Professional Documents

Culture Documents

Question Bank: Errorless Taxation by Ca Pranav Chandak at Pranav Chandak Academy, Pune

Uploaded by

Simran MeherOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Question Bank: Errorless Taxation by Ca Pranav Chandak at Pranav Chandak Academy, Pune

Uploaded by

Simran MeherCopyright:

Available Formats

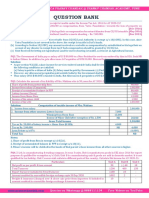

ERRORLESS TAXATION BY CA PRANAV CHANDAK @ PRANAV CHANDAK ACADEMY, PUNE

QUESTION BANK

PQ5. Mr. Vidyasagar, Resident Individual (age 64) is a Partner in Oscar Musicals & Co, a Partnership Firm. He also runs a

wholesale business in medical products. The following details are made available for PY 2019-20:

Particulars Rs. Rs.

1. Interest on Capital received from Oscar Musicals & Co. 1,50,000

2. Interest from Bank on Fixed Deposit (Net of TDS of Rs. 1,500) 13,500

3. Income Tax Refund received relating to AY 2018-19 34,500

4. Net Profit from Wholesale Business 5,60,000

Amount debited to P&L A/c includes the following:

- Depreciation as per books of A/c 34,000

- Motor Car Expenses 40,000

- Municipal Taxes for Shop (For 2 half years, payment for one half year made on 7,000

12.06.2020 & for other on 14.11.2020)

- Salary to Manager 21,000

5. WDV of Assets (as on 1.4.2019 used in above business)

- Computers 1,20,000

- Motor Car (20% used for personal use) 3,20,000

6. LIP paid for major son 60,000

- PPF of his wife 70,000

- NSC 30,000

Other Points:

1. Income Tax refund included interest of Rs. 2,300.

2. Salary to manager was paid in cash.

3. Rate of Interest on Capital received from Oscar Musicals & Co was 15%.

Compute Total Income of the Assessee for AY 2020-21. Compute WDV of Blocks of Assets as on 31.03.2020. [MAY 11]

Solution: Computation of Total Income

Particulars Rs. Rs. Rs.

I Income u/h ‘PGBP’

Net profit as per P&L A/c 5,60,000

Add: Expenses not deductible u/h ‘PGBP’ but debited to P&L A/c

1. Depreciation as per books of A/c 34,000

2. Muncipal taxes paid on 14.11.2020 (Disallowed u/s 43B since 3,500

paid after DD of RoI)

3. Motor Car expenses used for personal purpose [40,000 × 20%] 8,000

4. Salary paid to manager in cash [Disallowed u/s 40A(3)] 21,000 66,500

Add: Income taxable u/h ‘PGBP’ but not credited in P&L A/c

1. Interest on capital (Rs. 1,50,000 x 12% ÷ 15%) [Note 1] 1,20,000 1,20,000

Less: Expenses deductible but not debited to P&L A/c

1. Depreciation as per Income Tax Act [WN 2] 86,400 (86,400) 6,60,100

II Income u/h ‘IFOS’

1. Interest from Fixed Deposits (after grossing up) (13,500 + 1,500) 15,000

2. Interest on Income Tax Refund 2,300 17,300 17,300

Gross Total Income 6,77,400

Less: Deductions under Chapter VI-A:

Section 80C: LIP for Major Son 60,000

Section 80C: NSC 30,000

Section 80C: Contribution to PPF for his wife 70,000 1,60,000 (1,50,000)

Total (taxable) Income 5,27,400

www.pranavchandak.com Queries on Whatsapp @ 8888111134 Free Videos on YouTube

ERRORLESS TAXATION BY CA PRANAV CHANDAK @ PRANAV CHANDAK ACADEMY, PUNE

Working Notes:

1. Interest upto 12% is deductible in the hands of firm. Interest above 12% is disallowed in the hands of firm u/s 40(b).

As per sec 28, Remuneration/Interest is taxable in the hands of Partner to the extent it is deductible to firm.

2. Computation of WDV

Particulars Computer (40%) Motor Car (15%)

Opening WDV as on 01.04.2019 1,20,000 3,20,000

Less: Depreciation for PY (1,20,000 x 40%) = Rs. 48,000 (3,20,000 x 15%) = Rs. 48,000

Closing WDV as on 31.03.2020 Rs. 72,000 Rs. 2,72,000

Total Depreciation for PY = Rs. 48,000 (computer)+ 80% of Rs. 48,000 (Car)= Rs. 86,400. 20% of Depreciation on Motor

Car used for Personal Purpose is not allowed as deduction.

PC Note: Depreciation Rate of 30% is available only if motor car is acquired during 23.8.2019 - 31.3.2020 & put to use

on/before 31.3.2020. In this case, since it was purchased earlier, depreciation will be available @15% only.

3. Income Tax Refund: It is not taxable. However, Interest on Income Tax Refund is taxable u/h “IFOS”.

PQ6. Mr. Raghu, a Resident Individual (age 35 years), furnished following information from his P&L A/c for PY 2019-20:

Net Profit as per books of A/c was Rs. 6,50,000.

Following Incomes were credited in the P&L A/c.

Interest on Government Securities: Rs. 25,000.

Dividend from a Foreign Company: Rs. 50,000.

Gold Coins worth Rs. 55,000 received as Gift from his father.

Interest on Loan amounting to Rs. 68,000 was paid i.r.o Capital borrowed for purchase of New Asset which has not

been put to use till 31st March 2020.

General Expenses included:

Compensation of Rs. 4,500 paid to an Employee while terminating his services in Business Unit.

He contributed the following amounts by Cheque:

Rs. 20,000 to the Swachh Bharat Kosh set up by the Central Government.

Rs. 28,000 towards Premium for Health Insurance & Rs. 2,500 for Preventive Health Check up for Self & his wife.

Rs. 35,000 on Medical Expenses of his father (Age 82 yrs) [No Insurance had been taken on health of his father]

You are required to compute the Total Income of Mr. Raghu. [Mod. Nov 16]

Solution: Computation of Taxable Income & Tax Liability of Mr. Raghu

Particulars Rs. Rs. Rs.

I Income u/h ‘PGBP’

Net profit as per P&L A/c 6,50,000

Add: Expenses not deductible u/h ‘PGBP’ but debited to P&L A/c

1. Interest on Loan [Disallowed u/s 36(1)(iii)] [Note 1] 68,000 68,000

Less: Income which are taxable under other heads or Exempt

Incomes but credited to P&L A/c

1. Interest on Government Securities (considered u/h ‘IFOS’) (25,000)

2. Dividend from Foreign Company (considered u/h ‘IFOS’) (50,000)

3. Gold Coins from Father (considered u/h ‘IFOS’) (55,000) (1,30,000) 6,20,000

II Income u/h ‘IFOS’

1. Interest on Government Securities 25,000

2. Dividend from Foreign Company (Taxable since received from foregin company) 50,000

3. Gold Coin from Father (not taxable since received from Relative) Nil 75,000

Gross Total Income 6,72,500

Less: Deductions under Chapter VI-A

Section 80D: Health Insurance Premium for Assessee & Spouse [Max. of Rs. 25,000] (25,000)

Section 80D: Medical Expense of his Father (82 Yr) [Senior & thus Max. Limit is Rs. 50,000] (35,000)

Section 80G: Contribution to Swach Bharat Kosh [100% deduction allowed without restriction] (20,000) (80,000)

Total (taxable) Income

Notes:

1. As per Sec. 36(1)(iii), Interest on Capital borrowed for the purchase of asset, paid from the date on which the capital was

borrowed upto the date such asset was first put to use, shall not be allowed as a deduction.

2. Compensation to Employees for Termination is incurred for business & thus allowed u/s 37.

www.pranavchandak.com Queries on Whatsapp @ 8888111134 Free Videos on YouTube

ERRORLESS TAXATION BY CA PRANAV CHANDAK @ PRANAV CHANDAK ACADEMY, PUNE

PQ7. Mr. Rajiv (age 50) Resident Individual & Practicing CA gives you Receipts & Payments A/c for PY 2019-20:

Receipts Rs. Payments Rs.

Opening Balance: Staff Salary, Bonus & Stipend to Articled Clerks 1,50,000

Cash in Hand & Bank 12,000 Other Administrative Expenses 48,000

Fee from Professional Services 9,38,000 Office Rent 30,000

Car Loan @ 9% p.a from Bank 2,50,000 Housing Loan repaid to SBI (Including Interest of Rs. 88,000) 1,88,000

Rent 50,000 Life Insurance Premium 24,000

Motor Car (acquired in January 2020) 4,25,000

Medical Insurance Premium (for Self & Wife) 18,000

Books bought of Annual Publications 20,000

Computer acquired on 1.11.2019 (Professional use) 30,000

Domestic Drawings 2,72,000

Public Provident Fund subscription 20,000

Motor Car Maintenance 10,000

Closing Balance: Cash in Hand & Bank 15,000

Following further information is given to you:

1. He occupies 50% of the building for his own residence & 50% is let-out for business use at a monthly rent of Rs. 5,000.

Building was constructed during PY 1998-99.

2. Motor Car was put to use both for Official & Personal purpose. 1/5th Motor Car use is for personal purpose. No Interest

is paid during PY on Car Loan.

3. WDV of Assets on 1.4.2019 are as follows:

Furniture: Rs. 60,000;

P&M (AC, Photocopiers): Rs. 80,000;

Computers: 50,000.

Mr. Rajiv follows regularly Cash System of Accounting. Compute the Total Income for AY 2020-21. [May 11]

Solution: Computation of Taxable Income & Tax Liability of Mr. Rajiv

1 Loss from House Property (WN 1) (39,000)

2 Profits & Gains from Business or Profession [Receipts – Expenditures]

A. Receipts Taxable u/h ‘PGBP’

1. Fees from Professional Services 9,38,000

B. Expenditures deductible u/h ‘PGBP’

1. Staff Salary, Bonus & Stipend paid to Articled Clerks (1,50,000)

2. Other Administrative Expenses (48,000)

3. Office Rent (30,000)

4. Depreciation [WN 2] (103,000)

5. Motor Car Maintenance [10,000 x 4/5] (8,000) 5,99,000

Gross Total Income 5,60,000

Less: Deductions under Chapter VI-A

Section 80C: Housing Loan Repayment (Principal Portion = 1,88,000 - 88,000) 1,00,000

Life Insurance Premium 24,000

Contribution to PPF 20,000

Section 80D: Medical Insurance Premium (Self & Wife) 18,000 (1,62,000)

Total (Taxable) Income 3,98,000

Calculation of Tax Payable.

Tax on Rs. 3,98,000 = (Rs. 3,98,000 – Rs. 2,50,000) x 5% = Rs. 7,400.

Less: Rebate u/s 87A: (Lower of Tax Payable or Rs. 12,500): Rs. 7,400

Tax Payable = Nil.

www.pranavchandak.com Queries on Whatsapp @ 8888111134 Free Videos on YouTube

ERRORLESS TAXATION BY CA PRANAV CHANDAK @ PRANAV CHANDAK ACADEMY, PUNE

Working Notes:

1. Income from House Property:

A. 50% Self Occupied

Net Annual Value Nil

Less: Deduction u/s 24(b) - Interest on Borrowed Capital (88,000/2 = 44,000)

(Since Construction is prior to 01.04.1999, Maximum Interest allowable is Rs. 30,000) (30,000) (30,000)

B. 50% Let-Out

Gross Anuual Value = Actual Rent (since no information about MV, FR, SR is given) 50,000

It can be assumed that house was vacant for 2 months during PY. Because Rent should

have been Rs. 5,000 x 12 = Rs. 60,000. But in R&P A/c, only Rs. 50,000 is shown)

Less: Municipal Taxes (Nil)

Net Annual Value 50,000

Less: Standard Deduction u/s 24(a): 30% of Net Annual Value (15,000)

Less: Deduction u/s 24(b): Interest on borrowed Capital = (Rs. 88,000/2) (44,000) (9,000)

Income from House Property (39,000)

2. Computation of Depreciation:

Particulars Rs.

(a) Books bought of Annual Publication: RoD = 40%; Rs. 20,000 x 40% 8,000

(b) Furniture & Fitting: RoD = 10% Rs. 60,000 x 10% 6,000

(c) Plant & Machinery: RoD = 15% Rs. 80,000 x 15% 12,000

(d) Computers: RoD @ 40%

Opening WDV = Rs. 50,000 Rs. 50,000 x 40% 20,000

+ Additions during PY (< 180 days): Rs. 30,000 Rs. 30,000 x 40% x ½ 6,000

(e) Motor Car: RoD @ 30% (To the extent of Official Use only i.e 4/5th) Rs. 4,25,000 x 30% x ½ x 4/5 51,000

Total Depreciation for the PY 1,03,000

3. Motor Car Loan is not considered since it is a Capital Receipt. Interest is not paid during the year. Since the Assessee

follows Cash Basis of Accounting, it is not considered in the Profits & Gains of Business or Profession.

4. Domestic Drawings is not considered since it is a Personal Expenditure.

PQ8. Mr. Y carries on his Own Business. An analysis of his Trading & P&L A/c for PY 2019-20 revealed following information:

Net Profit as per P&L A/c was Rs. 1,11,20,000.

Following incomes were credited in the Profit & Loss Account:

Dividend from UTI Rs. 2,20,000.

Interest on Debentures Rs. 1,75,000.

Winnings from Races Rs. 1,50,000

It was found that some Stocks were omitted to be included in both Opening & Closing Stocks, the value of which

were: Opening Stock: Rs. 80,000 & Closing Stock: Rs. 1,20,000.

Rs. 10 lacs were debited in P&L A/c being contribution to a University approved & notified u/s 35(1)(ii).

Salary includes Rs. 2,00,000 paid to his brother which is unreasonable to the extent of Rs. 25,000.

Advertisement Expenses include 15 packets of dry fruits of 10,000 per piece presented to important Customers.

Total Expenses on Car = 7,80,000. Car was used for Business & Personal purposes. 3/4th is for Business.

Miscellaneous Expenses included 30,000 paid to A & Co., a Goods Transport Operator in Cash on 31.1.2020 for

distribution of the Company's Product to the Warehouse.

Depreciation debited in the Books was Rs. 5,50,000. Depreciation allowed as per IT Rules was Rs. 7,50,000.

Drawing Rs. 1,00,000.

Investment in NSC Rs. 1,50,000.

Compute the Total Income of Mr. Y for AY 2020-21. [MAY 12]

www.pranavchandak.com Queries on Whatsapp @ 8888111134 Free Videos on YouTube

ERRORLESS TAXATION BY CA PRANAV CHANDAK @ PRANAV CHANDAK ACADEMY, PUNE

Solution: Computation of Taxable Income & Tax Liability

Particulars Rs. Rs. Rs.

I Income u/h ‘PGBP’

Net profit as per P&L A/c 1,11,20,000

Add: Expenses not deductible u/h ‘PGBP’ but debited to P&L A/c

1. Amount paid to Approved University u/s 35(1)(ii) 10,00,000

2. Salary to Brother [unreasonable amount disallowed u/s 40A(2)] 25,000

3. Car Expenses disallowed (Personal use) - (7,80,000 x 1/4) 1,95,000

4. Depreciation as per Books of A/c 5,50,000

5. Drawings disallowed being personal in Nature 1,00,000

6. Investment in NSC 1,50,000 20,20,000

Less: Income which are taxable under other heads or Exempt

Incomes but credited to P&L A/c

1. Dividend Received from UTI (Exempt) (2,20,000)

2. Interest on Debentures (considered u/h “IFOS”) (1,75,000)

3. Winning from Races (considered u/h “IFOS”) (1,50,000) (5,45,000)

Less: Admissible Expenses not credited to P&L A/c

1. Depreciation as per IT Act (7,50,000)

2. Deduction u/s 35(1)(ii) [150% of Rs. 10 Lacs] (15,00,000) (22,50,000)

Less: Undervalued Opening Stock (Earlier omitted, to be included) (80,000) (80,000)

Add: Closing Stock (Earlier omitted, to be included) 1,20,000 1,20,000 1,03,85,000

II Income u/h ‘IFOS’

1. Dividend from UTI – Exempt u/s 10(35) Nil

2. Interest on Debentures 1,75,000

3. Winnings from Races 1,50,000 3,25,000

Gross Total Income 1,07,10,000

Less: Deductions under Chapter VI-A: Sec 80C – Investment in NSC (1,50,000)

Total (taxable) Income 1,05,60,000

Notes:

1. As per Sec. 40A(3), any payment in Cash made to any Transporter for the purpose of plying, hiring or leasing goods

carriage shall be disallowed if it exceeds Rs. 35,000 on any day. In the given case, assessee makes a payment of Rs. 30,000

in cash to A & Co., a Transport Operator on 31.01.2020. It is an allowable expenditure.

2. Advertisement Expense is incurred for purpose of Business & hence allowed u/s 37. So, no adjustment is required to be

made for the same.

www.pranavchandak.com Queries on Whatsapp @ 8888111134 Free Videos on YouTube

ERRORLESS TAXATION BY CA PRANAV CHANDAK @ PRANAV CHANDAK ACADEMY, PUNE

PQ9. Mr. X, a Chartered Accountant & has prepared the following income & expenditure account as on 31.03.2020.

Expenditure Amount Income Amount

Office expenses 12,000 Professional fee 65,00,000

Employee’s salary 20,000 Consultancy Fee 55,000

Magazines & newspapers 800 Dividend from Indian co. 8,500

Entertainment Expenses (Personal) 17,500 Profit on sale of debentures (STCG) 8,450

Donation for a charity show 600 Gift from father in-law 6,050

Interest on loan for professional purpose 800

Income Tax (advance tax) 5,000

Car Expenses 2,500

Purchase of books 2,000

Stationery 21,000

Diwali gift to employees 1,000

Rent of own building 60,000

Municipal tax 1,000

White washing & Painting of building 2,000

Expenses incurred on opening ceremony 3,000

You are required to compute his Total Income for AY 2020-21 considering the following points -

1. The car is used equally for official & personal purposes.

2. Rs. 1,500 for domestic servant’s salary is included in employee’s salary.

3. Books were purchased on 01.09.2019 & were put to use on the same date.

4. Payment of stationery Rs. 20,500 was made by a bearer cheque & Rs. 500 was paid in cash.

5. Mr. X is owner of a building. Opening WDV = Rs. 90,000. Building is used for official purposes. No depreciation is claimed.

6. Furniture having WDV of Rs. 30,000 as on 1.4.2019 is also used for profession. Office chairs & tables were purchased &

put to use on 30.03.2020 for the purpose of a new office which has been inaugurated on 31.03.2020. No depreciation

has been debited to the profit & loss account. Actual cost: Rs. 20,000.

7. Employee’s salary includes bonus of Rs. 5,000 which was paid to one of the employees on 1.7.2020.

Solution: Computation of professional income as per Income & Expenditure A/c

1 Profits & Gains from Business or Profession [Receipts – Expenditures]

A. Receipts Taxable u/h ‘PGBP’

Fees from Professional Services 65,00,000

Consultancy Fee 55,000

B. Expenditures deductible u/h ‘PGBP’

Office expenses (12,000)

Employee’s salary [20,000 – 1500] (18,500)

Magazines & newspapers (800)

Interest on loan for professional purpose (800)

Car Expenses [Rs. 2,500 x ½] (1250)

Diwali gift to employees (1,000)

Municipal tax (1,000)

White washing & Painting of building (2,000)

Expenses incurred on opening ceremony (3,000)

Depreciation on building (Rs. 90,000 @ 10%) (9,000)

Depreciation on books (2,000 @ 40%) (800)

Depreciation on furniture (Rs. 30,000 @ 10%) + (Rs. 20,000 @ 5%) (4,000) 65,00,850

2 Income from other sources

Dividend from Indian company – Exempt u/s 10(34) Nil

Gift from father in-law – Not taxable since received from Relative Nil Nil

3 Income u/h ‘Capital Gains’: STCG on sale of debentures 8,450

Gross Total Income 65,09,300

Note: Expenses on opening ceremony are allowed u/s 37(1).

www.pranavchandak.com Queries on Whatsapp @ 8888111134 Free Videos on YouTube

ERRORLESS TAXATION BY CA PRANAV CHANDAK @ PRANAV CHANDAK ACADEMY, PUNE

*PQ10. From the following P & L A/c of Mr. X for PY 2019-20, compute his total income for AY 2020-21:

Debits Rs. Credits Rs.

Opening Stock 9,50,000 Sales 101,06,000

Purchases 80,50,000 Closing Stock 3,60,000

Salaries 7,00,000 LTCG on sale of house property 36,000

Rent, rates & taxes 1,25,000 Dividends from foreign company 12,000

Miscellaneous Expenses 21,000 Winnings of a lottery (gross) 5,00,000

Provision for Income Tax 31,000

Provision for gratuity 24,000

Provision for GST 45,000

Salary to Mrs. X 48,000

Purchased a computer on 1.11.2019 & put to 40,000

use on the same date

Net Profit 9,38,000

Additional information:

(i) Purchases include -

(a) Purchase of Rs. 1,00,000 from a relative (market price Rs. 80,000) & payment was made in cash.

(b) Purchase of Rs. 25,000 being the products manufactured without aid of power in a cottage industry & payment was

made to its producer & payment was made in cash.

(c) Purchases of Rs. 35,000 from a person residing in village having no bank & payment was made in cash.

(ii) Opening & closing stock were overvalued by 10%.

(iii) Salary includes Rs. 25,000 being bonus paid to the staff on 1.11.2020 on the occasion of Diwali.

(iv) Rent, rates & taxes include Municipal tax paid on 1.11.2020: Rs. 30,000

(v) Provision for Gratuity is on actuarial basis.

(vi) Mrs. X is a housewife & payment is excessive by Rs. 48,000.

Mr. X has not opted for presumptive taxation of Income u/s 44AD.

Solution:

Net profit as per profit & loss A/c 9,38,000

Add: Expenses debited to P & L A/c but not allowable

Deposit in NSC (not an expenditure) 42,000

Provision for income tax 31,000

Provision for GST 45,000

Salary to Mrs. X [Sec 40A(2)] 48,000

Purchase of computer (capital expenditure) 40,000

Purchase from relative [Sec 40A(2)] 20,000

Payment in cash [Sec 40A(3)] 80,000

Adjustment for overvalued Opening stock (9,50,000 x 10/110) 86,363

Bonus paid after due date (Sec 43B) 25,000

Municipal tax paid after due date (Sec 43B) 30,000 4,47,363

Less: Permissible Expenses

Depreciation on computer (40,000 x 40% x ½) (8,000)

Closing stock overvalued (3,60,000 x 10/110) (32,727) (40,727)

Less: Incomes taxable under other head but not u/h PGBP

Long term capital gain (36,000)

Dividend from foreign company (12,000)

Winnings of lottery (5,00,000) (5,48,000)

Income u/h ‘PGBP 7,96,636

Income from Other Sources

Dividend from foreign company 12,000

Winnings from lottery 5,00,000 5,12,000

Income u/h ‘Capital Gains’: LTCG on sale of House (taxable @ 20%) 36,000

Gross Total Income 13,44,636

www.pranavchandak.com Queries on Whatsapp @ 8888111134 Free Videos on YouTube

ERRORLESS TAXATION BY CA PRANAV CHANDAK @ PRANAV CHANDAK ACADEMY, PUNE

PQ11. Mr. PC submits the profit & loss account for the year ending 31.03.2020 as under:

Debits Rs. Credits Rs.

Household expense 20,000 Gross Profit 5,28,500

Interest on loan taken from Mrs. X 2,000 Income tax refund 3,000

Income tax 12,000 Interest on income tax refund 300

Interest on loan for payment of income tax 1,200 GST refund 1,000

Contribution to Unrecognised Provident Fund 4,000 Interest on GST refund 400

Expenditure on advertisement (revenue) 25,000 Bad debts recovered 5,000

Public provident fund contribution 7,000 Dividends from foreign company 3,000

Investment in post-office saving bank account 12,000

Purchase of car (A/c payee cheque) 2,45,000

Purchase of Computer (By A/c payee cheque) 35,000

Purchase of plant (By A/c payee cheque) 23,000

Net Profit 1,55,000

Note: Car, Computer, P&M were purchased on 1.10.2019 & were put to use on same date. Compute TI of PC for AY 20-21.

Solution: Computation of Total Income

Net Profit as per profit & loss account 1,55,000

Add: Inadmissible Expenses

Household expenses 20,000

Income tax 12,000

Interest on loan for payment of income tax 1,200

Contribution to Unrecognised provident fund 4,000

Contribution to public provident fund 7,000

Investment in post office saving bank account 12,000

Purchase of car 2,45,000

Purchase of computer 35,000

Purchase of plant 23,000 3,59,200

Less:

Income tax refund (3,000)

Interest on Income tax Refund (300)

Dividends (3,000)

Depreciation on car (2,45,000 x 30% x ½) [Used for less than 180 days] (36,750)

Depreciation on computer (35,000 x 40% x ½) [Used for less than 180 days] (7,000)

Depreciation (23,000 x 15% x ½) on plant [Used for less than 180 days] (1,725) (51,775)

Income under the head Business/Profession 4,62,425

Income under the head Other Sources

(i) Interest on Income tax Refund 300

(ii) Dividends from foreign company 3,000 3,300

Gross Total Income 4,65,725

Less: Deductions u/s 80C – Contribution to PPF (7,000)

Total Income 4,58,725

www.pranavchandak.com Queries on Whatsapp @ 8888111134 Free Videos on YouTube

You might also like

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Business & Profession Q - A 02.9.2020Document42 pagesBusiness & Profession Q - A 02.9.2020shyamiliNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Taxation Review June2017Document9 pagesTaxation Review June2017Shaiful Alam FCANo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- IPCC Gr.I Paper 4 TaxationDocument10 pagesIPCC Gr.I Paper 4 TaxationAyushi RajputNo ratings yet

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- It 2Document44 pagesIt 2Business RecoveryNo ratings yet

- Paper - 4: Taxation Section A: Income TaxDocument24 pagesPaper - 4: Taxation Section A: Income TaxChhaya JajuNo ratings yet

- Tax AssignmentDocument11 pagesTax AssignmentAM NerdyNo ratings yet

- Tax SuggestedDocument28 pagesTax SuggestedHemaNo ratings yet

- TDS & TCSDocument11 pagesTDS & TCSKartikNo ratings yet

- Problems On Individual Taxation AY 2020-21 StudentsDocument9 pagesProblems On Individual Taxation AY 2020-21 StudentsAminul Islam RubelNo ratings yet

- Paper 4 Studycafe - inDocument28 pagesPaper 4 Studycafe - inApeksha ChilwalNo ratings yet

- Latest Tax CalculatIor 3.3.2Document16 pagesLatest Tax CalculatIor 3.3.2Bijender Pal Choudhary100% (3)

- 2nd Quizzer 1st Sem SY 2020-2021 - AKDocument6 pages2nd Quizzer 1st Sem SY 2020-2021 - AKMitzi WamarNo ratings yet

- For Revision of Income TaxDocument5 pagesFor Revision of Income TaxMA AttariNo ratings yet

- Taxation Material 4Document36 pagesTaxation Material 4Shaira BugayongNo ratings yet

- Question CAP III AND CA MEMBERHSIP New OneDocument17 pagesQuestion CAP III AND CA MEMBERHSIP New OneSuraj ThapaNo ratings yet

- Add: Depreciation As Per Books: © The Institute of Chartered Accountants of IndiaDocument15 pagesAdd: Depreciation As Per Books: © The Institute of Chartered Accountants of IndiaShubham KumarNo ratings yet

- Question On Income From Business and Profession 2Document9 pagesQuestion On Income From Business and Profession 2Ayush BholeNo ratings yet

- PDF Document E64dfec87bb0 1Document75 pagesPDF Document E64dfec87bb0 120BRM051 Sukant SNo ratings yet

- CA Ipcc Taxation Suggested Answers For Nov 2016Document16 pagesCA Ipcc Taxation Suggested Answers For Nov 2016Sai Kumar SandralaNo ratings yet

- ATLP - Practice - Questions - Direct Tax - & - International - Taxation PDFDocument86 pagesATLP - Practice - Questions - Direct Tax - & - International - Taxation PDFChanchal MisraNo ratings yet

- Provident FundDocument5 pagesProvident FundG MadhuriNo ratings yet

- PGBP-2Document10 pagesPGBP-2Srinivas T. RajuNo ratings yet

- Computation of Total Income & Tax LiabilityDocument24 pagesComputation of Total Income & Tax LiabilityKartikNo ratings yet

- Final BLT203 SemIV Bcom Spring 2020Document4 pagesFinal BLT203 SemIV Bcom Spring 2020SunnyNo ratings yet

- CA Inter Mighty 50Document47 pagesCA Inter Mighty 50INTER SMARTIANSNo ratings yet

- (I) (B) (Ii) (D) (Iii) (D) (Iv) (C) (V) (A) (Vi) (C) (Vii) (A) (Viii) (D) (Ix) (C) (X) (C)Document8 pages(I) (B) (Ii) (D) (Iii) (D) (Iv) (C) (V) (A) (Vi) (C) (Vii) (A) (Viii) (D) (Ix) (C) (X) (C)santosh palNo ratings yet

- Ty Baf TaxationDocument4 pagesTy Baf TaxationAkki GalaNo ratings yet

- Ty Baf TaxationDocument4 pagesTy Baf TaxationAkki GalaNo ratings yet

- Taxation of CompaniesDocument10 pagesTaxation of CompaniesnikhilramaneNo ratings yet

- T2 Ans (PS & ITA) REVISEDDocument6 pagesT2 Ans (PS & ITA) REVISEDalvinmono.718No ratings yet

- Principles of Taxation ND2020Document2 pagesPrinciples of Taxation ND2020Sharif MahmudNo ratings yet

- 18515pcc Sugg Paper Nov09 5 PDFDocument16 pages18515pcc Sugg Paper Nov09 5 PDFGaurang AgarwalNo ratings yet

- Taxation On Partnership FirmDocument11 pagesTaxation On Partnership FirmnarendraNo ratings yet

- Model Question BBS 3rd Taxation in NepalDocument6 pagesModel Question BBS 3rd Taxation in NepalAsmita BhujelNo ratings yet

- PGBP QuestionsDocument6 pagesPGBP QuestionsHdkakaksjsb100% (2)

- (April-19) (MBC-106) Ii Semester Income Tax Law and Practice Time: 3 Hours Max - Marks: 60Document3 pages(April-19) (MBC-106) Ii Semester Income Tax Law and Practice Time: 3 Hours Max - Marks: 60Bhuvaneswari karuturiNo ratings yet

- Taxation - Direct and IndirectDocument6 pagesTaxation - Direct and IndirectSahiba SadanaNo ratings yet

- Bba F&a Notes & ProbDocument5 pagesBba F&a Notes & ProbMouly ChopraNo ratings yet

- Taxation (Nov. 2007)Document17 pagesTaxation (Nov. 2007)P VenkatesanNo ratings yet

- Tax 5th Semeter Selected Questions PDFDocument40 pagesTax 5th Semeter Selected Questions PDFAvBNo ratings yet

- Division B - Descriptive Questions Question No. 1 Is CompulsoryDocument5 pagesDivision B - Descriptive Questions Question No. 1 Is CompulsoryUrvashi RNo ratings yet

- Tax Calculator - Indian Income Tax 2008-09Document7 pagesTax Calculator - Indian Income Tax 2008-09Jayamohan100% (29)

- Ca Inter, Group I Class Test 5. Test - DT Topic - . PGBP Date-TIME: 1:30 Hours MARKS:40 Total No - of Questions: 7 Total No - of Pages: 00Document5 pagesCa Inter, Group I Class Test 5. Test - DT Topic - . PGBP Date-TIME: 1:30 Hours MARKS:40 Total No - of Questions: 7 Total No - of Pages: 00Shrestha GuptaNo ratings yet

- Question Bank: Errorless Taxation by Ca Pranav Chandak at Pranav Chandak Academy, PuneDocument4 pagesQuestion Bank: Errorless Taxation by Ca Pranav Chandak at Pranav Chandak Academy, PuneSimran MeherNo ratings yet

- 06M Midterm Quiz No. 2 Income Tax On CorporationsDocument4 pages06M Midterm Quiz No. 2 Income Tax On CorporationsMarko IllustrisimoNo ratings yet

- IT Assignment - MDocument8 pagesIT Assignment - Mrushabh pareetNo ratings yet

- Asifamin - 3179 - 18893 - 6 - Taxation Pakistan - Session-10 PDFDocument21 pagesAsifamin - 3179 - 18893 - 6 - Taxation Pakistan - Session-10 PDFaemanNo ratings yet

- 17267pcc Sugg Paper June09 5Document18 pages17267pcc Sugg Paper June09 5nbaghrechaNo ratings yet

- Fifth PartDocument17 pagesFifth PartMahsinur RahmanNo ratings yet

- Accounting-Financial Statements of Companies-1653399167327513Document37 pagesAccounting-Financial Statements of Companies-1653399167327513Badhrinath ShanmugamNo ratings yet

- 54595bos43759 p4 PDFDocument33 pages54595bos43759 p4 PDFakkkNo ratings yet

- UNIT-4 - Income-From-BusinessDocument114 pagesUNIT-4 - Income-From-BusinessGuinevereNo ratings yet

- CONT .: (15 Minutes Extra Time Will Be Given Due To Slow Internet or Electricity Issues)Document4 pagesCONT .: (15 Minutes Extra Time Will Be Given Due To Slow Internet or Electricity Issues)ALEEM MANSOORNo ratings yet

- Questions & Answers Direct Taxes Issues On Tds Under The Head SalaryDocument4 pagesQuestions & Answers Direct Taxes Issues On Tds Under The Head Salarycgvipin8639No ratings yet

- 54606bos43769 p4Document27 pages54606bos43769 p4HARSHAL MITTALNo ratings yet

- New Course Solutions May 2019Document18 pagesNew Course Solutions May 2019Kali KhannaNo ratings yet

- Procedure For Incorporating A Company Through RUN (Reserve Unique Name)Document2 pagesProcedure For Incorporating A Company Through RUN (Reserve Unique Name)Simran MeherNo ratings yet

- Question Bank: Errorless Taxation by Ca Pranav Chandak at Pranav Chandak Academy, PuneDocument5 pagesQuestion Bank: Errorless Taxation by Ca Pranav Chandak at Pranav Chandak Academy, PuneSimran MeherNo ratings yet

- Theory Questions: Errorless Taxation by Ca Pranav Chandak at Pranav Chandak Academy, PuneDocument10 pagesTheory Questions: Errorless Taxation by Ca Pranav Chandak at Pranav Chandak Academy, PuneSimran MeherNo ratings yet

- Question Bank: Errorless Taxation by Ca Pranav Chandak at Pranav Chandak Academy, PuneDocument8 pagesQuestion Bank: Errorless Taxation by Ca Pranav Chandak at Pranav Chandak Academy, PuneSimran MeherNo ratings yet

- HR 0 K 31 It 4 SxstrjojltjDocument197 pagesHR 0 K 31 It 4 SxstrjojltjSimran MeherNo ratings yet

- Question Bank: Errorless Taxation by Ca Pranav Chandak at Pranav Chandak Academy, PuneDocument5 pagesQuestion Bank: Errorless Taxation by Ca Pranav Chandak at Pranav Chandak Academy, PuneSimran MeherNo ratings yet

- Question Bank: Errorless Taxation by Ca Pranav Chandak at Pranav Chandak Academy, PuneDocument4 pagesQuestion Bank: Errorless Taxation by Ca Pranav Chandak at Pranav Chandak Academy, PuneSimran MeherNo ratings yet

- CA Inter Unscheduled Test Series Nov 2021 1626503339Document7 pagesCA Inter Unscheduled Test Series Nov 2021 1626503339Simran MeherNo ratings yet

- Company Law NCLT Rules & Striking Off Section 248 To 252 Class Notes Uploaded On 07th Mar 2018 636560432861884854Document14 pagesCompany Law NCLT Rules & Striking Off Section 248 To 252 Class Notes Uploaded On 07th Mar 2018 636560432861884854Simran MeherNo ratings yet

- J20 TX VNM Sample - Suggested Solutions and Marking Schemes v1.0Document9 pagesJ20 TX VNM Sample - Suggested Solutions and Marking Schemes v1.0Đạt LêNo ratings yet

- Income Tax MCQ PDFDocument26 pagesIncome Tax MCQ PDFSachin PanchalNo ratings yet

- Trading SecuritiesDocument3 pagesTrading SecuritiesFreddierick JuntillaNo ratings yet

- Ananya Rai Sbi LifeDocument129 pagesAnanya Rai Sbi LifeNITISH CHANDRA PANDEYNo ratings yet

- NewClientChecklist 2022Document29 pagesNewClientChecklist 2022ChristineNo ratings yet

- Company Profile RFS Training Centre-PKEEDocument32 pagesCompany Profile RFS Training Centre-PKEEtonymuzioNo ratings yet

- Health Care Ethics Chapter 1-4Document30 pagesHealth Care Ethics Chapter 1-4chie9268No ratings yet

- Attendance ListDocument2 pagesAttendance Listbagasaji.0712No ratings yet

- Accenture - OfferletterDocument1 pageAccenture - OfferletternittingulatiNo ratings yet

- 2019 Complex Patient Bonus Fact SheetDocument4 pages2019 Complex Patient Bonus Fact SheetJoe GellatlyNo ratings yet

- PDIC LAW Lecture NotesDocument3 pagesPDIC LAW Lecture NotesmarkNo ratings yet

- Display - PDF - 2021-05-18T064418.503Document13 pagesDisplay - PDF - 2021-05-18T064418.503SureshNo ratings yet

- SalariesDocument35 pagesSalariesSamyak Jirawala100% (1)

- Experis Key InformationDocument11 pagesExperis Key InformationTahir SamadNo ratings yet

- Sti ImfDocument88 pagesSti ImfPema DorjiNo ratings yet

- F6 SMART Notes FA20 Till March-2022 byDocument44 pagesF6 SMART Notes FA20 Till March-2022 byAshfaq Ul Haq OniNo ratings yet

- Commercial Law CMA Inter (100 MCQS)Document13 pagesCommercial Law CMA Inter (100 MCQS)Abhijit Horo100% (1)

- Board Approved Cust Protection Policy - Docx-25012021Document18 pagesBoard Approved Cust Protection Policy - Docx-25012021BHATT ELECTRIC STORENo ratings yet

- IFRS17 Insurance ContractsDocument7 pagesIFRS17 Insurance ContractsIrishLove Alonzo BalladaresNo ratings yet

- Mint Delhi Mint 10-01-2024Document20 pagesMint Delhi Mint 10-01-2024Ravi PariharNo ratings yet

- Cumballa Hill Management Contract 27 July 18Document20 pagesCumballa Hill Management Contract 27 July 18naina vyasNo ratings yet

- TB 350 Owner ManualDocument13 pagesTB 350 Owner ManualabhilashrkNo ratings yet

- Philippine Income Taxation - Supplemental Quizzes Part 1 (CHAPTERS 1-6)Document9 pagesPhilippine Income Taxation - Supplemental Quizzes Part 1 (CHAPTERS 1-6)Wag mong ikalatNo ratings yet

- Bank of India Officer Employees (Discipline and Appeal) Regulations, 1976Document14 pagesBank of India Officer Employees (Discipline and Appeal) Regulations, 1976OmkarAmujuriNo ratings yet

- Important Schemes - Department of Financial Services - Ministry of Finance - Government of IndiaDocument4 pagesImportant Schemes - Department of Financial Services - Ministry of Finance - Government of IndiaritulNo ratings yet

- Link: HTTPS://WWW - Dti.gov - Ph/resources/downloadable-FormsDocument2 pagesLink: HTTPS://WWW - Dti.gov - Ph/resources/downloadable-FormsAyvz Martija LambioNo ratings yet

- VAJI (FLT5) (Pdfnotes Co)Document66 pagesVAJI (FLT5) (Pdfnotes Co)Joy jadhavNo ratings yet

- HDFC Life InsuranceDocument1 pageHDFC Life InsuranceSureshKarnanNo ratings yet

- Seguro ColectivoDocument2 pagesSeguro Colectivoreinaldodesousa92No ratings yet

- Claim Form GeneralDocument1 pageClaim Form GeneralTanya Rose-AppleNo ratings yet