Professional Documents

Culture Documents

Preweek Practical Accounting 2-23

Uploaded by

adssdasdsadCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Preweek Practical Accounting 2-23

Uploaded by

adssdasdsadCopyright:

Available Formats

.c.

-� •

q

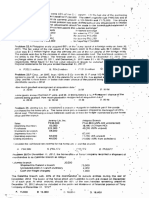

�m 30.0n Ja nuary 1 . : 0 1 3, Lebron 8a sh and D Nayne (the 101nt . .

operators) jointly buy a

"'-'opter for P .30 mill ion eac h · The J. o . nt a

11t-

·

i rrang e111ent nclud es the following terms

'.,, ll1e parties are the i· c,.int owners of the h

.

. :

, er. is at t e :disposal of eac e l icop1. , ,r

l: Tl'e l'eI".•copt � h part y f:>r 70 days each yea r

nie parties may d e ci

TI .

de to use the helic opte r 01 lease

'. it to a thi rd part y I

�rte

"' · ... m ai ntenance aM dispos al f

o the he licopt e· require the unanim ous cbnsent of the

,.,.. 1 es

E'. n,e cont ract u a l arrar:gerne

nt is for the expecti?d life (20 years) o f the helicopter and Ccln

l"le change oi-ly if :-ill 1 iarties

:.>greE: Th·:- res1du , I •1aluE of the ii ehco pter is ni l .

t

�qu.iJly among the joint! �rators .

• Revenues and expenses are to be shared

.

!: �013, the parties paid P300,000 to meet the cdsts .:f m a i n t ai ni ng the helicopter. In 201 3,

eact1 party also incurred costs of running the heli co pte r when they made use of the helicopter

\�-�- Lebron mcurred costs C•f P 20 0 , 00 0 Qn pilot fees. lVlation fuel and landing costs). I n 201 :3 .•

the P3fttes earned renta l mcl1me of P2.5 million by rer.nng the helicopter t o other s .

Vv1,st is the book value of tht� helicopter 1n the booKs ( f Lebron o n Decembe r 3 1 , 201 3?

I\.. P28.5M B P 1 9M C. P21 M D. P9.5M

Problom 3 1 . On January 1 201 1 entities A a nd 8 : ach acq u ired 30 per cent of the ordinary

snaresthat carry vot i ng rights at a general meeting 01 sh a rehold ers of entity Z for P300,000.(9)

E nllties A and 13 imme diat el y agreed to share control over ent ity" Z .

For the year ended Dec. 3 1 . 201 1 en t it y Z recogn1z! ·d a profit of P400,000. On �c. 30 201 :

.

entity z declared and pa id ci d iv id en d of Pi S0.000 fer the year 20X 1 . At Dec. 31 , 201 1the fa1r

value ot each venturers' m·.testment in entity Z is P425.000. H oweve r, there is no p u bl_i s he d -

;.:nee quotation tor e nt it y Z

. .

(ln Dec. 3 1 , 201 1 y

e ntit A sell� goods for F60,000 to entity Z. .L\t Dec. 3 1 ,• 20 1 1 t h e goods

purchased from en tity A wer e in e nt ity Z's invento rie s 'ie 'they had not bee n sold by ent�ty_ Z).

E.nt1�y A sells '.:JOOds at a t·O per cen t mark-up :in .:ost. En tiu es A and 8 account for JOmtly

c0ntrolled ent1t1es using the �qu1ty method.

The amount of investment to be rec ogni zed by ent i ty 1\ should be.

.l. 375.000 c 425 .002

�). 369.000 d. 30(},0CO

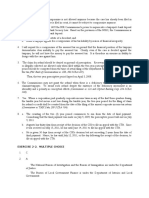

Pro blem �

32.0n December :31 , 2009 entit y A a n SME . acquired 30% of th e ordinary shares that

c a:ry votmg rights of entn y Z for P 1 00,000 . In � cqu 1 nn g those sh a res entity A incu rr� d

t ·a n s a ct 1on costs of P1 ,000 E ntity A h as entered 1nio a co nt ra ctu a l arrangement with a not he r

pa11y (entity C) tl1at owns 2!: % of t he ordinary sh.ires )f e ntit y Z , where by entities A and C j oi nt ly

controllet1 entity Z. E ntity A uses the cost model tc account for its i nve st ments in J C E . A fair

\ 3lu atio n of t hn inv-=stment!. in e n t ity Z d eterm inea using a reliable earnings multiple appro<lch

t:\1sts. In January 2 0 1 0 . ent it y Z dec la red and paid d vidend of P20,000 out of pro fi t s earned in

:.oo-:J. No furthm dividends v11e re paid 1n 2010, 20 1 1 a :)d 201 2. At Dece mb er 31 . 201 O, 201 1 and

::u 1 2. m a nagem e nt assessE'd the fair v a l ues of its inv � stm en t in entity Z as P1 02,000, P 1 1 0,000

: ·�,1 PPC'.000. 1 e$ped1vely 1 : o�ts to sel l are �·stirr.atE• I at P4 .OC1Q throughout E n tity A measures

. . ' 11

:•

its nwestment in ent ity Z on December 3 1 , 201 1 at?

P 1 1 0 . 000 b . P 1 0 1 . 000 c. P 1 06,000 d. P95,000

l'nihlem 3.tOn J a nu ary 1 , 2 0 1 3 e_nti ties· A and B (th•! venturers) f o rm a joint vent u re (entity 'I').

_ .

l ioon 1 nc o1 po ration of e ntity Y. e n ti t ies A ano B each take up 50 per cent of the sh a re capital of

t>nt11y Y . 111 return for their i n te re sts

m e nt it y Y . e nt 1 1 1es A a nd B ea ch contribute P 1 00,000 to •

E'nt.ty YEntity A con tri butes machine with a fair va l Je of P 1 00,000 and a carrying amount of

PB0.000 . Ent1tv B's c o ntr i b ution is P 1 00,000 in cash The m ach i ne contributed by entity A h a s

an e stim at ed useful life of 1 l J years with no re si du a l Vi slue.

i:�1t1ty Y's prof1 : for t!'e year e nde d December 3 1 , 20· 3 1s P30,000 (after ded ucti ng depreciation

t•xpense 01 P 1 0,000 on ti 1e machine. contributed by ent ity A . ) E nt ity A ac c o u nt s for the

hvestment usin g the equity m et h od What is the ca1 rym g amaunt of investment of ent it y A o n

\ �ecember 3 1 . 20 t :' ?

. ... A PM nn.� Q p , .., 1 ()()() r· 01nc: """ n n1 nc '"'"

.... ...�..,..

... ,.,,. -�.-- ·•>n ·--·· , T"

You might also like

- Law On Obligations and Contracts Quiz Bee Round 1 EasyDocument6 pagesLaw On Obligations and Contracts Quiz Bee Round 1 EasyadssdasdsadNo ratings yet

- Issuance Vested in "Higher Court.'' - The Issuance of The Writ Is Expressly Vested by ArticleDocument6 pagesIssuance Vested in "Higher Court.'' - The Issuance of The Writ Is Expressly Vested by ArticleadssdasdsadNo ratings yet

- Reviewer For 2nd Eval Auditing Theory Answer KeyDocument11 pagesReviewer For 2nd Eval Auditing Theory Answer KeyadssdasdsadNo ratings yet

- 10576-Article Text-41055-3-10-20191228 PDFDocument9 pages10576-Article Text-41055-3-10-20191228 PDFadssdasdsadNo ratings yet

- Impact of An Excise Tax On The Consumption of Sugar-Sweetened Beverages in Young People Living in Poorer Neighbourhoods of Catalonia, Spain: A Difference in Differences StudyDocument11 pagesImpact of An Excise Tax On The Consumption of Sugar-Sweetened Beverages in Young People Living in Poorer Neighbourhoods of Catalonia, Spain: A Difference in Differences StudyadssdasdsadNo ratings yet

- The Efficiency of Financial Ratios Analysis To Evaluate Company'S ProfitabilityDocument15 pagesThe Efficiency of Financial Ratios Analysis To Evaluate Company'S ProfitabilityadssdasdsadNo ratings yet

- Activity Ratio Influence On Profitability (At The Mining Company Listed in Indonesia Stock Exchange Period 2010-2013)Document23 pagesActivity Ratio Influence On Profitability (At The Mining Company Listed in Indonesia Stock Exchange Period 2010-2013)adssdasdsadNo ratings yet

- Preweek Practical Accounting 2-24Document1 pagePreweek Practical Accounting 2-24adssdasdsadNo ratings yet

- Virginia Wanjiku Mwangi Mba 2019Document87 pagesVirginia Wanjiku Mwangi Mba 2019adssdasdsadNo ratings yet

- An Initial Look at The TRAIN Law Are WeDocument20 pagesAn Initial Look at The TRAIN Law Are WeadssdasdsadNo ratings yet

- Preweek Practical Accounting 2-21Document1 pagePreweek Practical Accounting 2-21adssdasdsadNo ratings yet

- Preweek Practical Accounting 2-22Document1 pagePreweek Practical Accounting 2-22adssdasdsadNo ratings yet

- Chapter 1 To 4-1Document1 pageChapter 1 To 4-1adssdasdsadNo ratings yet

- Chapter 1 To 4-3Document1 pageChapter 1 To 4-3adssdasdsadNo ratings yet

- Preweek Practical Accounting 2-20Document1 pagePreweek Practical Accounting 2-20adssdasdsadNo ratings yet

- COE by Sir OcampoDocument22 pagesCOE by Sir OcampoadssdasdsadNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Consolidated Technique Procedure4Document45 pagesConsolidated Technique Procedure4imamNo ratings yet

- NON BANKING F. INSTITUTIONS - New2Document5 pagesNON BANKING F. INSTITUTIONS - New2Vedy de KinNo ratings yet

- How To Pass The 2017 FRM ExamDocument10 pagesHow To Pass The 2017 FRM ExamkrishnNo ratings yet

- What Have WE Learned So FarDocument4 pagesWhat Have WE Learned So FarKrystel Erika Tarre100% (1)

- Professional Money LaunderingDocument53 pagesProfessional Money LaunderingMR. KNo ratings yet

- TP 1 - Accounting IIDocument11 pagesTP 1 - Accounting IIAbiNo ratings yet

- Business Ownership and Operations Types of Business OwnershipDocument30 pagesBusiness Ownership and Operations Types of Business OwnershipRingle JobNo ratings yet

- Drill 1 - MidtermDocument3 pagesDrill 1 - MidtermcpacpacpaNo ratings yet

- R22 Capital Structue IFT NotesDocument11 pagesR22 Capital Structue IFT NotesAdnan MasoodNo ratings yet

- Anand Sen 1994. SHD Concepts and PrioritiesDocument7 pagesAnand Sen 1994. SHD Concepts and PrioritiesIndraNo ratings yet

- Risk Return and Dividend ProblemsDocument13 pagesRisk Return and Dividend ProblemsBISMA RAFIQNo ratings yet

- THE 12 Rs of OPPORTUNITY SCREENINGDocument1 pageTHE 12 Rs of OPPORTUNITY SCREENINGMaria AngelaNo ratings yet

- Porfolio Management GuidelinesDocument82 pagesPorfolio Management Guidelinespachino007No ratings yet

- Beekeeping Business Plan Workbook: Produced byDocument47 pagesBeekeeping Business Plan Workbook: Produced bychatzisNo ratings yet

- Bilant LB Engleza Model 2003Document5 pagesBilant LB Engleza Model 2003Monica FrangetiNo ratings yet

- Afar Exercise 5 PDF FreeDocument8 pagesAfar Exercise 5 PDF FreeRialeeNo ratings yet

- Forex Trading Tutorial PDFDocument75 pagesForex Trading Tutorial PDFneeds tripathiNo ratings yet

- Sweet Poison DayamaniDocument20 pagesSweet Poison DayamaniwillyindiaNo ratings yet

- Exam QA - Corporate Finance-1Document38 pagesExam QA - Corporate Finance-1NigarNo ratings yet

- Annual Report HuaweiDocument208 pagesAnnual Report HuaweiWael SalemNo ratings yet

- Preparation of Project, Project Identification and Formulation, Project Appraisal & Sources of FinanceDocument19 pagesPreparation of Project, Project Identification and Formulation, Project Appraisal & Sources of FinanceDrRashmiranjan PanigrahiNo ratings yet

- Formation of A Company Act 1956Document56 pagesFormation of A Company Act 1956Dhaval ThakorNo ratings yet

- Module 2 Conceptual Frameworks and Accounting Standards PDFDocument7 pagesModule 2 Conceptual Frameworks and Accounting Standards PDFJonabelle DalesNo ratings yet

- SEBI Cat III Template PPMDocument55 pagesSEBI Cat III Template PPMyashNo ratings yet

- Gold Monetisation SchemeDocument3 pagesGold Monetisation SchemeAmit GargNo ratings yet

- TATA EditedDocument17 pagesTATA EditedAshley WoodNo ratings yet

- Diff BTW CCM, SC & BursaDocument2 pagesDiff BTW CCM, SC & BursaZalikha ZainalNo ratings yet

- Solutions To Chapter 5Document13 pagesSolutions To Chapter 5Saskia SpencerNo ratings yet

- Assignment - UK GiltsDocument3 pagesAssignment - UK GiltsAryan AnandNo ratings yet

- Implementation StructureDocument2 pagesImplementation Structureamul65No ratings yet