Professional Documents

Culture Documents

Syllabus New

Uploaded by

12007856Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Syllabus New

Uploaded by

12007856Copyright:

Available Formats

ACC507:COST AND MANAGEMENT ACCOUNTING

Course Outcomes: Through this course students should be able to

CO1 :: employ the understanding of cost concepts to work analytically with cost data.

CO2 :: practice control techniques in order to minimize the blockage of financial resources.

CO3 :: apply cost-volume-profit analysis in business decision making and performance evaluation

process.

CO4 :: calculate material and labour variances, identify causes and develop skills for controlling

the adverse variances.

CO5 :: illustrate the use of cost management techniques for performance evaluation and goal

congruence.

Unit I

Introduction to management and cost accounting : comparison between cost and management

accounting, cost classification, preparation of cost sheet and estimated cost sheet

Unit II

Inventory control : inventory control system, management of inventory

Budgets and budgetary control : types of budgets, preparation of cash budget, preparation of

flexible budget

Unit III

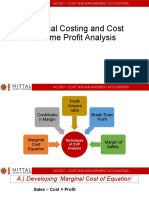

Marginal costing and profit planning : CVP analysis, break-even point and break-even analysis

Decision involving alternative choices : steps involved in decision making, profit planning, key

factor, determination of sales mix, make or buy decision, exploration of new markets, continue or

discontinue a product line

Unit IV

Standard costing : preliminaries in establishing a system of standard costing, variances analysis-

material variances, labour variances

Unit V

Activity based costing : activity based costing versus traditional costing, steps involved in activity

based costing, cost drivers, determination of cost under ABC

Responsibility accounting : pre-requisites, responsibility centres, steps of implementing

responsibility accounting, reporting to management

Unit VI

Transfer pricing : methods of calculating transfer price, problems associated with transfer pricing

Cost management : analysis of common costs in manufacturing and service industry, techniques for

profit improvement, cost reduction, value analysis

Text Books:

1. COST ACCOUNTING: A MANAGERIAL EMPHASIS by CHARLES T. HORNGREN, SHRIKANT M.

DATAR, MADHAV V. RAJAN, PEARSON

References:

1. A TEXTBOOK OF ACCOUNTING FOR MANAGEMENT by MAHESHWARI. S.N, MAHESHWARI

SHARAD.K, MAHESHWARI SUNEEL.K, VIKAS PUBLISHING HOUSE

2. ACCOUNTING FOR DECISION MAKING by NEEDLES BELVERD. E, CENGAGE LEARNING

3. MANAGEMENT ACCOUNTING (TEST, PROBLEMS AND CASES) by KHAN M.Y AND JAIN P.K,

MC GRAW HILL

Session 2020-21 Page:1/1

You might also like

- Accm507 SyllabusDocument2 pagesAccm507 Syllabusastitvaawasthi33No ratings yet

- Accounting SyllabusDocument1 pageAccounting SyllabusJonathan AddoNo ratings yet

- Cost & Management Accounting EssentialsDocument1 pageCost & Management Accounting EssentialsAkhand RanaNo ratings yet

- Management Accounting Syllabus LOCFDocument2 pagesManagement Accounting Syllabus LOCFDream And Draw -Atithi NagNo ratings yet

- Core BBADocument195 pagesCore BBAMohammed MubeenNo ratings yet

- II 2ManagerialAccountingDocument2 pagesII 2ManagerialAccountingRaja ShahabNo ratings yet

- Management AccountingDocument1 pageManagement AccountingDivyanshu PatniNo ratings yet

- Cost & Management Accounting Syllabus 2015Document3 pagesCost & Management Accounting Syllabus 2015KunalNo ratings yet

- Distribution of Syllabus of Cost and Management AccountingDocument2 pagesDistribution of Syllabus of Cost and Management AccountingCoc GemNo ratings yet

- Cost and Capital Accounting For Decision MakingDocument2 pagesCost and Capital Accounting For Decision MakingRishi CharanNo ratings yet

- Accounting for Managerial DecisionsDocument1 pageAccounting for Managerial DecisionsShakeeb AshaiNo ratings yet

- Semester/Year: I Sem / I Year Course Code: 20MBA5101 Title of The Course: Accounting For Managers L: T/A: P: C: 4: 0: 0: 4Document3 pagesSemester/Year: I Sem / I Year Course Code: 20MBA5101 Title of The Course: Accounting For Managers L: T/A: P: C: 4: 0: 0: 4tridib BhattacharjeeNo ratings yet

- Gujarat Technological UniversityDocument3 pagesGujarat Technological UniversitydhruvinNo ratings yet

- Acc223financial Decision Making-IiDocument2 pagesAcc223financial Decision Making-Iiyagefi3101No ratings yet

- Acc221financial ControlDocument2 pagesAcc221financial Controlmxam hienNo ratings yet

- Management AccountingDocument2 pagesManagement AccountingMAYUR KARSADIYENo ratings yet

- Core 10Document194 pagesCore 10Ashutosh Patro100% (1)

- BBA 3rd Semester Syllabus 2023Document17 pagesBBA 3rd Semester Syllabus 2023chaurasiya6369No ratings yet

- A FMDocument9 pagesA FMshalu_duaNo ratings yet

- Cost and Management Accounting PDFDocument2 pagesCost and Management Accounting PDFRajat Goyal80% (5)

- Cost and Management Accouting PDFDocument472 pagesCost and Management Accouting PDFMaxwell chanda100% (1)

- Bba Banking Finance (Syllabus) 2018Document21 pagesBba Banking Finance (Syllabus) 2018Aditya JhaNo ratings yet

- Accounting For ManagersDocument2 pagesAccounting For ManagersAnbazhagan AjaganandaneNo ratings yet

- CMASyllabusDocument3 pagesCMASyllabusAakash murarkaNo ratings yet

- Accounting For Managerial Decisions (B205201) Total Credits-5 L T P Semester 2 4 1 0 Course OutcomesDocument9 pagesAccounting For Managerial Decisions (B205201) Total Credits-5 L T P Semester 2 4 1 0 Course Outcomesmani singhNo ratings yet

- Accounting for Management DecisionsDocument2 pagesAccounting for Management DecisionsSomu TiwariNo ratings yet

- CMA II Course OutlineDocument1 pageCMA II Course OutlineHussen AbdulkadirNo ratings yet

- Cost Accounting PDFDocument261 pagesCost Accounting PDFRaksha Sharma100% (1)

- Cost &MGMT Acc For ABVMDocument71 pagesCost &MGMT Acc For ABVMabdigedefa49No ratings yet

- JMI BBA B.com Syllabus of Whole 3 YearsDocument5 pagesJMI BBA B.com Syllabus of Whole 3 YearsMohd aqilNo ratings yet

- MC 303 Syllabus Management AccountingDocument3 pagesMC 303 Syllabus Management AccountingKeran VarmaNo ratings yet

- BBA GGS Indraprastha University BBA 207: Management Accounting Course Code: BBA 207 L-4 T-0 Credit-4Document2 pagesBBA GGS Indraprastha University BBA 207: Management Accounting Course Code: BBA 207 L-4 T-0 Credit-4Shilpa AroraNo ratings yet

- II Semester Syllabus AutonomousDocument6 pagesII Semester Syllabus Autonomoussidmisha05No ratings yet

- Public Finance ReadingDocument241 pagesPublic Finance ReadingTushar Rana100% (1)

- Unit I-III Cost PDFDocument83 pagesUnit I-III Cost PDFRupak ChandnaNo ratings yet

- Management and Financial AccountingDocument5 pagesManagement and Financial AccountingSriya HalderNo ratings yet

- Mbcii 5 Cost Accounting 2019Document115 pagesMbcii 5 Cost Accounting 2019Kanchan Mishra100% (1)

- Cost Accounting and Control Prelims RevisedDocument63 pagesCost Accounting and Control Prelims RevisedKienthvxxNo ratings yet

- Human Values and Business EthicsDocument6 pagesHuman Values and Business EthicsGaurav GuptaNo ratings yet

- ACC 202 Cost and ManagementDocument10 pagesACC 202 Cost and Managementusm01No ratings yet

- BUSINESS ORGANIZATION AND MANAGEMENT COURSEDocument43 pagesBUSINESS ORGANIZATION AND MANAGEMENT COURSEJay PatelNo ratings yet

- DAIBB SysllabusDocument7 pagesDAIBB SysllabusShahinur AlamNo ratings yet

- Foundations of Management: I UnitDocument7 pagesFoundations of Management: I UnitPriyanka bhartiNo ratings yet

- CCF Commerce CSR 13 Sem. 1Document2 pagesCCF Commerce CSR 13 Sem. 1Toshani VermaNo ratings yet

- B_Com_Sem-5-6_CE-301-to-304-A_Adv_Acc_AudDocument12 pagesB_Com_Sem-5-6_CE-301-to-304-A_Adv_Acc_AudVijayaRamNo ratings yet

- Cost Accountancy BBA Part II Semester IIIDocument63 pagesCost Accountancy BBA Part II Semester IIIVarsha100% (3)

- ProgDocument18 pagesProgMukesh KumarNo ratings yet

- Cost Accountancy - BBA Part II Semester IIIDocument69 pagesCost Accountancy - BBA Part II Semester IIINishikant Rayanade100% (1)

- Semester-I V: Scheme of Examination and Courses of Reading For B. Com. (Prog.)Document34 pagesSemester-I V: Scheme of Examination and Courses of Reading For B. Com. (Prog.)dbNo ratings yet

- Cost AccountingDocument20 pagesCost AccountingGargi MPNo ratings yet

- Management Accounting (MA) Module OverviewDocument2 pagesManagement Accounting (MA) Module OverviewMD.TARIQUL ISLAM CHOWDHURYNo ratings yet

- Labor Costing and ControleDocument4 pagesLabor Costing and Controlenokia_rizNo ratings yet

- BBA III Sem Business Costing SyllabusDocument20 pagesBBA III Sem Business Costing SyllabusShubham BhadouriyaNo ratings yet

- Salybus of 1st SemDocument5 pagesSalybus of 1st SemAshish RanaNo ratings yet

- Course Title: Advanced Cost and Management Accounting Course Code: ACFN 521 Credit Hours: 3 Ects: 7 Course DescriptionDocument4 pagesCourse Title: Advanced Cost and Management Accounting Course Code: ACFN 521 Credit Hours: 3 Ects: 7 Course DescriptionSefiager MarkosNo ratings yet

- LO & LP of Cost Accounting 23-05-2012Document3 pagesLO & LP of Cost Accounting 23-05-2012Amit Kumar NagNo ratings yet

- (H) New Syllabus 2020-21Document42 pages(H) New Syllabus 2020-21Deepak PandeyNo ratings yet

- 1-Managerial AccountingDocument2 pages1-Managerial AccountingHaleem KhanNo ratings yet

- Standard Costing For StudentsDocument10 pagesStandard Costing For Students12007856No ratings yet

- Inventory ControlDocument9 pagesInventory Control12007856No ratings yet

- Decision Making For StudentsDocument18 pagesDecision Making For Students12007856No ratings yet

- Marginal Costing and Cost Volume Profit AnalysisDocument16 pagesMarginal Costing and Cost Volume Profit Analysis12007856No ratings yet

- Chapter 1133Document78 pagesChapter 1133Basanta K Sahu100% (1)

- Cost Sheet Preparation ProblemsDocument2 pagesCost Sheet Preparation Problems12007856No ratings yet

- Chapter 6 Six SigmaDocument15 pagesChapter 6 Six Sigma12007856No ratings yet

- Chapter 10 Quality AuditsDocument13 pagesChapter 10 Quality Audits12007856100% (1)

- Chapter 10 Quality AuditsDocument13 pagesChapter 10 Quality Audits12007856100% (1)

- Chapter 1Document15 pagesChapter 112007856No ratings yet

- Chapter 1Document41 pagesChapter 112007856No ratings yet

- Chapter 2 Acceptance Sampling and Inspection Plans 1Document15 pagesChapter 2 Acceptance Sampling and Inspection Plans 112007856No ratings yet

- Basic ToolsDocument12 pagesBasic Tools12007856No ratings yet

- Basic ToolsDocument12 pagesBasic Tools12007856No ratings yet