Professional Documents

Culture Documents

1.1 Lecture 20 - Expectancy PDF

1.1 Lecture 20 - Expectancy PDF

Uploaded by

sachOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1.1 Lecture 20 - Expectancy PDF

1.1 Lecture 20 - Expectancy PDF

Uploaded by

sachCopyright:

Available Formats

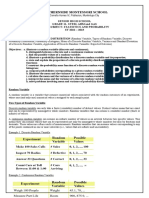

Lecture 20

Expactancy

Let’s play a game:

You have 2 envelopes from which to choose:

Scenario 1:

Envelope 1 has a 100% chance of having 1$

Envelope 2 has a 10% chance of having 10$

Which would you choose?

Scenario 1:

Envelope 1 has a 100% chance of having __$

Envelope 2 has a 10% chance of having __$

Which would you choose?

Scenario 1:

Envelope 1 has a 100% chance of having __$

Envelope 2 has a 10% chance of having __$

Which would you choose?

Expected Value (EV)

The expected value of a discrete random variable is the probability-weighted average

of all possible values.

Where, X is the value

P is the probability

Expected value: The expected value is an anticipated value for a given investment.

In statistics and probability analysis, the expected value is calculated by multiplying

each of the possible outcomes by the likelihood that each outcome will occur, and

summing all of those values. By calculating expected values, investors can choose the

scenario that is most likely to give them their desired outcome.

Trading example:

Stock ABC trades at 20$, you perceive that it has a 60% chance of going to 23$ or a

40% chance of going to 13$.

Stock XYZ trades at 10$, you perceive that it has a 40% chance of going to 16$ or a

60% chance of going to 8$.

Which stock should you buy?

You might also like

- Lecture 13 Candlesticks PDFDocument5 pagesLecture 13 Candlesticks PDFbraetto_1x1No ratings yet

- Lecture 18 Relative Strength Index RSI PDFDocument1 pageLecture 18 Relative Strength Index RSI PDFbraetto_1x1100% (1)

- Almonds - Feasibility Study For Processing PlanDocument15 pagesAlmonds - Feasibility Study For Processing Planbraetto_1x1No ratings yet

- MFIN6214 Lecture1 2020T3Document29 pagesMFIN6214 Lecture1 2020T3ulricaNo ratings yet

- sn13 ADocument6 pagessn13 AKarl Gerard SiaganNo ratings yet

- Choice Under Risk and UncertaintyDocument9 pagesChoice Under Risk and UncertaintyYibarek kinfeNo ratings yet

- Decision UncertaintyDocument19 pagesDecision Uncertaintycrinaus2003No ratings yet

- Concepts N Clarity ®: ProbabilityDocument17 pagesConcepts N Clarity ®: ProbabilitySakshiNo ratings yet

- 5 NopauseDocument95 pages5 NopauseLA garnerNo ratings yet

- Microeconomics II - Chapter 2Document18 pagesMicroeconomics II - Chapter 2anonymousninjatNo ratings yet

- Lecture 9 UncertaintyDocument68 pagesLecture 9 UncertaintyJ sarmaNo ratings yet

- Introduction To Game Theory 1 - Decision Theory: Helena PerroneDocument85 pagesIntroduction To Game Theory 1 - Decision Theory: Helena PerroneJofre BaganNo ratings yet

- Econ 04Document29 pagesEcon 04Andika SaputraNo ratings yet

- Assign 1Document3 pagesAssign 1Hrishikesh KasatNo ratings yet

- Chapter-6-Random Variables & Probability DistributionsDocument13 pagesChapter-6-Random Variables & Probability DistributionsKebede HaileNo ratings yet

- Expected Utility Theory: Behavioral Economics Patrick McalvanahDocument28 pagesExpected Utility Theory: Behavioral Economics Patrick McalvanahKübra ÇakırNo ratings yet

- API 111 Solutions 7Document8 pagesAPI 111 Solutions 76doitNo ratings yet

- Statistics and Probability: Simplified Learning Module 1 MELC CompetencyDocument9 pagesStatistics and Probability: Simplified Learning Module 1 MELC CompetencyRejen CuadraNo ratings yet

- Mathematics CH: Data Handling Topic: Probability: By: AkhileshDocument7 pagesMathematics CH: Data Handling Topic: Probability: By: AkhileshReshma SharmaNo ratings yet

- CH2 Prob SuppDocument5 pagesCH2 Prob Suppchangazi354No ratings yet

- 4 PDFDocument17 pages4 PDFBadrulNo ratings yet

- EC203 - Problem Set 9Document3 pagesEC203 - Problem Set 9Yiğit KocamanNo ratings yet

- Zaher - Expected Utility Theory FinanceDocument38 pagesZaher - Expected Utility Theory FinanceRahmat PasaribuNo ratings yet

- Financial Decision-Making Under UncertaintyDocument25 pagesFinancial Decision-Making Under UncertaintyMateo PulidoNo ratings yet

- Financial Decision-Making Under UncertaintyDocument25 pagesFinancial Decision-Making Under UncertaintyLuigi Pastrana RosarioNo ratings yet

- Introduction To Game Theory 1 - Decision Theory: Helena PerroneDocument52 pagesIntroduction To Game Theory 1 - Decision Theory: Helena PerroneÀlex SolàNo ratings yet

- Ch6projecterinandmaddie 1Document3 pagesCh6projecterinandmaddie 1api-346023709No ratings yet

- CH2 Prob Supp424Document5 pagesCH2 Prob Supp424孫晧晟No ratings yet

- Idencitifierccc 01Document87 pagesIdencitifierccc 01weebmyphone11No ratings yet

- Probability On Simple EventsDocument22 pagesProbability On Simple EventsAPRIL ROJONo ratings yet

- $RT27V29Document4 pages$RT27V29husseinmarwan589No ratings yet

- Chapter-6-Random Variables & Probability DistributionsDocument13 pagesChapter-6-Random Variables & Probability Distributionskenenisa.abdisastatNo ratings yet

- Fin 203Document3 pagesFin 203ledmabaya23No ratings yet

- Chapter 8Document30 pagesChapter 8NdomaduNo ratings yet

- CH 07Document21 pagesCH 07Tibet Boğazköy AkyürekNo ratings yet

- Chapter 5 Utility FunctionDocument32 pagesChapter 5 Utility FunctionNermine LimemeNo ratings yet

- 4Document17 pages4Anonymous 3hrzMH7No ratings yet

- BMA5001 Lecture Notes 4 - Economics of Uncertainty and RiskDocument33 pagesBMA5001 Lecture Notes 4 - Economics of Uncertainty and RiskAishwarya VijayaraghavanNo ratings yet

- Bas430 FPD 2 2021 2 PDFDocument121 pagesBas430 FPD 2 2021 2 PDFNkhandu S M WilliamsNo ratings yet

- Beyond RationalityDocument25 pagesBeyond RationalityVrinda GargNo ratings yet

- Chapter 6Document4 pagesChapter 6Ahmad baderNo ratings yet

- Probability DistributionDocument52 pagesProbability DistributionParul JainNo ratings yet

- Chapter-6 and 7Document16 pagesChapter-6 and 7Ellii YouTube channel100% (1)

- Choice MA Risk 1 17Document96 pagesChoice MA Risk 1 17Rana AhmedNo ratings yet

- O. Probability Random VariablesDocument31 pagesO. Probability Random VariablesBrian GarciaNo ratings yet

- Expected Utility Theory: Mark DeanDocument38 pagesExpected Utility Theory: Mark DeanKübra ÇakırNo ratings yet

- Risk Management (Part 2)Document49 pagesRisk Management (Part 2)Prime ShineNo ratings yet

- Notes 515 Summer 07 Chap 4Document12 pagesNotes 515 Summer 07 Chap 4Akanksha GoelNo ratings yet

- Uncertainty: Fair Gambles and Expected UtilityDocument8 pagesUncertainty: Fair Gambles and Expected UtilityDrNaveed Ul HaqNo ratings yet

- Notes3 StatProbaDocument3 pagesNotes3 StatProbaClarise VicenteNo ratings yet

- Managerial Economics: Unit 9: Risk AnalysisDocument49 pagesManagerial Economics: Unit 9: Risk AnalysisPablo SheridanNo ratings yet

- UtilityDocument25 pagesUtilityjadi2No ratings yet

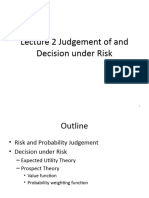

- Lecture 2 Decision Under RiskDocument46 pagesLecture 2 Decision Under Riskzhaofangjie0510No ratings yet

- Book OldDocument22 pagesBook OldRana AhmedNo ratings yet

- Chapter1 Decision Theory Under UncertaintyDocument27 pagesChapter1 Decision Theory Under UncertaintydianazokhrabekovaNo ratings yet

- Statistics - Class Work #5-1Document4 pagesStatistics - Class Work #5-1dc.yinhelenNo ratings yet

- Chapt 2 MICDocument13 pagesChapt 2 MICAkkamaNo ratings yet

- Statistics Probability11 q3 Week2 v4Document10 pagesStatistics Probability11 q3 Week2 v4revamay286No ratings yet

- Intermediate-Micro-Chapter6 Edited CleanDocument58 pagesIntermediate-Micro-Chapter6 Edited Cleannewsonukumar2003No ratings yet

- Statistics and Probability 2019-2020Document5 pagesStatistics and Probability 2019-2020DINDO L HIOCONo ratings yet

- Econometrics Complete NotesDocument9 pagesEconometrics Complete NotesMunnah BhaiNo ratings yet

- Lecture 30 Anchoring Effect PDFDocument1 pageLecture 30 Anchoring Effect PDFbraetto_1x1No ratings yet

- Loss Aversion: How Itaff Ects Our TradingDocument1 pageLoss Aversion: How Itaff Ects Our Tradingbraetto_1x1No ratings yet

- Chart Patterns: Head and ShouldersDocument6 pagesChart Patterns: Head and Shouldersbraetto_1x1No ratings yet

- Lecture 31 Confirmation Bias PDFDocument1 pageLecture 31 Confirmation Bias PDFbraetto_1x1No ratings yet

- Lecture 26 The Importance of Psychology PDFDocument1 pageLecture 26 The Importance of Psychology PDFbraetto_1x1No ratings yet

- Lecture 16 Volume PDFDocument1 pageLecture 16 Volume PDFbraetto_1x1No ratings yet

- Lecture 24 Money Management PDFDocument2 pagesLecture 24 Money Management PDFbraetto_1x1No ratings yet

- Lecture 22 Batting Average Win Loss Ratio PDFDocument1 pageLecture 22 Batting Average Win Loss Ratio PDFbraetto_1x1No ratings yet

- Lecture 8 Orders Driving Prices Level1 Level2 Time and Sales PDFDocument3 pagesLecture 8 Orders Driving Prices Level1 Level2 Time and Sales PDFbraetto_1x1No ratings yet

- Lecture 12 Charts Candlesticks PDFDocument1 pageLecture 12 Charts Candlesticks PDFbraetto_1x1No ratings yet

- Lecture 3 What Is A Stock PDFDocument1 pageLecture 3 What Is A Stock PDFbraetto_1x1No ratings yet

- S02 3G RPLS2 - v2-0 The Physical LayerDocument74 pagesS02 3G RPLS2 - v2-0 The Physical LayerginnboonyauNo ratings yet

- Lecture 4 What Is A Market PDFDocument1 pageLecture 4 What Is A Market PDFbraetto_1x1No ratings yet