Professional Documents

Culture Documents

Book 1

Uploaded by

Shiela DimaculanganOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Book 1

Uploaded by

Shiela DimaculanganCopyright:

Available Formats

RECEIVABLES- ADDITIONAL CONCEPTS

PROBLEM 5

1 ORIGINATION COSTS AND FEES

Principal amount 5,000,000

Direct origination cost 261,986

Origination fee (2Mx6%) -100,000

INITIAL CARRYING AMOUNT OF LOAN RECEIVABLE 5,161,986

FIRST TRIAL (using 9%)

Principal of (5,000,000 x PV of 1 @9%, n=4) +

Interest of (500,000 x PV of ordinary annuity @9%, n=4) = 5,161,986

(5,000,000 x 0.70842521105) + (500,000 x 3.23971987722) = 5,161,986

(3,542,126 + 1,619860) = 5,161,986

The effective interest rate is 9%

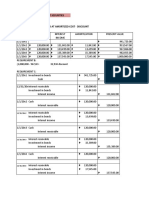

DATE COLLECTIONS INTEREST INCOME AMORTIZATION PRESENT VALUE

1/1/20x1 5,161,986

12/31/20x1 500,000 464,579 35,421 5,126,565

12/31/20x2 500,000 461,391 38,609 5,087,956

12/31/20x3 500,000 457,916 42,084 5,045,872

12/31/20x4 500,000 454,128 45,872 5,000,000

2 DAY-1 DIFFERENCE

INITIAL MEASUREMENT: 2M X PV of 1 @10%, n=4 = 1,366,027

Jan-01 Loan receivable 2,000,000

20x1 Unrealized loss 633,973

Cash 2,000,000

Unearned interest 633,973

3 IMPAIRMENT: 3-BUCKET APPROACH

SOLUTION

July 1, 20x1

Jul-01 Loan receivable 2,000,000

20x1 Cash 2,000,000

Jul-01 Impairment loss 20,000

20x1 Loss allowance 20,000

December 31, 20x1

Dec-31 Impairment loss 71,000

20x1 Loss allowance (91k-20k) 71,000

Dec-31 Interest receivable 100,000

20x1 Interest income (2M x 10% x 6/12) 100,000

December 31, 20x2

Dec-31 Loss allowance (91k-5k) 86,000

20x2 Impairment gain 86,000

Dec-31 Interest receivable 100,000

20x2 Interest income (2M x 10% x 6/12) 100,000

4 CREDIT IMPAIRED FINANCIAL ASSET

SOLUTION:

Present value of estimated future cash flows 2,486,852

Carrying amount before impairment -3,400,000

IMPAIRMENT LOSS -913,148

DATE COLLECTIONS INTEREST INCOME AMORTIZATION PRESENT VALUE

12/31/20x1 2,486,852

12/31/20x2 1,000,000 248,685 751,315 1,735,537

12/31/20x3 1,000,000 173,554 826,446 909,091

12/31/20x4 1,000,000 90,909 909,901 -

5 EVALUATION OF TRANSFERS OF FINANCIAL ASSET

Nov-14 Cash 28,000

20x1 Liability on repurchase agreement 28,000

You might also like

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- Bonds Payable Chapter ConceptsDocument23 pagesBonds Payable Chapter ConceptsAndrei BernardoNo ratings yet

- (Chapter 3) Sol Man Intermediate Accounting 2 by Zeus MillanDocument24 pages(Chapter 3) Sol Man Intermediate Accounting 2 by Zeus MillanJonathan Villazon RosalesNo ratings yet

- Urdaneta City University Accounts Receivable ChapterDocument12 pagesUrdaneta City University Accounts Receivable ChapterKyla Joy T. SanchezNo ratings yet

- Intacc2 Chapter 3 Answer KeysDocument24 pagesIntacc2 Chapter 3 Answer KeysATHALIAH LUNA MERCADEJASNo ratings yet

- IA-2-FINAL-EXAM-ANSWER-KEYDocument17 pagesIA-2-FINAL-EXAM-ANSWER-KEYIrene Grace Edralin AdenaNo ratings yet

- Notes Payable: Problem 1: True or FalseDocument16 pagesNotes Payable: Problem 1: True or FalseKim HanbinNo ratings yet

- (Chapter 2) Sol Man of Intermediate Accounting 2 by Zeus MillanDocument17 pages(Chapter 2) Sol Man of Intermediate Accounting 2 by Zeus MillanJonathan Villazon RosalesNo ratings yet

- Sol. Man. - Chapter 6 - Receivables - Addtl Concepts - Ia Part 1a - 2020 EditionDocument13 pagesSol. Man. - Chapter 6 - Receivables - Addtl Concepts - Ia Part 1a - 2020 EditionJapon, Jenn RossNo ratings yet

- MILLAN CHAPTER 6 Receivables - Additional ConceptsDocument16 pagesMILLAN CHAPTER 6 Receivables - Additional Concepts밀크milkeuNo ratings yet

- Chapter 5 Notes Receivable Ia Part 1aDocument12 pagesChapter 5 Notes Receivable Ia Part 1aannyeongNo ratings yet

- Notes Receivable Chapter 5 SummaryDocument20 pagesNotes Receivable Chapter 5 SummaryJapon, Jenn RossNo ratings yet

- Noncurrent Liabilities (Part 1) : Problem 23-1: True or FalseDocument10 pagesNoncurrent Liabilities (Part 1) : Problem 23-1: True or FalseMarjorie Zara CustodioNo ratings yet

- Notes Receivable: Problem 1: True or FalseDocument21 pagesNotes Receivable: Problem 1: True or FalseAbegail Joy De GuzmanNo ratings yet

- Notes Receivable: Problem 1: True or FalseDocument11 pagesNotes Receivable: Problem 1: True or FalseJamie Rose Aragones50% (2)

- NOTES AND INVENTORIES KEY CONCEPTSDocument10 pagesNOTES AND INVENTORIES KEY CONCEPTSAlizah Lariosa BucotNo ratings yet

- Sol. Man. - Chapter 7 Leases Part 1Document12 pagesSol. Man. - Chapter 7 Leases Part 1Miguel Amihan100% (1)

- Pa4-Chapter-3.Garcia J John Vincent DDocument5 pagesPa4-Chapter-3.Garcia J John Vincent DJohn Vincent GarciaNo ratings yet

- Sol. Man. - Chapter 5 - Notes Receivable - Ia Part 1aDocument11 pagesSol. Man. - Chapter 5 - Notes Receivable - Ia Part 1aKaisser Niel Mari FormentoNo ratings yet

- Intermediate Accounting 2 (Chapter 16 Answers)Document30 pagesIntermediate Accounting 2 (Chapter 16 Answers)Jamaica FloresNo ratings yet

- Chapter 2 Notes PayableDocument11 pagesChapter 2 Notes PayableThalia Rhine AberteNo ratings yet

- Sol. Man. - Chapter 6 - Teacher's Manual - Ia Part 1aDocument7 pagesSol. Man. - Chapter 6 - Teacher's Manual - Ia Part 1aYamateNo ratings yet

- Sol. Man. - Chapter 8 Leases Part 2Document9 pagesSol. Man. - Chapter 8 Leases Part 2Miguel Amihan100% (1)

- Sol. Man. - Chapter 2 Notes PayableDocument12 pagesSol. Man. - Chapter 2 Notes PayableChristine Mae Fernandez Mata100% (1)

- Chapter 3 - Bonds PayableDocument6 pagesChapter 3 - Bonds PayablePatricia EsplagoNo ratings yet

- Sol. Man. - Chapter 2 Notes PayableDocument10 pagesSol. Man. - Chapter 2 Notes PayableEinez B. CarilloNo ratings yet

- Chapter 8 Leases Part 2Document9 pagesChapter 8 Leases Part 2Thalia Rhine AberteNo ratings yet

- Problem 5-3 Requirement 1 2020Document7 pagesProblem 5-3 Requirement 1 2020Adyagila Ecarg NelehNo ratings yet

- Ias 32Document3 pagesIas 32Yến Hoàng HảiNo ratings yet

- Ia2 Final Exam A Test Bank - CompressDocument32 pagesIa2 Final Exam A Test Bank - CompressFiona MiralpesNo ratings yet

- Part 3 - AnswersDocument4 pagesPart 3 - AnswersFenladen AmbayNo ratings yet

- Sol. Man. - Chapter 6 - Receivables Addtl Concept - Ia Part 1aDocument7 pagesSol. Man. - Chapter 6 - Receivables Addtl Concept - Ia Part 1aJenny Joy Alcantara0% (1)

- Chapter 7 Leases Part 1Document10 pagesChapter 7 Leases Part 1Thalia Rhine AberteNo ratings yet

- Problem 6-1: Interest Expense Present ValueDocument3 pagesProblem 6-1: Interest Expense Present ValueAngieNo ratings yet

- Notes Payable Chapter 2Document7 pagesNotes Payable Chapter 2Herrah Joyce SalinasNo ratings yet

- Chapter 20 CompilationDocument41 pagesChapter 20 CompilationMaria Licuanan0% (1)

- Intermediate Accounting 1 Second Grading Examination Key AnswersDocument12 pagesIntermediate Accounting 1 Second Grading Examination Key AnswersAbegail Joy De GuzmanNo ratings yet

- Intermediate Accounting 1A Chapter 10 - Investment in Debt Securities Problem 3Document5 pagesIntermediate Accounting 1A Chapter 10 - Investment in Debt Securities Problem 3Yuki BarracaNo ratings yet

- Sol. Man. - Chapter 10 - Inv. in Debt Securities - Ia Part 1aDocument20 pagesSol. Man. - Chapter 10 - Inv. in Debt Securities - Ia Part 1aChristian James RiveraNo ratings yet

- 4 - Notes Receivable Problems With Solutions: From The TextbookDocument23 pages4 - Notes Receivable Problems With Solutions: From The TextbookKate BNo ratings yet

- Chapter 7 - Teacher's Manual - Ifa Part 1aDocument7 pagesChapter 7 - Teacher's Manual - Ifa Part 1aCharmae Agan CaroroNo ratings yet

- Chapter 3 Bonds PayableDocument6 pagesChapter 3 Bonds PayableShiela DimaculanganNo ratings yet

- MolinaDiannaLynn A220 Chapter 16 Problem 3Document4 pagesMolinaDiannaLynn A220 Chapter 16 Problem 3Dianna Lynn MolinaNo ratings yet

- Due Date Revised Payments PV of 1 @12%, N 0 1 and 2 Present ValueDocument2 pagesDue Date Revised Payments PV of 1 @12%, N 0 1 and 2 Present ValueCamille HornillaNo ratings yet

- PPE - Part - 2. CHAPTER16Document36 pagesPPE - Part - 2. CHAPTER16Ms VampireNo ratings yet

- Investments in Debt Securities ChapterDocument27 pagesInvestments in Debt Securities ChapterAlarich CatayocNo ratings yet

- 9TH Bonds Payable Part IIDocument8 pages9TH Bonds Payable Part IIAnthony DyNo ratings yet

- Quiz 2 - Audit of Receivables SolutionDocument1 pageQuiz 2 - Audit of Receivables SolutionmillescaasiNo ratings yet

- Pledging, Factoring, Discounting SolutionsDocument3 pagesPledging, Factoring, Discounting SolutionsAnonymous CuUAaRSNNo ratings yet

- Intermediate Accounting 2 Chapter 3 BondsDocument4 pagesIntermediate Accounting 2 Chapter 3 BondsMARRIETTE JOY ABADNo ratings yet

- 7 - AroDocument6 pages7 - Arobusiness docNo ratings yet

- Receivables - Additional Concepts Credit Impaired Financial AssetsDocument2 pagesReceivables - Additional Concepts Credit Impaired Financial Assetsfinn mertensNo ratings yet

- Intacc1A M5Assignment KeyDocument9 pagesIntacc1A M5Assignment KeyGabriel AfricaNo ratings yet

- 5 - FAAC Rules PDFDocument4 pages5 - FAAC Rules PDFDzulija TalipanNo ratings yet

- Sol. Man. - Chapter 7 - Notes (Part 1)Document13 pagesSol. Man. - Chapter 7 - Notes (Part 1)natalie clyde matesNo ratings yet

- Group Activities in Receivable FinancingDocument2 pagesGroup Activities in Receivable FinancingTrisha VillegasNo ratings yet

- Accounting PoliciesDocument10 pagesAccounting PoliciesHohohoNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Chapter 37 IntaccDocument23 pagesChapter 37 IntaccShiela DimaculanganNo ratings yet

- Tax P97Document1 pageTax P97Shiela DimaculanganNo ratings yet

- Diluted Earnings Per ShareDocument21 pagesDiluted Earnings Per ShareShiela DimaculanganNo ratings yet

- Chapter 2 Lesson 2Document3 pagesChapter 2 Lesson 2Shiela DimaculanganNo ratings yet

- Chapter 3 Bonds PayableDocument6 pagesChapter 3 Bonds PayableShiela DimaculanganNo ratings yet

- Investment in Debt Securities: Amortization, Discounts, PremiumsDocument5 pagesInvestment in Debt Securities: Amortization, Discounts, PremiumsShiela DimaculanganNo ratings yet

- Ais 2-ADocument2 pagesAis 2-AShiela DimaculanganNo ratings yet

- Audit Qs ExamDocument5 pagesAudit Qs ExamShiela DimaculanganNo ratings yet

- Chap 11Document6 pagesChap 11Shiela DimaculanganNo ratings yet

- Audit Q3A Register Reports InventoryDocument2 pagesAudit Q3A Register Reports InventoryShiela DimaculanganNo ratings yet

- Activity 4 (Finals)Document1 pageActivity 4 (Finals)Shiela DimaculanganNo ratings yet

- Ais 4-BDocument2 pagesAis 4-BShiela DimaculanganNo ratings yet

- Activiy 3 (Finals)Document1 pageActiviy 3 (Finals)Shiela DimaculanganNo ratings yet

- Bsit 1-1 MT Parreno Mjo L.Document2 pagesBsit 1-1 MT Parreno Mjo L.Parreno Michel josue OlverNo ratings yet

- Channels of DistributionDocument11 pagesChannels of DistributionkajalNo ratings yet

- Project Planning GuideDocument57 pagesProject Planning GuideDilip RavaliyaNo ratings yet

- Finance Wizard Challenge: Project Problem StatementDocument3 pagesFinance Wizard Challenge: Project Problem StatementAnay GuptaNo ratings yet

- 2nd NLC ReportDocument6 pages2nd NLC ReportMy gamesNo ratings yet

- Commvault Complete License GuideDocument27 pagesCommvault Complete License GuideemcviltNo ratings yet

- Case Study On Natureview Farm: Group 10 Section B Submitted To: Prof. Vibhava SrivastavaDocument19 pagesCase Study On Natureview Farm: Group 10 Section B Submitted To: Prof. Vibhava SrivastavaSwaraj DharNo ratings yet

- Birla Sunlife Mutual FundDocument76 pagesBirla Sunlife Mutual FundShahzadNo ratings yet

- Ecc427 BlessinginusaDocument2 pagesEcc427 Blessinginusainusa blessingNo ratings yet

- TRAVCRM India's Best Travel Management Software by DeBox GlobalDocument7 pagesTRAVCRM India's Best Travel Management Software by DeBox GlobalKm DeepaNo ratings yet

- Unit 6-1Document14 pagesUnit 6-1Abel ZegeyeNo ratings yet

- Situation:: BDE Percentage EarningDocument2 pagesSituation:: BDE Percentage Earninganon_508740366No ratings yet

- The Woody Case StudyDocument5 pagesThe Woody Case StudyniaaNo ratings yet

- Bab03 Memanage Dalam Lingkungan GlobalDocument38 pagesBab03 Memanage Dalam Lingkungan GlobalPerbasi SidoarjoNo ratings yet

- Bank ReconciliationDocument9 pagesBank ReconciliationhoxhiiNo ratings yet

- DabbawalaDocument25 pagesDabbawalaAks Anurag100% (2)

- VikasNagPrasanna CV PDFDocument1 pageVikasNagPrasanna CV PDFRahul NagrajNo ratings yet

- Tally ERP 9 Tutorial With ExamplesDocument3 pagesTally ERP 9 Tutorial With ExamplesAnurag KumarNo ratings yet

- The Fms Consulting Casebook 2021 22Document140 pagesThe Fms Consulting Casebook 2021 22Mr XpertNo ratings yet

- Sustainability at Wipro Case AnalysisDocument31 pagesSustainability at Wipro Case AnalysisSaurabh AudichyaNo ratings yet

- Charles R. Wood Theater Capital Campaign PlanDocument25 pagesCharles R. Wood Theater Capital Campaign PlanErin CoonNo ratings yet

- Futures Options and Swaps PPT MBA FINANCEDocument11 pagesFutures Options and Swaps PPT MBA FINANCEBabasab Patil (Karrisatte)No ratings yet

- Business Blueprint MMDocument89 pagesBusiness Blueprint MMKishore Kumar100% (3)

- Internal Control - Self Assessment ChecklistDocument7 pagesInternal Control - Self Assessment Checklist吳思穎No ratings yet

- Business and Financial Analysis of Emirates Over Three Year PeriodDocument15 pagesBusiness and Financial Analysis of Emirates Over Three Year PeriodwendryNo ratings yet

- ECON254 Lecture3 Costs-SupplyDocument37 pagesECON254 Lecture3 Costs-SupplyKhalid JassimNo ratings yet

- Reading 48-Portfolio Management An OverviewDocument24 pagesReading 48-Portfolio Management An OverviewAllen AravindanNo ratings yet

- SeMS Sample PagesDocument14 pagesSeMS Sample PagesXAVIER BUSTILLOS0% (1)

- SLATemplateDocument19 pagesSLATemplateTri Puji Lestari NNo ratings yet

- Project ControllingDocument39 pagesProject ControllingSamuel Richard0% (1)

- Module 8 - Standard CostingDocument49 pagesModule 8 - Standard Costingkaizen4apexNo ratings yet