Professional Documents

Culture Documents

Equity Averages Trade Between February Highs and March Lows

Uploaded by

ValuEngine.comOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Equity Averages Trade Between February Highs and March Lows

Uploaded by

ValuEngine.comCopyright:

Available Formats

Richard Suttmeier is the Chief Market Strategist at www.ValuEngine.com.

ValuEngine is a fundamentally-based quant research firm in Newtown, PA. ValuEngine

covers over 7,000 stocks every day.

A variety of newsletters and portfolios containing Suttmeier's detailed research, stock picks,

and commentary can be found HERE

To unsubscribe from this free email newsletter list, please click HERE.

March 25, 2011 – Equity Averages trade between February highs and March lows

It was Friday, February 18th when The Dow Industrial Average reached 12,391.29 with the

NASDAQ as high as 2840.51. It was Wednesday, March 16th when the Dow tested 11,555.48 with

the NASDAQ at 2603.50. The rebound since then has the Dow just 1.8% below its February high

with the NASDAQ 3.7% lower. At the high we had a ValuEngine Valuation Warning. At the lows

stocks were still fundamentally overvalued, and remain overvalued today. At the highs weekly

momentum for the Dow was at 9.5. Today weekly momentum has declined to 7.6, with a trend

below 8.0 a negative. February 18th was the Friday before the unrest in Egypt came to a head.

We reached the lows following Japan’s earthquake, tsunami and nuclear disaster. Since the

March lows these uncertainties continue with Libya and many other global problems all

bubbling under the stock market. Meanwhile at home the US housing market depression has

deepened, community banks remain extremely stressed and regional banks face new

assessments from the FDIC beginning in April.

Stocks Remain Overvalued Fundamentally – We are not operating under a ValuEngine Valuation

Warning, but 58.7% of all stocks are overvalued. In addition 15 of 16 sectors are overvalued with 5 by

double-digit percentages.

10-Year Note – (3.406) Weekly, annual, and semiannual value levels are 3.496 and 3.796 with daily,

and monthly risky levels at, 3.289 and 3.002.

Courtesy of Thomson / Reuters

Comex Gold – ($1428.8) Comex Gold traded as high as $1.448.6 the Troy ounce on Thursday, which

is a new all time high. Daily and annual value levels are $1413.3 and $1356.5 with weekly, monthly

and quarterly pivots at $1440.7, $1437.7 and $1441.7, and semiannual risky level at $1452.6.

Courtesy of Thomson / Reuters

Nymex Crude Oil – ($105.28) Nymex crude oil remained below its March 7th high at $106.96 per

barrel. Monthly and semiannual value levels are $96.43, and $87.52 with annual and pivots at $99.91,

$101.92 and $103.39, and semiannual and quarterly risky levels at $107.14 and $110.87.

Courtesy of Thomson / Reuters

The Euro – (1.4166) Weekly and quarterly value levels are 1.4028 and 1.3227 with daily, semiannual

and monthly risky levels at 1.4210, 1.4624 and 1.4637.

Courtesy of Thomson / Reuters

Daily Dow: (12,171) Daily, annual, quarterly, semiannual, and semiannual value levels are 11,914,

11,491, 11,395, 10,959, and 9,449 with weekly, monthly and annual risky levels at 12,271, 12,741 and

13,890.

Courtesy of Thomson / Reuters

Key Levels for the Major Equity Averages

• The Dow Industrial Average (12,171) Daily and annual value levels are 11,914 and 11,491

with weekly and monthly risky levels at 12,271 and 12,741. The Dow is 1.8% below its

February 18th high at 12,391.29.

• The S&P 500 (1309.7) Daily, quarterly and annual value levels are 1281.5, 1262.5 and 1210.7

with weekly and monthly risky levels at 1330.7 and 1381.3. SPX is 2.6% below its February

high at 1,344.07.

• The NASDAQ (2736) My daily value level is 2657 with weekly, quarterly and monthly risky

levels at 2792, 2853 and 2926. Semiannual and annual value levels are 2363, 2335 and 2172.

The NASDAQ is 3.7% below its February high at 2840.51.

• The NASDAQ 100 (NDX) (2312) My daily value level is 2226 with weekly, quarterly, and

monthly risky levels at 2360, 2438 and 2499. Semiannual value levels are 2006.8 and 1927.6.

NDX is 3.8% below its February high at 2,403.52.

• Dow Transports (5166) Daily and quarterly value levels are 5111 and 4671 with weekly and

annual pivots at 5164 and 5179. Transports are 2.7% below its February high at 5306.65.

• The Russell 2000 (817.10) Daily, annual and quarterly value levels are 806.39, 784.16 and

765.50 with weekly and monthly risky levels at 842.72 and 850.79. Semiannual value levels are

631.62 and 567.74. The Russell 2000 is 2.5% below its February high at 838.00.

• The Philadelphia Semiconductor Index (SOX) (437.41) My daily value level is 422.35 with

monthly, weekly, and quarterly risky levels at 453.89, 462.98 and 465.93. Semiannual and

annual value levels are 296.89, 270.98 and 259.30. The SOX is 7.8% below its February high

at 474.33.

That’s today’s Four in Four. Have a great day.

Richard Suttmeier

Chief Market Strategist

ValuEngine.com

(800) 381-5576

To unsubscribe from this free email newsletter list, please click HERE.

Send your comments and questions to Rsuttmeier@Gmail.com. For more information on our products

and services visit www.ValuEngine.com

As Chief Market Strategist at ValuEngine Inc, my research is published regularly on the website www.ValuEngine.com.

I have daily, weekly, monthly, and quarterly newsletters available that track a variety of equity and other data parameters as

well as my most up-to-date analysis of world markets. My newest products include a weekly ETF newsletter as well as the

ValuTrader Model Portfolio newsletter. You can go to http://www.valuengine.com/nl/mainnl to review sample issues

and find out more about my research.

“I Hold No Positions in the Stocks I Cover.”

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Chapter1-Carter Cleaning Centers PDFDocument4 pagesChapter1-Carter Cleaning Centers PDFNehal NabilNo ratings yet

- Client / Brand Analysis: 1.1. About GraingerDocument11 pagesClient / Brand Analysis: 1.1. About GraingerMiguel Angel RuizNo ratings yet

- Manpower, Consultant and HR Companies of UAEDocument5 pagesManpower, Consultant and HR Companies of UAENaeem Uddin95% (20)

- Chapter 14Document5 pagesChapter 14RahimahBawaiNo ratings yet

- Chapter 5 - Asset ValuationDocument4 pagesChapter 5 - Asset ValuationSteffany RoqueNo ratings yet

- John Deere Case Study 12 27 11Document3 pagesJohn Deere Case Study 12 27 11Rdx ProNo ratings yet

- 2Document14 pages2romeoremo13No ratings yet

- Nature and Source of Local Taxing Power: Grant of Local Taxing Power Under Existing LawDocument6 pagesNature and Source of Local Taxing Power: Grant of Local Taxing Power Under Existing LawFranco David BaratetaNo ratings yet

- Content/Elements of Business Plan: Mary Mildred P. de Jesus SHS TeacherDocument28 pagesContent/Elements of Business Plan: Mary Mildred P. de Jesus SHS TeacherMary De JesusNo ratings yet

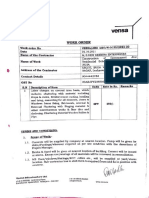

- Vensa WorkorderDocument9 pagesVensa WorkorderAshutosh Kumar DwivediNo ratings yet

- ABC Practice Problems Answer KeyDocument10 pagesABC Practice Problems Answer KeyKemberly AribanNo ratings yet

- A Study On Market Anomalies in Indian Stock Market IDocument10 pagesA Study On Market Anomalies in Indian Stock Market ISrinu BonuNo ratings yet

- Procurement Manual of WapdaDocument170 pagesProcurement Manual of WapdaWaqar Ali Rana69% (13)

- BAHRE 311 - Week 1 2 - ULO BDocument6 pagesBAHRE 311 - Week 1 2 - ULO BMarlyn TugapNo ratings yet

- Punjab Spatial Planning StrategyDocument12 pagesPunjab Spatial Planning Strategybaloch47No ratings yet

- John Menard KeynesDocument3 pagesJohn Menard KeynesSanthoshTelu100% (1)

- Backflush Accounting FM May06 p43-44Document2 pagesBackflush Accounting FM May06 p43-44khengmaiNo ratings yet

- Labour Economics: Albrecht GlitzDocument44 pagesLabour Economics: Albrecht GlitzmarNo ratings yet

- Checkpoint Exam 2 (Study Sessions 10-15)Document11 pagesCheckpoint Exam 2 (Study Sessions 10-15)Bảo TrâmNo ratings yet

- 1 Women's Entrepreneurship and Economic Empowerment (Sample Proposal)Document3 pages1 Women's Entrepreneurship and Economic Empowerment (Sample Proposal)ernextohoNo ratings yet

- Compensation 5Document10 pagesCompensation 5Pillos Jr., ElimarNo ratings yet

- BusFin PT 5Document5 pagesBusFin PT 5Nadjmeah AbdillahNo ratings yet

- Dea Aul - QuizDocument5 pagesDea Aul - QuizDea Aulia AmanahNo ratings yet

- Costing TheoryDocument26 pagesCosting TheoryShweta MadhuNo ratings yet

- Resume - Niyam ShresthaDocument3 pagesResume - Niyam ShresthaNiyam ShresthaNo ratings yet

- Find Solutions For Your Homework: Books Study Writing Flashcards Math Solver InternshipsDocument8 pagesFind Solutions For Your Homework: Books Study Writing Flashcards Math Solver InternshipsAbd ur Rehman BodlaNo ratings yet

- Project Report On Performance Apprasial of HDFC Bank Shipli Uttam Inst.Document92 pagesProject Report On Performance Apprasial of HDFC Bank Shipli Uttam Inst.Ayush Tiwari0% (2)

- Engg Eco Unit 2 D&SDocument129 pagesEngg Eco Unit 2 D&SSindhu PNo ratings yet

- MBA 509 Case Analysis ReportDocument10 pagesMBA 509 Case Analysis Reportcinthiya aliNo ratings yet

- Efqm Excellence Model: December 2013Document15 pagesEfqm Excellence Model: December 2013thelearner16No ratings yet