Professional Documents

Culture Documents

"Extra Costs": ENTER PRODUCT DETAILS (Delete The Lines That Are Not Needed.)

Uploaded by

callraza19Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

"Extra Costs": ENTER PRODUCT DETAILS (Delete The Lines That Are Not Needed.)

Uploaded by

callraza19Copyright:

Available Formats

IncoDocs' Landed Cost Calculator. Create your sales and shipping documents at www.incodocs.

com

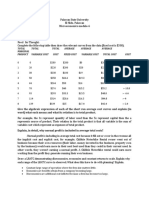

LANDED COST CALCULATED BY CUBIC SIZE

Enter the fields that are in green, and the Landed Cost will be calculated in the bottom table.

INCOTERM FOB "EXTRA COSTS" "Extra Costs" is the total of all seafreight + local import charges,

Must be your Local Currency customs clearance, trucking etc (not including import duty and taxes)

Check this link

BUY CURRENCY USD SEAFREIGHT $800.00 AUD

Supplier's sell currency

LOCAL CURRENCY AUD TOTAL IMPORT COSTS $2,200.00 AUD IMPORT TAX 10 %

Your Local Currency

EXCHANGE RATE 0.75 TOTAL EXTRA COSTS $3,000.00 AUD

Check this link

ENTER PRODUCT DETAILS (Delete the lines that are not needed.)

CODE / DESC. DUTY RATE UNIT BUY PRICE QTY WEIGHT (KG) WEIGHT CUBIC (M3) CUBIC Check this link for HS Code Classification (US Only)

(%) TTL TTL

PRODUCT 1 5 EACH $122.50 120 19 2280 0.015 1.8

PRODUCT 2 2.5 EACH $95.30 150 25.8 3870 0.05 7.5

PRODUCT 3 5 EACH $109.55 200 14 2800 0.02 4

PRODUCT 4 7.5 EACH $55.80 220 9 1980 0.05 11

PRODUCT 5 7.5 EACH $27.90 80 13 1040 0.03 2.4

TOTALS 11970 KGS 26.7 M3

LANDED COST DETAILS (This is a breakdown of your Landed Cost. Landed Cost is highlighted in green.)

CODE / DESC. BUY PRICE BUY PRICE "EXTRA COSTS" DUTY LANDED UNIT TAX QTY LANDED TTL TAX TTL

AMOUNT COST (EX)

PRODUCT 1 $122.50 USD $163.33 AUD $1.69 $6.13 $171.14 EACH $17.11 120 $20,537.25 $2,053.72

PRODUCT 2 $95.30 USD $127.07 AUD $5.62 $2.38 $135.07 EACH $13.51 150 $20,260.07 $2,026.01

PRODUCT 3 $109.55 USD $146.07 AUD $2.25 $5.48 $153.79 EACH $15.38 200 $30,758.27 $3,075.83

PRODUCT 4 $55.80 USD $74.40 AUD $5.62 $4.19 $84.20 EACH $8.42 220 $18,524.66 $1,852.47

PRODUCT 5 $27.90 USD $37.20 AUD $3.37 $2.09 $42.66 EACH $4.27 80 $3,413.06 $341.31

This Calculator is to be used as a guide only - it is your responsibility to check the accuracy of your Landed Cost. TOTALS $93,493.31 $9,349.33

Create your sales and shipping documents at www.incodocs.com

IncoDocs' Landed Cost Calculator. Create your sales and shipping documents at www.incodocs.com

HOW TO USE THE LANDED COST CALCULATOR:

Calculating the Landed Cost of products is quite difficult. This calculator is to be used as a guide only – it is your responsibility to check

the accuracy of your Landed Cost.

What to do:

Note – Are your products larger or heavier?

If 1m3 of product is less than 1000kg, use this first tab (this will split up additional costs over the size of your products).

If 1m3 of product is more than 1000kg, use the second tab (this will split up additional costs over the weight of your products).

Enter the fields marked in green.

Enter the Incoterm. Refer the link.

Enter Buy Currency (supplier’s currency), your Local Currency and the Exchange Rate that you secured when you made your International

payment. Refer the link.

Convert your Seafreight Costs and Total Import Costs (these include local port handling charges, customs clearance fees, documentation,

marine insurance, trucking etc) to your Local Currency. Enter them in the green fields.

Find your product’s HS Code and confirm the import Duty Rate (percentage per product) that applies to each product. Refer this link.

Confirm and enter the Import Tax (applies to all products) in the country of import.

Enter the products details into each row. You must delete each row that is not required. If you want to add more product lines, insert a

new row. You will have to make sure you drag the cell calculations into the new rows.

The Landed Cost per product will display in the bottom table in green.

Note – if you want to add a markup or margin to your Landed Cost, use the page on the right ---->

This Calculator is to be used as a guide only - it is your responsibility to check the accuracy of your Landed Cost.

Create your sales and shipping documents at www.incodocs.com

IncoDocs' Landed Cost Calculator. Create your sales and shipping documents at www.incodocs.com

ADD MARGIN TO YOUR LANDED COST

Use this page to enter a Margin to your cost price. Enter the Margin in the Green field below:

LANDED SELL / UNIT SELL / UNIT PROFIT / UNIT

CODE / DESC.

COST(EX TAX)

UNIT MARGIN % (EX TAX) TTL (EX TAX)

PROFIT TTL

PRODUCT 1 $171.14 EACH 10 % $190.16 $22,819.16 $19.02 $2,281.92

PRODUCT 2 $135.07 EACH 15 % $158.90 $23,835.38 $23.84 $3,575.31

PRODUCT 3 $153.79 EACH 20 % $192.24 $38,447.84 $38.45 $7,689.57

PRODUCT 4 $84.20 EACH 10 % $93.56 $20,582.95 $9.36 $2,058.30

PRODUCT 5 $42.66 EACH 15 % $50.19 $4,015.37 $7.53 $602.31

TOTALS $109,700.70 $16,207.39

Create your sales and shipping documents at www.incodocs.com

IncoDocs' Landed Cost Calculator. Create your sales and shipping documents at www.incodocs.com

LANDED COST CALCULATED BY WEIGHT

Enter the fields that are in green, and the Landed Cost will be calculated in the bottom table.

INCOTERM FOB "EXTRA COSTS" "Extra Costs" is the total of all seafreight + local import charges,

Must be your Local Currency customs clearance, trucking etc (not including import duty and taxes)

Check this link

BUY CURRENCY USD SEAFREIGHT $800.00 AUD

Supplier's sell currency

LOCAL CURRENCY AUD TOTAL IMPORT COSTS $2,200.00 AUD IMPORT TAX 10 %

Your Local Currency

EXCHANGE RATE 0.75 TOTAL EXTRA COSTS $3,000.00 AUD

Check this link

ENTER PRODUCT DETAILS (Delete the lines that are not needed.)

CODE / DESC. DUTY RATE UNIT BUY PRICE QTY WEIGHT (KG) WEIGHT CUBIC (M3) CUBIC Check this link for HS Code Classification (US Only)

(%) TTL TTL

PRODUCT 1 5 EACH $122.50 120 19 2280 0.015 1.8

PRODUCT 2 2.5 EACH $95.30 150 25.8 3870 0.05 7.5

PRODUCT 3 5 EACH $109.55 200 14 2800 0.02 4

PRODUCT 4 7.5 EACH $55.80 220 9 1980 0.05 11

PRODUCT 5 7.5 EACH $27.90 80 13 1040 0.03 2.4

TOTALS 11970 KGS 26.7 M3

LANDED COST DETAILS (This is a breakdown of your Landed Cost. Landed Cost is highlighted in green.)

CODE / DESC. BUY PRICE BUY PRICE "EXTRA COSTS" DUTY LANDED UNIT TAX QTY LANDED TTL TAX TTL

AMOUNT COST (EX)

PRODUCT 1 $122.50 USD $163.33 AUD $4.76 $6.13 $174.22 EACH $17.42 120 $20,906.43 $2,090.64

PRODUCT 2 $95.30 USD $127.07 AUD $6.47 $2.38 $135.92 EACH $13.59 150 $20,387.30 $2,038.73

PRODUCT 3 $109.55 USD $146.07 AUD $3.51 $5.48 $155.05 EACH $15.51 200 $31,010.59 $3,101.06

PRODUCT 4 $55.80 USD $74.40 AUD $2.26 $4.19 $80.84 EACH $8.08 220 $17,784.94 $1,778.49

PRODUCT 5 $27.90 USD $37.20 AUD $3.26 $2.09 $42.55 EACH $4.26 80 $3,404.05 $340.41

TOTALS $93,493.31 $9,349.33

Create your sales and shipping documents at www.incodocs.com

IncoDocs' Landed Cost Calculator. Create your sales and shipping documents at www.incodocs.com

HOW TO USE THE LANDED COST CALCULATOR:

What to do:

Enter the fields marked in green.

Enter the Incoterm. Refer the link.

Enter Buy Currency (supplier’s currency), your Local Currency and the Exchange Rate that you secured when you made your International

payment. Refer the link.

Convert your Seafreight Costs and Total Import Costs (these include local port handling charges, customs clearance fees, documentation,

marine insurance, trucking etc) to your Local Currency. Enter them in the green fields.

Find your product’s HS Code and confirm the import Duty Rate (percentage per product) that applies to each product. Refer this link.

Confirm and enter the Import Tax (applies to all products) in the country of import.

Enter the products details into each row. You must delete each row that is not required. If you want to add more product lines, insert a

new row. You will have to make sure you drag the cell calculations into the new rows.

The Landed Cost per product will display in the bottom table in green.

Note – if you want to add a markup or margin to your Landed Cost, use the page on the right ---->

This Calculator is to be used as a guide only - it is your responsibility to check the accuracy of your Landed Cost.

Create your sales and shipping documents at www.incodocs.com

IncoDocs' Landed Cost Calculator. Create your sales and shipping documents at www.incodocs.com

ADD MARGIN TO YOUR LANDED COST

Use this page to enter a Margin to your cost price. Enter the Margin in the Green field below:

LANDED SELL / UNIT SELL / UNIT PROFIT / UNIT

CODE / DESC.

COST(EX TAX)

UNIT MARGIN % (EX TAX) TTL (EX TAX)

PROFIT TTL

PRODUCT 1 $174.22 EACH 10 % $193.58 $23,229.37 $19.36 $2,322.94

PRODUCT 2 $135.92 EACH 15 % $159.90 $23,985.06 $23.99 $3,597.76

PRODUCT 3 $155.05 EACH 20 % $193.82 $38,763.23 $38.76 $7,752.65

PRODUCT 4 $80.84 EACH 10 % $89.82 $19,761.05 $8.98 $1,976.10

PRODUCT 5 $42.55 EACH 15 % $50.06 $4,004.77 $7.51 $600.71

TOTALS $109,743.47 $16,250.16

Create your sales and shipping documents at www.incodocs.com

You might also like

- Book1 Group Act5110Document9 pagesBook1 Group Act5110SAMNo ratings yet

- Ch11 Tool KitDocument368 pagesCh11 Tool KitRoy HemenwayNo ratings yet

- Group Activity: University of People BUS 5110 Group Activity Case StudyDocument11 pagesGroup Activity: University of People BUS 5110 Group Activity Case Studychristian allos100% (14)

- Case Study Topics5and6Document11 pagesCase Study Topics5and6team podivNo ratings yet

- Danshui PlantDocument5 pagesDanshui PlantSabbirAhmedNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Ima Case Study PDFDocument35 pagesIma Case Study PDFHimanshi Aplani100% (1)

- Chapter 6Document16 pagesChapter 6Novrika DaniNo ratings yet

- Sneaker 2013 ExcelDocument8 pagesSneaker 2013 ExcelMehwish Pervaiz67% (6)

- Business Concept:: Key Success FactorsDocument5 pagesBusiness Concept:: Key Success FactorsRoxan AssemienNo ratings yet

- Input Form: Input For Venture Guidance AppraisalDocument7 pagesInput Form: Input For Venture Guidance AppraisalgenergiaNo ratings yet

- DAIBB Foreign Exchange-2 - 01712 043880 PDFDocument15 pagesDAIBB Foreign Exchange-2 - 01712 043880 PDFashraf294100% (2)

- MGMT 3053 Exam 2018 PaperDocument8 pagesMGMT 3053 Exam 2018 PaperSamanthaNo ratings yet

- Landed Cost CalculatorDocument6 pagesLanded Cost CalculatorMi Mi100% (2)

- Investments Bodie Chapter 25 SolutionsDocument8 pagesInvestments Bodie Chapter 25 SolutionstaysisongNo ratings yet

- AP Macroeconomics - Unit 8 - 8.1 Final Exam QuestionsDocument19 pagesAP Macroeconomics - Unit 8 - 8.1 Final Exam QuestionsJame Chan33% (6)

- Material Ledger - Actual Costing CongratulationDocument39 pagesMaterial Ledger - Actual Costing CongratulationAmmar Arif100% (1)

- Inventory Valuation TutorialDocument4 pagesInventory Valuation TutorialSalma HazemNo ratings yet

- Vision 2041Document15 pagesVision 2041Khadija Akter100% (1)

- Landed Cost Sheet Excel TemplateDocument6 pagesLanded Cost Sheet Excel TemplateMario Rueda FdzNo ratings yet

- Landed Cost CalculatorDocument12 pagesLanded Cost Calculatorvaddana haisocheatNo ratings yet

- Tonnage Calc-4Document12 pagesTonnage Calc-4Emba MadrasNo ratings yet

- Alejandro Betancur: Cliente: Atn Paramo PresentaDocument1 pageAlejandro Betancur: Cliente: Atn Paramo PresentaAlejandro BetancurNo ratings yet

- 1perhitungan Soal SPM 2Document37 pages1perhitungan Soal SPM 2RamaNo ratings yet

- Solución BLACKHEATHDocument7 pagesSolución BLACKHEATHLucia QuevedoNo ratings yet

- Module 6 MicroeconomicsDocument3 pagesModule 6 MicroeconomicsChristian VillanuevaNo ratings yet

- Costing By-Product and Joint ProductsDocument34 pagesCosting By-Product and Joint ProductsArika KameliaNo ratings yet

- Costing By-Product and Joint ProductsDocument36 pagesCosting By-Product and Joint ProductseltantiNo ratings yet

- Breakeven Analysis With Charts1Document1 pageBreakeven Analysis With Charts1api-377773033No ratings yet

- Faculty of Management Science: Name: Fazil Ahmed Sec: B STUDENT ID: (27-2019)Document6 pagesFaculty of Management Science: Name: Fazil Ahmed Sec: B STUDENT ID: (27-2019)fazil ahmedNo ratings yet

- Extra PracticeDocument4 pagesExtra PracticevalderramamarysabelNo ratings yet

- Sales Price: Mark-Up On Total Variable Cost Per BatchDocument8 pagesSales Price: Mark-Up On Total Variable Cost Per BatchNikita SharmaNo ratings yet

- Jungle Scouts Profit Margin BreakdownDocument14 pagesJungle Scouts Profit Margin BreakdownSivaraja Gopinathan0% (1)

- Jan. Feb. Mar. Apr. May: Sensitivity: LNT Construction Internal UseDocument3 pagesJan. Feb. Mar. Apr. May: Sensitivity: LNT Construction Internal UseAkshay WahalNo ratings yet

- Case Study 1Document5 pagesCase Study 1henry nnoromNo ratings yet

- The Cost of Production: by Group-7Document25 pagesThe Cost of Production: by Group-7sheetalmoreyNo ratings yet

- Product Mix - 50% For Large and 50% For MediumDocument2 pagesProduct Mix - 50% For Large and 50% For Mediumemem buezaNo ratings yet

- 3 Year Sales ForecastDocument24 pages3 Year Sales ForecastM. Yusuf HermawanNo ratings yet

- Base CaseDocument9 pagesBase Casechanapa klongpobsukNo ratings yet

- Financial Plan SheetDocument7 pagesFinancial Plan Sheetkram ichuNo ratings yet

- 06 PA - Inventory FIFO-LIFO-Avg (09.10.22)Document10 pages06 PA - Inventory FIFO-LIFO-Avg (09.10.22)Meylita ViviyaniNo ratings yet

- IC-Sales-Tracker تتبع مبيعاتDocument3 pagesIC-Sales-Tracker تتبع مبيعاتعجلة الاكسسواراتNo ratings yet

- Cop Beef FeedlotfinishingDocument18 pagesCop Beef Feedlotfinishinganthonius70No ratings yet

- Tutorial ContDocument25 pagesTutorial ContJJ Rivera75% (4)

- This Bud's For Who The Battle For Anheuser-Busch, Spreadsheet SupplementDocument74 pagesThis Bud's For Who The Battle For Anheuser-Busch, Spreadsheet SupplementRikhabh DasNo ratings yet

- Nguyễn Khánh Hiền - additional exerciseDocument8 pagesNguyễn Khánh Hiền - additional exerciseANH NGUYEN THI THUYNo ratings yet

- Problem 8-35 Hansen Mowen Cornerstone of Managerial AccountingDocument4 pagesProblem 8-35 Hansen Mowen Cornerstone of Managerial Accountingwiwit_karyantiNo ratings yet

- Ampliz 3 Year Sales Forecast TemplateDocument25 pagesAmpliz 3 Year Sales Forecast TemplateRABIATUL ADAWIYAHNo ratings yet

- Chapter 11 Allocation of Joint Costs and Accounting For by ProductDocument18 pagesChapter 11 Allocation of Joint Costs and Accounting For by ProductCelestaire LeeNo ratings yet

- BepDocument2 pagesBepOkky Raymond CorneliusNo ratings yet

- CDM TemplateDocument9 pagesCDM TemplateRajshri SaranNo ratings yet

- Abcor MedhaDocument11 pagesAbcor MedharamanNo ratings yet

- Chapter 11 Allocation of Joint Costs and Accounting For by ProductDocument18 pagesChapter 11 Allocation of Joint Costs and Accounting For by ProductCelestaire LeeNo ratings yet

- Absorption and Variable CostingDocument3 pagesAbsorption and Variable CostingMohtasim Bin HabibNo ratings yet

- Sales Tracker TemplateDocument9 pagesSales Tracker TemplateAhmed Saeed KhanNo ratings yet

- Break Even PointsDocument21 pagesBreak Even PointsPrashant VermaNo ratings yet

- A02 BcaDocument103 pagesA02 BcaAlejandro RamosNo ratings yet

- H20124 - Ajay VermaDocument13 pagesH20124 - Ajay VermaajayNo ratings yet

- Designer Lamp Project Blank SpreadsheetDocument4 pagesDesigner Lamp Project Blank SpreadsheetAnna BudaevaNo ratings yet

- Ch24sol PDFDocument5 pagesCh24sol PDFSandeep MishraNo ratings yet

- Fixed and Variable Cost Calculator - Sheet1Document1 pageFixed and Variable Cost Calculator - Sheet1api-657656552No ratings yet

- FM and Dupont of GenpactDocument11 pagesFM and Dupont of GenpactKunal GarudNo ratings yet

- According To The Case, The Distribution Method Is Shown BelowDocument4 pagesAccording To The Case, The Distribution Method Is Shown BelowrizqighaniNo ratings yet

- LM Osburn SandyDocument14 pagesLM Osburn Sandyapi-514989921No ratings yet

- Dynatronics CaseDocument6 pagesDynatronics CaseScribdTranslationsNo ratings yet

- mgmt193 Lcma Stocks Marr Taylor 1Document6 pagesmgmt193 Lcma Stocks Marr Taylor 1api-644489994No ratings yet

- Lecture No03Document56 pagesLecture No03Cute Cats OverloadedNo ratings yet

- Solution SheetDocument4 pagesSolution Sheetsatishreddy71No ratings yet

- FX Rates Sheet Treasury & Capital Markets Group: Ready Transaction Rates Indicative FBP RatesDocument1 pageFX Rates Sheet Treasury & Capital Markets Group: Ready Transaction Rates Indicative FBP Ratescallraza19No ratings yet

- Notes On Clauses: CUSTOMS ACT, 1969 (IV OF 1969)Document37 pagesNotes On Clauses: CUSTOMS ACT, 1969 (IV OF 1969)callraza19No ratings yet

- BUCP - Ashraf Sb. ConsignmentsDocument10 pagesBUCP - Ashraf Sb. Consignmentscallraza19No ratings yet

- Cambridge International Advanced Subsidiary and Advanced LevelDocument12 pagesCambridge International Advanced Subsidiary and Advanced LevelZayed BoodhooNo ratings yet

- MAS (Shuffled)Document39 pagesMAS (Shuffled)Raymart SantiagoNo ratings yet

- Meaning and Calculation of Foreign Exchange by Sanya Juneja Pgdim 11-12Document10 pagesMeaning and Calculation of Foreign Exchange by Sanya Juneja Pgdim 11-12Sanya JunejaNo ratings yet

- ECON 461 Final ExamDocument18 pagesECON 461 Final Examttran198450% (2)

- Evolution To International BankingDocument28 pagesEvolution To International BankingSupriya Pawar100% (7)

- IBF NotesDocument35 pagesIBF NotesAsad Shah100% (1)

- CFA Level1 2017 Mock ExamDocument75 pagesCFA Level1 2017 Mock ExamMauricio CabreraNo ratings yet

- List A List BDocument6 pagesList A List BcherishletteNo ratings yet

- Problem Set 3 Foreign Exchange MarketDocument5 pagesProblem Set 3 Foreign Exchange MarketSumit GuptaNo ratings yet

- Mirza Nasir Jahan MehdiDocument18 pagesMirza Nasir Jahan MehdiAsad Abbas KhadimNo ratings yet

- Community Inclusion CurrenciesDocument27 pagesCommunity Inclusion CurrenciesalNo ratings yet

- Transtutors005 ch11 QuestionsDocument25 pagesTranstutors005 ch11 QuestionsAstha GoplaniNo ratings yet

- WMM - CF - 48h Iom Revision 3Document170 pagesWMM - CF - 48h Iom Revision 3Sandison stlNo ratings yet

- 6.97 Turkish Lira: People Also AskDocument1 page6.97 Turkish Lira: People Also Askmehmet canNo ratings yet

- CFA L1 FinQuizmockv12017juneamquestionsDocument39 pagesCFA L1 FinQuizmockv12017juneamquestionsAndre NizarNo ratings yet

- Bergsten & Williamson - Dollar Overvaluation and The World Economy (2003)Document331 pagesBergsten & Williamson - Dollar Overvaluation and The World Economy (2003)PatriotiKsNo ratings yet

- AssignmentDocument13 pagesAssignmentSmashed PotatoNo ratings yet

- Chapter 6. Forgein Currency TransactionsDocument45 pagesChapter 6. Forgein Currency TransactionsAnh Nguyen MinhNo ratings yet

- Macroeconomics II: Net-Export, International Trade and Real Exchange RateDocument39 pagesMacroeconomics II: Net-Export, International Trade and Real Exchange RateSzabó TamásNo ratings yet

- Measuring and Managing Economic ExposureDocument22 pagesMeasuring and Managing Economic ExposureMerryNo ratings yet

- Reliance Industries in ChinaDocument24 pagesReliance Industries in ChinaSanddeepTirukoveleNo ratings yet

- Chapter 10Document42 pagesChapter 10Nguyen NguyenNo ratings yet

- Global SAP Implementation Case Study For PDFDocument28 pagesGlobal SAP Implementation Case Study For PDFSid MehtaNo ratings yet