Professional Documents

Culture Documents

Introduction To Cost and Management Accounting: Question-1

Uploaded by

Alvarez StarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Introduction To Cost and Management Accounting: Question-1

Uploaded by

Alvarez StarCopyright:

Available Formats

Introduction to Cost and

1 Management Accounting

Question-1

STATE the Cost Control and Cost Reduction objectives of Cost and Management Accounting

system.

Answer:

Among other objectives of cost and management accounting system, cost control and cost

reduction are principal objectives. Cost control objective ensures the compliance with the set

standard of procedures, Cost Reduction objective explores the possibilities of improvements in

terms of both quantitative and qualitative aspects. Both objectives are briefly explained as

below:

Cost Control: Maintaining discipline in expenditure is one of the main objectives of a good

cost and management accounting system. It ensures that expenditures are in consonance with

predetermined set standard and any variation from these set standards is noted and reported

on continuous basis. To exercise control over cost, following steps are followed:

(a) Determination of pre-determined standard or results: Standard cost or performance

targets for a cost object or a cost centre is set before initiation of production or service

activity. These are desired cost or result that need to be achieved.

(b) Measurement of actual performance: Actual cost or result of the cost object or cost

centre is measured. Performance should be measured in the same manner in which the

targets are set i.e. if the targets are set up operation-wise, and then the actual costs

should also be collected and measured operation-wise to have a common basis for

comparison.

(c) Comparison of actual performance with set standard or target: The actual performance

so measured is compared against the set standard and desired target. Any deviation

(variance) between the two is noted and reported to the appropriate person or authority.

(d) Analysis of variance and action: The variance in results so noted are further analysed to

know the reasons for variance and appropriate action is taken to ensure compliance in

future. If necessary, the standards are further amended to take developments into

account.

Cost Reduction: It may be defined "as the achievement of real and permanent reduction in

the unit cost of goods manufactured or services rendered without impairing their suitability for

the use intended or diminution in the quality of the product."

Cost reduction is an approach of management where cost of an object is believed to be further

© The Institute of Chartered Accountants of India

@CAWORLD

Introduction to Cost and Management Accounting 1.2

reduced. No cost is termed as lowest and every possibility of cost reduction is explored. To do

cost reduction, the following action is taken:

(a) Each activity within an entity is segmented to analyse and identify value added and non-

value added activities. All non-value added activities are eliminated without affecting the

essential characteristics of the product or process. Value chain Analysis, a strategic tool,

developed by Michael Porter, is one of the methods to do value analysis.

(b) Conducting continuous research and study to know better way to do anything.

The three-fold assumptions involved in the definition of cost reduction may be summarised as

under:

(i) There is a saving in unit cost.

(ii) Such saving is of permanent nature.

(iii) The utility and quality of the goods and services remain unaffected, if not improved.

Question-2

STATE in brief how Cost Accounting and Management Accounting is related or different from

each other.

Answer:

The term Cost Accounting and Management Accounting is interchangeably by various

laureates as both the disciplines are interrelated. Management accounting to enable its

users to take timely and judicious decisions takes inputs from cost accounting, financial

accounting, statistics and operation management tools etc. Among other sources of

information Cost Accounting system provides cost related information. There are few

differences between these two disciplines which are tabulated as below:

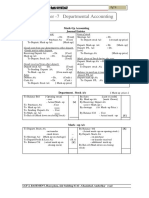

Difference between Cost Accounting and Management Accounting

Basis Cost Accounting Management Accounting

(i) Nature It records the quantitative aspect It records both qualitative and

only. quantitative aspect.

(ii) Objective It records the cost of producing a It Provides information to

product and providing a service. management for planning and

co-ordination.

(iii) Area It only deals with cost It is wider in scope as it includes

Ascertainment. financial accounting, budgeting,

taxation, planning etc.

© The Institute of Chartered Accountants of India

@CAWORLD

1.3 Cost and Management Accounting

(iv) Recording of It uses both past and present It is focused with the projection

data figures. of figures for future.

(v) Development Its development is related to It develops in accordance to the

industrial revolution. need of modern business world.

(vi) Rules and It follows certain principles and It does not follow any specific

Regulation procedures for recording costs rules and regulations.

of different products.

© The Institute of Chartered Accountants of India

@CAWORLD

2 Material Cost

Question 1 (Economic Order Quantity):

Arnav Ltd. manufactures a product X which requires two raw materials A and B in a ratio of

1:4. The sales department has estimated a demand of 5,00,000 units for the product for

the year. To produce one unit of finished product, 4 units of material A is required.

Stock position at the beginning of the year is as below:

Product- X 12,000 units

Material A 24,000 units

Material B 52,000 units

To place an order the company has to spend `15,000. The company is financing its

working capital using a bank cash credit @13% p.a.

Product X is sold at `1,040 per unit. Material A and B is purchased at `150 and `200

respectively.

Required:

COMPUTE economic order quantity (EOQ):

(i) If purchase order for the both materials is placed separately.

(ii) If purchase order for the both materials is not placed separately.

Answer:

Workings:

Annual production of Product X = Annual demand – Opening stock

= 5,00,000 – 12,000 = 4,88,000 units

Annual requirement for raw materials = Annual production × Material per unit – Opening

stock of material

Material A = 4,88,000 × 4 units – 24,000 units = 19,28,000 units

Material B = 4,88,000 × 16 units – 52,000 units = 77,56,000 units

(i) Computation of EOQ when purchase order for the both materials is placed

separately

© The Institute of Chartered Accountants of India

@CAWORLD

Material Cost 2.2

2 AnnualRe quirement for material Orderingcos t

EOQ =

Carryingcos t per unit per annum

2 19,28,000units `15,000 38,56,000 `15,000

Material A = = = 54,462 units

13%of `150 `19.5

2 77,56,000units `15,000 1,55,12,000 `15,000

Material B = = = 94,600 units

13%of `200 `26

(ii) Computation of EOQ when purchase order for the both materials is not placed

separately

2 (19,28,000 77,56,000)units `15,000

Material A & B =

13%of `190

1,93,68,000 `15,000

= = 1,08,452 units

`24.7

1,08,452 19,28,000

Material A = = 21,592 units

96,84,000

1,08,452 77,56,000

Material A = = 86,860 units

96,84,000

(`150 19,28,000) (`200 77,56,00)

* = `190

(19,28,000 77,56,000)

Question 2 (Stock levels):

A company manufactures 5,00,000 units of a product per month. The cost of placing an order

is `1,000. The purchase price of the raw material is `50 per kg. The re-order period is 4 to 8

days. The consumption of raw materials varies from 14,000 kg to 18,000 kg per day, the

average consumption being 16,000 kg. The carrying cost of inventory is 20% per annum.

You are required to CALCULATE

(i) Re-order quantity (ii) Re-order level

(iii) Maximum level (iv) Minimum level

(v) Average stock level

Answer:

(i) Reorder Quantity (ROQ) = 34,176 kg. (Refer to working note)

© The Institute of Chartered Accountants of India

@CAWORLD

2.3 Cost and Management Accounting

(ii) Reorder level (ROL) = Maximum usage × Maximum re-order period

= 18,000 kg. × 8 days = 1,44,000 kg.

(iii) Maximum level = ROL + ROQ – (Min. usage × Min. re-order period)

= 1,44,000 kg. + 34,176 kg. – (14,000 kg.× 4 days)

= 1,22,176 kg.

(iv) Minimum level = ROL – (Normal usage × Normal re-order period)

= 1,44,000 kg. – (16,000 kg. × 6 days)

= 48,000 kg.

1

(v) Average stock level = (Maximum level + Minimum level)

2

1

= (1,22,176 kg. + 48,000 kg.) = 85,088 kg.

2

OR

1

= Minimum level + ROQ

2

1

= 48,000 kg. + × 34,176 kg. = 65,088 kg.

2

Working Note

Annual consumption of raw material (A) = (16,000 kg. × 365 days) = 58,40,000 kg.

Cost of placing an order (O) = ` 1,000

Carrying cost per kg. Per annum (c × i) = ` 50 × 20% = ` 10

2AO

Economic order quantity (EOQ) =

C×i

2 58,40,000 kgs. `1,000

= = 34,176 kg.

` 10

© The Institute of Chartered Accountants of India

@CAWORLD

Employee Cost and Direct

3 Expenses

Question 1:

The following particulars have been extracted from the records of MJ Ltd.

Workers

A B C

Actual hours worked in a month 152 160 136

Hourly rate of wages ` 50 ` 55 ` 48

Production in units

Product- P 84 - 240

Product- Q 144 - 540

Product -R 184 100 -

Standard time allowed per unit of each product is:

P Q R

Minutes 12 18 30

For the purpose of piece rate, each minute is valued at `1/-

You are required to CALCULATE the wages of each worker under:

(i) Guaranteed hourly rates basis

(ii) Piece work earnings basis, but guaranteed at 75% of basic pay (guaranteed hourly rate)

if the earnings are less than 50% of basic pay.

(iii) Premium bonus basis where the worker receives bonus based on Rowan scheme.

Answer:

(i) Computation of wages of each worker under guaranteed hourly rate basis

Workers Actual hours Hourly rate of Wages

worked in a week wages (`) (`)

(a) (b) (c) (d) = (b) × (c)

A 152 50 7,600

B 160 55 8,800

© The Institute of Chartered Accountants of India

@CAWORLD

Employee Cost and Direct Expenses 3.2

C 136 48 6,528

(ii) Computation of wages of each worker under piece work earnings basis

Worker A Worker B Worker C

Product Rate per Units Wages Units Wages Units Wages

unit (`) (`) (`)

(a) (b) (c) (d= b*c) (e) (f = b*e) (g) (h=b*g)

P 12 84 1,008 - - 240 2,880

Q 18 144 2,592 - - 540 9,720

R 30 184 5,520 100 3,000 - -

9,120 3,000 12,600

Since each worker has been guaranteed at 75% of basic pay, if their earnings are less

than 50% of basic pay (guaranteed hourly rate), earning of the workers will be as follows:

Workers A and C will be paid the wages as computed viz., `9,120 and `12,600

respectively. The computed earnings under piece rate basis for worker B is `3,000 which

is less than 50% of basic pay i.e., ` 4,400 (`8,800 × 50%) therefore B would be paid

`6,600 i.e. 75% × `8,800 .

Working Notes:

1. Piece rate / per unit

Product Standard time per Piece rate each Piece rate per unit

unit in minutes minute (`) (`)

(a) (b) (c) (d) = (b) × (c)

P 12 1.00 12.00

Q 18 1.00 18.00

R 30 1.00 30.00

2. Time allowed to each worker

Worker A = (84 units × 12 minutes) + (144 units × 18 minutes) + (184 units × 30

minutes)

= 9,120 minutes or 152 hours

Worker B = 100 units × 30 minutes

= 3,000 minutes or 50 hours

Worker C = (240 units × 12 minutes) + (540 units × 18 minutes)

= 12,600 minutes or 210 hours

© The Institute of Chartered Accountants of India

@CAWORLD

3.3 Cost and Management Accounting

(iii) Computation of wages of each worker under Premium bonus basis (where each

worker receives bonus based on Rowan Scheme)

Workers Time Time Time Wage Earnings Bonus Total of

allowed taken saved rate/hour earning &

hours hours hours bonus

(`) (`) (`) (`)

A 152 152 - 50 7,600 - 7,600

B 50 160 - 55 8,800 - 8,800

C 210 136 74 48 6,528 2,300* 8,828

Time saved

* Bonus under Rowan scheme = × Time taken × Rate per hour

Time allowed

74 hours

= × 136 hours × `48 = `2,300

210hours

Question 2 :

The existing incentive system of Alpha Limited is as under:

Normal working week 5 days of 8 hours each plus 3 late shifts of 3

hours each

Rate of Payment Day work: `160 per hour

Late shift: `225 per hour

Average output per operator for 49-hours 240 articles

week i.e. including 3 late shifts

In order to increase output and eliminate overtime, it is decided to switch on to a system of

payment by results. The following information is obtained:

Time-rate (as usual) : `160 per hour

Basic time allowed for 15 : 2.5 hours

articles

Piece-work rate : Add 20% to basic piece-

rate

Premium Bonus : Add 50% to time.

If during the last week 270 articles are produced in a 40-hour week.

Required:

© The Institute of Chartered Accountants of India

@CAWORLD

Employee Cost and Direct Expenses 3.4

(i) CALCULATE weekly earnings, number of articles produced and labour cost per article for

one operator under the following systems:

(a) Existing time-rate

(b) Straight piece-work

(c) Rowan system

(d) Halsey premium system

(ii) PREPARE a Statement showing hours worked, weekly earnings, number of articles

produced and labour cost per article for one operator under the above systems.

Answer:

(i) (a) Existing time rate

Weekly wages:

Normal shift (40 hours × `160): `6,400

Late shift (9 hours × `225) `2,025

`8,425

(b) Piece Rate System

15 articles are produced in 2.5 hours

2.5hours

Therefore, to produce 270 articles, hours required is ×270articles = 45 hours.

15articles

Cost of producing 270 articles:

At basic time rate (45 hours × `160) = `7,200

Add: Bonus @ 20% on basic Piece rate `1,440

Earning for the week `8,640

(c) Rowan Premium System

2.5hours

(i) Time allowed for producing 270 articles ×270articles×150% = 67.5 hours

15articles

(ii) Time taken to produce 270 articles = 40.0 hours

(iii) Time Saved = 67.5 – 40 = 27.5 hours

Earnings under Rowan Premium system:

Time saved

= (Time taken×Rateper hour)+ ×Time taken×Rate per hour

Time allowed

© The Institute of Chartered Accountants of India

@CAWORLD

3.5 Cost and Management Accounting

27.5hours

= (40hours× ` 160)+ ×40hours× ` 160 = `9,007.41

67.5hours

(d) Halsey Premium System

1

= (Time taken×Rate per hour)+ ( ×Time saved×Rate per hour)

2

1

= (40hours× ` 160)+ ×27.5hours× ` 160 = `6,400 + `2,200 = `8,600

2

(ii) Statement showing hours worked, weekly earnings, number of articles produced and

cost per article

Method of Payment Hours Weekly Number of Labour cost

worked earnings articles per article

(`) produced (`)

Existing time rate 49 8,425.00 240 35.10

Straight piece rate system 40 8,640.00 270 32.00

Rowan Premium System 40 9,007.41 270 33.36

Halsey Premium System 40 8,600.00 270 31.85

© The Institute of Chartered Accountants of India

@CAWORLD

Overhead: Absorption

4 Costing Method

Question 1 (Re-apportionment of overheads using Trial and Error Method):

SA Ltd. has three production (M1, M2 and A1) and three service departments (Stores,

Engineering services and General service). Engineering department serves the M1 and M2

only.

The relevant information related with Product X and Y are as follows:

Product X Product Y

M1 10 Machine hours 6 Machine hours

M2 4 Machine hours 14 Machine hours

A1 14 Direct labour hours 18 Direct labour hours

The annual budgeted overhead cost for the year is

Indirect Wages (`) Consumable Supplies(`)

M1 9,30,400 2,52,000

M2 8,26,800 3,64,000

A1 3,24,400 84,000

Stores 1,64,000 56,000

Engineering Service 1,06,800 84,000

General Service 1,50,400 64,000

(`)

Depreciation on Machinery 7,92,000

Insurance of Machinery 1,44,000

Insurance of Building 64,800 (Total building insurance cost for M1 is

one third of annual premium)

Power 1,29,600

Light 1,08,000

Rent 2,53,500 (The general service deptt. is located in a

© The Institute of Chartered Accountants of India

@CAWORLD

Overhead: Absorption costing method 4.2

building owned by the company. It is

valued at `1,20,000 and is charged into

cost at notional value of 8% per annum.

This cost is additional to the rent shown

above)

The value of issues of materials to the production departments are in the same proportion

as shown above for the Consumable supplies.

The following data are also available:

Department Book value Area Effective Production Capacity

Machinery (`) (Sq. ft.) H.P. hours % Direct Labour Machine

hour hour

M1 24,00,000 5,000 50 2,00,000 40,000

M2 18,00,000 6,000 35 1,50,000 50,000

A1 6,00,000 8,000 05 3,00,000

Stores 2,40,000 2,000

Engg. Service 7,20,000 2,500 10

General 2,40,000 1,500

Service

Required:

(i) PREPARE an overhead analysis sheet, showing the bases of apportionment of overhead

to departments.

(ii) PREPARE a statement allocating service department overheads to production

department ignoring the apportionment of service department costs among service

departments.

(iii) CALCULATE suitable overhead absorption rate for the production departments.

(iv) CALCULATE the overheads to be absorbed by two products, X and Y.

Answer:

(i) Summary of Apportionment of Overheads

(`)

Basis of Total Production Deptt. Service Deptt.

Items Apportionment Amount M1 M2 A1 Store Enginee General

Service ring Service

Service

© The Institute of Chartered Accountants of India

@CAWORLD

4.3 Cost and Management Accounting

Indirect Allocation given 25,02,800 9,30,400 8,26,800 3,24,400 1,64,000 1,06,800 1,50,400

wages

Consumable Allocation given 9,04,000 2,52,000 3,64,000 84,000 56,000 84,000 64,000

stores

Depreciation Capital value of 7,92,000 3,16,800 2,37,600 79,200 31,680 95,040 31,680

machine

(20:15:5:2:6:2)

Insurance of Capital value of 1,44,000 57,600 43,200 14,400 5,760 17,280 5,760

Machine machine

(20:15:5:2:6:2)

Insurance on 1/3rd to M1 64,800 21,600 12,960 17,280 4,320 5,400 3,240

Building Balance area

basis

(-:12:16:4:5:3)

Power HP Hr% 1,29,600 64,800 45,360 6,480 12,960

(10:7:1:-:2:-)

Light Area 1,08,000 21,600 25,920 34,560 8,640 10,800 6,480

(10:12:16:4:5:3)

Rent* Area 2,53,500 53,940 64,720 86,300 21,580 26,960 --

(10:12:16:4:5:-)

Total 48,98,700 17,18,740 16,20,560 6,46,620 2,91,980 3,59,240 2,61,560

*Rent to be apportioned among the departments which actually use the rented building. The notional

rent is imputed cost and is not included in the calculation.

(ii) Allocation of service departments overheads

Production Deptt. Service Deptt.

Service Basis of

Deptt. Apportionment M1 M2 A1 Store Engineering General

Service Service Service

Store Ratio of

consumable 1,05,120 1,51,820 35,040 (2,91,980)

value (126 :182

: 42)

Engineering In Machine

service hours Ratio of 1,59,660 1,99,580 (3,59,240)

M1 and M2 (4 :

5)

© The Institute of Chartered Accountants of India

@CAWORLD

Overhead: Absorption costing method 4.4

General Labour hour

service Basis 80,480 60,360 1,20,720 (2,61,560)

(20 : 15 : 30)

Production 17,18,740 16,20,560 6,46,620

Department

allocated in

(i)

Total 20,64,000 20,32,320 8,02,380

(iii) Overhead Absorption rate

M1 M2 A1

Total overhead allocated 20,64,000 20,32,320 8,02,380

Machine hours 40,000 50,000

Labour hours 3,00,000

Rate per machine hour 51.60 40.65

Rate per Direct labour 2.67

(iv) Statement showing overhead absorption for Product X and Y

Machine Deptt. Absorption Rate Product X Product Y

Hours (`) Hours (`)

M1 51.60 10 516.00 6 309.60

M2 40.65 4 162.60 14 569.10

A1 2.67 14 37.38 18 48.06

715.98 926.76

Question 2 (Re-apportionment of overheads using Repeated distribution method):

DT Ltd. is a manufacturing company having three production departments, ‘A’, ‘B’ and ‘C’

and two service departments ‘X’ and ‘Y’. The following budget is for December 20X8:

Total (`) A (`) B (`) C (`) X (`) Y (`)

Direct 20,00,000 40,00,000 80,00,000 40,00,000 20,00,000

material

Direct wages 1,00,00,000 40,00,000 1,60,00,000 20,00,000 40,00,000

Factory rent 80,00,000

Power 50,00,000

© The Institute of Chartered Accountants of India

@CAWORLD

4.5 Cost and Management Accounting

Depreciation 20,00,000

Other 1,80,00,000

overheads

Additional information:

Area (Sq. ft.) 500 250 500 250 500

Capital value of assets (` 400 800 400 200 200

lakhs)

Machine hours 1,000 2,000 4,000 1,000 1,000

Horse power of machines 50 40 20 15 25

A technical assessment of the apportionment of expenses of service departments is as

under:

A B C X Y

Service Dept. ‘X’ (%) 45 15 30 – 10

Service Dept. ‘Y’ (%) 60 35 – 5 –

Required:

(i) PREPARE a statement showing distribution of overheads to various departments.

(ii) PREPARE a statement showing re-distribution of service departments expenses to

production departments.

(iii) CALCULATE machine hour rates of the production departments ‘A’, ‘B’ and ‘C’.

Answer:

(i) Overhead Distribution Summary

Basis Total (`) A (`) B (`) C (`) X (`) Y (`)

Direct Direct – – – – 40,00,000 20,00,000

materials

Direct wages Direct – – – – 20,00,000 40,00,000

Factory rent Area 80,00,000 20,00,000 10,00,000 20,00,000 10,00,000 20,00,000

Power H.P. × 50,00,000 10,00,000 16,00,000 16,00,000 3,00,000 5,00,000

Machine

Hrs.

Depreciation Capital 20,00,000 4,00,000 8,00,000 4,00,000 2,00,000 2,00,000

value

Other Machine 1,80,00,000 20,00,000 40,00,000 80,00,000 20,00,000 20,00,000

overheads hrs.

54,00,000 74,00,000 1,20,00,000 95,00,000 1,07,00,000

© The Institute of Chartered Accountants of India

@CAWORLD

Overhead: Absorption costing method 4.6

(ii) Redistribution of Service Department’s expenses

A (`) B (`) C (`) X (`) Y (`)

Total overheads 54,00,000 74,00,000 1,20,00,000 95,00,000 1,07,00,000

Dept. X overhead 42,75,000 14,25,000 28,50,000 (95,00,000) 9,50,000

apportioned in the ratio

(45:15:30: —:10)

Dept. Y overhead 69,90,000 40,77,500 5,82,500 (1,16,50,000)

apportioned in the ratio

(60:35: —:5: —)

Dept. X overhead 2,62,120 87,380 1,74,760 (5,82,500) 58,240

apportioned in the ratio

(45:15:30: —:10)

Dept. Y overhead 34,940 20,380 2,920 (58,240)

apportioned in the ratio

(60:35: —:5: —)

Dept. X overhead 1,300 440 880 (2,920) 300

apportioned in the ratio

(45:15:30: —:10)

Dept. Y overhead 180 120 - - (300)

apportioned in the ratio

(60:35: —:5: —)

1,69,63,540 1,30,10,820 1,50,25,640

(iii) Machine hour rate:

A B C

A Total overheads (`) 1,69,63,540 1,30,10,820 1,50,25,640

B Machine hours 1,000 2,000 4,000

C Machine hour rate (`) [A ÷ B] 16,963.54 6,505.41 3,756.41

© The Institute of Chartered Accountants of India

@CAWORLD

Activity Based

5 Costing (ABC)

Question-1

A company manufactures three products namely A, B and C in a factory. The following cost data

for the month of March, 20X8 are as under:

Activity A B C

Unit produced 10,000 15,000 20,000

Direct labour hour per unit 3 4.5 4

Machine hour per unit 6 4 5

Set-up of machines 20 25 30

Number of orders 15 12 10

Machine operating cost (`) 34,50,000

Machine set-up cost (`) 4,36,000

Order processing cost (`) 2,56,000

Required:

(i) IDENTIFY Cost pool, Cost drivers.

(ii) CALCULATE cost driver rate.

(iii) CALCULATE overheads rate per unit using activity- based costing method.

Answer:

(i) Identification of Cost pools and cost drivers:

Cost Pools Cost Drivers

Machine operating cost No. of machine hours

Machine set-up cost No. of machine set-ups

Order processing cost No. of orders

© The Institute of Chartered Accountants of India

@CAWORLD

Activity Based Costing (ABC) 5.2

(ii) Calculation of cost driver rate:

Cost Pools Cost (`) Cost Drivers Rate per cost

driver (`)

Machine operating 34,50,000 2,20,000 machine hours 15.68

cost {(10,000×6)+(15,000×4)+(20,000×5)}

Machine set-up 4,36,000 75 set-ups 5,813.33

cost (20+25+30)

Order processing 2,56,000 37 orders 6,918.92

cost (15+12+10)

(iii) Calculation of overhead rate per unit using ABC:

Activity Cost Products

driver A B C

rate (`)

Total Cost Rate Rate Rate

per per per

unit unit unit

(i) (ii) = (i)×Cost (iii) ÷ (ii) = (i)×Cost (iii) (ii) = (i)×Cost (iii)

driver units driver ÷ driver ÷

unit unit

s s

Machine 15.68 9,40,800 94.08 9,40,800 62.72 15,68,000 78.40

operating

(15.68×60000) (15.68×60000) (15.68×1,00000)

cost

Machine 5,813.33 1,16,267 11.63 1,45,333 9.69 1,74,400 8.72

set-up

(5,813.33×20) (5,813.33×25) (5,813.33×30)

cost

Order 6,918.92 1,03,784 10.38 83,027 5.54 69,189 3.46

processi

(6,918.92×15) (6,918.92×12) (6,918.92×10)

ng cost

Question-2

CDE Ltd. is following Activity based costing. Budgeted overheads, cost drivers and volume are

as follows:

Cost pool Budgeted Cost driver Budgeted volume

overheads (`)

© The Institute of Chartered Accountants of India

@CAWORLD

5.3 Cost and Management Accounting

Material 18,42,000 No. or orders 1,200

procurement

Material handling 8,50,000 No. of movement 1,240

Maintenance 24,56,000 Maintenance hours 17,550

Set-up 9,12,000 No. of set-ups 1,450

Quality control 4,42,000 No. of inspection 1,820

The company has produced a batch of 7,600 units, its material cost was `24,62,000 and wages

`4,68,500. Usage activities of the said batch are as follows:

Material orders 56

Material movements 84

Maintenance hours 1,420 hours

Set-ups 60

No. of inspections 18

Required:

(i) CALCULATE cost driver rates.

(ii) CALCULATE the total and unit cost for the batch.

Answer:

(i) Calculation of cost driver rate:

Cost pool Budgeted Cost driver Cost driver

overheads (`) rate (`)

Material 18,42,000 1,200 1,535.00

procurement

Material handling 8,50,000 1,240 685.48

Maintenance 24,56,000 17,550 139.94

Set-up 9,12,000 1,450 628.97

Quality control 4,42,000 1,820 242.86

(ii) Calculation of cost for the batch:

Particulars Amount (`) Amount (`)

Material cost 24,62,000.00

Wages 4,68,500.00

Overheads:

© The Institute of Chartered Accountants of India

@CAWORLD

Activity Based Costing (ABC) 5.4

- Material procurement (`1,535×56 orders) 85,960.00

- Material handling (`685.48×84 movements) 57,580.32

- Maintenance (`139.94×1,420 hours) 1,98,714.80

- Set-up (`628.97×60 set-ups) 37,738.20

- Quality control (`242.86×18 inspections) 4,371.48 3,84,364.80

Total Cost 33,14,864.80

No. of units 7,600

Cost per units 436.17

Question-3

MST Limited has collected the following data for its two activities. It calculates activity cost rates

based on cost driver capacity.

Activity Cost Driver Capacity Cost (`)

Power Kilowatt hours 50,000 kilowatt hours 40,00,000

Quality Inspections Number of 10,000 Inspections 60,00,000

Inspections

The company makes three products M, S and T. For the year ended March 31, 20X7, the following

consumption of cost drivers was reported:

Product Kilowatt hours Quality Inspections

M 10,000 3,500

S 20,000 2,500

T 15,000 3,000

Required:

(i) PREPARE a statement showing cost allocation to each product from each activity.

(ii) CALCULATE the cost of unused capacity for each activity.

(iii) STATE the factors the management considers in choosing a capacity level to compute the

budgeted fixed overhead cost rate.

Answer:

(i) Statement of cost allocation to each product from each activity

Product

M (`) S (`) T (`) Total (`)

© The Institute of Chartered Accountants of India

@CAWORLD

5.5 Cost and Management Accounting

Power 8,00,000 16,00,000 12,00,000 36,00,000

(Refer to (10,000 kWh ×`80) (20,000 kWh ×`80) (15,000 kWh ×`80)

working note)

Quality 21,00,000 15,00,000 18,00,000 54,00,000

Inspections (3,500 inspections (2,500 inspections (3,000 inspections

(Refer to ×`600) ×`600) ×`600)

working note)

Working Note:

Rate per unit of cost driver:

Power :(`40,00,000 ÷ 50,000 kWh) = `80/kWh

Quality Inspection :(`60,00,000 ÷ 10,000 inspections) = `600 per inspection

(ii) Calculation of cost of unused capacity for each activity:

(`)

Power 4,00,000

(`40,00,000 – `36,00,000)

Quality Inspections 6,00,000

(`60,00,000 – `54,00,000)

Total cost of unused capacity 10,00,000

(iii) Factors management consider in choosing a capacity level to compute the budgeted fixed

overhead cost rate:

- Effect on product costing & capacity management

- Effect on pricing decisions.

- Effect on performance evaluation

- Effect on financial statements

- Regulatory requirements.

- Difficulties in forecasting for any capacity level.

© The Institute of Chartered Accountants of India

@CAWORLD

6 Cost Sheet

Question 1:

Arnav Inspat Udyog Ltd. has the following expenditures for the year ended 31st March, 20X8:

Sl. Amount (`) Amount (`)

No.

(i) Raw materials purchased 10,00,00,000

(ii) GST paid on the above purchases @18% (eligible for 1,80,00,000

input tax credit)

(iii) Freight inward 11,20,600

(iv) Wages paid to factory workers 29,20,000

(v) Contribution made towards employees’ PF & ESIS 3,60,000

(vi) Production bonus paid to factory workers 2,90,000

(vii) Royalty paid for production 1,72,600

(viii) Amount paid for power & fuel 4,62,000

(ix) Amount paid for purchase of moulds and patterns (life 8,96,000

is equivalent to two years production)

(x) Job charges paid to job workers 8,12,000

(xi) Stores and spares consumed 1,12,000

(xii) Depreciation on:

- Factory building 84,000

- Office building 56,000

- Plant & Machinery 1,26,000

- Delivery vehicles 86,000 3,52,000

(xiii) Salary paid to supervisors 1,26,000

(xiv) Repairs & Maintenance paid for: 48,000

- Plant & Machinery

- Sales office building 18,000

- Vehicles used by directors 19,600 85,600

(xv) Insurance premium paid for:

- Plant & Machinery 31,200

© The Institute of Chartered Accountants of India

@CAWORLD

Cost Sheet 6.2

- Factory building 18,100

- Stock of raw materials & WIP 36,000 85,300

(xvi) Expenses paid for quality control check activities 19,600

(xvii) Salary paid to quality control staffs 96,200

(xviii) Research & development cost paid improvement in 18,200

production process

(xix) Expenses paid for pollution control and engineering & 26,600

maintenance

(xx) Expenses paid for administration of factory work 1,18,600

(xxi) Salary paid to functional mangers:

- Production control 9,60,000

- Finance & Accounts 9,18,000

- Sales & Marketing 10,12,000 28,90,000

(xxii) Salary paid to General Manager 12,56,000

(xxiii) Packing cost paid for:

- Primary packing necessary to maintain 96,000

quality

- For re-distribution of finished goods 1,12,000 2,08,000

(xxiv) Interest and finance charges paid 7,20,000

(xxv) Fee paid to auditors 1,80,000

(xxvi) Fee paid to legal advisors 1,20,000

(xxvii) Fee paid to independent directors 2,20,000

(xxviii) Performance bonus paid to sales staffs 1,80,000

(xxix) Value of stock as on 1st April, 20X7:

- Raw materials 18,00,000

- Work-in-process 9,20,000

- Finished goods 11,00,000 38,20,000

(xxx) Value of stock as on 31st March, 20X8:

- Raw materials 9,60,000

- Work-in-process 8,70,000

- Finished goods 18,20,000 36,50,000

Amount realized by selling of scrap and waste generated during manufacturing process –

`86,000/-

© The Institute of Chartered Accountants of India

@CAWORLD

6.3 Cost and Management Accounting

From the above data you are requested to PREPARE Statement of cost for Arnav Ispat Udyog

Ltd. for the year ended 31st March, 20X8, showing (i) Prime cost, (ii) Factory cost, (iii) Cost of

Production, (iv) Cost of goods sold and (v) Cost of sales.

Answer:

Statement of Cost of Arnav Ispat Udyog Ltd. for the year ended 31st March, 20X8:

Sl. Particulars Amount (`) Amount (`)

No.

(i) Material Consumed:

- Raw materials purchased 10,00,00,000

- Freight inward 11,20,600

Add: Opening stock of raw materials 18,00,000

Less: Closing stock of raw materials (9,60,000) 10,19,60,600

(ii) Direct employee (labour) cost:

- Wages paid to factory workers 29,20,000

- Contribution made towards employees’ PF 3,60,000

& ESIS

- Production bonus paid to factory workers 2,90,000 35,70,000

(iii) Direct expenses:

- Royalty paid for production 1,72,600

- Amount paid for power & fuel 4,62,000

- Amortised cost of moulds and patterns 4,48,000

- Job charges paid to job workers 8,12,000 18,94,600

Prime Cost 10,74,25,200

(iv) Works/ Factory overheads:

- Stores and spares consumed 1,12,000

- Depreciation on factory building 84,000

- Depreciation on plant & machinery 1,26,000

- Repairs & Maintenance paid for plant & 48,000

machinery

- Insurance premium paid for plant & 31,200

machinery

- Insurance premium paid for factory building 18,100

- Insurance premium paid for stock of raw 36,000

materials & WIP

© The Institute of Chartered Accountants of India

@CAWORLD

Cost Sheet 6.4

- Salary paid to supervisors 1,26,000

- Expenses paid for pollution control and

engineering & maintenance 26,600 6,07,900

Gross factory cost 10,80,33,100

Add: Opening value of W-I-P 9,20,000

Less: Closing value of W-I-P (8,70,000)

Factory Cost 10,80,83,100

(v) Quality control cost:

- Expenses paid for quality control check 19,600

activities

- Salary paid to quality control staffs 96,200 1,15,800

(vi) Research & development cost paid improvement in 18,200

production process

(vii) Administration cost related with production:

- Expenses paid for administration of factory 1,18,600

work

- Salary paid to Production control manager 9,60,000 10,78,600

(viii) Less: Realisable value on sale of scrap and waste (86,000)

(ix) Add: Primary packing cost 96,000

Cost of Production 10,93,05,700

Add: Opening stock of finished goods 11,00,000

Less: Closing stock of finished goods (18,00,000)

Cost of Goods Sold 10,86,05,700

(x) Administrative overheads:

- Depreciation on office building 56,000

- Repairs & Maintenance paid for vehicles 19,600

used by directors

- Salary paid to Manager- Finance & 9,18,000

Accounts

- Salary paid to General Manager 12,56,000

- Fee paid to auditors 1,80,000

- Fee paid to legal advisors 1,20,000

- Fee paid to independent directors 2,20,000

- Interest and finance charges paid 7,20,000 34,89,600

© The Institute of Chartered Accountants of India

@CAWORLD

6.5 Cost and Management Accounting

(assuming related with non-equity fund)

(xi) Selling overheads:

- Repairs & Maintenance paid for sales office 18,000

building

- Salary paid to Manager- Sales & Marketing 10,12,000

- Performance bonus paid to sales staffs 1,80,000 12,10,000

(xii) Distribution overheads:

- Depreciation on delivery vehicles 86,000

(xiii) - Packing cost paid for re-distribution of

finished goods 1,12,000 1,98,000

Cost of Sales 11,35,03,300

Notes:

(i) GST paid of purchase of raw materials would not be part of cost of materials as it is eligible for

input credit.

© The Institute of Chartered Accountants of India

@CAWORLD

8

Question-1

Unit & Batch Costing

A factory can produce 1,80,000 units per annum at its 60% capacity. The estimated costs of

production are as under:

Direct material `300 per unit

Direct employee cost `160 per unit

Indirect expenses:

- Fixed `32,50,000 per annum

- Variable `50 per unit

- Semi-variable `80,000 per annum up to 50% capacity and `15,000 for

every 20% increase in the capacity or part thereof.

If production program of the factory is as indicated below and the management desires to

ensure a profit of `10,00,000 for the year, DETERMINE the average selling price at which

each unit should be quoted:

First three months of the year- 50% of capacity;

Remaining nine months of the year- 75% of capacity.

Answer:

Statement of Cost

First three Remaining nine Total (`)

months (`) months (`)

37,500 units 1,68,750 units 2,06,250 units

Direct material 1,12,50,000 5,06,25,000 6,18,75,000

Direct employee cost 60,00,000 2,70,00,000 3,30,00,000

Indirect- variable expenses 18,75,000 84,37,500 1,03,12,500

Indirect – fixed expenses 8,12,500 24,37,500 32,50,000

Indirect- semi-variable expenses

- For first three months @ `80,000 20,000

p.a.

- For remaining nine months @ 82,500 1,02,500

`1,10,000 p.a.

© The Institute of Chartered Accountants of India

@CAWORLD

Unit & Batch Costing 8.2

Total cost 1,99,57,500 8,85,82,500 10,85,40,000

Desired profit - - 10,00,000

Sales value - - 10,95,40,000

Average selling price per unit 531.10

Question-2

Star study centre provides coaching classes to school students. The study centre has taken

an auditorium of 250 seat capacity on rent of `3,75,000 per month. It has also hired some

renowned teachers for taking classes. A teacher takes `3,000 per hour. The study centre has

decided to conduct a batch of 2-hour per day for 3 days a week for 4 months.

(i) CALCULATE the total cost per batch.

(ii) COMPUTE the minimum fee to be charged per student in a batch, if the centre operates

at 60% capacity.

(iii) DETERMINE the fee per student if the study centre desires to earn a profit of 50% and

study centre operates at 50% capacity.

Answer:

(i) Calculation of total cost per batch:

Particulars Amount (`)

(i) Auditorium hire charges (`3,75,000 × 4 months) 15,00,000

(ii) Teachers’ remuneration (`3,000 × 2 hours × 3 days × 4 2,88,000

weeks × 4 months)

Total cost 17,88,000

(ii) Computation of minimum fee per student per batch:

TotalCost `17,88,000

Minimum fee to be charged = = = `11,920/-

No. of students 150 students

Total Cost + Profit `17,88,000 +`8,94,000

(iii) Fee to be charged per student = =

No. of students 125 students

`26,82,000

= `21,456/-

125 students

© The Institute of Chartered Accountants of India

@CAWORLD

12 Service Costing

Question 1 (Costing of Toll Roads):

SLS Infrastructure built and operates 110 k.m. highway on the basis of Built-Operate-Transfer

(BOT) for a period of 25 years. A traffic assessment has been carried out to estimate the traffic

flow per day shows the following figures:

Sl. No. Type of vehicle Daily traffic volume

1. Two wheelers 44,500

2. Car and SUVs 3,450

3. Bus and LCV 1,800

4. Heavy commercial vehicles 816

The following is the estimated cost of the project:

Amount (` in

Sl. no. Activities lakh)

1 Site clearance 170.70

2 Land development and filling work 9,080.35

3 Sub base and base courses 10,260.70

4 Bituminous work 35,070.80

5 Bridge, flyovers, underpasses, Pedestrian subway, footbridge, etc 29,055.60

6 Drainage and protection work 9,040.50

7 Traffic sign, marking and road appurtenance 8,405.00

8 Maintenance, repairing and rehabilitation 12,429.60

9 Environmental management 982.00

Total Project cost 114,495.25

An average cost of `1,120 lakh has to be incurred on administration and toll plaza operation.

On the basis of the vehicle specifications (i.e. weight, size, time saving etc.), the following weights

has been assigned to the passing vehicles:

Sl. No. Type of vehicle

1. Two wheelers 5%

© The Institute of Chartered Accountants of India

@CAWORLD

Service Costing 12.2

2. Car and SUVs 20%

3. Bus and LCV 30%

4. Heavy commercial vehicles 45%

Required:

(i) CACULATE the total project cost per day of concession period.

(ii) COMPUTE toll fee to be charged for per vehicle of each type, if the company wants earn a profit

of 15% on total cost.

[Note: Concession period is a period for which an infrastructure is allowed to operate and recovers its

investment]

Answer:

(i) Calculation of total project cost per day of concession period:

Activities Amount (` in lakh)

Site clearance 170.70

Land development and filling work 9,080.35

Sub base and base courses 10,260.70

Bituminous work 35,070.80

Bridge, flyovers, underpasses, Pedestrian subway, footbridge, etc 29,055.60

Drainage and protection work 9,040.50

Traffic sign, marking and road appurtenance 8,405.00

Maintenance, repairing and rehabilitation 12,429.60

Environmental management 982.00

Total Project cost 114,495.25

Administration and toll plaza operation cost 1,120.00

Total Cost 115,615.25

Concession period in days (25 years × 365 days) 9,125

Cost per day of concession period (` in lakh) 12.67

(ii) Computation of toll fee:

Cost to be recovered per day = Cost per day of concession period + 15% profit on cost

= `12,67,000 + `1,90,050 = `14,57,050

© The Institute of Chartered Accountants of India

@CAWORLD

12.3 Cost and Management Accounting

`14,57,050

Cost per equivalent vehicle = = `19.06 per equivalent vehicle

76,444units(Re fer workingnote)

Vehicle type-wise toll fee:

Sl. Type of vehicle Equivalent cost Weight Toll fee per vehicle

No. [A] [B] [A×B]

1. Two wheelers `19.06 1 19.06

2. Car and SUVs `19.06 4 76.24

3. Bus and LCV `19.06 6 114.36

4. Heavy commercial vehicles `19.06 9 171.54

Working Note:

The cost per day has to be recovered from the daily traffic. The each type of vehicle is to be

converted into equivalent unit. Let’s convert all vehicle types equivalent to Two-wheelers..

Sl. Type of vehicle Daily traffic Weight Ratio [B] Equivalent Two-

No. volume [A] wheeler [A×B]

1. Two wheelers 44,500 0.05 1 44,500

2. Car and SUVs 3,450 0.20 4 13,800

3. Bus and LCV 1,800 0.30 6 10,800

4. Heavy commercial 816 0.45 9 7,344

vehicles

Total 76,444

© The Institute of Chartered Accountants of India

@CAWORLD

You might also like

- CPA REVIEW FBTDocument8 pagesCPA REVIEW FBTKendrew Sujide100% (1)

- DEPARTMENTAL ACCOUNTSDocument17 pagesDEPARTMENTAL ACCOUNTSAyush AcharyaNo ratings yet

- Analysis of Financial StatementsDocument41 pagesAnalysis of Financial StatementsSheilaMarieAnnMagcalasNo ratings yet

- BillDocument3 pagesBillnahlaNo ratings yet

- The Influence of Innovation Strategy and Organizational Innovation On Innovation Quality and Performance PDFDocument38 pagesThe Influence of Innovation Strategy and Organizational Innovation On Innovation Quality and Performance PDFEdward LumentaNo ratings yet

- Adobe Scan Mar 5 2022Document19 pagesAdobe Scan Mar 5 2022PAULA MENDITANo ratings yet

- Strategic Cost ManagementDocument21 pagesStrategic Cost ManagementDeepak ShettyNo ratings yet

- Cash ManagementDocument14 pagesCash ManagementSushant MaskeyNo ratings yet

- 13 17227rtp Ipcc Nov09 Paper3aDocument24 pages13 17227rtp Ipcc Nov09 Paper3aemmanuel JohnyNo ratings yet

- Paper - 3: Cost and Management Accounting Questions Material CostDocument31 pagesPaper - 3: Cost and Management Accounting Questions Material CostMohammed Mustafa KampuNo ratings yet

- Revision Test Paper CAP II Dec 2017Document163 pagesRevision Test Paper CAP II Dec 2017Dipen AdhikariNo ratings yet

- Practice Accounts Prime PDFDocument56 pagesPractice Accounts Prime PDFShraddha NepalNo ratings yet

- MTP1 May2022 - Paper 5 Advanced AccountingDocument24 pagesMTP1 May2022 - Paper 5 Advanced AccountingYash YashwantNo ratings yet

- Group - I Paper - 1 Accounting V2 Chapter 13 PDFDocument13 pagesGroup - I Paper - 1 Accounting V2 Chapter 13 PDFjashveer rekhiNo ratings yet

- 11 CaipccaccountsDocument19 pages11 Caipccaccountsapi-206947225No ratings yet

- Taxation Paper 4: Income-tax Law Multiple Choice QuestionsDocument20 pagesTaxation Paper 4: Income-tax Law Multiple Choice QuestionsKartik0% (1)

- Compiler CAP II Cost AccountingDocument187 pagesCompiler CAP II Cost AccountingEdtech NepalNo ratings yet

- CA IPCC Accounting Guideline Answers May 2015Document24 pagesCA IPCC Accounting Guideline Answers May 2015Prashant PandeyNo ratings yet

- Chap 6Document27 pagesChap 6Basant OjhaNo ratings yet

- Home Work Section Working CapitalDocument10 pagesHome Work Section Working CapitalSaloni AgrawalNo ratings yet

- Decemeber 2020 Examinations: Suggested Answers ToDocument41 pagesDecemeber 2020 Examinations: Suggested Answers ToDipen AdhikariNo ratings yet

- Suggested - Answer - CAP - II - June - 2010 2Document85 pagesSuggested - Answer - CAP - II - June - 2010 2Dipen AdhikariNo ratings yet

- Not For Profit OrganizationDocument69 pagesNot For Profit OrganizationDristi SaudNo ratings yet

- Revision Test Paper: Cap-Ii: Advanced Accounting: QuestionsDocument158 pagesRevision Test Paper: Cap-Ii: Advanced Accounting: Questionsshankar k.c.No ratings yet

- 7948final Adv Acc Nov05Document16 pages7948final Adv Acc Nov05Kushan MistryNo ratings yet

- Coc Departmental Accounting Ca/Cma Santosh KumarDocument11 pagesCoc Departmental Accounting Ca/Cma Santosh KumarAyush AcharyaNo ratings yet

- CAP II Scanner Corporate LawDocument121 pagesCAP II Scanner Corporate LawEdtech NepalNo ratings yet

- Banking CompaniesDocument34 pagesBanking CompaniesLodaNo ratings yet

- Tough LekkaluDocument42 pagesTough Lekkaludeviprasad03No ratings yet

- Paper - 5: Advanced Accounting: © The Institute of Chartered Accountants of IndiaDocument31 pagesPaper - 5: Advanced Accounting: © The Institute of Chartered Accountants of IndiaVarun reddyNo ratings yet

- Chartered Accountancy Professional CAP-II TitleDocument104 pagesChartered Accountancy Professional CAP-II TitleBAZINGANo ratings yet

- Direct Materials APFL Uses A Weighted Average Method For The Pricing of Materials IssuesDocument5 pagesDirect Materials APFL Uses A Weighted Average Method For The Pricing of Materials IssuesAbimanyu ShenilNo ratings yet

- Cost Acc Nov06Document27 pagesCost Acc Nov06api-3825774No ratings yet

- CA Intermediate Accounting Chapter 3 QuestionsDocument15 pagesCA Intermediate Accounting Chapter 3 QuestionsKabiir RathodNo ratings yet

- PCC 2008 NPO QuestionDocument10 pagesPCC 2008 NPO QuestionVaibhav MaheshwariNo ratings yet

- CA Inter Cost Important Questions For CA Nov'22Document93 pagesCA Inter Cost Important Questions For CA Nov'2202 Tapasvee ShahNo ratings yet

- Test 1 Question PaperDocument12 pagesTest 1 Question PaperNaveen R HegadeNo ratings yet

- M/s Alag Pre Post SolutionDocument2 pagesM/s Alag Pre Post SolutionAyush VermaNo ratings yet

- 2.problems On EOQ - 14.12.2018Document3 pages2.problems On EOQ - 14.12.2018Rajesh GuptaNo ratings yet

- Partnership PDFDocument28 pagesPartnership PDFBasant OjhaNo ratings yet

- Corporate Law RTP CAP-II June 2016Document18 pagesCorporate Law RTP CAP-II June 2016Artha sarokar100% (1)

- Risk-Coverage Risks: Chapter - 9 Insurance ClaimsDocument24 pagesRisk-Coverage Risks: Chapter - 9 Insurance Claimss2sNo ratings yet

- Chapter 7 - Value of Supply - NotesDocument16 pagesChapter 7 - Value of Supply - NotesPuran GuptaNo ratings yet

- CAP III - Suggested Answer Papers - All Subjects - June 2019 PDFDocument133 pagesCAP III - Suggested Answer Papers - All Subjects - June 2019 PDFsantosh thapa chhetriNo ratings yet

- Bos 28432 CP 10Document45 pagesBos 28432 CP 10hiral dattaniNo ratings yet

- Cost Accs Reconciliation Extra SumsDocument7 pagesCost Accs Reconciliation Extra Sumspurvi doshiNo ratings yet

- Job CostingDocument18 pagesJob CostingBiswajeet DashNo ratings yet

- Accounting For Branches Including Foreign Branch Accounts: © The Institute of Chartered Accountants of IndiaDocument53 pagesAccounting For Branches Including Foreign Branch Accounts: © The Institute of Chartered Accountants of IndiaHarikrishna100% (1)

- © The Institute of Chartered Accountants of IndiaDocument39 pages© The Institute of Chartered Accountants of IndiaGowriNo ratings yet

- Paper - 1: Principles & Practice of Accounting Questions True and FalseDocument29 pagesPaper - 1: Principles & Practice of Accounting Questions True and FalsePiyush GoyalNo ratings yet

- Accounting for Business Combinations and Internal ReconstructionsDocument27 pagesAccounting for Business Combinations and Internal ReconstructionsbinuNo ratings yet

- Suggested Answer CAP II June 2018Document128 pagesSuggested Answer CAP II June 2018Pradeep Bhattarai67% (3)

- 3246accounting - CA IPCCDocument116 pages3246accounting - CA IPCCPrashant Pandey100% (1)

- CHARTERED ACCOUNTANCY PROFESSIONAL CAP-II REVISION TEST PAPERDocument21 pagesCHARTERED ACCOUNTANCY PROFESSIONAL CAP-II REVISION TEST PAPERbinu100% (1)

- Group 2 May 07Document73 pagesGroup 2 May 07princeoftolgate100% (1)

- Illustrations AmalgamationDocument4 pagesIllustrations Amalgamationajay2741100% (1)

- 5 Debenture Material3619080524732228932Document14 pages5 Debenture Material3619080524732228932Prabin stha100% (1)

- Scanner CAP II Income Tax VATDocument162 pagesScanner CAP II Income Tax VATEdtech NepalNo ratings yet

- 5 6084915055709651012Document8 pages5 6084915055709651012Ajit Yadav100% (1)

- Contract Costing (Unsolved)Document6 pagesContract Costing (Unsolved)ArnavNo ratings yet

- Income From House PropertyDocument26 pagesIncome From House PropertySuyash Patwa100% (1)

- Operating CostingDocument13 pagesOperating CostingJoydip DasguptaNo ratings yet

- Ratio Analysis Rohit D. AkolkarDocument21 pagesRatio Analysis Rohit D. AkolkarRajendra Gawate100% (1)

- Bos 24780 CP 5Document114 pagesBos 24780 CP 5NmNo ratings yet

- Account Past Questions Compilation (2009june - 2020 Dec.)Document246 pagesAccount Past Questions Compilation (2009june - 2020 Dec.)Prashant Sagar Gautam100% (2)

- Portfolio Theory 2Document65 pagesPortfolio Theory 2Kevin NamiNo ratings yet

- 1) Answer Any Two From The Following: 10X2 20Document2 pages1) Answer Any Two From The Following: 10X2 20Alvarez StarNo ratings yet

- Corporate SME SummaryDocument13 pagesCorporate SME SummaryAlvarez StarNo ratings yet

- A Study On Equity Research of Selected FMCG Companies Listed On NSEDocument6 pagesA Study On Equity Research of Selected FMCG Companies Listed On NSEEditor IJTSRDNo ratings yet

- Module 8. BLDG - EnhancingDocument12 pagesModule 8. BLDG - EnhancingCristherlyn DabuNo ratings yet

- Student Assessment Task 4Document13 pagesStudent Assessment Task 4nicky wanjiru100% (1)

- Mandarin FrontDocument13 pagesMandarin FrontPaul Carlo GonzalesNo ratings yet

- Dubai Logistics CorridorDocument2 pagesDubai Logistics CorridorhapuenjerNo ratings yet

- 4 MsDocument37 pages4 MsJoycee Mae JabinesNo ratings yet

- ATP Term PaperDocument12 pagesATP Term PaperCarme Ann S. RollonNo ratings yet

- Managing foreign exchange risk and exposure at BCRDocument5 pagesManaging foreign exchange risk and exposure at BCRShashi Bhushan SonbhadraNo ratings yet

- Developing Global ProfessionalsDocument28 pagesDeveloping Global ProfessionalsNguyễn Thị Kiều GiangNo ratings yet

- 10 - LAS - WEEk3-Generating Ideas For BusinessDocument3 pages10 - LAS - WEEk3-Generating Ideas For BusinessJenelyn RusianaNo ratings yet

- Shopping Mall CoverDocument8 pagesShopping Mall CoverApurba SarmahNo ratings yet

- Elements of Cost and Cost Sheet - FYBBA-IBDocument25 pagesElements of Cost and Cost Sheet - FYBBA-IBSakuraNo ratings yet

- Feasibility OutlineDocument20 pagesFeasibility OutlineAlyyssa Julfa ArcenoNo ratings yet

- mktg1101 PDFDocument3 pagesmktg1101 PDFRaveesh HurhangeeNo ratings yet

- Chapter 618Document25 pagesChapter 618Pranav GargNo ratings yet

- Apllied Econ Wk1 - 2 Summative TestDocument2 pagesApllied Econ Wk1 - 2 Summative TestJay SyNo ratings yet

- Introduction Voucher ConceptDocument9 pagesIntroduction Voucher Conceptnagesh dashNo ratings yet

- Akhuwat - Potential For A Sustainable Islamic Interest Free MicrofDocument53 pagesAkhuwat - Potential For A Sustainable Islamic Interest Free MicrofmairaNo ratings yet

- Unemployment in IndiaDocument4 pagesUnemployment in IndiaChandan TiwariNo ratings yet

- Strategies and Human Resource Planning: Prepared By:-Akanksha Kumari 117503Document17 pagesStrategies and Human Resource Planning: Prepared By:-Akanksha Kumari 117503geetukumariNo ratings yet

- BancomundialpaperDocument32 pagesBancomundialpaperpaulo.bessa.antunesNo ratings yet

- Question CMA June 2019Document6 pagesQuestion CMA June 2019rumelrashid_seuNo ratings yet

- A Study On Overview of Employee Attrition Rate in India 150759937Document5 pagesA Study On Overview of Employee Attrition Rate in India 150759937Pramit NarayanNo ratings yet

- Uk Accounting Software MarketDocument43 pagesUk Accounting Software MarketSaravan VictoryShanmugamNo ratings yet

- Community Engagement and InvestmentDocument30 pagesCommunity Engagement and InvestmentCharlene KronstedtNo ratings yet

- Traffic and Revenue PresentationDocument15 pagesTraffic and Revenue Presentationvivek1280No ratings yet