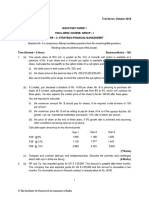

UNIT WISE IMP QUESTIONS FROM LAST THREE YEARS QUESTION PAPERS

UNIT-I

1.a) Explain Risk Management Process. b) Explain Risk Management Methods.(SEP-2020)

2)Risk Measurement.(DEC-19)

3. Define the term Risk and explain different types of risk. .(DEC-19)

4. Explain the risk management process.(DEC-19)

5.Explain types of risk( MAY-2019)

6. Examine the characteristics of different categorize of risks( MAY-2019)

7 Evaluate the steps in the risk management process. . ( MAY-2019)

UNIT-II

1.a) Briefly explain the concept of Cash Flow at Risk (CaR). b) How do you manage risk when

measured by CaR? .(SEP-2020)

2.Credit risk.(DEC-19)

3.Explain the following: a) Value at risk b) Liquidity risk .(DEC-19)

5.a) Write a note on regulatory framework related to risk management in India. b) Write a note

on Capital Adequacy Norms. .(DEC-19)

6.Compare and contrast interest rate risk and exchange rate risk( MAY-2019)

7. Discuss on the regulatory framework with regard to financial risk management. ( MAY-

2019)

8.Distinguish between the features of value at risk (VaR) and cash flow at risk (CaR) methods.

( MAY-2019)

� ‘

UNIT-III

1.a) What is a Futures Contract? b) What are the nature & salient features of Futures Contract?

.(SEP-2020)

2. Suppose that the price of RIL’s share at BSE is Rs.300 and Futures price for delivery in the

next 6-months is Rs.350 per share. An arbitrageur can borrow at 10% per annum. Should the

arbitrageur buy RIL’s shares? .(SEP-2020)

3.Future Contracts.(DEC-19)

4.Calculate the price of a forward contract from the information given below: Price of the share

: Rs.80 Time of expire : 10 months Dividend expected : Rs.2.50 per share Time of Dividend : 4

months Continuously compounded Risk free rate of interest : 10 percent per annum.(DEC-19)

5.a) Explain the impact of Financial market imperfections. b) Write a note on counterparty risk

in the forward contract. .(DEC-19)

6.What are the disadvantages of physical delivery of shares in a futures contract? ( MAY-2019)

7. Estimate the impact of financial market imperfections on various stakeholders of the

economy. ( MAY-2019)

UNIT-IV

1. What is Black-Scholes Model? Give Black-Scholes Model for valuing a European Call. What

are its advantages? .(SEP-2020)

2. Mr. Kalyan is bearish on the stock of Vijay Corporation. He purchases 5 put options (100

shares per Option) on Vijay shares for a premium of Rs. 4. The exercise price is Rs. 40 and has

a maturity period of 3 months. The current market price of the stock is Rs. 40. If Mr. Kalyan is

correct, and Vijay’s price falls to Rs. 30, how much profit will he earn over 3-months period?

.(SEP-2020)

3.Put Options.(DEC-19)

4.a) Explain why margin accounts are required when clients write options but not when they

buy options. b) Write a note on Option strategies. .(DEC-19)

5 a) List out the principles of Put option pricing. b) From the following information calculate

the value of a European call option on a non-dividend paying share using Blach-Scholes model:

Current Price of the Share : Rs.30 Exercise Price : Rs.42 Expire Date : Six months

�Instantaneous standard deviation of return : 0.5 Continuously compounded Risk free rate of

interest : .(DEC-19)

6.Build a case for an investor choosing call option. ( MAY-2019)

7.Predict suitable option strategies for a continuous bull market scenario and continuous bear

market scenario. ( MAY-2019)

8. Demonstrate the superiority of binomial option pricing model in a certain financial situation.

( MAY-2019)

9. Mr.ABC buys a Rupee put option (contract size is 250,000) at a premium of $ 0.01 per

Rupee. If the exercise price is $0.21 and the spot price of the franc at the date of the expiration

is $0.2016, what is Mr.ABC’s profit (loss) on the put option? ( MAY-2019)

UNIT-V

1.a) What is a Financial Swap? b) What are major types of Financial Swaps? .(SEP-2020)

2. What is a Currency Swap? What are the 3 basic steps involved in it? Give an example of

Currency Swap. .(SEP-2020)

3. Swapations .(DEC-19)

4.Explain the following: a) Commodity Swap b) Currency Swap . .(DEC-19)

5. X can borrow floating rate funds from dollar market at 1-year LIBOR or he can borrow at

fixed rate Euro at 7 percent. Y can borrow floating rate funds from US Dollar market at 9

percent. Y need fixed rate Euro and X need floating rate dollar. Can the currency swap be

gainful to both of them? .(DEC-19)

6. Outline the mechanism involved in the interest rate swaps with a suitable diagram. ( MAY-

2019)

7.Appraise of the features, advantages and limitations of swaptions over swaps. ( MAY-2019)