Professional Documents

Culture Documents

Module 8 - Answer Key

Uploaded by

Fiona MiralpesOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Module 8 - Answer Key

Uploaded by

Fiona MiralpesCopyright:

Available Formats

Module 8: Note Payable

Answer Key

1. C. Proceeds received

2. B Amortized as interest expense over the life of the note

3. B. More than the stated discount rate of 10%

4. A. Bears a stated rate of interest which is realistic.

5. D. Fair value minus transaction cost

6. C. Either amortized cost or fair value through profit or loss

7. D. Fair value

8. B. at initial recognition, an entity may irrevocably designate the note payable as a fair value

9. D. Amortizing the discount on note payable gradually decreases the carrying amount of

liability over the life of the note.

10. A. The present value of note payable must be approximately using an imputed interest rate

11. D. All of these are considered in measuring the present value of the note payable

12. D. The stated interest rate is equal to the market rate

13. B. Direct deduction from the face amount of note

14. B. If fair value is unavailable, the note payable should be recorded at present value

discounted at the market rate of interest

15. D. fair value minus transaction cost

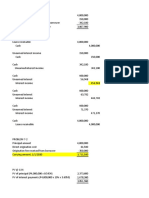

PROBLEM SOLVING

1. A 2,450,000 gain

Note Payable 5,000,000

Net Proceeds 2,550,000

Gain in change in fair value 2,450,000

2. D 71,000

Jan 1 - Oct 31, 2023 (400k x 12% x 10/12) 40,000

Feb 1 - Jul 31, 2023 (1M x 12% x 6/12) 60,000

May 1 - Dec 31, 2023 (700k x 12% x 8/12) 56,000

Total interest Expense- 2023 156,000

Recorded interest expense (85,000)

Understatement of Interest Expense 71,000

3. B 2,520,000

Present Value (700k x 3.60) 2,520,000

4. C 302,400

Interest Expense (2,520,000 x 12%) 302,400

5. B 48,000

Note Payable, 09/22 1,800,000

Less: Payment - 09/23 600,000

Balance - 09/23 1,200,000

Accrued Interest Payable 09/23 (1,200,000 x 4/12) 48,000

6. A 300,000

Interest Expense (3,000,000 x 10%) 300,000

7. D 2,500,000

Carrying amount of Note Payable 2,500,000

8. A 500,000 gain

3,000,000 - 2,500,000 = 500,000

9. C 20,250

Interest Expense (900,000 x 9% x 3/12) 20,250

10. A 704,700

Note Payable 900,000

Payment 195,300

Carrying Amount 704,700

11. D 1,391,200

Note Payable 2,400,000

Present Value 1,992,000

Discount on Note Payable 408,000

Amortization for 2023 (1,992,000 x 10%) 199,200

Discount on Note Payable 0 12/31/23 208,800

Note Payable - 01/01/23 2,400,000

Annual Payment (800,000)

Note Payable - 12/31/23 1,600,000

Discount on Note Payable (208,800)

Carrying Amount 1,391,200

11. D 165,000

1,200,000

(400,000)

800,000

Interest Paid 01/09 (1,200,000 X 15% X 9/12) 135,000

Interest Accrued 10/12 (800,000 x 15% x 3/12) 30,000

Interest Expense 165,000

12. A 1,160,000

Accrued Interest 03/2022 - 02/2023 (5M X12%) 600,000

Accrued Interest 03/2023 - 12/2023 (5M + 600k X 12% X 10/12) 560,000

Total Accrued Interest Payable 12/31/2023 1,160,000

13. B 414,000

Interest Expense (12% x 3,450,000) 414,000

14. C 471,200

PV of Note Payable (100,000 x 5.712) 571,200

Payment, 12/2023 (100,000)

Balance 12/2023 471,200

15. D 180,000

Note Payable, 10/2023 2,400,000

Payment on October 2022 (800,000)

Balance, 10/2022 1,600,000

Accrued Interest Payable from

October 2022 - June 2023 (1,600,000 x 10% x 9/12) 180,000

You might also like

- IA 1 - Chapter 6 Notes Receivable Problems Part 2Document11 pagesIA 1 - Chapter 6 Notes Receivable Problems Part 2John CentinoNo ratings yet

- Sol. Man. - Chapter 6 - Receivables Addtl Concept - Ia Part 1aDocument7 pagesSol. Man. - Chapter 6 - Receivables Addtl Concept - Ia Part 1aJenny Joy Alcantara0% (1)

- Angelica S. Rubios: Problem 10-19Document4 pagesAngelica S. Rubios: Problem 10-19Angel RubiosNo ratings yet

- Problem 11-7 Given:: Date Payment 10% Interest Principal Present ValueDocument2 pagesProblem 11-7 Given:: Date Payment 10% Interest Principal Present ValueDominic RomeroNo ratings yet

- Sol. Man. - Chapter 6 - Teacher's Manual - Ia Part 1aDocument7 pagesSol. Man. - Chapter 6 - Teacher's Manual - Ia Part 1aYamateNo ratings yet

- (Ust-Jpia) Quiz 1 Intermediate Accounting 2 Solution ManualDocument6 pages(Ust-Jpia) Quiz 1 Intermediate Accounting 2 Solution ManualRENZ ALFRED ASTRERONo ratings yet

- 93 - Final Preaboard AFAR SolutionsDocument11 pages93 - Final Preaboard AFAR SolutionsLeiNo ratings yet

- 5 27 LoansDocument9 pages5 27 LoansRengeline LucasNo ratings yet

- Audit of Liabilities SolManDocument3 pagesAudit of Liabilities SolManReyn Saplad PeralesNo ratings yet

- Audit of Long Term Liabilities 2Document5 pagesAudit of Long Term Liabilities 2Cesar EsguerraNo ratings yet

- Chapter 29Document6 pagesChapter 29Shane Ivory ClaudioNo ratings yet

- CPA Review School of The Philippines ManilaDocument4 pagesCPA Review School of The Philippines ManilaSophia PerezNo ratings yet

- Cpa Review School of The Philippines.2Document6 pagesCpa Review School of The Philippines.2Snow TurnerNo ratings yet

- 06 Notes Receivable Sec 2 MCPDocument3 pages06 Notes Receivable Sec 2 MCPkyle mandaresioNo ratings yet

- Intermediate Accounting 2 Millan 221013 124345Document233 pagesIntermediate Accounting 2 Millan 221013 124345Krazy Butterfly100% (1)

- Akm 2Document10 pagesAkm 2Putu DenyNo ratings yet

- Quiz Box 2 - QuestionnairesDocument13 pagesQuiz Box 2 - QuestionnairesCamila Mae AlduezaNo ratings yet

- Receivable Financing Receivable FinancingDocument10 pagesReceivable Financing Receivable FinancingMarjorie PalmaNo ratings yet

- Quiz 2 - Audit of Receivables SolutionDocument1 pageQuiz 2 - Audit of Receivables SolutionmillescaasiNo ratings yet

- Chapter 7 - Teacher's Manual - Ifa Part 1aDocument7 pagesChapter 7 - Teacher's Manual - Ifa Part 1aCharmae Agan CaroroNo ratings yet

- Loan ReceivableDocument10 pagesLoan ReceivableClyde SaladagaNo ratings yet

- Business Combi CH 6 de JesusDocument9 pagesBusiness Combi CH 6 de JesusMerel Rose FloresNo ratings yet

- Ia2 Final Exam A Test Bank - CompressDocument32 pagesIa2 Final Exam A Test Bank - CompressFiona MiralpesNo ratings yet

- FAR Problem Quiz 2Document3 pagesFAR Problem Quiz 2Ednalyn CruzNo ratings yet

- Problem 6-8 Answer A Savage CompanyDocument6 pagesProblem 6-8 Answer A Savage CompanyJurie BalandacaNo ratings yet

- In Acc Chris Jean Paden BsaDocument6 pagesIn Acc Chris Jean Paden BsaJurie BalandacaNo ratings yet

- Finalchapter 17Document4 pagesFinalchapter 17Jud Rossette ArcebesNo ratings yet

- In Acc April Lyn Limsan BsaDocument6 pagesIn Acc April Lyn Limsan BsaJurie BalandacaNo ratings yet

- AC13.1.2 Module 1 Answer KeyDocument6 pagesAC13.1.2 Module 1 Answer KeyDianaNo ratings yet

- Problem 6-8 Answer A Savage CompanyDocument6 pagesProblem 6-8 Answer A Savage CompanyJurie BalandacaNo ratings yet

- Inter AccDocument6 pagesInter AccshaylieeeNo ratings yet

- F7 - Mock A - AnswersDocument6 pagesF7 - Mock A - AnswerspavishneNo ratings yet

- Exercise 14Document11 pagesExercise 14dwitaNo ratings yet

- 188073f7174b4401b2d0a1b25da700e9Document4 pages188073f7174b4401b2d0a1b25da700e9520Sri Wahyuni NgabalinNo ratings yet

- Q3a. Capital Budget AssignmentDocument1 pageQ3a. Capital Budget AssignmentMorgan MunyoroNo ratings yet

- BONEO Pup Receivables3 SRC 2 1Document13 pagesBONEO Pup Receivables3 SRC 2 1hellokittysaranghaeNo ratings yet

- Notes Receivable: Long QuizDocument8 pagesNotes Receivable: Long Quizfinn mertensNo ratings yet

- RecFin AnswerKeySolutionsDocument3 pagesRecFin AnswerKeySolutionsHannah Jane UmbayNo ratings yet

- Loan Receivable ProblemsDocument6 pagesLoan Receivable ProblemsKathleen Frondozo100% (1)

- Chapter 1 - Contingent LiabilitiesDocument6 pagesChapter 1 - Contingent LiabilitiesJoshua AbanalesNo ratings yet

- RECEIVABLESDocument3 pagesRECEIVABLESJACQUELYN PABLITONo ratings yet

- Answers - Chapter 1 - Current LiabilitiesDocument5 pagesAnswers - Chapter 1 - Current LiabilitiesLhica EsterasNo ratings yet

- 02 FAR02-answersDocument18 pages02 FAR02-answersBea GarciaNo ratings yet

- Chapter 1-Problems Problems 1 Problems 2Document3 pagesChapter 1-Problems Problems 1 Problems 2Angela Ricaplaza ReveralNo ratings yet

- FR Mock Exam 4 - SolutionsDocument13 pagesFR Mock Exam 4 - Solutionsiram2005No ratings yet

- Problem SolutionsDocument6 pagesProblem SolutionsLovenia M. FerrerNo ratings yet

- Chapter 29Document19 pagesChapter 29Darlianne Klyne BayerNo ratings yet

- Finman Chapter 7Document6 pagesFinman Chapter 7Maria Kathreena Andrea AdevaNo ratings yet

- (Chapter 1) Sol Man Intermediate Accounting 2 by Zeus MillanDocument8 pages(Chapter 1) Sol Man Intermediate Accounting 2 by Zeus MillanJonathan Villazon Rosales67% (3)

- Batch 17 1st Preboard (P1)Document13 pagesBatch 17 1st Preboard (P1)Jericho Pedragosa100% (1)

- QUESTION 3 (B) - TAXATION OF INCOME - November 30, 2022Document4 pagesQUESTION 3 (B) - TAXATION OF INCOME - November 30, 2022Nathan NakibingeNo ratings yet

- Midterms Quiz 2 Answers PDFDocument7 pagesMidterms Quiz 2 Answers PDFFranz Campued100% (1)

- IFRS16 Lease In-Class PracticesDocument11 pagesIFRS16 Lease In-Class PracticesDAN NGUYEN THENo ratings yet

- Tutor UasDocument13 pagesTutor UasHENDY YUDHA PRAMANANo ratings yet

- Provisions, Contingencies and Other Liabilities ProblemsDocument7 pagesProvisions, Contingencies and Other Liabilities ProblemsGiander100% (1)

- Audit Probs 4 (Final Exam)Document6 pagesAudit Probs 4 (Final Exam)YameteKudasaiNo ratings yet

- Answer Key Final Exam IA 2Document4 pagesAnswer Key Final Exam IA 2Carlos arnaldo lavadoNo ratings yet

- Ia 2 Final Exam Answer KeyDocument17 pagesIa 2 Final Exam Answer KeyIrene Grace Edralin AdenaNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Finding Balance 2023: Benchmarking Performance and Building Climate Resilience in Pacific State-Owned EnterprisesFrom EverandFinding Balance 2023: Benchmarking Performance and Building Climate Resilience in Pacific State-Owned EnterprisesNo ratings yet

- TILADocument1 pageTILACJ IbaleNo ratings yet

- REFLECTIONDocument16 pagesREFLECTIONFiona MiralpesNo ratings yet

- ResearchDocument4 pagesResearchFiona MiralpesNo ratings yet

- ActivityDocument3 pagesActivityFiona MiralpesNo ratings yet

- Integration Course2Document61 pagesIntegration Course2Fiona MiralpesNo ratings yet

- Module 8 - ReviewerDocument8 pagesModule 8 - ReviewerFiona MiralpesNo ratings yet

- ResearchDocument5 pagesResearchFiona MiralpesNo ratings yet

- Module 8 - TheoriesDocument3 pagesModule 8 - TheoriesFiona MiralpesNo ratings yet

- Bsa Ii B Group 2 Music DanceDocument51 pagesBsa Ii B Group 2 Music DanceFiona MiralpesNo ratings yet

- Research Questionnaire GROUP-3Document1 pageResearch Questionnaire GROUP-3Fiona MiralpesNo ratings yet

- Rizal Commercial Bank v. Hi-Tri Devt. Corp.Document1 pageRizal Commercial Bank v. Hi-Tri Devt. Corp.Aiza OrdoñoNo ratings yet

- Module 8 - TheoriesDocument3 pagesModule 8 - TheoriesFiona MiralpesNo ratings yet

- MDL April 19Document1 pageMDL April 19Fiona MiralpesNo ratings yet

- Module 8 - THEORIESDocument5 pagesModule 8 - THEORIESFiona MiralpesNo ratings yet

- Module 8 - TheoriesDocument3 pagesModule 8 - TheoriesFiona MiralpesNo ratings yet

- Renato Dalomias: ExperienceDocument2 pagesRenato Dalomias: ExperienceFiona MiralpesNo ratings yet

- AIS Chapter 1 17feb24 ClassDocument35 pagesAIS Chapter 1 17feb24 ClassFiona MiralpesNo ratings yet

- AEAIS Module 2 Overview of Transaction Processing and Enterprise Resource Planning SystemsDocument28 pagesAEAIS Module 2 Overview of Transaction Processing and Enterprise Resource Planning SystemsFiona MiralpesNo ratings yet

- CASE #15 Spouses Danilo Clarita German Vs Spouses Benjamin and Editha Santuyo and Helen S. Mariano, Deceased Substituted by Heirs G.R. No. 210845 July 3, 2020 FactsDocument1 pageCASE #15 Spouses Danilo Clarita German Vs Spouses Benjamin and Editha Santuyo and Helen S. Mariano, Deceased Substituted by Heirs G.R. No. 210845 July 3, 2020 FactsHarlene HemorNo ratings yet

- Philippine Deposit Insurance Corporation (PDIC)Document4 pagesPhilippine Deposit Insurance Corporation (PDIC)Angelo Raphael B. DelmundoNo ratings yet

- ACTIVITY 10 - Ramirez, Jerrald Cliff S.Document3 pagesACTIVITY 10 - Ramirez, Jerrald Cliff S.Fiona MiralpesNo ratings yet

- Test Bank 1 - Ia 2Document18 pagesTest Bank 1 - Ia 2Xiena100% (2)

- AIS Chapter 1 17feb24 ClassDocument35 pagesAIS Chapter 1 17feb24 ClassFiona MiralpesNo ratings yet

- Sales LawDocument191 pagesSales LawFiona MiralpesNo ratings yet

- Intacc Answer KeyDocument232 pagesIntacc Answer KeyFiona MiralpesNo ratings yet

- Debt Restructuring Group ActDocument8 pagesDebt Restructuring Group ActYaka Waka100% (1)

- Black White Minimalist CV ResumeDocument1 pageBlack White Minimalist CV ResumeFiona MiralpesNo ratings yet

- Sales LawDocument191 pagesSales LawFiona MiralpesNo ratings yet

- Untitled SpreadsheetDocument5 pagesUntitled SpreadsheetFiona MiralpesNo ratings yet

- 3 - Valuation of Equity Shares - Assignment (26-04-19)Document4 pages3 - Valuation of Equity Shares - Assignment (26-04-19)AakashNo ratings yet

- Chapter 6 Exclusions From Gross Income PDFDocument12 pagesChapter 6 Exclusions From Gross Income PDFkimberly tenebroNo ratings yet

- NissanDocument31 pagesNissanRomilio CarpioNo ratings yet

- Part 5555Document2 pagesPart 5555RhoizNo ratings yet

- Warren Buffett's Mini Unofficial) BiographyDocument8 pagesWarren Buffett's Mini Unofficial) Biographydeepak150383No ratings yet

- Capital Structure Policy I Ebit-Eps Analysis: Page 1 of 2Document2 pagesCapital Structure Policy I Ebit-Eps Analysis: Page 1 of 2Danzo ShahNo ratings yet

- Banking RatiosDocument7 pagesBanking Ratioszhalak04No ratings yet

- Negen Angel Fund FAQsDocument8 pagesNegen Angel Fund FAQsAnil Kumar Reddy ChinthaNo ratings yet

- Module 4 - Executive Summary 6110Document7 pagesModule 4 - Executive Summary 6110auwal0112No ratings yet

- CFA Level 1 (Book-C)Document51 pagesCFA Level 1 (Book-C)butabuttNo ratings yet

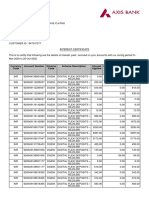

- Interest CertificateDocument2 pagesInterest CertificatesumitNo ratings yet

- LO3 ProblemsDocument11 pagesLO3 ProblemsKayla SheltonNo ratings yet

- Chapter 4 Cost AccountingDocument17 pagesChapter 4 Cost AccountingMel TrincheraNo ratings yet

- Learning Objectives: Assets Liabilities + EquityDocument13 pagesLearning Objectives: Assets Liabilities + EquityAira AbigailNo ratings yet

- Introduction To Debits and CreditsDocument8 pagesIntroduction To Debits and CreditsMJ Dulin100% (1)

- 40 Most Important Questions Business Studies SPCCDocument14 pages40 Most Important Questions Business Studies SPCCtwisha malhotraNo ratings yet

- Axis Smallcap FundDocument1 pageAxis Smallcap FundManoj JainNo ratings yet

- IAS 8 - Accounting Policies, Changes in Accounting Estimates and ErrorsDocument3 pagesIAS 8 - Accounting Policies, Changes in Accounting Estimates and ErrorsMarc Eric RedondoNo ratings yet

- IBO 3 - 10yearsDocument28 pagesIBO 3 - 10yearsManuNo ratings yet

- How To Secure A Bank Account From Levy 1Document5 pagesHow To Secure A Bank Account From Levy 1api-374440897% (124)

- Average Age of InventoryDocument10 pagesAverage Age of Inventoryrakeshjha91No ratings yet

- A B C D: 02 Objective / Objektif 2Document5 pagesA B C D: 02 Objective / Objektif 2foryourhonour wongNo ratings yet

- Us Engineering Construction Ma Due DiligenceDocument52 pagesUs Engineering Construction Ma Due DiligenceOsman Murat TütüncüNo ratings yet

- Time Value of MoneyDocument22 pagesTime Value of Moneyshubham abrolNo ratings yet

- Ali UblDocument135 pagesAli UblMuhammad SajidNo ratings yet

- Arvog Finance Corporate Presentation 2022Document9 pagesArvog Finance Corporate Presentation 2022Dinesh KandpalNo ratings yet

- COGM5 Final RequirementDocument24 pagesCOGM5 Final RequirementLadignon IvyNo ratings yet

- Case Study Vijay Mallya - Another Big NaDocument10 pagesCase Study Vijay Mallya - Another Big Najai sri ram groupNo ratings yet

- Write A Note On Previous Year and Assessment YearDocument2 pagesWrite A Note On Previous Year and Assessment YearBhaskar BhaskiNo ratings yet