Professional Documents

Culture Documents

PDF Content

Uploaded by

suresh sivadasanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PDF Content

Uploaded by

suresh sivadasanCopyright:

Available Formats

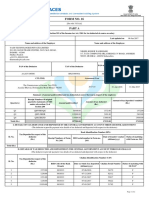

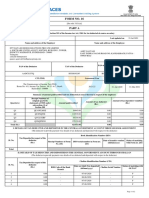

FORM NO.

16

[See rule 31(1)(a)]

PART A

Certificate under Section 203 of the Income-tax Act, 1961 for tax deducted at source on salary

Certificate No. SDQCIDA Last updated on 01-Jun-2020

Name and address of the Employer Name and address of the Employee

TECONNEX INDIA LLP

A Block, PAP-S-1, MIDC, Phase-II, Chakan, Industrial Area,Sawardari,

Khed, Pune - 410501 SURESH SIVADASAN

Maharashtra A-6 RADHIKA RESIDENCY, MUMBAI PUNE ROAD, PHUGEWADI

+(91)20-99999999 PUNE CITY, PUNE - 411012 Maharashtra

test@test.com

Employee Reference No.

PAN of the Employee

PAN of the Deductor TAN of the Deductor provided by the Employer

(If available)

AANFT9752H RTKT05436E AQZPS1846F

CIT (TDS) Assessment Year Period with the Employer

From To

The Commissioner of Income Tax (TDS)

2020-21 01-Apr-2019 31-Mar-2020

C.R. Building, Sector 17 . E, Himalaya Marg Chandigarh - 160017

Summary of amount paid/credited and tax deducted at source thereon in respect of the employee

Receipt Numbers of original

Amount of tax deposited / remitted

quarterly statements of TDS Amount of tax deducted

Quarter(s) Amount paid/credited (Rs.)

under sub-section (3) of (Rs.)

Section 200

Q1 QTQJEIFA 1800000.00 495040.00 495040.00

Q2 QTSAYJSG 1800000.00 495040.00 495040.00

Q3 QTWXWOHE 1800000.00 495041.00 495041.00

Q4 QTYYORHC 2081250.00 621262.00 621262.00

Total (Rs.) 7481250.00 2106383.00 2106383.00

I. DETAILS OF TAX DEDUCTED AND DEPOSITED IN THE CENTRAL GOVERNMENT ACCOUNT THROUGH BOOK ADJUSTMENT

(The deductor to provide payment wise details of tax deducted and deposited with respect to the deductee)

Book Identification Number (BIN)

Tax Deposited in respect of the

Sl. No. deductee Date of transfer voucher Status of matching

Receipt Numbers of Form DDO serial number in Form no.

(Rs.) (dd/mm/yyyy) with Form no. 24G

No. 24G 24G

Total (Rs.)

II. DETAILS OF TAX DEDUCTED AND DEPOSITED IN THE CENTRAL GOVERNMENT ACCOUNT THROUGH CHALLAN

(The deductor to provide payment wise details of tax deducted and deposited with respect to the deductee)

Challan Identification Number (CIN)

Tax Deposited in respect of the

Sl. No. deductee

(Rs.) BSR Code of the Bank Date on which Tax deposited Challan Serial Number Status of matching with

Branch (dd/mm/yyyy) OLTAS*

1 165013.00 0011352 09-05-2019 01573 F

2 165013.00 0004329 06-06-2019 06262 F

3 165014.00 0011349 05-07-2019 13817 F

4 165013.00 0013283 06-08-2019 18982 F

Signature Not Verified

Digitally signed by: SURESH SIVADASAN

Date: 2020.06.18 15.34.39 Page 1 of 2

Reason:

Location:

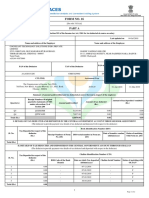

Certificate Number: SDQCIDA TAN of Employer: RTKT05436E PAN of Employee: AQZPS1846F Assessment Year: 2020-21

Challan Identification Number (CIN)

Tax Deposited in respect of the

Sl. No. deductee

(Rs.) BSR Code of the Bank Date on which Tax deposited Challan Serial Number Status of matching with

Branch (dd/mm/yyyy) OLTAS*

5 165014.00 0013283 06-09-2019 15367 F

6 165013.00 0013283 04-10-2019 10145 F

7 165014.00 0014431 06-11-2019 13751 F

8 165013.00 0011352 06-12-2019 16088 F

9 165014.00 0011349 07-01-2020 26454 F

10 165013.00 0013283 07-02-2020 18162 F

11 218780.00 0011349 06-03-2020 18986 F

12 237469.00 0011352 30-04-2020 04469 F

Total (Rs.) 2106383.00

Verification

I, SURESH SIVADASAN, son / daughter of SIVADASAN C PILLAI working in the capacity of DESIGNATED PARTNER (designation) do hereby certify that a sum of

Rs. 2106383.00 [Rs. Twenty One Lakh Six Thousand Three Hundred and Eighty Three Only (in words)] has been deducted and a sum of Rs. 2106383.00 [Rs. Twenty

One Lakh Six Thousand Three Hundred and Eighty Three Only] has been deposited to the credit of the Central Government. I further certify that the information

given above is true, complete and correct and is based on the books of account, documents, TDS statements, TDS deposited and other available records.

Place GURGAON

Date 08-Jun-2020 (Signature of person responsible for deduction of Tax)

Designation: DESIGNATED PARTNER Full Name:SURESH SIVADASAN

Notes:

1. Part B (Annexure) of the certificate in Form No.16 shall be issued by the employer.

2. If an assessee is employed under one employer during the year, Part 'A' of the certificate in Form No.16 issued for the quarter ending on 31st March of the financial year shall contain the details

of tax deducted and deposited for all the quarters of the financial year.

3. If an assessee is employed under more than one employer during the year, each of the employers shall issue Part A of the certificate in Form No.16 pertaining to the period for which such

assessee was employed with each of the employers. Part B (Annexure) of the certificate in Form No. 16 may be issued by each of the employers or the last employer at the option of the assessee.

4. To update PAN details in Income Tax Department database, apply for 'PAN change request' through NSDL or UTITSL.

Legend used in Form 16

* Status of matching with OLTAS

Legend Description Definition

Deductors have not deposited taxes or have furnished incorrect particulars of tax payment. Final credit will be reflected only when payment

U Unmatched

details in bank match with details of deposit in TDS / TCS statement

Provisional tax credit is effected only for TDS / TCS Statements filed by Government deductors."P" status will be changed to Final (F) on

P Provisional

verification of payment details submitted by Pay and Accounts Officer (PAO)

In case of non-government deductors, payment details of TDS / TCS deposited in bank by deductor have matched with the payment details

F Final mentioned in the TDS / TCS statement filed by the deductors. In case of government deductors, details of TDS / TCS booked in Government

account have been verified by Pay & Accounts Officer (PAO)

Payment details of TDS / TCS deposited in bank by deductor have matched with details mentioned in the TDS / TCS statement but the

O Overbooked amount is over claimed in the statement. Final (F) credit will be reflected only when deductor reduces claimed amount in the statement or

makes new payment for excess amount claimed in the statement

Signature Not Verified

Digitally signed by: SURESH SIVADASAN

Date: 2020.06.18 15.34.39 Page 2 of 2

Reason:

Location:

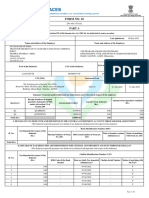

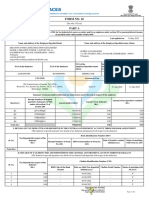

FORM NO. 16

PART B

Certificate under Section 203 of the Income-tax Act, 1961 for tax deducted at source on salary

Certificate No. SDQCIDA Last updated on 01-Jun-2020

Name and address of the Employer Name and address of the Employee

TECONNEX INDIA LLP

A Block, PAP-S-1, MIDC, Phase-II, Chakan, Industrial Area,Sawardari,

Khed, Pune - 410501 SURESH SIVADASAN

Maharashtra A-6 RADHIKA RESIDENCY, MUMBAI PUNE ROAD, PHUGEWADI

+(91)20-99999999 PUNE CITY, PUNE -411012 Maharashtra

test@test.com

PAN of the Deductor TAN of the Deductor PAN of the Employee

AANFT9752H RTKT05436E AQZPS1846F

CIT (TDS) Assessment Year Period with the Employer

From To

The Commissioner of Income Tax (TDS)

2020-21 01-Apr-2019 31-Mar-2020

C.R. Building, Sector 17 . E, Himalaya Marg Chandigarh - 160017

Details of Salary Paid and any other income and tax deducted Rs. Rs.

1. Gross Salary

(a) Salary as per provisions contained in section 17(1) 7481250.00

Value of perquisites under section 17(2) (as per Form No. 12BA,

(b) 0.00

wherever applicable)

Profits in lieu of salary under section 17(3) (as per Form No.

(c) 0.00

12BA, wherever applicable)

(d) Total 7481250.00

(e) Reported total amount of salary received from other employer(s) 0.00

2. Less: Allowances to the extent exempt under section 10

(a) Travel concession or assistance under section 10(5) 40582.00

(b) Death-cum-retirement gratuity under section 10(10) 0.00

(c) Commuted value of pension under section 10(10A) 0.00

Cash equivalent of leave salary encashment under section 10

(d) 0.00

(10AA)

(e) House rent allowance under section 10(13A) 240750.00

Signature Not Verified

Digitally signed by: SURESH SIVADASAN Page 1 of 4

Date: 2020.06.18 15.34.39

Reason:

Location:

Certificate Number: SDQCIDA TAN of Employer: RTKT05436E PAN of Employee: AQZPS1846F Assessment Year: 2020-21

Amount of any other exemption under section 10

[Note: Break-up to be prepared by employer and issued to

(f)

the employee, where applicable , before furnishing of Part B

to the employee]

(g) Total amount of any other exemption under section 10 57004.00

Total amount of exemption claimed under section 10 [2(a)+2(b)

(h) 338336.00

+2(c)+2(d)+2(e)+2(g)]

3. Total amount of salary received from current employer [1(d)-2(h)] 7142914.00

4. Less: Deductions under section 16

(a) Standard deduction under section 16(ia) 50000.00

(b) Entertainment allowance under section 16(ii) 0.00

(c) Tax on employment under section 16(iii) 2500.00

5. Total amount of deductions under section 16 [4(a)+4(b)+4(c)] 52500.00

6. Income chargeable under the head "Salaries" [(3+1(e)-5] 7090414.00

7. Add: Any other income reported by the employee under as per section 192 (2B)

Income (or admissible loss) from house property reported by

(a) -172935.00

employee offered for TDS

(b) Income under the head Other Sources offered for TDS 0.00

Total amount of other income reported by the employee [7(a)+7

8. -172935.00

(b)]

9. Gross total income (6+8) 6917479.00

10. Deductions under Chapter VI-A

Deduction in respect of life insurance premia, contributions to

(a) 150000.00

provident fund etc. under section 80C

Deduction in respect of contribution to certain pension funds

(b) under section 80CCC 0.00

Deduction in respect of contribution by taxpayer to pension

(c) scheme under section 80CCD (1) 0.00

(d) Total deduction under section 80C, 80CCC and 80CCD(1) 150000.00

Deductions in respect of amount paid/deposited to notified

pension scheme under section 80CCD (1B)

(e) 0.00

Signature Not Verified

Digitally signed by: SURESH SIVADASAN Page 2 of 4

Date: 2020.06.18 15.34.39

Reason:

Location:

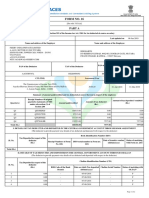

Certificate Number: SDQCIDA TAN of Employer: RTKT05436E PAN of Employee: AQZPS1846F Assessment Year: 2020-21

Deduction in respect of contribution by Employer to pension

(f) scheme under section 80CCD (2) 0.00

Deduction in respect of health insurance premia under section

(g) 5000.00

80D

Deduction in respect of interest on loan taken for higher

(h) education 0.00

under section 80E

Total Deduction in respect of donations to certain funds,

(i) 0.00

charitable institutions, etc. under section 80G

Deduction in respect of interest on deposits in savings account

(j) 0.00

under section 80TTA

Amount deductible under any other provision(s) of Chapter VI-A

[Note: Break-up to be prepared by employer and issued to

(k)

the employee, where applicable , before furnishing of Part B

to the employee]

Total of amount deductible under any other provision(s) of

(l) 0.00

Chapter VI-A

Aggregate of deductible amount under Chapter VI-A [10(d)+10

11. (e)+10(f)+10(g)+10(h)+10(i) 155000.00

10(j)+10(l)]

12. Total taxable income (9-11) 6762479.00

13. Tax on total income 1841244.00

14. Rebate under section 87A, if applicable 0.00

15. Surcharge, wherever applicable 184124.00

16. Health and education cess 81015.00

17. Tax payable (13+15+16-14) 2106383.00

18. Less: Relief under section 89 (attach details) 0.00

19. Net tax payable (17-18) 2106383.00

Verification

I, SURESH SIVADASAN, son/daughter of SIVADASAN C PILLAI .Working in the capacity of DESIGNATED PARTNER

(Designation) do hereby certify that the information given above is true, complete and correct and is based on the books of account,

documents, TDS statements, and other available records.

GURGAON (Signature of person responsible for deduction of

Place

tax)

Full

Date 08-Jun-2020 SURESH SIVADASAN

Name:

Signature Not Verified

Digitally signed by: SURESH SIVADASAN Page 3 of 4

Date: 2020.06.18 15.34.39

Reason:

Location:

Certificate Number: SDQCIDA TAN of Employer: RTKT05436E PAN of Employee: AQZPS1846F Assessment Year: 2020-21

2. (f) Break up for ‘Amount of any other exemption under section 10’ to be filled in the table below

Particular's of Amount for any other

Sl. exemption under section 10 Gross Amount Qualifying Amount Deductible Amount

No.

Rs. Rs. Rs. Rs.

1.

2..

3.

4.

5.

6.

10(k). Break up for ‘Amount deductible under any other provision(s) of Chapter VIA ‘to be filled in the table below

Particular's of Amount deductible under

Sl. any other provision(s) of Chapter VIA Gross Amount Qualifying Amount Deductible Amount

No.

Rs. Rs. Rs. Rs.

1.

2.

3.

4.

5.

6.

GURGAON (Signature of person responsible for deduction of

Place

tax)

Full

Date 08-Jun-2020 SURESH SIVADASAN

Name:

Signature Not Verified

Digitally signed by: SURESH SIVADASAN Page 4 of 4

Date: 2020.06.18 15.34.39

Reason:

Location:

TAN of Employer: PNET13950G PAN of Employee: AQZPS1846F Assessment Year: 2020-21

2.(f) Break up for 'Amount of any other exemption under section 10' to be filled in the table below

Sr.No Any other exemption under section 10 Gross Amount Qualifying Amount Deductible Amount

1 Telephone and Internet Reimbur 23,168 23,168 23,168

2 Books & Periodicals 5,036 5,036 5,036

3 Vehicle Reimbursement 353,882 28,800 28,800

10(k). Break up for 'Amount of any other provision(s) of Chapter VIA' to be filled in the table below

Sr.No Any other provision(s) of Chapter VIA Gross Amount Qualifying Amount Deductible Amount

Place: Khed, Pune Signature of the person responsible for deduction of tax

Date: 08-Jun-2020 Full Name: Suresh Sivadasan

Signature Not Verified

Digitally signed by: SURESH SIVADASAN

Date: 2020.06.18 15.34.39

Reason:

Location:

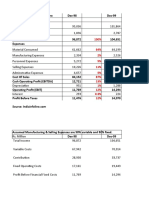

Suresh Sivadasan Annexure to Form No. 16

1. Gross Salary Total(Rs.)

Basic 2,955,000

House Rent Allowance 1,182,000

Vehicle Reimbursement 28,800

Telephone & Internet Reim 24,000

Children Education Allowa 2,400

Leave Travel Allowance 246,250

Food Coupons 13,200

Books & Periodicals 48,000

Special Allowance 2,887,850

Arrears-Basic 37,500

Arrear HRA 15,000

Arrear Leave Travel Allow 3,125

Arrear Special Allowance 38,125

Gross Salary 7,481,250

HRA Exemption Calculation

Period Basic Rent Paid HRA Recd Rent Paid Less 40/50% Salary Least of

Non Metro Metro (A) 10% Salary (B) (C) (A,B,C)

Apr-2019 240,000 45,000 0 96,000 21,000 96,000 21,000

May-2019 240,000 45,000 0 96,000 21,000 96,000 21,000

Jun-2019 240,000 45,000 0 96,000 21,000 96,000 21,000

Jul-2019 240,000 45,000 0 96,000 21,000 96,000 21,000

Aug-2019 240,000 45,000 0 96,000 21,000 96,000 21,000

Sep-2019 240,000 45,000 0 96,000 21,000 96,000 21,000

Oct-2019 240,000 45,000 0 96,000 21,000 96,000 21,000

Nov-2019 240,000 45,000 0 96,000 21,000 96,000 21,000

Dec-2019 240,000 45,000 0 96,000 21,000 96,000 21,000

Jan-2020 277,500 45,000 0 111,000 17,250 111,000 17,250

Feb-2020 277,500 45,000 0 111,000 17,250 111,000 17,250

Mar-2020 277,500 45,000 0 111,000 17,250 111,000 17,250

Totals: 2,992,500 540,000 1,197,000 240,750 1,197,000 240,750

Signature Not Verified

Digitally signed by: SURESH SIVADASAN

Date: 2020.06.18 15.34.39

Reason:

Location:

FORM NO. 12BA

[{See Rule 26A(2)(b)}]

Statement showing particulars of perquisites, other fringe benefits or amenities and profits in lieu of salary with value thereof

1. Name and address of employer : TECONNEX INDIA LLP

A Block, PAP-S-1, MIDC

Phase-II, Chakan

Industrial Area,Sawardari Khed, Pune 410501

2. TAN PNET13950G

3. TDS Assessment Range of employer: TDS CIRCLE NAME TDS CIRCLE ADD 1 TDS CIRCLE ADD 2

4. Name,designation and Suresh Sivadasan - Country Head India

PAN of employee: AQZPS1846F

5. Is the employee a director or a person with substantial interest NO

in the company (where the employer is a company):

6. Income under the head 'Salaries' of the employee: 7,481,250

(other than from perquisites)

7. Financial Year 2019-20

8. Valuation of Perquisites

Amount, if any,

Value of perquisite Amount of perquisite

S.No. Nature of perquisites (see rule 3) recovered from the

as per rules chargeable to tax

employee

(Rs.) (Rs.) (Rs.)

1 Total value of perquisites 0 0 0

2 Total value of profits in lieu of salary as per section 17(3) 0 0 0

9. Details of tax:

(a) Tax deducted from salary of the employee under section 192(1) 2,106,383

(b) Tax paid by employer on behalf of the employee under section 192(1A) 0

(c) Total tax paid 2,106,383

(d) Date of payment into Government treasury as per Form-16

DECLARATION BY EMPLOYER

I, Suresh Sivadasan, son of CP Sivadasan working as Authorised Signatory do hereby declare on behalf of TECONNEX INDIA LLP that the

information given above is based on the books of account, documents and other relevant records or information available with us and the details

of value of each such perquisite are in accordance with section 17 and rules framed thereunder and that such information is true and correct.

Signature of the person responsible for deduction of tax

Place: Khed, Pune Full Name: Suresh Sivadasan

Date: 08-Jun-2020 Designation: Authorised Signatory

Signature Not Verified

Digitally signed by: SURESH SIVADASAN

Date: 2020.06.18 15.34.39

Reason:

Location:

You might also like

- Abfpw1788f 2017-18 PDFDocument2 pagesAbfpw1788f 2017-18 PDFNikhil121314No ratings yet

- FORM 16 TDS CERTIFICATEDocument8 pagesFORM 16 TDS CERTIFICATESaleemNo ratings yet

- Form16 742768 PDFDocument6 pagesForm16 742768 PDFAtulsing thakurNo ratings yet

- Ahxxxxxxxq q4 2022-23Document2 pagesAhxxxxxxxq q4 2022-23AMAN DEEP SINGHNo ratings yet

- Form16 2022 2023Document8 pagesForm16 2022 2023arun poojariNo ratings yet

- Form 16: Wipro LimitedDocument8 pagesForm 16: Wipro LimitedpadduNo ratings yet

- Nandigam Chandrasekhar Anspc5216h Fy202223 SignedDocument6 pagesNandigam Chandrasekhar Anspc5216h Fy202223 SignedChandrasekhar NandigamNo ratings yet

- Form 16 SummaryDocument7 pagesForm 16 SummaryMithlesh SharmaNo ratings yet

- India JUN-2020 ...Document1 pageIndia JUN-2020 ...laxman luckyNo ratings yet

- Form16 Fiserv 2018-19Document8 pagesForm16 Fiserv 2018-19SiddharthNo ratings yet

- PDF 750925681261022Document1 pagePDF 750925681261022ansm businessNo ratings yet

- UnknownDocument1 pageUnknownBSNL BBOVERWIFINo ratings yet

- Form 16 TDS CertificateDocument9 pagesForm 16 TDS CertificateAmit GautamNo ratings yet

- Form 16 20-21Document2 pagesForm 16 20-21Mohammad AliNo ratings yet

- UnknownDocument1 pageUnknownAjit KumarNo ratings yet

- Ashok ITR 2022-23Document1 pageAshok ITR 2022-23SHIFAZ SULAIMANNo ratings yet

- Acct Statement XX2142 01032023Document9 pagesAcct Statement XX2142 01032023Change Your LifeNo ratings yet

- A-Radha@dxc - Com F16Document9 pagesA-Radha@dxc - Com F16Radha PraveenNo ratings yet

- PDF 309648880270623Document1 pagePDF 309648880270623Vinay PatelNo ratings yet

- Indian Income Tax Return Acknowledgement: Acknowledgement Number:924503630310723 Date of Filing: 31-Jul-2023Document1 pageIndian Income Tax Return Acknowledgement: Acknowledgement Number:924503630310723 Date of Filing: 31-Jul-2023bluetrans expressNo ratings yet

- BalajiGollapalli 3429 F16 2022-23Document10 pagesBalajiGollapalli 3429 F16 2022-23p. r ravichandraNo ratings yet

- 2122 ItrDocument1 page2122 ItrAjay PratapNo ratings yet

- PDF 236811830140623Document1 pagePDF 236811830140623Akeybo 340No ratings yet

- Subject: Merit Increase: Emp Code: 901105 Name: Ashish Kumar Singh Designation: Officer Department: ProductionDocument4 pagesSubject: Merit Increase: Emp Code: 901105 Name: Ashish Kumar Singh Designation: Officer Department: ProductionAshish SinghNo ratings yet

- Accenture PaySlip1Document1 pageAccenture PaySlip1Sudheer GoudNo ratings yet

- ACK - KIIPK2548R - 2021-22 - 110330000060423 ItrDocument1 pageACK - KIIPK2548R - 2021-22 - 110330000060423 Itrkhan sa bnNo ratings yet

- Kansupriya@Deloitte - Com f162022 2023Document10 pagesKansupriya@Deloitte - Com f162022 2023Supriya KandukuriNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document3 pagesItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Mohammad AliNo ratings yet

- Wipro FebruaryDocument1 pageWipro FebruaryDeum degOnNo ratings yet

- 110773Document6 pages110773asheesh kumarNo ratings yet

- Payslip 11860967 AugDocument1 pagePayslip 11860967 Augshreya arunNo ratings yet

- Itr 22 23Document1 pageItr 22 23biswa chakrabortyNo ratings yet

- Huhtamaki PPL LTD (Hyderabadplant) : Payslip For The Month of August-2019Document1 pageHuhtamaki PPL LTD (Hyderabadplant) : Payslip For The Month of August-2019Ashok SrinivasNo ratings yet

- Account STMTDocument3 pagesAccount STMTVidya InstituteNo ratings yet

- BSNLDocument1 pageBSNLRaj MasterNo ratings yet

- Payslip 11 2022Document1 pagePayslip 11 2022Md SharidNo ratings yet

- PDF 192659360280722Document1 pagePDF 192659360280722MILTON MOHANTYNo ratings yet

- Form No. 16: Part ADocument6 pagesForm No. 16: Part Asamir royNo ratings yet

- Wipro Form 16 DetailsDocument8 pagesWipro Form 16 DetailssaisindhuNo ratings yet

- Acct Statement XX2801 30042023Document4 pagesAcct Statement XX2801 30042023Rahul ReddyNo ratings yet

- Statement 6590792236 20220613 152347 5Document1 pageStatement 6590792236 20220613 152347 5mohamed arabathNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearAryan KulhariNo ratings yet

- YourForm16 2022Document8 pagesYourForm16 2022shanmuganathan716No ratings yet

- YourForm16 2022Document8 pagesYourForm16 2022BHARATH MPNo ratings yet

- JULY To AUG - 19 - 729289709Document3 pagesJULY To AUG - 19 - 729289709Anirban saikiaNo ratings yet

- Statement of Account: State Bank of IndiaDocument10 pagesStatement of Account: State Bank of IndiaSree ValsanNo ratings yet

- EPF Universal Account Number: LIC ID / Policy IDDocument1 pageEPF Universal Account Number: LIC ID / Policy IDRapole DathatriNo ratings yet

- January 2021 payslip for Ms. Laxmi Subhash UpadhyayDocument1 pageJanuary 2021 payslip for Ms. Laxmi Subhash UpadhyayEkta Upadhyay 48No ratings yet

- India SEP 2016Document1 pageIndia SEP 2016thirumaljrNo ratings yet

- 2019 20 PDFDocument7 pages2019 20 PDFSanjeet SinghNo ratings yet

- Salary Slip April 2022Document1 pageSalary Slip April 2022Rohit raagNo ratings yet

- Appraisal Letter Salary IncrementDocument2 pagesAppraisal Letter Salary Incrementmitendra pratap singhNo ratings yet

- Form 16 TDS CertificateDocument9 pagesForm 16 TDS CertificateDamodar SurisettyNo ratings yet

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2022-23: Assessment YearSagar GargNo ratings yet

- AAJCP8274HDocument1 pageAAJCP8274HSamNo ratings yet

- FORM 16 CERTIFICATEDocument3 pagesFORM 16 CERTIFICATEDebesh KuanrNo ratings yet

- Indian Income Tax Return Acknowledgement Form ITR-1Document1 pageIndian Income Tax Return Acknowledgement Form ITR-1Pixel computerNo ratings yet

- FORM 16 TAX DEDUCTION CERTIFICATEDocument2 pagesFORM 16 TAX DEDUCTION CERTIFICATEpiyushkumar patelNo ratings yet

- TDS Certificate Form 16Document9 pagesTDS Certificate Form 16Aman AgrawalNo ratings yet

- EyspsDocument2 pagesEyspsrasoolvaliskNo ratings yet

- Paytm Wallet TXN HistoryApr2021 9860500111Document3 pagesPaytm Wallet TXN HistoryApr2021 9860500111suresh sivadasanNo ratings yet

- Sulfa Supra CaseDocument1 pageSulfa Supra Casesuresh sivadasanNo ratings yet

- Financial Statement Construction ExerciseDocument3 pagesFinancial Statement Construction Exercisesuresh sivadasanNo ratings yet

- Sulfa Supra CaseDocument1 pageSulfa Supra Casesuresh sivadasanNo ratings yet

- Ceat Statement of P&L 201920Document1 pageCeat Statement of P&L 201920suresh sivadasanNo ratings yet

- Contribution BEP MOS Sensitivity AnalysisDocument4 pagesContribution BEP MOS Sensitivity Analysissuresh sivadasanNo ratings yet

- Accounting Case AnalysisDocument11 pagesAccounting Case Analysissuresh sivadasan0% (1)

- ABC Company Lense CaseDocument2 pagesABC Company Lense Casesuresh sivadasanNo ratings yet

- Sandhya Suresh Vaccine SlotDocument1 pageSandhya Suresh Vaccine Slotsuresh sivadasanNo ratings yet

- FeesCollectionReceipt 49883Document1 pageFeesCollectionReceipt 49883suresh sivadasanNo ratings yet

- Icici Lombard Mh!49966Document3 pagesIcici Lombard Mh!49966suresh sivadasanNo ratings yet

- Aryan Second Inst 3june 2021Document1 pageAryan Second Inst 3june 2021suresh sivadasanNo ratings yet

- Colgate HULDocument18 pagesColgate HULsuresh sivadasanNo ratings yet

- Impact of Events On Financial Statements 2Document2 pagesImpact of Events On Financial Statements 2suresh sivadasanNo ratings yet

- Draft JD CEODocument1 pageDraft JD CEOsuresh sivadasanNo ratings yet

- VSM & Operations Head Kadi: Company Name Company Location Kadi, Gujarat, IndiaDocument3 pagesVSM & Operations Head Kadi: Company Name Company Location Kadi, Gujarat, Indiasuresh sivadasanNo ratings yet

- About The JobDocument2 pagesAbout The Jobsuresh sivadasanNo ratings yet

- Managing DirectorDocument2 pagesManaging Directorsuresh sivadasanNo ratings yet

- Job Description - GM IndiaDocument2 pagesJob Description - GM Indiasuresh sivadasanNo ratings yet

- Enzen - Country Business Leader (15-25 Yrs) : #Consulting SalesDocument3 pagesEnzen - Country Business Leader (15-25 Yrs) : #Consulting Salessuresh sivadasanNo ratings yet

- JD General Manager IndiaDocument3 pagesJD General Manager Indiasuresh sivadasanNo ratings yet

- Kelvion India Private Limited 10-06-2021Document18 pagesKelvion India Private Limited 10-06-2021suresh sivadasanNo ratings yet

- 7350 - First 90 Days - Template.v6Document1 page7350 - First 90 Days - Template.v6Lemuel MaldonadoNo ratings yet

- Case - Putting Integrity Into FinanceDocument5 pagesCase - Putting Integrity Into Financesuresh sivadasanNo ratings yet

- 90-Day Plan On New JobDocument11 pages90-Day Plan On New JobCanberk DayanNo ratings yet

- Management Tax ResponsibilityDocument2 pagesManagement Tax ResponsibilityJohn Heil96% (25)

- Citizens National Bank Pay StubDocument1 pageCitizens National Bank Pay StubsherrieNo ratings yet

- MyGlamm Invoice 1682780534-39Document1 pageMyGlamm Invoice 1682780534-39Prince BaraiyaNo ratings yet

- 3033 - Pvmi - 2023 - 03Document1 page3033 - Pvmi - 2023 - 03Faize muflisahNo ratings yet

- Tax Invoice: Payment Terms: Installation AddressDocument1 pageTax Invoice: Payment Terms: Installation Address18-UPH-046 JEROME DANISH JNo ratings yet

- Correcting Erroneous Information Returns, Form #04.001Document144 pagesCorrecting Erroneous Information Returns, Form #04.001Sovereignty Education and Defense Ministry (SEDM)50% (2)

- BCOM VI Sem GST topicsDocument3 pagesBCOM VI Sem GST topicsVikram KatariaNo ratings yet

- 11zon Merged Files 1Document8 pages11zon Merged Files 1kabrashubham64No ratings yet

- Special NoticeDocument4 pagesSpecial Noticeraghu raghuNo ratings yet

- Downloadfile 30 PDFDocument114 pagesDownloadfile 30 PDFYianniAnd Sophia0% (1)

- Printing of Case Form 0505Document2 pagesPrinting of Case Form 0505Hanabishi RekkaNo ratings yet

- Iris - RuckusDocument1 pageIris - RuckusSwagBeast SKJJNo ratings yet

- Confirmation - Letter - Spectrum Printing Supplies LLCDocument2 pagesConfirmation - Letter - Spectrum Printing Supplies LLCzakariaeNo ratings yet

- 5405-Aj 21Document4 pages5405-Aj 21crazybearNo ratings yet

- Survey of Makati RatesDocument5 pagesSurvey of Makati RatesMarcus DoroteoNo ratings yet

- Tax FormDocument2 pagesTax FormJorge LuissNo ratings yet

- TAXATION - Filing of Returns + Tax Penalties and RemediesDocument7 pagesTAXATION - Filing of Returns + Tax Penalties and RemediesJohn Mahatma Agripa100% (1)

- Payroll CompletedDocument69 pagesPayroll Completedacctg2012No ratings yet

- Gravitas Labour BillDocument1 pageGravitas Labour BillSaurabh PandeyNo ratings yet

- Sample Template eFPS Letter of Intent For Individual TaxpayerDocument1 pageSample Template eFPS Letter of Intent For Individual Taxpayerelizabeth costales81% (16)

- Importance of Taxation KnowledgeDocument3 pagesImportance of Taxation KnowledgeElizabeth Wee Ern Cher33% (3)

- 27A1100001972546Document2 pages27A1100001972546Meet Communication ServicesNo ratings yet

- New Train Income Tax Table Year 2018 To 2022 and 2023 OnwardsDocument8 pagesNew Train Income Tax Table Year 2018 To 2022 and 2023 OnwardsSD AccountingNo ratings yet

- Tax Control Sheet Key ConceptsDocument1 pageTax Control Sheet Key ConceptsArman KhanNo ratings yet

- Tax invoice for HDPE tarpaulin saleDocument1 pageTax invoice for HDPE tarpaulin saleKunj KariaNo ratings yet

- Reliance Retail Limited: Sr. No. Item Name Hsn/Sac Qty Price/Unit Discount ValueDocument3 pagesReliance Retail Limited: Sr. No. Item Name Hsn/Sac Qty Price/Unit Discount ValuemukeshNo ratings yet

- Irs 2285 ManualDocument15 pagesIrs 2285 ManualMichael BarnesNo ratings yet

- Kishore Pay SlipDocument1 pageKishore Pay Slipsuperhit123No ratings yet

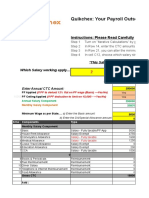

- Quikchex CTC Calculator AprilDocument8 pagesQuikchex CTC Calculator Aprilravipati46No ratings yet

- ITR-4 for Individuals with Income up to Rs. 50 LakhDocument12 pagesITR-4 for Individuals with Income up to Rs. 50 LakhPROBIR MANDALNo ratings yet