Professional Documents

Culture Documents

Valuation of Apollo Tyres Using 4 Methods Shows Undervaluation

Uploaded by

nityaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Valuation of Apollo Tyres Using 4 Methods Shows Undervaluation

Uploaded by

nityaCopyright:

Available Formats

Valuation and Analysis

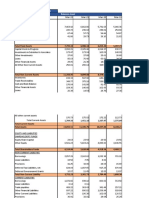

We value the company using 4 valuation methods. Namely, FCFF, FCFE, APV and CCF.

Free Cashflow to the Firm (FCFF):

2021E 2022E 2023E 2024E 2025E

EBIT (1-tax) 9213 10552 10958 11398 12608

Add: Depreciation 6207.05 7771.57 8211.08 8708.74 8778.88

Less: Capex 10,100.42 10,896.22 12,547.11 13,589.98 14,550.34

Less: Changes in Non-Cash WC -12324.93 7274.91 5493.53 1320.42 2384.24

FCFF 17644.57 152.25 1128.15 5196.67 4452.67

Terminal Value 144684.2

PV of Free Cash Flow 16148.84 127.53 864.88 3646.25 2859.38

PV of Terminal Value 92912.06

Enterprise Value 116558

.94

Less: Debt 48582.

38

Add: Cash 2365.8

4

Value of Equity 70342.

40

No. of Outstanding 572.05

Shares

Intrinsic Value per Share 122.97

Current Market Price 131.7

Potential Upside/ -6.63%

Downside

Free Cashflow to Equity (FCFE):

2021E 2022E 2023E 2024E 2025E

Projected Cash Flow 8024 9293 9606 10132 11316

Add: Depreciation 7771.57 8211.08 8708.74 8778.88 9287.16

Less: Capex 10,100.42 10,896.2 12,547.1 13,589.98 14,550.34

2 1

Less: Changes in Non-Cash WC -12324.93 7274.91 5493.53 1320.42 2384.24

less: Debt Repayment 525.99 -128.34 -1079.01 -701.20 -416.91

FCFE 17493.95 -539.03 1353.12 4701.36 4085.36

Terminal Value 76190.0

PV of Free Cash Flow 15663.83 -432.15 971.32 3021.78 2351.15

PV of Terminal Value 43847.76

Enterprise Value 65423.68

Add: Cash 2365.84

Value of Equity 67789.52

No. of Outstanding Shares 572.05

Intrinsic Value per Share 118.50

Current Market Price 131.7

Potential Upside/Downside -10.02%

Adjusted Present Value (APV):

2021E 2022E 2023E 2024E 2025E

EBIT (1-tax) 9213 10552 10958 11398 12608

Add: Depreciation 6207.05 7771.57 8211.08 8708.74 8778.88

Less: Capex 10,100.42 10,896.22 12,547.11 13,589.98 14,550.34

Less: Changes in Non-Cash WC -12324.93 7274.91 5493.53 1320.42 2384.24

Less: Depreciation 525.99 -128.34 -1079.01 -701.20 -416.91

FCFF 17118.59 280.59 2207.16 5897.87 4869.58

Terminal Value 90815.3

PV of Free Cash Flow 15327.73 224.95 1584.39 3790.83 2802.47

PV of Terminal Value 52264.68

Value of Unlevered Firm 75995.05

Finance Cost 1670.31 1768.61 1898.62 1779.18 1815.47

Tax Shield 481.16 509.47 546.93 512.52 522.97

Terminal Value of Tax Shield 31951.11

PV of Tax Shield 446.61 438.94 437.38 380.44 360.33

PV of Terminal Tax Shield 12780.44

Value of Tax Shield 14844.14

Value of Equity less Cash 90839.19

Add: Cash 2365.84

Value of Equity 93205.03

No. of Outstanding Shares 572.05

Intrinsic Value per Share 162.93

Current Market Price 131.7

Potential Upside/Downside 23.71%

Capital Cashflow (CCF):

2021E 2022E 2023E 2024E 2025E

Projected Cash Flow 8203 9578 9927 10302 11492

Add: Depriciation 7771.57 8211.08 8708.74 8778.88 9287.16

Less: Capex 10,100.42 10,896.22 12,547.1 13,589.98 14,550.34

1

Less: Changes in Non-Cash WC -12324.93 7274.91 5493.53 1320.42 2384.24

FCFF 18199.57 -381.81 595.37 4169.98 3844.51

Terminal Value 124922.8

PV of Free Cash Flow 16656.79 -319.82 456.43 2925.87 2468.84

PV of Terminal Value 80221.90

Enterprise Value 102410.01

less: Debt 48582.38

Add: Cash 2365.84

Value of Equity 104775.85

No. of Outstanding Shares 572.05

Intrinsic Value per Share 183.16

Current Market Price 131.7

Potential Upside/Downside 39.07%

Valuation Snapshot:

FCFF

Intrinsic Value per Share 122.97

Current Market Price 131.7

Potential Upside/Downside -6.63%

FCFE

Intrinsic Value per Share 118.50

Current Market Price 131.7

Potential Upside/Downside -10.02%

APV

Intrinsic Value per Share 162.93

Current Market Price 131.7

Potential Upside/Downside 23.71%

CCF

Intrinsic Value per Share 183.16

Current Market Price 131.7

Potential Upside/Downside 39.07%

Recommendation and Conclusion

Apollo Tyres if we go with FCFF & FCFE method of valuation is slightly over-valued around 6.63% and

10.02% respectively. However, with the modest assumptions, using APV & CCF method we can find

that the Apollo Tyres looks under-valued based on the above calculations.

Apollo Tyres expects domestic replacement demand to remain strong in coming months, with July

continuing Q1FY21 strength. The company expects to post sequential growth in Europe, going

ahead, and retain focus on costs with operating at 90% of normal levels in Europe during Q2FY21E.

The management said that rebound in India replacement demand had been much higher than

expected.

Hence, with the above-mentioned factors in place and the market demand recovering from the

COVID-19 crisis, the company is likely to be well-positioned against it competitors. Hence, we give a

HOLD recommendation on Apollo Tyres.

You might also like

- CAM License Exam Prep PPDocument18 pagesCAM License Exam Prep PPLilliam TorresNo ratings yet

- (FreeCourseWeb - Com) 2019-11-01RobbReport PDFDocument227 pages(FreeCourseWeb - Com) 2019-11-01RobbReport PDFdeloopse50% (2)

- Common Abbreviations: Basic Hotel TerminologyDocument8 pagesCommon Abbreviations: Basic Hotel TerminologyCarlo TrinioNo ratings yet

- AirThread CalcDocument15 pagesAirThread CalcSwati VermaNo ratings yet

- MPPL-02Project Management PDFDocument21 pagesMPPL-02Project Management PDFbaraNo ratings yet

- Ducati Valuation - LPDocument11 pagesDucati Valuation - LPuygh gNo ratings yet

- Globalisation and ManagementDocument6 pagesGlobalisation and ManagementmickyNo ratings yet

- Power Markets and Economics: Energy Costs, Trading, EmissionsFrom EverandPower Markets and Economics: Energy Costs, Trading, EmissionsNo ratings yet

- Management Prerogatives CompilationDocument21 pagesManagement Prerogatives CompilationRap SantosNo ratings yet

- Abm 12 Marketing q1 Clas3 Value of Customer v1 - Rhea Ann NavillaDocument11 pagesAbm 12 Marketing q1 Clas3 Value of Customer v1 - Rhea Ann NavillaKim Yessamin MadarcosNo ratings yet

- Acova RadiateursDocument10 pagesAcova RadiateursAnandNo ratings yet

- Al Shaheer CompsDocument4 pagesAl Shaheer CompsAbdullah YousufNo ratings yet

- The Magnificent-Equity ValuationDocument70 pagesThe Magnificent-Equity ValuationMohit TewaryNo ratings yet

- DCF TVSDocument17 pagesDCF TVSSunilNo ratings yet

- Projections 2023Document8 pagesProjections 2023DHANAMNo ratings yet

- Colgate Palmolive ModelDocument51 pagesColgate Palmolive ModelAde FajarNo ratings yet

- DCF Calculation of Dabur India Ltd.Document6 pagesDCF Calculation of Dabur India Ltd.Radhika ChaudhryNo ratings yet

- Dion Global Solutions LimitedDocument10 pagesDion Global Solutions LimitedArthurNo ratings yet

- Comparative Balance Sheet of Tata Steels For Year 2009-10: Particulars 2009 2010 Increase or DecreaseDocument10 pagesComparative Balance Sheet of Tata Steels For Year 2009-10: Particulars 2009 2010 Increase or DecreasedrrameshgargNo ratings yet

- FM WK 5 PmuDocument30 pagesFM WK 5 Pmupranjal92pandeyNo ratings yet

- Reliance FSA PrachiDocument16 pagesReliance FSA PrachiPrachi SrivastavaNo ratings yet

- Cfin2 HW1Document25 pagesCfin2 HW1Anirudh BharNo ratings yet

- ColgateDocument32 pagesColgateapi-3702531No ratings yet

- Mar-19 Dec-18 Sep-18 Jun-18 Figures in Rs CroreDocument12 pagesMar-19 Dec-18 Sep-18 Jun-18 Figures in Rs Croreneha singhNo ratings yet

- 32 - Akshita - Sun Pharmaceuticals Industries.Document36 pages32 - Akshita - Sun Pharmaceuticals Industries.rajat_singlaNo ratings yet

- YashDocument6 pagesYashvanshita.garud23No ratings yet

- Radico Khaitan SSGR Report and ForecastDocument38 pagesRadico Khaitan SSGR Report and Forecasttapasya khanijouNo ratings yet

- Tvs Motor 2019 2018 2017 2016 2015Document108 pagesTvs Motor 2019 2018 2017 2016 2015Rima ParekhNo ratings yet

- CH 32Document2 pagesCH 32Mukul KadyanNo ratings yet

- FCFF vs. FCFE CompletedDocument1 pageFCFF vs. FCFE CompletedPragathi T NNo ratings yet

- Valuation by FCFF: in Rs Crs. Mar-17 Mar-18 E Mar-19 E Mar-20 E AssumptionsDocument2 pagesValuation by FCFF: in Rs Crs. Mar-17 Mar-18 E Mar-19 E Mar-20 E AssumptionsVishesh DaveNo ratings yet

- Ramco Cements StandaloneDocument13 pagesRamco Cements StandaloneTao LoheNo ratings yet

- Particulars 2009-10 2008-09Document1 pageParticulars 2009-10 2008-09Chethan PuttaswamyNo ratings yet

- Accltd.: Income & Expenditure Summary: Dec 2010 - Dec 2019: Non-Annualised: Rs. CroreDocument6 pagesAccltd.: Income & Expenditure Summary: Dec 2010 - Dec 2019: Non-Annualised: Rs. Crorehardik aroraNo ratings yet

- Shree Cement Financial Model Projections BlankDocument10 pagesShree Cement Financial Model Projections Blankrakhi narulaNo ratings yet

- Revenue, Costs, and Profits Over TimeDocument19 pagesRevenue, Costs, and Profits Over TimeELIF KOTADIYANo ratings yet

- NilkamalDocument14 pagesNilkamalNandish KothariNo ratings yet

- GilletteDocument14 pagesGilletteapi-3702531No ratings yet

- Accm507 Shruti 12101804Document15 pagesAccm507 Shruti 12101804priyanshu kumariNo ratings yet

- Ashok Leyland DCF TempletDocument9 pagesAshok Leyland DCF TempletSourabh ChiprikarNo ratings yet

- Daaj Hotels Valuation Report as of 31st December 2019Document23 pagesDaaj Hotels Valuation Report as of 31st December 2019Chulbul PandeyNo ratings yet

- The Project (Or Subsidiary) Cashflows: Lecture ExampleDocument15 pagesThe Project (Or Subsidiary) Cashflows: Lecture ExamplelucaNo ratings yet

- Company Financial Analysis and Ratio Comparison Over 5 YearsDocument6 pagesCompany Financial Analysis and Ratio Comparison Over 5 YearsAanchal MahajanNo ratings yet

- This Is An Open Book Examination. 2. Attempt Any Four Out of Six Questions. 3. All Questions Carry Equal MarksDocument32 pagesThis Is An Open Book Examination. 2. Attempt Any Four Out of Six Questions. 3. All Questions Carry Equal MarksSukanya Shridhar 1 9 9 0 3 5No ratings yet

- United Breweries Holdings LimitedDocument7 pagesUnited Breweries Holdings Limitedsalini sasiNo ratings yet

- BS1 - Balance Sheet Summary Dec 2008Document7 pagesBS1 - Balance Sheet Summary Dec 2008Avanti GampaNo ratings yet

- Trend AnalysisDocument5 pagesTrend Analysisabbas ali100% (1)

- Sree Lakshimi Organic Cotton Industry Balance Sheet Balance Sheet Particulars 2010-2011 2011-2012 2012-2013 2013-2014 2014-2015Document5 pagesSree Lakshimi Organic Cotton Industry Balance Sheet Balance Sheet Particulars 2010-2011 2011-2012 2012-2013 2013-2014 2014-2015ananthakumarNo ratings yet

- DCF NHLDocument5 pagesDCF NHLMittal Kirti MukeshNo ratings yet

- UFS AssignmentDocument10 pagesUFS AssignmentTrishika ShettyNo ratings yet

- MaricoDocument13 pagesMaricoRitesh KhobragadeNo ratings yet

- Financial Forecasting: Revenue, Costs, Profits, EPSDocument54 pagesFinancial Forecasting: Revenue, Costs, Profits, EPSRonakk MoondraNo ratings yet

- Common Sized Balance Sheet As at 31st December, 2018: Acc LimitedDocument6 pagesCommon Sized Balance Sheet As at 31st December, 2018: Acc LimitedVandita KhudiaNo ratings yet

- Financial performance and ratios of manufacturing companyDocument6 pagesFinancial performance and ratios of manufacturing companyShubham RankaNo ratings yet

- Horizontal Vertical Ratio Analysis Problem Soln 16.04.2013Document15 pagesHorizontal Vertical Ratio Analysis Problem Soln 16.04.2013Ojas MaheshwaryNo ratings yet

- Assignment File FMDocument4 pagesAssignment File FMvineeth kumarNo ratings yet

- 0.134 0.1082 Step 1 Cash Flow PV Factor: Problem 21-2Document5 pages0.134 0.1082 Step 1 Cash Flow PV Factor: Problem 21-2alvinNo ratings yet

- Nike Inc Cost of Capital Blaine KitchenwDocument11 pagesNike Inc Cost of Capital Blaine KitchenwAlvaro Gallardo FernandezNo ratings yet

- IndusInd BankDocument9 pagesIndusInd BankSrinivas NandikantiNo ratings yet

- Income Statement Analysis and Projections 2005-2010Document5 pagesIncome Statement Analysis and Projections 2005-2010Gullible KhanNo ratings yet

- FSA GroupDocument87 pagesFSA GroupSanjib Kumar RamNo ratings yet

- 2012 2013 2014 2015 2016e Input Profit and Loss Statement: Cash Flow EstimatesDocument3 pages2012 2013 2014 2015 2016e Input Profit and Loss Statement: Cash Flow EstimatesBilal AhmedNo ratings yet

- Ara ReportDocument60 pagesAra Reportvineeth singhNo ratings yet

- Airthread ValuationDocument7 pagesAirthread ValuationAbhinav UtkarshNo ratings yet

- CV Assignment - Agneesh DuttaDocument14 pagesCV Assignment - Agneesh DuttaAgneesh DuttaNo ratings yet

- Uv0052 Xls EngDocument12 pagesUv0052 Xls Engpriyanshu14No ratings yet

- Apollo Tyres: About The CompanyDocument3 pagesApollo Tyres: About The CompanynityaNo ratings yet

- Tyre Industry OverviewDocument2 pagesTyre Industry OverviewnityaNo ratings yet

- Valuation MRFDocument4 pagesValuation MRFnityaNo ratings yet

- Valuation JK TyresDocument4 pagesValuation JK TyresnityaNo ratings yet

- Valuation: Beta and WACCDocument4 pagesValuation: Beta and WACCnityaNo ratings yet

- Apollo Tyres: About The CompanyDocument3 pagesApollo Tyres: About The CompanynityaNo ratings yet

- Assumption JK TYRESDocument2 pagesAssumption JK TYRESnityaNo ratings yet

- Assumption MRFDocument2 pagesAssumption MRFnityaNo ratings yet

- Financial Statement Analysis: IT Sector CompaniesDocument49 pagesFinancial Statement Analysis: IT Sector CompaniesnityaNo ratings yet

- Managing Resources and Talent in MediaDocument3 pagesManaging Resources and Talent in MedianityaNo ratings yet

- India's rising energy demand and dependence on importsDocument4 pagesIndia's rising energy demand and dependence on importsnityaNo ratings yet

- Empathy MapDocument3 pagesEmpathy MapnityaNo ratings yet

- Television SUN TV Networks Is One of The Largest TV Networks in Asia and Represents A MajorDocument3 pagesTelevision SUN TV Networks Is One of The Largest TV Networks in Asia and Represents A MajornityaNo ratings yet

- Recruitments, Training & DevelopmentDocument6 pagesRecruitments, Training & DevelopmentnityaNo ratings yet

- HR PainPointsDocument3 pagesHR PainPointsnityaNo ratings yet

- Interview Transcript Company InformationDocument3 pagesInterview Transcript Company InformationnityaNo ratings yet

- Bharat Electronic LimitedDocument9 pagesBharat Electronic LimitednityaNo ratings yet

- Inventory Management and Budgetary Control System in Investment IndustryDocument36 pagesInventory Management and Budgetary Control System in Investment IndustrynityaNo ratings yet

- D FSC ProgramDocument18 pagesD FSC ProgramShirley FarraceNo ratings yet

- RFL Profile of BODDocument2 pagesRFL Profile of BODabdul ohabNo ratings yet

- Associations & Industry Bodies GlobalDocument4 pagesAssociations & Industry Bodies GlobalJa JUOINo ratings yet

- Used Machinery Expo 2011Document8 pagesUsed Machinery Expo 2011Swati SinghNo ratings yet

- Muhammad Saarim GhaziDocument36 pagesMuhammad Saarim GhaziShahid JappaNo ratings yet

- MAVOKO WATER BILL DETAILSDocument1 pageMAVOKO WATER BILL DETAILSAtito OnyxNo ratings yet

- Five Forces Analysis of Vadilal Ice-creams IndustryDocument100 pagesFive Forces Analysis of Vadilal Ice-creams IndustrySuraj VaidyaNo ratings yet

- FinGame 5.0 Participants Ch05Document30 pagesFinGame 5.0 Participants Ch05Martin VazquezNo ratings yet

- Oracle Unified Method 069204Document82 pagesOracle Unified Method 069204majidNo ratings yet

- Minera Perú Copper S.A. tratará aguas del Túnel KingsmillDocument44 pagesMinera Perú Copper S.A. tratará aguas del Túnel KingsmillBryan Arévalo100% (1)

- Sharekhan Trainee Recruitment and Selection Process and Information About The CompanyDocument18 pagesSharekhan Trainee Recruitment and Selection Process and Information About The CompanyAjeet SinghNo ratings yet

- Object Oriented Analysis and Design Lab ManualDocument93 pagesObject Oriented Analysis and Design Lab ManualSHIVALKAR J70% (10)

- Temba - DissertationDocument69 pagesTemba - Dissertationdeo847No ratings yet

- Summary of RMA Accounting and COGS RecognitionDocument8 pagesSummary of RMA Accounting and COGS RecognitionnimishhshahNo ratings yet

- V MartDocument47 pagesV MartHarshit JainNo ratings yet

- 04 Professional Resume Template in WordDocument1 page04 Professional Resume Template in WordDevarajanNo ratings yet

- Amazon Case StudyDocument3 pagesAmazon Case StudyChristian Jay PorciunculaNo ratings yet

- Engineering Management CASE STUDYDocument5 pagesEngineering Management CASE STUDYGeorge Nomio Barbridge Jr.No ratings yet

- Sales PromotionDocument16 pagesSales PromotionAlyaSabbanNo ratings yet

- Lay's ProjectDocument8 pagesLay's Projecthmz6No ratings yet

- C Statment - Ivan Maleakhi - Des 2020Document4 pagesC Statment - Ivan Maleakhi - Des 2020Budi ArtantoNo ratings yet

- CT071-3.5-3-DDAC - Designing Developing Cloud Applications v1Document7 pagesCT071-3.5-3-DDAC - Designing Developing Cloud Applications v1anashj2No ratings yet

- Fund Investment ObjectiveDocument3 pagesFund Investment ObjectiveSobia RasheedNo ratings yet