100% found this document useful (1 vote)

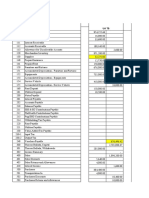

4K views12 pagesThe Accounting Process: Adjusting The Accounts Cash Versus Accrual Basis of Accounting

The document discusses several key accounting concepts:

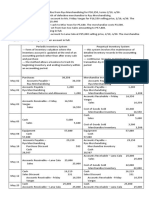

1) Adjusting entries are needed at the end of an accounting period to properly record revenues earned and expenses incurred that period. This ensures financial statements accurately reflect economic activity.

2) The accrual basis of accounting recognizes revenues when sales are made and expenses when incurred, regardless of cash receipt or payment. Adjusting entries are used to update account balances.

3) Accounting periods are usually monthly, quarterly, or annually. Adjusting entries assign revenues and expenses to the appropriate period to match revenues with related expenses.

Uploaded by

Kim Patrick VictoriaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

100% found this document useful (1 vote)

4K views12 pagesThe Accounting Process: Adjusting The Accounts Cash Versus Accrual Basis of Accounting

The document discusses several key accounting concepts:

1) Adjusting entries are needed at the end of an accounting period to properly record revenues earned and expenses incurred that period. This ensures financial statements accurately reflect economic activity.

2) The accrual basis of accounting recognizes revenues when sales are made and expenses when incurred, regardless of cash receipt or payment. Adjusting entries are used to update account balances.

3) Accounting periods are usually monthly, quarterly, or annually. Adjusting entries assign revenues and expenses to the appropriate period to match revenues with related expenses.

Uploaded by

Kim Patrick VictoriaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd