Professional Documents

Culture Documents

Exercises On Journalizing (Debit and Credit)

Uploaded by

kimOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Exercises On Journalizing (Debit and Credit)

Uploaded by

kimCopyright:

Available Formats

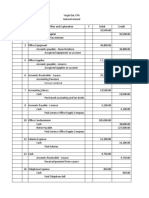

ACCOUNTING CYCLE

EXERCISE 1: JOURNALIZE THE BUSINESS TRANSACTIONS OF LAURA DIMOS

USING A JOURNAL SHEET

Laura Dimos started her own consulting firm, Dimos Consulting, on 1 May 2015.

The following transactions occurred during the month of May.

1. Dimos invested 16,000 cash in the business

2. Paid 1,600 for office rent for the month.

3. Purchased 1000 supplies on account.

4. Paid 100 to advertise in the Philippine Daily Inquirer.

5. Received 6000 cash for services provided.

6. Withdrew 1,400 cash for personal use.

7. Performed 6,600 of services on account.

8. Paid 8000 for employee salaries.

9. Paid for the supplies purchased on account on May.

10. Received a cash payment of 4,000 for services provided

11. Borrowed 10,000 from the bank on a note payable.

12. Purchased office equipment for 4,800 on account

13. Paid 300 for utilities

14. Collected half of the receivables.

15. Purchased equipment for 8,800 and paid 2,000 in cash only.

EXERCISE 2: JOURNALIZE THE FOLLOWING TRANSACTIONS OF SAM SHEERAN

Sam Sheeran opened a legal services business on June 1. During July, the following transactions

occurred:

July 2: Paid P 2,400 cash on accounts payable.

4: Collected P 1,200 of accounts receivable.

6: Purchased additional office equipment for P 8,400 on account.

8: Earned revenue of P 23,600.

10: Sam Sheeran withdrew P 12,000 for personal use.

12: Paid salaries P 14,000 for July.

14: Paid rent P 18,000.

16: Received P 28,000 from PS Bank for money borrowed on a note payable.

18: Represented a client in a court hearing and earned P 20,000 but the client did not pay cash.

20: Bought office supplies for P 2000 on credit.

EXERCISE 3: JOURNALIZE THE FOLLOWING BUSINESS TRANSACTIONS

Mar. 2 Purchased auto cleaning supplies from Robert Suppliers for $750 on account.

4 Collected an account receivable of $525 from a customer, Elegant Kitchens.

5 Paid $275 in partial payment of an account payable to Lucy Co for equipment purchased in

February.

7 Issued shares in exchange for $5,600 cash.

9 Purchased office equipment from Diamond’s Warehouse for $3,700; paid $1,700 cash and issued

a note payable due in 90 days for the balance.

EXERCISE 4: JOURNALIZE THE FOLLOWING TRANSACTIONS

Capital Financial Advisors Limited had the following transactions during January, its first month of operations:

Jan. 1: Issued to Marvin Tycoon 9,000 shares of share capital in exchange for his investment of $45,000

cash.

5: Borrowed $30,000 from a bank and signed a note payable due in three months.

8: Purchased office furniture costing $19,750; paid $6,000 cash and charged the balance on account.

12: Paid $6,000 of the amount owed for office furniture.

15: Issued an additional 2,000 shares to an individual who invests $10,000 in the business.

You might also like

- Accounting ActivityDocument2 pagesAccounting ActivityRoberta Gonzales Sison80% (5)

- Fabm Sample Exercises With Answer KeyDocument7 pagesFabm Sample Exercises With Answer KeySg Dimz100% (1)

- Practice Set #1 (3-56) Recording Transactions in A Financial Transaction WorksheetDocument11 pagesPractice Set #1 (3-56) Recording Transactions in A Financial Transaction WorksheetBenedict FajardoNo ratings yet

- Journalizing TransactionsDocument24 pagesJournalizing TransactionsManuel Panotes Reantazo50% (2)

- 10.03.2021 FABM 1 - Journal, Ledger and WorksheetDocument7 pages10.03.2021 FABM 1 - Journal, Ledger and WorksheetLynmar EnorasaNo ratings yet

- Drill ABMDocument1 pageDrill ABMGeorge Gonzales78% (23)

- The Accounting Process: Adjusting The Accounts Cash Versus Accrual Basis of AccountingDocument12 pagesThe Accounting Process: Adjusting The Accounts Cash Versus Accrual Basis of AccountingKim Patrick Victoria100% (1)

- Accounting Journal (Shiela) Output 1Document5 pagesAccounting Journal (Shiela) Output 1TJ JT100% (1)

- Performance Task IIDocument3 pagesPerformance Task IIJomar VillenaNo ratings yet

- Acc and BMDocument8 pagesAcc and BMShawn Mendez100% (1)

- Adjusting Entries 11-23Document2 pagesAdjusting Entries 11-23Allen CarlNo ratings yet

- Acctg 1 - PrelimDocument1 pageAcctg 1 - PrelimRalph Christer Maderazo80% (5)

- Problem 16Document4 pagesProblem 16Alyssa Jane G. Alvarez100% (1)

- Ass - FinalDocument15 pagesAss - FinalSteffane Mae SasutilNo ratings yet

- The Accounting EquationDocument10 pagesThe Accounting EquationMylene Salvador100% (1)

- Special Journals Accounting)Document15 pagesSpecial Journals Accounting)Ardialyn100% (3)

- Compilation Notes On Journal Ledger and Trial Balance - Part 2Document8 pagesCompilation Notes On Journal Ledger and Trial Balance - Part 2Andra FleurNo ratings yet

- Comprehensive Problem - Merchandising BusinessDocument1 pageComprehensive Problem - Merchandising BusinessJasper Andrew Adjarani80% (5)

- Accounting ExerciseDocument5 pagesAccounting ExerciseJess Caburnay100% (3)

- FABM1 Q4 Module 8 Terminologies Used in Merchandising BusinessDocument20 pagesFABM1 Q4 Module 8 Terminologies Used in Merchandising BusinessrioNo ratings yet

- Journal Entries in Merchandising OperationsDocument4 pagesJournal Entries in Merchandising OperationsArrabela PalmaNo ratings yet

- Activity 1: Recording Transactions in The JournalDocument2 pagesActivity 1: Recording Transactions in The JournalSieadel Dalumpines50% (2)

- Senior High School Department: Quarter 3 - Module 12: Adjusting Journal EntriesDocument14 pagesSenior High School Department: Quarter 3 - Module 12: Adjusting Journal EntriesJaye Ruanto100% (2)

- Step 1: Transaction Analysis: Chapter 3: The 10-Steps in The Accounting CycleDocument16 pagesStep 1: Transaction Analysis: Chapter 3: The 10-Steps in The Accounting CycleSteffane Mae Sasutil100% (1)

- Senior High School Department: Quarter 3 - Module 2: The Accounting EquationDocument12 pagesSenior High School Department: Quarter 3 - Module 2: The Accounting EquationJaye RuantoNo ratings yet

- Problem Solving: Merchandising Problem (Periodic Inventory System)Document1 pageProblem Solving: Merchandising Problem (Periodic Inventory System)Vincent Madrid100% (6)

- Problem 02Document1 pageProblem 02Angelito Eclipse0% (2)

- Answer Sheet in Fundamentals of Accountancy, Business and Management 1 Quarter1 Week 7Document1 pageAnswer Sheet in Fundamentals of Accountancy, Business and Management 1 Quarter1 Week 7Florante De Leon100% (1)

- Merchandising Perpetual Inv Sys Coco Computer StoreDocument18 pagesMerchandising Perpetual Inv Sys Coco Computer StoreMadelyn Espiritu100% (4)

- FABM ProblemsDocument1 pageFABM ProblemsNeil Gumban40% (5)

- Bookkeeping Mock TestDocument22 pagesBookkeeping Mock Testrozen d100% (1)

- Accounting I Activity Jordan River LaundryDocument1 pageAccounting I Activity Jordan River LaundryMikaela Jean63% (8)

- 6 ProblemsDocument6 pages6 ProblemsAzelAnnAlibinNo ratings yet

- Act110 Accounting CycleDocument109 pagesAct110 Accounting CycleKilwa Dy100% (2)

- ACTIVITY. On February 1, 20A4, Mira Delamar Opened A Store That SellsDocument1 pageACTIVITY. On February 1, 20A4, Mira Delamar Opened A Store That SellsMiguel Lulab100% (1)

- FABM2 PreTest - 1stQtrDocument4 pagesFABM2 PreTest - 1stQtrRossano DavidNo ratings yet

- Midterm Exam FABM 2Document2 pagesMidterm Exam FABM 2Vee Ma100% (2)

- Addams&Family IncDocument16 pagesAddams&Family IncKim KoalaNo ratings yet

- Fabm 1: Quarter 3 - Module 7: Recording Transactions of A Service Business in The General JournalDocument15 pagesFabm 1: Quarter 3 - Module 7: Recording Transactions of A Service Business in The General JournalIva Milli Ayson80% (5)

- Perpetual ActualDocument17 pagesPerpetual ActualgegegeeNo ratings yet

- Adjusting Entries Exercises LandscapeDocument3 pagesAdjusting Entries Exercises LandscapeTatyanna Kaliah100% (3)

- Assignment1 M1 Transaction AnalysisDocument2 pagesAssignment1 M1 Transaction AnalysisAngel DIMACULANGANNo ratings yet

- Accounting Cycle of A Service BusinessDocument17 pagesAccounting Cycle of A Service BusinessAmie Jane Miranda100% (1)

- Week 1 AccountingDocument5 pagesWeek 1 AccountingWawie Cañete50% (2)

- ABM 1 Module 4 Accounting Concepts and PrinciplesDocument9 pagesABM 1 Module 4 Accounting Concepts and PrinciplesJey Di100% (2)

- MODULE 4 - Completing The Accounting Cycle - MerchandisingDocument27 pagesMODULE 4 - Completing The Accounting Cycle - MerchandisingFRANCES JEANALLEN DE JESUSNo ratings yet

- Journal and LedgersDocument3 pagesJournal and LedgersRhea Ramirez55% (11)

- Fabm - Q2 - Las-For LearnersDocument113 pagesFabm - Q2 - Las-For LearnersABM-AKRISTINE DELA CRUZNo ratings yet

- Fundamentals of Accountancy, Business and Management 1: Second QuarterDocument26 pagesFundamentals of Accountancy, Business and Management 1: Second QuarterELIANNE VY100% (1)

- Mr. Labandero Journalizing Posting and Unadjusted Trial Balance ASSIGNMENT KEYDocument8 pagesMr. Labandero Journalizing Posting and Unadjusted Trial Balance ASSIGNMENT KEYMiguel Nieves67% (6)

- Furniture Repair Shop Chart of Accounts AssetsDocument6 pagesFurniture Repair Shop Chart of Accounts AssetsRechelleRuthM.DeiparineNo ratings yet

- Problems in AccountingDocument4 pagesProblems in AccountingRaul Soriano CabantingNo ratings yet

- EN FABM - Final ExaminationDocument2 pagesEN FABM - Final ExaminationArsebelle Bais50% (6)

- Fabm 2 Practice SetDocument33 pagesFabm 2 Practice SetJen Trixie Gallardo57% (7)

- FABM 2 MIDTERM AutoRecoveredDocument15 pagesFABM 2 MIDTERM AutoRecoveredMerdwindelle AllagonesNo ratings yet

- Test Bank 4Document5 pagesTest Bank 4Jinx Cyrus RodilloNo ratings yet

- Acctg1c Accounting ProjectDocument22 pagesAcctg1c Accounting ProjectHasim Tantuas100% (1)

- Chapter One Test ExercisesDocument2 pagesChapter One Test Exerciseskaahiye cadeNo ratings yet

- Assignment No. 01 FAPDocument4 pagesAssignment No. 01 FAPUmar FaridNo ratings yet

- Chapter 2 Practice ExercisesDocument2 pagesChapter 2 Practice ExercisesSokrit SoeurNo ratings yet

- Caldon Lefm 240ci Ultrasonic Flow Meters: Integral Manifold DesignDocument6 pagesCaldon Lefm 240ci Ultrasonic Flow Meters: Integral Manifold DesignJim LimNo ratings yet

- 2 Year Spares List For InstrumentationDocument2 pages2 Year Spares List For Instrumentationgudapati9No ratings yet

- CLASS XI (COMPUTER SCIENCE) HALF YEARLY QP Bhopal Region Set-IIDocument4 pagesCLASS XI (COMPUTER SCIENCE) HALF YEARLY QP Bhopal Region Set-IIDeepika AggarwalNo ratings yet

- A Project Report On "A Comparative Study Between Hero Honda Splendor+ and Its Competitors To Increase The Market Share in MUDHOL RegionDocument70 pagesA Project Report On "A Comparative Study Between Hero Honda Splendor+ and Its Competitors To Increase The Market Share in MUDHOL RegionBabasab Patil (Karrisatte)No ratings yet

- Lupon National Comprehensive High School Ilangay, Lupon, Davao Oriental Grade 10-Household ServicesDocument4 pagesLupon National Comprehensive High School Ilangay, Lupon, Davao Oriental Grade 10-Household ServicesJohn Eirhene Intia BarreteNo ratings yet

- Sample Valuation ReportDocument15 pagesSample Valuation Reportayush singlaNo ratings yet

- Amsterdam Pipe Museum - Snuff WorldwideDocument1 pageAmsterdam Pipe Museum - Snuff Worldwideevon1No ratings yet

- Sco 8th Class Paper - B Jee-Main Wtm-15 Key&Solutions Exam DT 17-12-2022Document4 pagesSco 8th Class Paper - B Jee-Main Wtm-15 Key&Solutions Exam DT 17-12-2022Udaya PrathimaNo ratings yet

- Polyembryony &its ImportanceDocument17 pagesPolyembryony &its ImportanceSURIYA PRAKASH GNo ratings yet

- Technical and Business WritingDocument3 pagesTechnical and Business WritingMuhammad FaisalNo ratings yet

- O Repensar Da Fonoaudiologia Na Epistemologia CienDocument5 pagesO Repensar Da Fonoaudiologia Na Epistemologia CienClaudilla L.No ratings yet

- Genie PDFDocument264 pagesGenie PDFjohanaNo ratings yet

- Onco Case StudyDocument2 pagesOnco Case StudyAllenNo ratings yet

- IBS and SIBO Differential Diagnosis, SiebeckerDocument1 pageIBS and SIBO Differential Diagnosis, SiebeckerKrishna DasNo ratings yet

- Game ApiDocument16 pagesGame ApiIsidora Núñez PavezNo ratings yet

- Eureka Math Grade 2 Module 3 Parent Tip Sheet 1Document2 pagesEureka Math Grade 2 Module 3 Parent Tip Sheet 1api-324573119No ratings yet

- De On Tap So 4-6Document8 pagesDe On Tap So 4-6Quy DoNo ratings yet

- SetupDocument4 pagesSetupRsam SamrNo ratings yet

- Lab Report 2Document5 pagesLab Report 2Md jubayer SiddiqueNo ratings yet

- I. Objectives:: Semi-Detailed Lesson Plan in Reading and Writing (Grade 11)Document5 pagesI. Objectives:: Semi-Detailed Lesson Plan in Reading and Writing (Grade 11)Shelton Lyndon CemanesNo ratings yet

- When I Was A ChildDocument2 pagesWhen I Was A Childapi-636173534No ratings yet

- Singer 900 Series Service ManualDocument188 pagesSinger 900 Series Service ManualGinny RossNo ratings yet

- CBSE Class 10 Science Sample Paper SA 2 Set 1Document5 pagesCBSE Class 10 Science Sample Paper SA 2 Set 1Sidharth SabharwalNo ratings yet

- Development of A Small Solar Thermal PowDocument10 pagesDevelopment of A Small Solar Thermal Powעקיבא אסNo ratings yet

- Discover It For StudentsDocument1 pageDiscover It For StudentsVinod ChintalapudiNo ratings yet

- Gummy Bear Story RubricDocument1 pageGummy Bear Story Rubricapi-365008921No ratings yet

- T Rex PumpDocument4 pagesT Rex PumpWong DaNo ratings yet

- Prospectus (As of November 2, 2015) PDFDocument132 pagesProspectus (As of November 2, 2015) PDFblackcholoNo ratings yet

- Ajsl DecisionMakingModel4RoRoDocument11 pagesAjsl DecisionMakingModel4RoRolesta putriNo ratings yet

- 07 EPANET Tutorial-SlidesDocument26 pages07 EPANET Tutorial-SlidesTarhata Kalim100% (1)