Professional Documents

Culture Documents

Dela Cruz, Chelsea Joy C. 207 Assignment

Uploaded by

Chelsea Dela Cruz0 ratings0% found this document useful (0 votes)

6 views4 pagesOriginal Title

DELA CRUZ, CHELSEA JOY C. 207 ASSIGNMENT

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views4 pagesDela Cruz, Chelsea Joy C. 207 Assignment

Uploaded by

Chelsea Dela CruzCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 4

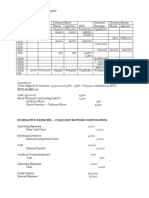

Problem 17-8 KALE COMPANY ANSWER:A

Checking account #101 1,750,000

Checking account #201 (100,000)

Time Deposit 250,000

Commercial papers 1,000,000

90 days treasury bill 500,000

Total cash and cash equivalents 3,400,000

17-10 SEAWALL COMPANY ANSWER:A

Cash-January 1 1,200,000

Cash flow from operating activities (squeeze) 4,200,000

Cash flow from investing activities (2,500,000)

Cash flow from financing activities (800,000)

Cash-December 31 2,100,000

17-12 MOON COMPANY

ANSWER: C

Depreciation 1,900,000

Accounts Receivable (1,100,000)

Inventory (730,000)

Accounts Payable 1,220,000

TOTAL 1,290,000

Increase in investment carried at equity,

representing share in net income of investee (55,000)

Amortization on of premium on bonds payable (14,000)

Increase in deferred tax liabilty 18,000

Cash provided by operating activities 1,449,000

17-16 BLACKTOWN COMPANY ANSWER: A

Net Income(squeeze) 3,300,000

Decrease in accounts payable (150,000)

Increase in inventory (50,000)

Decrease in accounts receivable 100,000

Decrease in prepaid expenses 200,000

Depreciation 900,000

Gain on sale of equipment (300,000)

Cash flow from oeprations 4,000,000

17-18 STONE COMPANY ANSWER:A

Net income 2,120,000

Depreciation 240,000

Amortization 80,000

Gain on sale of land (200,000)

Decrease in accounts receivable 60,000

Increase in inventory (120,000)

Decrease in accounts payable (140,000)

Increase in accrued expenses 160,000

Net cash provided by operating activities 2,200,000

17-20 MAHOGANY COMPANY

ANSWER: B

Net Income 3,400,000

Depreciation Expense 1,000,000

Loss on Sale of Equipment 100,000

Decrease Accounts Payable (200,000)

Decrease Inventory 150,000

Decrease Accounts Receivable (50,000)

Net cash provided by operating activities 4,400,000

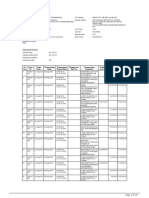

17-22 MATTHEW COMPANY ANSWER B

Purchase of land (3,500,000)

Vendor financing 1,000,000

Cash payment (2,500,000)

Purchase of plant for cash (2,500,000)

Cash proceeds from sale of plant 400,000

Net cash outflows-investing (4,600,000)

17-24 RIVERSIDE COMPANY ANSWER 1.D 2.C

a. Cash paid for purchase of building 400,000

Cash paid for purchase of land 350,000

Net cash-investing 750,000

Long term loan 550,000

Payment of cash dividend (300,000)

Net cash provided-financing 250,000

17-26 FAYE COMPANY ANSWERS: 1.C 2. B

Sale of treasury 750,000

Payment of dividend (4,000,000)

Net cash used in financing activities 3,750,000

Purchase of Ace bonds (1,800,000)

Sale of equipment 100,000

Net cash used in investing activities 1,700,000

17-28 TEB COMPANY ANSWER: D

Payment for the long-term bonds payable 7,500,000

Payment of cash dividend (600,000)

Sale of treasury shares 950,000

Net cash used in financing activities 7,850,000

17-30 MOUNTAIN COMPANY ANSWERS: 1.A

2.B 3.C

Net income 6,500,000

Decrease in accounts receivable 500,000

Increase in inventory (1,500,000)

Decrease in prepaid expenses 200,000

Gain on sale of equipment (300,000)

Depreciation 4,500,000

Decrease in accounts payable (3,500,000)

Increase in accrued expenses 1,000,000

Net cash provided by operating activities 7,400,000

Payment for new equipment (15,000,000)

Proceeds fro sale of equipment 1,800,000

Net cash used in investing activities (13,200,000)

PPE 42,000,000

Payment for new equipment(squeeze) 15,000,000

Total 57,000,000

Cost of equipment sold (2,000,000)

PPE 55,000,000

Proceeds from borrowing on a long term note payable 10,000,000

Dividend paid (3,000,000)

Payment of current bank note payable(5m-2m) (3,000,000)

Net cash provided by financing activities 4,000,000

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Writing Business Proposals, Business Plan and Case ReportsDocument47 pagesWriting Business Proposals, Business Plan and Case ReportsAbhishek Agarwal100% (2)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Cashflow 101 Game Instructions Home Pages 1 To 30Document31 pagesCashflow 101 Game Instructions Home Pages 1 To 30Princessa Lopez MasangkayNo ratings yet

- Banking Business Processes PDFDocument10 pagesBanking Business Processes PDFsupriyo100% (1)

- Ong Motors CorporationDocument4 pagesOng Motors CorporationJudy Ann Acruz100% (1)

- Responsibility AccountingDocument10 pagesResponsibility AccountingCheny MabiniNo ratings yet

- La Sec Dev Survey Trahan 2011Document181 pagesLa Sec Dev Survey Trahan 2011JeremyNo ratings yet

- New Asset and FundDocument15 pagesNew Asset and FundUdupiSri groupNo ratings yet

- Corporate Governance Reforms in India PDFDocument64 pagesCorporate Governance Reforms in India PDFAnkit YadavNo ratings yet

- Assessment Brief: The University of NorthamptonDocument11 pagesAssessment Brief: The University of NorthamptonThara DasanayakaNo ratings yet

- Review Materials For Final ExamDocument3 pagesReview Materials For Final ExamLenen L. RabagoNo ratings yet

- Bounding BermudansDocument6 pagesBounding Bermudans楊約翰No ratings yet

- Int To Security AnalysisDocument50 pagesInt To Security AnalysisMuhammad ZubairNo ratings yet

- Asset Accounting - Retirements & TransfersDocument12 pagesAsset Accounting - Retirements & TransfersVihaan BorbachhiNo ratings yet

- Donation Letter of IntentDocument2 pagesDonation Letter of IntentVALIANT NAJIB ERESUELANo ratings yet

- WCM Assignment 1Document3 pagesWCM Assignment 1gfdsa12345No ratings yet

- Matalino Corporation FSDocument2 pagesMatalino Corporation FSAiron AlongNo ratings yet

- Afm 2810001 May 2019Document3 pagesAfm 2810001 May 2019PILLO PATELNo ratings yet

- A STUDY ON FINANCIAL PERFORMANCE IN DORA PLASTICS NewDocument12 pagesA STUDY ON FINANCIAL PERFORMANCE IN DORA PLASTICS Newtriveni Kollathuru001No ratings yet

- Stage of Quality Development of Accounting in New UzbekistanDocument6 pagesStage of Quality Development of Accounting in New UzbekistanResearch ParkNo ratings yet

- Content ACCOUNTSDocument7 pagesContent ACCOUNTSjhanvi tandonNo ratings yet

- Audit RiskDocument36 pagesAudit RiskpaponNo ratings yet

- Detailed StatementDocument18 pagesDetailed Statementwolf8585.inNo ratings yet

- Final Report of Strategic ManagementDocument5 pagesFinal Report of Strategic ManagementMuhammad ShakeelNo ratings yet

- Contol Soal Partnership Akuntansi Keuangan Lanjutan 1Document3 pagesContol Soal Partnership Akuntansi Keuangan Lanjutan 1Istiqlal RamadhanNo ratings yet

- Accounting Tutorial 2 Part 2Document18 pagesAccounting Tutorial 2 Part 2Sim Pei Ying100% (1)

- Uniform Fraudulant Transfer Act - Ufta84Document40 pagesUniform Fraudulant Transfer Act - Ufta84Richarnellia-RichieRichBattiest-CollinsNo ratings yet

- MCQ On Individual Income TaxDocument14 pagesMCQ On Individual Income TaxRandy ManzanoNo ratings yet

- Investment Banking QP - PGDM - TRIM 3Document6 pagesInvestment Banking QP - PGDM - TRIM 3SharmaNo ratings yet

- DocumentDocument2 pagesDocumentNorelkis Thais Perez ArangurenNo ratings yet

- 2020 Annual Report: The Goodyear Tire & Rubber CompanyDocument104 pages2020 Annual Report: The Goodyear Tire & Rubber CompanyRock StarNo ratings yet