Professional Documents

Culture Documents

October 155 July 160 Aug 170

Uploaded by

Vivek KavtaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

October 155 July 160 Aug 170

Uploaded by

Vivek KavtaCopyright:

Available Formats

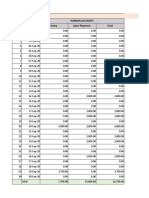

P-11

Identify Intrinsic Value, Time Value of American Call and Lower Bound of European Call:

The stock is priced at 165.13. The expirations are July 17, August 21, and October 16. The risk-

free rates are 0.0516, 0.0550, and 0.0588, respectively.

Exercise Market Intrinsic Time value

price value of value Ca (S0, T,X) ≥Max(S0-X,0) Lower

share (S0) Max(S0-X,0) bounds

Oct July Aug Max(S0-

14.00 6.00 3.20 X(1+r)-T)

October 155 165.13 10.13 3.87 11.17

July 160 165.13 5.13 0.87 5.371

Aug 170 165.13 0.00 3.20 0

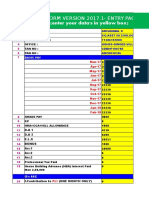

P-12

Identify Intrinsic Value, Time Value of American Call and Lower Bound of European Call:

The stock is priced at 165.13. The expirations are July 17, August 21, and October 16. The risk-

free rates are 0.0516, 0.0550, and 0.0588, respectively.

Exercise Market Intrinsic Time value

price value of value Ca (S0, T,X) ≥Max(S0-X,0) Lower

share (S0) Max(S0-X,0) bounds

July 165 165.13 0.00 2.375 0

Aug 160 165.13 0.00 2.750 0

Oct 170 165.13 0.00 4.125 2.184

You might also like

- Call Option Payoff Patterns: Time 0 Time TDocument23 pagesCall Option Payoff Patterns: Time 0 Time TSyed Ameer Ali ShahNo ratings yet

- Week 1 Probability DistributionDocument25 pagesWeek 1 Probability DistributionAneka Sto DomingoNo ratings yet

- PDF DocumentDocument1 pagePDF DocumentMemet YașarNo ratings yet

- Weather - Rainfall - Pompa KSO SPC, Agustus 2016.Document6 pagesWeather - Rainfall - Pompa KSO SPC, Agustus 2016.Yayat RinaldyNo ratings yet

- Options PDFDocument8 pagesOptions PDFSAMRAT PAULNo ratings yet

- 2.1 Kardex A SALASDocument7 pages2.1 Kardex A SALASCristofer Edgard Ivan Romero HuertaNo ratings yet

- Fit Symbol 50H8/d9 100H7/ 60 /h12Document21 pagesFit Symbol 50H8/d9 100H7/ 60 /h12Prajwal ShakyaNo ratings yet

- Solutions Hd605Document1 pageSolutions Hd605DenosisNo ratings yet

- DOSIFDocument14 pagesDOSIFJuan QmNo ratings yet

- September Hannan Accounts Sr. No. Date Salary Labor Playment TotalDocument15 pagesSeptember Hannan Accounts Sr. No. Date Salary Labor Playment TotalhasanshafieNo ratings yet

- Sample SPC ADocument4 pagesSample SPC ADaday IskandarNo ratings yet

- Date Gicre (S1) Closing Icicigi (S2) Closing Spread Differential RatioDocument3 pagesDate Gicre (S1) Closing Icicigi (S2) Closing Spread Differential RatioMnvd prasadNo ratings yet

- Fa2 Slides PDFDocument19 pagesFa2 Slides PDFR ANo ratings yet

- RMG Building LoadDocument1 pageRMG Building LoadShazid-ul Alam ShishirNo ratings yet

- Force & Acceleration Spectral Test Levels Calculator: 9.0 Lbs Test Article Mass 1.0Document8 pagesForce & Acceleration Spectral Test Levels Calculator: 9.0 Lbs Test Article Mass 1.0AhmadMoaazNo ratings yet

- Investor Services - Futures, Clearing and Collateral: Euro (CME)Document2 pagesInvestor Services - Futures, Clearing and Collateral: Euro (CME)sirdquantsNo ratings yet

- Bar Chart Without Holidays&SundaysDocument44 pagesBar Chart Without Holidays&SundaysRenzo AguilarNo ratings yet

- Pricing Sheet3Document10 pagesPricing Sheet3Suraj Srivatsav.SNo ratings yet

- E-Reload System Transaction Summary ReportDocument9 pagesE-Reload System Transaction Summary ReportsueenNo ratings yet

- ZZ La Curva de Peso 2016Document42 pagesZZ La Curva de Peso 2016Graciela SosaNo ratings yet

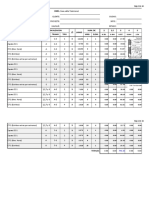

- Aitp - It Form Version 2017.1 - OriginalDocument15 pagesAitp - It Form Version 2017.1 - OriginalGuna SeelanNo ratings yet

- Customer Report 1663244873838Document3 pagesCustomer Report 1663244873838p1 GamerNo ratings yet

- Case Study - 175 TPH Coal Fired AFBC BoilerDocument11 pagesCase Study - 175 TPH Coal Fired AFBC BoilerKsatishpavanNo ratings yet

- Date Gicre (S1) Closing Icicigi (S2) Closing Spread Differential RatioDocument3 pagesDate Gicre (S1) Closing Icicigi (S2) Closing Spread Differential RatioFredNo ratings yet

- 5 Axis MachinesDocument33 pages5 Axis MachinesgsNo ratings yet

- C2 Power ChartDocument241 pagesC2 Power ChartRishad Mubtasim JaberNo ratings yet

- SergesrtrtDocument8 pagesSergesrtrtRizalBahtiarNo ratings yet

- NO Date Aset Cash Prepaid Rent: Acounting EquationDocument3 pagesNO Date Aset Cash Prepaid Rent: Acounting EquationvalentinoNo ratings yet

- NCEE Reações Nas EstacasDocument1 pageNCEE Reações Nas EstacasGustavoBormannNo ratings yet

- EQ-502 2D Frame Truss Matrix CalculatorDocument6 pagesEQ-502 2D Frame Truss Matrix Calculatoradpanfeq100% (4)

- Ships, Skills, Items Prices and More Finado BSGODocument238 pagesShips, Skills, Items Prices and More Finado BSGOHardzaqueroNo ratings yet

- CARDÁPIO GASPAR ATUALIZADO 1.1 - CompressedDocument1 pageCARDÁPIO GASPAR ATUALIZADO 1.1 - CompressedRoni RigoniNo ratings yet

- Assignment 2Document24 pagesAssignment 2V Min SongNo ratings yet

- LelDocument5 pagesLelPaolo sebastian LeonardoNo ratings yet

- ITE Tutorials Chapter 2Document3 pagesITE Tutorials Chapter 2Teresa TanNo ratings yet

- June Dec10Document2 pagesJune Dec10Dushyant ParikhNo ratings yet

- Unidades A Flote 2020Document6 pagesUnidades A Flote 2020saul rodriguez padronNo ratings yet

- Mod-4 ProblemsDocument4 pagesMod-4 ProblemsSaalif RahmanNo ratings yet

- Assignment Data and Information - 2022Document3 pagesAssignment Data and Information - 2022Hanna AjonNo ratings yet

- Date Gicre (S1) Closing Icicigi (S2) Closing Spread Differential RatioDocument3 pagesDate Gicre (S1) Closing Icicigi (S2) Closing Spread Differential RatioNarender sharmaNo ratings yet

- Summary ReportDocument16 pagesSummary Reportsyed kashif pervezNo ratings yet

- Generador de AceroDocument64 pagesGenerador de AceroJuan Carlos PedrazaNo ratings yet

- Wp-021 Borntech: Tanggal Engine Total H/M Cumm H/M RPM H/M Awal H/M AkhirDocument2 pagesWp-021 Borntech: Tanggal Engine Total H/M Cumm H/M RPM H/M Awal H/M AkhirAndani Cakti PrasetyaNo ratings yet

- WP 021 Borntech April 2017Document2 pagesWP 021 Borntech April 2017Andani Cakti PrasetyaNo ratings yet

- Anev 3P - 4W RevisiDocument6 pagesAnev 3P - 4W RevisiMuhammad Nur HidNo ratings yet

- ECS Smith Chart PDFDocument1 pageECS Smith Chart PDFMehul ShahNo ratings yet

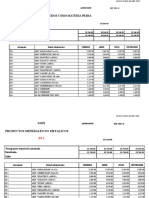

- Market Price Report: Gold (Bullion, in USD) Bullion (For Silver and Gold)Document5 pagesMarket Price Report: Gold (Bullion, in USD) Bullion (For Silver and Gold)theindianfaustNo ratings yet

- Mess November, 09Document15 pagesMess November, 09Piyal HossainNo ratings yet

- Cross Exmen de FluidosDocument19 pagesCross Exmen de FluidosJoselin Santiago GonzalesNo ratings yet

- Lingua LatinaDocument31 pagesLingua LatinaMariamUngiadzeNo ratings yet

- Model: P830 Series (316L Type) : High Purity Pressure Gauge (BA Grade)Document6 pagesModel: P830 Series (316L Type) : High Purity Pressure Gauge (BA Grade)민성규No ratings yet

- 21000689 - Nguyễn Xuân LợiDocument10 pages21000689 - Nguyễn Xuân LợiTran DuNo ratings yet

- Most Common Petrophysical Scales Curve Scale Most To Least CommonDocument2 pagesMost Common Petrophysical Scales Curve Scale Most To Least CommonakNo ratings yet

- Pavimentación en Zona de Vias de Acceso Y Estacionamiento Taller de Mantenim. Curva AvanceDocument2 pagesPavimentación en Zona de Vias de Acceso Y Estacionamiento Taller de Mantenim. Curva AvanceVictor Pablo Cantaro MelgarejoNo ratings yet

- Costo Diario de Excavadoras Al 10-10-19 - 1Document22 pagesCosto Diario de Excavadoras Al 10-10-19 - 1Alvaro GuerreroNo ratings yet

- Prussians: 1866 BohemiaDocument7 pagesPrussians: 1866 Bohemiadoorman46No ratings yet

- Listing & DelistingDocument3 pagesListing & DelistingVivek KavtaNo ratings yet

- Deal Mechanics: 1) PRE-MARKETING (Length: 2-4 Weeks)Document3 pagesDeal Mechanics: 1) PRE-MARKETING (Length: 2-4 Weeks)Vivek KavtaNo ratings yet

- Notes: 1. Two-Period Return Will Be Geometric Mean (Average) of Two One-Period Return'Document1 pageNotes: 1. Two-Period Return Will Be Geometric Mean (Average) of Two One-Period Return'Vivek KavtaNo ratings yet

- MS Excel Interview Questions and AnswersDocument4 pagesMS Excel Interview Questions and AnswersVivek Kavta100% (1)

- Simple Interest: Amount 7500Document4 pagesSimple Interest: Amount 7500Vivek KavtaNo ratings yet

- Accounting Interview Questions: Corporate Finance Institute®Document18 pagesAccounting Interview Questions: Corporate Finance Institute®Vivek KavtaNo ratings yet

- Chapter #2: Exercise Price or Strike PriceDocument5 pagesChapter #2: Exercise Price or Strike PriceVivek KavtaNo ratings yet

- Chapter #1Document4 pagesChapter #1Vivek KavtaNo ratings yet

- Budgeting NotesDocument3 pagesBudgeting NotesVivek KavtaNo ratings yet

- Fintech NotesDocument5 pagesFintech NotesVivek KavtaNo ratings yet

- Credit Risk ManagementDocument6 pagesCredit Risk ManagementVivek KavtaNo ratings yet

- Big Data NotesDocument4 pagesBig Data NotesVivek KavtaNo ratings yet

- Blockchain Technology (Distributed Ledger Technology)Document4 pagesBlockchain Technology (Distributed Ledger Technology)Vivek KavtaNo ratings yet