Professional Documents

Culture Documents

RecFin AnswerKeySolutions

Uploaded by

Hannah Jane Umbay0 ratings0% found this document useful (0 votes)

52 views3 pagesOriginal Title

RecFin_AnswerKeySolutions

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

52 views3 pagesRecFin AnswerKeySolutions

Uploaded by

Hannah Jane UmbayCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

ANSWERS

1. a. I, II, III and IV

2. d. Does not require note disclosure relating to details of transaction.

3. c. Remain the same

4. c. debit to Allowance for Doubtful Accounts of P7,400.

5. d. P297,820

6. a. P872,500

7. b. P89,500

8. c. The factor assumes the risk of collectability and absorbs any credit losses in collecting the receivables.

9. c. The factor’s net income will be the difference between the financing income of P30,000 and the amount of any uncollectible receivables.

10. a. Milktea Co. reports both a receivable and a liability of P1,000,000 in its statement of financial position.

11. c. P922,000

12. a. P2,546,250

13. c. P100,800

14. b. P1,200

15. c. The entity shall report net interest income of P800.

16. a. P13,310

17. c. Both a and b.

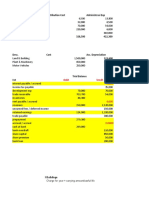

SOLUTIONS

4. Accounts receivable - assigned 1,000,000.00

Accounts receivable 1,000,000.00

Cash (840,000 x 98%) 823,200.00

Service charge (840,000 x 2%) 16,800.00

Loan payable 840,000.00

Cash 220,000.00

Sales dicount 760.00

Accounts receivable - assigned 220,760.00

Sales return 2,700.00

Accounts receivable - assigned 2,700.00

Allowance for doubtful accounts 7,400.00

Accounts receivable - assigned 7,400.00

5. Accounts receivable - assigned

(1,800,000 - 700,000 - 1,120 -1,060) 1,097,820.00

Loan payable (1,500,000 - 700,000) - 800,000.00

Equity in assigned accounts 297,820.00

6. Loan payable (2,500,000 x 90%) 2,250,000.00

Accrued interest (2,250,000 x 1%) 22,500.00

Remittance (1,500,000 - 100,000) - 1,400,000.00

Carrying amount, December 31 872,500.00

7.

Interest (900,000 x 14% x 1/12) 10,500.00

Accounts receivable - assigned

(1,000,000 - 80,000) 920,000.00

Loan payable (900,000 - (80,000 - 10,500)) - 830,500.00

Equity in assigned accounts 89,500.00

11. Face value of accounts receivable factored 400,000.00

Factoring fee (400,000 x 10%) - 40,000.00

Factor's holdback (400,000 x 5%) - 20,000.00

Proceeds from factoring 340,000.00

Proceeds from assignment (600,000 x 97%) 582,000.00

Total proceeds 922,000.00

12. Principal 2,500,000.00

Interest (2,500,000 x 10% x 6/12) 125,000.00

Maturity value 2,625,000.00

Discount (2,625,000 x 12% x 3/12) - 78,750.00

Net cash proceeds from discounting 2,546,250.00

13. Principal 100,000.00

Interest (100,000 x 12%) 12,000.00

Maturity value 112,000.00

Discount (112,000 x 12% x 10/12) - 11,200.00

Net cash proceeds from discounting 100,800.00

14. Principal 100,000.00

Accrued interest receivable (100,000 x 12% x 2/12) 2,000.00

Carrying amount 102,000.00

Net cash procees from carrying amount - 100,800.00

Loss on discounting 1,200.00

15. Interest income 2,000.00

Interest expense - 1,200.00

Net interest income 800.00

16. Principal amount 13,000.00

Interest income (13,000 x 8% x 90/360) 260.00

Maturity value 13,260.00

Protest fee 50.00

Notes Receivable Dishonored 13,310.00

You might also like

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Final Exam Far1Document4 pagesFinal Exam Far1Chloe CatalunaNo ratings yet

- Intermediate Accounting 2 Millan 221013 124345Document233 pagesIntermediate Accounting 2 Millan 221013 124345Krazy Butterfly100% (1)

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Homework SolutionsDocument5 pagesHomework SolutionsAnonymous CuUAaRSNNo ratings yet

- Exercises Module 8 For UploadDocument16 pagesExercises Module 8 For UploadjpNo ratings yet

- Sol. Man. - Chapter 6 - Receivables Addtl Concept - Ia Part 1aDocument7 pagesSol. Man. - Chapter 6 - Receivables Addtl Concept - Ia Part 1aJenny Joy Alcantara0% (1)

- Sol. Man. - Chapter 6 - Teacher's Manual - Ia Part 1aDocument7 pagesSol. Man. - Chapter 6 - Teacher's Manual - Ia Part 1aYamateNo ratings yet

- Answers - Chapter 1 - Current LiabilitiesDocument5 pagesAnswers - Chapter 1 - Current LiabilitiesLhica EsterasNo ratings yet

- Ia Forcadela Part IIIDocument5 pagesIa Forcadela Part IIIMary Joanne forcadelaNo ratings yet

- Current Liabilities ChapterDocument8 pagesCurrent Liabilities ChapterJonathan Villazon Rosales67% (3)

- Fair Value of Net AssetsDocument8 pagesFair Value of Net AssetsGanbilegBatnasanNo ratings yet

- 06 Notes Receivable Sec 2 MCPDocument3 pages06 Notes Receivable Sec 2 MCPkyle mandaresioNo ratings yet

- FAR First Preboard Batch 89 SolutionDocument6 pagesFAR First Preboard Batch 89 SolutionZiee00No ratings yet

- Batch 93 FAR First Preboard February 2023 - SolutionDocument5 pagesBatch 93 FAR First Preboard February 2023 - SolutionlorenzNo ratings yet

- CPA Review School of The Philippines ManilaDocument4 pagesCPA Review School of The Philippines ManilaSophia PerezNo ratings yet

- Audit Probs 4 (Final Exam)Document6 pagesAudit Probs 4 (Final Exam)YameteKudasaiNo ratings yet

- FAR Final Preboard SolutionsDocument6 pagesFAR Final Preboard SolutionsVillanueva, Mariella De VeraNo ratings yet

- INTACCDocument4 pagesINTACCApple RoncalNo ratings yet

- CPAR B94 FAR Final PB Exam - Answers - SolutionsDocument8 pagesCPAR B94 FAR Final PB Exam - Answers - SolutionsJazehl ValdezNo ratings yet

- Chapter 22 Current Liabilities ReviewDocument8 pagesChapter 22 Current Liabilities ReviewErwin Dave M. DahaoNo ratings yet

- Sol. Man. - Chapter 10 - She (Part 1) - 2021Document18 pagesSol. Man. - Chapter 10 - She (Part 1) - 2021Ventilacion, Jayson M.No ratings yet

- Sol. Man. - Chapter 4 - Accounts Receivable - Ia Part 1aDocument19 pagesSol. Man. - Chapter 4 - Accounts Receivable - Ia Part 1aMiguel AmihanNo ratings yet

- Cpa Review School of The Philippines Mani LaDocument6 pagesCpa Review School of The Philippines Mani LaSophia PerezNo ratings yet

- Book1Document14 pagesBook1Kawaii SevennNo ratings yet

- Chapter 9 Financial Reporting in Hyperinflationary EconomiesDocument10 pagesChapter 9 Financial Reporting in Hyperinflationary EconomiesKathrina RoxasNo ratings yet

- Chapter 14 AssociatesDocument15 pagesChapter 14 AssociatesChristian James RiveraNo ratings yet

- Perry - SolutionsDocument4 pagesPerry - SolutionsCharles TuazonNo ratings yet

- Acctg 4 Serdan Quiz 3Document7 pagesAcctg 4 Serdan Quiz 3Rica CatanguiNo ratings yet

- Intac QuizDocument4 pagesIntac QuizPamela Joy AlvarezNo ratings yet

- SW Chapter9 BDocument4 pagesSW Chapter9 BAnonnNo ratings yet

- Final Test - AnswersDocument6 pagesFinal Test - Answersnguyễn hiềnNo ratings yet

- Solution - B124 - FTHE - V2 Summer 2020-2021 2 - V1Document13 pagesSolution - B124 - FTHE - V2 Summer 2020-2021 2 - V1AhmEd GhayasNo ratings yet

- STAR LORD CORP. EMPLOYEE STOCK OPTIONSDocument20 pagesSTAR LORD CORP. EMPLOYEE STOCK OPTIONSadieNo ratings yet

- Cpa Review School of The Philippines.2Document6 pagesCpa Review School of The Philippines.2Snow TurnerNo ratings yet

- Teacher's Manual - Financial Acctg 2Document233 pagesTeacher's Manual - Financial Acctg 2Adrian Mallari71% (21)

- Alcaide, Daiane L. - Activity 1Document10 pagesAlcaide, Daiane L. - Activity 1Daiane AlcaideNo ratings yet

- Pledging, Factoring, Discounting SolutionsDocument3 pagesPledging, Factoring, Discounting SolutionsAnonymous CuUAaRSNNo ratings yet

- FIRST PB FAR Solutions PDFDocument6 pagesFIRST PB FAR Solutions PDFStephanie Joy NogollosNo ratings yet

- Activity 4-IntAcc1Document2 pagesActivity 4-IntAcc10322-1975No ratings yet

- Afar SolutionsDocument8 pagesAfar Solutionspopsie tulalianNo ratings yet

- FAR Problem Quiz 2Document3 pagesFAR Problem Quiz 2Ednalyn CruzNo ratings yet

- Assignment FARDocument2 pagesAssignment FARCykee Hanna Quizo LumongsodNo ratings yet

- Sol. Man. - Chapter 7 - Notes (Part 1)Document13 pagesSol. Man. - Chapter 7 - Notes (Part 1)natalie clyde matesNo ratings yet

- Accountancy Answer Key - II Puc Annual Exam March 2019Document8 pagesAccountancy Answer Key - II Puc Annual Exam March 2019Akash kNo ratings yet

- ABC Chap 9 SolmanDocument11 pagesABC Chap 9 SolmanKimberly ToraldeNo ratings yet

- Accounting calculations and journal entriesDocument6 pagesAccounting calculations and journal entriesZatsumono YamamotoNo ratings yet

- Chapter 06 - AdjustmentsDocument26 pagesChapter 06 - AdjustmentsMkhonto Xulu100% (1)

- Problem 8Document3 pagesProblem 8Coleen Lara SedillesNo ratings yet

- AssignmentDocument40 pagesAssignmentnoeljrpajaresNo ratings yet

- R&L Company: Assignment 1 Premium Liability, Warranty LiabilityDocument6 pagesR&L Company: Assignment 1 Premium Liability, Warranty Liabilityangelian bagadiongNo ratings yet

- Ass.1 Acctng. For Special TransactionDocument17 pagesAss.1 Acctng. For Special TransactionJea Ann CariñozaNo ratings yet

- Cash Basis to Accrual Basis ConversionDocument8 pagesCash Basis to Accrual Basis Conversioncortezzz100% (2)

- Sharon PLC (Long Question)Document4 pagesSharon PLC (Long Question)Jimmy LimNo ratings yet

- NUDJPIA FAR AND AFAR SOLUTIONS - ReceivablesDocument6 pagesNUDJPIA FAR AND AFAR SOLUTIONS - ReceivablesKyla Artuz Dela CruzNo ratings yet

- Receivables Practice SolvingDocument15 pagesReceivables Practice SolvingddalgisznNo ratings yet

- Miracle, Cascade, Pop, Sony, Erika, Mill, Topsy, Milan company premium analysisDocument10 pagesMiracle, Cascade, Pop, Sony, Erika, Mill, Topsy, Milan company premium analysisPhoebe Dayrit CunananNo ratings yet

- Solution in Partnership Liquidation LumpsumDocument4 pagesSolution in Partnership Liquidation LumpsumNikki GarciaNo ratings yet

- Inequality and Market ReformDocument1 pageInequality and Market ReformHannah Jane UmbayNo ratings yet

- Discussion On PesoDocument2 pagesDiscussion On PesoHannah Jane UmbayNo ratings yet

- Discussion On PesoDocument2 pagesDiscussion On PesoHannah Jane UmbayNo ratings yet

- MGA DAMBIEEE!!!! Complete AnswerDocument12 pagesMGA DAMBIEEE!!!! Complete AnswerHannah Jane UmbayNo ratings yet

- Economic GrowthDocument1 pageEconomic GrowthHannah Jane UmbayNo ratings yet

- GlobaL MARKETDocument1 pageGlobaL MARKETHannah Jane UmbayNo ratings yet

- GlobaL MARKETDocument1 pageGlobaL MARKETHannah Jane UmbayNo ratings yet

- Why Entrepreneurship Is Considered As A Backbone of Our Local EconomyDocument1 pageWhy Entrepreneurship Is Considered As A Backbone of Our Local EconomyHannah Jane UmbayNo ratings yet

- GlobaL MARKETDocument1 pageGlobaL MARKETHannah Jane UmbayNo ratings yet

- AR AnswerKeySolutions-1Document3 pagesAR AnswerKeySolutions-1Hannah Jane UmbayNo ratings yet

- Knowledge InsightDocument1 pageKnowledge InsightHannah Jane UmbayNo ratings yet

- Investment in Debt Securities Qualifying Exam Review Sample QuestionsDocument7 pagesInvestment in Debt Securities Qualifying Exam Review Sample QuestionsHannah Jane Umbay100% (1)

- RecFin AnswerKeySolutionsDocument3 pagesRecFin AnswerKeySolutionsHannah Jane UmbayNo ratings yet

- Cash and Cash Equivalents Sample ProblemsDocument6 pagesCash and Cash Equivalents Sample ProblemsAmabie De Chavez50% (2)

- All Chords Has Three Notes: KEYS: Black and WhiteDocument1 pageAll Chords Has Three Notes: KEYS: Black and WhiteHannah Jane UmbayNo ratings yet

- PIANO DetailsDocument5 pagesPIANO DetailsHannah Jane UmbayNo ratings yet

- Receivable Financing Qualifying Exam Review Sample QuestionsDocument4 pagesReceivable Financing Qualifying Exam Review Sample QuestionsHannah Jane Umbay0% (1)

- Test Bank - Assurance Principles (Cpar) LDocument56 pagesTest Bank - Assurance Principles (Cpar) Ljsus22100% (8)

- Answer Key On Sample Questions of Partnership LawDocument8 pagesAnswer Key On Sample Questions of Partnership LawHannah Jane Umbay100% (2)

- SadhguruDocument1 pageSadhguruHannah Jane UmbayNo ratings yet

- EmpowermentDocument1 pageEmpowermentHannah Jane UmbayNo ratings yet

- Answer Key On Sample Questions of Partnership LawDocument8 pagesAnswer Key On Sample Questions of Partnership LawHannah Jane Umbay100% (2)

- Philippines Law on Obligations and ContractsDocument8 pagesPhilippines Law on Obligations and ContractsHannah Jane UmbayNo ratings yet

- Philippines Law on Obligations and ContractsDocument8 pagesPhilippines Law on Obligations and ContractsHannah Jane UmbayNo ratings yet

- Handouts For The Law On ContractsDocument5 pagesHandouts For The Law On ContractsHannah Jane UmbayNo ratings yet

- Bank ReconDocument5 pagesBank ReconHannah Jane Umbay67% (3)

- Handouts For The Law On ContractsDocument5 pagesHandouts For The Law On ContractsHannah Jane UmbayNo ratings yet

- Common Sense Excerpt on Examining Connection to BritainDocument1 pageCommon Sense Excerpt on Examining Connection to BritainHannah Jane UmbayNo ratings yet

- Common Sense Excerpt on Examining Connection to BritainDocument1 pageCommon Sense Excerpt on Examining Connection to BritainHannah Jane UmbayNo ratings yet

- Separation AgreementDocument4 pagesSeparation Agreementaliagamps411100% (1)

- Accountants TodayDocument6 pagesAccountants TodayAkmal RosliNo ratings yet

- Right To SubrogationDocument11 pagesRight To SubrogationNikhil Hans83% (6)

- CWTSP 4.8 03-18-20 at 103 - 2017.05.02Document1 pageCWTSP 4.8 03-18-20 at 103 - 2017.05.02pempekplgNo ratings yet

- Public Revenue SourcesDocument29 pagesPublic Revenue SourcesNayan BhalotiaNo ratings yet

- Activity 1: PPA Checklist: Management Enhancement WorksheetDocument7 pagesActivity 1: PPA Checklist: Management Enhancement Worksheetanon-307431No ratings yet

- 12 USC 95a PDFDocument25 pages12 USC 95a PDFfreetradezoneNo ratings yet

- ATS BlankDocument4 pagesATS Blankdak_s14No ratings yet

- Conventional Redemption Period cannot exceed 10 yearsDocument29 pagesConventional Redemption Period cannot exceed 10 yearsTim TanNo ratings yet

- Chapter1 - Operations and ProductivityDocument34 pagesChapter1 - Operations and ProductivityrafthaNo ratings yet

- Medina Guce Galindes Salanga 2018 Barangay Governance PDFDocument16 pagesMedina Guce Galindes Salanga 2018 Barangay Governance PDFPaulojoy BuenaobraNo ratings yet

- Cocube AptitudeDocument15 pagesCocube AptitudenaveenNo ratings yet

- BASEL I, II, III-uDocument43 pagesBASEL I, II, III-uMomil FatimaNo ratings yet

- 24-Hour Call Center: 16221 For Overseas Callers: +880 2 55668056Document8 pages24-Hour Call Center: 16221 For Overseas Callers: +880 2 55668056Number ButNo ratings yet

- Bond Valuation and YieldDocument45 pagesBond Valuation and YieldAryan PandeyNo ratings yet

- Mingo Spring - A Senior Living CommunityDocument21 pagesMingo Spring - A Senior Living CommunityRyan SloanNo ratings yet

- FAQs about Lijjat's operations, products and marketing strategyDocument44 pagesFAQs about Lijjat's operations, products and marketing strategyAditya MaluNo ratings yet

- Coa - M2013-004 Cash Exam Manual PDFDocument104 pagesCoa - M2013-004 Cash Exam Manual PDFAnie Guiling-Hadji Gaffar88% (8)

- 18th Circuit Court DocumentDocument11 pages18th Circuit Court DocumentwicholacayoNo ratings yet

- Kulachi LARPFinal PDFDocument45 pagesKulachi LARPFinal PDFMuzafer Abbas MastoiNo ratings yet

- Merit Enterprise CorpDocument3 pagesMerit Enterprise Corpibrahim ghonemNo ratings yet

- Intro To CmaDocument21 pagesIntro To CmaRima PrajapatiNo ratings yet

- EECONDocument15 pagesEECONJoshua CruzNo ratings yet

- All ExamsDocument135 pagesAll Examsfaith050883% (6)

- Roman L. Weil's Appreciation of Macaulay's Duration MeasureDocument5 pagesRoman L. Weil's Appreciation of Macaulay's Duration MeasureanotheralternateNo ratings yet

- CASHFLOW The Board Game Personal Financial Statement PDFDocument1 pageCASHFLOW The Board Game Personal Financial Statement PDFCarl SoriaNo ratings yet

- NCP-29 Construction Finance ManagementDocument18 pagesNCP-29 Construction Finance ManagementArvind KumarNo ratings yet

- Private Equity ExplainedDocument27 pagesPrivate Equity Explainedleonnox100% (2)

- Corpo Digest 34-36Document6 pagesCorpo Digest 34-36Sherleen Anne Agtina DamianNo ratings yet

- Port Reform ToolkitDocument20 pagesPort Reform ToolkitblahNo ratings yet

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantFrom EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantRating: 4.5 out of 5 stars4.5/5 (146)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- Profit First for Therapists: A Simple Framework for Financial FreedomFrom EverandProfit First for Therapists: A Simple Framework for Financial FreedomNo ratings yet

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (12)

- Financial Accounting For Dummies: 2nd EditionFrom EverandFinancial Accounting For Dummies: 2nd EditionRating: 5 out of 5 stars5/5 (10)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistFrom EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistRating: 4.5 out of 5 stars4.5/5 (73)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 4.5 out of 5 stars4.5/5 (14)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!From EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Rating: 4.5 out of 5 stars4.5/5 (14)

- Excel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetFrom EverandExcel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetNo ratings yet

- Joy of Agility: How to Solve Problems and Succeed SoonerFrom EverandJoy of Agility: How to Solve Problems and Succeed SoonerRating: 4 out of 5 stars4/5 (1)

- Value: The Four Cornerstones of Corporate FinanceFrom EverandValue: The Four Cornerstones of Corporate FinanceRating: 4.5 out of 5 stars4.5/5 (18)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisFrom EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisRating: 5 out of 5 stars5/5 (6)

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItFrom EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItRating: 5 out of 5 stars5/5 (13)

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 5 out of 5 stars5/5 (1)

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyFrom EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyRating: 5 out of 5 stars5/5 (1)

- Mastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsFrom EverandMastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsNo ratings yet

- Product-Led Growth: How to Build a Product That Sells ItselfFrom EverandProduct-Led Growth: How to Build a Product That Sells ItselfRating: 5 out of 5 stars5/5 (1)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialFrom EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNo ratings yet