Professional Documents

Culture Documents

BACC200 Chapter 10 Extra Exercises Solution

Uploaded by

123312960 ratings0% found this document useful (0 votes)

4 views2 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views2 pagesBACC200 Chapter 10 Extra Exercises Solution

Uploaded by

12331296Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

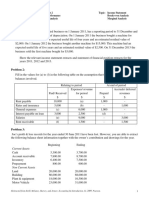

BACC200 Financial Accounting

Chapter Ten

Plant Assets, Natural Resources and Intangible Assets

Exercise One:

# Expenditures Land Land Building

Improvements

1. Cash purchase price of land $120,000. X

2. Architect’s fees for building plans. X

Parking lots and driveways with a total cost of

3. X

$18,000.

Demolition and removal costs of the old building

4. X

$22,000.

Attorney’s fees for legal services provided during

5. X

land purchases $2,000.

6. Cost of fences $6,000. X

Exercise Two:

a.

# Description Included Not Included

1. Cash price of $40,000. X

2. Sales taxes of $2,000 and freight costs of $500. X

Electricity bill of $200 was paid for the current

3. X

month for using the machine.

One year fire insurance policy covering the

4. X

machine at a cost of $3,000.

Material and labor costs in installing and testing

5. X

the machine of $1,500.

b.

Date Account Title and Explanation Ref Debit Credit

2014 Equipment 44,000

Cash 44,000

April 10

($40,000 + $2,000 + $500 + $1,500)

Electricity Expense 200

April 10

Cash 200

Prepaid Insurance 3,000

April 10

Cash 3,000

Exercise Three:

a) Depreciable Cost = $40,000 - $8,000 = $32,000

Annual depreciation expense = 32,000/ 4years = $8,000

Depreciation Accumulated Book Value

Year Cost

Expense Depreciation (End of Year)

2015 $40,000 $8,000 $8,000 $32,000

2016 40,000 8,000 16,000 24,000

2017 40,000 8,000 24,000 16,000

2018 40,000 8,000 32,000 8,000

a)

b)

Date Account Title and Explanation Ref. Debit Credit

Dec 31 Depreciation Expense 8,000

2016 Accumulated Depreciation – Equipment 8,000

You might also like

- Real Estate License Exam Calculation Workbook: Volume 2 (2023 Edition)From EverandReal Estate License Exam Calculation Workbook: Volume 2 (2023 Edition)No ratings yet

- 5BAP5D03 PPEforprintingDocument8 pages5BAP5D03 PPEforprintingCykee Hanna Quizo LumongsodNo ratings yet

- Posting Transactions to the General LedgerDocument19 pagesPosting Transactions to the General Ledgerdanica gomez88% (8)

- Acc Pro Sol EXERDocument17 pagesAcc Pro Sol EXERAli Al AjamiNo ratings yet

- Income Statement TutorialDocument5 pagesIncome Statement TutorialKhiren MenonNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- Mock 1 Mid-Term Exam AcountabilityDocument6 pagesMock 1 Mid-Term Exam AcountabilityJhon WickNo ratings yet

- ManaccDocument12 pagesManaccCynthia KesumaNo ratings yet

- Quiz 3 Ppe QuestionsDocument4 pagesQuiz 3 Ppe QuestionsJessica Marie MigrasoNo ratings yet

- Accounting Practice 4 First Partial 2021-3Document13 pagesAccounting Practice 4 First Partial 2021-3ScribdTranslationsNo ratings yet

- #3 Financial Accounting and Reporting Test BankDocument32 pages#3 Financial Accounting and Reporting Test BankPatOcampo100% (5)

- Financial Accounting and Reporting Test Bank 80102016 - 3: - Investment in AssociateDocument10 pagesFinancial Accounting and Reporting Test Bank 80102016 - 3: - Investment in AssociateFery AnnNo ratings yet

- Final Long Quiz Acct 039Document3 pagesFinal Long Quiz Acct 039Karen YpilNo ratings yet

- QUIZ 9 fINACRDocument9 pagesQUIZ 9 fINACRJen NerNo ratings yet

- Quiz 9 FinacrDocument9 pagesQuiz 9 FinacrJen Ner100% (5)

- Financial Accouting 1 Final PaperDocument2 pagesFinancial Accouting 1 Final PaperadnanNo ratings yet

- Corporate Liquidation & ReorganizationDocument6 pagesCorporate Liquidation & ReorganizationNahwi KimpaNo ratings yet

- PPE Part 1 ReviewerDocument13 pagesPPE Part 1 ReviewerMariel DichosoNo ratings yet

- Pengakun CH 09Document10 pagesPengakun CH 09nadia salsabilaNo ratings yet

- Mock 1 mid-term exam (answers and explanations)Document8 pagesMock 1 mid-term exam (answers and explanations)100519554No ratings yet

- Capitalization Rate Total Interest Expense On General Borrowings Total General BorrowingsDocument2 pagesCapitalization Rate Total Interest Expense On General Borrowings Total General BorrowingsKeith NavalNo ratings yet

- Quiz Chapter 15 Ppe Part 1 2020ed 1Document3 pagesQuiz Chapter 15 Ppe Part 1 2020ed 1Mark Rafael MacapagalNo ratings yet

- M.B.A (2019 Pattern)Document157 pagesM.B.A (2019 Pattern)girishpawarudgirkarNo ratings yet

- Ppe - WorksheetDocument7 pagesPpe - Worksheetbereket nigussieNo ratings yet

- Accounting For Transactions: Key Terms and Concepts To KnowDocument19 pagesAccounting For Transactions: Key Terms and Concepts To KnowAileenNo ratings yet

- ACC101 Chapter2newDocument19 pagesACC101 Chapter2newDEREJENo ratings yet

- Accounting For Transactions: Key Terms and Concepts To KnowDocument19 pagesAccounting For Transactions: Key Terms and Concepts To KnowMaria Nicole OroNo ratings yet

- ACC101 Chapter2newDocument19 pagesACC101 Chapter2newCASTOR JAVIERNo ratings yet

- ACC101 Chapter2new EditedDocument19 pagesACC101 Chapter2new EditedCASTOR JAVIERNo ratings yet

- Exhibit 7. Revenue and Expense RecognitionDocument6 pagesExhibit 7. Revenue and Expense RecognitionЭниЭ.No ratings yet

- Guide to Non-Current Asset AccountingDocument3 pagesGuide to Non-Current Asset Accountingshera haniNo ratings yet

- Principles of Accounting, Chapter 10, Plant Asset SolutionDocument10 pagesPrinciples of Accounting, Chapter 10, Plant Asset SolutionMahmudur Rahman83% (6)

- Corporate Liquidation QuizDocument4 pagesCorporate Liquidation QuizMarinoNo ratings yet

- ACCOUNTING FAIR - Soal Babak 1 Penyisihan OnlineDocument16 pagesACCOUNTING FAIR - Soal Babak 1 Penyisihan OnlineGaidon HercNo ratings yet

- Date Transaction: 1. Journalize and Post To The LedgerDocument5 pagesDate Transaction: 1. Journalize and Post To The LedgerArlyn Ragudos BSA1No ratings yet

- Latihan - Aset Tidak Berwujud-JAWABDocument7 pagesLatihan - Aset Tidak Berwujud-JAWABAndreas HottoNo ratings yet

- Assessment No. 3-Midterm - Exam SheetDocument7 pagesAssessment No. 3-Midterm - Exam Sheetarnel buanNo ratings yet

- Financial Accounting and Reporting Test Bank 80102016 - 3: Problem 1 - Investment in AssociateDocument5 pagesFinancial Accounting and Reporting Test Bank 80102016 - 3: Problem 1 - Investment in AssociateCarlo ParasNo ratings yet

- Assignment PPE PArt 1Document7 pagesAssignment PPE PArt 1JP Mirafuentes100% (1)

- BookkeepingDocument5 pagesBookkeepingfikaNo ratings yet

- FMA Assignment 01Document5 pagesFMA Assignment 01Dejen TagelewNo ratings yet

- Intermediate Accounting 1Document4 pagesIntermediate Accounting 1reg capiral100% (1)

- SELF TEST 7 PROPERTY, PLANT AND EQUIPMENTDocument4 pagesSELF TEST 7 PROPERTY, PLANT AND EQUIPMENTJose Conrad Nupia BagonNo ratings yet

- Acct 6065 Second Exam Spring 202104262021Document14 pagesAcct 6065 Second Exam Spring 202104262021Michael Pirone100% (1)

- Chapter 10 Homework and Solutions 1.: Account Titles and Explanation Debit CreditDocument24 pagesChapter 10 Homework and Solutions 1.: Account Titles and Explanation Debit Creditlana del reyNo ratings yet

- Problem Set 3 Financial Statements BS SE S18Document8 pagesProblem Set 3 Financial Statements BS SE S18Nust Razi100% (1)

- 201.AFA IP.L II December 2020Document4 pages201.AFA IP.L II December 2020leyaketjnuNo ratings yet

- Acc 201 CH 9Document7 pagesAcc 201 CH 9Trickster TwelveNo ratings yet

- Del Capítulo 9, Resolver: 1. Ejercicio E9-3 Página 428Document10 pagesDel Capítulo 9, Resolver: 1. Ejercicio E9-3 Página 428Estefanía ZavalaNo ratings yet

- PA1 Group1 Week8Document8 pagesPA1 Group1 Week8Phuong Nguyen MinhNo ratings yet

- QUIZ - CHAPTER 15 - PPE PART 1 - 2020edDocument3 pagesQUIZ - CHAPTER 15 - PPE PART 1 - 2020edjanna napili100% (1)

- ACT301 (Final), Spring-21Document4 pagesACT301 (Final), Spring-21Papon SarkerNo ratings yet

- Practice Question Paper - Financial AccountingDocument6 pagesPractice Question Paper - Financial AccountingNaomi SaldanhaNo ratings yet

- M.B.A (2019 Pattern)Document291 pagesM.B.A (2019 Pattern)SurajNo ratings yet

- Chapter 9 Question Review PDFDocument12 pagesChapter 9 Question Review PDFAbdul AkberNo ratings yet

- Chapter 10 - Plant Assets & Depreciation Methods: Practice ExercisesDocument8 pagesChapter 10 - Plant Assets & Depreciation Methods: Practice ExercisesLý Nguyễn Tuyết MaiNo ratings yet

- Chapter 20 Non-Current Assets Acquisition and DepreciationDocument6 pagesChapter 20 Non-Current Assets Acquisition and DepreciationDasun LakshithNo ratings yet

- Tutorial Chpater 10-11 Part BDocument32 pagesTutorial Chpater 10-11 Part BKate BNo ratings yet

- JOURNAL ENTRIES FOR INVENTORY TRANSACTIONSDocument9 pagesJOURNAL ENTRIES FOR INVENTORY TRANSACTIONSOmar PerezNo ratings yet

- 4th Annual Aerotropolis Brochure 7 PDFDocument6 pages4th Annual Aerotropolis Brochure 7 PDFPablo Gil-CornaroNo ratings yet

- GGGI - Procurement Rules (2018) PDFDocument25 pagesGGGI - Procurement Rules (2018) PDFFerry MarkotopNo ratings yet

- Ethics in Business 1Document7 pagesEthics in Business 1Hana 64No ratings yet

- Unit 4 TdsDocument18 pagesUnit 4 TdsAnshu kumarNo ratings yet

- ASAL Economics Coursebook AnswersDocument174 pagesASAL Economics Coursebook AnswersNicole Kayra Budiawan100% (1)

- StraMa Module 3Document10 pagesStraMa Module 3Christalyn MaputolNo ratings yet

- Operators-Data-Sheet (Quezon City) PDFDocument3 pagesOperators-Data-Sheet (Quezon City) PDFGene JabonNo ratings yet

- Commercial Invoice Gas Sale MozambiqueDocument1 pageCommercial Invoice Gas Sale Mozambiquealsone07No ratings yet

- Professional CV ResumeDocument1 pageProfessional CV ResumenetoameNo ratings yet

- Insular Life Assurance Co LTD Vs NLRC, 179 Scra 439Document2 pagesInsular Life Assurance Co LTD Vs NLRC, 179 Scra 439Earvin Joseph BaraceNo ratings yet

- Argumenative EssayDocument4 pagesArgumenative Essaynhbtoxwhd100% (2)

- Enhancing Container Terminal Productivity: A Co-Maker Approach Between Carriers and OperatorsDocument3 pagesEnhancing Container Terminal Productivity: A Co-Maker Approach Between Carriers and OperatorsAdn AdinaNo ratings yet

- NBL AbidDocument72 pagesNBL AbidSharif AhmedNo ratings yet

- Ontel v. Shop LC - ComplaintDocument29 pagesOntel v. Shop LC - ComplaintSarah BursteinNo ratings yet

- Ms-Excel Assignment: Slno Student Name Course Joined Semester Fees Paid Fees DueDocument5 pagesMs-Excel Assignment: Slno Student Name Course Joined Semester Fees Paid Fees Dueviveksbdesai99@yahoo.co.inNo ratings yet

- AP Macro Cram Chart 2021Document1 pageAP Macro Cram Chart 2021weronikaNo ratings yet

- Pengantar Hukum Dagang Introduction To CommercialDocument2 pagesPengantar Hukum Dagang Introduction To CommercialAngela TambunanNo ratings yet

- Business PlanDocument26 pagesBusiness Planroshan kcNo ratings yet

- Aristocrat VP Named President of Gaming AssociationDocument2 pagesAristocrat VP Named President of Gaming AssociationSergey VissarionovNo ratings yet

- CMPD 424 Chapter 8: Social Networks, Auctions and PortalsDocument12 pagesCMPD 424 Chapter 8: Social Networks, Auctions and Portalsamirul hakimNo ratings yet

- Aarti Industries Limiteds Board Approves The Proposal For Buyback of Its Equity Shares (Company Update)Document3 pagesAarti Industries Limiteds Board Approves The Proposal For Buyback of Its Equity Shares (Company Update)Shyam SunderNo ratings yet

- SUS H101 Aspen HYSYS CCS ACU Study GuideDocument3 pagesSUS H101 Aspen HYSYS CCS ACU Study GuideOttors kebin philipNo ratings yet

- PGP 1 Group M2 Improves Maya SalesDocument4 pagesPGP 1 Group M2 Improves Maya SalesApoorva SharmaNo ratings yet

- Managing Change and Innovation: Stephen P. Robbins Mary CoulterDocument31 pagesManaging Change and Innovation: Stephen P. Robbins Mary CoulterRatul HasanNo ratings yet

- Download ebook Marketing 5Th Edition 2021 Pdf full chapter pdfDocument67 pagesDownload ebook Marketing 5Th Edition 2021 Pdf full chapter pdfbrian.williams904100% (20)

- Webcast - Secure Database Configurations and Meet CIS Benchmark StandardsDocument24 pagesWebcast - Secure Database Configurations and Meet CIS Benchmark StandardsTimNo ratings yet

- Dispute Freight ContractDocument15 pagesDispute Freight ContractVy Trần Thị ThảoNo ratings yet

- HINDUSTAN UNILEVER LTD HulDocument41 pagesHINDUSTAN UNILEVER LTD Hulviveknegandhi100% (2)

- 5035.assignment 1 Frontsheet (2021 - 2022)Document9 pages5035.assignment 1 Frontsheet (2021 - 2022)Nguyen Vo Minh Anh (FGW DN)No ratings yet

- IDT CASE LAW & Amendments For May 12 FinalDocument229 pagesIDT CASE LAW & Amendments For May 12 FinalRoopendra PrasadNo ratings yet