Professional Documents

Culture Documents

Mbaf Syllabus

Uploaded by

Jewelyn C. Espares-CioconOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mbaf Syllabus

Uploaded by

Jewelyn C. Espares-CioconCopyright:

Available Formats

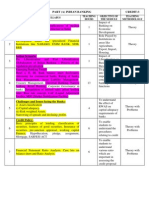

MBAF: 310 TREASURY MANAGEMENT

Time Allowed : 3 Hours M.M:70

Objective: The objective of this course is to analyze the major concepts, theories of

treasury management in logical and critical manner.

Course Contents:

UNIT-I

Scope and Function of Treasury Management: Objectives of Treasury, Structure and

Organization, Responsibilities of Treasury Manager, Function of treasury – Centralized

vs. Decentralized. Domestic Cash Management: Short Term/Medium Term Funding –

Meaning and Importance of Cash Management, Objectives of Cash Management, Cash

Flow Cycle, Cash Flow Budgeting and Forecasting, Electronic Cash Management

UNIT-II

Medium term and Long term Funding: FDs/NCDs/Term Loans, Securitization; Cost

Centre / Profit Centre: Financial Planning and Control, Capital Budgeting, Risk Analysis;

Liquidity Management: Objectives, Sources of Liquidity, Maturity Concerns: Projected

Cash Flow and Core Sources-Contingency Plans.

UNIT-III

Treasury’s role in International Banking: Changing Global Scenario and Treasury

Functions, Treasury Structure- Front and Back Office, Forex Cash Management –

Positions vs. Cash Flows- Funding Alternatives, Control of Dealing Operations – Trading

Limits – Trading and Operational Policy – Moral and Ethical aspects, Confirmations,

Revaluation Mark to Market and Profit Calculations.

UNIT-IV

Regulation, Supervision and Compliance: The Need and Significance of Internal and

External Audit, The Objectives, Role and Functions of Reserve Bank’s Supervision and

Exchange Control Departments, RBI requirements, Recent Developments in the Central

Bank’s Policy Framework.

Suggested Readings:

1. Steven M. Bragg , “Treasury Management: The Practitioner's Guide”, Willey Publication.

2. Robert Cooper, “Corporate Treasury and Cash Management”, Palgrave Macmillan

Publishers.

3. S.K. Bagchi, “Treasury Risk Management”, 2nd Edition, Jaico Publishing House

4. V. A. Avadhani, “Treasury Management In India”, Himalaya Publishing House

5. Indian Institute of Banking and Finance, “Theory and Practice of Treasury and Risk

Management in Banks” Taxman Publishers.

6. Indian Institute of Banking and Finance, “Treasury Management, Macmillan Publishers.

Note:

1. The list of cases and specific references including recent articles will be announced in the class at

the time of launching of the course.

2. The examiner is required to set nine questions in all. The first question will be compulsory

consisting of seven short questions covering the entire syllabus. In addition, eight more questions

will be set comprising two questions from each unit. The students shall be required to attempt five

questions in all selecting one question from each unit in addition to compulsory Question No. 1.

All questions shall carry equal marks.

You might also like

- Islamic Finance: The New Regulatory ChallengeFrom EverandIslamic Finance: The New Regulatory ChallengeRating: 1 out of 5 stars1/5 (1)

- Bank Fin Managem PDFDocument38 pagesBank Fin Managem PDFOdirile MasogoNo ratings yet

- Banking Practice & Proc. Course OutlineDocument5 pagesBanking Practice & Proc. Course OutlineSuresh Vadde50% (2)

- Bank Regulation and Resolution of Banking Crises: 15PFMC097 15 Year 1 Term 1Document4 pagesBank Regulation and Resolution of Banking Crises: 15PFMC097 15 Year 1 Term 1Tazeentaj MahatNo ratings yet

- Abubeker ProposalDocument15 pagesAbubeker ProposalKalayu KirosNo ratings yet

- Theory and Practice of Banking MMHDocument3 pagesTheory and Practice of Banking MMHtaslima khatunNo ratings yet

- Part (A) Indian Banking Credit:3: MOD NO. Detailed Syllabus Teaching Hours Objective of The Module Teaching MethodologyDocument3 pagesPart (A) Indian Banking Credit:3: MOD NO. Detailed Syllabus Teaching Hours Objective of The Module Teaching Methodologyrajat_177229No ratings yet

- 22 4536 SampleDocument36 pages22 4536 SampleSanjay SolankiNo ratings yet

- CONCEPT AND ROLE OF BANKING June 22 PDFDocument210 pagesCONCEPT AND ROLE OF BANKING June 22 PDFgizachewnani2011No ratings yet

- M422 Module-SampleDocument37 pagesM422 Module-SampleJM KoffiNo ratings yet

- Outline Topic For Financial ManagementDocument2 pagesOutline Topic For Financial ManagementPurisima NavarroNo ratings yet

- Ayesha's Intern ReportDocument85 pagesAyesha's Intern Reportatif attariNo ratings yet

- 13 Mbfi - at - 191104 PDFDocument2 pages13 Mbfi - at - 191104 PDFAkshayNo ratings yet

- Treasury Management Strategies and Challenges in The Banking IndustryDocument46 pagesTreasury Management Strategies and Challenges in The Banking IndustryDaniel Obasi100% (1)

- Financial Management SyllabusDocument2 pagesFinancial Management SyllabusEric Dela CruzNo ratings yet

- Bachelors OF Business AdministrationDocument27 pagesBachelors OF Business AdministrationDrKashXNo ratings yet

- FIN-612 Islamic Banking FinalDocument7 pagesFIN-612 Islamic Banking FinalM.TalhaNo ratings yet

- Banking: Treasury ManagementDocument117 pagesBanking: Treasury ManagementRoelienNo ratings yet

- BMT6115 - Financial-Management - Decisions-And-Applications - TH - 1.0 - 55 - BMT6115 - 54 AcpDocument2 pagesBMT6115 - Financial-Management - Decisions-And-Applications - TH - 1.0 - 55 - BMT6115 - 54 AcpM AnuradhaNo ratings yet

- BF SyllabusDocument6 pagesBF Syllabusnghiep tranNo ratings yet

- Treasury Management Module OutlineDocument4 pagesTreasury Management Module OutlineAbubakarr MansarayNo ratings yet

- SyllabusDocument2 pagesSyllabusNitin DNo ratings yet

- Unec 1681379813Document9 pagesUnec 1681379813Elgün AbdullayevNo ratings yet

- Banking and Financial InstitutionDocument61 pagesBanking and Financial InstitutionMariel Crista Celda Maravillosa89% (9)

- 0-BF-1 MBA Course OutlineDocument2 pages0-BF-1 MBA Course OutlineSZANo ratings yet

- Unec 1680447941Document10 pagesUnec 1680447941Elgün AbdullayevNo ratings yet

- Credit Risk Managementofnepalese Commercial Bank: A Thesis Proposal BY: Khim Raj B.CDocument11 pagesCredit Risk Managementofnepalese Commercial Bank: A Thesis Proposal BY: Khim Raj B.Canup bidariNo ratings yet

- Syllabus Aug 2022 NHTM 2Document10 pagesSyllabus Aug 2022 NHTM 2Dương Thuỳ TrangNo ratings yet

- Chapter # 1 Introduction To The Report: 1 2 Purpose of The StudyDocument76 pagesChapter # 1 Introduction To The Report: 1 2 Purpose of The StudyOrderofPhoenixsNo ratings yet

- Niraj Report On NMB BankDocument45 pagesNiraj Report On NMB BankNiraj SinghNo ratings yet

- Introduction of Financial ManagementDocument22 pagesIntroduction of Financial Managementhaarsh23No ratings yet

- Fundamentals of Financial Management: (Theory and Practicals)Document15 pagesFundamentals of Financial Management: (Theory and Practicals)tawandaNo ratings yet

- Syllabus Commercial Banking 2Document9 pagesSyllabus Commercial Banking 2Ảo Tung ChảoNo ratings yet

- Principles of FinanceDocument1 pagePrinciples of FinanceSaiful Islam100% (1)

- MELINDADocument27 pagesMELINDACristina maeNo ratings yet

- International Finance: ND TH THDocument2 pagesInternational Finance: ND TH THFahadKhanNo ratings yet

- Kumari Bank LimitedDocument16 pagesKumari Bank LimitedPooja BhandariNo ratings yet

- Money and Monetary PolicyDocument2 pagesMoney and Monetary Policyjolly soNo ratings yet

- Money and Banking Course OutlineDocument3 pagesMoney and Banking Course Outlinekuashask2No ratings yet

- Money & Banking BBA 5thDocument2 pagesMoney & Banking BBA 5thMehmud Raffæy0% (1)

- Syllabus Jan 2020-NHTM 2Document10 pagesSyllabus Jan 2020-NHTM 2Đặng Phước LộcNo ratings yet

- Law Banking FinalDocument6 pagesLaw Banking FinalAsif AhmedNo ratings yet

- Money and Banking Mgt-304Document3 pagesMoney and Banking Mgt-304Anonymous 7nY38BNo ratings yet

- Bu Mba Syllabus Full Time 3 Sem FSF 2 Working Capital ManagementDocument1 pageBu Mba Syllabus Full Time 3 Sem FSF 2 Working Capital ManagementPawan PrajapatiNo ratings yet

- THREE-5548-Banking Law and PracticeDocument8 pagesTHREE-5548-Banking Law and PracticeMisbha AliNo ratings yet

- 1.1 Background of The StudyDocument15 pages1.1 Background of The StudyswetasahNo ratings yet

- Internship Report Credit Management in Janata BankDocument53 pagesInternship Report Credit Management in Janata BankKuasha Nirob81% (21)

- Course Outline2013Document6 pagesCourse Outline2013Arslan Naseer WarraichNo ratings yet

- "Study of Treasury Management Banking in Sector: With Reference To: SBI and ICICI BanksDocument91 pages"Study of Treasury Management Banking in Sector: With Reference To: SBI and ICICI BanksAashika ShahNo ratings yet

- University of Gujrat: Faculty of Management and Administrative SciencesDocument4 pagesUniversity of Gujrat: Faculty of Management and Administrative SciencesTajalli Fatima0% (1)

- 4.36 M.com Banking & FinanceDocument18 pages4.36 M.com Banking & FinancegoodwynjNo ratings yet

- Lecture Note On BankingDocument68 pagesLecture Note On Bankinggeta beleteNo ratings yet

- Brickwork Finance AcademyDocument4 pagesBrickwork Finance AcademyVarun GuptaNo ratings yet

- BComHons Sem V Syllabus CBCS 2017Document15 pagesBComHons Sem V Syllabus CBCS 2017Anoushka HarkarNo ratings yet

- Report JanatabankDocument95 pagesReport JanatabankManiul IslamNo ratings yet

- Financial Management SummariesDocument7 pagesFinancial Management SummariesPatrick MfungweNo ratings yet

- Financial Management-Important ConceptsDocument7 pagesFinancial Management-Important ConceptsPankaj YadavNo ratings yet

- Commercial Banking-New OutlineDocument3 pagesCommercial Banking-New OutlineWaheed AkhterNo ratings yet

- Metropolitan Community College Course Outline FormDocument4 pagesMetropolitan Community College Course Outline FormFelipe Pablo Velasquez GuerinoNo ratings yet

- T A RegressionDocument34 pagesT A RegressionJewelyn C. Espares-CioconNo ratings yet

- CG and FP AustraliaDocument60 pagesCG and FP AustraliaJewelyn C. Espares-CioconNo ratings yet

- 2 Module 2 - Securities-For ModuleDocument22 pages2 Module 2 - Securities-For ModuleJewelyn C. Espares-CioconNo ratings yet

- Hand Sizeactivity Workshop - USCOTS07.v4Document52 pagesHand Sizeactivity Workshop - USCOTS07.v4Jewelyn C. Espares-CioconNo ratings yet

- 1 Module 1 Investment Environment-For ModuleDocument47 pages1 Module 1 Investment Environment-For ModuleJewelyn C. Espares-CioconNo ratings yet

- FTFM - Final - MagandaDocument573 pagesFTFM - Final - MagandaJewelyn C. Espares-CioconNo ratings yet

- About The Book The Book Attempts To Make Treasury Management An Enjoyable Work and A PractitionerDocument1 pageAbout The Book The Book Attempts To Make Treasury Management An Enjoyable Work and A PractitionerJewelyn C. Espares-CioconNo ratings yet

- INVESTMENT MANAGEMENT-lakatan and CondoDocument22 pagesINVESTMENT MANAGEMENT-lakatan and CondoJewelyn C. Espares-CioconNo ratings yet

- Diploma: in Treasury ManagementDocument45 pagesDiploma: in Treasury ManagementJewelyn C. Espares-Ciocon100% (1)

- 2 Application of Supply and Demand AnalysisDocument39 pages2 Application of Supply and Demand AnalysisChristian Jorge LenoxNo ratings yet

- B (Petition Change of First Name)Document2 pagesB (Petition Change of First Name)Diane PachaoNo ratings yet

- Best Practices in Asian Corporate GovernanceDocument203 pagesBest Practices in Asian Corporate Governanceshubhagyaldh6253No ratings yet

- Donor's Tax Computation PDFDocument1 pageDonor's Tax Computation PDFJewelyn C. Espares-CioconNo ratings yet

- Corp Gov UgandaDocument19 pagesCorp Gov UgandaJewelyn C. Espares-CioconNo ratings yet

- CG and FP AustraliaDocument60 pagesCG and FP AustraliaJewelyn C. Espares-CioconNo ratings yet

- Department Store ConversationDocument2 pagesDepartment Store ConversationJewelyn C. Espares-CioconNo ratings yet

- Calida Details ABSDocument3 pagesCalida Details ABSJewelyn C. Espares-CioconNo ratings yet

- Description of Place in Nihongo-1Document1 pageDescription of Place in Nihongo-1Jewelyn C. Espares-CioconNo ratings yet

- Answer 10 T12 PDFDocument2 pagesAnswer 10 T12 PDFJewelyn C. Espares-CioconNo ratings yet

- Basic JapaneseDocument4 pagesBasic JapaneseJewelyn C. Espares-CioconNo ratings yet

- 52 Digital DownloadsDocument2 pages52 Digital DownloadsChristine Mae Mata100% (1)

- Description of Place in NihongoDocument1 pageDescription of Place in NihongoJewelyn C. Espares-CioconNo ratings yet

- Course AssessmentDocument1 pageCourse AssessmentJewelyn C. Espares-CioconNo ratings yet

- ADVISORYDocument1 pageADVISORYJewelyn C. Espares-CioconNo ratings yet

- CG and FP AustraliaDocument60 pagesCG and FP AustraliaJewelyn C. Espares-CioconNo ratings yet

- Codigo MPGC IBGC - 5a.edição-InglêsDocument110 pagesCodigo MPGC IBGC - 5a.edição-InglêsAntonio Thomaz Pacheco Lessa NetoNo ratings yet

- 8 Steps To ForgivenessDocument1 page8 Steps To ForgivenessJewelyn C. Espares-CioconNo ratings yet

- Chinese Medicine For DiabetesDocument8 pagesChinese Medicine For DiabetesJewelyn C. Espares-CioconNo ratings yet

- A Prayer For EmploymentDocument1 pageA Prayer For EmploymentJewelyn C. Espares-CioconNo ratings yet

- Maraston Marble Corporation Is Considering A Merger With The ConDocument1 pageMaraston Marble Corporation Is Considering A Merger With The ConAmit Pandey0% (1)

- GST 231 Pq&a IiiDocument4 pagesGST 231 Pq&a IiiMuhammad Ibrahim SugunNo ratings yet

- Comparable Evidence in Property Valuation 1st Edition PGguidance 2011 PDFDocument22 pagesComparable Evidence in Property Valuation 1st Edition PGguidance 2011 PDFSiva PrasadNo ratings yet

- Portfolio ManagmentDocument5 pagesPortfolio ManagmentKavithaNo ratings yet

- Ey frd42856 08 02 2022Document83 pagesEy frd42856 08 02 2022Shri Ramanujar Dhaya AaraamudhamNo ratings yet

- 2019-Fin ST NestleDocument402 pages2019-Fin ST NestleArnab Paul ChoudhuryNo ratings yet

- Ubs GlobalDocument24 pagesUbs GlobalJoOANANo ratings yet

- InfinityPools WPDocument8 pagesInfinityPools WPAndong LiuNo ratings yet

- 2024 GIO - APAC Report - Final - CompressedDocument24 pages2024 GIO - APAC Report - Final - Compressedbotoy26No ratings yet

- Manual For Finance QuestionsDocument56 pagesManual For Finance QuestionssamiraZehra85% (13)

- Handout-Operations of Indian Stock MarketDocument8 pagesHandout-Operations of Indian Stock MarketDrsumit Sharma100% (1)

- Debt FinancingDocument36 pagesDebt Financingrobinjames24No ratings yet

- What Is BootstrappingDocument3 pagesWhat Is BootstrappingCharu SharmaNo ratings yet

- The Market Maker's MatrixDocument72 pagesThe Market Maker's Matrixjlaudirt100% (4)

- Comparitive Analysis of Mutual Funds and Ulips - Project ReportDocument134 pagesComparitive Analysis of Mutual Funds and Ulips - Project Reportkamdica95% (21)

- Thomas Russo: Global Value Investing - Richard Ivey School of Business, 2013Document34 pagesThomas Russo: Global Value Investing - Richard Ivey School of Business, 2013Hedge Fund ConversationsNo ratings yet

- Demat Account OpeningDocument8 pagesDemat Account OpeningNivas NowellNo ratings yet

- Novus OverlapDocument8 pagesNovus OverlaptabbforumNo ratings yet

- HW 3 WTPC 2 S14Document1 pageHW 3 WTPC 2 S14Dong Tap DoanNo ratings yet

- Notes 3 OptionsDocument12 pagesNotes 3 OptionsAravind SNo ratings yet

- NVCA Yearbook 2012Document122 pagesNVCA Yearbook 2012Justin GuoNo ratings yet

- CPALE Syllabus Covere1Document7 pagesCPALE Syllabus Covere1Rian EsperanzaNo ratings yet

- Clarkson Lumber Company (7.0)Document17 pagesClarkson Lumber Company (7.0)Hassan Mohiuddin100% (1)

- Chapter 4 Why Do Interest Rates Change?: Financial Markets and Institutions, 7e (Mishkin)Document21 pagesChapter 4 Why Do Interest Rates Change?: Financial Markets and Institutions, 7e (Mishkin)Yousef AD100% (1)

- Foundations of FinanceDocument22 pagesFoundations of FinanceNur Akmal100% (1)

- Hedge Fund Due DiligenceDocument38 pagesHedge Fund Due DiligenceMartin K Mwananshiku100% (1)

- Fabm Week 2 FinalsDocument8 pagesFabm Week 2 FinalsDaniella Dela Peña100% (1)

- PALOMARIA-MODULE 4 - Consumer MathDocument16 pagesPALOMARIA-MODULE 4 - Consumer MathALMIRA LOUISE PALOMARIANo ratings yet

- FEC ContractsDocument2 pagesFEC ContractssatyambhanduNo ratings yet

- CMT Level3 ReadingDocument7 pagesCMT Level3 Readingsankarjv0% (1)