Professional Documents

Culture Documents

Tanga Cement Audited Ending December 30 2016

Uploaded by

laxmikant sharmaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tanga Cement Audited Ending December 30 2016

Uploaded by

laxmikant sharmaCopyright:

Available Formats

AUDITED FINANCIAL RESULTS FOR YEAR ENDED 31 DECEMBER 2016

CHAIRMAN’S STATEMENT

Introduction

It is with pleasure that the audited trading results of Tanga Cement Public Limited Company for the year ended The company’s focus to improve operational efficiencies and cost management initiatives, was one of the main drivers

31st December 2016 is presented. of the sixteen percent (16%) growth in Gross Profit to Tanzania Shillings fifty four billion (Tzs54 bn) year-on-year. We

managed to keep operating costs low and will continue to monitor and control costs to identify areas of saving without

We are proud of the significant role Tanga Cement PLC continues to play in Tanzania to ensure sustainable compromising on product quality. The reduced manufacturing cost base positively impacted Operating EBITDA by

economic growth and development through the pillars enshrined in our strategic narrative of “STRENGTH twenty nine percent (29%) to Tanzania Shillings thirty eight billion (Tzs38 bn) over Tanzania Shillings twenty nine

WITHIN”. Our commitment to our stakeholders through its premier Simba Cement brand continues to be clear billion (Tzs29 bn) achieved in 2015.

as we uphold and honour the strength within our people for what we have and will still achieve.

Operating Profit is down zero point three percent (0.3%) to Tanzania Shillings nineteen point eight billion (Tzs19.8 bn)

Macro-Economic Overview compared to Tanzania Shillings nineteen point nine billion (Tzs19.9 bn) in 2015 mostly due to the anticipated One

Our growth in business continues to be anchored on the economic progress of Tanzania. The Tanzanian Shilling hundred ninenty eight percent (198%) increase in depreciation resulting from the extensive capital expansion of the

maintained its stability against the dollar throughout 2016, due to improved performance recorded in the export new integrated production line that was commissioned in early 2016.

values of travel, manufactured goods and gold whilst traditional exports declined. Tanzania also experienced

a year of political stability following the election of President Magafuli. The annual headline inflation rate Profit before tax declined to Tanzania Shillings five point seven billion (Tzs5.7 bn) from Tanzania Shillings eight point

decreased to five point zero percent (5.0%) in 2016 from six point eight percent (6.8%) recorded in 2015, as a seven billion (Tzs8.7 bn) in the prior year as a result of the increased financing cost of the senior debt which financed

result of strict fiscal and monetary policies. the expansion of our production capacity.

In the year under review, Tanzania’s GDP grew by an estimated 6.8% compared to seven percent (7%) in 2015. The Group recorded a net profit after tax of Tanzania Shillings four point three billion (Tzs4.3 bn) which is down from

This was supported by growth in various economic sectors mainly: Mining, Construction, Telecommunications the Tanzania Shillings eight point two billion (8.2 bn) of 2015 impacted by the tax charge for the year. Cash flows

and Agriculture. from normal trading activities improved by eighteen percent (18%) to Tanzania Shillings thirty five point eight billion

(Tzs35.8 bn) in 2016 underlining the positive performance of the Group in a very competitive cement market.

The construction sector is estimated to have expanded by seven point three percent (7.3%) in 2016, at a slower

rate compared to 2015 due to stalled public infrastructure projects rollout and rapid policy changes which The company utilised a significant portion of available free cash to settle capital expansion costs instead of utilising

precipitated uncertainty for businesses. Nonetheless, projected infrastructure development and anticipated the full available loan facilities. This initiative will significantly benefit the company’s financing costs expenditure in

sector growth attracted new entrants into the cement industry keen to earn returns from increased demand, as the long term. Accordingly cash on hand at 31 December 2016 decreased to Tanzania Shillings two point five billion

well as the influx of cheap imported cement by middlemen during 2015 and early 2016. To address the issue of (Tzs2.5 bn) from Tanzania Shillings eighteen point three billion (Tzs18.3 bn) in the prior year.

cheap imports, cement companies in Tanzania through the Tanzania Chapter of East African Cement Producers

Association (EACPA), engaged the Government which imposed an additional ten percent (10%) excise duty up Tanga Cement PLC remains committed to its sales and cost optimisation initiatives as it continually seeks to enhance

to thirty five percent (35%) on imported cement for a year. value for its stakeholders. The company remains positive about 2017 despite the competitive landscape. Government

initiatives to spur economic growth through infrastructure development and promotion of local industries, will boost

We remain optimistic of the ambitious infrastructure development plans under the Government’s Development local cement output and consumption while reducing the influx of cheap cement imports.

Vision 2025 programme and expect the projects to pick up momentum in second quarter of 2017. Tanga

Cement PLC has capacity to meet a large share of the cement demand in the country and remains committed to Dividend

production of superior cement products. Subsequent to year-end, the Board proposed a final dividend for 2016 totalling Tanzania shillings one point five

nine two billion (Tzs1.592 bn) (2015: Tzs1.592 bn) being Tzs25 per share (2015: Tzs25 per share). The total dividend

Financial and Operational Overview proposed for the year amounts to Tanzania shillings five point zero nine four billion (Tzs5.094 bn) (Tzs80 per share)

In the year 2016, our business focus was on profitability driven by operational efficiency and overall business [2015: Tanzania shillings five point zero nine four billion (Tzs5.094 bn) (Tzs80 per share)] which will be recommended

effectiveness in order to remain competitive in challenging market conditions. to shareholders at the upcoming annual general meeting in May 2017.

During the year, the company commissioned the second integrated cement production line with a new kiln Conclusion

at its Tanga plant, eliminating the need to purchase clinker and delivering additional revenue from the sale of Tanga Cement PLC remains grateful to its staff for their passion and dedication to the company and to its customers for

excess clinker. As a result, our clinker production capacity increased to One million two hundred fifty thousand their belief in the Simba Cement brand, as the company works to achieve its short-term and long-term goals.

per annum (1.25 mio tons/yr) in 2016. The company made its first clinker sales in the year under review, following

the commissioning of the second kiln. With Tanzania being the second-largest construction market in East Africa, cement output is anticipated to increase

and Tanga Cement is well positioned to take advantage of the growth opportunities in the market. We look forward to

Market headwinds during the year under review negatively impacted Tanga Cement’s sales revenue by twenty reaching greater heights together in 2017 in co-operation with all our stakeholders.

percent (20%) year-on-year from Tanzania Shillings two hundred and nine billion (TZS 209 bn) in 2015 to Tanzania

Shillings one hundred sixty seven billion (Tzs167 bn) for the year under review due to continued competitive For and on behalf of the Board

market pressure and lower infrastructure project spending from Government. Advocate Lau Masha

Chairman of the Board

Consolidated Statement of Group Group Company Company Consolidated Statement Group Group Company Company

Comprehensive Income Dec 2016 Dec 2015 Dec 2016 Dec 2015 of Cash Flows Dec 2016 Dec 2015 Dec 2016 Dec 2015

for the year ended 31 December 2016 TZS’000 TZS’000 TZS’000 TZS’000 for the six months ended 30 June 2016 TZS’000 TZS’000 TZS’000 TZS’000

Cash (used in)/generated from operating

Revenue 166,975,482 209,116,045 153,775,982 194,349,261 activities

Cost of sales (112,553,046) (162,031,875) (101,865,441) (150,081,111) Operating profit 19,838,619 19,900,373 19,574,749 19,866,008

Gross profit 54,422,436 47,084,170 51,910,541 44,268,150 Depreciation 17,801,172 5,978,005 17,694,713 5,797,879

Impairment charges 293,771 3,549,424 293,771 3,105,726

Other income 2,066,529 236,609 2,062,325 199,266 Gain on disposal of investment (380,174) - (380,174) -

Selling and administration expenses (18,555,403) (17,892,978) (16,409,633) (15,697,803) (Gain)/loss on disposal of assets (1,492,467) 1,076 (1,488,872) 1,076

Depreciation and amortization (17,801,172) (5,978,004) (17,694,713) (5,797,879) Other non cash items (191,198) 1,663,857 (247,860) 1,658,108

Impairment of investments in other entities (293,771) (3,549,424) (293,771) (3,105,726) Cash generated from trading 35,869,723 31,092,735 35,446,327 30,428,797

Operating profit 19,838,619 19,900,373 19,574,749 19,866,008

De/(Increase) in inventories 5,496,581 (2,673,551) 5,251,902 (2,436,304)

Share of loss of an associate - (128,288) - - (In)/Decrease in accounts receivable (7,871,181) 10,174,206 (6,450,464) 14,899,403

Net finance costs (14,185,713) (11,093,317) (13,950,824) (10,991,958) De/(increase) in VAT recoverable 7,524,730 (16,493,801) 7,513,872 (16,983,726)

Net profit before taxation 5,652,906 8,678,768 5,623,925 8,874,050 Decrease in amount due from employees' share

53,440 - 53,440 -

trust

Current income tax 126,503 (6,027,411) 170,253 (5,931,215) (De)/Increase in accounts payable (19,852,447) 7,331,611 (21,166,933) 3,211,358

Deferred tax (charge)/credit (1,517,925) 5,590,326 (1,517,925) 5,590,326 Cash flow from operations 21,220,846 29,431,200 20,648,144 29,119,528

Net profit for the year 4,261,484 8,241,683 4,276,253 8,533,161 Interest income received 83,059 320,327 83,059 320,327

Interest expense paid (17,522,122) (1,441,548) (17,522,122) (1,441,548)

Exchange differences on translation of foreign operations (64,235) 87,004 - - Income tax paid (656,832) (9,232,983) (358,183) (9,070,233)

Total comprehensive income 4,197,249 8,328,687 4,276,253 8,533,161 Net cash flows from operations 3,124,951 19,076,996 2,850,898 18,928,074

Attributable to:

Owners of the parent 4,197,249 8,328,687 4,276,253 8,533,161 Investing activities

Total comprehensive income 4,197,249 8,328,687 4,276,253 8,533,161 Proceeds on disposal 2,003,503 31,916 1,999,320 4,236

Purchase of fixed assets (17,288,687) (127,361,220) (17,284,923) (127,346,515)

Weighted average number of shares in issue 62,967,893 63,124,445 62,967,893 63,124,445

Net cash flows used in investing activities (15,285,184) (127,329,304) (15,285,603) (127,342,279)

(less treasury shares)

Earnings per share (Tzs) 68 131 68 135

Financing activities

Dividends per share (Tzs) 80 80 80 80

Proceeds from borrowings - 116,742,350 - 116,742,350

Ordinary dividend paid (4,992,277) (7,640,525) (4,992,277) (7,640,525)

Consolidated Statement of Group Group Company Company Net cash flows (used in)/from financing

(4,992,277) 109,101,825 (4,992,277) 109,101,825

Financial Position Dec 2016 Dec 2015 Dec 2016 Dec 2015 activities

as at 31 December 2016 TZS’000 TZS’000 TZS’000 TZS’000

Net (De)/Increase in cash and cash equivalents (17,152,510) 849,517 (17,426,982) 687,620

ASSETS

Non-current assets

Property Plant and Equipment 373,366,218 373,177,406 371,599,649 371,307,653 Net foreign exchange differences 1,379,093 6,643,079 1,678,316 6,647,654

Investment in subsidiary - - 1,746,976 1,746,976 Cash and cash equivalents at 1 January 18,292,592 10,799,996 17,250,165 9,914,891

Investment in associate 100 271,712 100 271,712 Cash and cash equivalents at 31 December 2,519,175 18,292,592 1,501,499 17,250,165

Financial asset - Interest rate cap 7,152,393 7,629,752 7,152,393 7,629,752

380,518,711 381,078,870 380,499,118 380,956,093

Current assets

Due from employees' share trust - - 1,506,571 1,853,782

Inventories 32,673,142 38,123,889 32,018,334 37,224,402

Information to Members

Trade and other receivables 15,568,106 7,776,853 15,185,452 8,758,254 The company secretary would like to inform the members that dividends can be directly transferred to their bank

VAT recoverable 9,494,637 17,019,367 9,469,854 16,983,726 accounts.

Current income tax recoverable 2,557,299 1,773,964 2,129,325 1,600,889

Cash and bank balances 9,503,431 24,339,787 8,485,755 23,297,360 Members can contact The Dar es Salaam Stock Exchange on +255 (0)22 2123983 or on +255 (0)22 2128522 for

information on how to have the dividends deposited directly into their bank accounts.

69,796,615 89,033,860 68,795,291 89,718,413

TOTAL ASSETS 450,315,326 470,112,730 449,294,409 470,674,506

EQUITY AND LIABILITIES

Capital and Reserves

Issued share capital 1,273,421 1,273,421 1,273,421 1,273,421

Translation reserve 22,769 87,004 - -

Treasury shares (1,506,571) (1,853,782) - -

Retained earnings 189,884,783 190,122,837 190,095,631 190,318,916 L Masha R Swart Q Ganijee

Equity attributable to owners of the parent 189,674,402 189,629,480 191,369,052 191,592,337 Chairperson Managing Director Company Secretary

Total equity 189,674,402 189,629,480 191,369,052 191,592,337 24 April 2017

Non-current Liabilities

Provision for site restoration 21,364 145,602 21,364 145,602

Deferred tax liability 16,757,451 15,239,526 16,757,451 15,239,526

Term borrowings: Non-current portion 189,212,984 197,362,531 189,212,984 197,362,531

205,991,799 212,747,659 205,991,799 212,747,659 Tanga Cement Public Limited Company

P O Box 5053

Current liabilities

Tanga

Term borrowings: Current portion 13,157,583 7,430,069 13,157,583 7,430,069

Tanzania

Trade and other payables 34,507,286 54,258,327 31,791,719 52,857,246 info@simbacement.co.tz

Bank overdrafts 6,984,256 6,047,195 6,984,256 6,047,195

54,649,125 67,735,591 51,933,558 66,334,510

TOTAL EQUITY AND LIABILITIES 450,315,326 470,112,730 449,294,409 470,674,506

You might also like

- Tanga Cement Annual Summary Report 2017 OnlineDocument20 pagesTanga Cement Annual Summary Report 2017 OnlineedgarmerchanNo ratings yet

- BUSINESS ANAYLSIS AND VALUATION AssignmentDocument18 pagesBUSINESS ANAYLSIS AND VALUATION AssignmentEugene RugoNo ratings yet

- Case Study - Lucky Cement and OthersDocument16 pagesCase Study - Lucky Cement and OthersKabeer QureshiNo ratings yet

- FY20 Media Release - 260620 (F)Document5 pagesFY20 Media Release - 260620 (F)Gan Zhi HanNo ratings yet

- Golden Stocks PortfolioDocument6 pagesGolden Stocks PortfoliocompangelNo ratings yet

- Stylam IDBI Capital 200516Document20 pagesStylam IDBI Capital 200516Vikas AggarwalNo ratings yet

- DG Khan Cement Company LimitedDocument7 pagesDG Khan Cement Company LimitedhsbkhanNo ratings yet

- GHCL Limited - : 1 P - (FaxDocument30 pagesGHCL Limited - : 1 P - (FaxShyam SunderNo ratings yet

- Tci-Express Concall-Transcript January28-2020Document28 pagesTci-Express Concall-Transcript January28-2020Ayush JhunjhunwalaNo ratings yet

- Compact Metal AR17 Annual Report2017Document108 pagesCompact Metal AR17 Annual Report2017Zaheer ZaheerNo ratings yet

- Yulon Nissan Motor (2227 TT) BUY: FY16 Earnings Expected To Pick Up On Cross-Strait IncentivesDocument8 pagesYulon Nissan Motor (2227 TT) BUY: FY16 Earnings Expected To Pick Up On Cross-Strait Incentivesyudy-chenNo ratings yet

- Results Press Release (Company Update)Document3 pagesResults Press Release (Company Update)Shyam SunderNo ratings yet

- Tata Motors IntroDocument11 pagesTata Motors Introprathamesh tawareNo ratings yet

- FGV Draft Pest&5Forces Version1.0Document19 pagesFGV Draft Pest&5Forces Version1.0Zee BNo ratings yet

- PT Astra International TBK 2016 Full Year Financial StatementsDocument7 pagesPT Astra International TBK 2016 Full Year Financial StatementsAchmad Rifaie de JongNo ratings yet

- Industrial Manufacturing SCMDocument9 pagesIndustrial Manufacturing SCMmuthumtsNo ratings yet

- KPMG Budget Commentary 2018Document38 pagesKPMG Budget Commentary 2018Rossana CairaNo ratings yet

- 1pil4 PDFDocument14 pages1pil4 PDFPuja BhallaNo ratings yet

- Unaudited Financial Results Half-Year Ended September 30, 2017Document14 pagesUnaudited Financial Results Half-Year Ended September 30, 2017Puja BhallaNo ratings yet

- Thien Long Group (HSX:TLG) : Pure Fundamentals Play With Attractive ValuationDocument25 pagesThien Long Group (HSX:TLG) : Pure Fundamentals Play With Attractive ValuationVy vêNo ratings yet

- Third Quarter Report MAR 31 2012Document20 pagesThird Quarter Report MAR 31 2012Asad Imran MunawwarNo ratings yet

- Food and BeverageDocument11 pagesFood and BeverageDestinNo ratings yet

- Top Textile CompaniesDocument7 pagesTop Textile CompaniesHafizUmarArshadNo ratings yet

- Jan - MarDocument23 pagesJan - Marsanayaseen yaseenNo ratings yet

- Good Sintext Report by DREDocument4 pagesGood Sintext Report by DREMLastTryNo ratings yet

- Results Press Release (Company Update)Document3 pagesResults Press Release (Company Update)Shyam SunderNo ratings yet

- Introduction:-: Cement Industry Economic OverviewDocument9 pagesIntroduction:-: Cement Industry Economic Overviewnitinahir20105726No ratings yet

- Investor Update (Company Update)Document16 pagesInvestor Update (Company Update)Shyam SunderNo ratings yet

- Consolidated Financial Results For The Year Ended March 31, 2008Document44 pagesConsolidated Financial Results For The Year Ended March 31, 2008Anurag AgarwalNo ratings yet

- Mahindra & Mahindra LTD.: Key Result Highlights - Q4FY17Document6 pagesMahindra & Mahindra LTD.: Key Result Highlights - Q4FY17anjugaduNo ratings yet

- Transcript Regarding Investors' Conference Call (Company Update)Document25 pagesTranscript Regarding Investors' Conference Call (Company Update)Shyam SunderNo ratings yet

- IPS-Industry, Trade & Business Statistics - MillsDocument5 pagesIPS-Industry, Trade & Business Statistics - MillsAndrei ItemNo ratings yet

- Signature International Berhad - Recovery To Take Place in FY17 - 151230Document3 pagesSignature International Berhad - Recovery To Take Place in FY17 - 151230Anonymous aYBBxvw0dNo ratings yet

- Dalal Broacha-Titan Company Ltd. Initiating Coverage-201901Document14 pagesDalal Broacha-Titan Company Ltd. Initiating Coverage-201901rchawdhry123No ratings yet

- HeidelbergDocument11 pagesHeidelbergTaqsim E RabbaniNo ratings yet

- Monitoring Policies To Support Industrialisation in TanzaniaDocument19 pagesMonitoring Policies To Support Industrialisation in TanzaniaAsaph DanielNo ratings yet

- Astra 2010-10-28 - 9M10 Results ReleaseDocument4 pagesAstra 2010-10-28 - 9M10 Results ReleaseJim Andy HermawanNo ratings yet

- Tata Motors'domestic Biz Reports Best Net Sales: On A HighDocument1 pageTata Motors'domestic Biz Reports Best Net Sales: On A HighLalith KumarNo ratings yet

- Q1 FY 21 (Consolidated) Key Highlights:: For Immediate ReleaseDocument4 pagesQ1 FY 21 (Consolidated) Key Highlights:: For Immediate Releasesrinivas murthyNo ratings yet

- Market Outlook Market Outlook: I-Direct Top PicksDocument9 pagesMarket Outlook Market Outlook: I-Direct Top PicksJleodennis RajNo ratings yet

- Tencent IrDocument14 pagesTencent IrAbie KatzNo ratings yet

- Goldis AR 2010Document139 pagesGoldis AR 2010AshNo ratings yet

- Continuing On Its Strong Growth Trajectory, The Electronics Industry Posted A Growth of 7.8pcDocument12 pagesContinuing On Its Strong Growth Trajectory, The Electronics Industry Posted A Growth of 7.8pcFaria AlamNo ratings yet

- TATA Technologies Note LegalDocument12 pagesTATA Technologies Note LegalRaghav HNo ratings yet

- I-Direct Top Picks: Market Outlook: Key Triggers Ahead Market Outlook: Key Triggers AheadDocument14 pagesI-Direct Top Picks: Market Outlook: Key Triggers Ahead Market Outlook: Key Triggers AheadkumarrajdeepbsrNo ratings yet

- MOC - 637036322182074251 - Annual Report 2018-19 EnglishDocument258 pagesMOC - 637036322182074251 - Annual Report 2018-19 Englishrolee.srivastava100% (1)

- Significant Post Balance Sheet EventsDocument1 pageSignificant Post Balance Sheet EventsSiddhant SinghNo ratings yet

- q4 Ceo Remarks - FinalDocument11 pagesq4 Ceo Remarks - Finalakshay kumarNo ratings yet

- HMT Limited 2010Document91 pagesHMT Limited 2010Sandeep PatilNo ratings yet

- Financial Management: Assignment IiDocument8 pagesFinancial Management: Assignment Iisridhar mohantyNo ratings yet

- Press Release Q2fy1415Document6 pagesPress Release Q2fy1415MLastTryNo ratings yet

- Market Outlook Market Outlook: I-Direct Top PicksDocument9 pagesMarket Outlook Market Outlook: I-Direct Top PicksAnonymous W7lVR9qs25No ratings yet

- Vodafone Idea Limited - Annual Report - 2017-18 PDFDocument228 pagesVodafone Idea Limited - Annual Report - 2017-18 PDFAniruddh KanodiaNo ratings yet

- GT Capital Full Year 2018 Media Release Final VersionDocument3 pagesGT Capital Full Year 2018 Media Release Final VersionJan SanielNo ratings yet

- Pendragon PLC - FY21 HY ResultsDocument46 pagesPendragon PLC - FY21 HY ResultsMessina04No ratings yet

- Cement Industry and ACC Ambuja and Ultratech AnalysisDocument27 pagesCement Industry and ACC Ambuja and Ultratech AnalysisPiyush Sharma100% (1)

- Tech Mahindra (TECMAH) : LacklustreDocument11 pagesTech Mahindra (TECMAH) : Lacklustrejitendrasutar1975No ratings yet

- Thilawa SEZDocument36 pagesThilawa SEZorlendo wpNo ratings yet

- CAREC Integrated Trade Agenda 2030 and Rolling Strategic Action Plan 2018–2020From EverandCAREC Integrated Trade Agenda 2030 and Rolling Strategic Action Plan 2018–2020No ratings yet

- En-1581066679-Gazetted - THEMINING (INTERGRITY PLEDGE) REGULATIONS 2018, GN NO. 304 OF 2018Document10 pagesEn-1581066679-Gazetted - THEMINING (INTERGRITY PLEDGE) REGULATIONS 2018, GN NO. 304 OF 2018laxmikant sharmaNo ratings yet

- en-1603769565-GN NO.937 OF 2020 - THE MINING (MINERAL RIGHTS) (AMENDMENT) REGULATIONS 2020Document13 pagesen-1603769565-GN NO.937 OF 2020 - THE MINING (MINERAL RIGHTS) (AMENDMENT) REGULATIONS 2020laxmikant sharmaNo ratings yet

- EAC Customs 2011 EditedDocument9 pagesEAC Customs 2011 Editedlaxmikant sharmaNo ratings yet

- Chapter 148-The Value Added Tax Act PDFDocument88 pagesChapter 148-The Value Added Tax Act PDFEsther MaugoNo ratings yet

- The Value Added Tax (Act No SWDocument35 pagesThe Value Added Tax (Act No SWlaxmikant sharmaNo ratings yet

- Chapter 290-The Local Government Finance Act PDFDocument62 pagesChapter 290-The Local Government Finance Act PDFEsther MaugoNo ratings yet

- Sw1592900234-Appropriation Bill, 2020 Final No - 7Document21 pagesSw1592900234-Appropriation Bill, 2020 Final No - 7laxmikant sharmaNo ratings yet

- Value Added Tax 2Document38 pagesValue Added Tax 2wihengeNo ratings yet

- Cement SAP Implementation & IT Solutions Provider in India - JKT ConsultingDocument4 pagesCement SAP Implementation & IT Solutions Provider in India - JKT Consultinglaxmikant sharmaNo ratings yet

- Cement SAP Implementation & IT Solutions Provider in India - JKT ConsultingDocument4 pagesCement SAP Implementation & IT Solutions Provider in India - JKT Consultinglaxmikant sharmaNo ratings yet

- sw1571208922-REPORT ON BASIC PRICE LIST AUGUST 2019 - 1 - First Draft August2019Document78 pagessw1571208922-REPORT ON BASIC PRICE LIST AUGUST 2019 - 1 - First Draft August2019Jankey NdagileNo ratings yet

- Architect Strengths and Weaknesses - 16personalitiesDocument4 pagesArchitect Strengths and Weaknesses - 16personalitiesIsaacNo ratings yet

- LGC CasesDocument97 pagesLGC CasesJeshe BalsomoNo ratings yet

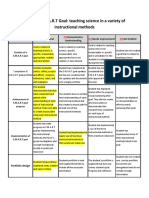

- Smart Goals Rubric 2Document2 pagesSmart Goals Rubric 2api-338549230100% (2)

- Model of Triple Friction PendulumDocument382 pagesModel of Triple Friction Pendulumlaherrerac100% (2)

- Digests OnlyDocument337 pagesDigests OnlyMaria Zola Estela GeyrozagaNo ratings yet

- Q No. Questions CO No.: C C W That Results in GDocument2 pagesQ No. Questions CO No.: C C W That Results in GSamarth SamaNo ratings yet

- Step by Step Dilr Preparation GuideDocument22 pagesStep by Step Dilr Preparation GuideVishakha TNo ratings yet

- Caustic - Soda - 17.02.2020 PDFDocument53 pagesCaustic - Soda - 17.02.2020 PDFsanjay sharmaNo ratings yet

- 1.1.4.A PulleyDrivesSprockets FinishedDocument4 pages1.1.4.A PulleyDrivesSprockets FinishedJacob DenkerNo ratings yet

- AIFI Association of Indian Forgin IndustryDocument7 pagesAIFI Association of Indian Forgin IndustryDnyanesh ThorathNo ratings yet

- Suite Popular Brasileira: 5. Shorinho Heitor Villa-LobosDocument4 pagesSuite Popular Brasileira: 5. Shorinho Heitor Villa-Loboshuong trinhNo ratings yet

- EE 4702 Take-Home Pre-Final Questions: SolutionDocument11 pagesEE 4702 Take-Home Pre-Final Questions: SolutionmoienNo ratings yet

- 6063 Grade Aluminum ProfileDocument3 pages6063 Grade Aluminum ProfileVJ QatarNo ratings yet

- SWP-10 Loading & Unloading Using Lorry & Mobile Crane DaimanDocument2 pagesSWP-10 Loading & Unloading Using Lorry & Mobile Crane DaimanHassan AbdullahNo ratings yet

- KUTAI MCCB Circuit Breaker Transfer Switch With Remote Monitoring OptionsDocument11 pagesKUTAI MCCB Circuit Breaker Transfer Switch With Remote Monitoring OptionsJanice LuNo ratings yet

- Aegps Manual Fluxpower Hpi Installation enDocument44 pagesAegps Manual Fluxpower Hpi Installation enAbdus SalamNo ratings yet

- Cenomar Request PSA Form-NewDocument1 pageCenomar Request PSA Form-NewUpuang KahoyNo ratings yet

- Laser Pointing StabilityDocument5 pagesLaser Pointing Stabilitymehdi810No ratings yet

- LabVIEW - Connect To MySQLDocument6 pagesLabVIEW - Connect To MySQLDavidleonardo GalindoNo ratings yet

- Science and Technology in Nation BuildingDocument40 pagesScience and Technology in Nation BuildingDorothy RomagosNo ratings yet

- RRB Alp Tech. CBT 2 Master Question Paper Electrician Trade Date 22 1 2019 Shift 1Document58 pagesRRB Alp Tech. CBT 2 Master Question Paper Electrician Trade Date 22 1 2019 Shift 1arpitrockNo ratings yet

- Modelling and Simulation of Armature ControlledDocument7 pagesModelling and Simulation of Armature ControlledPrathap VuyyuruNo ratings yet

- SEBI Circular On Online Processing of Investor Service Requests and Complaints by RTAs - June 8, 2023Document5 pagesSEBI Circular On Online Processing of Investor Service Requests and Complaints by RTAs - June 8, 2023Diya PandeNo ratings yet

- قدرة تحمل التربةDocument3 pagesقدرة تحمل التربةjaleelNo ratings yet

- Conceptual Framework For Financial Reporting: Student - Feedback@sti - EduDocument4 pagesConceptual Framework For Financial Reporting: Student - Feedback@sti - Eduwaeyo girlNo ratings yet

- GMD 15 3161 2022Document22 pagesGMD 15 3161 2022Matija LozicNo ratings yet

- January 2017Document80 pagesJanuary 2017Alexandre AGNo ratings yet

- Hazard ManagementDocument18 pagesHazard Managementsthiyagu0% (1)

- Persons Digests For 090613Document10 pagesPersons Digests For 090613pyriadNo ratings yet

- Case Laws IBBIDocument21 pagesCase Laws IBBIAbhinjoy PalNo ratings yet