Professional Documents

Culture Documents

India Bengaluru Residential Q4 2020 v2

Uploaded by

swopnilrOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

India Bengaluru Residential Q4 2020 v2

Uploaded by

swopnilrCopyright:

Available Formats

M A R K E T B E AT

BENGALURU

Residential Q4 2020

Lower launches during the quarter, completion remains the focus

Despite Bengaluru being one of the few metros with a relatively manageable inventory overhang and the city witnessing a gradual revival in its housing demand during Q4,

developers released less supply in the market during the last quarter of the year. While Q3 had seen an increase in unit launches from that in Q2, a marginal q-o-q drop of 4%

3,516 NEW UNIT LAUNCHES IN Q4 2020

was recorded with 3,516 units getting launched in Q4. This adds up to a total of 12,470 unit launches during the year, which marks a 57% drop y-o-y when compared to 2019

numbers. With a perceptible increase in buyer enquiries for ready-to-move in projects during the pandemic, projects with plan sanctions are also not being launched currently

since developers are focusing on completion and sale of their existing inventory. While the mid-segment projects continued to dominate the quarterly (59%) and annual (70%)

launch numbers, the affordable sector witnessed a revival in supply in Q4 post the pandemic, accounting for 40% and 25% of the quarterly and annual unit launches in 2020,

59% SHARE OF MID SEGMENT IN

NEW UNIT LAUNCHES (Q4 2020)

respectively. Rising demand for plotted housing and villa projects has also been a notable trend during the last two quarters of 2020, resulting in mid-sized project launches in

the said category at peripheral locations like Chikballapur, off Sarjapur Road, Devanahalli, Anekal and Uttarahalli among others. With larger unit size of apartments being the

flavour of the season and with increased demand for extra space, developers are trying to introduce higher proportion of 2.5 & 3 BHKs in their newly launched projects. While

55% and 41% of total units launched during the quarter were of 2.5/3 BHK and 1BHK respectively, developers in the city have further plans of increasing the former’s share

41% SHARE OF AFFORDABLE SEGMENT

IN NEW UNIT LAUNCHES (Q4 2020)

from approx. 55-60% to 70-75% post the pandemic. Furthermore, developers are also trying to fit in an additional room as workstation or study area for kids contrary to the

reduction in apartment sizes that was being ensured to increase affordability over the last few years, before the pandemic. With higher focus of consumers being on quality

and on-time delivery assurance, launches continue to be largely driven by medium to large scale branded developers accounting for around 70-75% of the total unit launches

in 2019 as well as in 2020. Medium scale developers of local repute who launched projects in Q4 at peripheral locations were Adarsh Group, Casagrand Builders, DS MAX

Properties and Ramky Group, among others. However, with restricted launches during the year and with developers continuing to aim at lower launches over the next 6-9

months, increased demand for quality ready-to-move in projects of reputed developers might result in limited stock of such ready properties in the city over the medium term.

Revival in demand amid changing buyer preferences

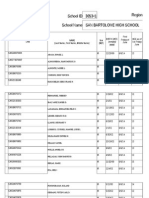

RESIDENTIAL INDICATORS Q4 2020

While demand in the high-end and luxury segment continues to get driven largely by cash-rich buyers and NRIs/investors who intend to get great bargain deals during the

current slowdown, the mid and affordable segment projects witnessed a spike in demand due to increased interest among end users in the 25-40 years age group to invest in

Y-O-Y 12-Months residential properties. This has been a perceptible shift from the trend till last year when a major proportion of this population were reluctant to invest in property since pocket

Change Forecast friendly options were mostly available at outskirt locations. Work from home till H1 2021, lower bank interest rates (mostly below 7%), need for spacious homes at less

crowded locations irrespective of distance from workplace, tech enabled home offerings by developers, state government declaring lower registration rates for properties below

INR 35 lakh and discounts and freebies being offered by developers have all resulted in higher sales conversion of enquiries now, than before the pandemic. Developers

New Launches adopting an omni-channel approach of conventional physical site visits, virtual walkthroughs and launch of their projects through social media platforms to reach the customers

has further enabled a recovery in demand post the pandemic. A shift in preference of mid segment target clientele for apartments in gated communities than standalone or

smaller complexes has also resulted in higher enquiries (at 60-65% of pre-COVID levels) for such gated projects in the core and peripheral areas of the city, basis the

integrated services they offer. Furthermore, Bengaluru’s realistic property prices in an end user driven market, availability of variety of options across price points, it’s

competitive edge in terms of prices, lower speculative investments and declining gap between demand and supply with launches being kept on hold by developers have all

Units Sold supported the residential sector’s prompt revival post the pandemic.

Resilient pricing likely to enable faster pace of recovery

Average Capital Despite the city seeing a 2-4% drop in property prices during Q2&Q3, resilient pricing structure and demand recovery has restricted any further price decline during the

quarter, except for a 1-2% drop at select peripheral locations. However, even with a higher sales conversion during the quarter, developers have continued to offer incentive

Values (INR/sf) schemes to boost sales and overcome liquidity issues. In terms of rental housing, while landlords have been offering lower security deposits and rental reductions to an extent

of 5-10% in select markets over the last two quarters, the percentage decline in rentals too has come down (2-3%) in Q4 since landlords at prime locations are optimistic of a

recovery in demand for rental homes with people returning to the city to continue their jobs amid partial reopening of offices. The rate of rental reduction has also reduced with

an increase in number of enquiries from tenants, who in the current scenario are considering an upgrade to better rental accommodation in their present budget, thereby

creating traction for the rental housing sector in the city.

SIGNIFICANT PROJECTS LAUNCHED IN Q4 2020

BUILDING LOCATION DEVELOPER UNITS LAUNCHED RATE*(INR/SF)

DS MAX Sahara Chikkanagamangala, Anekal DS MAX Properties 470 3,100

Casagrand Boulevard Phase II Chikkagubbi, Hennur Road Casagrand Builder Pvt Ltd 528 4,599

M A R K E T B E AT

BENGALURU

Residential Q4 2020

RENTAL VALUES AS OF Q4 2020 CAPITAL VALUES AS OF Q4 2020

AVERAGE QUOTED

QoQ CHANGE YoY SHORT TERM

AVERAGE QUOTED QoQ CHANGE YoY SHORT TERM SUBMARKET CAPITAL VALUE

SUBMARKET (%) (%) OUTLOOK

RENT (IND/MONTH) (%) (%) OUTLOOK (IND/SF)

High-end segment

High-end segment Central 18,000-30,000 0% 0%

Central 150,000-350,000 0% 0% South 9,000-12,500 0% 14%

East 7,500-11,500 0% 3%

South 60,000-120,000 0% 0%

North 8,000-12,500 0% 2%

East 85,000-300,000 0% 15% Mid segment

Central 9,500-15,000 0% 0%

North 70,000-200,000 0% 0%

East 4,600-5,800 0% -7%

Mid segment

South East 4,900-6,100 -1% -7%

Central 70,000-100,000 0% 0%

North 5,300-6,500 -1% -9%

South East 24,000-40,500 -2% -8% South 5,500-7,000 0% -4%

North West 23,000-33,000 0% -7% Off Central I 8,000-12,000 0% 0%

Off Central II 7,500 - 8,900 0% -4%

West 19,000-25,500 -3% -11%

North West 6,300-7,000 0% -7%

East 23,500-32,000 -2% -8% Far South 3,500-4,000 -2% -11%

West 3,800-4,400 -2% -11%

SIGNIFICANT PROJECTS COMPLETED IN Q4 2020

BUILDING LOCATION DEVELOPER UNITS LAUNCHED UNIT SIZE (SF)

Rohan Sharma

Jeevanadi Sampoorna Kodigehalli Jeevanadi Estates 128 1,207-1,816

Director, Research Services

DSR Waterscape Channasandra, Horamavu DSR infrastructure 334 1,179-1,752

+91 124 4695555 / rohan.sharma1@cushwake.com

SIGNIFICANT PROJECTS UNDER CONSTRUCTION-TO BE COMPLETED IN NEXT 12 MONTHS

Kapil Kanala

BUILDING LOCATION DEVELOPER UNITS LAUNCHED EXPECTED COMPLETION Senior Associate Director, Research Services

Sumadhura Eden Gardens Whitefield Sumadhura Infracon Pvt Ltd (Sumadhura 1,113 Q2 2021 +91 40 40405555 / kapil.kanala@ap.cushwake.com

Group)

Vaishnavi North 24 Hebbal Vaishnavi Group 150 Q3 2021

cushmanwakefield.com

Data collated from primary and secondary resources. Estimations are subject to change

* Rental and capital values have been depicted only for key submarkets

** Quoted capital value on carpet area based on agreement values which includes, Base Rate, Car Parking Charges, Internal Development Charges, etc.

The above values for high-end segment are for units typically of 2,000-4,000 sf

The above values for mid segment are for units typically of 1,600-2,000 sf

cushmanwakefield.com

Affordable housing has been defined as units with a carpet area of 60 sq.mt in metros / 90 sq.mt in non-metros and value up to INR 45 lakhs

A CUSHMAN & WAKEFIELD RESEARCH PUBLICATION

KEY T O SUBMARKET S Cushman & Wakefield (NYSE: CWK) is a leading global real estate services firm that

Mid Segment delivers exceptional value for real estate occupiers and owners. Cushman &

High-end Segment Central: Brunton Road, Artillery Road, Ali Askar Road, Cunningham Road Wakefield is among the largest real estate services firms with approximately 53,000

Central: Lavelle Road, Palace Cross Road, Off Cunningham East: W hitefield, Old Airport Road, Old Madras Road, Budigere Cross employees in 400 offices and 60 countries. In 2019, the firm had revenue of $8.8

Road, Ulsoor Road, Richmond Road, Sankey Road South-east: Sarjapur Road, Outer Ring Road (Marathahalli - Sarjapur), HSR Layout, Hosur Road billion across core services of property, facilities and project management, leasing,

South: Koramangala, Bannerghatta Road, JP Nagar, South: Jayanagar, J P Nagar, Kanakapura Road, Bannerghatta Road, BTM Layout, Banashankari capital markets, valuation and other services. To learn more, visit

Banashankari www.cushmanwakefield.com or follow @CushWake on Twitter.

North: Hebbal, Bellary Road, Yelahanka, Doddaballapur Road, Hennur Road, Thanisandra Road

Off Central: Frazer town, Benson Town, Richards Town, Off Central-I: Vasanth Nagar, Richmond Town, Indiranagar ©2020 Cushman & Wakefield. All rights reserved. The information contained within this report is

Dollars Colony Off Central-II: Cox Town, Frazer Town, Benson Town, etc. gathered from multiple sources believed to be reliable. The information may contain errors or

East: W hitefield, Old Airport Road North-west: Malleshwaram, Rajajinagar, Tumkur Road omissions and is presented without any warranty or representations as to its accuracy.

North: Hebbal, Jakkur, Devanahalli Far South: Electronic City, Attibele, Chandapur

North-west: Malleshwaram, Rajajinagar, Yeshwanthpu r West: Mysore Road, Uttarahalli Main Road, Magadi Road

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Fluoroscopy Initial TestDocument3 pagesFluoroscopy Initial Testthepharaoh1234No ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- NCP Risk For Bleeding Related To Decreased Platelet CountDocument2 pagesNCP Risk For Bleeding Related To Decreased Platelet CountKC Ignacio83% (24)

- SANAR Investment Proposition 260421Document18 pagesSANAR Investment Proposition 260421swopnilrNo ratings yet

- Business Profile (Company) of SKYLINE PROFITS PTE. LTD. (201903683G)Document4 pagesBusiness Profile (Company) of SKYLINE PROFITS PTE. LTD. (201903683G)swopnilrNo ratings yet

- 30M3 PSA Medical Oxygen Plant ProposalDocument10 pages30M3 PSA Medical Oxygen Plant ProposalswopnilrNo ratings yet

- FLUSARC 36kV - 630A - 25ka Maintenance Manual PDFDocument18 pagesFLUSARC 36kV - 630A - 25ka Maintenance Manual PDFJoey Real CabalidaNo ratings yet

- Taking Luxury To New Heights at Santacruz (E)Document8 pagesTaking Luxury To New Heights at Santacruz (E)swopnilrNo ratings yet

- Rising City SynopsisDocument3 pagesRising City SynopsisswopnilrNo ratings yet

- BKC - RentDocument1 pageBKC - RentswopnilrNo ratings yet

- Waaree Energies - R - 29122016Document4 pagesWaaree Energies - R - 29122016swopnilrNo ratings yet

- Godrej Trees BrochureDocument30 pagesGodrej Trees BrochureswopnilrNo ratings yet

- A New Age E-Learning and Knowledge Sharing PlatformDocument28 pagesA New Age E-Learning and Knowledge Sharing PlatformswopnilrNo ratings yet

- Sociology Review QuestionsDocument6 pagesSociology Review QuestionsNIYONSHUTI VIATEURNo ratings yet

- Toyota/Lexus U140E/F, U240E, U241E: Click On Part Numbers For Product Details or VisitDocument1 pageToyota/Lexus U140E/F, U240E, U241E: Click On Part Numbers For Product Details or Visitvipper king2012No ratings yet

- Testing and Commissioning Procedure: 2017 EDITIONDocument242 pagesTesting and Commissioning Procedure: 2017 EDITIONvin ssNo ratings yet

- Pile Hammer Delmag d12-42Document1 pagePile Hammer Delmag d12-42Jorge Rosero QuevedoNo ratings yet

- Draft - Model Chandigarh Rules Under RPWD Act, 2016Document32 pagesDraft - Model Chandigarh Rules Under RPWD Act, 2016Disability Rights AllianceNo ratings yet

- 02 TBS Lightning Protection System PDFDocument448 pages02 TBS Lightning Protection System PDFgilbertomjcNo ratings yet

- Fs Chapter I Vi ApprovalDocument119 pagesFs Chapter I Vi ApprovalPauline OrtegaNo ratings yet

- Form 1 Nutrition in Animals A Teacher - Co .KeDocument6 pagesForm 1 Nutrition in Animals A Teacher - Co .Kelydiaciru01No ratings yet

- PETRODETAILSDocument2 pagesPETRODETAILSAlexanderNo ratings yet

- Disease and IllnessDocument3 pagesDisease and IllnessAntonius Robby100% (1)

- Lost Youth Assignment-2Document2 pagesLost Youth Assignment-2api-363462333No ratings yet

- Chapter 3: Curriculum Design: The Teacher and The School Curriculum A Guide To Curriculum DevelopmentDocument14 pagesChapter 3: Curriculum Design: The Teacher and The School Curriculum A Guide To Curriculum Developmenthannah mari100% (1)

- Rasio EkstraksiDocument29 pagesRasio Ekstraksidevi enjelikaNo ratings yet

- People. Passion. Possibilities.: .30 .11 Thread Relief As RequiredDocument40 pagesPeople. Passion. Possibilities.: .30 .11 Thread Relief As RequiredFranciscoNo ratings yet

- Chapter 10Document14 pagesChapter 10Khorshedul IslamNo ratings yet

- Sf1 Cinderella JuneDocument60 pagesSf1 Cinderella JuneLaLa FullerNo ratings yet

- Obstetrical EmergencyDocument41 pagesObstetrical EmergencyDrPreeti Thakur ChouhanNo ratings yet

- Iso 27001 PDFDocument7 pagesIso 27001 PDFMonica MoreiraNo ratings yet

- The Perception of College Students About A Healthy Lifestyle and Its Effect On Their Health 2155 9600 1000437Document4 pagesThe Perception of College Students About A Healthy Lifestyle and Its Effect On Their Health 2155 9600 1000437onnNo ratings yet

- Apply Health, Safety and Security Procedures in The WorkplaceDocument9 pagesApply Health, Safety and Security Procedures in The WorkplaceRene EspenocillaNo ratings yet

- Character Strengths and Virtues A Handbook of Classification MindmapDocument1 pageCharacter Strengths and Virtues A Handbook of Classification MindmapJorge Luis Villacís NietoNo ratings yet

- C1 - C7 General Requirements For Equipment ErectionDocument24 pagesC1 - C7 General Requirements For Equipment ErectionephNo ratings yet

- I - Bba Office Management I - Bba Office ManagementDocument2 pagesI - Bba Office Management I - Bba Office ManagementRathna KumarNo ratings yet

- Metrel D.D. - Class A Power Quality AnalysersDocument7 pagesMetrel D.D. - Class A Power Quality AnalysersMonster LifeNo ratings yet

- The Role of Social Support and Parity On Contraceptive Use in CambodiaDocument10 pagesThe Role of Social Support and Parity On Contraceptive Use in CambodiaMokhamad AuliaNo ratings yet

- 2300 - Performing The EngagementDocument1 page2300 - Performing The EngagementAlexandra AvîrvareiNo ratings yet

- Recent Advances in Natural Polymer-Based Drug Delivery SystemsDocument18 pagesRecent Advances in Natural Polymer-Based Drug Delivery SystemsTelmoNo ratings yet