerezNo ratings yet

- Topic 4 - Investment AppraisalDocument46 pagesTopic 4 - Investment AppraisalmaureenNo ratings yet

- Assignments F7-5Document4 pagesAssignments F7-5HabibaNo ratings yet

- Apax PE Associate Recruiting PromptDocument2 pagesApax PE Associate Recruiting PromptLuisNo ratings yet

- Remittance VoucherDocument2 pagesRemittance VoucherЕвгений БулгаковNo ratings yet

- f7sgp 2009 Dec QDocument9 pagesf7sgp 2009 Dec Q10 SPACENo ratings yet

- Fs Analysis Quizzer PDF FreeDocument22 pagesFs Analysis Quizzer PDF FreeXela Mae BigorniaNo ratings yet

- IGCSE Economics Self Assessment Chapter 26 AnswersDocument3 pagesIGCSE Economics Self Assessment Chapter 26 AnswersDesreNo ratings yet

- Answer in Tax-Prelim ExamDocument5 pagesAnswer in Tax-Prelim ExamCharina Balunso-BasiloniaNo ratings yet

- Tax Calculator User ManualDocument6 pagesTax Calculator User Manualravinder vermaNo ratings yet

- Bir RMC No. 97-2021: Philippine Tax Perspective On Social Media InfluencersDocument6 pagesBir RMC No. 97-2021: Philippine Tax Perspective On Social Media InfluencersIvan AnaboNo ratings yet

- Pollux Properties LTD - Annual Report - FPE 31.12.2020Document135 pagesPollux Properties LTD - Annual Report - FPE 31.12.2020guntur secoundNo ratings yet

- Debt management ratios analysisDocument4 pagesDebt management ratios analysisJohn MuemaNo ratings yet

- Tybcom Question BankDocument21 pagesTybcom Question BankPraful KhatateNo ratings yet

- BUS. MATH Q2 - Week3Document4 pagesBUS. MATH Q2 - Week3DARLENE MARTINNo ratings yet

- Across National Tax Jurisdictions. Hence, A Company's Transfer-Pricing PoliciesDocument2 pagesAcross National Tax Jurisdictions. Hence, A Company's Transfer-Pricing PoliciesLJBernardoNo ratings yet

- LLP Financial StatementsDocument10 pagesLLP Financial Statementssejal ambetkarNo ratings yet

- Financial Accounting and Analysis AssignmentDocument13 pagesFinancial Accounting and Analysis Assignmentbhaskar paliwalNo ratings yet

- BCF AssignmentDocument2 pagesBCF AssignmentArchismanNo ratings yet

- Question Bank: Errorless Taxation by Ca Pranav Chandak at Pranav Chandak Academy, PuneDocument8 pagesQuestion Bank: Errorless Taxation by Ca Pranav Chandak at Pranav Chandak Academy, PuneSimran MeherNo ratings yet