Professional Documents

Culture Documents

Ais 2-A

Uploaded by

Shiela DimaculanganOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ais 2-A

Uploaded by

Shiela DimaculanganCopyright:

Available Formats

AUDIT QUESTION 2-A

1. What is the amount of check number 3839 shown on the general journal report?

o 311.86

2. What are the total of the debit and credit columns of the general journal report

(before the adjusting and closing entries)?

o 32,172.03

3. What is the balance in the Rent Expense account (before closing)?

o 17,400

4. What is the balance (before closing) in the Dues & Subscriptions Expense

account you added to the chart of accounts?

o 415.00

5. What are the debit and credit totals shown in the trial balance report (before

adjusting entries)?

o 172,114.69

6. . What are the total of the debit and credit columns of the adjusting entries shown

on the general journal report for adjusting entries?

o 790.86

7. What is the total operating revenue for the month?

o 9,975.00

8. What are the total operating expenses for the year?

o 71, 598.74

9. What are the total operating expenses for the month as a percentage of total

operating revenue?

o 62.51

10. What is the net income for the month?

o 3,739.68

11. . What is the net income for the year as a percentage of total operating revenue?

o 40.28

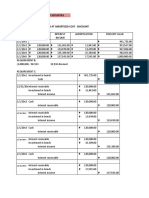

12. What is the owner's equity at the end of the fiscal period?

o 48,042.73

13. What are the total assets?

o 48,948.06

14. What are the total liabilities?

o 905.33

15. From the Expense Distribution pie chart, what are the three highest expenses for

the year?

o Salary Expense

o Rent Expense

o Automobile expense

16. From the bank reconciliation report, what is the amount of the adjusted check

book and bank balances?

o 13, 035.96

You might also like

- How to Read a Financial Report: Wringing Vital Signs Out of the NumbersFrom EverandHow to Read a Financial Report: Wringing Vital Signs Out of the NumbersRating: 5 out of 5 stars5/5 (5)

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionNo ratings yet

- Financial Management MCQsDocument42 pagesFinancial Management MCQssaeedsjaan90% (41)

- Finance For Non FinanceDocument56 pagesFinance For Non Financeamitiiit31100% (3)

- ACCT504 Case Study 1 The Complete Accounting Cycle-13varnadoDocument16 pagesACCT504 Case Study 1 The Complete Accounting Cycle-13varnadoRegina Lee FordNo ratings yet

- Peel Ports Shareholders FiananceCo Directors' Report & Financial Statements (2010)Document41 pagesPeel Ports Shareholders FiananceCo Directors' Report & Financial Statements (2010)ChristianErikssonNo ratings yet

- Financial Accounting QuizDocument4 pagesFinancial Accounting QuizGadafi Abd MalikNo ratings yet

- DLP Fs Analysis Concepts and FormatDocument14 pagesDLP Fs Analysis Concepts and FormatDia Did L. RadNo ratings yet

- Guide to Management Accounting CCC for managers 2020 EditionFrom EverandGuide to Management Accounting CCC for managers 2020 EditionNo ratings yet

- Audit QuestionsDocument2 pagesAudit QuestionsJoseph Bayo Basan0% (1)

- Audit Questions For Final ExaminationDocument5 pagesAudit Questions For Final ExaminationShiela DimaculanganNo ratings yet

- Ais 4-BDocument2 pagesAis 4-BShiela DimaculanganNo ratings yet

- Tutorial 2Document5 pagesTutorial 2Jian Zhi Teh0% (1)

- Foundation Nov 2019Document138 pagesFoundation Nov 2019Ntinu joshuaNo ratings yet

- ExampleDocument4 pagesExampleMuhammad HaroonNo ratings yet

- Audit Question 5-B: AnswersDocument2 pagesAudit Question 5-B: Answerskristelle0marisseNo ratings yet

- FND - Pilot Question & AnswerDocument118 pagesFND - Pilot Question & AnswerSunday OluwoleNo ratings yet

- Aviation Industry Accounting-Ass 1Document6 pagesAviation Industry Accounting-Ass 1Sukhi MakkarNo ratings yet

- Fi 410 Chapter 3Document50 pagesFi 410 Chapter 3Austin Hazelrig100% (1)

- Acct 504 Week 8 Final Exam All 4 Sets - DevryDocument17 pagesAcct 504 Week 8 Final Exam All 4 Sets - Devrycoursehomework0% (1)

- Bbap18011159 Fin 2013 (WM) Financial ManagementDocument8 pagesBbap18011159 Fin 2013 (WM) Financial ManagementRaynold RaphaelNo ratings yet

- Financial Analyses On The Various Davao City-Based CompaniesDocument24 pagesFinancial Analyses On The Various Davao City-Based CompaniesmasterdrewsNo ratings yet

- FABM2-Analysis and Interpretation of Financial StatementsDocument7 pagesFABM2-Analysis and Interpretation of Financial StatementsGerlen MendozaNo ratings yet

- 4Q2013 DefDocument24 pages4Q2013 DefcoccobillerNo ratings yet

- JB Hi Fi Familiarisation ExerciseDocument2 pagesJB Hi Fi Familiarisation ExerciseRobertNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document5 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report, Results Press Release For March 31, 2016 (Result)Document7 pagesStandalone Financial Results, Form A, Auditors Report, Results Press Release For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Session 16 - FA&ADocument21 pagesSession 16 - FA&AYASH BATRANo ratings yet

- Ratio Analysis (Group 5-Glc - Ib)Document53 pagesRatio Analysis (Group 5-Glc - Ib)Nikam PranitNo ratings yet

- Topic 1 Introduction To Finance What You Need To DoDocument17 pagesTopic 1 Introduction To Finance What You Need To DoLiweiki shopsNo ratings yet

- Accounting For ManagersDocument14 pagesAccounting For ManagersKabo Lucas67% (3)

- Consolidated AFR 31mar2011Document1 pageConsolidated AFR 31mar20115vipulsNo ratings yet

- SamarProv ES2012Document9 pagesSamarProv ES2012J JaNo ratings yet

- Standalone Financial Results, Form B, Auditors Report For March 31, 2016 (Result)Document8 pagesStandalone Financial Results, Form B, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Analysis of Anuual Report of Tata Consultancy Services (TCS) 2019Document17 pagesAnalysis of Anuual Report of Tata Consultancy Services (TCS) 2019AparnaNo ratings yet

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document10 pagesStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Individual Assignment Financial Accounting and Report 1Document7 pagesIndividual Assignment Financial Accounting and Report 1Sahal Cabdi AxmedNo ratings yet

- Summary of Consolidated Financial Results For The Year Ended March 31, 2014 (U.S. GAAP)Document34 pagesSummary of Consolidated Financial Results For The Year Ended March 31, 2014 (U.S. GAAP)pathanfor786No ratings yet

- Investor Presentation (Company Update)Document34 pagesInvestor Presentation (Company Update)Shyam SunderNo ratings yet

- 9.liability Questionnaire QUIZDocument10 pages9.liability Questionnaire QUIZMark GaerlanNo ratings yet

- 01 - Hi 5020 3 - 270918Document8 pages01 - Hi 5020 3 - 270918Indhumathi DNo ratings yet

- Non Trading ConcernsDocument27 pagesNon Trading ConcernsMuhammad Salim Ullah Khan0% (1)

- Tutorial 4Document6 pagesTutorial 4Amirul Noris0% (1)

- 06-B Audit Questions Kristelle Bautista.Document2 pages06-B Audit Questions Kristelle Bautista.kristelle0marisseNo ratings yet

- Test (Far)Document9 pagesTest (Far)Aira Kaye MartosNo ratings yet

- Accounting EquationDocument11 pagesAccounting EquationNacelle SayaNo ratings yet

- Post Test KB Akuntansi UndoneDocument6 pagesPost Test KB Akuntansi UndoneKiras SetyaNo ratings yet

- Financial Statement Analysis: Learning ObjectivesDocument24 pagesFinancial Statement Analysis: Learning Objectiveshesham zakiNo ratings yet

- Birla Institute of Technology and Science, Pilani: X First Semester, 2017-2018 Evaluative Tutorial IDocument2 pagesBirla Institute of Technology and Science, Pilani: X First Semester, 2017-2018 Evaluative Tutorial IArjun Jaideep BhatnagarNo ratings yet

- Practise Chapter 1+3+4 (For Quiz 1)Document16 pagesPractise Chapter 1+3+4 (For Quiz 1)Phạm Hồng Trang Alice -No ratings yet

- Annual Report Weha 2011Document94 pagesAnnual Report Weha 2011Fruizer FredNo ratings yet

- Financial RatioDocument12 pagesFinancial RatiomannavantNo ratings yet

- HCL Annual Report Analysis Final 2015Document16 pagesHCL Annual Report Analysis Final 2015mehakNo ratings yet

- UntitledDocument197 pagesUntitledMillsRINo ratings yet

- Signed LGE FY16 Q1 English Report Separate PDFDocument62 pagesSigned LGE FY16 Q1 English Report Separate PDFvinodNo ratings yet

- Curve CCC!C CC"#$%C& CCC C''C (CC) CCC:) c11111111111111111cc2 cc11111111111111111111111c "$$3c4cc56"7cccccc CCCCCCCCCCDocument7 pagesCurve CCC!C CC"#$%C& CCC C''C (CC) CCC:) c11111111111111111cc2 cc11111111111111111111111c "$$3c4cc56"7cccccc CCCCCCCCCC037boyNo ratings yet

- General Automotive Repair Revenues World Summary: Market Values & Financials by CountryFrom EverandGeneral Automotive Repair Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Guide to Management Accounting CCC (Cash Conversion Cycle) for ManagersFrom EverandGuide to Management Accounting CCC (Cash Conversion Cycle) for ManagersNo ratings yet

- Guide to Management Accounting CCC (Cash Conversion Cycle) for Managers 2020 EditionFrom EverandGuide to Management Accounting CCC (Cash Conversion Cycle) for Managers 2020 EditionNo ratings yet

- Technical & Trade School Revenues World Summary: Market Values & Financials by CountryFrom EverandTechnical & Trade School Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Diluted Earnings Per ShareDocument21 pagesDiluted Earnings Per ShareShiela DimaculanganNo ratings yet

- Tax P97Document1 pageTax P97Shiela DimaculanganNo ratings yet

- Chapter 37 IntaccDocument23 pagesChapter 37 IntaccShiela DimaculanganNo ratings yet

- Chapter 2 Lesson 2Document3 pagesChapter 2 Lesson 2Shiela DimaculanganNo ratings yet

- Book 1Document2 pagesBook 1Shiela DimaculanganNo ratings yet

- Chap 11Document6 pagesChap 11Shiela DimaculanganNo ratings yet

- Chap 10Document5 pagesChap 10Shiela DimaculanganNo ratings yet

- Chapter 3 Bonds PayableDocument6 pagesChapter 3 Bonds PayableShiela DimaculanganNo ratings yet

- Ais 3-ADocument2 pagesAis 3-AShiela DimaculanganNo ratings yet

- Activity 4 (Finals)Document1 pageActivity 4 (Finals)Shiela DimaculanganNo ratings yet

- Activiy 3 (Finals)Document1 pageActiviy 3 (Finals)Shiela DimaculanganNo ratings yet