Professional Documents

Culture Documents

AFDM

Uploaded by

Ahsan Iqbal0 ratings0% found this document useful (0 votes)

6 views6 pagesThis document summarizes the financial performance and position of a company from 2003-2012. It shows trends over time in key metrics like net sales, gross profit, operating profit, assets and liabilities. Overall revenues and profits grew from 2003-2007, then declined in 2008 before recovering in 2009-2010 as net sales and operating profit increased again. Total assets also steadily increased during this period as the company continued to invest in long term assets like property, plant and equipment.

Original Description:

accc

Original Title

AFDM (1)

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document summarizes the financial performance and position of a company from 2003-2012. It shows trends over time in key metrics like net sales, gross profit, operating profit, assets and liabilities. Overall revenues and profits grew from 2003-2007, then declined in 2008 before recovering in 2009-2010 as net sales and operating profit increased again. Total assets also steadily increased during this period as the company continued to invest in long term assets like property, plant and equipment.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views6 pagesAFDM

Uploaded by

Ahsan IqbalThis document summarizes the financial performance and position of a company from 2003-2012. It shows trends over time in key metrics like net sales, gross profit, operating profit, assets and liabilities. Overall revenues and profits grew from 2003-2007, then declined in 2008 before recovering in 2009-2010 as net sales and operating profit increased again. Total assets also steadily increased during this period as the company continued to invest in long term assets like property, plant and equipment.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 6

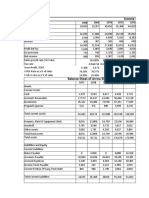

Profit & Loss 2003 2004 2005 2006 2007 2008

Net Sales 2,447 3,256 4,595 6,530 8,902 9,972

Gross Profit 1,703 2,299 3,138 4,467 5,866 6,442

Selling/Admin 78 85 163 238 435 554

Dep & Amortz 435 806 958 1,332 1,807 2,310

Interest 115 218 392 588 886 985

Impairment 100 300

Restructuring 24 152 423 345 420

Operating profit 1,075 1,166 1,373 1,886 2,393 1,873

Tax 355 396 440 603 766 637

Net Income 720 770 933 1,283 1,627 1,236

Balance Sheet 2003 2004 2005 2006 2007 2008

Net PP & E 4,193 6,444 9,452 15,521 22,425 24,210

LT Assets 354 321 714 495 462 447

Current Assets 1,770 1,600 3,173 4,295 3,380 4,274

Total Assets 6,317 8,365 13,339 20,311 26,267 28,931

Other CL 318 381 674 785 939 1,264

ST Debt 320 595 733 168

Other LT Liab 165 185 224 306 486 444

Long term debt 1,520 2,636 5,366 10,070 13,100 13,840

SH equity 4,314 5,163 6,755 8,555 11,009 13,215

Total Equity & Liab 6,317 8,365 13,339 20,311 26,267 28,931

Other Data 2003 2004 2005 2006 2007 2008

Market Price 20.45 24.54 28.98 40.24 68.12 48.21

Market Cap 6,626 8,049 9,534 13,279 22,548 16,295

# of Shares 324 328 329 330 331 338

2003 2004 2005 2006 2007 2008

Cash 1250 827 2127 2503 1550 1667

Account Recei 376 553 857 1467 1401 1802

inventory 0 0 0 0 145 140

other current 144 220 189 325 284 665

2009 2010 2011 2012

7,468 7,728 8,234 8,611

4,697 5,039 5,336 5,606

469 409 439 528

2,043 1,675 1,846 1,920

965 956 930 929

1,200 110 650 850

350 463 684 985

-330 1,426 787 394

-119 499 252 130

-211 927 535 264

2009 2010 2011 2012

23,428 25,104 25,243 24,321

415 544 714 990

4,092 2,999 3,220 3,271

27,935 28,647 29,177 28,582

1,072 1,354 1,064 818

122 448 158 102

258 495 276 137

13,840 13,040 13,040 12,980

12,643 13,310 14,639 14,545

27,935 28,647 29,177 28,582

2009 2010 2011 2012

52.71 50.22 39.27 41.24

18,396 17,175 14,687 15,754

349 342 374 382

2009 2010 2011 2012

1787 671 825 701

1371 1506 1593 1686

190 102 101 144

744 720 701 740

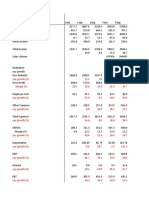

2003 2004 2005 2006 2007

EBIDTA 1,625 2,190 2,723 3,806 5,086

EBIT 1,190 1,384 1,765 2,474 3,279

Enterprise Value 6,896 9,858 13,093 21,441 34,831

Book Value / Share 13.31 15.74 20.53 25.92 33.26

EPS 2.22 2.35 2.84 3.89 4.92

Cash div 1.5 1.5 1.5 1.5 1.5

Payout ratio 68% 64% 53% 39% 31%

Div yield 7.3% 6.1% 5.2% 3.7% 2.2%

Gross Margin 69.60% 70.60% 68.29% 68.41% 65.90%

Net margin 29.42% 23.65% 20.30% 19.65% 18.28%

ROE 16.20% 15.66% 16.76% 16.63%

Revenue Growth 33.10% 41.12% 42.11% 36.32%

EBIDTA Growth 34.80% 24.34% 39.77% 33.63%

Debt to Equity 35.23% 51.10% 79.44% 117.71% 118.99%

Debt to captz 18.66% 24.70% 36.01% 43.13% 36.75%

Interest coverage 10.3 6.3 4.5 4.2 3.7

Current Ratio 5.6 4.2 3.2 3.1 2.0

Quick Ratio 5.57 4.20 3.19 3.11 1.96

PE Ratio 9.2 10.5 10.2 10.4 13.9

PB Ratio 1.5 1.6 1.4 1.6 2.0

EV/EBIDTA 4.2 4.5 4.8 5.6 6.8

2008 2009 2010 2011 2012

5,168 2,678 4,057 3,563 3,243

2,858 635 2,382 1,717 1,323

28,636 30,571 29,992 27,060 28,135

39.10 36.23 38.92 39.14 38.08

3.66 -0.60 2.71 1.43 0.69

1.5 1.5 1.5 1.5 1.5

41% -248% 55% 105% 217%

3.1% 2.8% 3.0% 3.8% 3.6%

64.60% 62.90% 65.20% 64.80% 65.10%

12.39% -2.83% 12.00% 6.50% 3.07%

10.20% -1.63% 7.14% 3.83% 1.81%

12.02% -25.11% 3.48% 6.55% 4.58%

1.61% -48.18% 51.49% -12.18% -8.98%

104.73% 109.47% 97.97% 89.08% 89.24%

45.93% 42.93% 43.16% 47.03% 45.17%

2.9 0.7 2.5 1.8 1.4

3.0 3.4 1.7 2.6 3.6

2.89 3.27 1.61 2.55 3.40

13.2 -87.2 18.5 27.5 59.7

1.2 1.5 1.3 1.0 1.1

5.5 11.4 7.4 7.6 8.7

Profit & Loss 2003 2004 2005 2006 2007 2008

Net Sales 2,447 3,256 4,595 6,530 8,902 9,972

Gross Profit 1,703 2,299 3,138 4,467 5,866 6,442

Selling/Admin 78 85 163 238 435 554

Dep & Amortz 435 806 958 1,332 1,807 2,310

Interest 115 218 392 588 886 985

Impairment 100 300

Restructuring 24 152 423 345 420

Operating profit 1,075 1,166 1,373 1,886 2,393 1,873

Tax 355 396 440 603 766 637

Net Income 720 770 933 1,283 1,627 1,236

Balance Sheet 2003 2004 2005 2006 2007 2008

Net PP & E 4,193 6,444 9,452 15,521 22,425 24,210

LT Assets 354 321 714 495 462 447

Current Assets 1,770 1,600 3,173 4,295 3,380 4,274

Total Assets 6,317 8,365 13,339 20,311 26,267 28,931

Other CL 318 381 674 785 939 1,264

ST Debt 320 595 733 168

Other LT Liab 165 185 224 306 486 444

Long term debt 1,520 2,636 5,366 10,070 13,100 13,840

SH equity 4,314 5,163 6,755 8,555 11,009 13,215

Total Equity & Liab 6,317 8,365 13,339 20,311 26,267 28,931

Other Data 2003 2004 2005 2006 2007 2008

Market Price 20.45 24.54 28.98 40.24 68.12 48.21

Market Cap 6,626 8,049 9,534 13,279 22,548 16,295

# of Shares 324 328 329 330 331 338

2003 2004 2005 2006 2007 2008

Cash 1250 827 2127 2503 1550 1667

A/c rec 376 553 857 1467 1401 1802

Inventory 0 0 0 0 0 140

other C.A 144 220 189 325 325 665

1770 1600 3173 4295 3276 4274

2009 2010 2011 2012

7,468 7,728 8,234 8,611

4,697 5,039 5,336 5,606

469 409 439 528

2,043 1,675 1,846 1,920

965 956 930 929

1,200 110 650 850

350 463 684 985

-330 1,426 787 394

-119 499 252 130

-211 927 535 264

2009 2010 2011 2012

23,428 25,104 25,243 24,321

415 544 714 990

4,092 2,999 3,220 3,271

27,935 28,647 29,177 28,582

1,072 1,354 1,064 818

122 448 158 102

258 495 276 137

13,840 13,040 13,040 12,980

12,643 13,310 14,639 14,545

27,935 28,647 29,177 28,582

2009 2010 2011 2012

52.71 50.22 39.27 41.24

18,396 17,175 14,687 15,754

349 342 374 382

2009 2010 2011 2012

1787 671 825 701

1371 1506 1593 1686

190 102 101 144

744 720 701 740

4092 2999 3220 3271

You might also like

- United States Census Figures Back to 1630From EverandUnited States Census Figures Back to 1630No ratings yet

- SR No. Year Face Value No. of Shares Dividend Per Share EPSDocument10 pagesSR No. Year Face Value No. of Shares Dividend Per Share EPSPraharsha ChowdaryNo ratings yet

- Newfield QuestionDocument8 pagesNewfield QuestionNasir MazharNo ratings yet

- Hindustan Petrolium Corporation LTD: ProsDocument9 pagesHindustan Petrolium Corporation LTD: ProsChandan KokaneNo ratings yet

- Private Sector Banks Comparative Analysis 1HFY22Document12 pagesPrivate Sector Banks Comparative Analysis 1HFY22Tushar Mohan0% (1)

- Apple V SamsungDocument4 pagesApple V SamsungCarla Mae MartinezNo ratings yet

- FSP Tuka CheckDocument25 pagesFSP Tuka CheckAlina Binte EjazNo ratings yet

- Tech MahindraDocument17 pagesTech Mahindrapiyushpatil749No ratings yet

- Income Statement & Balance Sheet AnalysisDocument78 pagesIncome Statement & Balance Sheet Analysisasifabdullah khanNo ratings yet

- Automobile Sales: Assets and Working CapitalDocument16 pagesAutomobile Sales: Assets and Working CapitalKshitishNo ratings yet

- Technofunda Investing Excel Analysis - Version 1.0: Watch Screener TutorialDocument57 pagesTechnofunda Investing Excel Analysis - Version 1.0: Watch Screener TutorialParth DanagayaNo ratings yet

- Income Statement-2014Quarterly - in MillionsDocument6 pagesIncome Statement-2014Quarterly - in MillionsHKS TKSNo ratings yet

- Technofunda Investing Excel Analysis - Version 1.0: Watch Screener TutorialDocument57 pagesTechnofunda Investing Excel Analysis - Version 1.0: Watch Screener TutorialParth DanagayaNo ratings yet

- CAMPOFRIO RATIOSv1Document15 pagesCAMPOFRIO RATIOSv1Nacho MarijuanNo ratings yet

- DlfDocument10 pagesDlfkukrejanikhil70No ratings yet

- HDFC Bank - BaseDocument613 pagesHDFC Bank - BasebysqqqdxNo ratings yet

- Book1 2Document10 pagesBook1 2Aakash SinghalNo ratings yet

- Allahabad Bank Sep 09Document5 pagesAllahabad Bank Sep 09chetandusejaNo ratings yet

- AmcDocument19 pagesAmcTimothy RenardusNo ratings yet

- Technofunda Investing Excel Analysis - Version 1.0: Watch Screener TutorialDocument57 pagesTechnofunda Investing Excel Analysis - Version 1.0: Watch Screener TutorialParth DanagayaNo ratings yet

- So PriamDocument5 pagesSo PriamSel MaNo ratings yet

- Narration Mar-19 Mar-20 Mar-21 Mar-22 Mar-23 Mar-24 Mar-25 Mar-26 Mar-27Document11 pagesNarration Mar-19 Mar-20 Mar-21 Mar-22 Mar-23 Mar-24 Mar-25 Mar-26 Mar-27Manan ToganiNo ratings yet

- HanssonDocument11 pagesHanssonJust Some EditsNo ratings yet

- US$ Millions, Except Number of Shares Which Are Reflected in Thousands and Per Share Amounts Consolidated Statement of OperationsDocument31 pagesUS$ Millions, Except Number of Shares Which Are Reflected in Thousands and Per Share Amounts Consolidated Statement of OperationsT CNo ratings yet

- Probation SupervisionDocument2 pagesProbation SupervisionLesson Plan ni Teacher GNo ratings yet

- Pidilite Industries Limited Historical Financial Data from FY11 to FY23Document55 pagesPidilite Industries Limited Historical Financial Data from FY11 to FY23shivam vermaNo ratings yet

- ITC Ltd Financial Analysis and Key Ratios from 2010-2020Document10 pagesITC Ltd Financial Analysis and Key Ratios from 2010-2020deepanshuNo ratings yet

- Coca Cola Company Financial Ratios SummaryDocument66 pagesCoca Cola Company Financial Ratios SummaryZhichang ZhangNo ratings yet

- Projected Financials and Valuation of a Pharmaceutical CompanyDocument14 pagesProjected Financials and Valuation of a Pharmaceutical Companyvardhan100% (1)

- PSU Banks Comparative Analysis FY21Document10 pagesPSU Banks Comparative Analysis FY21Ganesh V0% (1)

- LVSfinancialDocument6 pagesLVSfinancial可惜可惜No ratings yet

- DCF Calculator QweDocument24 pagesDCF Calculator QweAlimurthuja KhanNo ratings yet

- Public Sector Banks Comparative Analysis 3QFY24Document10 pagesPublic Sector Banks Comparative Analysis 3QFY24Sujay AnanthakrishnaNo ratings yet

- HDFC Bank Annual Report 2009 10Document137 pagesHDFC Bank Annual Report 2009 10yagneshroyalNo ratings yet

- Thomas Mack - "Distribution-Free" Calculation of Standard ErrorDocument1 pageThomas Mack - "Distribution-Free" Calculation of Standard ErrorDio TimaNo ratings yet

- Exihibit 1: Key Financial and Market Value Data, 2002-2011 (In Millions of Dollars Except For Ratios)Document22 pagesExihibit 1: Key Financial and Market Value Data, 2002-2011 (In Millions of Dollars Except For Ratios)JuanNo ratings yet

- Income Statement - 2014 - in MillionsDocument2 pagesIncome Statement - 2014 - in MillionsHKS TKSNo ratings yet

- Britannia IndsDocument18 pagesBritannia IndsVishalPandeyNo ratings yet

- Georgian Water Power 2018 Financial StatementDocument35 pagesGeorgian Water Power 2018 Financial StatementTinatini BakashviliNo ratings yet

- Narration Mar-09 Mar-10 Mar-11 Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Trailing Best Case Worst CaseDocument18 pagesNarration Mar-09 Mar-10 Mar-11 Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Trailing Best Case Worst CaseVishalPandeyNo ratings yet

- NHPC LTDDocument9 pagesNHPC LTDMit chauhanNo ratings yet

- Oil IndiaDocument10 pagesOil India0000No ratings yet

- NMDC AnalysisDocument59 pagesNMDC Analysisshivani guptaNo ratings yet

- Vertical Analysis of Income Statement 0F Blessed TextileDocument208 pagesVertical Analysis of Income Statement 0F Blessed TextileB SNo ratings yet

- Revenue, Costs, and Profits Over TimeDocument19 pagesRevenue, Costs, and Profits Over TimeELIF KOTADIYANo ratings yet

- Britannia IndustriesDocument12 pagesBritannia Industriesmundadaharsh1No ratings yet

- Finolex Cables LimitedDocument55 pagesFinolex Cables Limitedshivam vermaNo ratings yet

- 唯品会估值模型Document21 pages唯品会估值模型Yiang QinNo ratings yet

- FDI-China AfricaDocument39 pagesFDI-China AfricaNadia BustosNo ratings yet

- Narration Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Mar-19 Mar-20 Mar-21 Trailing Best Case Worst CaseDocument10 pagesNarration Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Mar-19 Mar-20 Mar-21 Trailing Best Case Worst CaseEshant KubdeNo ratings yet

- Local Banks Financial AnalysisDocument637 pagesLocal Banks Financial AnalysiszainabNo ratings yet

- DownloadDocument136 pagesDownloadrdhNo ratings yet

- Customer Demand Cube: PurposeDocument15 pagesCustomer Demand Cube: PurposeTiyaNo ratings yet

- P&L Statement Analysis Mar 12-Mar 21Document16 pagesP&L Statement Analysis Mar 12-Mar 21tapasya khanijouNo ratings yet

- Cement Grade Wise Report-2021-2022Document28 pagesCement Grade Wise Report-2021-2022fjohnmajorNo ratings yet

- MSFTDocument83 pagesMSFTJohn wickNo ratings yet

- Project 1Document91 pagesProject 1Varsha MohapatraNo ratings yet

- Mba M Fall 2019 Schedule 230819Document1 pageMba M Fall 2019 Schedule 230819Ahsan IqbalNo ratings yet

- Sir Salim RazaDocument8 pagesSir Salim RazaAhsan IqbalNo ratings yet

- Ca 5717 enDocument158 pagesCa 5717 enAhsan IqbalNo ratings yet

- Business Analytics Course Outline V3Document3 pagesBusiness Analytics Course Outline V3Ahsan IqbalNo ratings yet

- Syllabus Finals CS Fall2019Document1 pageSyllabus Finals CS Fall2019Ahsan IqbalNo ratings yet

- Tuitions For All Standards of ClassesDocument1 pageTuitions For All Standards of ClassesAhsan IqbalNo ratings yet

- ProcessDocument1 pageProcessAhsan IqbalNo ratings yet

- 52-Project DetailDocument1 page52-Project DetailAhsan IqbalNo ratings yet

- 48-MBA Project Details Template Filled1Document1 page48-MBA Project Details Template Filled1Ahsan IqbalNo ratings yet

- Dr. Nasir Afghan to advise start-up daycare projectDocument1 pageDr. Nasir Afghan to advise start-up daycare projectAhsan IqbalNo ratings yet

- 50-MBA Project Detail1Document1 page50-MBA Project Detail1Ahsan IqbalNo ratings yet

- City Spring 2019Document14 pagesCity Spring 2019Ahsan IqbalNo ratings yet

- PROJECT Lifecycle PEM AssignmentDocument3 pagesPROJECT Lifecycle PEM AssignmentAhsan IqbalNo ratings yet

- Competing On Resources, Collins and MontgomeryDocument5 pagesCompeting On Resources, Collins and MontgomeryMansi BaranwalNo ratings yet

- Epo - Morning Mid Term Exam Schedule City Campus - Fall 2019Document10 pagesEpo - Morning Mid Term Exam Schedule City Campus - Fall 2019Ahsan IqbalNo ratings yet

- Epo - Morning Mid Term Exam Schedule City Campus - Fall 2019Document10 pagesEpo - Morning Mid Term Exam Schedule City Campus - Fall 2019Ahsan IqbalNo ratings yet

- Template - GROUP PROFILEDocument1 pageTemplate - GROUP PROFILEAhsan IqbalNo ratings yet

- Flash Memory IncDocument3 pagesFlash Memory IncAhsan IqbalNo ratings yet

- SCM ReportDocument10 pagesSCM ReportAhsan IqbalNo ratings yet

- Urdu NotesDocument2 pagesUrdu NotesAhsan Iqbal100% (1)

- BF FinalDocument6 pagesBF FinalAhsan IqbalNo ratings yet

- Netflix Feb 2016Document73 pagesNetflix Feb 2016Ahsan IqbalNo ratings yet

- MBA8155 Syllabus Spring 08Document5 pagesMBA8155 Syllabus Spring 08umarrchNo ratings yet

- Quiz 3solutionDocument5 pagesQuiz 3solutionAhsan IqbalNo ratings yet

- Direct Cost Variances Chapter 10Document15 pagesDirect Cost Variances Chapter 10Ahsan IqbalNo ratings yet

- 1878Document2 pages1878elfo111No ratings yet

- This Content Downloaded From 103.244.172.219 On Sun, 12 May 2019 13:24:21 UTCDocument12 pagesThis Content Downloaded From 103.244.172.219 On Sun, 12 May 2019 13:24:21 UTCAhsan IqbalNo ratings yet

- Fragrances in PakistanDocument8 pagesFragrances in PakistanAhsan IqbalNo ratings yet

- Apparel and Footwear Specialist Retailers in PakistanDocument7 pagesApparel and Footwear Specialist Retailers in PakistanAhsan IqbalNo ratings yet

- Short-Term Finance and Planning: Mcgraw-Hill/IrwinDocument25 pagesShort-Term Finance and Planning: Mcgraw-Hill/IrwinMhmood Al-saadNo ratings yet

- The Master Budget - 1st QTRDocument41 pagesThe Master Budget - 1st QTRqueene50% (4)

- Monthly Operating Report: United States Bankruptcy CourtDocument23 pagesMonthly Operating Report: United States Bankruptcy CourtsperlingreichNo ratings yet

- Self Balancing and Sectional Balancing - ProblemsDocument4 pagesSelf Balancing and Sectional Balancing - ProblemsPronojit BasakNo ratings yet

- Bangkok Chain Hospital: A New Lease of LifeDocument11 pagesBangkok Chain Hospital: A New Lease of LifebodaiNo ratings yet

- Nishi Sirs Accounts NotesDocument34 pagesNishi Sirs Accounts NotesKshitij RedijNo ratings yet

- 15.515 Financial Accounting Preliminary Final ReviewDocument21 pages15.515 Financial Accounting Preliminary Final ReviewAnant AgarwalNo ratings yet

- Accounting FactsheetDocument1 pageAccounting FactsheetBhumika MehtaNo ratings yet

- Month-End Close Process in Om, Ar, AP, Po, Assets, Wip, Inventory and GLDocument30 pagesMonth-End Close Process in Om, Ar, AP, Po, Assets, Wip, Inventory and GLMuthumariappan21No ratings yet

- Short Term Budgeting PDF FreeDocument15 pagesShort Term Budgeting PDF FreeKei CambaNo ratings yet

- Frank Wood's Principle of Accounts For HK Book1 Appendix2 Revision PracticeDocument4 pagesFrank Wood's Principle of Accounts For HK Book1 Appendix2 Revision PracticeCHRISTINA LEE100% (1)

- AFAR Problems WorksheetDocument13 pagesAFAR Problems WorksheetjajajaredredNo ratings yet

- Danica Reign C. Figueroa Financial Accounting and Reporting Bsa 1C Problem 14Document4 pagesDanica Reign C. Figueroa Financial Accounting and Reporting Bsa 1C Problem 14Danica Reign FigueroaNo ratings yet

- Spices Processing Cost and Revenue SheetDocument6 pagesSpices Processing Cost and Revenue SheetJahangir AliNo ratings yet

- Partnership - Jaboy - v2.1.1Document19 pagesPartnership - Jaboy - v2.1.1Van DahuyagNo ratings yet

- Anna's Car Repair ShopDocument10 pagesAnna's Car Repair ShopNextdoor Cosplayer0% (1)

- General Journal Entries for Survey CompanyDocument24 pagesGeneral Journal Entries for Survey CompanyMc Clent CervantesNo ratings yet

- Colgate Estados Financieros 2021Document3 pagesColgate Estados Financieros 2021Lluvia RamosNo ratings yet

- Partnership FormationDocument5 pagesPartnership FormationRyou ShinodaNo ratings yet

- Exams BookkeepigDocument5 pagesExams BookkeepigRosita Aquino PacibeNo ratings yet

- Chapter 8 Short Exercise SolutionsDocument8 pagesChapter 8 Short Exercise Solutionsbaseballjunker4No ratings yet

- Ratio Analysis: Balance Sheet of HPCLDocument8 pagesRatio Analysis: Balance Sheet of HPCLrajat_singlaNo ratings yet

- Rosetta Stone 2009 IPO Financial ForecastDocument8 pagesRosetta Stone 2009 IPO Financial ForecastgerardoNo ratings yet

- Reporting ProfitsDocument52 pagesReporting ProfitsxxmbetaNo ratings yet

- Chapter 13 Mini-CaseDocument5 pagesChapter 13 Mini-CaseSaima Fazal0% (1)

- Horngrens Accounting 12th Edition Nobles Solutions ManualDocument109 pagesHorngrens Accounting 12th Edition Nobles Solutions ManualAnnGregoryDDSytidk100% (16)

- Solution To E2-5&7&10Document4 pagesSolution To E2-5&7&10Adam100% (1)

- THEORIES AND COMPUTATIONSDocument5 pagesTHEORIES AND COMPUTATIONSThomas MarianoNo ratings yet

- Merchandising Lecture MRFDDocument59 pagesMerchandising Lecture MRFDMaria Louella MagadaNo ratings yet

- Chapter-1 Accounting For NgoDocument70 pagesChapter-1 Accounting For Ngoshital_vyas1987100% (1)