Professional Documents

Culture Documents

Chapter 10 Homework: Asset Costs, Depreciation, Capital vs Revenue

Uploaded by

Jacob SheridanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 10 Homework: Asset Costs, Depreciation, Capital vs Revenue

Uploaded by

Jacob SheridanCopyright:

Available Formats

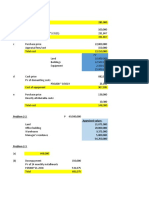

Chapter 10 Homework

1. Determining The Cost Of An Asset

Land $402,300

Cash $102,300

Notes Payable $300,000

2. Making a Lump-Sum Asset Purchase

Land $105,000

Building $84,000

Equipment $21,000

Notes Payable $210,000

3. Computing First-Year Depreciation And Book Value

1)

a. $6,400,000

b. $11,200,000

c. $14,800,000

2) Straight-Line Method Book Value: $30,600,000

Units-of-Production Method Book Value: $25,800,000

Double-Declining-Balance Method Book Value: $22,200,000

17. Determining The Cost Of Assets

1) Land = $333,000

Land Improvements = $74,000

Building = $400,000

2) Land Improvements and Building

19. Distinguishing Capital Expenditures From Revenue Expenditures

a) C

b) R

c) C

d) R

e) C

f) C

g) R

h) C

i) C

You might also like

- BUSI 353 S18 Assignment 6 SOLUTIONDocument4 pagesBUSI 353 S18 Assignment 6 SOLUTIONTanNo ratings yet

- Special Transactions (2019) by Millan Solman PDFDocument157 pagesSpecial Transactions (2019) by Millan Solman PDFMichael Angelou Raymundo90% (20)

- Global Human Resources Consultants: Importing Tables and Modifying Tables and Table PropertiesDocument3 pagesGlobal Human Resources Consultants: Importing Tables and Modifying Tables and Table PropertiesJacob SheridanNo ratings yet

- Health and Wellness at Cress Insurance: Five Steps To A Heart-Healthy DietDocument1 pageHealth and Wellness at Cress Insurance: Five Steps To A Heart-Healthy DietJacob SheridanNo ratings yet

- Accounting - Text & Cases - 13 Edition Basic Accounting Concepts: The Balance SheetDocument7 pagesAccounting - Text & Cases - 13 Edition Basic Accounting Concepts: The Balance SheetV Hemanth KumarNo ratings yet

- Principles of Accounting, Chapter 10, Plant Asset SolutionDocument10 pagesPrinciples of Accounting, Chapter 10, Plant Asset SolutionMahmudur Rahman83% (6)

- Intermediate Accounting 1 Solution Manual: Chapter 15 - Property, Plant and Equipment To Chapter 17 - Depletion of Mineral ResourcesDocument20 pagesIntermediate Accounting 1 Solution Manual: Chapter 15 - Property, Plant and Equipment To Chapter 17 - Depletion of Mineral ResourcesMckenzieNo ratings yet

- Problem 23-1, Page 650 Erica Company: Required: # Debit CreditDocument14 pagesProblem 23-1, Page 650 Erica Company: Required: # Debit CreditDeanne LumakangNo ratings yet

- Soal Kombinasi Bisnis 1Document4 pagesSoal Kombinasi Bisnis 1Melati Sepsa100% (1)

- Summary ExcersizeDocument1 pageSummary ExcersizeJacob SheridanNo ratings yet

- City OF Glenb Rook: Planning ReportDocument4 pagesCity OF Glenb Rook: Planning ReportJacob SheridanNo ratings yet

- Metro Plaza in Downtown Wilmington: 20,000 Square Feet of Office Space For LeaseDocument5 pagesMetro Plaza in Downtown Wilmington: 20,000 Square Feet of Office Space For LeaseJacob SheridanNo ratings yet

- Sol. Man. - Chapter 15 - Ppe Part 1 - Ia Part 1BDocument5 pagesSol. Man. - Chapter 15 - Ppe Part 1 - Ia Part 1BMahasia MANDIGANNo ratings yet

- Use The Following Information For Questions 63 andDocument2 pagesUse The Following Information For Questions 63 andjbsantos09100% (1)

- Sol. Man. - Chapter 15 - Ppe Part 1 - Ia Part 1B 1Document9 pagesSol. Man. - Chapter 15 - Ppe Part 1 - Ia Part 1B 1Rezzan Joy Camara Mejia100% (1)

- BACC200 Chapter 10 Extra Exercises SolutionDocument2 pagesBACC200 Chapter 10 Extra Exercises Solution12331296No ratings yet

- 12 - Impairment of Assets Problems With Solutions: From The TextbookDocument30 pages12 - Impairment of Assets Problems With Solutions: From The Textbookbusiness docNo ratings yet

- PPE Initial Meas Assignment With Answers FormattedDocument5 pagesPPE Initial Meas Assignment With Answers FormattedCJ IbaleNo ratings yet

- Balance Sheet ExercisesNameTaskDocument2 pagesBalance Sheet ExercisesNameTaskchavyr.vikaNo ratings yet

- Universal Company mining journal entries 2020-2022Document2 pagesUniversal Company mining journal entries 2020-2022Jerbert JesalvaNo ratings yet

- Casey Sarah R. Erato Block D: Amount Paid For The Property AcquiredDocument3 pagesCasey Sarah R. Erato Block D: Amount Paid For The Property AcquiredJerbert JesalvaNo ratings yet

- Balance Sheet SolutionsDocument3 pagesBalance Sheet SolutionsAbhishekKumarNo ratings yet

- Akm. P10Document5 pagesAkm. P10Diandra MurtiNo ratings yet

- Accounting For Property, Plant and Equipment and Intangible AssetsDocument19 pagesAccounting For Property, Plant and Equipment and Intangible AssetsMichael Linard SamileyNo ratings yet

- Advanced Accounting 1 - Millan: Problem 1-4: Exercises: ComputationalDocument10 pagesAdvanced Accounting 1 - Millan: Problem 1-4: Exercises: ComputationalFritzNo ratings yet

- Ppe - WorksheetDocument7 pagesPpe - Worksheetbereket nigussieNo ratings yet

- Partnership Formation and Capital AccountsDocument157 pagesPartnership Formation and Capital AccountsRaven PicorroNo ratings yet

- Weygandt Acctg Princ 9eDocument4 pagesWeygandt Acctg Princ 9e劉亮宏No ratings yet

- Problem 2-1Document18 pagesProblem 2-1ILIG, Pauline Joy E.No ratings yet

- Berikut Ini Adalah Soal Untuk Menjawan Pertanyaan Nomor 71 and 72Document3 pagesBerikut Ini Adalah Soal Untuk Menjawan Pertanyaan Nomor 71 and 72Rahmad SantosoNo ratings yet

- AFAR1 Chap 1Document7 pagesAFAR1 Chap 1CilNo ratings yet

- Assessment No. 3-Midterm - Exam SheetDocument7 pagesAssessment No. 3-Midterm - Exam Sheetarnel buanNo ratings yet

- Homework Chapter 9Document15 pagesHomework Chapter 9Trung Kiên Nguyễn100% (1)

- 645873Document3 pages645873mohitgaba19No ratings yet

- Chapter 9 Question Review PDFDocument12 pagesChapter 9 Question Review PDFAbdul AkberNo ratings yet

- Chapter 7 (Case) : Joan HoltzDocument2 pagesChapter 7 (Case) : Joan Holtzjenice joy100% (1)

- Apportionment of acquisition cost and depreciation calculationDocument2 pagesApportionment of acquisition cost and depreciation calculationKailash Kumar0% (1)

- TUGAS AKM II PERTEMUAN 2Document2 pagesTUGAS AKM II PERTEMUAN 2Mei AstridNo ratings yet

- Tugas AKM1 Pertemuan 10Document3 pagesTugas AKM1 Pertemuan 10Siti rahmahNo ratings yet

- Chapter 2 - FADocument23 pagesChapter 2 - FANouh Al-SayyedNo ratings yet

- Firda Arfianti - LC53 - CONSOLIDATION BALANCE SHEET Exercise 3-3Document2 pagesFirda Arfianti - LC53 - CONSOLIDATION BALANCE SHEET Exercise 3-3FirdaNo ratings yet

- Illustrative Example - Cash Flow StatementDocument6 pagesIllustrative Example - Cash Flow StatementNausheenNo ratings yet

- 1035 - Balance Sheet ExercisesNameDocument2 pages1035 - Balance Sheet ExercisesNameChelsea MortleyNo ratings yet

- 1035 - Balance Sheet ExercisesNameDocument2 pages1035 - Balance Sheet ExercisesNameRingle JobNo ratings yet

- TIP: Transaction (A) Is Presented Below As An Example.: 1. Ejercicio E2-12 de La Página 85 yDocument9 pagesTIP: Transaction (A) Is Presented Below As An Example.: 1. Ejercicio E2-12 de La Página 85 yEstefanía ZavalaNo ratings yet

- Capitalization Rate Total Interest Expense On General Borrowings Total General BorrowingsDocument2 pagesCapitalization Rate Total Interest Expense On General Borrowings Total General BorrowingsKeith NavalNo ratings yet

- BOQ Dili Main Roads 1ADocument64 pagesBOQ Dili Main Roads 1ARey YnoNo ratings yet

- Acc 201 CH 9Document7 pagesAcc 201 CH 9Trickster TwelveNo ratings yet

- BE Chap 10Document4 pagesBE Chap 10TIÊN NGUYỄN LÊ MỸNo ratings yet

- Chapter 10 - Plant Assets & Depreciation Methods: Practice ExercisesDocument8 pagesChapter 10 - Plant Assets & Depreciation Methods: Practice ExercisesLý Nguyễn Tuyết MaiNo ratings yet

- Assignment 3.1 WorksheetDocument1 pageAssignment 3.1 WorksheetMary Grace DegamoNo ratings yet

- Ex. 10-135-Nonmonetary ExchangeDocument4 pagesEx. 10-135-Nonmonetary ExchangeCarlo ParasNo ratings yet

- Homework Chapter 9Document5 pagesHomework Chapter 9Linh TranNo ratings yet

- Sol. Man. - Chapter 17 - Depletion of Mineral Resources - Ia Part 1B 1Document6 pagesSol. Man. - Chapter 17 - Depletion of Mineral Resources - Ia Part 1B 1Rezzan Joy Camara Mejia67% (6)

- Solution CH 2Document14 pagesSolution CH 2razaffd410No ratings yet

- Contemporary Engineering Economics 5th Edition Park Solutions ManualDocument38 pagesContemporary Engineering Economics 5th Edition Park Solutions Manualdorismmohurn8fcn100% (15)

- Real Estate License Exam Calculation Workbook: Volume 2 (2023 Edition)From EverandReal Estate License Exam Calculation Workbook: Volume 2 (2023 Edition)No ratings yet

- SynthesisDocument4 pagesSynthesisJacob SheridanNo ratings yet

- Tea Density Lab DataDocument2 pagesTea Density Lab DataJacob SheridanNo ratings yet

- COVID-19 PaperDocument3 pagesCOVID-19 PaperJacob SheridanNo ratings yet

- Week 2 Lab ReportDocument2 pagesWeek 2 Lab ReportJacob SheridanNo ratings yet

- Determination of The Relationship Between The Celsius and Fahrenheit Temperature ScalesDocument2 pagesDetermination of The Relationship Between The Celsius and Fahrenheit Temperature ScalesJacob SheridanNo ratings yet

- ML of EDTA vs. AbsorbanceDocument6 pagesML of EDTA vs. AbsorbanceJacob SheridanNo ratings yet

- Job's Plot For The Stoichiometric Analysis of The Formation of A ComplexDocument2 pagesJob's Plot For The Stoichiometric Analysis of The Formation of A ComplexJacob SheridanNo ratings yet

- Research ProposalDocument1 pageResearch ProposalJacob SheridanNo ratings yet

- The Project Rubric Spring 2020Document2 pagesThe Project Rubric Spring 2020Jacob Sheridan100% (1)

- Experiment Lab 11Document4 pagesExperiment Lab 11Jacob SheridanNo ratings yet

- Vapor Pressure of A Liquid: 4.5 5 F (X) 4972.07607066223 X + 20.8345560095235 R 0.988193546860382Document2 pagesVapor Pressure of A Liquid: 4.5 5 F (X) 4972.07607066223 X + 20.8345560095235 R 0.988193546860382Jacob SheridanNo ratings yet

- SSProblem2E PPT Part 5Document30 pagesSSProblem2E PPT Part 5Jacob SheridanNo ratings yet

- Annotated BibliographyDocument4 pagesAnnotated BibliographyJacob SheridanNo ratings yet

- The Project Rubric Spring 2020Document2 pagesThe Project Rubric Spring 2020Jacob Sheridan100% (1)

- Project One For Online - 2Document5 pagesProject One For Online - 2Jacob SheridanNo ratings yet

- Project One For Online - 2Document5 pagesProject One For Online - 2Jacob SheridanNo ratings yet

- Ar Zoo Id: 8. The Name of The File You Submit in Blackboard Should Be Your Full Name (5 Points)Document1 pageAr Zoo Id: 8. The Name of The File You Submit in Blackboard Should Be Your Full Name (5 Points)Jacob SheridanNo ratings yet

- Orderdate Region Rep Item UnitsDocument4 pagesOrderdate Region Rep Item UnitsMohd Wirawan PutraNo ratings yet

- Part 4: Group Decision Making and Problem SolvingDocument29 pagesPart 4: Group Decision Making and Problem SolvingJacob SheridanNo ratings yet

- Business Problem Solving Project 1Document6 pagesBusiness Problem Solving Project 1Jacob SheridanNo ratings yet

- Test Scores and Projected Profitability AnalysisDocument10 pagesTest Scores and Projected Profitability AnalysisJacob SheridanNo ratings yet

- Gurda 1: The Idea of A Smart City Was Introduced in 1974Document4 pagesGurda 1: The Idea of A Smart City Was Introduced in 1974Jacob SheridanNo ratings yet

- HR projects to improve processesDocument1 pageHR projects to improve processesJacob SheridanNo ratings yet

- Safeway Insurance: Services and SupportDocument7 pagesSafeway Insurance: Services and SupportJacob SheridanNo ratings yet

- Aspen Trails Maps Guided Hiking Backpacking ClimbingDocument9 pagesAspen Trails Maps Guided Hiking Backpacking ClimbingJacob SheridanNo ratings yet