Professional Documents

Culture Documents

Date Payment 10% Interest Principal Present Value

Uploaded by

Dominic RomeroOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Date Payment 10% Interest Principal Present Value

Uploaded by

Dominic RomeroCopyright:

Available Formats

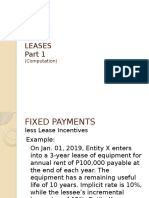

Problem 10-19

Given: Answers:

PV = 1,352,000 Lease Liability = P 1,152,000 (B)

Equal Annual Payment = 200,000 Noncurrent LL = P 1,067,200 (C)

Interest = 10% Interest Expense = P 115,200 (B)

Useful life = 20 years

Date Payment 10% Interest Principal Present Value

1/1/2020 P 1,352,000

1/1/2020 P 200,000 - P 200,000 1,152,000

1/1/2021 200,000 P 115,200 84,800 1,067,200

Lease liability – Dec 31, 2020 P 1,152,000

Less: Current Portion – paid on Jan 1, 2021 (84,800)

Noncurrent Liability – Dec 31, 2020 P 1,067,200

Interest Expense - 2020 P 115,200

Depreciation – 2020 (PV/UL) P 67,600

Problem 10-20 Answer: Lease Liability = P 2,431,500 (B)

Given:

PV = 3,165,000

Implicit Interest Rate = 10%

Annual Payment = 500,000

PV P 3,165,000

Less: Annual Payment – Dec 31, 2020 500,000

Balance – Dec 31, 2020 2,665,000

Less: Annual Payment – Dec 31, 2021

Payment 500,000

Interest 266,500 233,500

Lease Liability – Dec 31, 2021 P 2,431,500

Problem 10-22 Answer: Current Lease Liability = P 85,000 (B)

Given:

Lease Liability = 1,350,000

Annual Payment = 200,000

Interest = 10%

Initial Lease Liability – Dec 31, 2020 P 1,350,000

Less: Annual Payment – Dec 31, 2020 200,000

Lease Liability – Dec 31, 2020 1,150,000

Less: Principal Payment (Current)

Annual Payment 200,000

Interest for 2021 (10% of 1,150,000) 115,000 85,000

Noncurrent Lease Liability – Dec 31, 2020 P 1,065,000

Problem 10-23 Answer: Lease Liability w/ Interest = P 4,578,000 (A)

Given:

Lease Liability – Jan 1, 2020 = 4,900,000

Annual Payment = 700,000

Implicit Interest Rate = 9%

Lease Liability – Jan 1, 2020 P 4,900,000

Less: Annual Payment – Jan 1, 2020 700,000

Lease Liability – Dec 30, 2020 4,200,000

Accrued Interest Payable – Dec 31, 2020 (9% of LL on Dec 30) 378,000

Total Lease Liability – Dec 31, 2020 P 4,578,000

Problem 10-27

Given: Answer:

Lease Liability – Dec 31, 2020 = 2,700,000 Reduction of Lease Liability

Annual Payment = 400,000 = 170,000 (D)

Implicit Interest Rate = 10% Interest Expense = 230,000 (B)

Lease Liability – Dec 31, 2021

= 2,130,000 (C)

Lease Liability – Dec 31, 2020 P 2,700,000

Less: Annual payment – Dec 31, 2020 400,000

Lease Liability – Dec 31, 2020 2,300,000

Annual Payment – Dec 31, 2021 400,000

Less: Interest for 2021 (10% of 2,300,000) 230,000

Reduction of lease liability – Dec 31, 2021 170,000

Lease Liability – Dec 31, 2020 2,300,000

Less: Reduction of lease liability – Dec 31, 2021 170,000

Lease Liability – Dec 31, 2021 2,130,000

Problem 10-28 Answer: Cost of Actual Purchase of Leased Equipment

= P 4,578,000 (A)

Given:

Right of Use Asset = 4,000,000

Accumulated Depreciation = 2,450,000

Lease Liability = 1,300,000

Cash Payment for Equipment = 1,600,000

Leased Equipment P 4,000,000

Less: Accumulated Depreciation 2,450,000

Carrying Amount 1,550,000

Cash Payment 1,600,000

Total 3,150,000

Less: Lease Liability 1,300,000

Cost of Actual Purchase of Leased Equipment P 1,850,000

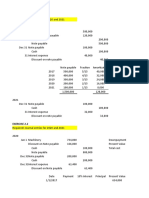

Problem 10-30

Given: (Only the Important Details) Answer:

Annual Fixed Payment in Advance = 1,000,000 Initial Lease Liability

PV of an Annuity of 1 = 4.31 = 4,310,000 (B)

Initial Direct Cost = 350,000 Cost of Right of Use Asset

Lease Incentive Received = 150,000 = 4,810,000 (B)

Lease Bonus = 100,000 Annual Depreciation

Cost of Restoration = 200,000 = 962,000 (C)

Lease Term = 5 years Interest Expense

Implicit Interest Rate = 8% = 264,800 (C)

Initial Lease Liability (1,000,000 * 4.31) 4,310,000

Initial Direct Cost 350,000

Lease Bonus 100,000

Cost of Restoration 200,000

Less: Lease Incentive Received 150,000

Cost of Right of Use Asset 4,810,000

Useful Life / 5 years

Annual Depreciation 962,000

Date Payment 8% Interest Principal Present Value

1/1/2020 P 4,310,000

1/1/2020 P 1,000,000 - P 1,000,000 3,310,000

1/1/2021 1,000,000 264,800 735,200 2,574,800

1/1/2022 1,000,000 205,984 794,016 1,780,784

You might also like

- Private Debt: Yield, Safety and the Emergence of Alternative LendingFrom EverandPrivate Debt: Yield, Safety and the Emergence of Alternative LendingNo ratings yet

- Angelica S. Rubios: Problem 10-19Document4 pagesAngelica S. Rubios: Problem 10-19Angel RubiosNo ratings yet

- Leases (Part 1) : Problem 1: True or FalseDocument26 pagesLeases (Part 1) : Problem 1: True or FalseKim HanbinNo ratings yet

- Ia2 Final Exam A Test Bank - CompressDocument32 pagesIa2 Final Exam A Test Bank - CompressFiona MiralpesNo ratings yet

- Final Grading Exam - Key AnswersDocument35 pagesFinal Grading Exam - Key AnswersJEFFERSON CUTE97% (32)

- Audit of Liabilities SolManDocument3 pagesAudit of Liabilities SolManReyn Saplad PeralesNo ratings yet

- BSA 314 Module 4 Output, Atillo Lyle CDocument10 pagesBSA 314 Module 4 Output, Atillo Lyle CJeth MahusayNo ratings yet

- Inter AccDocument6 pagesInter AccshaylieeeNo ratings yet

- Ass in Ia 3 Act. 3Document7 pagesAss in Ia 3 Act. 3Resty VillaroelNo ratings yet

- Problem 11-7 Given:: Date Payment 10% Interest Principal Present ValueDocument2 pagesProblem 11-7 Given:: Date Payment 10% Interest Principal Present ValueDominic RomeroNo ratings yet

- Far Situational Solution-1Document6 pagesFar Situational Solution-1Baby BearNo ratings yet

- Ia2 QuestionsDocument6 pagesIa2 QuestionsSharjaaahNo ratings yet

- Ch7. LEASES Part 1 (Computation)Document29 pagesCh7. LEASES Part 1 (Computation)Hazell DNo ratings yet

- Finalchapter 17Document4 pagesFinalchapter 17Jud Rossette ArcebesNo ratings yet

- Year Note For P 1,100,000 Plus Interest 10% Compounded AnnuallyDocument7 pagesYear Note For P 1,100,000 Plus Interest 10% Compounded AnnuallyIvory ClaudioNo ratings yet

- AE121-PPE Lecture Prob SolDocument7 pagesAE121-PPE Lecture Prob SolGero MarinasNo ratings yet

- Perez Long Quiz Auditing and Assurance Concepts and ApplicationDocument7 pagesPerez Long Quiz Auditing and Assurance Concepts and ApplicationMitch MinglanaNo ratings yet

- 5 27 LoansDocument9 pages5 27 LoansRengeline LucasNo ratings yet

- Acctg Lab 7Document8 pagesAcctg Lab 7AngieNo ratings yet

- Assignment 3 - Financial Accounting - February 4Document7 pagesAssignment 3 - Financial Accounting - February 4Ednalyn PascualNo ratings yet

- Fin Acc 2 Chap 7Document10 pagesFin Acc 2 Chap 7MkaeDizonNo ratings yet

- Investments: SolutionDocument8 pagesInvestments: SolutionAce LimpinNo ratings yet

- CHAPTER 12 Operating Lease - Lessor Operating LeaseDocument5 pagesCHAPTER 12 Operating Lease - Lessor Operating LeaseLady PilaNo ratings yet

- Leases Problems Solution GuideDocument11 pagesLeases Problems Solution Guidedane f.100% (1)

- IA 1 - Chapter 6 Notes Receivable Problems Part 2Document11 pagesIA 1 - Chapter 6 Notes Receivable Problems Part 2John CentinoNo ratings yet

- Audit of Long Term Liabilities 2Document5 pagesAudit of Long Term Liabilities 2Cesar EsguerraNo ratings yet

- Accounting 1Document10 pagesAccounting 1Jay EbuenNo ratings yet

- AC13.1.2 Module 1 Answer KeyDocument6 pagesAC13.1.2 Module 1 Answer KeyDianaNo ratings yet

- January 1, 2020 P5,388,835 December 31, 2020 P550,000 P484,995 P65,005Document7 pagesJanuary 1, 2020 P5,388,835 December 31, 2020 P550,000 P484,995 P65,005gazer beamNo ratings yet

- ACCT 4410 Depreciation Allowance Illustration (DA) (2023S)Document2 pagesACCT 4410 Depreciation Allowance Illustration (DA) (2023S)何健珩No ratings yet

- Module - IA Chapter 6Document10 pagesModule - IA Chapter 6Kathleen EbuenNo ratings yet

- Practice Set 9 BondsDocument11 pagesPractice Set 9 BondsVivek JainNo ratings yet

- Finance Lease Exercise 1Document13 pagesFinance Lease Exercise 1Jenyl Mae NobleNo ratings yet

- AssignmentDocument40 pagesAssignmentnoeljrpajaresNo ratings yet

- Chapter 8: Leases Part II: Problem 4: Multiple Choice - Computational 1. D 2. BDocument7 pagesChapter 8: Leases Part II: Problem 4: Multiple Choice - Computational 1. D 2. Bmarriette joy abadNo ratings yet

- Module 8 - Answer KeyDocument3 pagesModule 8 - Answer KeyFiona MiralpesNo ratings yet

- PPE1&2Document3 pagesPPE1&2Kailah CalinogNo ratings yet

- Intacc2-Quiz ExamDocument10 pagesIntacc2-Quiz ExamCmNo ratings yet

- Note Payable Irrevocably Designated As at Fair Value Through Profit or LossDocument4 pagesNote Payable Irrevocably Designated As at Fair Value Through Profit or Lossnot funny didn't laughNo ratings yet

- R2. TAX ML Solution CMA January 2022 ExaminationDocument6 pagesR2. TAX ML Solution CMA January 2022 ExaminationPavel DhakaNo ratings yet

- F7 - Mock A - AnswersDocument6 pagesF7 - Mock A - AnswerspavishneNo ratings yet

- Module 5 Note Payable and Debt RestructureDocument15 pagesModule 5 Note Payable and Debt Restructuremmh100% (1)

- Tugas Akuntansi Keuangan Menengah 2Document3 pagesTugas Akuntansi Keuangan Menengah 2Alisya UmariNo ratings yet

- Quiz Box 2 - QuestionnairesDocument13 pagesQuiz Box 2 - QuestionnairesCamila Mae AlduezaNo ratings yet

- FAR Problem Quiz 2Document3 pagesFAR Problem Quiz 2Ednalyn CruzNo ratings yet

- Problem 5-3 Requirement 1 2020Document7 pagesProblem 5-3 Requirement 1 2020Adyagila Ecarg NelehNo ratings yet

- Computation For Exercise 1Document10 pagesComputation For Exercise 1Xyzra AlfonsoNo ratings yet

- Sol. Man. - Chapter 8 Leases Part 2Document9 pagesSol. Man. - Chapter 8 Leases Part 2Miguel Amihan100% (1)

- 2021 - A2S2 Solution-OplossingDocument19 pages2021 - A2S2 Solution-OplossingmeghdyckNo ratings yet

- Liquidation PQ SolDocument5 pagesLiquidation PQ SolKaran MokhaNo ratings yet

- Intacc ReviewerDocument11 pagesIntacc ReviewerMaster GTNo ratings yet

- Solutions - LiabilitiesDocument10 pagesSolutions - LiabilitiesjhobsNo ratings yet

- INTACC1 - Time Value of MoneyDocument5 pagesINTACC1 - Time Value of MoneysfsdfsdfNo ratings yet

- Far 811S Test 2 2023Document7 pagesFar 811S Test 2 2023Grechen UdigengNo ratings yet

- Tutorial 2 - Property TaxDocument5 pagesTutorial 2 - Property Tax周小荷No ratings yet

- FR Mock Exam 4 - SolutionsDocument13 pagesFR Mock Exam 4 - Solutionsiram2005No ratings yet

- Assignment 3 - SolutionsDocument4 pagesAssignment 3 - SolutionsEsther LiuNo ratings yet

- Chapter 13 A-C PDFDocument13 pagesChapter 13 A-C PDFKim Arvin DalisayNo ratings yet

- ACOT103 Midterms AnswerDocument1 pageACOT103 Midterms AnswerDominic RomeroNo ratings yet

- Incoming First Year College Students of XXX University (Sy 2021-2022) Gender Course SAI RPM Math ENG Hs AveDocument6 pagesIncoming First Year College Students of XXX University (Sy 2021-2022) Gender Course SAI RPM Math ENG Hs AveDominic RomeroNo ratings yet

- Quiz 1Document6 pagesQuiz 1Dominic RomeroNo ratings yet

- ACOT103 Preliminary ExamDocument5 pagesACOT103 Preliminary ExamDominic RomeroNo ratings yet

- Exercises 2.1-3.2Document8 pagesExercises 2.1-3.2Dominic RomeroNo ratings yet

- 1 Gender 2 Course 3 Sai 4 RPM 5 Math 6 Eng 7 School CategoryDocument4 pages1 Gender 2 Course 3 Sai 4 RPM 5 Math 6 Eng 7 School CategoryDominic RomeroNo ratings yet

- Statistics (Exercise Using R)Document7 pagesStatistics (Exercise Using R)Dominic RomeroNo ratings yet

- Solution To Intermediate Accounting 1 Part 2Document3 pagesSolution To Intermediate Accounting 1 Part 2Dominic RomeroNo ratings yet

- Assignment Problem SolutionDocument1 pageAssignment Problem SolutionDominic RomeroNo ratings yet

- Case 2 Decision: Using The Utilitarian Approach, Carlos Should NOT Take The MoneyDocument1 pageCase 2 Decision: Using The Utilitarian Approach, Carlos Should NOT Take The MoneyDominic RomeroNo ratings yet

- Solution To Intermediate Accounting 1Document2 pagesSolution To Intermediate Accounting 1Dominic RomeroNo ratings yet

- Exercises 2.1-3.2Document8 pagesExercises 2.1-3.2Dominic RomeroNo ratings yet

- Project SchedulingDocument2 pagesProject SchedulingDominic RomeroNo ratings yet

- Variable Value Reduced CostsDocument2 pagesVariable Value Reduced CostsDominic RomeroNo ratings yet

- To Let Go or To Let Live: The Case of MalouDocument4 pagesTo Let Go or To Let Live: The Case of MalouDominic Romero100% (1)

- Problem 13-12 To 13-15Document3 pagesProblem 13-12 To 13-15Dominic RomeroNo ratings yet

- PERT (Uncertain) SolutionDocument2 pagesPERT (Uncertain) SolutionDominic RomeroNo ratings yet

- Problem 11-1 Given: (Refer To Book) Required:: Date Payment 9% Interest Principal Present ValueDocument2 pagesProblem 11-1 Given: (Refer To Book) Required:: Date Payment 9% Interest Principal Present ValueDominic RomeroNo ratings yet

- Problem 11-7 Given:: Date Payment 10% Interest Principal Present ValueDocument2 pagesProblem 11-7 Given:: Date Payment 10% Interest Principal Present ValueDominic RomeroNo ratings yet

- Contemporary Challenges To RegionalismDocument14 pagesContemporary Challenges To RegionalismDominic Romero100% (1)

- ConversionDocument1 pageConversionDominic RomeroNo ratings yet

- Book of PrayersDocument1 pageBook of PrayersDominic RomeroNo ratings yet

- Spract 2 ADocument30 pagesSpract 2 ARonelaine MaputiNo ratings yet

- Problem 11-1 Given: (Refer To Book) Required:: Date Payment 9% Interest Principal Present ValueDocument2 pagesProblem 11-1 Given: (Refer To Book) Required:: Date Payment 9% Interest Principal Present ValueDominic RomeroNo ratings yet

- For Peace, One WorldDocument2 pagesFor Peace, One WorldDominic RomeroNo ratings yet

- Government Actions Against Corruption Reflection PaperDocument2 pagesGovernment Actions Against Corruption Reflection PaperDominic RomeroNo ratings yet

- New Central Bank Act Sec 85-112Document3 pagesNew Central Bank Act Sec 85-112Dominic RomeroNo ratings yet

- New Central Bank Act SEC57-84Document4 pagesNew Central Bank Act SEC57-84Dominic RomeroNo ratings yet

- New Central Bank Act (R.A. 7653) : Establishment and Organization of The Bangko Sentral NG PilipinasDocument17 pagesNew Central Bank Act (R.A. 7653) : Establishment and Organization of The Bangko Sentral NG PilipinasDominic Romero75% (4)

- Micro Perspective of Tourism and Hospitality (Thc1)Document11 pagesMicro Perspective of Tourism and Hospitality (Thc1)Jomharey Agotana BalisiNo ratings yet

- CULTRARO - Food For The Gods - Animal Consumption and Ritual Activities in The Early Bronze Age SDocument11 pagesCULTRARO - Food For The Gods - Animal Consumption and Ritual Activities in The Early Bronze Age SGustavo OliveiraNo ratings yet

- Global Economy Market IntegrationDocument3 pagesGlobal Economy Market IntegrationROSARIO BOHOL.No ratings yet

- Microeconomics An Intuitive Approach With Calculus 2nd Edition Thomas Nechyba Test BankDocument11 pagesMicroeconomics An Intuitive Approach With Calculus 2nd Edition Thomas Nechyba Test Bankjamesgregoryfzwjdynogt100% (26)

- European Politics in Transition 6th Edition PDFDocument2 pagesEuropean Politics in Transition 6th Edition PDFGunaraj0% (3)

- International Pepper Community: Report of The 36 Peppertech MeetingDocument26 pagesInternational Pepper Community: Report of The 36 Peppertech MeetingV Lotus Hbk0% (1)

- The Importance of Government RegulationDocument2 pagesThe Importance of Government RegulationAxel HagosojosNo ratings yet

- G20 & IndiaDocument2 pagesG20 & IndiaGRAMMAR SKILLNo ratings yet

- ATOLE 1 NigeriaDocument24 pagesATOLE 1 NigeriaDaniel AigbeNo ratings yet

- 21st Century LiteratureDocument9 pages21st Century LiteratureNolan NolanNo ratings yet

- Richard Pieris Exports PLCDocument9 pagesRichard Pieris Exports PLCDPH ResearchNo ratings yet

- MODAUD2 Unit 4 Audit of Bonds Payable T31516 FINALDocument3 pagesMODAUD2 Unit 4 Audit of Bonds Payable T31516 FINALmimi960% (2)

- Deviz, Ateriale Vopsitorie STBDocument3 pagesDeviz, Ateriale Vopsitorie STBGeorge MironNo ratings yet

- Film Budget Template StudioBinderDocument41 pagesFilm Budget Template StudioBinderDavid AzoulayNo ratings yet

- Sep 22Document1 pageSep 22K2Rankon K2RankonNo ratings yet

- ResearchDocument11 pagesResearchharishvadde15No ratings yet

- Exercises 2 - SolutionsDocument3 pagesExercises 2 - SolutionsbatuhanNo ratings yet

- RDO No. 57 - Biคan City, West Laguna 2Document298 pagesRDO No. 57 - Biคan City, West Laguna 2Yana PynNo ratings yet

- Intercompany Sales Problem Solving Exercises (Test Bank)Document2 pagesIntercompany Sales Problem Solving Exercises (Test Bank)Kristine Esplana ToraldeNo ratings yet

- Activity-Partnerships-METRILLO, JOHN KENNETH R.Document4 pagesActivity-Partnerships-METRILLO, JOHN KENNETH R.LordCelene C MagyayaNo ratings yet

- Grease04Interchange Proof 1Document1 pageGrease04Interchange Proof 1smhea123No ratings yet

- Solbridge IBS 301 Spring 2024 Course Syllabus Tuesday SectionDocument13 pagesSolbridge IBS 301 Spring 2024 Course Syllabus Tuesday SectionNgân Hà ĐỗNo ratings yet

- LESSON 1 The CW and GlobalizationDocument14 pagesLESSON 1 The CW and GlobalizationoykemsNo ratings yet

- GE3 NotesDocument4 pagesGE3 NotesPhyNo ratings yet

- Banking, Customer Satisfaction & IDBI Bank Awareness: HereDocument15 pagesBanking, Customer Satisfaction & IDBI Bank Awareness: HereAyush GadeNo ratings yet

- WK2 - Business ExpansionDocument28 pagesWK2 - Business ExpansionIsmailNo ratings yet

- 1 MT PreviewDocument7 pages1 MT Previewjdalvaran100% (1)

- UCSP Economic Institutions and Market TransactionsDocument36 pagesUCSP Economic Institutions and Market TransactionsApple Biacon-CahanapNo ratings yet

- Ibm Case Study File-2Document15 pagesIbm Case Study File-2Vishwajeet DasNo ratings yet

- Handmaid of Ethics: Corporate Social ResponsibilityDocument16 pagesHandmaid of Ethics: Corporate Social ResponsibilitySom yaNo ratings yet