Professional Documents

Culture Documents

Preweek Practical Accounting 2-17

Uploaded by

adssdasdsadCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Preweek Practical Accounting 2-17

Uploaded by

adssdasdsadCopyright:

Available Formats

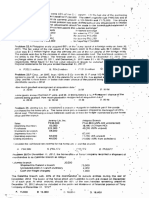

f'rc- b lem 5.

On De: cem ber :3 1 , 20 1 2 a foreign

031a nce s h eet s t a t e d rn forei gn cur

suL..;1 J1ary in Hongkong submitted the follow!ng

ren c•.

;otal a sset s.

. $SOO C')O

1 OO,OOC

� ot a l L1a b1!1t1e�;

G o m � o n stock

250 000

fletai ned Earni ngs

1 50 000

:

The exc ha n g e rate are :

Curre· nt rate f' 3 4C

histo . 1cal rate J. 1 C

We i g nt ed a ve rag e • I •3 00

,J,ssu�ing . t h e functional currency of tr.e suc:; :;1ar; iS the not the currency of !:he ; •

hype�inflat1onary economy was used ano tr-J<:? retain,!d earnings ·of the subsidiary on Decerrf'Je-f"

3 1 . 200 1 2transl ated to Peso is p 460,000. What amc unt of Cumulative tra n s lation ad1ustment ::

lo be reported in the co ns o lidated balance sheer on C •ecembe r 3 1 20 1 2 ?

a . 2 5 , 000 b. 1 0,000 ::: 50. 000 d. 1 25, 000

PrcU>lem 6.M Company sold merchandis9 tor" 11 . 2 00 rupees t o a customer in India or.

N ove mbe r 02, 2 0 1 2. C oll e cti on in India rupeas was c ue on January 3 1 . 20 1 3. Dec. 3 1 . 2012. to

l1edge this foreign c urre nc y exposure . M C ompa r y entered imo a futures contract to �

1 1 1 .200 rupees to a bank for delivery on januarv 3 1 . 2 0 1 3 . Exchange rates for rupees on

different dates a re a s foll ows :

Nov . 2

"'"" �

31

. I _:\.,

.

Jan. 3 1

Strike price P8 1 . 8 ?B 1 . a P8 1 . 8

Bid spot ra te 81.9 80 1 8 0. 1

Offer spot rate 81.7 8 0. 5 80. 3

30-day futures 82 . 3 ':(> '· 83 . 9

GO-day tutures 31.3 ;)J .> 82. q ··= ·

.

9D-day futures 80. 6 81 6 83.4

1 20-day futures 80. 1 51 4 82. 8

What was the net im pa ct i n M ·company s 11 1 co m e i n 2 0 1 2 a s a result of this hecging

•

act1v1ty?

•

a. P22,240 b P 1 1 1 ,200 c. i ' 3 : . 360 d. P1 33.4401oss

ga in loss qa1 n

Problem 7.0n Nov . 1, 20 1 .2, Cars took d eli ve ry fror.1 US firm of inventory costing US t 00,000.

Payments 1s due on January 30, 2 0 1 3. Concurrenrly C a rs paid P900 cas h to acquire a 90 day

call option for U S 1 G 0.000

::

Nov. 1 , 2 0 1 2 •)ec. 31, 20 1 2 Jan. 30, 20 1 3

::.

Spot rate 1 .2 � .22 1 .23

.,

Strike price 1 .2 ?

FV of call option ? . !. 2 00 ?

What is the net FOREX gair• (Joss) to be recognizeo � y Cars on 0-ec. 3 1 , 20 1 2 should be: ....

a. 700 net toss .: 1 300 net loss

b. I ,300 net gain c.:: 2 000 net gain

• I

Problem 8.0n Nov 2, 20 1 ;: , NICO entered into f1. m .:::c mm1tment ·,uith Japanese firm to acquire

an equipment, delivery and passage of title on Marc. n 3 1 . 2 0 1 2, at a price of 4,375 yen. On me

same date, to hedge against unfavorable changes ir1 exchange- rate of the yen. NICO ente�

into a 1 50 day forwa rd contract with BPI for 4 , 3 7 5 1en Tne relevant exchange rate were as

follows ·

1 1 /2/ 1 2 213 1 1 1 2 313 1 / 1 3

Spot rate 37 :;z 35

Forward rate 40 :13 35

How much 1s the amount debited to t h e equr pm e nt ac::ount o n t h e date of:

ci.200,000 ; 1 1 /2/1 2 --: 1 8 5 , G ·: 0 ;. 1 1 /21 1 2

t). 200.000 , L./3 1 / i 3 d . 1 ?5 . 0C O ; 3/3 1 / 1 3

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Law On Obligations and Contracts Quiz Bee Round 1 EasyDocument6 pagesLaw On Obligations and Contracts Quiz Bee Round 1 EasyadssdasdsadNo ratings yet

- Issuance Vested in "Higher Court.'' - The Issuance of The Writ Is Expressly Vested by ArticleDocument6 pagesIssuance Vested in "Higher Court.'' - The Issuance of The Writ Is Expressly Vested by ArticleadssdasdsadNo ratings yet

- Reviewer For 2nd Eval Auditing Theory Answer KeyDocument11 pagesReviewer For 2nd Eval Auditing Theory Answer KeyadssdasdsadNo ratings yet

- 10576-Article Text-41055-3-10-20191228 PDFDocument9 pages10576-Article Text-41055-3-10-20191228 PDFadssdasdsadNo ratings yet

- Impact of An Excise Tax On The Consumption of Sugar-Sweetened Beverages in Young People Living in Poorer Neighbourhoods of Catalonia, Spain: A Difference in Differences StudyDocument11 pagesImpact of An Excise Tax On The Consumption of Sugar-Sweetened Beverages in Young People Living in Poorer Neighbourhoods of Catalonia, Spain: A Difference in Differences StudyadssdasdsadNo ratings yet

- The Efficiency of Financial Ratios Analysis To Evaluate Company'S ProfitabilityDocument15 pagesThe Efficiency of Financial Ratios Analysis To Evaluate Company'S ProfitabilityadssdasdsadNo ratings yet

- Activity Ratio Influence On Profitability (At The Mining Company Listed in Indonesia Stock Exchange Period 2010-2013)Document23 pagesActivity Ratio Influence On Profitability (At The Mining Company Listed in Indonesia Stock Exchange Period 2010-2013)adssdasdsadNo ratings yet

- Preweek Practical Accounting 2-24Document1 pagePreweek Practical Accounting 2-24adssdasdsadNo ratings yet

- Virginia Wanjiku Mwangi Mba 2019Document87 pagesVirginia Wanjiku Mwangi Mba 2019adssdasdsadNo ratings yet

- An Initial Look at The TRAIN Law Are WeDocument20 pagesAn Initial Look at The TRAIN Law Are WeadssdasdsadNo ratings yet

- Preweek Practical Accounting 2-21Document1 pagePreweek Practical Accounting 2-21adssdasdsadNo ratings yet

- Preweek Practical Accounting 2-22Document1 pagePreweek Practical Accounting 2-22adssdasdsadNo ratings yet

- Chapter 1 To 4-1Document1 pageChapter 1 To 4-1adssdasdsadNo ratings yet

- Chapter 1 To 4-3Document1 pageChapter 1 To 4-3adssdasdsadNo ratings yet

- Preweek Practical Accounting 2-20Document1 pagePreweek Practical Accounting 2-20adssdasdsadNo ratings yet

- COE by Sir OcampoDocument22 pagesCOE by Sir OcampoadssdasdsadNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Executive Order 11490Document44 pagesExecutive Order 11490nacfuzzy0% (1)

- First Coin of Ancient Khmer Kingdom Disc PDFDocument14 pagesFirst Coin of Ancient Khmer Kingdom Disc PDFRaj SinghNo ratings yet

- GlobalizationDocument7 pagesGlobalizationNAITIK SHAHNo ratings yet

- Affiliate Lite API V2.0Document12 pagesAffiliate Lite API V2.0Luthfil HakimNo ratings yet

- Central Bank of SrilankaDocument14 pagesCentral Bank of Srilankadharadhakan99No ratings yet

- Towards Central BankingDocument46 pagesTowards Central BankingLinda RicciNo ratings yet

- Quarter 1 - MathDocument12 pagesQuarter 1 - MathPRINCESS PAOLAH DE GUZMANNo ratings yet

- CryptocurrencyDocument19 pagesCryptocurrencyAnmol Chamodi100% (1)

- ISO 4217 Currency CodeDocument7 pagesISO 4217 Currency CodeSudhir PandeyNo ratings yet

- The Globalization of Markets The Globalization of ProductionDocument21 pagesThe Globalization of Markets The Globalization of Production2312 DoleeeNo ratings yet

- THE LONGEST HATRED AN EXAMINATION OF ANTI-GENTILISM - AnnontéDocument23 pagesTHE LONGEST HATRED AN EXAMINATION OF ANTI-GENTILISM - Annonté2901SPAD100% (1)

- REVIEWERDocument15 pagesREVIEWERRenz Jerome BregabrielNo ratings yet

- The GigaPowersDocument103 pagesThe GigaPowersIslamiaNo ratings yet

- Money Banking and Financial Markets 4th Edition Cecchetti Solutions ManualDocument15 pagesMoney Banking and Financial Markets 4th Edition Cecchetti Solutions Manualsamsondorothyuu2100% (26)

- Jrwheelspreseasonexport2019 PDFDocument3 pagesJrwheelspreseasonexport2019 PDFAnonymous sVHKQMzNo ratings yet

- Module 16Document10 pagesModule 16sandeepNo ratings yet

- International Finance A SR Jwhe3pDocument11 pagesInternational Finance A SR Jwhe3pRajni KumariNo ratings yet

- MODULE 1 - ECONOMIC GLOBALIZATION - CONTEMPORARY WORLD - PotDocument21 pagesMODULE 1 - ECONOMIC GLOBALIZATION - CONTEMPORARY WORLD - PotRyan PatarayNo ratings yet

- How Many Key Flexfields Are There in Oracle Financials?Document93 pagesHow Many Key Flexfields Are There in Oracle Financials?priyanka joshiNo ratings yet

- Foreign Exchange RateDocument8 pagesForeign Exchange RatePintu RaoNo ratings yet

- T3TLC - Letters of Credit - R10.2Document155 pagesT3TLC - Letters of Credit - R10.2KLB USERNo ratings yet

- Limitation of Liability For Maritime ClaimsDocument26 pagesLimitation of Liability For Maritime ClaimsAman GautamNo ratings yet

- B - B - A - (Banking) 122 13 Banking Theory Juhb PDFDocument254 pagesB - B - A - (Banking) 122 13 Banking Theory Juhb PDFGargi MehrotraNo ratings yet

- A Study On FOREX Risk Management With A PDFDocument44 pagesA Study On FOREX Risk Management With A PDFnikhilreddy muskuNo ratings yet

- Introduction To Later Medieval Coins PDFDocument23 pagesIntroduction To Later Medieval Coins PDFŽeljko Slijepčević100% (1)

- Class III Maths MoneyDocument8 pagesClass III Maths MoneyHDDRTYNo ratings yet

- AUD USD Technical AnalysisDocument3 pagesAUD USD Technical AnalysisYudhishthir KumarNo ratings yet

- Duit Ayam (Chicken Coins) : March 1990Document2 pagesDuit Ayam (Chicken Coins) : March 1990Maulana M FikriNo ratings yet

- History of MoneyDocument4 pagesHistory of MoneyyangysjNo ratings yet

- Currancy Name and SymbolDocument56 pagesCurrancy Name and SymboladihappyNo ratings yet