Professional Documents

Culture Documents

Regular Income Tax Seatwork

Uploaded by

Jean Diane JoveloOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Regular Income Tax Seatwork

Uploaded by

Jean Diane JoveloCopyright:

Available Formats

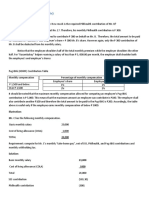

Compute for the taxable income and tax due of the following:

1. Mr. A had a gross taxable compensation income of P400,00. She also earned an additional

P2,000 by investing her money in time deposits plus P3,000 interest income from lending money

to a friend.

2. Mr.C had a business net income of 300,00. She also earned 3,000 commission from selling load

and 12,000 dividends from a domestic corporation.

3. Mr. P earned a total gross receipts of P800,000 and paid 300,000 in expenses in his accounting

practice. During the same year, he also earned a total of P60,000 net gain from the sale of

domestic stocks directly to a buyer. He also disposed a vacant lot at a net gain of P140,000.

4. Mr. M earned a gross compensation income of 200,000, exclusive of 20,000 non taxable

compensation income and gross business income of 500,000 before expenses of 200,000. He

also earned book royalties of 10,000 and 8,000 interest income from client’s promissory notes.

He has personal expenses of P170,000 during the year.

5. Mr. Bangul earned a compensation income of 120,000 and net income from business of

300,000. He earned 8,000 prizes from a dancing competition and 45,000 royalties from his

musical composition. Mr. B has 150,000 personal expenses.

6. In 2020, Mr. B eanred 450,000 compensation income but incurred 120,00 net loss in her

business.

7. Mr. G , with a 75,000 personal exemption had the following date in 2020:

Philippines Abroad

Gross income from sales 4,000,000 6,000,000

Interest income on deposits 40,000 80,000

Less: Deductions 2,000,000 3,600,000

You might also like

- Tax DeductionsDocument4 pagesTax DeductionsAnonymous LC5kFdtcNo ratings yet

- Income Tax Quiz AnswerDocument4 pagesIncome Tax Quiz AnswerMarco Alejandro Ibay100% (1)

- Tax On Individuals Quiz - ProblemsDocument3 pagesTax On Individuals Quiz - ProblemsJP Mirafuentes100% (1)

- 8.1 Assignment - Regular Income TaxDocument3 pages8.1 Assignment - Regular Income TaxCharles Mateo0% (1)

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)From EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Income Tax Finals Sample Questions Final ExamDocument19 pagesIncome Tax Finals Sample Questions Final ExamAnie P. Martinez0% (1)

- Pa-Note Nalang Pag May Babaguhin Kayong SagotDocument26 pagesPa-Note Nalang Pag May Babaguhin Kayong SagotErika Mae LegaspiNo ratings yet

- Taxation - Final ExamDocument4 pagesTaxation - Final ExamKenneth Bryan Tegerero Tegio100% (1)

- Individual Tax Payer - TeachersDocument8 pagesIndividual Tax Payer - TeachersKhervin EvangelistaNo ratings yet

- Tax INDIVIDUALPre-Board NCPARDocument6 pagesTax INDIVIDUALPre-Board NCPARlorenceabad07100% (1)

- Tax Computations SampleDocument5 pagesTax Computations Samplelcsme tubodaccountsNo ratings yet

- COMEX1 TAX REVIEW Canvas-1Document18 pagesCOMEX1 TAX REVIEW Canvas-1LhowellaAquinoNo ratings yet

- Taxation - Corporation - Quizzer - 2018Document4 pagesTaxation - Corporation - Quizzer - 2018Kenneth Bryan Tegerero Tegio100% (4)

- MASTERY TAXATION October-2019 PDFDocument12 pagesMASTERY TAXATION October-2019 PDFJuvelyn Gregorio100% (1)

- 8.6 Assignment - Regular Income Tax On CorporationsDocument3 pages8.6 Assignment - Regular Income Tax On CorporationsRoselyn LumbaoNo ratings yet

- Reviewer For Final Examination - ProblemsDocument11 pagesReviewer For Final Examination - Problemsreynald animosNo ratings yet

- Individual Income TaxDocument13 pagesIndividual Income TaxDaniel Dialino100% (1)

- Government Accounting SyllabusDocument12 pagesGovernment Accounting SyllabusJean Diane JoveloNo ratings yet

- Tax QuizDocument3 pagesTax QuizLora Mae JuanitoNo ratings yet

- Chapter 7 Regular Income Tax Activity Valdez KJ PDFDocument5 pagesChapter 7 Regular Income Tax Activity Valdez KJ PDFBisag Asa50% (4)

- Quiz Week 2 No AnswerDocument10 pagesQuiz Week 2 No AnswerKatherine EderosasNo ratings yet

- Assignment No. 2: Part 1: Determination of Income Tax Due/PayableDocument4 pagesAssignment No. 2: Part 1: Determination of Income Tax Due/PayableKenneth Pimentel100% (1)

- Taxation - Gross Income - Quizzer - 2018 - MayDocument5 pagesTaxation - Gross Income - Quizzer - 2018 - MayKenneth Bryan Tegerero TegioNo ratings yet

- Tax ProblemsDocument14 pagesTax Problemsrav dano100% (1)

- Midterm Exam Principles of Taxation and Income TaxationDocument6 pagesMidterm Exam Principles of Taxation and Income TaxationKitagawa, Misia Sophia Jan B.No ratings yet

- Gross Income Quiz With Answer KeyDocument10 pagesGross Income Quiz With Answer KeyMylene AlfantaNo ratings yet

- SW05Document7 pagesSW05Nadi HoodNo ratings yet

- Income Taxation Ind PracticeDocument3 pagesIncome Taxation Ind PracticeJanine Tividad100% (1)

- TX 201Document4 pagesTX 201Pau SantosNo ratings yet

- Individual Illustration and Activity No. 2Document22 pagesIndividual Illustration and Activity No. 2Angela CanayaNo ratings yet

- 03 Income Taxation For Individuals Sample ProblemsDocument15 pages03 Income Taxation For Individuals Sample ProblemsclaraNo ratings yet

- Take Home Seatwork 11.25.2023Document2 pagesTake Home Seatwork 11.25.2023rhenzadrian.11No ratings yet

- Individual Illustration and Activity No. 2Document19 pagesIndividual Illustration and Activity No. 2김유나100% (1)

- Basic Principles of TaxationDocument18 pagesBasic Principles of TaxationAlexandra Nicole IsaacNo ratings yet

- SW04Document8 pagesSW04Nadi Hood0% (1)

- Prv-Tax 1Document4 pagesPrv-Tax 1Kathylene GomezNo ratings yet

- Ea - TaxDocument8 pagesEa - TaxKc SevillaNo ratings yet

- Deductions From Gross IncomeDocument10 pagesDeductions From Gross IncomewezaNo ratings yet

- Quiz 1 - StrataxDocument3 pagesQuiz 1 - Strataxspongebob SquarepantsNo ratings yet

- BAM 031 Income Taxation 2nd Periodical Exam With AKDocument8 pagesBAM 031 Income Taxation 2nd Periodical Exam With AKbrmo.amatorio.uiNo ratings yet

- Required: Compute The Taxable Rental Income and Tax Liability AssumeDocument2 pagesRequired: Compute The Taxable Rental Income and Tax Liability AssumeTilahun GirmaNo ratings yet

- Tax Midterm ExamDocument21 pagesTax Midterm ExamLili esNo ratings yet

- Corporation ActivityDocument4 pagesCorporation ActivityLFGS FinalsNo ratings yet

- PRe Departmental ReviwersDocument7 pagesPRe Departmental ReviwersCañon, Lorenz GeneNo ratings yet

- Homework Number 4Document8 pagesHomework Number 4ARISNo ratings yet

- Philhealth Contribution (Table) : Illustration: Mr. C Has The Following Monthly CompensationDocument5 pagesPhilhealth Contribution (Table) : Illustration: Mr. C Has The Following Monthly CompensationMaraiah InciongNo ratings yet

- Tax 1 Bsais Quiz4 Theories W AnsDocument6 pagesTax 1 Bsais Quiz4 Theories W AnsCyrss BaldemosNo ratings yet

- Proceeds of Property Insurance (BV 4,000,000)Document11 pagesProceeds of Property Insurance (BV 4,000,000)zeref dragneelNo ratings yet

- Exclusions and DeductionsDocument4 pagesExclusions and DeductionsOG FAM0% (1)

- Yellow - Not Sure, Green - CorrectDocument7 pagesYellow - Not Sure, Green - CorrectIsaiah John Domenic M. CantaneroNo ratings yet

- Assignment 1 Taxes On IndividualsDocument7 pagesAssignment 1 Taxes On IndividualsMarynissa CatibogNo ratings yet

- IAET TaxationDocument2 pagesIAET TaxationRandy Manzano100% (1)

- IA3 Chapter 12 21Document12 pagesIA3 Chapter 12 21ZicoNo ratings yet

- Taxation Elims 1Document3 pagesTaxation Elims 1Valerie Faye BadajosNo ratings yet

- Learning Activity 3 - Inc TaxDocument3 pagesLearning Activity 3 - Inc TaxErica FlorentinoNo ratings yet

- Preparation of Income Tax Return IndividualDocument2 pagesPreparation of Income Tax Return IndividualFRAULIEN GLINKA FANUGAONo ratings yet

- Taxation Situational ProblemsDocument32 pagesTaxation Situational ProblemsMilo MilkNo ratings yet

- Additional Income Tax QuizzerDocument3 pagesAdditional Income Tax QuizzerJolina Mancera0% (1)

- TAX.03 Exercises On Corporate Income TaxationDocument7 pagesTAX.03 Exercises On Corporate Income Taxationleon gumbocNo ratings yet

- Make Money With Dividends Investing, With Less Risk And Higher ReturnsFrom EverandMake Money With Dividends Investing, With Less Risk And Higher ReturnsNo ratings yet

- The Impact of Cost of Capital On Financi PDFDocument238 pagesThe Impact of Cost of Capital On Financi PDFJean Diane JoveloNo ratings yet

- Incorporating Multidimensional Images in PDFDocument18 pagesIncorporating Multidimensional Images in PDFJean Diane JoveloNo ratings yet

- Measuring Success of Accounting Informat PDFDocument10 pagesMeasuring Success of Accounting Informat PDFJean Diane JoveloNo ratings yet

- Literacy On The Fundamental Information PDFDocument14 pagesLiteracy On The Fundamental Information PDFJean Diane JoveloNo ratings yet

- Knowledge Impact On Information Quality PDFDocument12 pagesKnowledge Impact On Information Quality PDFJean Diane JoveloNo ratings yet

- Introducing The Approach To Unwell Child PDFDocument128 pagesIntroducing The Approach To Unwell Child PDFJean Diane JoveloNo ratings yet

- The Effectiveness of Learning Design ModDocument172 pagesThe Effectiveness of Learning Design ModJean Diane JoveloNo ratings yet

- European Journal of Human Resource ManagDocument27 pagesEuropean Journal of Human Resource ManagJean Diane JoveloNo ratings yet

- Habit and Hedonic Motivation Are The STRDocument18 pagesHabit and Hedonic Motivation Are The STRJean Diane JoveloNo ratings yet

- The Role of Accounting Information SysteDocument17 pagesThe Role of Accounting Information SysteJean Diane JoveloNo ratings yet

- The 3rd AAGBS International Conference oDocument46 pagesThe 3rd AAGBS International Conference oJean Diane JoveloNo ratings yet

- 3rd Pharmacoeconomics and Outcomes ReseaDocument54 pages3rd Pharmacoeconomics and Outcomes ReseaJean Diane JoveloNo ratings yet

- The Effect of Social Media On Hotel InduDocument141 pagesThe Effect of Social Media On Hotel InduJean Diane JoveloNo ratings yet

- GR12 Business Finance Module 9-10Document7 pagesGR12 Business Finance Module 9-10Jean Diane JoveloNo ratings yet

- Agency Action Plan-SECDocument4 pagesAgency Action Plan-SECJean Diane JoveloNo ratings yet

- GR12 Business Finance Module 7-8Document10 pagesGR12 Business Finance Module 7-8Jean Diane JoveloNo ratings yet

- Government BenefitsDocument2 pagesGovernment BenefitsJean Diane JoveloNo ratings yet

- GR12 Business Finance Module 3-4Document8 pagesGR12 Business Finance Module 3-4Jean Diane JoveloNo ratings yet

- GR12 Business Finance Module 1-2Document7 pagesGR12 Business Finance Module 1-2Jean Diane JoveloNo ratings yet

- In Partial Fulfillment of The Requirements in Marketing ManagementDocument26 pagesIn Partial Fulfillment of The Requirements in Marketing ManagementJean Diane JoveloNo ratings yet

- GR12 Business Finance Module 5-6Document10 pagesGR12 Business Finance Module 5-6Jean Diane JoveloNo ratings yet

- Chapter1 201212072034Document10 pagesChapter1 201212072034Jean Diane JoveloNo ratings yet

- Sponsorship Letter For 1st Webinar 26 Nov 2020Document1 pageSponsorship Letter For 1st Webinar 26 Nov 2020Jean Diane JoveloNo ratings yet

- Streat VibesDocument78 pagesStreat VibesJean Diane JoveloNo ratings yet

- Summary of Comments of Sir EdDocument4 pagesSummary of Comments of Sir EdJean Diane JoveloNo ratings yet

- THE HOUSE OF NUTS FEASIB Revision Part 1finalDocument51 pagesTHE HOUSE OF NUTS FEASIB Revision Part 1finalJean Diane JoveloNo ratings yet

- THE HOUSE OF NUTS FEASIB Revision Part 1Document49 pagesTHE HOUSE OF NUTS FEASIB Revision Part 1Jean Diane JoveloNo ratings yet