Professional Documents

Culture Documents

Morgan Dry Cleaners Excersice

Uploaded by

KAREN RAMIREZ LUNA0 ratings0% found this document useful (0 votes)

21 views1 pageOriginal Title

Morgan Dry cleaners excersice

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

21 views1 pageMorgan Dry Cleaners Excersice

Uploaded by

KAREN RAMIREZ LUNACopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

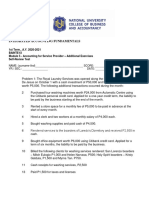

Morgan Dry Cleaners began operations with the following accounts:

Cash $1000

Accounts Receivable $2200

Supplies $850

Land $11450

Accounts Payable $2030

2. We received cash from customers for dry cleaning sales $8928

3. We paid creditors on account of what we owe $1755 in cash

4. We received cash from Mr. Morgan (the owner) as additional investment $4700

5. We open a bank account with $3000 cash

6. We paid the rent of the month $1200 with a deposit

7. We charged customers for dry cleaning sales on account $1025 in cash

8. We purchased soap and clothes shampoo $245 with a cheque

9. The customers made another payment from their debt $1000 in cash and $1000 with a

cheque

10. We paid utilities from the laundromat $635 with a deposit

11. We paid the weekly salary of the manager $2000 in cash

12. We bought a new washing machine $12000 paying 25% in cash and we signed a note

for the rest to be paid in 15 months

13. The owner withdraws $500 from the bank for his personal use

14. We received a government grant to expand the business for $5000 with a cheque

Determine the Balance Sheet, Income Statement, Statement of Owner’s Equity and Cash

Flow for the Company.

You might also like

- 5 Journal Entries More ExamplesDocument4 pages5 Journal Entries More Examplesapi-299265916No ratings yet

- Principles of Accounting Spring 2022 Bba 1-A & B Worksheet No 1: Basic Accounting Equation - Identification of AccountsDocument3 pagesPrinciples of Accounting Spring 2022 Bba 1-A & B Worksheet No 1: Basic Accounting Equation - Identification of AccountsYumna TauqeerNo ratings yet

- Bookkeeping ActivityDocument11 pagesBookkeeping ActivityIest HinigaranNo ratings yet

- Lesson 2 (Basic Accounting Equation)Document47 pagesLesson 2 (Basic Accounting Equation)GRADE TEN EMPATHYNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Practice Set #1 (3-56) Recording Transactions in A Financial Transaction WorksheetDocument11 pagesPractice Set #1 (3-56) Recording Transactions in A Financial Transaction WorksheetBenedict FajardoNo ratings yet

- Chapter 2Document5 pagesChapter 2Sundaramani SaranNo ratings yet

- Accounting Equation-Examples and ProblemsDocument3 pagesAccounting Equation-Examples and ProblemsMuhammed Hasan100% (3)

- Ca$h is Fact: Implementing a Credit and Collections Policy From Application to Payment and BeyondFrom EverandCa$h is Fact: Implementing a Credit and Collections Policy From Application to Payment and BeyondNo ratings yet

- Exercises On Journalizing (Debit and Credit)Document2 pagesExercises On Journalizing (Debit and Credit)kim100% (4)

- Fundamentals of ABM 1 & 2: Accounting ExercisesDocument22 pagesFundamentals of ABM 1 & 2: Accounting ExercisesRezel Funtilar100% (2)

- The Accounting EquationDocument10 pagesThe Accounting EquationMylene Salvador100% (1)

- Chapter 2 Practice ExercisesDocument2 pagesChapter 2 Practice ExercisesSokrit SoeurNo ratings yet

- Bookkeeping Assignment JournalizingDocument1 pageBookkeeping Assignment JournalizingPhilpNil8000No ratings yet

- Fiji National University ACC501 Computerized AccountingDocument3 pagesFiji National University ACC501 Computerized AccountingRoy GastroNo ratings yet

- Analyzing sole proprietorship transactionsDocument4 pagesAnalyzing sole proprietorship transactionswedNo ratings yet

- Homework AccDocument5 pagesHomework AcckxinyunNo ratings yet

- Problems For Accounting Equation: Mandy ArnoldDocument4 pagesProblems For Accounting Equation: Mandy ArnoldDipika tasfannum salamNo ratings yet

- Exercise For Chapter 2Document6 pagesExercise For Chapter 2Dĩm MiNo ratings yet

- ACTIVITY 06 Accounting For A Service Provider Additional ExercisesDocument3 pagesACTIVITY 06 Accounting For A Service Provider Additional Exercises이시연No ratings yet

- Accounting Double Entry (0625)Document12 pagesAccounting Double Entry (0625)Emaan KhanNo ratings yet

- Bon Voyage Travel June TransactionsDocument18 pagesBon Voyage Travel June TransactionsbhaviniiNo ratings yet

- Topic 3 - Recording Transactions - ExerciseDocument14 pagesTopic 3 - Recording Transactions - Exercisethiennnannn45No ratings yet

- 01 Activity 01 Basic AccountingDocument2 pages01 Activity 01 Basic AccountingKim Ahn ObuyesNo ratings yet

- Accounting records for new businessDocument21 pagesAccounting records for new businessVismaya SNo ratings yet

- 1Document9 pages1Shah Alam Badshah100% (1)

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- Assignment 1 1Document1 pageAssignment 1 1Ossama FatehyNo ratings yet

- Exercise-3-for-Grade-11-ABM-R.-OngpinDocument1 pageExercise-3-for-Grade-11-ABM-R.-OngpinJowen PergisNo ratings yet

- Accounting Case Study 2019 Financial StatementsDocument1 pageAccounting Case Study 2019 Financial StatementsAhmad ZakariaNo ratings yet

- Romaine Corporation Iloilo Branch January 2020 Financial StatementsDocument1 pageRomaine Corporation Iloilo Branch January 2020 Financial Statementsclient bugoNo ratings yet

- WorkbookDocument84 pagesWorkbookTheinfiniteroarNo ratings yet

- Assignment 1Document8 pagesAssignment 1SaidurRahamanNo ratings yet

- Correct Erroneous Journal EntriesDocument2 pagesCorrect Erroneous Journal EntriesLizette MedranoNo ratings yet

- Five Steps of Accounting Cycle: by Umair AmjadDocument6 pagesFive Steps of Accounting Cycle: by Umair Amjadhammadthelion204080No ratings yet

- Quiz - 1a (Bba 2C)Document2 pagesQuiz - 1a (Bba 2C)mahistudyaccNo ratings yet

- Chapter 2 Math For PracticeDocument3 pagesChapter 2 Math For Practiceehratul.bagNo ratings yet

- 2010 Yr 9 POA AnsDocument67 pages2010 Yr 9 POA AnsMuhammad SamhanNo ratings yet

- Accounting Business Case 2Document6 pagesAccounting Business Case 2doshizzleNo ratings yet

- Accounting Equation and General JournalDocument3 pagesAccounting Equation and General JournalWaqar AhmadNo ratings yet

- ACCE 112 Analysis Reservior Stores QPDocument2 pagesACCE 112 Analysis Reservior Stores QPnazmirakaderNo ratings yet

- New TQDocument7 pagesNew TQroseregineNo ratings yet

- Form Three AssignmentDocument5 pagesForm Three AssignmentKennedy Odhiambo OchiengNo ratings yet

- Tutorial 2 Journalizing PostingDocument5 pagesTutorial 2 Journalizing Postinglalala lalalaNo ratings yet

- Problems To Be Completed ManuallyDocument2 pagesProblems To Be Completed Manuallysk3 khanNo ratings yet

- FABM2 Module - 1Document3 pagesFABM2 Module - 1Jennifer NayveNo ratings yet

- Chapter 1 - Some Basic QuestionsDocument6 pagesChapter 1 - Some Basic QuestionsBracu 2023No ratings yet

- PST Quiz PA Chap 2Document5 pagesPST Quiz PA Chap 2Phuong PhamNo ratings yet

- Answers AccountingDocument5 pagesAnswers AccountingnanakethanNo ratings yet

- Q4Document2 pagesQ4Sundaramani Saran100% (1)

- Principles of Accounting ActivitiesDocument1 pagePrinciples of Accounting ActivitiesJenalyn OrtegaNo ratings yet

- Financial Reporting and Analysis: Assignment - 1Document8 pagesFinancial Reporting and Analysis: Assignment - 1Sai Chandan Duggirala100% (1)

- Exercise TwoDocument2 pagesExercise TwoHassan YassinNo ratings yet

- Lpam Practical Exercises 2024 - 1Document9 pagesLpam Practical Exercises 2024 - 1simoneeaveningNo ratings yet

- Choose the Correct Accounting AnswerDocument3 pagesChoose the Correct Accounting AnswerMIRA DANTESNo ratings yet

- Carleo Answering Service PDFDocument1 pageCarleo Answering Service PDFJessica YulianiNo ratings yet

- FABM 1-III practice recording business transactionsDocument3 pagesFABM 1-III practice recording business transactionshahaniNo ratings yet

- FA Week 1Document8 pagesFA Week 1Azure JohnsonNo ratings yet

- TN Cô Cho ThêmDocument3 pagesTN Cô Cho ThêmDĩm MiNo ratings yet

- Reinforcement Practice. FOODDocument7 pagesReinforcement Practice. FOODKAREN RAMIREZ LUNANo ratings yet

- STUDY GUIDE. Reinforcement Practice. March 22nd.Document8 pagesSTUDY GUIDE. Reinforcement Practice. March 22nd.KAREN RAMIREZ LUNANo ratings yet

- Here We Go Again ExcersiceDocument1 pageHere We Go Again ExcersiceKAREN RAMIREZ LUNANo ratings yet

- Project Management ConstraintsDocument2 pagesProject Management ConstraintsKAREN RAMIREZ LUNANo ratings yet

- Morgan Dry CleanersDocument6 pagesMorgan Dry CleanersKAREN RAMIREZ LUNANo ratings yet

- Morgan Dry CleanersDocument6 pagesMorgan Dry CleanersKAREN RAMIREZ LUNANo ratings yet

- Capital Advertising Expenses Debit Credit Debit CreditDocument7 pagesCapital Advertising Expenses Debit Credit Debit CreditKAREN RAMIREZ LUNANo ratings yet