Professional Documents

Culture Documents

Quiz 2 - Audit of Receivables Solution

Uploaded by

millescaasiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Quiz 2 - Audit of Receivables Solution

Uploaded by

millescaasiCopyright:

Available Formats

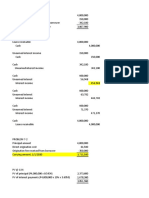

Problem 1

Number of days outstanding Amount Uncollectibility Total

0-30 5,000,000 3% 150,000

31-60 2,000,000 6% 120,000

61-90 1,000,000 15% 150,000

Over 90 200,000 30% 60,000

1. Allowance for doubtful accounts, 12/31/23 480,000

Allowance for doubtful accounts, 1/1/23 520,000

Recovery of accounts written off 750,000

Accounts written off (1,250,000)

Allwaonce for doubtful accounts before adjustments 20,000

Allowance for doubtful accounts before adjustments 20,000

Allowance for doubtful accounts as adjusted (480,000)

2. Depreciation Expense, 2023 (460,000)

0-30 5,000,000

31-60 2,000,000

61-90 1,000,000

Over 90 200,000

Accounts Receivable, 12/31 8,200,000

Allowance for doubtful accounts (480,000)

3. Accounts Receivable, net 7,720,000

Problem 2

Face Value of Note 2,000,000

PVOA @ 10% 2.4869

1. Initial Measurement 4,973,800

Selling Price 4,973,800

Carrying Value (10M-4.5M) (5,500,000)

2. Loss on Sale (526,200)

3. Journal Entry

Note Receivable 6,000,000

Accumulated Depreciation 4,500,000

Loss on Sale 526,200

Discount on Notes Receivable 1,026,200

Equipment 10,000,000

Date Annual Collection Interest Income Collection applied Carrying Value

to Principal

1/1/2022 4,973,800

12/31/2022 2,000,000 497,380 1,502,620 3,471,180

12/31/2023 2,000,000 347,118 1,652,882 1,818,298

12/31/2024 2,000,000 181,702 1,818,298 -

Problem 3

Principal - PV of 1 (500,000 x 0.6209) 310,450

Interest - PVOA (500k x 12% x 3.7908) 227,448

1. Initial Measurement, 1/1/22 537,898

Selling Price 537,898

Cost (1M - 500k) (500,000)

2. Gain on Sale 37,898

Date Interest received Interest income Amortization Carrying Value

1/1/2022 537,898

12/31/2022 60,000 53,790 6,210 531,688

12/31/2023 60,000 53,169 6,831 524,857

12/31/2024 60,000 52,486 7,514 517,342

12/31/2025 60,000 51,734 8,266 509,076

12/31/2026 60,000 50,924 9,076 500,000

Problem 4.

Principal 4,000,000

Interest (4M x 10% x 9/12) 300,000

Maturity value 4,300,000

Discount (4.3M x 12% x 6/12) (258,000)

1. Proceeds from discounting 4,042,000

Carrying value of the note:

Principal 4,000,000

Interest as of 4/1 (4M x 10% x 3/12) 100,000 4,100,000

2. Interest Expense (58,000)

Maturity Value 4,300,000

Protest Fee 15,000

Total 4,315,000

Interest (4.315M x 10% x 3/12) 107,875

3. Amount collected from customer 4,422,875

You might also like

- Sol. Man. - Chapter 6 - Teacher's Manual - Ia Part 1aDocument7 pagesSol. Man. - Chapter 6 - Teacher's Manual - Ia Part 1aYamateNo ratings yet

- Sol. Man. - Chapter 6 - Receivables Addtl Concept - Ia Part 1aDocument7 pagesSol. Man. - Chapter 6 - Receivables Addtl Concept - Ia Part 1aJenny Joy Alcantara0% (1)

- Gov't Grant, Depreciation, Revaluation and ImpairmentDocument6 pagesGov't Grant, Depreciation, Revaluation and Impairment夜晨曦No ratings yet

- Receivables Morning Star Corporation: I Will Manually Check Your Answer For Rounding Off DifferencesDocument3 pagesReceivables Morning Star Corporation: I Will Manually Check Your Answer For Rounding Off DifferencesGlance BautistaNo ratings yet

- Homework SolutionsDocument5 pagesHomework SolutionsAnonymous CuUAaRSNNo ratings yet

- Audit of Long-Term Liabilities - SDocument6 pagesAudit of Long-Term Liabilities - SEva DagusNo ratings yet

- Solution 3Document6 pagesSolution 3Bunbun 221No ratings yet

- Problem 6-1: Interest Expense Present ValueDocument3 pagesProblem 6-1: Interest Expense Present ValueAngieNo ratings yet

- Audit of Liabilities SolManDocument3 pagesAudit of Liabilities SolManReyn Saplad PeralesNo ratings yet

- Problem 6-8 Answer A Savage CompanyDocument6 pagesProblem 6-8 Answer A Savage CompanyJurie BalandacaNo ratings yet

- IA 1 - Chapter 6 Notes Receivable Problems Part 2Document11 pagesIA 1 - Chapter 6 Notes Receivable Problems Part 2John CentinoNo ratings yet

- In Acc April Lyn Limsan BsaDocument6 pagesIn Acc April Lyn Limsan BsaJurie BalandacaNo ratings yet

- Problem 7-1 2019: Date Interest Received Interest Income Amortization Carrying ValueDocument11 pagesProblem 7-1 2019: Date Interest Received Interest Income Amortization Carrying ValueJane Carla GarbidaNo ratings yet

- In Acc Chris Jean Paden BsaDocument6 pagesIn Acc Chris Jean Paden BsaJurie BalandacaNo ratings yet

- Loan ReceivableDocument10 pagesLoan ReceivableClyde SaladagaNo ratings yet

- Loan ReceivablesDocument3 pagesLoan ReceivablesAdam CuencaNo ratings yet

- Acctg 4 Serdan Quiz 3Document7 pagesAcctg 4 Serdan Quiz 3Rica CatanguiNo ratings yet

- Assignment 22 23 26 39Document4 pagesAssignment 22 23 26 39Georgina Francheska RamirezNo ratings yet

- Problem 6-8 Answer A Savage CompanyDocument6 pagesProblem 6-8 Answer A Savage CompanyJurie BalandacaNo ratings yet

- 07 Loan Receivable MCPDocument4 pages07 Loan Receivable MCPkyle mandaresioNo ratings yet

- Exercises Module 3Document12 pagesExercises Module 3jpNo ratings yet

- MASTERY CLASS IN AUDITING PROBLEMS Part 1 Prob 1 9Document35 pagesMASTERY CLASS IN AUDITING PROBLEMS Part 1 Prob 1 9Mark Gelo WinchesterNo ratings yet

- 5 27 LoansDocument9 pages5 27 LoansRengeline LucasNo ratings yet

- AA Chapter2Document6 pagesAA Chapter2Nikki GarciaNo ratings yet

- Loan Receivable ProblemsDocument6 pagesLoan Receivable ProblemsKathleen Frondozo100% (1)

- Intac QuizDocument4 pagesIntac QuizPamela Joy AlvarezNo ratings yet

- Answer Key Final Exam IA 2Document4 pagesAnswer Key Final Exam IA 2Carlos arnaldo lavadoNo ratings yet

- IA 2 Chapter 6 ActivitiesDocument14 pagesIA 2 Chapter 6 ActivitiesShaina TorraineNo ratings yet

- HW On Sinking Fund C Solutions and AnswersDocument5 pagesHW On Sinking Fund C Solutions and AnswersAmjad Rian MangondatoNo ratings yet

- Require 1 Require 2: Date Interest PaymentDocument7 pagesRequire 1 Require 2: Date Interest PaymentKiều OanhNo ratings yet

- Learning Materials - Chapters 4, 5, and 7Document12 pagesLearning Materials - Chapters 4, 5, and 7Kyla Joy T. SanchezNo ratings yet

- Problem 7-5Document2 pagesProblem 7-5Micah April SabularseNo ratings yet

- Audit of Long Term Liabilities 2Document5 pagesAudit of Long Term Liabilities 2Cesar EsguerraNo ratings yet

- SolutionsDocument4 pagesSolutionsRaymond ManalangNo ratings yet

- Cost Residual Value Dapriciable Amount Useful Life Building Machinery EquipmentDocument14 pagesCost Residual Value Dapriciable Amount Useful Life Building Machinery EquipmentcharlottevinsmokeNo ratings yet

- Cost Residual Value Dapriciable Amount Useful Life Building Machinery EquipmentDocument9 pagesCost Residual Value Dapriciable Amount Useful Life Building Machinery EquipmentcharlottevinsmokeNo ratings yet

- Chapter 06 - AdjustmentsDocument26 pagesChapter 06 - AdjustmentsMkhonto Xulu100% (1)

- Acctg 4 Quiz 3 Debt Restructuring Payables 1Document11 pagesAcctg 4 Quiz 3 Debt Restructuring Payables 1Competente, Jhonna W.No ratings yet

- AE 16 Solutions To Chapter 5 2 1Document10 pagesAE 16 Solutions To Chapter 5 2 1Miles CastilloNo ratings yet

- CFASDocument4 pagesCFASAdam CuencaNo ratings yet

- Accounting LesseeDocument7 pagesAccounting Lesseeangelian bagadiongNo ratings yet

- 93 - Final Preaboard AFAR SolutionsDocument11 pages93 - Final Preaboard AFAR SolutionsLeiNo ratings yet

- CPA Review School of The Philippines ManilaDocument4 pagesCPA Review School of The Philippines ManilaSophia PerezNo ratings yet

- Problem 7 - 6 & 7Document2 pagesProblem 7 - 6 & 7Micah April SabularseNo ratings yet

- FAR Problem Quiz 2Document3 pagesFAR Problem Quiz 2Ednalyn CruzNo ratings yet

- CH 8 LiabilitiesDocument10 pagesCH 8 LiabilitiesKrizia Oliva100% (1)

- (Chapter 1) Sol Man Intermediate Accounting 2 by Zeus MillanDocument8 pages(Chapter 1) Sol Man Intermediate Accounting 2 by Zeus MillanJonathan Villazon Rosales67% (3)

- Assignment FARDocument2 pagesAssignment FARCykee Hanna Quizo LumongsodNo ratings yet

- Problem 5-31 (Verna Company)Document7 pagesProblem 5-31 (Verna Company)Jannefah Irish SaglayanNo ratings yet

- Short-Term ExamDocument6 pagesShort-Term Examymkuzangwe16No ratings yet

- Running Head: Financial AccountingDocument9 pagesRunning Head: Financial AccountingKashémNo ratings yet

- Problem 6-4Document1 pageProblem 6-4Gio BurburanNo ratings yet

- Lobrigas Unit3 Topic1 AssessmentDocument9 pagesLobrigas Unit3 Topic1 AssessmentClaudine LobrigasNo ratings yet

- Chapter 20 CompilationDocument41 pagesChapter 20 CompilationMaria Licuanan0% (1)

- Book 1Document2 pagesBook 1Shiela DimaculanganNo ratings yet

- Intermediate Accounting 2 Millan 221013 124345Document233 pagesIntermediate Accounting 2 Millan 221013 124345Krazy Butterfly100% (1)

- Chapter 9 - Discounting of NRDocument3 pagesChapter 9 - Discounting of NRAnne MauricioNo ratings yet

- 06 Notes Receivable Sec 2 MCPDocument3 pages06 Notes Receivable Sec 2 MCPkyle mandaresioNo ratings yet

- Hospicemd Data From Elner PDFDocument2 pagesHospicemd Data From Elner PDFLisette TrujilloNo ratings yet

- Account Statement From 1 Apr 2019 To 16 Aug 2019: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument7 pagesAccount Statement From 1 Apr 2019 To 16 Aug 2019: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceMathews JoseNo ratings yet

- Internal Control Practices: Accounts Payable: Faculty & StaffDocument4 pagesInternal Control Practices: Accounts Payable: Faculty & StaffThe TravellerNo ratings yet

- At Reviewer PT 3Document22 pagesAt Reviewer PT 3lender kent alicanteNo ratings yet

- Guideline Answers: Executive ProgrammeDocument70 pagesGuideline Answers: Executive ProgrammeRiya GoyalNo ratings yet

- Submitted To: Prof. Ram Adhar Chopra: A Detailed Analysis of The ConglomerateDocument19 pagesSubmitted To: Prof. Ram Adhar Chopra: A Detailed Analysis of The ConglomerateAnkit Goel50% (2)

- Internship Report NiB BankDocument10 pagesInternship Report NiB BankAbdul WaheedNo ratings yet

- Job Description of Branch StaffDocument3 pagesJob Description of Branch StaffEleanor JamcoNo ratings yet

- BPP Q 111 P 59 KAPLAN Q 227 P 120 Purchase and Payment System Deficiency and RecommendationsDocument1 pageBPP Q 111 P 59 KAPLAN Q 227 P 120 Purchase and Payment System Deficiency and Recommendationsjazz 3814No ratings yet

- Banking and Insurance (Bbh461) - 1515423225879Document8 pagesBanking and Insurance (Bbh461) - 1515423225879SamarthGoelNo ratings yet

- 05 Activity 1 in TECHNODocument2 pages05 Activity 1 in TECHNOCzed Palmos100% (1)

- ExperianDocument12 pagesExperianmills annNo ratings yet

- Arup Sinha. Topic - ACI Ltd.Document49 pagesArup Sinha. Topic - ACI Ltd.pranta senNo ratings yet

- Advanced Diploma in Islamic FinanceDocument7 pagesAdvanced Diploma in Islamic FinanceJMF2020No ratings yet

- ACTSC 221 - Review For Final ExamDocument2 pagesACTSC 221 - Review For Final ExamDavidKnightNo ratings yet

- Fixed DepositsDocument1 pageFixed DepositsTiso Blackstar GroupNo ratings yet

- Startup Valuation ExplorerDocument22 pagesStartup Valuation Explorershandhin.malviya07No ratings yet

- Resort Membership Registration Form SampleDocument2 pagesResort Membership Registration Form SampleChristian LayeseNo ratings yet

- Mahatma Education Society'S Pillai College of Arts, Commerce & Science (Autonomous) NEW PANVELDocument5 pagesMahatma Education Society'S Pillai College of Arts, Commerce & Science (Autonomous) NEW PANVELraksharekhashetty2003No ratings yet

- ISA 800 Revised Updated 2022Document27 pagesISA 800 Revised Updated 2022peieng0409No ratings yet

- Post Date Value Date Cheq Ue No Particulars DR CR Balance TR LocationDocument3 pagesPost Date Value Date Cheq Ue No Particulars DR CR Balance TR LocationVinay YadavNo ratings yet

- Do Women Make Better ManagersDocument8 pagesDo Women Make Better ManagersShatarupa BhattacharyaNo ratings yet

- Solution. Investment 1: Simple Interest, With Annual Rate RDocument11 pagesSolution. Investment 1: Simple Interest, With Annual Rate RLucky Gemina67% (3)

- Redemption of Preference SharesDocument12 pagesRedemption of Preference Sharesbhawanar3950No ratings yet

- Historycal of The Development Bank of SingaporeDocument3 pagesHistorycal of The Development Bank of SingaporeNur NasuhaNo ratings yet

- Motilal OswalDocument37 pagesMotilal OswalDd SssNo ratings yet

- Government Accounting ExamDocument4 pagesGovernment Accounting ExamAllen GonzagaNo ratings yet

- Ginnie Mae 2007 Bank of America PrimerDocument37 pagesGinnie Mae 2007 Bank of America PrimerJylly Jakes100% (2)

- Payment Instructions FormDocument1 pagePayment Instructions FormalfonsxxxNo ratings yet

- 2022 ICAEW CR Pre Course GuidanceDocument6 pages2022 ICAEW CR Pre Course GuidanceIma AdakaNo ratings yet