Professional Documents

Culture Documents

Guide to Non-Current Asset Accounting

Uploaded by

shera haniOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Guide to Non-Current Asset Accounting

Uploaded by

shera haniCopyright:

Available Formats

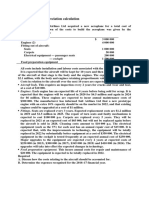

TUTORIAL: NON-CURRENT ASSETS

1. Ramirez Company installs a computerized manufacturing machine in its factory at the

beginning of the year at a cost of $43,500. The machine’s useful life is estimated at 10 years,

or 385,000 units of product, with a $5,000 salvage value. During its second year, the

machine produces 32,500 units of product.

a) Determine the machine’s second-year depreciation and year end book value under the

straight-line method, and provide the appropriate journal entry.

b) Determine the machine’s second-year depreciation using the units-of-production method,

and provide the appropriate journal entry.

c) Determine the machine’s second-year depreciation using the double-declining-balance

method, and provide the appropriate journal entry.

a) Second-year end depreciation: Straight-line : (43500-5000)/ 10 = 3850

Year-end book value: 43500-3850-3850= 35800

b) Units-of-production method : (43500-5000/385000)*32500= 3250

Deprecition expense (dt) 3250 Accumulated depreciation (ct)3250

c) Double-declining-balance method :

Depreciation : (1/useful life)*2 = (1/10)*2= 0.2 *100 = 20%

First year depreciation: 43500 * 20% =8700

Second year depreciation : 34800*20% =6960

2. On January 1, the Matthews Band pays $65,800 for sound equipment. The band estimates it

will use this equipment for four years and after four years it can sell the equipment for

$2,000. Matthews Band uses straight-line depreciation but realizes at the start of the second

year that this equipment will last only a total of three years. The salvage value is not

changed.

Compute the revised depreciation for both the second and third years.

Annual Depreciation = ( cost price- salvage value) / useful life

= (65800-2000)/4 = 15950

Book value at the point of revision = Cost price - Depreciation for year 1 = 65800-15950

=49850

Remaining depreciation cost = 49850-2000 = 47850

Depreciation for second and third year = 47850/2 = 23925

3. Perez Company acquires an ore mine at a cost of $1,400,000. It incurs additional costs of

$400,000 to access the mine, which is estimated to hold 1,000,000 tons of ore. 180,000 tons

of ore are mined and sold the first year. The estimated value of the land after the ore is

removed is $200,000. Calculate the depletion expense from the information given.

Prepare the entry to record the cost of the ore mine and year-end adjusting entry.

Cost = 1400000+400000 1800000

Salvage value 200000

Depletion expense(cost-salvage value ) 1600000

Totals unit of capacity 1000000tons

Depletion per unit (1,600,000/1000000) $1.60 per unit

Units extracted and sold in period 180000 tons

Depletion expense (1.60* 180000) $288000

Date accounts & explanation debit credit

Ore Mine 1,800,000

4. Cash 1,800,000 Classify

the (Cost of Ore Mine with Additional Cost to access the Mine) following

Depletion expense $288,000

Accumulated depletion $288,000

(Depletion expense as calculated Above)

transactions as either a revenue expenditure or a capital expenditure, and prepare the

appropriate journal entry.

a. Paid $42,000 cash to replace a motor on equipment that extends its useful life by four

years.

Capital expenditure Equipment 42000(dt) , Cash 42000(ct)

b. Paid $210 cash per truck for the cost of their annual tune-ups.

Revenue expenditure Cash ct 210 Repair and maintainance dt 210

c. Paid $168 for the monthly cost of replacement filters on an air-conditioning system.

Revenue expenditure Repair and maintainece expense DT 168 Cash ct 168

d. Completed an addition to a building for $236,250 cash.

Capital Expenditure Building 236250 (DT) Cash 236250 (ct)

5. Garcia Company owns equipment that cost $76,800, with accumulated depreciation of

$40,800.

Record the sale of the equipment under the following three separate cases assuming Garcia

sells the equipment for (1) $47,000 cash, (2) $36,000 cash, and (3) $31,000 cash.

Cash 47000(dt)

Accumulated depreciation 40800(dt)

Equipment 76800(ct)

Gain on disposal 11000(ct)

Carrying amount equipment = cost- accum dep

= 76800-40800 = 36000

You might also like

- Financial Accounting Reviewer - Chapter 58Document13 pagesFinancial Accounting Reviewer - Chapter 58Coursehero PremiumNo ratings yet

- Ppe - Intpraa - 03182020 - Part 2Document6 pagesPpe - Intpraa - 03182020 - Part 2Mich ClementeNo ratings yet

- Intercompany Sale of Fixed AssetsDocument5 pagesIntercompany Sale of Fixed AssetsasdasdaNo ratings yet

- Airline pricing considerations beyond costDocument10 pagesAirline pricing considerations beyond costZoeNo ratings yet

- Wasting Assets AnnotatedDocument3 pagesWasting Assets AnnotatedLloydNo ratings yet

- Depletion: Problem 34-1 (IFRS)Document20 pagesDepletion: Problem 34-1 (IFRS)수지100% (8)

- Principles of Accounting, Chapter 10, Plant Asset SolutionDocument10 pagesPrinciples of Accounting, Chapter 10, Plant Asset SolutionMahmudur Rahman83% (6)

- 5BAP5D03 PPEforprintingDocument8 pages5BAP5D03 PPEforprintingCykee Hanna Quizo LumongsodNo ratings yet

- Unit and Output Costing QuestionDocument14 pagesUnit and Output Costing QuestionSilver TricksNo ratings yet

- Income Statement TutorialDocument5 pagesIncome Statement TutorialKhiren MenonNo ratings yet

- T4 - (Assets) - Qs and SolutionDocument22 pagesT4 - (Assets) - Qs and SolutionCalvin MaNo ratings yet

- Chapter 9-1Document5 pagesChapter 9-1jou20220354No ratings yet

- Sol. Man. - Chapter 17 - Depletion of Mineral Resources - Ia Part 1B 1Document6 pagesSol. Man. - Chapter 17 - Depletion of Mineral Resources - Ia Part 1B 1Rezzan Joy Camara Mejia67% (6)

- Depreciation CalculationDocument29 pagesDepreciation CalculationRavineahNo ratings yet

- BACC200 Chapter 10 Extra Exercises SolutionDocument2 pagesBACC200 Chapter 10 Extra Exercises Solution12331296No ratings yet

- Depletion PDFDocument3 pagesDepletion PDFAlexly Gift UntalanNo ratings yet

- Lec04 SolutionDocument12 pagesLec04 SolutionedrianclydeNo ratings yet

- Acc Pro Sol EXERDocument17 pagesAcc Pro Sol EXERAli Al AjamiNo ratings yet

- Exploration For Evaluatio of Mineral ResourcesDocument8 pagesExploration For Evaluatio of Mineral ResourcesRNo ratings yet

- Tutorial 3 MFRS 116 QDocument15 pagesTutorial 3 MFRS 116 QN FrzanahNo ratings yet

- Intermediate Accounting 1 Solution Manual: Chapter 15 - Property, Plant and Equipment To Chapter 17 - Depletion of Mineral ResourcesDocument20 pagesIntermediate Accounting 1 Solution Manual: Chapter 15 - Property, Plant and Equipment To Chapter 17 - Depletion of Mineral ResourcesMckenzieNo ratings yet

- QUIZ - CHAPTER 16 - PPE PART 2 - 2020edDocument5 pagesQUIZ - CHAPTER 16 - PPE PART 2 - 2020edjanna napiliNo ratings yet

- Cost of Land and Buildings Purchased by Esculent CoDocument7 pagesCost of Land and Buildings Purchased by Esculent Coprey kunNo ratings yet

- Review Handouts and Materials: Semester First Semester School Year 2019-2020 Subject Handout # TopicDocument9 pagesReview Handouts and Materials: Semester First Semester School Year 2019-2020 Subject Handout # TopicKarlayaanNo ratings yet

- PPE Sample ProblemsDocument5 pagesPPE Sample ProblemsKathleen FrondozoNo ratings yet

- Acc Q4Document9 pagesAcc Q4risvana rahimNo ratings yet

- Universiti Teknologi Mara Common Test 1 Answer Scheme: Confidential AC/OCT2018/FAR320Document5 pagesUniversiti Teknologi Mara Common Test 1 Answer Scheme: Confidential AC/OCT2018/FAR320iqbalhakim123No ratings yet

- Answer KEY PPEDocument6 pagesAnswer KEY PPExjammerNo ratings yet

- Quiz 3 Ppe QuestionsDocument4 pagesQuiz 3 Ppe QuestionsJessica Marie MigrasoNo ratings yet

- IA Activity 6 AssDocument6 pagesIA Activity 6 AssWeStan LegendsNo ratings yet

- Ppe Problems 3Document4 pagesPpe Problems 3venice cambryNo ratings yet

- AP-5903 - PPE & IntangiblesDocument8 pagesAP-5903 - PPE & IntangiblesDreiu EsmeleNo ratings yet

- Bba 1 Sem Cost Accounting Compulsory 5547 Summer 2019 PDFDocument5 pagesBba 1 Sem Cost Accounting Compulsory 5547 Summer 2019 PDFNikhil MohaneNo ratings yet

- 108A W23++Homework+8Document8 pages108A W23++Homework+8Julius SuhermanNo ratings yet

- Case Study (Cost Approach) by Vineesh VidhyadharanDocument47 pagesCase Study (Cost Approach) by Vineesh Vidhyadharanhimanshu.rajpurohit.29No ratings yet

- 9 QuijanoDocument3 pages9 QuijanoARISNo ratings yet

- Cost-Accounting 2017 WinterDocument5 pagesCost-Accounting 2017 WinterRusHuNo ratings yet

- Acc 205-Intermediate Accounting I Part Ii Ppe Part 2: Long QuizDocument5 pagesAcc 205-Intermediate Accounting I Part Ii Ppe Part 2: Long Quizemielyn lafortezaNo ratings yet

- Solution.: ST ND RD THDocument4 pagesSolution.: ST ND RD THhaggaiNo ratings yet

- Chapter 17 MineralDocument3 pagesChapter 17 MineralKiminosunoo LelNo ratings yet

- Asset Depreciation and Revaluation ReportDocument10 pagesAsset Depreciation and Revaluation ReportAaliyah ManuelNo ratings yet

- Solutionchapter 18 - Advacc Solutionchapter 18 - AdvaccDocument68 pagesSolutionchapter 18 - Advacc Solutionchapter 18 - AdvaccDvcLouisNo ratings yet

- Sol. Man. - Chapter 15 - Ppe Part 1 - Ia Part 1B 1Document9 pagesSol. Man. - Chapter 15 - Ppe Part 1 - Ia Part 1B 1Rezzan Joy Camara Mejia100% (1)

- Property, Plant and Equipment: Chapter 23 AnswerDocument34 pagesProperty, Plant and Equipment: Chapter 23 AnswerYuuNeko08No ratings yet

- END Examination: Ques. L (A) (B) (8+7) Ques. 2 (A) (B)Document2 pagesEND Examination: Ques. L (A) (B) (8+7) Ques. 2 (A) (B)Lavi LakhotiaNo ratings yet

- Asset Acquisition Costs and Capitalized ValuesDocument8 pagesAsset Acquisition Costs and Capitalized ValuesPeter Elijah AntonioNo ratings yet

- Property, plant and equipment audit of SKDJGNRUIBIDUG CorporationDocument8 pagesProperty, plant and equipment audit of SKDJGNRUIBIDUG CorporationROMAR A. PIGANo ratings yet

- Revaluation of PPE AssetsDocument17 pagesRevaluation of PPE AssetsKatrina PetracheNo ratings yet

- Final Long Quiz Acct 039Document3 pagesFinal Long Quiz Acct 039Karen YpilNo ratings yet

- AUDITING PROBLEMS EXAM REVIEWDocument8 pagesAUDITING PROBLEMS EXAM REVIEWROMAR A. PIGANo ratings yet

- Accounting Practice 4 First Partial 2021-3Document13 pagesAccounting Practice 4 First Partial 2021-3ScribdTranslationsNo ratings yet

- 28 Solved PCC Cost FM Nov09Document16 pages28 Solved PCC Cost FM Nov09Karan Joshi100% (1)

- FAIIQuiz 1 BsolDocument3 pagesFAIIQuiz 1 BsolHuzaifa Bin SaeedNo ratings yet

- Handout Standard ABC and PERTDocument3 pagesHandout Standard ABC and PERTdarlenexjoyceNo ratings yet

- Real Estate License Exam Calculation Workbook: Volume 2 (2023 Edition)From EverandReal Estate License Exam Calculation Workbook: Volume 2 (2023 Edition)No ratings yet

- The Process of Capitalist Production as a Whole (Capital Vol. III)From EverandThe Process of Capitalist Production as a Whole (Capital Vol. III)No ratings yet

- Mechanical Properties and Performance of Engineering Ceramics and Composites X: A Collection of Papers Presented at the 39th International Conference on Advanced Ceramics and CompositesFrom EverandMechanical Properties and Performance of Engineering Ceramics and Composites X: A Collection of Papers Presented at the 39th International Conference on Advanced Ceramics and CompositesDileep SinghNo ratings yet

- Southern Marine Engineering Desk Reference: Second Edition Volume IFrom EverandSouthern Marine Engineering Desk Reference: Second Edition Volume INo ratings yet

- Exercise Presentation InformationDocument17 pagesExercise Presentation Informationshera haniNo ratings yet

- Teaching Audience with StorytellingDocument18 pagesTeaching Audience with Storytellingshera haniNo ratings yet

- EXERCISE Speech OutlineDocument16 pagesEXERCISE Speech Outlineshera haniNo ratings yet

- C. The Materials Used To Support A Speaker's Idea.: A. Examples, Statistics and TestimonyDocument8 pagesC. The Materials Used To Support A Speaker's Idea.: A. Examples, Statistics and Testimonyshera haniNo ratings yet

- C. The Materials Used To Support A Speaker's Idea.: A. Examples, Statistics and TestimonyDocument8 pagesC. The Materials Used To Support A Speaker's Idea.: A. Examples, Statistics and Testimonyshera haniNo ratings yet

- Exercise 2 Public Oration (Communication Concepts)Document18 pagesExercise 2 Public Oration (Communication Concepts)shera haniNo ratings yet

- Lpe2301 SCL Worksheet 3 Sem2.20.21Document2 pagesLpe2301 SCL Worksheet 3 Sem2.20.21shera haniNo ratings yet

- Lpe2301 SCL Worksheet 5 Sem2.20.21Document3 pagesLpe2301 SCL Worksheet 5 Sem2.20.21shera haniNo ratings yet

- Public Speaking Exam: Test Your Knowledge of Key Speech ConceptsDocument15 pagesPublic Speaking Exam: Test Your Knowledge of Key Speech Conceptsshera haniNo ratings yet

- Lpe2301 SCL Worksheet 1 Sem2.20.21Document3 pagesLpe2301 SCL Worksheet 1 Sem2.20.21shera haniNo ratings yet

- BALI COMPANY 2020 Financial StatementsDocument4 pagesBALI COMPANY 2020 Financial Statementsshera haniNo ratings yet

- BGB Unit 40 & 50Document7 pagesBGB Unit 40 & 50Julia LonerNo ratings yet

- Regulation S DisclaimerDocument2 pagesRegulation S DisclaimerDouglas SlainNo ratings yet

- Sannyasi and Fakir RebellionDocument17 pagesSannyasi and Fakir RebellionNityapriyaSrivastavaNo ratings yet

- PERLINDUNGAN HUKUM TERHADAP PEMILIK SAHAM PERUSAHAAN YANG PAILIT-Abraham Gilbert SimatupangDocument15 pagesPERLINDUNGAN HUKUM TERHADAP PEMILIK SAHAM PERUSAHAAN YANG PAILIT-Abraham Gilbert SimatupangIMBHB UHNNo ratings yet

- Level 3 CPNI Certification 2016 For 2015 Final (2.26.2016) PDFDocument3 pagesLevel 3 CPNI Certification 2016 For 2015 Final (2.26.2016) PDFFederal Communications Commission (FCC)No ratings yet

- Test Bank For Business Law Today Comprehensive 12th Edition Roger Leroy MillerDocument18 pagesTest Bank For Business Law Today Comprehensive 12th Edition Roger Leroy Millercooly.maharmahb89a8100% (46)

- Ensure Transparency of School Canteen ReportsDocument14 pagesEnsure Transparency of School Canteen ReportsJessa GeronNo ratings yet

- Taxation PDFDocument8 pagesTaxation PDFleighNo ratings yet

- Pakistan Study: Presented By: Bisma Baby Predented To: Sir Gulam MurtazaDocument10 pagesPakistan Study: Presented By: Bisma Baby Predented To: Sir Gulam MurtazagmusamaNo ratings yet

- External Audit ThesisDocument8 pagesExternal Audit ThesisLisa Riley100% (2)

- General LedgerDocument143 pagesGeneral Ledgerlog_anupam100% (1)

- CO Traffic Crash Report on I25 at Milepoint 242Document6 pagesCO Traffic Crash Report on I25 at Milepoint 242Debra DreilingNo ratings yet

- Cmo 9 S 2019 Suc Level of 106 SucsDocument4 pagesCmo 9 S 2019 Suc Level of 106 SucsTân Trịnh LêNo ratings yet

- CBSE Class 11 Physics Mechanical Properties of SolidsDocument1 pageCBSE Class 11 Physics Mechanical Properties of SolidsSanjana MehtaNo ratings yet

- Borol II Elementary School Alternative Work Arrangements for SY 2021-2022Document3 pagesBorol II Elementary School Alternative Work Arrangements for SY 2021-2022Mitzi Faye CabbabNo ratings yet

- Certificate Analysis Indonesian Coal ShipmentDocument2 pagesCertificate Analysis Indonesian Coal ShipmentGora PribadiNo ratings yet

- Fin440 Sample Report-Kohinoor-Keya PDFDocument35 pagesFin440 Sample Report-Kohinoor-Keya PDFTamim ChowdhuryNo ratings yet

- Triple Canopy Base InfoDocument5 pagesTriple Canopy Base InfojmusseryNo ratings yet

- Carlos TRABAJO FINAL INGLES 1 1Document7 pagesCarlos TRABAJO FINAL INGLES 1 1Greis sayuri Arellano AvendañoNo ratings yet

- Walkathon Brochure - 2021 Trifold 2Document2 pagesWalkathon Brochure - 2021 Trifold 2api-208159640No ratings yet

- HazingDocument29 pagesHazingJulius ManaloNo ratings yet

- Distinguishing The Types of Historical SourcesDocument3 pagesDistinguishing The Types of Historical SourcesCassandraNo ratings yet

- For Land & JusticeDocument23 pagesFor Land & JusticeUMAPilipinasNo ratings yet

- Aud Red SirugDocument12 pagesAud Red SirugRisaline CuaresmaNo ratings yet

- EL SINIRUBE Habilitador de Politica Social de Precision en Costa RicaDocument51 pagesEL SINIRUBE Habilitador de Politica Social de Precision en Costa RicaRoberto Cascante VindasNo ratings yet

- Cloud Digital LeaderDocument39 pagesCloud Digital LeaderAnubhav SinghNo ratings yet

- Annual General Information Sheet for Stock CorporationDocument12 pagesAnnual General Information Sheet for Stock Corporationedgar sean galvezNo ratings yet

- Types of Bailment: Compressive Study Special Contract: Parinsha Sharma Division B Roll No 53 Class 2013-18 ofDocument13 pagesTypes of Bailment: Compressive Study Special Contract: Parinsha Sharma Division B Roll No 53 Class 2013-18 ofNiyati BagweNo ratings yet

- Boat Travel and Scuba Diving: Non-Agency Disclosure and Acknowledgment AgreementDocument2 pagesBoat Travel and Scuba Diving: Non-Agency Disclosure and Acknowledgment AgreementAhsan TaqveemNo ratings yet

- Jacquin Nationalism and Secession in The Horn of AfricaDocument300 pagesJacquin Nationalism and Secession in The Horn of AfricaDiego HatadaNo ratings yet