Professional Documents

Culture Documents

International Tax - Practice Sr. No. Topics A. An Overview of International Taxation

Uploaded by

NIKHIL KASAT0 ratings0% found this document useful (0 votes)

6 views4 pagescitax

Original Title

42389citax32097cc

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentcitax

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views4 pagesInternational Tax - Practice Sr. No. Topics A. An Overview of International Taxation

Uploaded by

NIKHIL KASATcitax

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 4

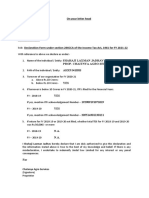

COURSE CURRICULUM TO BE COVERED IN THE PROFESSIONAL TRAINING

(INTT PT) TO BE IMPARTED IN 120 HOURS THROUGH PHYSICAL TRAINING/

84 HOURS THROUGH ONLINE MODE

International Tax - Practice

Sr. No. Topics

A. AN OVERVIEW OF INTERNATIONAL TAXATION

What is International Taxation?

International Tax Conflicts and Double Taxation

Double Tax Treaties

Domestic Tax Systems

International Offshore Financial Centres

Anti – avoidance Measures

B. PRINCIPLES OF INTERNATIONAL TAX LAW

International Tax Law

Application of Tax Treaties

Interpretation of Tax Treaties

Legal Systems and Treaty Interpretations

Model Tax Conventions

Bilateral Tax Treaties

Multilateral Tax Agreements

European Union

Harmful Tax Competition

C. MODEL TAX CONVENTIONS ON DOUBLE TAX AVOIDANCE

Comparison of the model conventions: OECD Model convention of

Income and Capital (OECD MC), UN Model Convention (UN MC),

U.S. Model Convention (US MC)

Articles in the Model Conventions keeping in view the UN

convention

o Article 1 – Persons Covered

o Article 2 – Taxes Covered

o Article 3 – General Definitions

o Article 4 - Resident

o Article 5 - Permanent Establishment

o Article 6 - Income from Immovable Property

o Article 7 - Business Profits

o Article 8 - Shipping, inland waterways transport and air

transport

o Article 9 – Associated Enterprises

o Article 10 - Dividend

o Article 11- Interest

o Article 12 - Royalties and Fees for Technical Services

o Article 13 - Capital Gains

o Article 14 - Independent Personal Services

o Article 15 - Dependent Personal Services

Sr. No. Topics

o Article 16 - Director’s Fees

o Article 17 - Artistes and Sportsmen

o Article 18 - Pensions

o Article 19 - Government service

o Article 20 - Students

o Article 21 - Other Income

o Article 22 – Capital

o Article 23 - Methods of Elimination of Double Taxation:

A - Exemption Method

B - Credit Method

o Article 24 - Non – Discrimination

o Article 25 - Mutual Agreement Procedure

o Article 26 - Exchange of Information

o Article 27 - Assistance in the collection of Taxes

o Article 28 - Members of Diplomatic missions and consular

posts

o Article 29 - Territorial Extensions

o Article 30 - Entry into force

o Article 31 – Termination

D. IMPACT OF DOMESTIC TAX SYSTEMS

Tax Residence of Fiscal Domicile

Source of Income or Gain

Basis of Tax Computation

Treatment of Tax Losses

Foreign Tax Relief

Advance Tax Rulings

Tax deduction at source/ Withholding taxes

E. BASIC INTERNATIONAL TAX STRUCTURES

International Tax Structures

Tax structuring for Cross-border Transactions

International Tax structuring for Expatriate Individuals

Avoidance of Economic Double Taxation of Dividends

Tax Consolidation Rules (“Group Taxation”)

F. ANTI-AVOIDANCE MEASURES

Judicial Anti-avoidance Doctrines

Anti-treaty Shopping Measures

Controlled Foreign Corporation

Some Other Anti-avoidance Measures

Sr. No. Topics

G. OTHER ISSUES IN INTERNATIONAL TAXATION

Electronic Commerce

Treatment of Exchange Gains and Losses

Trusts

Base Erosion and profit Shifting (BEPS)

Multilateral Instruments

Diverted profit tax

Partnerships

Financial Instruments

Recent judicial developments in India

Triangular Cases

International Tax - Transfer pricing

Sr. No. Topic

A. AN OVERVIEW/ INTRODUCTION OF TRANSFER PRICING

What is Transfer Pricing?

Historical background

International Transactions

Associated Enterprises Relationship

Arms length Principle –Article 9 of OECD/UN TP Model

Methods of Transfer pricing

Documentation

Audit Report

B. FUNCTIONAL ANALYSIS

Functional Analysis

Asset Analysis

Risk Analysis

An Overview of Economic Analysis

C. SELECTION OF TRANSFER PRICNG METHODS

Selection of Most appropriate method

Comparability adjustments

Transfer pricing controversies

D. COMPARABILITY ANALYSIS

Selection or rejection of comparables

Timing issues in comparability

Arm’s Length range

Multiple year data

Case study for use of available data base

A comparison of Indian TP Rules with OECD TP Guidelines 2017

and UN TP regulations

Sr. No. Topic

E. DOCUMENTATION AND DRAFTING

Discussion with examples and case studies relating to

documentation

Drafting of Audit Report

Drafting of Transfer Pricing Study Report

BEPS requirements Action Plan-13

Penalty Provisions

F. MISCELLANEOUS

Thin capitalization

Advance Pricing Arrangements (APA)

Mutual Agreement Procedures

Special consideration for

Intangible property

Evaluation of the contractual terms (Substance over

form)

Location specific advantages

Intra-group services

Cost contribution arrangements

Financial transactions (interest and financial

guarantees)

Value chains and use of profit spilt in BEPS scenario

Business restructuring

Dispute resolution

Safe Harbour

Secondary Adjustments (Section 92CE)

BEPS Action Plan-8-10- Assure that transfer pricing outcomes are

in line with value creation

G. SPECIFIED DOMESTIC TRANSACTIONS' (DOMESTIC TP)

H. TRANSFER PRICING ASSESSMENTS AND LITIGATIONS

You might also like

- Cheat Sheet TaxDocument6 pagesCheat Sheet TaxShravan NiranjanNo ratings yet

- Legal Data for Banking: Business Optimisation and Regulatory ComplianceFrom EverandLegal Data for Banking: Business Optimisation and Regulatory ComplianceNo ratings yet

- Tax AvoidanceDocument55 pagesTax AvoidanceAli AlreianNo ratings yet

- Tax Challenges Digitalisation Part 1 Comments On Request For Input 2017Document180 pagesTax Challenges Digitalisation Part 1 Comments On Request For Input 2017Rajeev ShuklaNo ratings yet

- ADIT Principles of International Taxation Module BrochureDocument4 pagesADIT Principles of International Taxation Module BrochureLady Campos BallartaNo ratings yet

- Transfer PricingDocument29 pagesTransfer PricinghezronNo ratings yet

- 01 - Introduction To International Taxation PDFDocument30 pages01 - Introduction To International Taxation PDFvaibhav4yadav-4100% (1)

- Syllabus UCC Business Law and Taxation IntegrationDocument9 pagesSyllabus UCC Business Law and Taxation IntegrationArki Torni100% (1)

- China Aircraft Lease IndustryDocument26 pagesChina Aircraft Lease IndustryblueraincapitalNo ratings yet

- ADIT Transfer Pricing Module BrochureDocument48 pagesADIT Transfer Pricing Module BrochureJohn RockefellerNo ratings yet

- Persetujuan Penghindaran Pajak Berganda-P3B (Double Tax Treaties)Document54 pagesPersetujuan Penghindaran Pajak Berganda-P3B (Double Tax Treaties)ferry irawanNo ratings yet

- Taxation Law ReviewerDocument18 pagesTaxation Law ReviewerFrancis Puno100% (2)

- Transfer Pricing PPT 190714 FinalDocument268 pagesTransfer Pricing PPT 190714 Finalvijaywin6299No ratings yet

- Impact Analysis of Tax Policy and The Performance of Small and MediumDocument25 pagesImpact Analysis of Tax Policy and The Performance of Small and Mediumkara albueraNo ratings yet

- FI S P00 07000134 JPN Execute The Withholding Tax ReportDocument13 pagesFI S P00 07000134 JPN Execute The Withholding Tax ReportnguyencaohuyNo ratings yet

- CIR Vs Goodyear PhilippinesDocument2 pagesCIR Vs Goodyear Philippinesmaikadjim100% (1)

- New CITG Exams Scheme & SyllabusDocument35 pagesNew CITG Exams Scheme & SyllabussamuelNo ratings yet

- Diploma in International Taxation - Course ContentDocument4 pagesDiploma in International Taxation - Course ContentSuppy PNo ratings yet

- Introduction To International TaxationDocument13 pagesIntroduction To International TaxationChantia Riva SiallaganNo ratings yet

- International TaxationDocument4 pagesInternational TaxationAnonymous H1TW3YY51KNo ratings yet

- Beps Webcast 8 Launch 2015 Final Reports 151005150005 Lva1 App6891Document78 pagesBeps Webcast 8 Launch 2015 Final Reports 151005150005 Lva1 App6891Tural AbbasovNo ratings yet

- Syllabus - Tax Law Rev.-Corporate Income Taxation - Mvavaug3-2019Document8 pagesSyllabus - Tax Law Rev.-Corporate Income Taxation - Mvavaug3-2019doraemoanNo ratings yet

- Loyens Loeff Webinar - Oecd TP Standards - Where To Start - Session 1 - The Arms Length PrincipleDocument18 pagesLoyens Loeff Webinar - Oecd TP Standards - Where To Start - Session 1 - The Arms Length PrincipleIoanna ZlatevaNo ratings yet

- 04 Ey Examining The Impact of Beps On The Life Sciences SectorDocument24 pages04 Ey Examining The Impact of Beps On The Life Sciences Sectorwenjin GuNo ratings yet

- Introduction To International TaxationDocument30 pagesIntroduction To International TaxationJessnah GraceNo ratings yet

- GX Deloitte Global Mining Tax Trends 2017Document40 pagesGX Deloitte Global Mining Tax Trends 2017Pran RNo ratings yet

- Overview of International Taxation & DTAA: Apt & Co LLPDocument49 pagesOverview of International Taxation & DTAA: Apt & Co LLPanon_127497276No ratings yet

- 1986 Biac Comments DAFFE-CFA-WP1 (86) 8EDocument40 pages1986 Biac Comments DAFFE-CFA-WP1 (86) 8EHoracio VianaNo ratings yet

- Income Tax NotesDocument221 pagesIncome Tax NotesManoj GuptaNo ratings yet

- Revenue Code Fy 2017 2021Document123 pagesRevenue Code Fy 2017 2021MPDC SANTA MAGDALENANo ratings yet

- Advanced Tax Seminar Syllabus 05192014Document5 pagesAdvanced Tax Seminar Syllabus 05192014Jerome MoradaNo ratings yet

- Aec 004 Week 14 ModuleDocument44 pagesAec 004 Week 14 ModuleJohn Andrei ValenzuelaNo ratings yet

- C4 - Advanced Taxation - SyllabusDocument6 pagesC4 - Advanced Taxation - SyllabusEmmaNo ratings yet

- PDF To WordDocument27 pagesPDF To WordTripathi OjNo ratings yet

- Transfer Pricing Handout With Text - Lesson 2Document32 pagesTransfer Pricing Handout With Text - Lesson 2Rasel AshrafulNo ratings yet

- Double Tax Treaties (Compatibility Mode)Document16 pagesDouble Tax Treaties (Compatibility Mode)Satria DutaNo ratings yet

- ATP 108 Commercial Transactions Course Outline 2023 - 2024Document5 pagesATP 108 Commercial Transactions Course Outline 2023 - 2024Topz TrendzNo ratings yet

- ADIT Syllabus 2016Document68 pagesADIT Syllabus 2016Ali ZafaarNo ratings yet

- First Preboard PRTCDocument1 pageFirst Preboard PRTCDianeL.ChuaNo ratings yet

- 1 1-PetruzziDocument39 pages1 1-PetruzziClaude M.No ratings yet

- Tolley Exam Training: Practice Examination Adit Paper 1 Principles of International TaxationDocument11 pagesTolley Exam Training: Practice Examination Adit Paper 1 Principles of International TaxationMohamed HusseinNo ratings yet

- Losses Vis-A-Vis Transfer PricingDocument10 pagesLosses Vis-A-Vis Transfer PricingChirag ShahNo ratings yet

- Meaning of Royalties and Fees For Technical ServicesDocument13 pagesMeaning of Royalties and Fees For Technical ServicesTripathi OjNo ratings yet

- Bermuda Second Round Review (2017)Document146 pagesBermuda Second Round Review (2017)OECD: Organisation for Economic Co-operation and DevelopmentNo ratings yet

- Bermuda Second Round Review (2017)Document146 pagesBermuda Second Round Review (2017)Jeremy MaddisonNo ratings yet

- Note 1Document33 pagesNote 1sohamdivekar9867No ratings yet

- TJN-A Academy - Sol PicciottoDocument33 pagesTJN-A Academy - Sol PicciottoKwesi_WNo ratings yet

- Legal and Systematic Issues in The Interim Economic Partnership Agreements: Which Way Now?Document40 pagesLegal and Systematic Issues in The Interim Economic Partnership Agreements: Which Way Now?antea.290No ratings yet

- PEB Foundation Certificate Trade Mark Law FC5 (P7)Document13 pagesPEB Foundation Certificate Trade Mark Law FC5 (P7)Pradeep KumarNo ratings yet

- Transfer PricingDocument39 pagesTransfer PricingAum Swastik PandaNo ratings yet

- Doing Business in Vietnam 16000319 PDFDocument153 pagesDoing Business in Vietnam 16000319 PDFNguyễn Ngọc Phương LinhNo ratings yet

- Wipo Pub 121 2010 01Document32 pagesWipo Pub 121 2010 01saidiNo ratings yet

- Note 6Document55 pagesNote 6sohamdivekar9867No ratings yet

- Domestic and International Tax Treatment of Royalties and Fees For Technical ServicesrDocument23 pagesDomestic and International Tax Treatment of Royalties and Fees For Technical ServicesrTripathi OjNo ratings yet

- Course Information Pibt v3Document3 pagesCourse Information Pibt v379569zdqtwNo ratings yet

- Fund Formation - The Beginning of The Fund LifecycleDocument87 pagesFund Formation - The Beginning of The Fund LifecycleKumar MangalamNo ratings yet

- Domestic and International Tax Treatment of Royalties and Fees For Technical ServicesrDocument23 pagesDomestic and International Tax Treatment of Royalties and Fees For Technical ServicesrTripathi OjNo ratings yet

- LLM Dissertation - Taxation On Hybrid SecuritiesDocument52 pagesLLM Dissertation - Taxation On Hybrid Securitiesz_xar1884No ratings yet

- Sesi 2 - Bpk. Darussalam - International Taxation DDTC-1Document35 pagesSesi 2 - Bpk. Darussalam - International Taxation DDTC-1ridy venny teffendyNo ratings yet

- Syllabus. Income Tax. Mvavjanuary 15, 2018Document6 pagesSyllabus. Income Tax. Mvavjanuary 15, 2018Christine Ang CaminadeNo ratings yet

- 2019 Tax SyllabusDocument11 pages2019 Tax SyllabusLowie SantiaguelNo ratings yet

- Note 1 Overview MCCDocument5 pagesNote 1 Overview MCCNikhil SinghNo ratings yet

- International TaxDocument26 pagesInternational TaxabdirahmamsaladNo ratings yet

- Covid19 Transfer Pricing CrisisDocument185 pagesCovid19 Transfer Pricing Crisisamandeep kansalNo ratings yet

- A Tale of Two Technologies Transfer Pricing of Intangibles in The Digital EconomyDocument7 pagesA Tale of Two Technologies Transfer Pricing of Intangibles in The Digital Economyandri heryantoNo ratings yet

- An Introduction To Incoterms - Shipping SolutionsDocument24 pagesAn Introduction To Incoterms - Shipping SolutionsVincent LawNo ratings yet

- 2019 09 02 Pres Int'l Tax Law For MNEs - 1920 - Class 1Document26 pages2019 09 02 Pres Int'l Tax Law For MNEs - 1920 - Class 1DanielaNo ratings yet

- Paper 11 PDFDocument6 pagesPaper 11 PDFKaysline Oscar CollinesNo ratings yet

- GST@FAQ Builders 09.10.2017Document10 pagesGST@FAQ Builders 09.10.2017NIKHIL KASATNo ratings yet

- Declarartion Us 194QDocument1 pageDeclarartion Us 194QNIKHIL KASATNo ratings yet

- 1000Document4 pages1000NIKHIL KASATNo ratings yet

- Documents For Identity Verification Sr. No. Particulars Optional/Mandatory ChecklistDocument3 pagesDocuments For Identity Verification Sr. No. Particulars Optional/Mandatory ChecklistNIKHIL KASATNo ratings yet

- GST State Code ListDocument1 pageGST State Code ListNIKHIL KASATNo ratings yet

- Auditor's Certificate FormatDocument2 pagesAuditor's Certificate FormatArunai GarmentsNo ratings yet

- R028 Hanuman Sahay MeenaDocument3 pagesR028 Hanuman Sahay MeenaNIKHIL KASATNo ratings yet

- Summer 2012 ResultsDocument2,655 pagesSummer 2012 ResultsNIKHIL KASATNo ratings yet

- Yd AssDocument8 pagesYd AssNIKHIL KASATNo ratings yet

- R042 MayureshDocument2 pagesR042 MayureshNIKHIL KASATNo ratings yet

- R025 Ankit GomkaleDocument2 pagesR025 Ankit GomkaleNIKHIL KASATNo ratings yet

- Foods To Try by Talking StreetDocument3 pagesFoods To Try by Talking StreetNIKHIL KASATNo ratings yet

- Thesis FormatDocument4 pagesThesis FormatNIKHIL KASATNo ratings yet

- R021 AniketDocument3 pagesR021 AniketNIKHIL KASATNo ratings yet

- Name of The Public Trust - Balance Sheet As On 31St March, 2004Document2 pagesName of The Public Trust - Balance Sheet As On 31St March, 2004NIKHIL KASATNo ratings yet

- Burning The LettersDocument2 pagesBurning The LettersNIKHIL KASATNo ratings yet

- Grade Card: Visvesvaraya National Institute of Technology NagpurDocument363 pagesGrade Card: Visvesvaraya National Institute of Technology NagpurNIKHIL KASATNo ratings yet

- SURVEYOR PPT FOR REGISTRATIONDocument32 pagesSURVEYOR PPT FOR REGISTRATIONNIKHIL KASAT100% (1)

- Poultry Hatchery & Cattle Feed IndustryDocument2 pagesPoultry Hatchery & Cattle Feed IndustryNIKHIL KASATNo ratings yet

- 8085 Assembly Language ProgramsDocument9 pages8085 Assembly Language ProgramsNIKHIL KASATNo ratings yet

- Audit Information SampleDocument13 pagesAudit Information SampleNIKHIL KASATNo ratings yet

- Companies ListDocument10 pagesCompanies ListNIKHIL KASATNo ratings yet

- Adventure SportsDocument1 pageAdventure SportsNIKHIL KASATNo ratings yet

- Effective Awk Programming:, TITLE.24009 Page 1 Tuesday, October 9, 2001 1:55 AMDocument3 pagesEffective Awk Programming:, TITLE.24009 Page 1 Tuesday, October 9, 2001 1:55 AMNIKHIL KASATNo ratings yet

- CLCSS Subsidy Checklist: Sr. No. Document Name StatusDocument1 pageCLCSS Subsidy Checklist: Sr. No. Document Name StatusNIKHIL KASATNo ratings yet

- Best Executive MBA Programs 2013Document2 pagesBest Executive MBA Programs 2013NIKHIL KASATNo ratings yet

- Top Law Schools in IndiaDocument1 pageTop Law Schools in IndiaNIKHIL KASATNo ratings yet

- Front PageDocument4 pagesFront PageNIKHIL KASATNo ratings yet

- Banking Committees LinksDocument1 pageBanking Committees LinksNIKHIL KASATNo ratings yet

- Different Audit SectorsDocument4 pagesDifferent Audit SectorsNIKHIL KASATNo ratings yet

- Public Comments Received Scoping of Future Revision of chapterIV Transfer Pricing Guidelines PDFDocument133 pagesPublic Comments Received Scoping of Future Revision of chapterIV Transfer Pricing Guidelines PDFIhda NurdianaNo ratings yet

- Schesule CA Final Icai Class With Forex NDDocument9 pagesSchesule CA Final Icai Class With Forex NDGabbarNo ratings yet

- Axcelasia 2 PDFDocument408 pagesAxcelasia 2 PDFInvest StockNo ratings yet

- GE Energy Parts PEDocument85 pagesGE Energy Parts PEJaspreetNo ratings yet

- TJN-A Academy - Sol PicciottoDocument33 pagesTJN-A Academy - Sol PicciottoKwesi_WNo ratings yet

- Transfer Pricing-A Case Study of Vodafone: ArticleDocument5 pagesTransfer Pricing-A Case Study of Vodafone: ArticleRazafinandrasanaNo ratings yet

- Overview of International Taxation & DTAA: Apt & Co LLPDocument49 pagesOverview of International Taxation & DTAA: Apt & Co LLPanon_127497276No ratings yet

- Beps PPT Atad 3 1704896464Document30 pagesBeps PPT Atad 3 1704896464avnidikaNo ratings yet

- Interfaith One Billioon Dollar Question Review - A Policy Brief October 2019Document10 pagesInterfaith One Billioon Dollar Question Review - A Policy Brief October 2019Camillus KassalaNo ratings yet

- PGDTDocument68 pagesPGDTFahmi AbdullaNo ratings yet

- Tax Haven Report Finance Committee MainDocument62 pagesTax Haven Report Finance Committee MainFaraz AliNo ratings yet

- Consolidated Digest of Case Laws Jan 2011 To Sept 2011Document198 pagesConsolidated Digest of Case Laws Jan 2011 To Sept 2011itatonline.org100% (1)

- Branch OfficeDocument32 pagesBranch OfficeVedang GupteNo ratings yet

- International Tax Vietnam Highlights 2017Document4 pagesInternational Tax Vietnam Highlights 2017Thanh TrucNo ratings yet

- Bos 50847 MCQP 7Document192 pagesBos 50847 MCQP 7Garipalli Aravind100% (1)

- Taxation PDFDocument69 pagesTaxation PDFcpasl123No ratings yet

- FinalDocument1,200 pagesFinalRahulNo ratings yet

- Tax Guide 2015Document58 pagesTax Guide 2015Anatolii PasichnykNo ratings yet

- Bir 072-10Document25 pagesBir 072-10Emil A. MolinaNo ratings yet

- Vodafone Case - Supreme Court DecisionDocument275 pagesVodafone Case - Supreme Court Decisionraghul_sudheeshNo ratings yet

- PAN AO Codes International Taxation Ver2.6 17072012Document10 pagesPAN AO Codes International Taxation Ver2.6 17072012ThangaselviSubramanianNo ratings yet