Professional Documents

Culture Documents

Exercise WACC

Exercise WACC

Uploaded by

Mina Zahari0 ratings0% found this document useful (0 votes)

2 views2 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views2 pagesExercise WACC

Exercise WACC

Uploaded by

Mina ZahariCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

Exercise-WACC

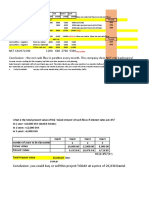

1. Given the following information for Dunhill Power Company, find the WACC. Assume

the company’s tax rate is 35%

Debt: 3,000 of 8 % coupon bonds outstanding, $1,000 par value, 20 years

to maturity, selling for $1,030, the bonds make semiannual

payments.

Preferred stocks: 13,000 shares of 7% dividend payment, par is $100, currently

selling for $108 per share with flotation cost of $3 per share.

Common stocks: 90,000 shares outstanding, selling for $45 per share, the beta is 1.2.

Market: 13% market return, and 6% risk free rate.

Solution:

1. Cost of each source of fund:

rd → Find yield to maturity of bonds

Number of period = 20*2 = 40 periods

Coupon payment = (8%*1000)/2 = $40 per periods

40 40 40 1000

1,030 = 1

+ 2

+ ⋯+ 40

+

(1 + 𝑌𝑚 ) (1 + 𝑌𝑚 ) (1 + 𝑌𝑚 ) (1 + 𝑌𝑚 )40

𝑌𝑚 = 3.85% / period → 7.70% / year

rps = Dividend per share / Price after Flotation cost

= (7%*100) / (108-3) = 7/105 = 6.67%

rs = rRF + beta (rM – rRF)

= 6% + 1.2 (13% - 6%) = 14.40%

2. Weight of each source of funds

Debt = 3,000 * 1,030 = 3,090,000 Wd = 3,090,000 / 8,544,000 = 36.17%

PS = 13,000 * 108 = 1,404,000 WPS = 1,404,000 / 8,544,000 = 16.43%

CS = 90,000 *45 = 4,050,000 WCS = 4,050,000 / 8,544,000 = 47.40%

Total Capital = 8,544,000

WACC = Wd rd (1-T) + WPS rPS + WCS rCS

= (36.17%*7.7%*(1-0.35)) + (16.43%*6.67%) + (47.40%*14.40%)

= 9.73%

You might also like

- Case of Bond Valuation Kelompok 1Document2 pagesCase of Bond Valuation Kelompok 1kota lainNo ratings yet

- EBW1063 Managerial Finance Tutorial - StockValuation - AnswerDocument3 pagesEBW1063 Managerial Finance Tutorial - StockValuation - AnswerJune JoysNo ratings yet

- Econ S-190 Introduction To Financial and Managerial Economics Mock Final Examination 2021 Question #1Document6 pagesEcon S-190 Introduction To Financial and Managerial Economics Mock Final Examination 2021 Question #1ADITYA MUNOTNo ratings yet

- Final-Term Quiz Mankeu Roki Fajri 119108077Document4 pagesFinal-Term Quiz Mankeu Roki Fajri 119108077kota lainNo ratings yet

- Fim Model SolutionDocument7 pagesFim Model Solutionhyp siinNo ratings yet

- 4.chapter 8 - Stock ValuationDocument40 pages4.chapter 8 - Stock ValuationMohamed Sayed FadlNo ratings yet

- CA Inter FM SM A MTP 2 May 2024 Castudynotes ComDocument19 pagesCA Inter FM SM A MTP 2 May 2024 Castudynotes ComsanjanavijjapuNo ratings yet

- Financial Management Assignment 2Document6 pagesFinancial Management Assignment 2Sayaf ArbabNo ratings yet

- BONDS TaskDocument5 pagesBONDS TaskKelly Milagros Orozco RosalesNo ratings yet

- This Study Resource Was: Asc714 - Assignment 3 September 20, 2018 Chapter 12: The Bond MarketDocument2 pagesThis Study Resource Was: Asc714 - Assignment 3 September 20, 2018 Chapter 12: The Bond MarketFazal Rehman Mandokhail100% (1)

- Problem Set 3 (Duration II) With AnswersDocument5 pagesProblem Set 3 (Duration II) With Answerskenny013No ratings yet

- Chapter 1Document13 pagesChapter 1clara2300181No ratings yet

- Economia Mineral: I N I N N NDocument10 pagesEconomia Mineral: I N I N N NClaudio Herman CHNo ratings yet

- Solution 6Document11 pagesSolution 6askdgasNo ratings yet

- Cheatsheet AF UASDocument2 pagesCheatsheet AF UASIndera HadiNo ratings yet

- FIN 301 B Porter Rachna Exam III - Review II Soln.Document3 pagesFIN 301 B Porter Rachna Exam III - Review II Soln.Badar MunirNo ratings yet

- Tutorial 1 (Solutions)Document11 pagesTutorial 1 (Solutions)AlfieNo ratings yet

- Exercise - Chap 2Document4 pagesExercise - Chap 2K59 Dao Phuong MaiNo ratings yet

- 3.3 Coupon Bonds: Coupon Bonds Make Regular Interest Payments. Coupon Bonds Generally SellDocument4 pages3.3 Coupon Bonds: Coupon Bonds Make Regular Interest Payments. Coupon Bonds Generally SellSalma ElNo ratings yet

- Supplemental Notes On CH 6 PDFDocument2 pagesSupplemental Notes On CH 6 PDFRuel Jr DellovaNo ratings yet

- 1 - Linear Programming Problem: SolutionDocument12 pages1 - Linear Programming Problem: Solution'Hady' HadiyantoNo ratings yet

- Công TH CDocument9 pagesCông TH CLê Hồng ThuỷNo ratings yet

- Investment Assignment - A1Document17 pagesInvestment Assignment - A1Joyin OyeludeNo ratings yet

- Tugas 2 Manajemen Keuangan - Dhea Nuralifiani - Nim 2011070615Document5 pagesTugas 2 Manajemen Keuangan - Dhea Nuralifiani - Nim 2011070615Dhea Nuralifiani SafitriNo ratings yet

- Ms. Tasneem Bareen HasanDocument13 pagesMs. Tasneem Bareen HasanMahin TabassumNo ratings yet

- Sem 2 Question Bank (Moderated) - Financial ManagementDocument63 pagesSem 2 Question Bank (Moderated) - Financial ManagementSandeep SahadeokarNo ratings yet

- Solution CH 12 - 15Document11 pagesSolution CH 12 - 15Chintya ChrismatinNo ratings yet

- FIN 630.assignmentDocument2 pagesFIN 630.assignmentMuhammad ArbazNo ratings yet

- FIN 630.assignmentDocument2 pagesFIN 630.assignmentMuhammad ArbazNo ratings yet

- Comprehensive ExampleDocument3 pagesComprehensive ExampleCarolina LopezNo ratings yet

- Net Cash Flow 1200 600 2760 5340 Conclusion:: The Net Cash Flow Is Positive Every Month. The Company Does NOT Risk Bankruptcy!Document5 pagesNet Cash Flow 1200 600 2760 5340 Conclusion:: The Net Cash Flow Is Positive Every Month. The Company Does NOT Risk Bankruptcy!Dalila BeheNo ratings yet

- Chapter 14 Book ValueDocument7 pagesChapter 14 Book ValueThalia Rhine AberteNo ratings yet

- FM II Assignment 17 Solution 19Document3 pagesFM II Assignment 17 Solution 19RaaziaNo ratings yet

- Risk Management Solution To Chapter 15Document3 pagesRisk Management Solution To Chapter 15BombitaNo ratings yet

- Chapter 16 EditedDocument5 pagesChapter 16 Editedomar_geryesNo ratings yet

- FM Practice Questions KeyDocument7 pagesFM Practice Questions KeykeshavNo ratings yet

- Solution Bebelac Uas Abm 2Document9 pagesSolution Bebelac Uas Abm 2Hasna SeptianiNo ratings yet

- Long QuestionsDocument18 pagesLong Questionssaqlainra50% (2)

- Assignment SolutionDocument2 pagesAssignment SolutionMuhammad ArbazNo ratings yet

- HW 7Document2 pagesHW 7Jordy JordanNo ratings yet

- Illustrative Algebraic Formulations - Basic Linear ProgrammingDocument8 pagesIllustrative Algebraic Formulations - Basic Linear ProgrammingJDesconectado18No ratings yet

- Question of Cost of CapitalDocument3 pagesQuestion of Cost of CapitalAngel Atia IbnatNo ratings yet

- Bond Characteristic and ValuationDocument6 pagesBond Characteristic and ValuationWednesday AddamsNo ratings yet

- Investment Rev23Document7 pagesInvestment Rev23tapiwanashejakaNo ratings yet

- Cost of Capital: - Example: Tax Rate 40%Document3 pagesCost of Capital: - Example: Tax Rate 40%Alex NievaNo ratings yet

- Tugas Cost of CapitalDocument16 pagesTugas Cost of CapitalBudi Arifian HakimNo ratings yet

- WACC - WorksheetDocument4 pagesWACC - Worksheetvwfn8f7xmtNo ratings yet

- Bond & Stock Sample Problemsv1.1Document4 pagesBond & Stock Sample Problemsv1.1An HoàiNo ratings yet

- Bond Valuation ProblemsDocument4 pagesBond Valuation ProblemsMary Justine Paquibot100% (1)

- Fixed Income ValuationDocument43 pagesFixed Income ValuationZonio Nina Bonita T.No ratings yet

- Tutorial Chapter 11 SolDocument7 pagesTutorial Chapter 11 SolMadina SuleimenovaNo ratings yet

- Chapter-10 Market Risk Math Problems and SolutionsDocument6 pagesChapter-10 Market Risk Math Problems and SolutionsruponNo ratings yet

- Valuation of SecuritiesDocument71 pagesValuation of Securitieskuruvillaj2217No ratings yet

- Ss 2Document6 pagesSs 2Lim Kuan YiouNo ratings yet

- Use The Following Information For The Next Three Questions:: Book Value Per ShareDocument6 pagesUse The Following Information For The Next Three Questions:: Book Value Per ShareYazNo ratings yet

- Venture Capital Method With Multiple Rounds.Document4 pagesVenture Capital Method With Multiple Rounds.Shivani KarkeraNo ratings yet

- Scenario Analysis: ExampleDocument4 pagesScenario Analysis: ExampledefectivepieceNo ratings yet

- Cost of Capital FormulaDocument12 pagesCost of Capital FormulaCasey SolisNo ratings yet

- Corporate Finance Formulas: A Simple IntroductionFrom EverandCorporate Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Company V&P Balance Sheet (Unit: Million Yuan) As of December 31, 2019Document3 pagesCompany V&P Balance Sheet (Unit: Million Yuan) As of December 31, 2019Mina ZahariNo ratings yet

- Exercise - Time Value of MoneyDocument2 pagesExercise - Time Value of MoneyMina Zahari100% (1)

- SimeDarbyProperty AR2020Document435 pagesSimeDarbyProperty AR2020Mina ZahariNo ratings yet

- Bjcorp 20Document390 pagesBjcorp 20Mina ZahariNo ratings yet

- Sime Darby Ar2020 Full Book Website.02112020Document329 pagesSime Darby Ar2020 Full Book Website.02112020Mina Zahari0% (1)

- Bjcorp19 1Document378 pagesBjcorp19 1Mina ZahariNo ratings yet

- Frankincense Essential Oil: Fun FactsDocument1 pageFrankincense Essential Oil: Fun FactsMina ZahariNo ratings yet