Professional Documents

Culture Documents

Untitled

Uploaded by

Sankalp MishraCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Untitled

Uploaded by

Sankalp MishraCopyright:

Available Formats

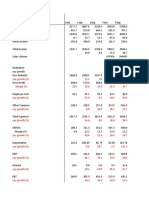

Average CAPM beta 0.

585 1 2 3

Market return 12% 2017 2018 2019

Risk free rate 6.80% Revenue 2979 4107 4538.7

Cost of equity 9.84% Total Exp 3035.2 3865.4 4077.9

Pre tax cost of debt 11.75% Depreciation 126.1 196.1 203.9

Tax rate 33.89% Finance cost 136.9 145.1 113.9

Debt 278.74 Op. exp 2898.3 3720.3 3964

Equity 526.91

Total 805.65 EBIT 80.7 386.7 574.7

WACC 7.81% (-) Cash Taxes 14.5 84.4 156.2

Perpetual G 2% NOPAT 66.2 302.3 418.5

(+) Depreciaiton 126.1 196.1 203.9

(-)CAPEX - - -

(+/-) WC Changes 150.85 163.5 40.2

FCFF 41.45 334.9 582.2

0.92751839 0.86029 0.797935

PV 38.4 288.1 464.6

Terminal Value 11,930

Sum of PV 1,294

Total (million) 13,225

NoSH (million) 19.932384

Intrinsic value 663.49

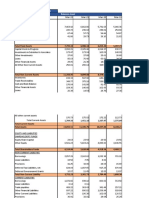

2014 2015 2016

No of shares 9685470 15017681 19932384

New 5.332211 4.914703

Value 251.38 150.86

Price 47.1 30.7

4

2020 2016 2017 2018 2019 2020

4926.8 Assets 1852.4 1718.3 1580.4 1451.8

4278 Dep 126.1 196.1 203.9 212.1

212.1 1978.5 1914.4 1784.3 1663.9

73.7

4204.3 Inv 49.52 85.1 109.3 119.2 127.4

Deb 234.94 579.8 713.1 789.7 860.4

722.5 Cred 355.11 584.7 578.7 625 669.3

219.9 NWC -70.65 80.2 243.7 283.9 318.5

502.6 150.85 163.5 40.2 34.6

212.1

-

34.6

680.1

0.740099

503.3

663.49 1.50% 1.75% 2% 2.25% 2.50% 2.75% 3%

6%

6.50%

7%

7.50%

8%

8.50%

9%

3.25% 3.50%

You might also like

- Bangladesh Economic Review 2020: Key Macroeconomic IndicatorsDocument98 pagesBangladesh Economic Review 2020: Key Macroeconomic IndicatorsArthurNo ratings yet

- Projections & ValuationDocument109 pagesProjections & ValuationPulokesh GhoshNo ratings yet

- AmcDocument19 pagesAmcTimothy RenardusNo ratings yet

- Revenue, Costs, and Profits Over TimeDocument19 pagesRevenue, Costs, and Profits Over TimeELIF KOTADIYANo ratings yet

- Book1 2Document10 pagesBook1 2Aakash SinghalNo ratings yet

- CH 32Document2 pagesCH 32Mukul KadyanNo ratings yet

- BIOCON Ratio AnalysisDocument3 pagesBIOCON Ratio AnalysisVinuNo ratings yet

- Equity AutoDocument33 pagesEquity AutoHashith SNo ratings yet

- Rosetta Stone IPODocument5 pagesRosetta Stone IPOFatima Ansari d/o Muhammad AshrafNo ratings yet

- Exhibit 1: Income Taxes 227.6 319.3 465.0 49.9Document11 pagesExhibit 1: Income Taxes 227.6 319.3 465.0 49.9rendy mangunsongNo ratings yet

- Fiscal Operations Table for December 2021Document21 pagesFiscal Operations Table for December 2021Mohammed ShbairNo ratings yet

- Caso PolaroidDocument45 pagesCaso PolaroidByron AlarcònNo ratings yet

- Statistical - Appendix Eng-21Document96 pagesStatistical - Appendix Eng-21S M Hasan ShahriarNo ratings yet

- Al Shaheer CompsDocument4 pagesAl Shaheer CompsAbdullah YousufNo ratings yet

- 2.1 Gross National Product: SBP Annual Report-Statistical Supplement FY 10Document11 pages2.1 Gross National Product: SBP Annual Report-Statistical Supplement FY 10farmuz1No ratings yet

- Statistical Appendix (English-2023)Document103 pagesStatistical Appendix (English-2023)Fares Faruque HishamNo ratings yet

- SWM Annual Report 2016Document66 pagesSWM Annual Report 2016shallynna_mNo ratings yet

- 2006 2007 2008 Sales Net Sales Less CogsDocument17 pages2006 2007 2008 Sales Net Sales Less CogsMohammed ArifNo ratings yet

- Ten Year Review - Standalone: Asian Paints LimitedDocument10 pagesTen Year Review - Standalone: Asian Paints Limitedmaruthi631No ratings yet

- Cfin2 HW1Document25 pagesCfin2 HW1Anirudh BharNo ratings yet

- AFDMDocument6 pagesAFDMAhsan IqbalNo ratings yet

- HanssonDocument11 pagesHanssonJust Some EditsNo ratings yet

- P&L - Panacea Y2 Q2Document16 pagesP&L - Panacea Y2 Q2X CastroNo ratings yet

- Allahabad Bank Sep 09Document5 pagesAllahabad Bank Sep 09chetandusejaNo ratings yet

- Weekends TareaDocument9 pagesWeekends Tareasergio ramozNo ratings yet

- Tech MahindraDocument17 pagesTech Mahindrapiyushpatil749No ratings yet

- Pidilite Industries Company ValuationDocument39 pagesPidilite Industries Company ValuationKeval ShahNo ratings yet

- Ashok Leyland DCF TempletDocument9 pagesAshok Leyland DCF TempletSourabh ChiprikarNo ratings yet

- Projected 2013 2014 2015 2016 2017Document11 pagesProjected 2013 2014 2015 2016 2017Aijaz AslamNo ratings yet

- Table C1.5 Gross Domestic Product and Expenditure at Current Purchaser's Price (N' Million)Document4 pagesTable C1.5 Gross Domestic Product and Expenditure at Current Purchaser's Price (N' Million)Osaz AihoNo ratings yet

- SBI AbridgedProfitnLossDocument1 pageSBI AbridgedProfitnLossRohitt MutthooNo ratings yet

- Maruti Suzuki: Submitted byDocument17 pagesMaruti Suzuki: Submitted byMukesh KumarNo ratings yet

- Ten year financial performance of Asian PaintsDocument10 pagesTen year financial performance of Asian Paintsmaruthi631No ratings yet

- Case StudyDocument5 pagesCase StudybadshaahhamanNo ratings yet

- FCFF Vs Fcfe StudentDocument5 pagesFCFF Vs Fcfe StudentKanchan GuptaNo ratings yet

- Stryker Corporation: Capital BudgetingDocument8 pagesStryker Corporation: Capital Budgetinggaurav sahuNo ratings yet

- JSW Energy Valuation 2022Document40 pagesJSW Energy Valuation 2022ShresthNo ratings yet

- Apollo Hospitals Enterprise LimitedDocument10 pagesApollo Hospitals Enterprise LimitedHemendra GuptaNo ratings yet

- SR No. Year Face Value No. of Shares Dividend Per Share EPSDocument10 pagesSR No. Year Face Value No. of Shares Dividend Per Share EPSPraharsha ChowdaryNo ratings yet

- Vitex Corp Income Statement and Balance Sheet AnalysisDocument12 pagesVitex Corp Income Statement and Balance Sheet AnalysissopiantiNo ratings yet

- Ultratech Cement LTD.: Total IncomeDocument36 pagesUltratech Cement LTD.: Total IncomeRezwan KhanNo ratings yet

- RNO 1RFQ004208 PKI Comparision Sheet 20-2-2023 2Document7 pagesRNO 1RFQ004208 PKI Comparision Sheet 20-2-2023 2THE CPRNo ratings yet

- IOL Chemicals & Pharmaceuticals Ltd. Company Report Card-StandaloneDocument4 pagesIOL Chemicals & Pharmaceuticals Ltd. Company Report Card-StandaloneVenkatesh VasudevanNo ratings yet

- DCF TVSDocument17 pagesDCF TVSSunilNo ratings yet

- Key Ratio Analysis: Profitability RatiosDocument27 pagesKey Ratio Analysis: Profitability RatioskritikaNo ratings yet

- ExecutivesummaryDocument4 pagesExecutivesummaryMayurNo ratings yet

- 199.44 - 12.86462 Excluding Finance Cost 653.92 615.11Document2 pages199.44 - 12.86462 Excluding Finance Cost 653.92 615.11Nivedita YadavNo ratings yet

- Balance Sheet (2009-2001) of Maruti Suzuki: All Numbers Are in INR and in x10MDocument16 pagesBalance Sheet (2009-2001) of Maruti Suzuki: All Numbers Are in INR and in x10MGirish RamachandraNo ratings yet

- Apple V SamsungDocument4 pagesApple V SamsungCarla Mae MartinezNo ratings yet

- Britannia IndustriesDocument12 pagesBritannia Industriesmundadaharsh1No ratings yet

- P&L Statement Analysis of PI Industries LtdDocument45 pagesP&L Statement Analysis of PI Industries LtddixitBhavak DixitNo ratings yet

- Income Statement - CTR 2020 2021Document10 pagesIncome Statement - CTR 2020 2021Lâm Ninh TùngNo ratings yet

- Altagas Green Exhibits With All InfoDocument4 pagesAltagas Green Exhibits With All InfoArjun NairNo ratings yet

- Y-Y Growth (%) Y-Y Growth (%) Y-Y Growth (%) Utilization (%) Y-Y Growth (%) % of Sales % of Sales % of SalesDocument45 pagesY-Y Growth (%) Y-Y Growth (%) Y-Y Growth (%) Utilization (%) Y-Y Growth (%) % of Sales % of Sales % of SalesSHIKHA CHAUHANNo ratings yet

- 2021 Statistics Bulletin - Public FinanceDocument16 pages2021 Statistics Bulletin - Public FinanceIbeh CosmasNo ratings yet

- Optimally managed VOC and synergiesDocument10 pagesOptimally managed VOC and synergiesmereetikaNo ratings yet

- Ramco Cements StandaloneDocument13 pagesRamco Cements StandaloneTao LoheNo ratings yet

- Alro SA (ALR RO) Enterprise Value and Multiples AnalysisDocument147 pagesAlro SA (ALR RO) Enterprise Value and Multiples AnalysisAlexLupescuNo ratings yet

- United States Census Figures Back to 1630From EverandUnited States Census Figures Back to 1630No ratings yet

- Power Markets and Economics: Energy Costs, Trading, EmissionsFrom EverandPower Markets and Economics: Energy Costs, Trading, EmissionsNo ratings yet

- Burton SensorsDocument2 pagesBurton SensorsSankalp MishraNo ratings yet

- BD22092 - Session Dated - 08th Feb 2023Document1 pageBD22092 - Session Dated - 08th Feb 2023Sankalp MishraNo ratings yet

- Preparation Report Week 3Document4 pagesPreparation Report Week 3Sankalp MishraNo ratings yet

- LP Laboratories LTD Financing Working Capital Final Report Google PDFDocument10 pagesLP Laboratories LTD Financing Working Capital Final Report Google PDFSankalp MishraNo ratings yet

- Sahrudaya SolutionDocument2 pagesSahrudaya SolutionSankalp MishraNo ratings yet

- BD22092 8Document1 pageBD22092 8Sankalp MishraNo ratings yet

- BD22092 16Document1 pageBD22092 16Sankalp MishraNo ratings yet

- BD22092 18Document1 pageBD22092 18Sankalp MishraNo ratings yet

- BD22092 19Document1 pageBD22092 19Sankalp MishraNo ratings yet

- BD22092 11Document1 pageBD22092 11Sankalp MishraNo ratings yet

- Amazon Order FormatDocument4 pagesAmazon Order FormatAlok S YadavNo ratings yet

- RE Sector IssuesDocument7 pagesRE Sector Issuessahaye.vikramjitNo ratings yet

- Charter - Diego SaldariniDocument2 pagesCharter - Diego SaldariniCuneyt CelikNo ratings yet

- Chapter 3 ParcorDocument6 pagesChapter 3 Parcornikki sy40% (5)

- E00a6 Non Performance Assets - HDFC BankDocument62 pagesE00a6 Non Performance Assets - HDFC BankwebstdsnrNo ratings yet

- Transaction Information: Remitbee IncDocument1 pageTransaction Information: Remitbee IncPIRATEJOURNEYNo ratings yet

- Hire-Purchase GuideDocument5 pagesHire-Purchase GuideNUR AINA NAJEEHAH RUSHDANNo ratings yet

- Seminar Presentation On: Small Scale IndustriesDocument7 pagesSeminar Presentation On: Small Scale IndustriesSAATHVIK SHEKARNo ratings yet

- Attendance - Inst1 - Batch 1 & 2 (Oct.4,2021-DSF)Document2 pagesAttendance - Inst1 - Batch 1 & 2 (Oct.4,2021-DSF)Aljay LabugaNo ratings yet

- Group-8 NIKE INS3021-02 PDFDocument26 pagesGroup-8 NIKE INS3021-02 PDF20070305 Nguyễn Thu PhươngNo ratings yet

- PO GCWS G85012 To MIDocument6 pagesPO GCWS G85012 To MIandika bukopinNo ratings yet

- Fin 531 Exam 1Document19 pagesFin 531 Exam 1Gaurav SonkeshariyaNo ratings yet

- InvoiceDocument1 pageInvoice10-XII-Sci-A Saima ChoudharyNo ratings yet

- Tax Invoice/Bill of Supply/Cash MemoDocument1 pageTax Invoice/Bill of Supply/Cash MemoPrem ChanderNo ratings yet

- Gujarat Urban Development Mission invites PMC bids for Smart City projectsDocument152 pagesGujarat Urban Development Mission invites PMC bids for Smart City projectsriju nairNo ratings yet

- Energy, Climate and The EnvironmentDocument271 pagesEnergy, Climate and The EnvironmentMikel MendezNo ratings yet

- Marketing ManagementDocument6 pagesMarketing ManagementMohammad Fajar SidikNo ratings yet

- Money (Rupiahs)Document5 pagesMoney (Rupiahs)Indarwati Siska PertiwiNo ratings yet

- Case Study ChicoryDocument2 pagesCase Study ChicoryUmar KhattakNo ratings yet

- Final Black Book GST in ResturentsDocument66 pagesFinal Black Book GST in Resturentsirfan khan100% (2)

- College Entrepreneurship Homework GuideDocument5 pagesCollege Entrepreneurship Homework GuideH MNo ratings yet

- Black BookDocument26 pagesBlack BookYash soshteNo ratings yet

- MFSA Annual Report 2006Document52 pagesMFSA Annual Report 2006cikkuNo ratings yet

- Economics WordsearchDocument1 pageEconomics WordsearchSandy SaddlerNo ratings yet

- Analisis SWOT Pemasaran Produk Kerupuk Buah Di UD. Sukma Kecamatan Takisung Kabupaten Tanah LautDocument11 pagesAnalisis SWOT Pemasaran Produk Kerupuk Buah Di UD. Sukma Kecamatan Takisung Kabupaten Tanah Lautrohmatul sahriNo ratings yet

- Keventer DRHPDocument479 pagesKeventer DRHPKamalapati BeheraNo ratings yet

- 3000 High CPC KeywordsDocument114 pages3000 High CPC KeywordsSuara PesanNo ratings yet

- 11 04 2Document1 page11 04 2muppala gowthamNo ratings yet

- International Package Services Invoice SummaryDocument12 pagesInternational Package Services Invoice SummaryBingmondoy Feln Lily Canonigo0% (1)

- Ard 140Document2 pagesArd 140Rakhimane67% (3)